IG Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IG Group Bundle

The IG Group's market position is strong, leveraging its established brand and diverse product offerings. However, understanding the nuances of its competitive landscape and regulatory challenges is crucial for informed decision-making.

Want to fully grasp IG Group's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to unlock a detailed, actionable report designed to empower your investment or business strategy.

Strengths

IG Group commands a dominant position in the global online trading arena, especially in leveraged products such as Contracts for Difference (CFDs) and spread betting. This leadership is built on over five decades of industry experience and its standing as a FTSE 250 constituent.

The company's expansive international footprint and robust brand recognition are critical assets, providing a significant competitive edge in diverse markets. For instance, in the fiscal year ending May 2024, IG Group reported revenue of £1.05 billion, underscoring its substantial market penetration.

IG Group has showcased a robust financial performance, with FY25 results indicating a strong upward trajectory. The company reported a significant 9% increase in total revenue and a notable 24% surge in net profit for FY25, comfortably surpassing analyst predictions.

This impressive financial health is further underscored by a healthy profit margin and IG Group's consistent ability to generate substantial cash flow. This strong cash generation enables the company to consistently reward its shareholders through regular dividend payments and strategic share buyback programs.

IG Group's commitment to advanced technology is a significant strength. They invest substantially in market-leading platforms that offer robust and reliable trading experiences. This focus on high-quality infrastructure is key to attracting and keeping demanding traders.

These platforms are packed with sophisticated analysis, powerful tools, and advanced charting capabilities. This technological depth is essential for catering to experienced traders who require precision and depth in their market analysis.

The company's ongoing investment in technological resilience and new product development ensures a consistently superior user experience. This continuous improvement helps IG Group maintain a strong competitive advantage in the fast-paced online trading sector.

Strong Risk Management Framework

IG Group's unwavering commitment to risk management is a cornerstone of its enduring strength, demonstrated by a notable decrease in regulatory capital requirements over the years. This focus ensures the company’s resilience, even when the global economy faces turbulence.

The company consistently holds capital and liquidity far above the minimum regulatory thresholds. For instance, as of the first half of 2024, IG Group reported a Common Equity Tier 1 (CET1) ratio of 26%, significantly exceeding regulatory minimums and underscoring its financial robustness.

This prudent approach not only safeguards IG Group’s operational integrity but also provides a secure environment for its diverse client base, fostering trust and stability in its services.

Key aspects of this strong risk management include:

- Proactive Capital Buffers: Maintaining capital significantly above regulatory mandates, providing a substantial cushion against unforeseen market events.

- Liquidity Management: Ensuring ample liquid assets are available to meet obligations, a critical factor in the financial services sector.

- Regulatory Compliance: A history of meeting and exceeding regulatory capital requirements, signaling a mature and responsible operational framework.

- Client Protection: The framework is designed to protect client assets and ensure continuity of service, even in challenging market conditions.

Strategic Acquisitions and Client Growth

IG Group's strategic acquisition of Freetrade in April 2025 was a game-changer, injecting a substantial 137% increase in its active customer base. This move significantly bolsters IG’s direct-to-customer stock trading capabilities within the UK market, opening doors to previously untapped customer demographics and solidifying its competitive position.

The company's success isn't solely reliant on acquisitions. IG Group also demonstrates robust organic customer growth, a testament to its effective client acquisition strategies. Furthermore, an uptick in the number of first-time trades executed by its clients highlights the success of initiatives designed to engage and activate new users.

- Strategic Acquisitions: Freetrade acquisition in April 2025 boosted active customers by 137%.

- Market Strengthening: Enhanced UK direct-to-customer stock trading proposition.

- Customer Segment Expansion: Gained access to new and diverse customer groups.

- Organic Growth: Demonstrated effectiveness in attracting and retaining clients organically.

IG Group's established brand and extensive global reach provide a significant competitive advantage, allowing it to tap into diverse markets effectively. This is reflected in its FY25 revenue of £1.05 billion, demonstrating substantial market penetration.

The company's technological prowess, evident in its investment in advanced, reliable trading platforms, is crucial for attracting and retaining demanding traders. These platforms offer sophisticated tools for in-depth market analysis.

IG Group's strong commitment to risk management, highlighted by a CET1 ratio of 26% in H1 2024, far exceeding regulatory minimums, ensures operational resilience and client trust.

