Inpex Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inpex Bundle

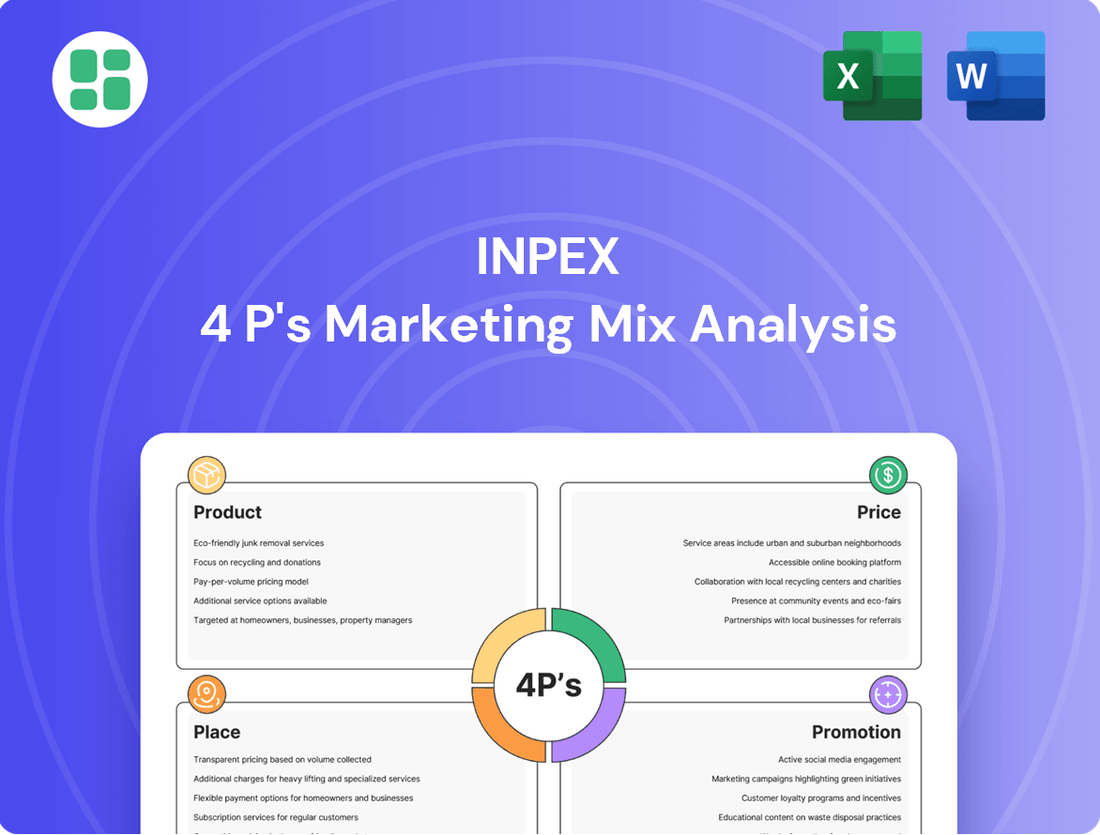

Discover how Inpex leverages its product portfolio, strategic pricing, global distribution network, and integrated promotional campaigns to maintain its market leadership. This analysis provides a clear roadmap to understanding their success.

Ready to unlock the full picture? Get access to an in-depth, ready-made Marketing Mix Analysis covering Inpex's Product, Price, Place, and Promotion strategies, perfect for business professionals and students seeking strategic insights.

Product

INPEX's foundational product line centers on the exploration, development, production, and sale of crude oil and natural gas. A prime example is the Ichthys LNG facility in Australia, a massive operation capable of producing significant volumes of liquefied natural gas. This project underscores INPEX's commitment to supplying vital energy resources.

The Abadi LNG Project in Indonesia's Masela Block represents another key component, currently in the Front-End Engineering and Design (FEED) stage. Upon completion, it is projected to generate 9.5 million tons of LNG annually, further solidifying INPEX's position in the global energy market.

