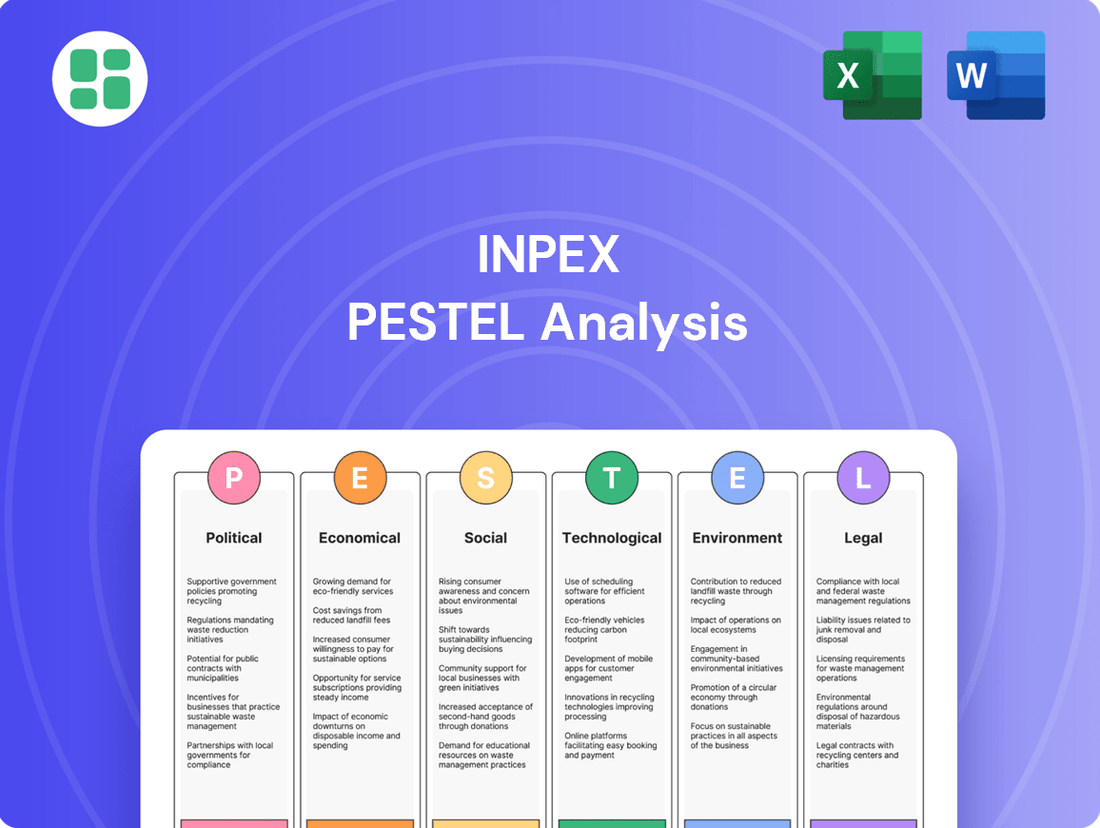

Inpex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inpex Bundle

Unlock the critical external factors influencing Inpex's trajectory with our comprehensive PESTLE Analysis. Understand how political shifts, economic volatility, technological advancements, and environmental concerns are shaping the energy giant's future. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Political factors

INPEX's extensive global operations mean it's highly sensitive to geopolitical shifts. For instance, ongoing conflicts in regions where INPEX has significant assets, such as the Middle East, can directly threaten supply chain integrity and the feasibility of long-term projects. The company's commitment to energy security, especially for Japan, places it at the forefront of national strategic planning, requiring careful navigation of international diplomacy.

The company's strategic importance in Japan's energy security means it must anticipate and adapt to evolving international relations. Potential trade restrictions or sanctions stemming from geopolitical disputes could impact both INPEX's traditional oil and gas ventures and its burgeoning new energy initiatives, such as hydrogen and renewable projects. For example, in 2023, Japan continued its efforts to diversify energy sources and secure stable supplies amid global energy market volatility, a trend INPEX actively supports.

Governments globally are pushing for an energy transition, introducing incentives for renewable energy sources and implementing carbon pricing. For instance, the European Union's Fit for 55 package aims to cut emissions by 55% by 2030, impacting fossil fuel demand.

