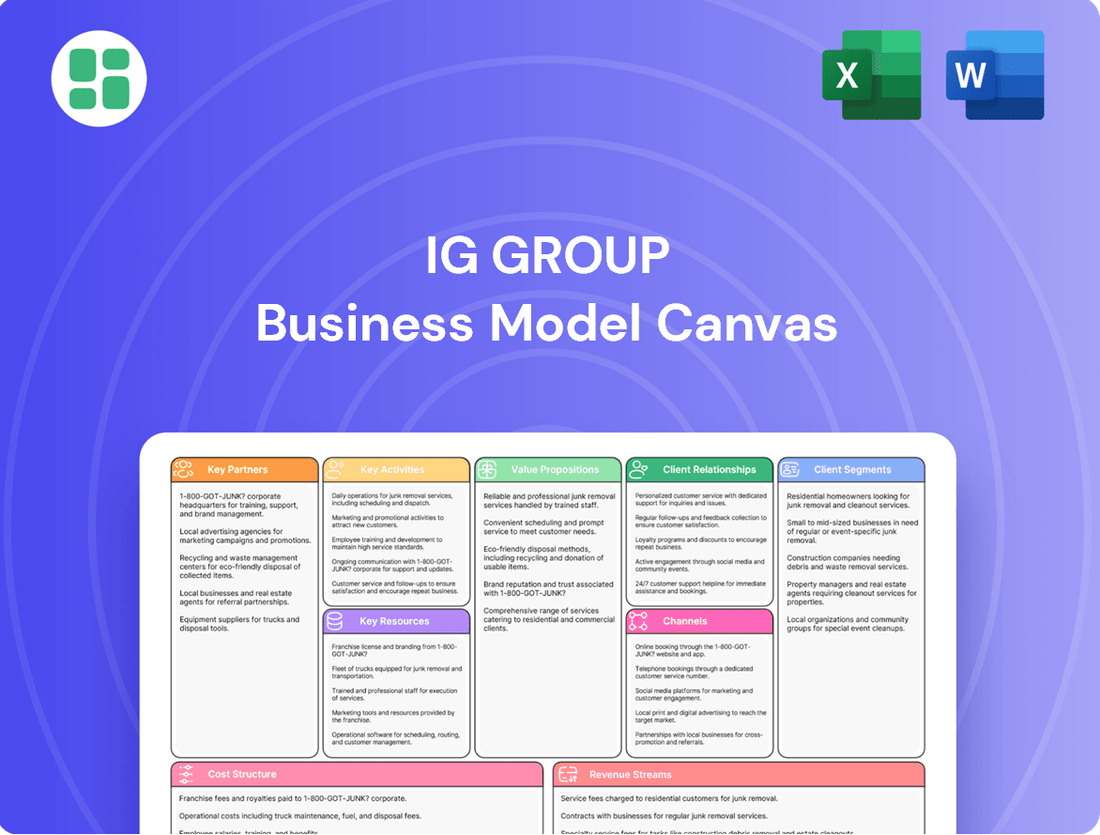

IG Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IG Group Bundle

Unlock the core strategies of IG Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they attract and retain clients, manage key resources, and generate revenue in the competitive financial services market. Gain a strategic edge by understanding their value proposition and cost structure.

Partnerships

IG Group's relationship with regulatory bodies like the UK's Financial Conduct Authority (FCA) and Singapore's Monetary Authority of Singapore (MAS) is fundamental. In 2024, these partnerships are critical for navigating the complex and ever-changing landscape of financial regulations, ensuring IG Group maintains its operating licenses and adheres to global compliance standards.

Maintaining these key partnerships involves rigorous adherence to capital adequacy ratios, transparent reporting, and demonstrating effective risk management protocols. Failure to comply can result in significant penalties and operational restrictions, underscoring the vital nature of these relationships for IG Group's global presence and continued business operations.

IG Group relies on a network of liquidity providers to ensure clients receive competitive pricing and swift trade execution across its diverse financial product offerings. These partnerships are critical for maintaining deep liquidity in markets like forex, indices, equities, commodities, and even cryptocurrencies.

This access to robust liquidity is essential for IG Group to manage significant trading volumes effectively and reduce price discrepancies, known as slippage, for its user base. For instance, in the first half of fiscal year 2024, IG Group reported a 12% increase in revenue from its core OTC products, underscoring the importance of efficient execution facilitated by strong liquidity provision.

IG Group relies on key partnerships with technology and market data providers to fuel its sophisticated trading platforms. These collaborations are vital for delivering real-time market data feeds, robust infrastructure, and specialized trading software, all of which are crucial for an enhanced user experience and platform reliability. For instance, in 2024, IG Group continued to leverage partnerships for its advanced charting tools and analytical resources, ensuring its offerings remain at the forefront of innovation.

Payment Processors

IG Group relies heavily on payment processors to ensure clients can easily and securely move funds in and out of their trading accounts. These partnerships are fundamental to client experience, especially given IG's global reach. In 2024, IG Group processed billions of dollars in client deposits and withdrawals, underscoring the vital role of these payment gateways.

These partnerships extend to a variety of financial institutions, including traditional banks, popular e-wallets, and other fintech solutions. This diversification ensures that clients worldwide have convenient and accessible payment options. For instance, in 2023, IG Group reported that a significant portion of its new client acquisition was driven by enhanced digital onboarding and payment experiences, directly influenced by its payment processor network.

- Global Reach: Partnerships with payment processors enable IG Group to serve a diverse international client base by offering localized payment methods.

- Security and Trust: Collaborations with reputable financial institutions and payment providers build client confidence in the safety of their funds.

- Transaction Efficiency: Streamlined payment processes, facilitated by these key partners, are crucial for client satisfaction and operational smoothness.

Strategic Acquisition Targets

IG Group actively pursues strategic partnerships via acquisitions to bolster its market position and product suite. A prime example is the acquisition of Freetrade, which significantly expanded IG's reach within the retail investing sector and broadened its service portfolio.