The company's strategic focus is on guaranteeing a consistent and reliable supply of these crucial energy commodities worldwide. This commitment is particularly evident in its supply chains to Japan and other nations across Asia, meeting their ongoing energy demands.

Liquefied Natural Gas (LNG) is a cornerstone of INPEX's product strategy, notably featuring the massive Ichthys LNG facility in Australia, which commenced production in 2018. The company is also actively developing the Abadi LNG Project in Indonesia, underscoring its commitment to expanding its LNG footprint. These ventures are crucial for supplying cleaner energy to meet rising demand, particularly in Asian markets.

INPEX's LNG offerings are positioned as a more environmentally friendly alternative to other fossil fuels, aligning with global energy transition goals. The company is strategically investing in growing its overall LNG portfolio and enhancing its trading operations to provide greater supply flexibility and reliability to its customers.

INPEX is strategically investing in low-carbon solutions, notably Carbon Capture and Storage (CCS) and hydrogen. Their commitment is demonstrated by projects like the blue hydrogen and ammonia production plant in Kashiwazaki City, Japan, and significant CCS endeavors such as the Bonaparte CCS Project in Australia. These initiatives are designed to both reduce INPEX's operational emissions and provide greenhouse gas reduction services to external clients, thereby generating new revenue streams in support of their net-zero by 2050 objective.

Renewable Energy and Power

INPEX is actively diversifying its energy offerings by investing in renewable energy and integrated power systems. This strategic move aims to expand its business beyond traditional oil and gas, aligning with global decarbonization trends. As of early 2025, the company's commitment is evident through significant investments in Australian renewable energy ventures.

A key element of this strategy involves INPEX's stake in Potentia Energy Group Pty Ltd. Potentia has secured a substantial portfolio exceeding one gigawatt (GW) of renewable energy assets. This acquisition underscores INPEX's tangible progress in building a robust renewable energy footprint.

Furthermore, INPEX is exploring diverse geographical opportunities to bolster its clean power supply. These include investigating geothermal power generation in Japan and engaging with offshore wind power projects in Europe. These initiatives are designed to contribute to clean and high-value-added power solutions.

- Diversification Strategy: INPEX is expanding into renewable energy and integrated power systems to broaden its portfolio.

- Australian Investments: Significant stake in Potentia Energy Group Pty Ltd, which holds over 1 GW of renewable assets.

- Global Exploration: Pursuing geothermal power in Japan and offshore wind in Europe.

- Clean Energy Focus: Aiming to provide clean and high-value-added power supply systems.

Energy Transition Technologies

INPEX is actively investing in energy transition technologies as part of its Product strategy, moving beyond traditional oil and gas. This includes the development of methanation technology, which converts carbon dioxide and hydrogen into synthetic methane, a cleaner fuel source. The company is also exploring novel business ventures such as extracting valuable metals from brine, showcasing a commitment to diversifying its energy and resource portfolio.

These initiatives are central to INPEX Vision 2035, a strategic roadmap designed to harness the company's unique strengths. The goal is to pioneer advancements in new energy sectors and resource development, thereby contributing to a more sustainable global energy landscape. For instance, INPEX has been involved in projects exploring blue hydrogen production, aiming to decarbonize natural gas. By 2023, the company had announced plans to invest in projects supporting the hydrogen supply chain, indicating a concrete financial commitment to these future-oriented technologies.

Key areas of focus within their Product expansion include:

- Methanation technology development

- Exploration of metal recovery from brine

- Investment in hydrogen supply chain infrastructure

- Leveraging distinctive capabilities for new energy ventures

INPEX's product strategy is evolving from traditional hydrocarbons to a diversified energy portfolio. Key offerings include Liquefied Natural Gas (LNG) from projects like Ichthys, supplying Asia with cleaner energy. The company is also heavily investing in low-carbon solutions such as Carbon Capture and Storage (CCS) and hydrogen, with a blue hydrogen and ammonia plant in Japan as a prime example.

