IG Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IG Group Bundle

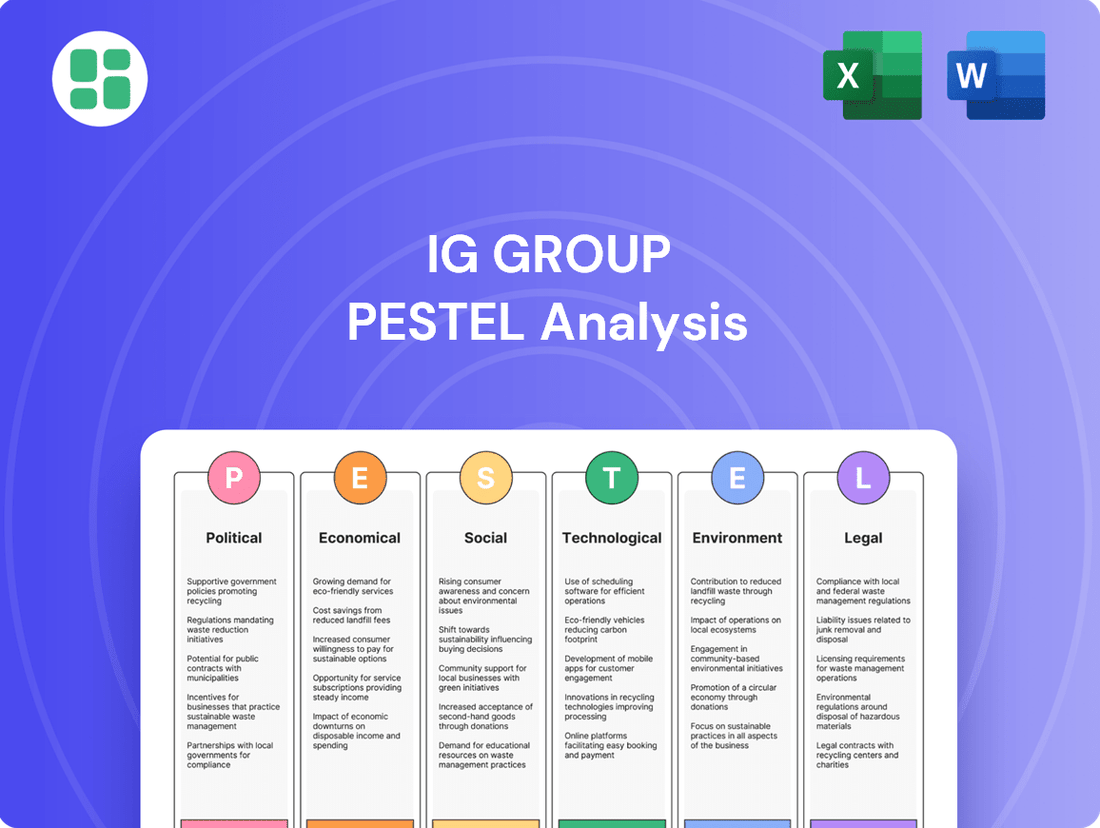

Navigate the complex external environment affecting IG Group with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping the company's strategic landscape. Gain a competitive edge by leveraging these critical insights to inform your own business planning and investment decisions. Download the full, actionable report now.

Political factors

Governments and financial watchdogs worldwide, including the UK's Financial Conduct Authority (FCA) and the European Securities and Markets Authority (ESMA), are keeping a close eye on products like Contracts for Difference (CFDs) and spread betting. These bodies are implementing rules such as limits on how much leverage traders can use and requiring clear warnings about potential losses. For instance, the FCA has maintained its 2018 rules on retail CFD trading, including leverage limits and product governance requirements, which continue to shape the market in 2024 and 2025.

The regulatory environment for digital assets is a significant political factor for IG Group, with key markets actively shaping new rules. The UK's move to bring stablecoins and crypto trading platforms under the Financial Services and Markets Act (FSMA) perimeter by early 2025 highlights this evolution. This regulatory shift is designed to enhance legal clarity and market integrity, directly impacting how IG Group can structure and offer its crypto-related derivative products.