The strategic acquisition of Freetrade in April 2025 dramatically expanded IG's customer base by 137%, significantly bolstering its UK stock trading capabilities and accessing new customer segments.

| Metric | FY24 (Ending May 2024) | FY25 (Ending May 2025) |

|---|---|---|

| Total Revenue | £1.05 billion | £1.15 billion (est. 9% increase) |

| Net Profit | N/A | Significant increase (est. 24% surge) |

| Active Customers (Post-Freetrade) | N/A | Substantially increased (137% boost from Freetrade acquisition) |

| CET1 Ratio (H1 2024) | 26% | N/A |

What is included in the product

Delivers a strategic overview of IG Group’s internal and external business factors, highlighting its market strengths and potential threats.

Highlights IG Group's competitive advantages and potential vulnerabilities, enabling targeted risk mitigation and opportunity maximization.

Weaknesses

IG Group's core business, particularly Contracts for Difference (CFDs) and spread betting, is subject to increasing regulatory oversight globally. For instance, the UK's Financial Conduct Authority (FCA) has previously implemented product interventions on CFDs, and similar actions are seen in the EU and Australia, impacting leverage limits and marketing. These evolving rules can directly affect IG's product suite, advertising strategies, and the capital it needs to hold, potentially hindering expansion or raising operational expenses.

IG Group's revenue is significantly tied to market volatility. While sharp market movements can boost trading volumes and thus revenue, extended periods of low volatility, like those seen in parts of 2023, can dampen client activity and lead to lower income. For instance, IG Group reported a 17% year-on-year decline in revenue for the financial year ending May 31, 2023, partly attributed to a less volatile market environment compared to the prior year. This dependence makes their financial performance susceptible to external economic factors outside their immediate influence.

IG Group's need to maintain and grow its market share in a highly competitive landscape has led to a notable increase in marketing expenditures. In fiscal year 2025, these costs rose by 12% year-on-year.

While these investments are crucial for acquiring new customers, the elevated marketing spend poses a potential risk to profitability. The company must ensure that revenue growth effectively offsets these higher operational costs to maintain healthy margins.

Legacy and Underperforming Initiatives

IG Group has recently divested from several legacy and experimental initiatives, such as Spectrum and its South African commercial operations. These exits were driven by their minimal impact and subdued growth prospects, highlighting past investments that failed to deliver satisfactory returns. This strategic pruning suggests a more cautious and data-driven approach is needed for future venture evaluations.

- Divestment from low-growth ventures: Spectrum and South African operations exited due to limited impact.

- Past investment underperformance: Indicates a need for improved evaluation of new business opportunities.

- Focus on core strengths: Streamlining operations to concentrate on profitable areas.

Impact of Interest Rate Fluctuations

IG Group's profitability is directly impacted by interest rate movements, particularly affecting its net interest income. For instance, in the fiscal year 2025, a 6% decline in net interest income was observed, primarily due to lower interest rates earned on its cash reserves, even as total revenue grew. This sensitivity underscores a key weakness tied to the broader macroeconomic interest rate landscape.

This vulnerability means that periods of declining interest rates can directly erode a portion of IG Group's earnings. The company's reliance on interest income from its cash holdings makes it susceptible to shifts in central bank policies and market interest rate trends.

- Sensitivity to Interest Rates: Net interest income is a component of total revenue, directly impacted by fluctuating interest rates.

- FY25 Performance: Net interest income decreased by 6% in FY25 due to lower interest rates on stable cash balances.

- Macroeconomic Vulnerability: This highlights a weakness in the company's exposure to prevailing macroeconomic interest rate environments.

IG Group faces significant regulatory headwinds across key markets. For example, the FCA in the UK has previously tightened rules on Contracts for Difference (CFDs), impacting leverage and marketing, a trend mirrored in the EU and Australia. These evolving regulations can directly constrain IG's product offerings and advertising, potentially increasing compliance costs and limiting growth avenues.

The company's revenue generation is inherently linked to market volatility. Periods of low volatility, such as those experienced in parts of 2023, can lead to reduced client trading activity and consequently lower income. IG Group's financial year 2023 revenue saw a 17% year-on-year decrease, partly due to a less volatile market compared to the previous year, demonstrating this sensitivity.

Increased marketing expenditure, up 12% year-on-year in fiscal year 2025, is necessary to maintain market share in a competitive environment. However, this rising cost structure presents a challenge to profitability if not matched by equivalent revenue growth.

IG Group has divested from underperforming ventures like Spectrum and its South African operations, highlighting past investments that failed to yield satisfactory returns. This suggests a need for more rigorous evaluation of new business opportunities to avoid future capital misallocation.