These strategic moves are instrumental in IG's growth trajectory, aiming to diversify revenue streams and tap into new customer demographics or advanced technological platforms. This inorganic growth strategy is a cornerstone of their plan to achieve more robust and sustainable expansion.

The Freetrade acquisition, completed in early 2024, brought approximately 600,000 new customers onto IG's platform, demonstrating the tangible impact of such strategic integrations. This move also provided IG with access to Freetrade's innovative app and a younger demographic of investors, aligning with IG's objective to broaden its appeal.

- Acquisition of Freetrade: Enhanced IG's retail offering and customer base, adding around 600,000 users in early 2024.

- Market Expansion: Gained access to a younger demographic and a user-friendly mobile platform.

- Revenue Diversification: Integrated Freetrade's business model to create new income streams.

- Technological Capabilities: Leveraged Freetrade's app technology to improve user experience and attract new segments.

IG Group's key partnerships are multifaceted, encompassing regulatory bodies, liquidity providers, technology firms, payment processors, and strategic acquisition targets. These collaborations are essential for maintaining operational integrity, offering competitive services, and driving future growth.

In 2024, IG Group's relationships with regulators like the FCA and MAS are paramount for compliance and license retention. Simultaneously, partnerships with liquidity providers ensure efficient trade execution across a wide range of assets. The acquisition of Freetrade in early 2024 exemplifies a strategic move to expand its retail investor base and enhance its technological offerings.

| Partnership Type | Key Role | 2024 Impact/Data |

|---|---|---|

| Regulatory Bodies (e.g., FCA, MAS) | Ensuring compliance, maintaining operating licenses | Critical for navigating evolving global regulations. |

| Liquidity Providers | Facilitating competitive pricing and trade execution | Supported a 12% revenue increase in core OTC products (H1 FY24). |

| Technology & Data Providers | Enhancing platform functionality and user experience | Continued integration of advanced charting and analytics tools. |

| Payment Processors | Enabling secure and efficient client fund transfers | Processed billions in client transactions globally. |

| Strategic Acquisitions (e.g., Freetrade) | Expanding market reach and product suite | Added ~600,000 retail customers in early 2024. |

What is included in the product

A detailed breakdown of IG Group's operations, outlining its core customer segments, diverse revenue streams, and key partnerships in the financial services industry.

This model highlights IG's competitive advantages in online trading and investment, focusing on its technology platform and global reach.

The IG Group Business Model Canvas acts as a pain point reliever by providing a clear, visual overview that simplifies complex strategies and facilitates rapid understanding.

It alleviates the pain of lengthy documentation and scattered information by condensing the entire business model into a single, easily digestible page.

Activities

IG Group's core activities revolve around the ongoing development, enhancement, and maintenance of its sophisticated online trading platforms. This critical function ensures both web and mobile interfaces are user-friendly, stable, and feature-rich, incorporating advanced analytical tools and new functionalities. For instance, in the fiscal year ending May 31, 2024, IG Group reported a 3% increase in revenue to £1.07 billion, partly driven by continued investment in platform technology to attract and retain traders.

IG Group's core activities heavily revolve around managing the inherent risks of leveraged trading and navigating complex global regulations. This includes continuous monitoring of market exposures to protect against adverse price movements and diligently managing client positions to prevent excessive leverage. Ensuring capital adequacy, a critical requirement for financial institutions, is a daily focus, with IG Group maintaining robust capital buffers well above regulatory minimums. For instance, as of their fiscal year ending May 2024, IG Group reported a strong Common Equity Tier 1 (CET1) ratio, significantly exceeding regulatory thresholds, demonstrating their commitment to financial resilience.

Adherence to compliance is not merely a legal obligation but a cornerstone of IG Group's operational integrity and client trust. This involves real-time adaptation to evolving regulatory landscapes across the numerous jurisdictions where they operate, such as the UK's Financial Conduct Authority (FCA) and similar bodies in Europe and Asia. Their compliance framework is designed to safeguard client assets and ensure fair market practices, a crucial element in maintaining their reputation as a trusted financial services provider in the competitive online trading sector.

IG Group's key activities center on attracting and keeping clients. This includes robust marketing and sales initiatives aimed at both individual retail traders and larger institutional investors. For instance, in the financial year ending May 2024, IG Group reported a significant increase in active clients, demonstrating the effectiveness of their acquisition strategies.

Retaining these clients, particularly those who generate substantial revenue, is paramount. IG employs various tactics, such as offering premium services and personalized support, to foster loyalty. Their focus on customer income retention underscores the importance of keeping high-value clients engaged and satisfied with the platform's offerings.

These efforts are supported by targeted advertising, valuable content marketing like educational webinars and market analysis, and a streamlined client onboarding process. By making it easy for new clients to start trading and providing ongoing support, IG aims for sustained growth and a strong, loyal customer base.

Market Analysis and Product Innovation

IG Group's market analysis is a core activity, focusing on identifying emerging trading opportunities across a broad spectrum of financial instruments. This proactive approach allows them to stay ahead of market shifts and client preferences. For instance, in the fiscal year ending May 2024, IG Group reported significant growth in its diversified offerings, reflecting successful product innovation.

Product innovation at IG Group involves continuously expanding their tradable asset classes and enhancing trading functionalities. This means adding new markets like emerging cryptocurrencies or developing advanced charting tools. Their commitment to this is evident in their consistent investment in technology and research, aiming to deliver a superior trading experience.

- Market Identification: IG Group actively monitors global financial markets, including forex, indices, shares, commodities, and cryptocurrencies, to pinpoint lucrative trading opportunities.

- Product Development: They innovate by expanding the variety of tradable assets and introducing new trading features and platforms designed to meet evolving client needs.

- Client Demand Focus: Product velocity is driven by a deep understanding of client requirements, ensuring new offerings are relevant and in demand.

- Fiscal Year 2024 Performance: IG Group's revenue for the year ending May 31, 2024, reached £1.06 billion, demonstrating the success of their strategic market analysis and product innovation efforts.