Further diversification includes significant investments in renewable energy, notably through its stake in Potentia Energy Group, which manages over 1 GW of renewable assets. INPEX is also exploring new energy ventures like methanation technology and metal recovery from brine, aligning with its Vision 2035 for a sustainable energy future.

| Product Category | Key Projects/Initiatives | Capacity/Scale | Target Markets | Strategic Importance |

| Liquefied Natural Gas (LNG) | Ichthys LNG (Australia) | Significant production volumes | Asia | Core business, reliable energy supply |

| Low-Carbon Solutions | Abadi LNG (Indonesia - FEED stage) | Projected 9.5 million tons/year | Global | Expanding LNG footprint |

| Renewable Energy | Blue Hydrogen/Ammonia Plant (Japan) | Production facility | Japan | Decarbonization, new revenue streams |

| Emerging Energy | Bonaparte CCS Project (Australia) | CCS endeavors | Global | Environmental services, net-zero target |

What is included in the product

This analysis provides a comprehensive breakdown of Inpex's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It delves into Inpex's real-world marketing practices, positioning, and competitive context, making it ideal for marketers and consultants seeking a detailed understanding.

Simplifies complex marketing strategies by providing a clear, actionable overview of Inpex's 4Ps, alleviating the pain of strategic ambiguity.

Place

INPEX boasts a robust global operational footprint, spanning Asia, Oceania, the Middle East, Africa, and the Americas. This extensive reach allows for diversified access to energy resources and markets, effectively mitigating regional risks and bolstering supply chain stability. For instance, as of fiscal year 2023, INPEX's operations in Australia contributed significantly to its overall production, underscoring the strategic importance of this region.

Inpex's major project hubs are strategically positioned to support its diverse energy portfolio. Australia, with the Ichthys LNG project and the Bonaparte CCS initiative, is a cornerstone for liquefied natural gas production and carbon capture solutions. In 2023, Ichthys LNG's production reached approximately 8.9 million tonnes of LNG, demonstrating significant operational capacity.

Indonesia hosts the Abadi LNG project, a key development for future gas supply. This project is progressing towards a final investment decision, with estimated reserves of around 10.4 trillion cubic feet of natural gas. Japan, Inpex's home market, features domestic gas fields and pioneering hydrogen and ammonia demonstration plants, reflecting a commitment to energy transition technologies.

INPEX's integrated supply chain is a cornerstone of its marketing strategy, encompassing everything from offshore extraction to final delivery. This seamless flow includes production facilities, subsea pipelines, and onshore processing plants, ensuring product integrity and timely availability. For instance, the Ichthys LNG project showcases this by transporting gas via a 890-kilometer subsea pipeline to a Darwin-based facility, a critical link in their global supply network.

Strategic Partnerships and Collaborations

INPEX leverages strategic partnerships to significantly bolster its market access and distribution networks. These alliances are crucial for expanding its operational footprint and delivering energy solutions more effectively. For instance, collaborations on the Bonaparte CCS Project with major players like TotalEnergies and Woodside Energy are key to developing new energy frontiers.

Further illustrating this strategy, INPEX's work with local utilities such as Chubu Electric Power on carbon capture and storage (CCS) value chains demonstrates a commitment to building robust, integrated energy systems. These collaborations not only enhance INPEX's ability to serve existing markets but also open doors to new opportunities and markets by sharing expertise and resources.

- Bonaparte CCS Project: Collaboration with TotalEnergies and Woodside Energy to enhance market access in the CCS sector.

- CCS Value Chains: Partnerships with entities like Chubu Electric Power to expand distribution capabilities for new energy solutions.

- Market Reach: Strategic alliances are vital for INPEX to tap into new markets and strengthen its presence in existing ones through shared infrastructure and expertise.

Direct Sales and Trading Capabilities

INPEX directly markets its crude oil and natural gas to a diverse customer base, including refiners, power generation companies, and industrial consumers. This direct engagement ensures tailored solutions and fosters strong client relationships.

The company is actively enhancing its liquefied natural gas (LNG) trading operations. This strategic move aims to provide greater supply flexibility and responsiveness, allowing INPEX to better adapt to shifting global energy demands and maximize its market reach.