Ongoing geopolitical tensions, including conflicts in Eastern Europe and the Middle East, coupled with persistent inflationary pressures and currency fluctuations, are significantly amplifying market volatility. For instance, the IMF projected global inflation to be 5.9% in 2024, a slight decrease from 6.9% in 2023, but still elevated, impacting investment strategies.

This heightened volatility creates both opportunities for speculative trading and a critical need for robust risk management, a core function for firms like IG Group. The impact of political events on investor sentiment is substantial; for example, major elections or trade policy shifts can trigger rapid trading volume surges across forex, equities, and commodities.

Government Stance on Financial Innovation

Governments globally are navigating a complex path, aiming to protect consumers while simultaneously encouraging advancements in financial technology, such as AI in trading and digital payment systems. This balancing act is crucial for maintaining competitive financial hubs.

For IG Group, this means adapting to evolving regulatory landscapes. For instance, the UK's Financial Conduct Authority (FCA) continues to refine its approach to cryptoassets and decentralized finance, impacting how firms can engage with these markets. In 2024, discussions around AI governance in finance intensified, with bodies like the European Union proposing frameworks to ensure responsible AI deployment.

- Regulatory Scrutiny: Increased focus on consumer protection in digital assets and AI-driven financial services.

- Innovation Support: Efforts to foster fintech growth to maintain financial center competitiveness.

- Global Harmonization: Ongoing efforts by international bodies to standardize regulations for emerging financial technologies.

International Regulatory Divergence

Despite ongoing efforts toward global financial standards, significant differences in regulatory frameworks persist across key markets, creating operational complexities for a multinational entity like IG Group. For instance, the European Union's Markets in Crypto-Assets (MiCAR) regulation, fully implemented in June 2024, establishes a comprehensive regime for digital assets, contrasting with the United Kingdom's more phased and evolving approach to crypto regulation, which began with consultations in 2023 and continued through 2024.

This divergence means IG Group must maintain distinct compliance strategies tailored to each jurisdiction it operates within, impacting product offerings and operational procedures. For example, navigating the varying capital requirements and consumer protection rules between the EU and the UK necessitates robust legal and compliance teams.

- EU MiCAR Implementation: The EU's MiCAR framework, fully effective from June 30, 2024, mandates specific licensing and operational requirements for crypto-asset service providers across member states.

- UK Regulatory Evolution: The UK's approach, as outlined in its Financial Services and Markets Act 2023 and subsequent consultations, continues to develop, with a focus on phased implementation and specific asset classes.

- Compliance Costs: Adhering to these differing regimes can lead to increased compliance expenditure, estimated by some industry reports to be in the tens of millions of pounds annually for large financial institutions operating across multiple regions.

Political factors significantly shape IG Group's operating environment through evolving regulations and geopolitical stability. The UK's Financial Conduct Authority (FCA) continues to enforce strict rules on leveraged products, with leverage limits and product governance requirements remaining in place through 2024 and 2025. Similarly, the EU's Markets in Crypto-Assets (MiCAR) regulation, fully implemented in June 2024, sets new standards for crypto service providers, requiring distinct compliance strategies for IG Group across different jurisdictions.

Geopolitical tensions, such as those in Eastern Europe and the Middle East, contribute to market volatility, impacting trading volumes and necessitating robust risk management. The IMF projected global inflation at 5.9% for 2024, a figure that, while down from 2023, still signals an environment where political events can trigger rapid market shifts.

Governments are also focused on fostering fintech innovation while ensuring consumer protection, leading to frameworks for AI in finance, like those proposed by the EU in 2024. This dual focus means IG Group must navigate a complex landscape of supporting new technologies while adhering to stringent consumer safety measures.

| Factor | Description | Implication for IG Group | Data Point/Example |

| Regulatory Scrutiny | Increased oversight on leveraged products and digital assets. | Requires adherence to diverse and evolving compliance standards. | FCA leverage limits maintained through 2024-2025. |

| Geopolitical Instability | Conflicts and trade tensions amplify market volatility. | Creates trading opportunities but demands enhanced risk management. | IMF projects 5.9% global inflation in 2024. |

| Fintech Regulation | Balancing innovation with consumer protection in areas like AI and crypto. | Necessitates adaptation to new technological and ethical guidelines. | EU MiCAR regulation fully implemented June 2024. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing IG Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate these complex dynamics, empowering IG Group to identify opportunities and mitigate risks in its operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting IG Group.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences on IG Group.