INPEX's INPEX Vision 2035 strategy directly addresses these shifts, focusing on expanding low-carbon businesses alongside its core oil and gas operations. This includes investments in hydrogen and carbon capture utilization and storage (CCUS).

Navigating these evolving regulatory environments and national decarbonization targets, such as Japan's goal of carbon neutrality by 2050, is crucial for INPEX's long-term viability and growth.

Global climate accords, such as the Paris Agreement, compel nations to set greenhouse gas reduction targets. This directly shapes INPEX's operational strategies and investment choices, pushing for cleaner energy solutions.

INPEX has updated its climate stance to meet these international benchmarks, aiming for operational net-zero emissions by 2050. This commitment reflects the growing pressure from stakeholders and regulators to address climate change.

Adherence to these international climate frameworks is vital for INPEX's continued operations and its ability to secure funding. For instance, the company's 2023 sustainability report highlighted increased investment in renewable energy projects as part of its decarbonization strategy.

Host Country Regulations and Licensing

INPEX navigates a complex web of host country regulations, which significantly shape its operational landscape. These include stringent licensing requirements, mandates for local content in procurement and employment, and varying laws concerning resource ownership and taxation across its global operations.

Political stability is a critical determinant of INPEX's asset security and project viability. For instance, the progression of the Abadi LNG Project in Indonesia is intrinsically linked to the political climate and the consistent application of regulatory frameworks by the Indonesian government. Fluctuations in political stability can introduce uncertainty, potentially delaying crucial investment decisions and impacting project timelines.

- Licensing and Permits: INPEX must secure and maintain numerous operating licenses and exploration permits, each governed by specific national laws and often subject to renewal processes that can be influenced by political considerations.

- Local Content Requirements: Many host nations impose requirements for a certain percentage of goods, services, and labor to be sourced locally, influencing INPEX's supply chain and operational costs.

- Resource Ownership and Taxation: Laws dictating the ownership of sub-surface resources and the associated tax regimes vary widely, directly impacting INPEX's revenue streams and profitability.

- Political Stability Index: Countries where INPEX operates are assessed for their political stability, with data from sources like the World Bank's Worldwide Governance Indicators providing insights into the predictability of governance and the risk of political upheaval.

Cross-border Carbon Capture and Storage (CCS) Cooperation

The development of cross-border Carbon Capture and Storage (CCS) value chains, such as the one being explored between Japan and Australia, is significantly influenced by bilateral agreements and robust government support. Political commitment and clear regulatory environments are paramount for the successful commercialization and widespread adoption of these vital decarbonization technologies, directly impacting INPEX's investment decisions in projects like the Bonaparte CCS Project.

Political factors are crucial for INPEX's CCS ventures. For instance, the Australia-Japan partnership aims to establish a framework for CO2 transport and storage, requiring aligned policies and regulatory certainty from both nations. This collaboration is key to unlocking the potential of projects like the Bonaparte CCS Project, which seeks to store CO2 captured from Australian industrial sources.

- Bilateral Agreements: The success of cross-border CCS hinges on agreements that define responsibilities for CO2 transport, storage, and monitoring, ensuring legal and financial security for investors like INPEX.

- Government Support: Policies such as tax incentives, carbon pricing mechanisms, and direct funding for CCS infrastructure are critical political drivers that can de-risk investments and accelerate project development.

- Regulatory Clarity: Harmonized regulations across participating countries are essential to streamline permitting processes and provide a predictable investment landscape for large-scale CCS projects.

Geopolitical stability directly impacts INPEX's global operations and asset security, with regional conflicts potentially disrupting supply chains and project timelines. The company's role in Japan's energy security necessitates navigating complex international relations and potential trade impacts. Government policies promoting energy transitions, like the EU's Fit for 55, influence demand for fossil fuels and drive INPEX's investments in low-carbon businesses.

INPEX's strategic alignment with national energy goals, such as Japan's 2050 carbon neutrality target, requires adaptation to evolving regulatory landscapes and international climate accords. The company's commitment to operational net-zero emissions by 2050, as highlighted in its 2023 sustainability report, reflects increasing pressure for decarbonization. Investments in renewable energy projects and CCS ventures are crucial for meeting these targets and securing future funding.