Customer Support and Education

IG Group places a strong emphasis on customer support and education as a core activity. This involves offering a variety of channels for assistance, including phone, live chat, and email support, ensuring clients can get help when they need it. This multi-channel approach is crucial for retaining clients and building trust in their platform.

Beyond immediate support, IG Group provides a wealth of educational resources. This includes a comprehensive library of articles, tutorials, and webinars designed to educate traders on market dynamics, trading strategies, and risk management. For instance, in the first half of fiscal year 2024, IG Group reported a significant increase in client engagement with their educational content, indicating its value.

- Multi-channel Support: Phone, chat, and email availability for client inquiries.

- Extensive Educational Library: Articles, tutorials, and webinars covering trading essentials.

- Risk Management Tools: Resources to help clients understand and manage trading risks effectively.

- Client Empowerment: Differentiates IG Group by focusing on informed trading decisions.

IG Group's key activities center on attracting and retaining clients through robust marketing and sales initiatives, targeting both retail and institutional investors. In the financial year ending May 2024, IG Group reported a notable increase in active clients, underscoring the success of their acquisition strategies.

Retaining high-value clients is paramount, with IG employing tactics like premium services and personalized support to foster loyalty and customer income retention. Their efforts are bolstered by targeted advertising, valuable content marketing such as webinars and market analysis, and a streamlined client onboarding process, all aimed at building a strong, loyal customer base.

IG Group's market analysis is a core activity, focusing on identifying emerging trading opportunities across a broad spectrum of financial instruments and continuously expanding their tradable asset classes and trading functionalities. Their commitment to product innovation is evident in consistent investment in technology and research, aiming to deliver a superior trading experience.

| Key Activity | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Client Acquisition & Retention | Marketing, sales, premium services, personalized support | Increased active clients; focus on high-value client retention |

| Market Analysis & Product Innovation | Identifying opportunities, expanding asset classes, enhancing features | Significant growth in diversified offerings; commitment to technology investment |

| Platform Development & Maintenance | Enhancing user-friendly, stable, feature-rich online trading platforms | 3% revenue increase to £1.07 billion, partly driven by platform investment |

| Risk Management & Regulatory Compliance | Monitoring market exposures, managing client positions, ensuring capital adequacy, adhering to regulations | Strong CET1 ratio exceeding regulatory thresholds; robust capital buffers |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact, complete document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is processed, you'll gain full access to this comprehensive business tool, ready for your immediate use and customization.

Resources

IG Group's proprietary trading technology, including its web and mobile platforms, is a cornerstone of its business model. These in-house developed systems handle order management, market data, and risk, ensuring speed and reliability for a seamless user experience.

In 2024, IG Group continued to invest heavily in its technological infrastructure, recognizing its importance for client retention and acquisition. This ongoing commitment to innovation allows them to offer a competitive edge in a fast-paced financial market.

IG Group's human capital is a cornerstone, featuring a highly skilled workforce. This includes financial analysts, software engineers, compliance officers, marketing specialists, and customer support teams, all crucial for operations.

Their collective expertise fuels innovation, maintains operational excellence, and ensures superior client service. For instance, in 2024, IG Group continued to invest heavily in training and development programs to keep these professionals at the forefront of financial technology and market understanding.

Talent acquisition and retention are paramount for IG Group to sustain its leadership. The company actively recruits top-tier talent, recognizing that its people are its most valuable asset in a competitive global market.

IG Group's brand reputation, cultivated over nearly five decades, is a cornerstone of its business model, fostering significant trust among its global clientele and regulatory bodies. This established credibility is vital in the highly competitive and regulated financial services sector, directly impacting client acquisition and retention.

As of early 2024, IG Group continues to leverage this strong brand, which underpins its market leadership in online trading and CFD services. The company's long-standing presence and commitment to transparency have solidified its position, enabling it to attract and maintain a substantial customer base, thereby supporting its continued market share growth.

Financial Capital

IG Group relies on substantial financial capital to fuel its global trading operations and meet stringent regulatory demands. This capital is crucial for ensuring smooth client transactions and providing the necessary liquidity.

A robust balance sheet and consistent cash flow generation are vital for IG Group. These financial strengths allow the company to seize growth opportunities, such as strategic acquisitions, and to invest in cutting-edge technology development, thereby enhancing its competitive edge.

For the fiscal year ending May 31, 2024, IG Group reported revenue of £1.05 billion. Their strong financial position, evidenced by a healthy cash reserve, enables them to not only manage day-to-day operations effectively but also to explore avenues for shareholder returns.

- Capital for Trading: Supports extensive trading activities and market presence.

- Regulatory Compliance: Meets capital adequacy requirements across various jurisdictions.

- Client Facilitation: Ensures seamless execution of client trades and fund management.

- Strategic Investment: Funds acquisitions, technology upgrades, and organic growth initiatives.

Extensive Market Access and Liquidity

IG Group's extensive market access is a cornerstone of its business model, granting clients entry to a vast array of global financial markets. This includes popular areas like foreign exchange, major stock indices, individual shares, commodities, and increasingly, cryptocurrencies. This breadth ensures a diverse offering, catering to a wide spectrum of investor interests and strategies.

Crucially, IG Group cultivates strong relationships with numerous liquidity providers. This network is vital for ensuring that trades are executed swiftly and at competitive prices, regardless of market conditions. For instance, in 2024, IG Group continued to leverage these relationships to offer tight spreads on major currency pairs, a key draw for active forex traders.

- Global Market Reach: Access to over 17,000 financial markets across 24 countries.

- Liquidity Network: Partnerships with multiple tier-1 liquidity providers ensure robust execution.

- Competitive Pricing: Broad market access and strong liquidity enable tight spreads and competitive pricing for clients.

- Diverse Product Offering: Facilitates a wide range of tradable instruments, from forex to cryptocurrencies.

IG Group's key resources also encompass its intellectual property and proprietary data analytics. This includes algorithms for pricing, risk management, and client behavior analysis, which are crucial for maintaining a competitive edge and optimizing service offerings.

