IG Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IG Group Bundle

IG Group operates in a dynamic financial services landscape where intense competition and evolving client demands shape its market. Understanding the forces of rivalry, buyer power, and the threat of new entrants is crucial for navigating this environment.

The complete report reveals the real forces shaping IG Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

IG Group's ability to secure competitive pricing and execute trades efficiently hinges on its access to liquidity providers. These suppliers are crucial for offering tight spreads and rapid execution, especially in volatile markets. For instance, in 2024, the FX market saw significant liquidity shifts, with major banks adjusting their market-making activities, potentially increasing the bargaining power of remaining key providers.

The bargaining power of these liquidity providers can be substantial if IG Group faces limited alternative sources or if the liquidity offered is highly specialized. A concentrated market for specific asset classes means fewer options for IG, allowing providers to dictate terms. Conversely, a robust and diverse network of liquidity providers significantly dilutes their individual power, enabling IG to negotiate more favorable conditions.

While IG Group is known for its in-house platform development, it still relies on external technology and platform providers for essential infrastructure, software, and specialized tools. The leverage these suppliers hold hinges on how unique their solutions are and how costly it would be for IG to switch to a different provider. For example, a critical cloud service provider or a specialized data analytics software vendor could wield significant power if IG has deeply integrated their systems.

In 2024, the increasing complexity of financial technology means brokers like IG often depend on niche providers for areas like cybersecurity or advanced AI-driven trading analytics. High switching costs, stemming from proprietary integrations or data migration challenges, can amplify supplier bargaining power. IG's strategy to mitigate this involves maintaining a diverse technology ecosystem and actively seeking to avoid single-vendor dependencies, which is crucial for maintaining operational flexibility and cost control.

Market data and news feed providers hold significant bargaining power over IG Group. Access to real-time, accurate financial information is the lifeblood of IG's trading platforms and client services. Suppliers like Bloomberg or Refinitiv can command substantial licensing fees, and their control over proprietary data sets can limit IG's options. In 2023, the global financial data market was valued at over $30 billion, with a significant portion attributed to terminal services, highlighting the financial leverage these providers possess.

Regulatory Compliance Services

IG Group, as a globally regulated entity, faces significant pressure from regulatory bodies and the compliance service providers that help it navigate complex rules. These are not typical suppliers, but their influence is substantial due to the costs and effort involved in maintaining adherence across various jurisdictions. For instance, the increasing stringency of regulations from bodies like the FCA in the UK and ASIC in Australia, particularly evident in 2024 and continuing into 2025, directly impacts IG Group's operational expenses and strategic planning.

The bargaining power of these quasi-suppliers is amplified by the ever-evolving regulatory landscape. IG Group must invest heavily in legal counsel, auditing firms, and specialized consulting services to ensure compliance. Failure to do so can result in severe penalties, further underscoring the leverage these entities hold. The sheer complexity of global financial regulations means that specialized expertise is often scarce, allowing these service providers to command premium fees.

- Increased Regulatory Costs: IG Group's compliance expenditure is a direct reflection of the power exerted by regulatory frameworks and the service providers that interpret and implement them.

- Dependence on Expertise: The specialized knowledge required for regulatory adherence creates a dependency, limiting IG Group's ability to switch providers easily without incurring significant transition costs and risks.

- Impact of Evolving Rules: For example, the ongoing focus on client protection and capital requirements by regulators throughout 2024 and into 2025 necessitates continuous adaptation and investment in compliance infrastructure.

Human Capital and Specialized Talent

The fintech sector, particularly online trading platforms, heavily depends on a specialized workforce. Think developers, cybersecurity wizards, and sharp financial analysts. The demand for these skills often outstrips supply, giving these professionals considerable leverage.

This scarcity directly impacts companies like IG Group, influencing how much they spend on attracting and keeping top talent. It's a constant battle in a tech landscape that changes at lightning speed.

- Talent Scarcity: The fintech industry faces a persistent shortage of highly skilled professionals, particularly in areas like software development and cybersecurity.