- Direct Sales: INPEX sold approximately 255,000 barrels of oil equivalent per day (boepd) in the fiscal year ended March 2024, with a significant portion going to direct industrial customers.

- LNG Trading Growth: The company's LNG portfolio saw increased trading activity in 2024, reflecting its commitment to optimizing sales across different geographical markets.

- Market Responsiveness: By strengthening its trading capabilities, INPEX is better positioned to capitalize on price differentials and meet the dynamic needs of the global energy market.

INPEX's global presence, with operations spanning Asia, Oceania, the Middle East, Africa, and the Americas, ensures diverse market access. Australia, for instance, is a critical hub, with the Ichthys LNG project contributing significantly to production. This wide geographical spread allows INPEX to serve a broad customer base and mitigate regional risks.

| Region | Key Projects | FY2023 Contribution (Illustrative) |

|---|---|---|

| Oceania (Australia) | Ichthys LNG, Bonaparte CCS | Significant LNG production; ~8.9 million tonnes LNG from Ichthys |

| Asia (Indonesia) | Abadi LNG | Progressing towards FID; ~10.4 Tcf estimated gas reserves |

| Asia (Japan) | Domestic Gas Fields, Hydrogen/Ammonia Plants | Home market focus, energy transition initiatives |

What You Preview Is What You Download

Inpex 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Inpex 4P's Marketing Mix Analysis you'll receive instantly after purchase. This document is fully prepared and ready for your immediate use, ensuring no surprises or missing information. You are viewing the exact version that will be delivered to you upon completing your order.

Promotion

INPEX actively communicates its corporate branding and long-term strategy, notably its 'INPEX Vision 2035 – Realizing a Responsible Energy Transition.' This vision emphasizes their dedication to ensuring a stable energy supply while pursuing decarbonization efforts. For instance, in the fiscal year ending March 2024, INPEX reported a net profit of ¥271.7 billion, showcasing financial strength to support these ambitious transition goals.

The company disseminates this vision through various channels, including corporate videos, press releases, and investor presentations. These platforms are crucial for reinforcing INPEX's image as an innovative and responsible energy provider committed to sustainable practices and future energy solutions.

Inpex actively cultivates strong investor relations, a crucial promotional element. They provide shareholders and financial stakeholders with extensive financial data, integrated reports, and detailed sustainability reports. For instance, their commitment to transparency is evident in their consistent release of quarterly and annual financial results, often accompanied by investor presentations.

Key promotional activities include these regular financial announcements and investor presentations, which are designed to build trust and attract capital. Inpex has also garnered recognition, such as winning the Daiwa Internet IR Award, underscoring their dedication to effective communication and investor engagement, a vital aspect of their marketing mix.

INPEX actively promotes its commitment to sustainability and climate change initiatives through comprehensive Environmental, Social, and Governance (ESG) reporting. Their annual Sustainability Report, a key element of their marketing strategy, showcases tangible progress in decarbonization efforts and biodiversity conservation. For instance, in their 2023 report, INPEX highlighted a 7.7% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating concrete action towards their climate goals.

This transparent reporting fosters a responsible corporate image, particularly appealing to socially conscious investors and stakeholders. The company's community engagement programs, also detailed in these reports, further solidify their dedication to social responsibility. This focus on ESG performance is crucial for attracting capital and building long-term value in the current investment landscape, where sustainability is increasingly a deciding factor.

Public Relations and Media Engagement

INPEX actively shapes its public image through strategic public relations, utilizing media releases and news announcements to highlight project developments, technological innovations, and community involvement. For instance, in 2024, INPEX announced the successful commencement of production at the Abadi LNG project, a significant milestone that garnered considerable media attention and reinforced its position as a key energy provider.

This proactive media engagement extends to sponsorships, fostering positive public perception by showcasing INPEX's commitment to social responsibility and industry leadership. The company's ongoing support for environmental initiatives, including a significant contribution to marine conservation efforts in 2025, further solidifies its reputation.