In 2024, the company continued to refine its data analytics capabilities, aiming to provide more personalized trading experiences and identify emerging market trends. This focus on data-driven insights is fundamental to their strategy.

The company's regulatory licenses and approvals are indispensable key resources. These licenses, obtained across numerous global jurisdictions, permit IG Group to operate legally and offer its services to a broad international client base, underpinning its global expansion efforts.

These licenses are not merely permissions but represent a significant barrier to entry for competitors and a testament to IG Group's commitment to robust compliance frameworks. Maintaining these licenses requires continuous investment in regulatory adherence and reporting, a key operational focus throughout 2024.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Proprietary Technology | In-house trading platforms and systems | Continued investment in speed, reliability, and user experience. |

| Human Capital | Skilled workforce across finance, tech, compliance, etc. | Emphasis on training and development for market expertise. |

| Brand Reputation | Nearly 50 years of cultivated trust and credibility | Underpins market leadership and client acquisition/retention. |

| Financial Capital | Substantial capital for operations and regulatory demands | Supported £1.05 billion revenue in FY24 and strategic investments. |

| Market Access & Liquidity | Access to 17,000+ markets via strong liquidity provider relationships | Enabled tight spreads and competitive pricing in 2024. |

| Intellectual Property | Algorithms for pricing, risk management, and analytics | Refined data analytics for personalized trading and trend identification. |

| Regulatory Licenses | Approvals to operate in multiple global jurisdictions | Permitted legal operation and global expansion, requiring continuous compliance investment. |

Value Propositions

IG Group provides clients with unparalleled access to a wide spectrum of global financial markets. This includes major asset classes like forex, global indices, individual shares, commodities, and even cryptocurrencies, all accessible through their innovative spread betting and CFD products.

This extensive market reach empowers traders to speculate on price movements across a diverse range of asset classes from a single, user-friendly platform. For instance, as of early 2024, IG Group's platform supports trading in over 17,000 global markets, reflecting its commitment to broad accessibility.

IG's advanced trading platforms offer clients sophisticated, intuitive, and highly functional interfaces accessible via web and mobile. These tools are packed with cutting-edge charting, in-depth analytical capabilities, and robust risk management features, empowering users for informed decisions.

In 2024, IG reported that over 70% of its trades were executed through its proprietary digital platforms, highlighting their central role in client engagement and operational efficiency. This focus on technology ensures traders have the resources for efficient execution and strategic market navigation.

IG Group offers a wealth of educational resources designed to empower traders. This includes in-depth articles, live webinars, and practical tutorials covering everything from basic trading concepts to advanced strategies. For instance, in the fiscal year ending May 2024, IG reported a significant increase in engagement with their educational content, with over 1.5 million unique visitors accessing their learning materials.

Beyond self-directed learning, IG provides robust customer support across various channels. Clients can reach out via phone, email, or live chat for assistance with platform navigation, account queries, or market insights. This multi-channel support ensures that traders, whether beginners or seasoned professionals, receive timely and effective help, contributing to their confidence and ability to manage risk in volatile markets.

Robust Risk Management and Security

IG Group prioritizes client protection through advanced risk management tools. Guaranteed stop-loss orders and negative balance protection are key features, allowing traders to cap potential losses and prevent owing more than their initial deposit. This commitment to limiting downside risk is a cornerstone of their offering.

Security and regulatory adherence are paramount for IG Group, fostering a trustworthy trading environment. Operating across numerous regulated jurisdictions, the company adheres to strict financial standards, ensuring client funds are segregated and protected. This robust framework underpins their reputation as a secure platform.

- Risk Mitigation: Guaranteed stops and negative balance protection limit client exposure.

- Security Measures: Robust systems safeguard client data and assets.

- Regulatory Compliance: Adherence to multiple jurisdictional regulations builds trust.

- Client Confidence: These features collectively create a secure and reliable trading experience.

Global Reach and Localized Service

IG Group leverages its extensive global footprint, with a presence in key financial hubs across Europe, North America, Africa, Asia-Pacific, and the Middle East. This expansive network enables them to offer localized services and support, ensuring clients receive tailored assistance relevant to their specific markets and regulatory environments.

This strategic positioning allows IG Group to effectively serve a diverse international clientele. By adapting their offerings and adhering to local regulations, they build trust and provide a seamless trading experience, regardless of a client's geographical location.

For instance, as of their fiscal year ending May 2024, IG Group reported a significant portion of their revenue originating from international markets, underscoring the success of their global reach and localized service strategy. Their commitment to understanding and navigating varied regulatory landscapes, such as those in the EU and Australia, is a cornerstone of this value proposition.

- Global Office Network: Presence in over 20 countries.

- Localized Support: Dedicated teams in major regions.

- Regulatory Compliance: Adherence to over 15 different regulatory bodies.

- International Revenue Contribution: Over 70% of revenue derived from outside the UK in recent fiscal periods.

IG Group's value proposition centers on providing broad market access, sophisticated trading platforms, and comprehensive educational resources. They empower traders with tools for risk management and security, all while maintaining a strong global presence with localized support.

| Value Proposition Element | Key Features | Supporting Data (FY24) |

|---|---|---|

| Market Access | Forex, indices, shares, commodities, crypto | 17,000+ global markets available |

| Trading Platforms | Intuitive, charting, analytics, risk management | 70%+ of trades via proprietary digital platforms |

| Education & Support | Articles, webinars, tutorials, multi-channel support | 1.5M+ unique visitors to learning materials |

| Risk Management & Security | Guaranteed stops, negative balance protection, regulated | Operates under 15+ regulatory bodies |

| Global Reach | Presence in 20+ countries, localized services | 70%+ revenue from outside the UK |

Customer Relationships

IG Group heavily emphasizes self-service and digital tools, empowering clients to manage accounts, execute trades, and access market data independently through its intuitive platforms. This digital-first strategy not only boosts operational efficiency but also caters to the growing demand for client autonomy and convenience in financial management.