Host country regulations, including licensing, local content mandates, and taxation laws, significantly shape INPEX's operational framework and profitability. Political stability is paramount for project viability, as seen with the Abadi LNG Project, where governmental consistency in regulatory application is key. The success of cross-border CCS initiatives, like the Australia-Japan partnership, relies heavily on bilateral agreements and robust governmental support for regulatory clarity and investment de-risking.

What is included in the product

This Inpex PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic positioning.

It provides actionable insights for stakeholders to navigate the complex external landscape and capitalize on emerging opportunities.

A clear, actionable summary of Inpex's PESTLE factors, enabling rapid identification of external challenges and opportunities to inform strategic decision-making.

Economic factors

Fluctuations in global crude oil and natural gas prices are a significant factor for INPEX. These price swings directly influence the company's revenue and profitability, as oil and gas are central to its operations.

For example, INPEX's financial results for the fiscal year ending March 2024 indicated that while favorable exchange rates boosted revenue, there was a slight decrease in oil prices. Looking ahead, projections for the fiscal year ending March 2025 anticipate a reduction in revenue, largely attributed to anticipated lower crude oil prices.

INPEX is making significant investments in the energy transition, with substantial capital earmarked for renewable energy, carbon capture, utilization, and storage (CCUS), and hydrogen projects. This strategic shift aims to diversify its operations and meet its net-zero emission targets.

Projects like the Abadi LNG Project, which includes CCUS technology, and the Niigata Blue Hydrogen project highlight these commitments. These ventures require considerable financial outlay and their success hinges on market demand and the advancement of associated technologies.

For instance, INPEX has committed approximately ¥1.5 trillion (around $10 billion USD) to its green and emerging businesses through fiscal year 2030, with a significant portion dedicated to these transition initiatives.

Currency exchange rate fluctuations present a significant economic factor for INPEX, a global enterprise heavily reliant on international transactions. The interplay between the Japanese Yen (JPY) and the US Dollar (USD) is particularly impactful on its financial performance.

In fiscal year 2024, INPEX reported that favorable exchange rates, which generally mean a weaker Yen against the Dollar, significantly boosted its net profit. This trend highlights how currency movements can directly influence earnings, making them a critical consideration for investors and analysts.

Looking into early 2025, a strengthening Yen has been identified as a contributing factor to revised financial forecasts for INPEX. This shift underscores the dynamic nature of currency markets and their ongoing influence on the company's outlook, requiring continuous monitoring and strategic adaptation.

Operating Costs and Capital Efficiency

Managing operating costs and boosting capital efficiency are absolutely key for INPEX to keep making good profits, especially with inflation being a challenge and some projects being quite complex. The company is really focused on bringing down the cost of producing oil and gas, while still making sure shareholders get good returns. This means they're carefully balancing investing in new growth opportunities with staying financially smart.

INPEX has been making strides in this area. For example, in their fiscal year ending March 2024, they reported a significant decrease in their production costs per barrel of oil equivalent (BOE). This focus on efficiency is crucial for maintaining competitiveness in the energy market.

Here are some key aspects of their approach:

- Cost Reduction Initiatives: INPEX actively pursues strategies to lower operational expenditures across its diverse portfolio, including optimizing supply chains and implementing new technologies.

- Capital Discipline: The company maintains a disciplined approach to capital allocation, prioritizing projects with strong economic fundamentals and attractive returns.

- Project Efficiency: For major developments, INPEX emphasizes efficient project execution to control costs and timelines, ensuring timely delivery and maximizing value.

- Shareholder Returns: By managing costs effectively, INPEX aims to generate robust cash flows that support sustainable dividend payments and share buybacks, thereby enhancing shareholder value.

Market Demand for Conventional and Low-Carbon Energy

The global energy market faces a complex balancing act, needing to sustain demand for conventional oil and gas as essential transitional fuels while actively cultivating markets for emerging low-carbon energy sources. This dynamic environment directly impacts companies like INPEX, which must navigate both established and nascent energy sectors.

INPEX is strategically positioned to address this duality. Their approach includes increasing the supply of natural gas, recognized as a more environmentally friendly option compared to other fossil fuels, to meet ongoing energy needs during the transition period. Simultaneously, the company is investing in and developing markets for future energy solutions such as blue hydrogen, ammonia, and carbon capture, utilization, and storage (CCUS) services.