Key PR and media engagement activities include:

- Dissemination of project updates and discovery announcements

- Highlighting technological advancements and operational successes

- Showcasing community investment and sponsorship activities

- Securing positive media coverage to enhance brand reputation

Digital and Social Media Presence

Inpex actively leverages digital and social media, including platforms like X, Instagram, and YouTube, to share operational updates and highlight its commitment to sustainability. This digital strategy is crucial for engaging a broad audience, from potential talent to the general public, and for reinforcing its corporate identity.

The company's digital presence is key to communicating its value proposition and fostering transparency. For instance, Inpex's YouTube channel often features detailed explanations of its projects and environmental initiatives, providing tangible evidence of its operational and sustainability performance.

- Digital Reach: Inpex utilizes X, Instagram, and YouTube to disseminate information and engage stakeholders.

- Stakeholder Engagement: These platforms facilitate direct interaction with a diverse audience, including potential employees and the public.

- Brand Reinforcement: The multi-channel approach strengthens Inpex's brand messaging around operations and sustainability.

- Transparency: Digital platforms provide a transparent view into the company's projects and environmental efforts.

INPEX's promotional strategy focuses on communicating its vision for a responsible energy transition and its commitment to sustainability. This is achieved through consistent investor relations, comprehensive ESG reporting, and strategic public relations, all aimed at building trust and enhancing its corporate image.

The company utilizes digital platforms to broaden its reach and engage a diverse audience, reinforcing its brand message of operational excellence and environmental responsibility. This multi-faceted approach ensures INPEX effectively conveys its value proposition and commitment to stakeholders.

INPEX's promotional efforts are supported by concrete financial performance, such as the ¥271.7 billion net profit reported for the fiscal year ending March 2024, which underpins its capacity to invest in future energy solutions and sustainability initiatives.

Key promotional metrics and achievements include:

| Activity Area | Key Initiatives | Impact/Data Point |

|---|---|---|

| Corporate Vision Communication | INPEX Vision 2035 – Realizing a Responsible Energy Transition | Reinforces commitment to stable energy supply and decarbonization. |

| Investor Relations | Regular financial data, integrated reports, investor presentations | Awarded Daiwa Internet IR Award, demonstrating effective communication. |

| Sustainability & ESG | Annual Sustainability Report, ESG reporting | 7.7% reduction in Scope 1 & 2 GHG emissions intensity (FY2023 vs. 2019 baseline). |

| Public Relations & Media | Project updates, technological innovation highlights | Commencement of production at Abadi LNG project (2024) garnered significant media attention. |

| Digital & Social Media | X, Instagram, YouTube engagement | Showcases projects and sustainability efforts, fostering transparency. |

Price

The price of INPEX's core products, crude oil and natural gas/LNG, is directly tied to global commodity market forces. Factors like shifts in supply and demand, geopolitical tensions, and overall economic health significantly impact these prices. For instance, Brent crude oil, a key benchmark, saw averages around $83 per barrel in early 2024, influencing INPEX's revenue potential.

INPEX's financial projections are consistently updated to reflect anticipated movements in crude oil prices and foreign exchange rates. This dynamic adjustment is crucial for accurate forecasting, as demonstrated by the company's reliance on oil price assumptions in its medium-term plans, which often factor in scenarios ranging from $70 to $90 per barrel for planning purposes.

INPEX strategically employs a mix of long-term contracts for its liquefied natural gas (LNG) and natural gas, ensuring a stable revenue stream. This is complemented by participation in spot markets for crude oil and any surplus gas, allowing the company to capitalize on favorable price fluctuations. For example, the Abadi LNG project, slated for development, is anticipated to deliver low-carbon energy through long-term agreements, reinforcing revenue predictability.

INPEX's pricing strategies are deeply intertwined with the significant costs of exploration, development, and production of energy resources, alongside crucial transportation expenses. These upfront investments directly influence the final price point offered to consumers and industrial clients.