In 2024, IG Group reported a significant portion of its trading volume was executed through its digital channels, underscoring the success of its self-service model. This reliance on digital tools allows IG to scale its operations cost-effectively while providing a seamless and responsive experience for its diverse global client base.

For IG Group's high-value clients, a dedicated account manager is the cornerstone of their customer relationship strategy. This personalized approach ensures that institutional and high-volume traders receive tailored support, including bespoke product offerings and in-depth market analysis. This fosters a strong sense of loyalty and significantly boosts client retention.

IG Group cultivates strong customer relationships through extensive educational initiatives. This includes a robust offering of webinars, seminars, and in-depth trading courses designed to equip clients with essential market knowledge and trading skills.

By consistently providing valuable educational content, IG Group fosters a sense of partnership, moving beyond a transactional relationship. This focus on client empowerment not only enhances user confidence but also significantly contributes to long-term client retention and loyalty.

For instance, in their 2024 fiscal year, IG Group reported a significant increase in engagement with their educational resources, with over 500,000 participants attending their online and in-person learning events, underscoring the importance of this strategy in building lasting customer connections.

Responsive Multi-Channel Support

IG Group offers responsive multi-channel support, ensuring clients can connect through phone, email, and live chat. This accessibility is vital for quick issue resolution and assistance, especially in the dynamic trading world.

This approach directly impacts client retention and trust. In 2024, IG Group reported a significant portion of customer queries being resolved within minutes via their live chat service, demonstrating the effectiveness of their multi-channel strategy.

- Phone Support: Available for immediate, in-depth assistance.

- Email Support: For less urgent inquiries and detailed explanations.

- Live Chat: Offering real-time solutions and quick query handling.

- Self-Service Resources: A comprehensive FAQ and knowledge base also available.

Community and Content Interaction

IG Group cultivates strong customer bonds by offering a wealth of educational resources through platforms like DailyFX. This content-driven approach, combined with social trading features, creates a vibrant community where clients can learn from each other and seasoned traders.

This active engagement within the IG ecosystem not only deepens client loyalty but also fosters a sense of belonging. For instance, in the first half of fiscal year 2024, IG reported a significant increase in user engagement across its content platforms, reflecting the success of this strategy.

- DailyFX provides market analysis and trading education, attracting and retaining clients.

- Social trading features enable peer-to-peer learning and community building.

- This integrated approach enhances the client experience and strengthens loyalty.

- User engagement metrics for H1 FY24 indicate a positive trend in community interaction.

IG Group's customer relationship strategy is multifaceted, blending digital self-service with personalized support for high-value clients. This approach aims to foster loyalty and retention through education and responsive assistance.

In fiscal year 2024, IG Group saw a substantial portion of its trading volume generated through its digital platforms, highlighting the effectiveness of its self-service model. This digital focus allows for scalable operations and consistent client experience.

For key clients, dedicated account managers provide tailored services, including bespoke product offerings and market insights, which are crucial for maintaining strong relationships and high retention rates.

Educational resources, such as webinars and trading courses, are a cornerstone of IG's strategy, empowering clients and fostering a sense of partnership. In H1 FY24, over 500,000 clients engaged with these learning events.

| Relationship Type | Key Features | FY24 Data/Impact |

|---|---|---|

| Self-Service Digital | Intuitive platforms, account management, market data access | Significant portion of trading volume executed via digital channels |

| Personalized High-Value | Dedicated account managers, tailored support, bespoke offerings | Crucial for institutional and high-volume trader retention |

| Educational Engagement | Webinars, seminars, trading courses, DailyFX content | Over 500,000 participants in H1 FY24; enhances client confidence and loyalty |

| Multi-Channel Support | Phone, email, live chat, FAQ/knowledge base | High query resolution via live chat; builds trust and responsiveness |

Channels

IG Group's primary channels for reaching its diverse client base are its sophisticated proprietary web-based trading platform and its user-friendly native mobile applications for both iOS and Android devices. These digital gateways are the core touchpoints where clients engage with financial markets, execute trades efficiently, and manage their investment portfolios. The platforms are meticulously engineered for intuitive navigation and robust performance, ensuring a seamless trading experience.

In 2024, IG Group continued to invest heavily in its digital infrastructure. The company reported that the majority of its client trades were executed through these online channels, reflecting a strong preference for digital access. Mobile trading, in particular, saw significant growth, with a substantial percentage of daily active users accessing their accounts via the IG app, demonstrating the critical role of mobile accessibility in client engagement and retention.

IG Group actively engages potential clients through a multi-channel approach, encompassing robust online marketing strategies like SEO, paid search, and targeted social media advertising. These efforts are designed to attract and convert prospects into active users on their trading platforms.

Content marketing plays a crucial role, providing valuable educational resources to attract and retain clients. In 2024, IG Group continued to invest heavily in digital advertising, aiming to drive significant traffic and lead generation through these direct sales and marketing initiatives.

IG Group leverages a robust network of introducing brokers (IBs) and affiliate partners to significantly broaden its market presence. These partnerships are crucial for client acquisition, especially in territories where direct outreach is challenging or expensive. For instance, in 2024, IG reported that a substantial portion of its new client onboarding was driven through these indirect channels, highlighting their effectiveness in expanding the customer base.

These IBs and affiliates act as vital conduits, referring potential clients to IG's trading platforms and services. In return for their efforts, they receive competitive compensation, typically structured as commissions on trades executed by their referred clients or a share of the revenue generated. This mutually beneficial arrangement incentivizes partners to actively promote IG's offerings, contributing directly to the company's growth trajectory.

Educational Content Portals (e.g., DailyFX)

Educational content portals like DailyFX serve as vital channels for IG Group, attracting and educating potential clients through free market analysis, trading news, and comprehensive learning resources. These platforms solidify IG Group's reputation as a trusted authority in the financial markets, drawing in individuals keen on understanding and engaging with trading.