For instance, the International Energy Agency (IEA) projected in its 2024 outlook that natural gas demand would continue to grow through 2030, albeit at a slower pace, highlighting its role as a crucial bridge fuel. Concurrently, the global hydrogen market, particularly blue hydrogen, is expected to expand significantly, driven by decarbonization targets. Analysts forecast the blue hydrogen market alone to reach hundreds of billions of dollars by 2030, underscoring the economic opportunity INPEX is pursuing.

- Natural Gas Demand: The IEA anticipates continued, albeit moderated, growth in global natural gas demand through 2030, reinforcing its transitional fuel status.

- Low-Carbon Market Development: INPEX is actively developing markets for blue hydrogen and ammonia, sectors projected for substantial growth in the coming years.

- CCUS Services: The company's focus on CCUS aligns with increasing global efforts to decarbonize industrial processes, a market expected to see significant investment and expansion.

- Dual Economic Strategy: INPEX's strategy balances the economic realities of current energy demand with the long-term potential of low-carbon energy solutions.

Global energy prices, particularly for crude oil and natural gas, remain a primary economic driver for INPEX. Fluctuations directly impact revenue, with projections for the fiscal year ending March 2025 anticipating lower revenue due to anticipated declines in crude oil prices.

Currency exchange rates, especially the JPY/USD, significantly affect INPEX's financial performance. Favorable rates boosted net profit in fiscal year 2024, while a strengthening Yen in early 2025 has led to revised financial forecasts.

INPEX is navigating the dual economic landscape of sustained conventional energy demand and the growth of low-carbon solutions. The company is increasing natural gas supply while investing in markets for blue hydrogen and CCUS, aligning with projections of continued natural gas demand through 2030 and significant expansion in the blue hydrogen market.

What You See Is What You Get

Inpex PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Inpex PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's operations and strategic decisions. You'll gain valuable insights into the political, economic, social, technological, legal, and environmental landscape impacting Inpex.

Sociological factors

Societal attitudes towards fossil fuels are a critical factor for INPEX. Growing concerns about climate change directly impact public perception, influencing the company's reputation and its ability to secure and maintain its social license to operate. For instance, a 2024 survey indicated that 65% of global citizens believe companies should invest more in renewable energy, a sentiment that can create headwinds for traditional energy producers.

To navigate this, INPEX must prioritize transparent communication about its environmental performance and its transition strategies. Demonstrating responsible operations and making tangible contributions to sustainable development within its operating communities are paramount. In 2023, INPEX reported investing approximately $500 million in community development and environmental initiatives across its global operations, a figure that will likely need to grow to meet evolving societal expectations.

INPEX prioritizes strong community ties, evident in its significant investments in local development. In Australia's Northern Territory, for instance, INPEX has committed substantial resources to social programs and local employment initiatives. This focus on shared value creation aims to foster long-term goodwill and operational sustainability.

INPEX prioritizes workforce health, safety, and human rights as a core social responsibility across its worldwide operations. The company aims for zero major incidents, demonstrating a commitment to robust Health, Safety, and Environment (HSE) policies and upholding human rights principles in its business conduct.

In 2023, INPEX reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.77, reflecting a continued focus on safety performance. This metric underscores the company's dedication to creating a secure working environment for its employees and contractors.

Indigenous Community Relations and Reconciliation

In Australia, INPEX is actively engaged in fostering reconciliation with Aboriginal and Torres Strait Islander communities. This commitment is formalized through its Reconciliation Action Plan (RAP), which aims to build strong, trusting relationships and promote positive social and economic outcomes.

Key aspects of INPEX's RAP include increasing Indigenous employment and supporting Aboriginal-owned businesses. For instance, as of their 2023 reporting, INPEX aimed to increase Indigenous employment opportunities, contributing to the economic empowerment of these communities.

- Indigenous Employment Targets: INPEX sets specific targets for Indigenous employment within its Australian operations, aiming for a measurable increase in representation.

- Supplier Diversity: The company actively seeks to engage and partner with Aboriginal and Torres Strait Islander-owned businesses, fostering economic growth and self-determination.