Economic factors

The global economy is anticipated to maintain its growth trajectory through 2024 and into 2025, though this expansion will likely exhibit regional disparities. These varying economic conditions directly influence investor confidence and, consequently, the volume of trading activity across financial markets. IG Group's own financial results for the fiscal year ending May 31, 2025, underscore this, with a reported 9% rise in total revenue, indicative of favorable market environments and successful strategic execution.

Emerging markets, in particular, are poised for robust economic expansion. This growth, combined with a steady increase in internet accessibility worldwide, is a significant tailwind for the online trading platform sector. More people gaining online access means a larger potential customer base for services like those offered by IG Group.

Central bank decisions on interest rates and inflation trends are major drivers for financial markets, impacting how assets are valued and how investors behave. For a company like IG Group, these factors are paramount.

For instance, IG Group reported a 6% decrease in net interest income for FY25, a direct consequence of evolving interest rate policies. However, the increased market volatility that often accompanies these policy shifts can simultaneously boost trading activity, particularly in leveraged products, which are a core offering for IG Group.

These macroeconomic forces directly influence trading volumes and client engagement, making them critical considerations for IG Group's strategic planning and operational performance.

Heightened market volatility, fueled by global economic uncertainties and geopolitical tensions, creates a fertile ground for trading opportunities, particularly in speculative instruments like Contracts for Difference (CFDs). This dynamic environment often draws in a greater number of retail investors seeking to capitalize on price fluctuations. For instance, retail CFD trading volumes saw significant expansion in 2024, a trend anticipated to persist into 2025, according to industry analysts.

IG Group is well-positioned to leverage this increased activity, as its business model thrives on clients' capacity to trade on both upward and downward market movements. The company's platform facilitates speculation across a wide range of volatile assets, directly benefiting from the heightened trading volumes characteristic of such market conditions.

Disposable Income and Retail Investor Participation

Rising disposable income is a significant tailwind for online trading platforms like IG Group. As individuals have more discretionary funds, they are more likely to explore investment opportunities. This trend is particularly pronounced in emerging markets, where a growing middle class is gaining access to financial markets for the first time.

The accessibility of online trading platforms and a general increase in financial literacy are empowering more people to participate in financial markets. This democratization of investing means a broader pool of potential clients for IG Group. For instance, global wealth is projected to reach $77.7 trillion by 2025, up from $45.6 trillion in 2019, indicating a substantial increase in the capital available for investment.

- Global Wealth Growth: Total global wealth is expected to reach $77.7 trillion by 2025, presenting a larger potential client base for investment platforms.

- Emerging Market Potential: Rising disposable incomes in developing economies are opening up new avenues for retail investor participation.

- Digital Accessibility: The proliferation of user-friendly online and mobile trading platforms lowers the barrier to entry for new investors.

- Financial Literacy Initiatives: Increased focus on financial education is equipping more individuals with the knowledge to engage in trading and investment.

Competitive Market Dynamics and Pricing

The online trading platform sector is intensely competitive, forcing brokers like IG Group to constantly refine pricing and bolster their service offerings. This environment necessitates attractive spreads and value-added features to retain clients and attract new ones.

IG Group's strategic initiatives, including efforts to enhance customer income retention and operational efficiency, are crucial for maintaining its market position. The acquisition of Freetrade in late 2023, valued at £140 million, is a prime example of this strategy, aiming to broaden IG's reach within the retail investing market and capture a larger share of the addressable market.

- Intense Competition: The online trading platform market is characterized by numerous players, leading to significant pricing pressure.

- Focus on Retention: IG Group prioritizes improving customer income retention and operational efficiency to stay competitive.

- Strategic Acquisitions: The acquisition of Freetrade for £140 million in late 2023 demonstrates IG's commitment to expanding its market share and customer base.

- Service Differentiation: Brokers must offer attractive spreads and a comprehensive suite of services to stand out in this crowded market.

Global economic growth is projected to continue through 2024 and 2025, though regional variations will persist. IG Group reported a 9% revenue increase for FY25, reflecting positive market conditions. Emerging markets, with growing internet access, offer significant potential for online trading platforms. Interest rate decisions and inflation trends heavily influence investor behavior and asset valuations, impacting IG Group's performance.