In 2024, DailyFX continued to be a cornerstone of IG Group's client acquisition strategy, with its content reaching millions of users seeking market insights. The portal's commitment to providing accessible, high-quality educational material is key to converting interested visitors into active traders.

- Client Acquisition: DailyFX attracts a broad audience interested in financial markets, acting as a primary lead generation channel for IG Group.

- Brand Authority: The portal's consistent delivery of expert analysis and educational content builds trust and positions IG Group as a thought leader.

- User Engagement: Offering free, valuable resources encourages repeat visits and deeper engagement with IG Group's broader service offerings.

- Market Reach: In 2024, DailyFX's global audience demonstrated the platform's effectiveness in reaching diverse segments of potential traders worldwide.

Strategic Acquisitions

Strategic Acquisitions represent a key channel for IG Group's business model, enabling swift expansion into new customer segments and markets. A prime example is the acquisition of Freetrade, which significantly bolstered IG's reach, particularly among younger, digitally-native investors. This inorganic growth strategy allows IG to rapidly scale its customer base and market penetration.

In 2024, IG Group's strategic acquisition of Freetrade, a commission-free trading platform, was a significant move. This acquisition aimed to tap into a younger demographic and expand IG's market share in the retail investment space. The integration of Freetrade's user base and technology is designed to accelerate IG's growth trajectory.

- Customer Acquisition: Acquisitions like Freetrade provide immediate access to a pre-existing customer base, accelerating customer acquisition efforts.

- Market Penetration: By acquiring companies with established presence in specific niches or demographics, IG can deepen its market penetration.

- Service Expansion: Acquired entities often bring unique technologies or service offerings that can be integrated to broaden IG's overall value proposition.

- Synergistic Growth: Strategic acquisitions can unlock synergies, leading to cost efficiencies and enhanced revenue opportunities through cross-selling and platform integration.

IG Group's channels are predominantly digital, centered around its proprietary web and mobile trading platforms, which are the primary interaction points for clients. Complementing these direct channels are extensive online marketing efforts, including SEO and social media, designed to attract new users. Furthermore, strategic partnerships with introducing brokers and affiliates significantly expand IG's market reach, while content platforms like DailyFX serve as crucial educational and lead generation tools.

| Channel Type | Description | Key 2024 Insight |

|---|---|---|

| Proprietary Platforms | Web-based and mobile apps for trading and portfolio management. | Majority of client trades executed digitally; mobile usage showed significant growth. |

| Online Marketing | SEO, paid search, social media advertising. | Continued heavy investment in digital advertising for traffic and lead generation. |

| Introducing Brokers & Affiliates | Partnerships for client acquisition, especially in new markets. | Substantial portion of new client onboarding driven by these indirect channels. |

| Content Platforms (e.g., DailyFX) | Educational resources, market analysis, news. | Attracted millions of users, reinforcing brand authority and acting as a lead source. |

| Strategic Acquisitions | Acquiring companies to expand customer base and market reach. | Acquisition of Freetrade aimed to tap into younger demographics and expand retail market share. |

Customer Segments

Active Retail Traders are IG Group's bedrock, individuals who dive into leveraged trading via CFDs and spread bets across a wide array of financial markets. These clients are drawn to IG's sophisticated trading platforms, extensive market offerings, and a wealth of educational materials designed to support their speculative trading strategies.

In 2024, the retail trading landscape remained dynamic, with platforms like IG continuing to attract a significant volume of individual investors. These traders are typically looking for opportunities to profit from short-term price fluctuations, often utilizing leverage to amplify potential gains, though this also increases risk.

IG's focus on this segment is evident in its continuous investment in technology and product development, aiming to provide a competitive edge. The company’s ability to offer access to thousands of global markets, from equities and forex to indices and commodities, is a key differentiator for these active participants.

Experienced and professional traders, including high-net-worth individuals and institutional clients, represent a key customer segment for IG Group. These sophisticated users demand robust trading infrastructure, including deep liquidity and advanced execution tools, often leveraging products like L2 Dealer for direct market access and complex strategies.

New and aspiring traders are individuals venturing into online trading for the first time. They actively seek user-friendly platforms, robust educational resources, and effective risk management tools to build their trading knowledge and confidence. IG Group's commitment to simplifying the onboarding journey and offering extensive learning support directly addresses these needs.

Stock Trading and Investment Clients (e.g., Freetrade acquisition)

IG Group's acquisition of Freetrade significantly broadens its customer base, bringing in individuals focused on direct stock trading and long-term investing. These clients often prioritize commission-free or low-cost access to the equities market, expanding IG's reach beyond its traditional leveraged trading clientele.

This strategic move allows IG to tap into a growing segment of retail investors. For instance, Freetrade reported over 1 million customers by the end of 2023, demonstrating a substantial market presence in this area. This influx of users diversifies IG's revenue streams and competitive positioning.

- Expanded Market Reach: Gaining access to a large pool of retail investors interested in direct equity ownership.

- Diversified Revenue Streams: Supplementing existing revenue from leveraged products with potential income from increased trading volumes and other services.

- Competitive Advantage: Offering a more comprehensive suite of investment products, catering to both short-term traders and long-term investors.

- Client Acquisition: Freetrade's existing customer base of over 1 million provides an immediate growth opportunity for IG Group.

Institutional Clients

While IG Group is widely recognized for its retail trading platform, it also caters to institutional clients, offering specialized trading solutions. This segment benefits from IG’s robust infrastructure, including API access for algorithmic trading and bespoke liquidity arrangements. For example, in the fiscal year ending May 31, 2024, IG Group reported significant revenue growth, with its institutional division contributing to this expansion through tailored services.

This institutional segment, though smaller than its retail counterpart, represents a high-value client base. These clients, often hedge funds, asset managers, and proprietary trading firms, demand sophisticated trading tools and reliable execution. IG's ability to provide customized liquidity and direct market access through its institutional arm, IG Prime, underscores its commitment to serving diverse market participants.

Key offerings for institutional clients include:

- API Access: Direct integration for automated trading strategies.