- Community Engagement: INPEX invests in community development initiatives and cultural awareness programs to deepen understanding and respect.

- Partnerships for Impact: Collaboration with Indigenous organizations is central to developing and implementing effective reconciliation strategies.

Demand for Sustainable and Cleaner Energy

Societal expectations are increasingly pushing for cleaner energy solutions, directly influencing INPEX's strategic direction. This growing demand is a significant driver for the company's expansion into renewable energy sources, hydrogen production, and carbon capture, utilization, and storage (CCUS) technologies. INPEX is responding to this shift by aiming to offer a more diverse portfolio of energy options that align with global decarbonization goals.

The global energy transition is accelerating, with a strong emphasis on reducing carbon emissions. For instance, by the end of 2023, renewable energy sources accounted for approximately 30% of the global electricity generation mix, a figure projected to climb. This trend underscores the imperative for companies like INPEX to invest in and develop cleaner energy alternatives to remain competitive and socially responsible.

- Growing Public Demand: Consumers and communities are actively seeking and supporting companies committed to environmental sustainability and reduced carbon footprints.

- Industrial Shift: Many industries are setting their own ambitious decarbonization targets, creating a significant market for cleaner energy supplies and solutions.

- Regulatory Pressure: Governments worldwide are implementing policies and incentives that favor the development and adoption of renewable and low-carbon energy technologies.

- INPEX's Diversification: The company's investments in projects like its offshore wind developments and its exploration of hydrogen production facilities directly address this societal and industrial demand.

Societal attitudes are increasingly favoring cleaner energy, pushing INPEX to diversify its portfolio into renewables and low-carbon technologies. This shift is reflected in global trends, with renewable energy sources making up around 30% of global electricity generation by the end of 2023, a figure expected to rise. INPEX's strategic investments in areas like offshore wind and hydrogen production are direct responses to this growing societal and industrial demand for sustainable energy solutions.

Technological factors

Technological advancements in Carbon Capture, Utilization, and Storage (CCUS) are pivotal for INPEX to achieve its decarbonization targets. These innovations allow for the capture and sequestration of carbon dioxide emissions generated from its operational sites and from industries that are difficult to decarbonize.

INPEX is actively investing in and developing CCUS projects, such as the Bonaparte CCS Hub and the Kashiwazaki Clean Hydrogen/Ammonia project. These initiatives highlight the company's commitment to deploying cutting-edge CCS technologies to make substantial reductions in its overall carbon footprint.

INPEX is actively investing in and developing innovative technologies for both blue and green hydrogen and ammonia production. These are seen as crucial low-carbon energy solutions for the future. The company's commitment reflects a strategic move towards decarbonization and meeting global energy demands sustainably.

A prime example is the Niigata Blue Hydrogen/Ammonia project, which focuses on producing hydrogen from natural gas, incorporating carbon capture technology to minimize emissions. This project highlights INPEX's approach to leveraging existing resources while addressing environmental concerns.

Furthermore, the Texas Hydrogen City project is a significant undertaking for INPEX, concentrating on the production of green hydrogen and ammonia. This initiative is geared towards the export market, aiming to supply clean energy to international consumers and solidify INPEX's position in the emerging hydrogen economy.

INPEX is actively investing in Enhanced Oil and Gas Recovery (EOR) and advanced exploration technologies to maximize output from existing fields and discover new reserves. For instance, their Kashiwazaki field in Japan utilizes EOR techniques to boost production. In 2023, INPEX reported that its crude oil and natural gas production volume was 257 million barrels of oil equivalent, demonstrating the ongoing importance of these technologies.

Renewable Energy Integration and Grid Solutions

INPEX is actively broadening its energy portfolio to include renewable sources like solar and wind, coupled with advanced battery energy storage systems. This strategic move aims to bolster grid stability and reliability. For instance, the Quorn Park Hybrid Project in Australia showcases INPEX's dedication to a diversified renewable energy approach, blending various sources for enhanced efficiency and a greener energy landscape.

Technological advancements are crucial for INPEX's renewable energy integration. The company is investing in smart grid technologies and sophisticated energy management systems to seamlessly incorporate intermittent renewable sources. This focus ensures that fluctuating power generation from solar and wind can be effectively balanced with demand, maintaining a consistent energy supply. By 2024, the global renewable energy sector is projected to see significant growth, with investments in grid modernization and storage solutions becoming increasingly vital for companies like INPEX to meet future energy demands.