- Recruitment Costs: Companies like IG Group often experience increased recruitment expenses due to competitive hiring markets for specialized talent.

- Retention Challenges: High demand for skilled employees means businesses must invest in robust retention strategies to prevent attrition, impacting overall operational costs.

- Industry Growth Impact: The ability of IG Group and similar firms to innovate and scale is directly tied to their capacity to secure and retain this specialized human capital.

The bargaining power of IG Group's suppliers, particularly liquidity providers and technology vendors, remains a key consideration. In 2024, the financial markets continued to experience shifts in liquidity provision, potentially empowering key players. Similarly, the reliance on specialized fintech solutions means that providers of critical infrastructure, like cloud services or advanced analytics, can exert significant influence due to integration costs and the uniqueness of their offerings.

What is included in the product

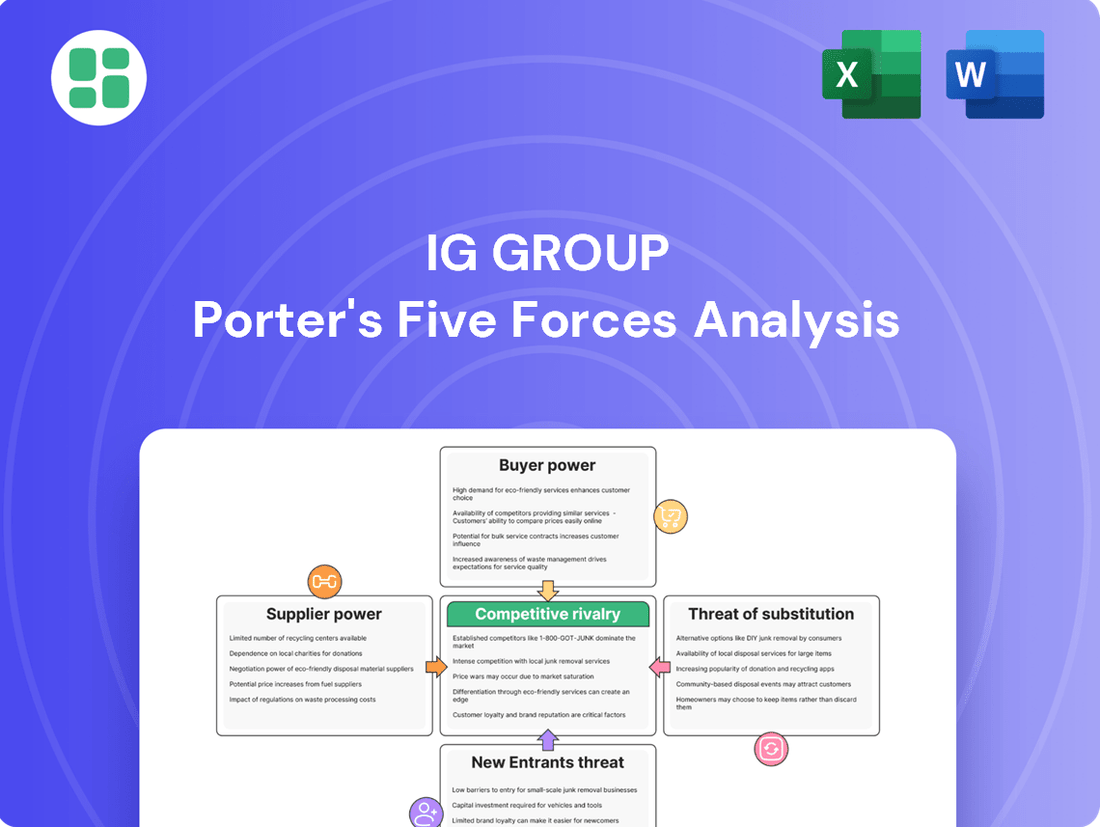

This analysis meticulously examines the five forces shaping IG Group's competitive environment, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly visualize competitive intensity across all five forces with a dynamic, interactive dashboard, simplifying complex market analysis for strategic planning.