- Bespoke Liquidity: Tailored pricing and execution for large volumes.

- Prime Brokerage Services: Comprehensive support for institutional trading needs.

- Dedicated Account Management: Specialized service for high-net-worth and institutional accounts.

IG Group serves a broad spectrum of customers, from individual retail traders to institutional entities. Active retail traders, a core segment, engage in leveraged trading across numerous financial markets, attracted by IG's advanced platforms and extensive educational resources.

The company also targets experienced and professional traders, including high-net-worth individuals and institutions, who require sophisticated infrastructure and advanced execution tools for complex strategies. Furthermore, new and aspiring traders are a key demographic, seeking user-friendly platforms and robust learning support to build their trading acumen.

IG's strategic acquisition of Freetrade in 2024 expanded its reach to a significant base of retail investors focused on direct stock trading and long-term investing, with Freetrade boasting over 1 million customers by the end of 2023. This diversification caters to a wider range of investment preferences.

| Customer Segment | Key Characteristics | IG's Value Proposition |

|---|---|---|

| Active Retail Traders | Speculative, short-term trading, leverage users | Sophisticated platforms, broad market access, educational tools |

| Experienced/Professional Traders | High-net-worth, institutions, complex strategies | Robust infrastructure, deep liquidity, advanced execution (e.g., L2 Dealer) |

| New/Aspiring Traders | First-time traders, seeking guidance | User-friendly platforms, extensive learning resources, risk management tools |

| Freetrade Customers (Acquired) | Direct stock trading, long-term investing | Low-cost equity access, expanded product suite |

| Institutional Clients | Hedge funds, asset managers, prop trading firms | API access, bespoke liquidity, prime brokerage services |

Cost Structure

IG Group invests heavily in its proprietary trading platforms and the underlying IT infrastructure. These costs are substantial, covering the ongoing development, maintenance, and upgrades necessary to ensure a robust and high-performing trading environment for its global customer base.

Significant expenses are allocated to software development, acquiring and maintaining hardware, utilizing cloud services, and implementing stringent cybersecurity measures. These investments are critical for platform reliability, speed, and the protection of client data, directly impacting the user experience and operational integrity.

For the fiscal year ending May 31, 2023, IG Group reported technology costs of £235.9 million. This figure underscores the considerable investment required to maintain its technological edge in the competitive online trading landscape, with ongoing efforts to enhance platform capabilities and security protocols.

IG Group dedicates a significant portion of its budget to acquiring new clients and building its brand. This includes spending on advertising, various digital marketing strategies like search engine optimization and paid ads, and payments to affiliates. These marketing and sales expenses are crucial for attracting new customers and ensuring the company remains visible in a crowded marketplace.

Personnel and employee costs are a significant component of IG Group's operational expenses. This includes salaries, benefits, and ongoing training for their global workforce, which spans technology development, sales and marketing, customer support, compliance, and management functions.

In 2024, IG Group, like many in the financial services sector, likely continued to invest heavily in attracting and retaining top talent, particularly in specialized areas like cybersecurity and data analytics. These investments are crucial for innovation and maintaining a competitive edge in service delivery.

The company's commitment to human capital development is a strategic imperative, directly impacting its ability to innovate, adapt to market changes, and ensure high-quality customer service across its diverse product offerings.

Regulatory and Compliance Costs

Operating within the financial services sector necessitates substantial investment in regulatory and compliance activities. IG Group, like its peers, faces significant expenses associated with securing and retaining licenses in various global markets, alongside the ongoing costs of meticulous regulatory reporting and adherence to evolving financial laws. These expenditures encompass legal counsel, the salaries of dedicated compliance professionals, and the costs of regular audits to ensure full adherence.

For instance, in the fiscal year ending May 31, 2023, IG Group reported that its operating expenses included significant allocations towards regulatory and compliance frameworks. While specific line items for regulatory costs are often embedded within broader operational expenses, the sheer volume of regulatory oversight in markets like the UK (FCA regulated), Europe (CySEC, BaFin, etc.), and Australia (ASIC regulated) underscores the continuous financial commitment required. These costs are not static; they fluctuate with regulatory changes and the expansion into new territories, demanding constant vigilance and resource allocation.

- Licensing and Authorization: Costs incurred to obtain and maintain operating licenses in jurisdictions like the UK, EU, and Australia.

- Regulatory Reporting: Expenses related to submitting detailed financial and operational reports to regulatory bodies.

- Compliance Personnel and Systems: Investment in staff salaries, training, and technology to manage and monitor adherence to regulations.

- Legal and Advisory Fees: Payments to legal firms and consultants for guidance on complex and changing regulatory landscapes.

Data Subscriptions and Liquidity Provider Fees

IG Group incurs significant costs for data subscriptions, sourcing real-time market feeds from numerous global exchanges and leading financial information providers. These subscriptions are vital for delivering accurate pricing and up-to-the-minute market insights to their clients.

Furthermore, the company pays substantial fees to liquidity providers. These payments are essential for securing reliable market access and ensuring efficient, swift trade execution for the vast volume of transactions processed on their platforms. In 2024, for example, such operational costs are a core component of their expense base, directly impacting profitability.

- Data Feed Subscriptions: Costs for accessing real-time price and news feeds from exchanges like the LSE, NYSE, and CME, as well as data aggregators.

- Liquidity Provider Fees: Payments made to banks and other financial institutions for providing bid and offer prices and facilitating trade execution.

- Technology Infrastructure: Expenses related to maintaining the high-speed, low-latency trading systems required to process these data feeds and execute trades efficiently.

IG Group's cost structure is heavily influenced by its technology investments, which are crucial for platform performance and security. In the fiscal year ending May 31, 2023, technology costs alone reached £235.9 million, highlighting the significant expenditure required to maintain a competitive edge.

Marketing and sales are another major cost area, essential for client acquisition and brand visibility. Personnel costs, encompassing salaries, benefits, and training for a global workforce, also represent a substantial portion of their expenses, particularly in specialized roles.