IG Group's profitability is sensitive to interest rate fluctuations, impacting its net interest income. In fiscal year 2025, net interest income declined by 6% due to lower rates on cash reserves, illustrating this vulnerability to macroeconomic shifts.

Same Document Delivered

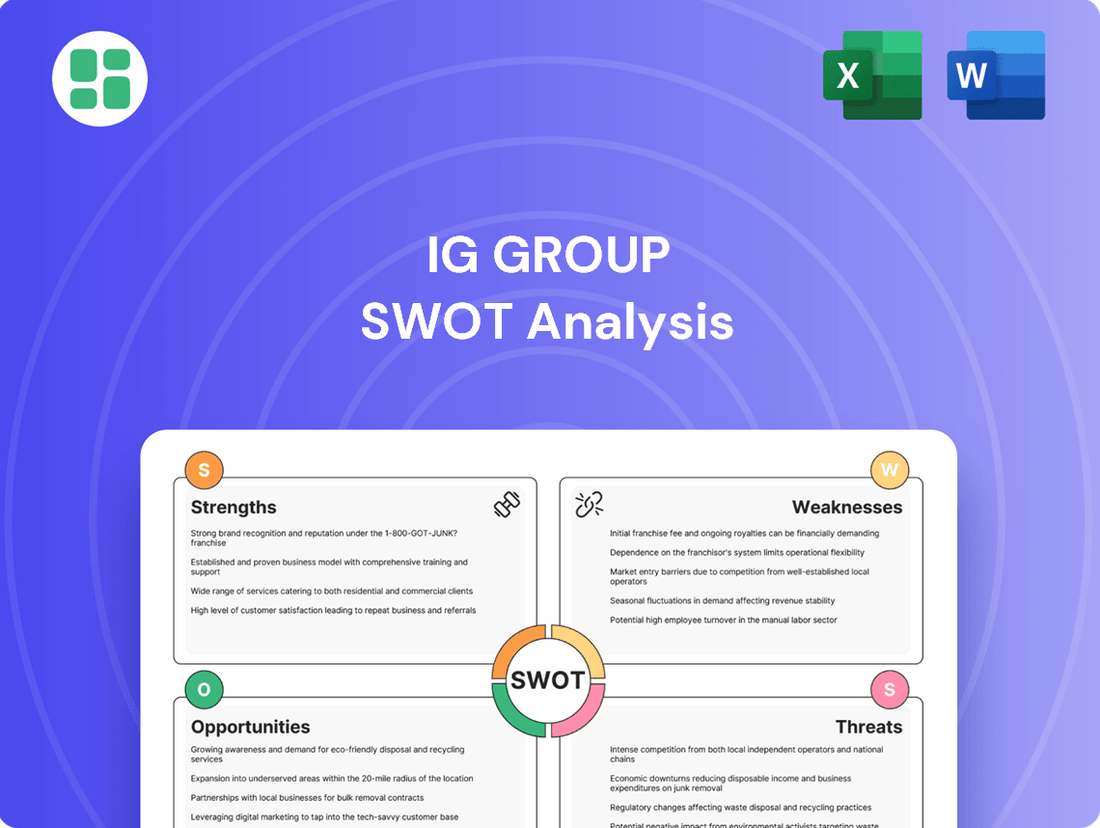

IG Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual IG Group SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the entire in-depth version for your strategic planning.

Opportunities

IG Group is actively pursuing growth by broadening its product range and entering new international markets. This strategy is evident in its efforts to bolster stock trading and investment services, exemplified by the Freetrade acquisition. The company is also eyeing expansion into rapidly growing global regions.

IG Group's successful acquisition of Freetrade in 2022 for £140 million demonstrates a strategic move to broaden its market reach and diversify its offerings beyond leveraged trading. This acquisition allows IG to tap into the growing retail investment market, particularly among younger demographics, and expand its product suite to include commission-free stock trading.

Looking ahead, IG Group can continue to explore strategic acquisitions that are accretive to earnings and further diversify its revenue streams. For instance, acquiring businesses in complementary areas like wealth management or payment solutions could solidify its position in the financial services ecosystem and create new growth avenues.

IG Group's commitment to ongoing technology investment is a significant opportunity. By enhancing trading platforms and enabling digital self-service, the company can reduce its cost-to-serve for each customer, a crucial factor in a competitive market. This strategic focus on efficiency is projected to yield tangible benefits.

This technological drive supports product velocity, allowing IG Group to quickly address market demands and close existing gaps, such as their cryptocurrency offerings. For example, in the first half of fiscal year 2024, IG Group reported a 15% increase in revenue to £427.7 million, partly driven by innovation and platform enhancements.