Customers Bargaining Power

Customers in the online trading sector, including those engaging with IG Group, generally face low switching costs. This means a trader can move their account and business to a different platform with relative ease, often without significant financial penalties or technical hurdles. For example, in 2023, the average client retention rate across major online brokers remained competitive, indicating that while loyalty exists, the ability to switch is a constant factor.

This low friction in moving between providers directly amplifies customer bargaining power. Traders can readily compare and demand better terms, such as tighter spreads, reduced commission fees, or access to more advanced trading tools and research. This competitive landscape pressures platforms like IG Group to continuously innovate and offer compelling value propositions to retain their client base.

IG Group actively works to mitigate this by investing in sophisticated trading platforms, extensive educational resources, and personalized client support. These initiatives are designed to foster customer loyalty and increase the perceived value of staying with IG, thereby reducing the likelihood of clients switching purely based on minor cost differences.

Retail and institutional clients are keenly aware of trading costs, making them highly sensitive to spreads, commissions, and overnight fees. For instance, in 2024, average retail forex spreads on major currency pairs across leading platforms often hovered around 0.5 to 1.5 pips, with significant variations depending on the broker and market conditions. This sensitivity directly impacts IG Group's pricing strategies.

The ease of comparing pricing across various trading platforms online significantly boosts customer bargaining power. Tools that clearly display spreads, commission structures, and other charges allow clients to readily identify the most cost-effective options available. This transparency compels IG Group to continuously review and adjust its fee models to remain competitive in the market.

The internet has revolutionized how customers shop for financial services, and for IG Group, this means customers can easily compare trading platforms. They can check out features, what assets are available, and even how regulated a platform is. This ease of access to information means customers have more power because they can make smarter choices after looking at everything available. For instance, a recent survey in early 2024 indicated that over 70% of retail investors conduct online research before selecting a trading platform.

Regulatory Protections for Retail Clients

Regulatory bodies like the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) are crucial in safeguarding retail clients. These organizations implement stringent rules, such as caps on leverage and mandatory negative balance protection, which directly enhance customer bargaining power by limiting potential downside risk.

The ongoing intensification of these regulations throughout 2024 and into 2025 has significantly shifted the balance. For instance, the FCA’s product intervention rules introduced in 2021, which limit leverage for retail CFD clients, continue to shape market dynamics, giving customers more confidence and therefore more leverage in their dealings with firms like IG Group.

- FCA and ASIC oversight

- Key protections: leverage limits, negative balance protection, risk warnings

- Regulations intensified in 2024-2025

- Increased transparency and reduced client risk

Demand for Advanced Tools and Education

Modern traders, particularly in the retail segment, are no longer satisfied with basic trading functionalities. They actively seek advanced tools, including AI-powered analytics and in-depth educational content to navigate complex markets. For instance, in 2024, the global online trading platform market was valued at approximately USD 12.5 billion, with a significant portion driven by the demand for enhanced user experience and analytical capabilities.

This elevated expectation for sophisticated features empowers customers. Platforms like IG Group that can consistently deliver these advanced resources are better positioned to attract and retain clients. However, this also means customers have a higher bar for service, potentially increasing their collective bargaining power as they can more easily switch to competitors offering superior tools.

- Demand for Sophistication: Retail investors in 2024 showed a marked preference for platforms offering AI-driven insights and advanced charting tools.

- Educational Resources: A significant percentage of new traders reported using educational materials provided by their platform as a key factor in their choice.

- Customer Retention: Platforms investing in advanced tools and education saw higher retention rates, indicating customer willingness to pay for enhanced value.

Customers wield significant power due to low switching costs and easy price comparison. In 2024, retail investors actively researched platforms, with over 70% conducting online due diligence before selecting a provider.

This transparency pressures IG Group to offer competitive pricing, as evidenced by average retail forex spreads often remaining between 0.5 to 1.5 pips across major platforms in 2024.

Regulatory protections, such as leverage limits and negative balance protection, further bolster customer power, with rules intensifying through 2024-2025, increasing client confidence.