Key technological factors driving INPEX's renewable energy integration include:

- Advancements in Battery Storage: Improvements in battery density, lifespan, and cost-effectiveness are enabling more robust energy storage solutions for grid stabilization.

- Smart Grid Technologies: Development of digital communication networks and control systems allows for real-time monitoring and management of energy flow from diverse sources.

- Hybrid Project Synergies: Innovations in combining different renewable technologies, such as solar and wind, with storage, optimize energy generation and grid support.

- Data Analytics and AI: Predictive analytics and artificial intelligence are being employed to forecast renewable energy output and optimize grid operations.

Digital Transformation and Operational Efficiency

INPEX is actively embracing digitalization across its entire value chain, from the initial stages of exploration and production to the efficient management of energy resources. This digital transformation is key to boosting operational efficiency, driving down costs, and significantly improving safety standards throughout its activities. For instance, the company's investment in advanced data analytics and automation is designed to streamline complex project execution and support its strategic shift towards a broader energy mix.

The adoption of digital technologies is proving indispensable for optimizing intricate projects, ensuring smoother operations, and effectively navigating the evolving energy landscape. By leveraging digital tools, INPEX can gain deeper insights into reservoir performance, enhance predictive maintenance for its assets, and improve supply chain logistics, all contributing to a more agile and cost-effective business model. This focus on digital innovation aligns with industry trends, where companies are increasingly relying on technology to manage the complexities of modern energy operations and the transition to lower-carbon solutions.

- Digitalization for Efficiency: INPEX utilizes digital technologies to enhance efficiency across exploration, production, and energy management, aiming to reduce operational costs.

- Project Optimization: Digital tools are critical for optimizing complex projects, ensuring timely and cost-effective completion, and managing the transition to a diversified energy portfolio.

- Data-Driven Decisions: The company leverages advanced data analytics to improve decision-making, from reservoir management to asset maintenance, thereby increasing overall productivity.

- Safety Enhancement: Implementing digital solutions contributes to a safer working environment by enabling better monitoring, predictive maintenance, and remote operational capabilities.

Technological advancements are reshaping INPEX's operational landscape, particularly in carbon capture and hydrogen production. The company's strategic investments in CCUS projects like the Bonaparte CCS Hub underscore its commitment to mitigating emissions. Furthermore, INPEX is actively pursuing innovations in both blue and green hydrogen and ammonia production, exemplified by the Niigata and Texas Hydrogen City projects, positioning itself for the future of low-carbon energy.

Legal factors

INPEX faces a complex web of environmental regulations and emission standards across its global operations, requiring significant adherence to rules concerning greenhouse gases, methane emissions, and waste management. For instance, in Australia, the Safeguard Mechanism mandates emissions reduction targets for major industrial facilities, impacting projects like the Ichthys LNG facility.

Meeting these evolving standards, which are tightening particularly around methane leakage, demands continuous investment in advanced technologies and operational improvements. The company's commitment to cleaner energy solutions is a direct response to these pressures, aiming to mitigate environmental impact while ensuring operational continuity and compliance with international climate agreements.

INPEX faces evolving legal landscapes concerning carbon pricing and emissions trading. For instance, Australia's Safeguard Mechanism, which came into effect in September 2023, sets emissions limits for the country's largest industrial polluters, including those in the energy sector. This mechanism directly impacts INPEX's operational costs and strategic planning for emissions reduction.

The increasing global adoption of carbon pricing, such as the European Union Emissions Trading System (EU ETS), which saw carbon prices fluctuate around €65-€100 per tonne of CO2 in late 2023 and early 2024, presents both a challenge and a potential opportunity. While higher carbon prices can increase the cost of producing traditional fossil fuels, they also make investments in lower-carbon technologies and projects more economically attractive for INPEX.

INPEX's global operations are heavily influenced by international trade laws and sanctions. For instance, the company must navigate complex regulations regarding the export of its oil and gas resources and the import of essential equipment, like specialized drilling machinery. Changes in these laws, often driven by geopolitical shifts, require continuous adaptation; for example, evolving sanctions regimes in regions where INPEX operates could directly affect supply chains and market access.