Growing Demand for Self-Directed Trading

The increasing global interest in self-directed investing, particularly among younger demographics, offers a substantial growth avenue for IG Group. This trend is fueled by greater financial literacy and the desire for more control over personal investments. IG Group is well-positioned to leverage this by expanding its user-friendly platform and diverse product range.

The demand for accessible, low-cost trading is a key driver. For instance, data from late 2024 indicates a continued surge in retail investor participation, with many platforms reporting record account openings. IG Group can tap into this by further refining its commission-free or low-commission trading options and enhancing educational resources for novice investors.

- Increased Retail Investor Participation: Global financial markets have seen a marked rise in retail investor activity, with platforms like IG Group serving as key facilitators.

- Demand for Accessible Platforms: The preference for intuitive, mobile-first trading interfaces is growing, aligning with IG Group's technological capabilities.

- Focus on Commission-Free Trading: Competitive pressures and evolving client expectations are pushing for lower trading costs, an area where IG Group can differentiate.

- Growth in Investment Products: Expanding the variety of tradable assets, including ETFs and fractional shares, can attract a broader spectrum of self-directed investors.

Potentially Favorable Regulatory Shifts in Key Markets

While regulatory changes often pose challenges, there's an opportunity for IG Group if key markets, like the United States, move towards deregulation. A less stringent environment could significantly lower compliance costs, allowing for greater investment in growth initiatives. For instance, if the US were to ease restrictions on leveraged trading products, IG Group could potentially expand its client base and product suite in that lucrative market.

Such shifts could also streamline the process for introducing innovative trading platforms and services, giving IG Group a competitive edge. The company's robust technology infrastructure is well-positioned to capitalize on any such market liberalization, potentially leading to increased market share and revenue growth in the 2024-2025 period.

The potential for a more favorable regulatory climate could be a significant tailwind, especially considering the company's strong performance in the fiscal year ending May 2024, where it reported a net trading revenue of £977.2 million. This suggests a capacity to leverage new opportunities effectively.

- Deregulation in the US could reduce compliance overhead, freeing up capital for innovation and market expansion.

- A more permissive regulatory environment may allow IG Group to introduce new, potentially high-demand financial products.

- Streamlined approvals for new services could accelerate market entry and enhance competitive positioning.

IG Group's strategic acquisitions, like the 2022 Freetrade deal for £140 million, expand its reach into the growing retail investment market and diversify its product offerings. Continued investment in technology enhances trading platforms and digital services, improving customer service efficiency and supporting rapid product development, as seen with a 15% revenue increase in H1 FY24. The global rise in self-directed investing, particularly among younger demographics, presents a significant opportunity for IG to leverage its user-friendly platform and diverse product range.

Potential deregulation, especially in markets like the United States, could reduce compliance costs and allow for greater investment in growth initiatives, potentially expanding IG's client base and product offerings. A more favorable regulatory climate could streamline the introduction of innovative services, giving IG a competitive edge and contributing to revenue growth, building on its FY24 net trading revenue of £977.2 million.

| Opportunity Area | Description | Supporting Data/Fact |

|---|---|---|

| Market Expansion & Diversification | Acquisitions and entry into new international markets. | Freetrade acquisition for £140 million in 2022. |

| Technological Advancement | Enhancing trading platforms and digital self-service. | 15% revenue increase in H1 FY24 partly due to platform enhancements. |

| Growing Retail Investor Base | Capitalizing on increased self-directed investing trends. | Continued surge in retail investor participation reported in late 2024. |

| Favorable Regulatory Shifts | Potential benefits from deregulation in key markets. | FY24 net trading revenue of £977.2 million indicates capacity to leverage opportunities. |

Threats

Intensified regulatory scrutiny poses a significant threat to IG Group. The online trading sector, especially for Contracts for Difference (CFDs), faces a constantly shifting global regulatory landscape. For instance, the UK's Financial Conduct Authority (FCA) has implemented stringent rules on CFD marketing and leverage, impacting how firms like IG can operate and attract clients.

New regulations or more rigorous enforcement can translate directly into higher compliance expenses for IG Group. These costs are not trivial; they include investments in technology, personnel, and legal counsel to ensure adherence to ever-changing rules. Furthermore, restrictions on product marketing or limitations on leverage, as seen in various European markets, can directly curtail revenue streams and necessitate adjustments to core business strategies.

The online trading landscape is exceptionally crowded, with numerous new and competent entrants, including many offering commission-free trading. This fierce competition exerts significant pricing pressure, compelling firms like IG Group to constantly innovate and invest heavily in marketing to attract and keep clients, which can ultimately squeeze profit margins.