Customers also demand sophisticated tools and educational content, with the global online trading platform market valued at approximately USD 12.5 billion in 2024, driven by this need for enhanced features.

| Factor | Impact on IG Group | Evidence (2024 Data) |

|---|---|---|

| Switching Costs | Low, increasing customer power | High client retention competitiveness suggests ease of switching. |

| Price Sensitivity | High, forcing competitive pricing | Average retail forex spreads around 0.5-1.5 pips. |

| Information Access | Empowers customers to compare | Over 70% of retail investors research platforms online. |

| Regulatory Environment | Enhances customer protection and power | Intensified regulations in 2024-2025 provide greater client confidence. |

| Demand for Features | Drives platform innovation | USD 12.5 billion market value driven by demand for advanced tools. |

Preview Before You Purchase

IG Group Porter's Five Forces Analysis

This preview showcases the exact IG Group Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive examination of the competitive landscape. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the online trading sector. This professionally formatted document is ready for your immediate use, ensuring no surprises and full value from your investment.

Rivalry Among Competitors

The online trading arena is crowded, with numerous domestic and international players. This includes established CFD and spread betting firms like Plus500 and CMC Markets, alongside traditional brokers and emerging fintech companies, all competing fiercely for customer acquisition and market share.

This intense competition means companies must constantly innovate and offer competitive pricing to attract and retain clients. For instance, in 2024, the global online trading platform market was valued at approximately $12 billion and is projected to grow, indicating a dynamic and actively contested sector.

Low switching costs for customers significantly intensify competitive rivalry within the online trading sector. Clients can readily move between platforms, often with minimal effort or expense, forcing brokers like IG Group to constantly vie for their business. This dynamic means that if one platform offers a slightly better price, a more intuitive interface, or a novel feature, customers might not hesitate to make the change.

This ease of customer migration compels brokers to engage in aggressive marketing and pricing strategies to retain their client base and attract new ones. For instance, in 2024, many online brokers continued to offer commission-free trading on certain assets or provide attractive sign-up bonuses, directly reflecting the pressure to win and keep customers in a low-switching-cost environment. IG Group, therefore, must continuously invest in product development and client service to maintain its competitive edge.

Competitive rivalry within the online trading sector is significantly fueled by product differentiation. IG Group, for instance, distinguishes itself through its sophisticated trading platforms, offering access to over 17,000 tradable markets. This extensive selection, coupled with robust educational resources and advanced risk management tools, aims to attract and retain a diverse client base.

Innovation is a critical battleground, with firms actively integrating cutting-edge technologies. In 2024 and heading into 2025, key trends include the incorporation of artificial intelligence to enhance trading insights, the growth of social trading features allowing users to follow and replicate other traders' strategies, and the expansion of multi-asset capabilities, enabling clients to trade a broader spectrum of financial instruments from a single platform.

Regulatory Environment and Compliance Costs

IG Group operates within an increasingly stringent regulatory landscape, with bodies like the UK's Financial Conduct Authority (FCA) and Australia's ASIC imposing rigorous compliance demands. These regulations translate into substantial costs for technology, legal expertise, and reporting, impacting operational complexity. For instance, in 2024, the FCA continued to emphasize consumer protection measures, potentially increasing oversight on product suitability and marketing, which directly affects firms like IG Group.

The high cost of compliance acts as a significant barrier to entry for new players, thereby reducing the threat of new entrants. IG Group, as an established entity, possesses the scale and resources to navigate these complexities more effectively than smaller or emerging competitors. This allows them to absorb compliance expenses, which can be upwards of millions of pounds annually for large financial services firms, and maintain a competitive edge.

- FCA fines and regulatory actions: In 2023, the FCA reported issuing £563.5 million in fines for various misconducts, highlighting the financial risks of non-compliance.

- ASIC enforcement: Australia's ASIC has also been active, with significant enforcement actions in 2023-2024 related to financial advice and product governance, impacting firms operating in that market.

- Capital requirements: Increased capital requirements, often linked to regulatory frameworks like Basel III, necessitate larger financial reserves, which established firms are better positioned to meet.