To maintain competitive pricing and manage these substantial outlays, INPEX actively pursues enhancements in productivity and operational efficiency across its diverse project portfolio. For instance, in fiscal year 2023, the company reported a 10.8% increase in production volume from its Ichthys LNG project, a testament to ongoing efforts to optimize output and control per-unit costs.

Foreign Exchange Rate Impact

As a global energy company, INPEX's financial performance is intrinsically linked to foreign exchange rate fluctuations. The Japanese yen's value against major currencies, especially the U.S. dollar, directly influences its reported revenues and profitability. For instance, a weaker yen generally boosts yen-denominated earnings from dollar-priced oil and gas sales, while a stronger yen can erode these gains.

This sensitivity to currency movements necessitates robust financial strategies. INPEX must actively manage its foreign exchange exposure to mitigate potential negative impacts and capitalize on favorable shifts. The company's financial reporting, often in yen, means that even stable operational results can appear to vary significantly due to currency translation effects.

- Yen vs. USD Volatility: INPEX's earnings are particularly sensitive to the USD/JPY exchange rate.

- Revenue Impact: A depreciating yen against the USD typically increases yen-equivalent revenue from dollar-denominated sales.

- Profitability Influence: Conversely, an appreciating yen can reduce profit margins when translated back into the company's reporting currency.

- Financial Management: Strategic hedging and financial planning are crucial to navigate these currency risks effectively.

Investment Discipline and Shareholder Returns

INPEX's pricing and financial strategies are carefully calibrated to balance reinvestment in growth opportunities with a steadfast commitment to shareholder returns. This dual focus ensures the company's long-term viability while rewarding its investors.

The company pursues a stable shareholder return policy, incorporating progressive dividends and opportunistic share buybacks. These initiatives are directly supported by the robust revenue streams derived from INPEX's energy sales and its strategic market positioning.

- Progressive Dividend Policy: INPEX aims to consistently increase its dividend payouts over time, reflecting its financial health and confidence in future earnings.

- Share Buybacks: The company utilizes flexible share repurchase programs to return excess capital to shareholders, enhancing earnings per share.

- Revenue Generation: Strong performance in energy markets and effective cost management underpin the financial capacity for these shareholder return strategies.

- Financial Discipline: A disciplined approach to capital allocation ensures that growth investments and shareholder returns are managed in a sustainable and value-creating manner.

INPEX's pricing strategy is fundamentally linked to the volatile global commodity markets for crude oil and natural gas. The company's revenue potential is directly shaped by supply and demand dynamics, geopolitical events, and the broader economic climate. For instance, the average price of Brent crude in early 2024 hovered around $83 per barrel, a key indicator influencing INPEX's financial outlook.

The company's financial planning actively incorporates anticipated fluctuations in oil prices and foreign exchange rates, often using price scenarios between $70 and $90 per barrel to guide its medium-term strategies. This dynamic approach ensures that projections remain relevant amidst market shifts.

INPEX balances predictable revenue streams from long-term LNG and natural gas contracts with opportunistic participation in spot markets for crude oil. This hybrid approach allows INPEX to secure stable income while also benefiting from favorable price movements, as seen with the planned Abadi LNG project's long-term agreements for low-carbon energy delivery.

| Metric | Value (Early 2024/FY23) | Impact on INPEX Pricing |

|---|---|---|

| Brent Crude Average Price | ~$83/barrel | Directly influences revenue potential and cost recovery for oil sales. |

| Ichthys LNG Production Increase | 10.8% (FY23) | Improves operational efficiency, potentially lowering per-unit production costs and supporting competitive pricing. |

| USD/JPY Exchange Rate | Fluctuating (e.g., ~150 JPY/USD) | Impacts yen-denominated earnings from dollar-priced sales; a weaker yen boosts revenue. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis for Inpex leverages a comprehensive blend of official company disclosures, including annual reports and investor presentations, alongside detailed industry research and competitive intelligence. This ensures our insights into Inpex's Product, Price, Place, and Promotion strategies are grounded in verifiable data and current market realities.