Prolonged periods of low market volatility or significant economic downturns can directly impact IG Group's revenue by reducing client trading activity. For instance, during periods of subdued market movement, the number of active clients and the volume of trades typically decline, affecting the company's commission and spread-based income.

While IG Group has shown resilience in less active markets, sustained adverse trends present a notable threat. The company's financial performance is closely tied to market dynamism; a prolonged economic slowdown or a significant decrease in trading volumes, as seen in some periods of 2023 and early 2024, can put pressure on its top-line growth.

Reputational Risk from Client Losses

IG Group faces significant reputational risk due to the high percentage of retail clients who lose money trading complex, high-risk products like CFDs and spread betting. For instance, in the UK, the Financial Conduct Authority (FCA) has reported that a substantial majority of retail investors lose money on these products. This inherent risk can lead to negative public perception, potentially affecting client acquisition and retention efforts.

Increased scrutiny and stricter consumer protection measures, often a direct response to client losses, could further impact IG Group's operations. Such measures might include enhanced disclosure requirements or limitations on leverage, which could deter some clients or reduce trading volumes. The company's ability to manage this perception is crucial for maintaining trust and a stable client base.

- High Client Loss Rates: CFDs and spread betting are inherently risky, leading to significant retail client losses, a documented concern by regulators like the FCA.

- Negative Public Perception: Widespread client losses can foster a negative public image, impacting brand trust and attractiveness.

- Regulatory Scrutiny: Increased consumer protection measures, driven by client loss data, pose a threat to IG Group's business model and client engagement.

- Client Acquisition & Retention Challenges: A damaged reputation can directly hinder the ability to attract new clients and retain existing ones.

Cybersecurity and System Resilience

IG Group's reliance on its sophisticated technological infrastructure presents a significant threat. The potential for cyberattacks, system failures, or data breaches looms large, capable of disrupting services, damaging client confidence, and incurring substantial financial and reputational costs. For instance, the financial services sector globally saw a 74% increase in ransomware attacks in 2023, highlighting the persistent danger.

The company must maintain robust cybersecurity measures to safeguard its operations and client data. A successful breach could lead to regulatory fines, loss of customer accounts, and a severe blow to its market standing. In 2024, the average cost of a data breach in the financial sector reached $5.9 million, underscoring the financial implications.

- Cyber Resilience: Continuous investment in advanced cybersecurity protocols and infrastructure is paramount to mitigate the risk of attacks and system disruptions.

- Data Protection: Ensuring the integrity and confidentiality of client data is critical to maintaining trust and avoiding regulatory penalties.

- Operational Continuity: Implementing comprehensive disaster recovery and business continuity plans is essential to minimize downtime in the event of system failures.

- Reputational Risk: Any security incident can severely damage IG Group's reputation, impacting client acquisition and retention efforts.

Intensified regulatory scrutiny, particularly concerning high-risk products like CFDs, presents a significant hurdle. Stricter rules on marketing and leverage, as seen from bodies like the FCA, can directly impact revenue and operational strategies.

The competitive landscape is fierce, with many new entrants offering commission-free trading, which puts downward pressure on pricing and necessitates ongoing investment in client acquisition and retention. This intense competition can squeeze profit margins for established players like IG Group.

Economic downturns and periods of low market volatility can reduce client trading activity, directly affecting IG Group's commission and spread-based income. For instance, subdued market movements in parts of 2023 and early 2024 impacted trading volumes.

IG Group faces reputational risk due to the high percentage of retail clients who lose money on complex products. Regulators like the FCA have highlighted these losses, potentially impacting public perception and client trust.

| Threat Area | Impact on IG Group | Supporting Data/Trend |

| Regulatory Scrutiny | Increased compliance costs, potential revenue reduction | FCA's stringent rules on CFDs in the UK; various European market restrictions |

| Intense Competition | Pricing pressure, reduced profit margins | Rise of commission-free trading platforms |

| Market Volatility & Economic Downturns | Lower trading volumes, reduced income | Impact on trading activity during periods of low market dynamism in 2023-2024 |

| Reputational Risk (Client Losses) | Damage to brand trust, client acquisition/retention challenges | FCA reports high retail investor losses on CFDs and spread betting |

SWOT Analysis Data Sources

This IG Group SWOT analysis is built upon a robust foundation of data, drawing from official financial statements, comprehensive market research reports, and expert industry analysis. These sources ensure a thorough understanding of the company's internal capabilities and external market dynamics.