- Ongoing compliance investment: Firms like IG Group must continually invest in compliance technology and personnel to adapt to evolving regulations, a cost that can be prohibitive for smaller firms.

Market Growth and Volatility

The global online trading platform market is expected to see robust growth, with projections indicating continued expansion through 2025 and beyond. This upward trend is fueled by a surge in retail investor participation and ongoing technological innovations that make trading more accessible.

Within this landscape, the CFD (Contracts for Difference) broker market also presents a positive outlook. Increased engagement from individual investors, seeking to profit from price movements in various assets, is a key driver for this segment.

Market volatility, often exacerbated by global macroeconomic pressures, can paradoxically intensify competitive rivalry. Periods of uncertainty can lead to increased trading volumes as investors attempt to capitalize on price swings, creating a heightened demand for efficient trading platforms and potentially leading to aggressive client acquisition strategies among brokers.

- Projected Market Growth: The global online trading platform market is anticipated to expand significantly, with the CFD broker market showing a positive trajectory through 2025.

- Key Growth Drivers: Increased retail investor participation and advancements in trading technology are primary factors propelling market growth.

- Impact of Volatility: Global macroeconomic pressures contribute to market volatility, which can stimulate trading activity and intensify competition for client acquisition among brokers.

Competitive rivalry within the online trading sector is intense, driven by numerous domestic and international players including established CFD firms, traditional brokers, and fintech startups. This crowded market forces companies like IG Group to continuously innovate and offer competitive pricing to attract and retain clients, with the global online trading platform market valued at approximately $12 billion in 2024.

Low switching costs empower customers to move between platforms easily, compelling brokers to employ aggressive marketing and pricing strategies, such as commission-free trading and sign-up bonuses, to maintain their client base. Product differentiation, exemplified by IG Group's extensive market access and advanced tools, is crucial for standing out. Innovation in areas like AI-driven insights and social trading is also a key battleground, with firms investing heavily in new technologies to gain an edge.

| Competitor | Key Offerings | 2024 Market Focus |

| Plus500 | CFDs on various assets, user-friendly platform | Expansion into new markets, enhanced mobile trading |

| CMC Markets | CFDs, spread betting, stockbroking, advanced charting tools | Investment in technology, focus on institutional clients |

| eToro | Social trading, CFDs, cryptocurrencies, stocks | Growth in social features, user education |

| IG Group | CFDs, spread betting, forex, stocks, options, futures, ETFs | Platform innovation, regulatory compliance, client retention |

SSubstitutes Threaten

A significant substitute for IG Group's offerings like CFDs and spread betting is direct investment in the actual assets. This means buying shares of a company, physical commodities, or cryptocurrencies outright through a traditional broker. For instance, in 2024, the global stock market capitalization approached $100 trillion, representing a vast pool of assets investors can directly own.

Many investors prefer direct ownership for its perceived simplicity and lower risk, especially for long-term wealth building. They might also opt for this route due to potentially more favorable tax treatments compared to leveraged derivative products. In 2023, retail investors globally poured billions into direct equity investments, indicating a strong preference for owning assets outright.

Exchange-Traded Funds (ETFs) and mutual funds present a significant threat of substitution for IG Group's core offerings, particularly its Contracts for Difference (CFDs). These products provide investors with diversified exposure to a wide range of markets and asset classes, often with lower leverage and less complexity than CFDs. For instance, as of early 2024, the global ETF market alone was valued in the trillions of dollars, demonstrating their widespread appeal. Investors increasingly favor these vehicles for their managed risk and straightforward approach to market participation, directly competing with the more speculative nature of CFD trading.

For more sophisticated traders, traditional futures and options contracts represent a significant substitute for CFDs. These instruments offer leveraged exposure to markets, much like CFDs, but operate under distinct regulatory frameworks and market structures. Some market participants gravitate towards these established derivatives due to their specific characteristics and often deeper liquidity, particularly in highly liquid markets.