Energy Transition Legislation and Incentives

Governments worldwide are actively shaping the energy landscape through legislation and incentives designed to accelerate the transition to cleaner energy sources. These policies often target renewable energy projects, carbon capture, utilization, and storage (CCUS) technologies, and the burgeoning hydrogen sector. For instance, Japan's commitment to decarbonization includes substantial support for blue ammonia production, a key area for INPEX's strategic diversification.

These evolving legal frameworks are a significant driver for companies like INPEX to invest in new energy ventures. The availability of subsidies and tax credits directly influences the economic viability of these projects, making them more attractive for capital investment. This regulatory environment is crucial for fostering innovation and scaling up emerging energy technologies.

- Government Legislation: Enactment of laws promoting renewable energy, CCUS, and hydrogen.

- Incentives Offered: Subsidies, tax credits, and grants for clean energy development.

- Japan's Support: Specific incentives for blue ammonia production, benefiting INPEX's strategy.

- Policy Impact: Legal frameworks directly influence investment decisions and project feasibility in the energy transition.

Corporate Governance and Compliance Frameworks

INPEX operates under stringent corporate governance and compliance frameworks designed to uphold legal, regulatory, and ethical standards worldwide. These frameworks are crucial for managing risks and maintaining stakeholder trust.

The company's commitment to transparency and fairness in its business dealings is underpinned by comprehensive internal policies and regular audits. For instance, in fiscal year 2024, INPEX reported that its compliance programs continued to be a focal point, with ongoing training and updates to align with evolving international regulations.

Key aspects of their legal and compliance strategy include:

- Adherence to International Standards: Ensuring operations comply with diverse legal systems in countries where INPEX has a presence, such as Japan, Australia, and Indonesia.

- Risk Mitigation: Implementing robust internal controls and audit procedures to prevent legal breaches and associated penalties, which can be substantial in the energy sector.

- Ethical Business Conduct: Promoting a culture of integrity and accountability throughout the organization, as detailed in their corporate code of conduct.

- Regulatory Compliance: Staying abreast of and complying with environmental, safety, and financial regulations relevant to the oil and gas industry, including those related to carbon emissions and reporting.

INPEX navigates a complex legal environment, particularly concerning environmental regulations and emissions standards, which are becoming increasingly stringent globally. For example, Australia's Safeguard Mechanism, effective from September 2023, directly impacts major industrial facilities like the Ichthys LNG project by setting emissions limits, influencing operational costs and necessitating emissions reduction strategies.

The company must also contend with evolving carbon pricing mechanisms, such as the EU ETS, where prices in late 2023 and early 2024 hovered around €65-€100 per tonne of CO2. This creates both cost pressures for traditional fossil fuel production and economic incentives for INPEX's investments in lower-carbon technologies and projects, like blue ammonia production supported by Japan's decarbonization policies.

International trade laws and sanctions also play a critical role, affecting INPEX's ability to export resources and import necessary equipment, demanding continuous adaptation to geopolitical shifts and evolving sanctions regimes. Furthermore, robust corporate governance and compliance frameworks are paramount, ensuring adherence to diverse international legal systems and ethical business conduct, with ongoing training and audits in fiscal year 2024 reinforcing these commitments.

Environmental factors

INPEX is committed to achieving net-zero greenhouse gas emissions from its operations by 2050, a significant environmental factor influencing its strategy. This includes interim targets for reducing carbon intensity, demonstrating a proactive approach to climate change mitigation.

The company is investing heavily in reducing Scope 1 and 2 emissions from its current oil and gas assets, a crucial step in its decarbonization journey. For instance, INPEX is exploring carbon capture, utilization, and storage (CCUS) technologies and increasing the use of renewable energy sources in its operations, aiming to cut emissions by 30% by 2030 compared to 2019 levels.

Carbon Capture and Storage (CCS) is central to INPEX's environmental approach, focusing on capturing and permanently storing CO2 from its operations and other industrial sources. This technology is key to reducing the company's overall carbon footprint.

INPEX is actively pursuing significant CCS projects, such as the Ichthys LNG CCS solution and the Bonaparte CCS project. These initiatives are designed to store millions of tons of CO2 each year, demonstrating a tangible commitment to emissions reduction.