Furthermore, regulatory and compliance activities demand continuous financial commitment, including licensing, reporting, and legal fees. Finally, data subscriptions and liquidity provider fees are vital operational costs for ensuring accurate pricing and efficient trade execution.

| Cost Category | Description | Fiscal Year Ending May 31, 2023 (Millions £) |

|---|---|---|

| Technology | Platform development, IT infrastructure, cybersecurity | 235.9 |

| Marketing & Sales | Client acquisition, advertising, digital marketing | [Data not separately disclosed, but significant] |

| Personnel | Salaries, benefits, training for global workforce | [Data not separately disclosed, but significant] |

| Regulatory & Compliance | Licensing, reporting, legal fees | [Embedded within operating expenses, significant] |

| Operational (Data & Liquidity) | Data feeds, liquidity provider fees | [Embedded within operating expenses, significant] |

Revenue Streams

IG Group's core revenue generation hinges on the spreads applied to Contracts for Difference (CFDs) and spread bets. These are offered across a wide array of financial instruments including forex, major stock indices, and commodities, effectively capturing the difference between the bid and ask prices.

For the fiscal year ending May 31, 2024, IG Group reported significant revenue from these trading activities. The company's revenue for FY24 reached £1.07 billion, with a substantial portion directly attributable to the trading income derived from client transactions in CFDs and spread betting.

Net Interest Income is a key revenue stream for IG Group, stemming from interest earned on segregated client funds and their own cash reserves, especially when interest rates are elevated. This diversifies their financial performance, adding a stable element to overall earnings.

In the first half of fiscal year 2024, IG Group reported a substantial £107 million in net interest income, highlighting its growing importance. This figure represented a significant increase, underscoring the benefit of the higher interest rate environment on this particular revenue stream.

IG Group generates revenue from its exchange-traded derivatives, like those offered through Spectrum. This stream comes from fees and commissions earned on trading activities conducted on regulated exchanges, broadening their offerings beyond leveraged over-the-counter products.

Stock Trading and Investment Fees (from acquisitions like Freetrade)

IG Group’s revenue streams have expanded to include stock trading and investment services, notably through acquisitions like Freetrade. This strategic move diversifies their income beyond traditional leveraged products, allowing them to capture revenue from a wider range of investor activities. This includes potential income from subscription fees for premium investment features, revenue generated from order flow, and commissions earned on equity transactions.

The integration of Freetrade, a popular commission-free trading platform, significantly bolsters IG's presence in the retail investment market. This allows IG to tap into a younger demographic and those seeking to invest in a broader array of assets beyond CFDs and forex. For instance, in the first half of FY24, IG reported a substantial increase in its stockbroking client numbers, reflecting the success of these diversification efforts and the growing appeal of their expanded offering.

- Diversification into Stock Trading: IG Group now generates revenue from commissions and fees associated with executing stock trades for its clients.

- Subscription and Order Flow Revenue: Potential income streams include recurring subscription fees for enhanced trading tools or data, and revenue from payment for order flow arrangements.

- Expanded Investor Base: Acquisitions like Freetrade allow IG to attract and serve a broader spectrum of investors, including those focused on long-term equity investments rather than solely leveraged products.

- Market Share Growth: This expansion positions IG to compete more directly with other online brokers and investment platforms, aiming to capture a larger share of the retail investment market.

Premium Services and Data Subscriptions

While IG Group's core revenue comes from trading spreads and commissions, a significant opportunity lies in premium services and data subscriptions. These offerings cater to a more sophisticated clientele seeking an edge.

For instance, advanced charting tools, real-time premium news feeds, or exclusive market analysis reports can be bundled into subscription packages. These value-added services can generate recurring income from engaged users, particularly professional traders and institutional clients who rely on superior data and analytics.

Consider the potential for tiered subscription models. A basic tier might offer enhanced charting, while a premium tier could include direct access to IG's research analysts or specialized algorithmic trading tools. This approach allows IG to monetize its expertise and proprietary data effectively.

- Premium Features: Offering advanced trading platforms, sophisticated charting tools, and proprietary analytical indicators for a subscription fee.

- Specialized Data Feeds: Providing real-time, in-depth market data, news, and research tailored to specific asset classes or trading strategies.

- Professional Client Services: Bundling dedicated account management, personalized trading insights, and priority support for high-value or institutional customers.

- Educational Content: Monetizing exclusive webinars, advanced trading courses, and in-depth market commentary for subscribers.

IG Group diversifies its revenue through stock trading and investment services, particularly after acquiring platforms like Freetrade. This broadens their income beyond leveraged products to include commissions on equity transactions and potential subscription fees for premium features.

This strategic expansion allows IG to attract a wider investor base, including those focused on traditional investing, not just speculative trading. For example, in the first half of FY24, IG saw a notable increase in stockbroking clients, demonstrating the success of this diversification.

The company also generates revenue from premium services and data subscriptions, catering to clients seeking advanced tools and insights. These value-added offerings, such as enhanced charting or exclusive market analysis, create recurring income streams, especially from professional traders.

| Revenue Stream | Description | FY24 Contribution (Approximate) |

|---|---|---|

| Trading Spreads & Commissions | Core business from CFDs, spread bets, forex, indices, commodities | £1.07 billion (Total Revenue) |

| Net Interest Income | Interest on client funds and own cash reserves | £107 million (H1 FY24) |

| Exchange-Traded Derivatives | Fees and commissions from trading on regulated exchanges (e.g., Spectrum) | Included within trading revenue |

| Stock Trading & Investment Services | Commissions and fees from equity transactions, subscription revenue | Growing contribution, boosted by Freetrade acquisition |

| Premium Services & Data Subscriptions | Recurring fees for advanced tools, data, and research | Potential for significant recurring income |

Business Model Canvas Data Sources

The IG Group Business Model Canvas is built upon a foundation of comprehensive financial reports, extensive market research, and internal operational data. These diverse sources ensure each component of the canvas is informed by accurate, actionable insights.