Robo-Advisors and Automated Investing

Robo-advisors and automated investing platforms are emerging as significant substitutes for traditional active trading, including instruments like CFDs offered by IG Group. These digital solutions provide a low-cost, algorithm-driven approach to portfolio management, appealing to a growing segment of investors who prefer a passive, hands-off strategy for wealth accumulation. For instance, the global robo-advisor market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, indicating a clear shift in investor preference towards automated solutions.

These platforms directly compete by offering a simpler, often more transparent, alternative to the complex and potentially higher-risk nature of leveraged trading. Investors can access diversified portfolios tailored to their risk tolerance and financial goals with minimal human interaction, a stark contrast to the active decision-making and market monitoring required for CFD trading. The ease of use and reduced fees associated with robo-advisors make them an attractive substitute for many retail investors.

- Robo-advisor market growth: Projected to reach significant figures, with some estimates suggesting a CAGR exceeding 20% in the coming years.

- Lower cost structure: Robo-advisors typically charge lower management fees compared to traditional financial advisors or the potential costs associated with active trading.

- Accessibility: Many robo-advisor platforms have low minimum investment requirements, making them accessible to a broader range of investors.

- Passive investing trend: A growing preference among investors for passive investment strategies aligns with the core offering of robo-advisors.

Gambling and Other Forms of Speculation

Gambling and other speculative activities present a significant threat of substitutes for IG Group's offerings. Products like spread betting and Contracts for Difference (CFDs) are inherently leveraged and often focus on short-term price fluctuations, mirroring aspects of online gambling. This similarity can lead individuals to view these financial products as alternative avenues for risk-taking and entertainment.

The perception of these products as akin to gambling is amplified by the high reported losses experienced by retail clients. For instance, in 2023, IG Group reported that a substantial portion of its retail clients incurred losses on leveraged trading products. This trend can deter potential customers or cause existing ones to seek out other forms of speculative engagement or outright gambling, diverting capital and attention away from IG's platforms.

- High Retail Client Losses: In FY23, IG Group noted that 72% of its retail clients lost money trading CFDs, a figure that underscores the high-risk nature and potential for perceived substitutability with gambling.

- Alternative Risk-Taking: Individuals seeking high-stakes, short-term excitement may opt for traditional gambling avenues like casinos or sports betting, especially if they perceive financial trading as equally or more volatile and less accessible.

- Regulatory Scrutiny: The association with gambling can attract stricter regulatory oversight, potentially limiting marketing or product innovation, which in turn could push users towards less regulated or more entertainment-focused speculative channels.

The threat of substitutes for IG Group's offerings is substantial, encompassing direct asset ownership, diversified investment vehicles like ETFs and mutual funds, traditional derivatives, and even automated investing platforms. Many investors are drawn to the perceived simplicity and lower risk of owning assets outright, a trend supported by the massive global stock market capitalization, which neared $100 trillion in 2024. Furthermore, the growing popularity of ETFs, with a global market valued in the trillions by early 2024, highlights a preference for diversified and less complex investment avenues.

Entrants Threaten

The online trading sector, particularly for Contracts for Difference (CFDs), faces substantial regulatory hurdles globally. Major markets impose rigorous licensing, capital requirements, and consumer protection rules, making it difficult for newcomers to establish operations. These barriers are expected to become even more pronounced in 2024 and 2025, significantly deterring potential entrants.

Establishing a sophisticated online trading platform, like those operated by IG Group, demands considerable financial resources. This includes hefty investments in cutting-edge technology, robust cybersecurity measures, extensive marketing campaigns to build brand awareness, and navigating complex regulatory landscapes. For instance, in 2024, the global fintech market, encompassing trading platforms, saw significant investment, with companies needing to demonstrate substantial capital to even consider entering.

The financial services industry, especially for products like Contracts for Difference (CFDs), places immense value on brand reputation and customer trust. Newcomers face a significant hurdle in establishing this credibility, as clients entrust their capital to firms with proven track records. For instance, in 2023, IG Group reported a client asset balance of £10.5 billion, underscoring the scale of trust placed in established entities.