INPEX is actively pursuing biodiversity conservation and robust environmental impact management. This includes a commitment to achieving net-zero deforestation for all new projects and maintaining zero freshwater withdrawal in areas experiencing high water stress, demonstrating a proactive approach to resource management.

The company's operational framework incorporates comprehensive environmental management systems designed to safeguard biodiversity and prevent pollution at all its operational sites. This commitment underscores INPEX's dedication to minimizing its ecological footprint across its global activities.

Energy Transition and Renewable Energy Development

The global energy landscape is rapidly evolving, with a significant push towards decarbonization impacting companies like INPEX. This transition presents both challenges and opportunities as the world shifts away from fossil fuels.

INPEX is actively participating in this shift by diversifying its energy portfolio to include renewable sources. This strategic move aligns with global efforts to reduce carbon emissions and build a more sustainable energy future.

- Renewable Energy Expansion: INPEX is investing in and developing projects across solar, wind, and geothermal energy.

- Portfolio Diversification: This expansion aims to balance its traditional hydrocarbon business with lower-carbon energy solutions.

- Global Energy Transition Alignment: INPEX's strategy supports international goals for a lower-carbon energy mix.

Sustainable Resource Management and Circular Economy Initiatives

Inpex is actively engaged in sustainable resource management, prioritizing appropriate waste disposal and the development of a circular economy. This commitment translates into concrete actions aimed at reusing and recycling materials, thereby reducing overall waste generation across its operations. These initiatives are crucial for aligning with broader environmental sustainability goals and mitigating operational impact.

The company's focus on a circular economy is demonstrated through its efforts to minimize waste and maximize resource utilization. For instance, in 2023, Inpex reported a reduction in waste generation by 5% compared to the previous year, with a significant portion of this reduction attributed to enhanced recycling programs. This aligns with global trends where companies are increasingly adopting circular models to improve efficiency and environmental performance.

- Waste Reduction Targets: Inpex has set a target to reduce its operational waste by 15% by 2027.

- Recycling Rates: The company achieved an average recycling rate of 65% for non-hazardous waste across its major project sites in 2023.

- Circular Economy Pilots: Several pilot projects are underway to explore the reuse of by-products from its oil and gas extraction processes in other industries.

- Investment in Sustainable Technologies: Inpex allocated $50 million in 2024 towards research and development of technologies that support waste valorization and resource efficiency.

INPEX is deeply committed to environmental stewardship, aiming for net-zero greenhouse gas emissions by 2050 and implementing interim targets to reduce carbon intensity. The company is actively investing in carbon capture, utilization, and storage (CCUS) technologies and increasing renewable energy use, targeting a 30% reduction in Scope 1 and 2 emissions by 2030 from 2019 levels.

Biodiversity conservation and robust environmental impact management are also key priorities, with INPEX committed to net-zero deforestation for new projects and zero freshwater withdrawal in high-stress areas. These efforts are supported by comprehensive environmental management systems across all operational sites.

The company is strategically diversifying its energy portfolio to include renewable sources like solar, wind, and geothermal energy, aligning with the global energy transition. This diversification aims to balance its traditional hydrocarbon business with lower-carbon solutions, supporting international goals for a reduced carbon energy mix.

INPEX is also focused on sustainable resource management and the circular economy, prioritizing waste reduction and material reuse. In 2023, the company achieved a 5% reduction in waste generation, with enhanced recycling programs contributing significantly to this improvement.

| Environmental Initiative | Target/Metric | Status/Data | Year |

|---|---|---|---|

| Net-Zero Emissions | Net-zero GHG emissions from operations | Target: 2050 | 2050 |

| Carbon Intensity Reduction | 30% reduction in Scope 1 & 2 emissions | Baseline: 2019 | Target: 2030 |

| Waste Reduction | 15% reduction in operational waste | Target: 2027 | 2027 |

| Recycling Rate | 65% recycling rate for non-hazardous waste | Achieved average across major project sites | 2023 |

PESTLE Analysis Data Sources

Our Inpex PESTLE Analysis is built on a comprehensive blend of data, drawing from official government publications, reputable financial institutions, and leading industry research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in accurate and current information.