Technological Complexity and Innovation Pace

The threat of new entrants in the online trading and financial services sector is significantly influenced by technological complexity and the rapid pace of innovation. Developing and maintaining a sophisticated, secure, and high-volume trading platform, especially one incorporating AI and real-time analytics across diverse asset classes, demands substantial capital investment and specialized expertise. This high barrier to entry deters many potential newcomers who may lack the necessary R&D capabilities and financial resources to compete effectively.

New entrants must not only replicate existing technological infrastructure but also innovate to gain a competitive edge. The fintech landscape is constantly evolving, with companies like IG Group investing heavily in technology. For instance, in their 2024 fiscal year, IG Group reported technology expenditure of £200 million, highlighting the ongoing need for significant investment to stay ahead. This relentless innovation cycle means that emerging players need to demonstrate a strong capacity for research and development from the outset.

- High Capital Investment: Building and maintaining advanced trading platforms requires significant upfront and ongoing financial commitment, often in the hundreds of millions of pounds for established players like IG Group.

- Rapid Technological Advancement: The fintech sector sees constant innovation, demanding continuous R&D investment to integrate new features such as AI-driven analytics and enhanced user interfaces.

- Regulatory Compliance: New entrants must navigate complex and evolving regulatory frameworks, adding another layer of cost and complexity to market entry.

- Talent Acquisition: Securing skilled personnel in areas like AI, cybersecurity, and quantitative analysis is crucial but competitive, further increasing operational costs.

Customer Acquisition Costs

The online trading arena is fiercely competitive, driving up the expenses associated with acquiring new customers through extensive marketing campaigns and attractive promotions. Newcomers face the daunting task of investing significant capital to lure clients away from established firms, which can impede their path to early profitability.

IG Group's strategic acquisition of Freetrade in early 2025 exemplifies a proactive approach to rapidly expanding its customer base, demonstrating the lengths to which established players will go to maintain market share and grow.

- High Marketing Spend: The average customer acquisition cost (CAC) in the online brokerage sector often ranges from $200 to $500, with some firms exceeding this significantly during promotional periods.

- Brand Loyalty Challenges: Building trust and brand recognition is crucial, as investors often stick with platforms they are familiar with, making it harder for new entrants to gain traction.

- Regulatory Hurdles: New entrants must also navigate complex regulatory landscapes, adding to upfront costs and time-to-market, which can deter potential competitors.

- Platform Development: Significant investment is required in technology and user experience to match the offerings of incumbent players, further increasing the barrier to entry.

The threat of new entrants for IG Group is considerably low due to the immense capital required for platform development, regulatory compliance, and marketing. For instance, in 2024, the fintech sector continued to see substantial investment, with new trading platforms needing millions to establish robust infrastructure and secure necessary licenses. The need for continuous technological innovation, exemplified by IG Group's £200 million technology spend in fiscal year 2024, also presents a significant barrier.

Building brand trust and customer loyalty in financial services is a lengthy and costly process, making it difficult for new players to attract clients from established entities like IG Group, which held £10.5 billion in client assets in 2023. Furthermore, the high customer acquisition costs, often ranging from $200 to $500 per client in the online brokerage sector, deter many potential entrants who cannot afford aggressive marketing campaigns.

| Barrier | Description | Example Data Point |

| Capital Investment | High upfront and ongoing costs for technology, operations, and regulatory capital. | IG Group's technology spend: £200 million (FY24) |

| Regulatory Hurdles | Complex licensing, compliance, and consumer protection rules globally. | Strict capital requirements for CFD providers. |

| Brand & Trust | Established reputation and client confidence are difficult to replicate. | IG Group's client asset balance: £10.5 billion (2023) |

| Customer Acquisition Cost (CAC) | Significant marketing investment needed to attract clients from incumbents. | Industry average CAC: $200 - $500 |

Porter's Five Forces Analysis Data Sources

Our IG Group Porter's Five Forces analysis is built upon a robust foundation of data, including IG Group's annual reports, investor presentations, and official regulatory filings. We also incorporate insights from reputable financial news outlets and industry-specific market research reports to provide a comprehensive view of the competitive landscape.