Market volatility, driven by economic uncertainties, creates trading opportunities, especially in leveraged products like CFDs. Retail CFD trading saw substantial growth in 2024, a trend expected to continue into 2025. IG Group's model benefits from this, as it facilitates trading on both rising and falling markets. Rising disposable incomes globally, projected to reach $77.7 trillion by 2025, expand the potential client base for investment platforms.

| Economic Factor | Impact on IG Group | Supporting Data/Trend |

| Global Economic Growth | Increased trading volumes, higher investor confidence | Projected continued growth through 2024-2025 |

| Interest Rates & Inflation | Influence asset valuation, investor behavior, net interest income | IG Group reported a 6% decrease in net interest income for FY25 |

| Market Volatility | Boosts trading activity, particularly in leveraged products | Retail CFD trading volumes expanded significantly in 2024 |

| Disposable Income Growth | Expands potential client base for investment platforms | Global wealth projected to reach $77.7 trillion by 2025 |

Preview the Actual Deliverable

IG Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive IG Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping IG Group's market landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis provides actionable insights into the opportunities and threats facing IG Group, crucial for competitive advantage.

Sociological factors

The landscape of retail trading is undergoing a significant demographic shift. We're seeing a marked rise in younger individuals, particularly those in their 20s and 30s, who are increasingly turning to trading as a supplementary income source and are actively participating in global financial markets. This trend highlights a demand for intuitive, readily accessible trading platforms that also offer a diverse array of financial instruments.

IG Group's strategic acquisition of Freetrade in late 2022 was a pivotal move, directly addressing this evolving demographic. This acquisition integrated a substantial base of active customers, primarily within the younger trading cohort, thereby expanding IG's reach and solidifying its position in this growing market segment. Freetrade brought with it a user-friendly interface, appealing to a generation accustomed to digital-first experiences.

The surge in online trading platforms has fueled a significant rise in demand for financial literacy and educational resources. Many new investors, eager to participate in markets, are actively seeking guidance on trading strategies and understanding investment risks. This trend is evident as platforms offering educational content and robust risk management tools, like those provided by IG Group, are increasingly attractive to a broader client base.

Public perception of online trading, especially with leveraged products, remains a significant factor, often shaped by ongoing regulatory oversight and anxieties surrounding high-risk investments. For IG Group, cultivating and maintaining trust is paramount, requiring clear communication about potential risks.

Demonstrating unwavering integrity is key to attracting and retaining clients in the online trading space. This means companies like IG Group must prioritize transparent risk disclosures and diligently uphold consumer protection obligations. For instance, in the UK, the Financial Conduct Authority (FCA) has implemented stricter rules on leveraged products, impacting how firms market these instruments, a trend likely to continue through 2024 and 2025, influencing public confidence.

Influence of Digitalization and Mobile Adoption

The accelerating pace of digitalization and the near-ubiquitous adoption of smartphones have fundamentally reshaped how individuals engage with financial markets. This shift has democratized access to online trading, bringing sophisticated investment tools to a much wider global audience. For instance, by the end of 2024, projections indicate over 7 billion people worldwide will be smartphone users, a significant portion of whom are increasingly comfortable managing their finances digitally.

The ease with which users can now execute trades and monitor their investment portfolios directly from their mobile devices has dramatically boosted engagement across a diverse spectrum of investors. This convenience fosters a deeper connection with financial platforms, encouraging more frequent interaction and active participation. As of early 2025, mobile trading apps account for over 60% of all retail trading volume in major developed markets, highlighting their critical importance.

Consequently, there's a pronounced and growing demand for trading applications that are not only powerful but also exceptionally user-friendly and intuitive. Companies like IG Group must continually invest in refining their mobile offerings to meet these evolving user expectations. This includes features such as:

- Real-time market data and charting tools

- Seamless execution of trades across various asset classes

- Personalized portfolio management dashboards

- Integrated educational resources for new traders

Social Media and Information Dissemination

Social media platforms are now central to how financial information spreads, directly shaping market sentiment. This rapid dissemination, which can include both factual insights and misinformation, profoundly affects how traders assess risk and make investment choices. For IG Group, this necessitates a dynamic approach to marketing, not only to connect with digitally native demographics but also to uphold stringent standards for financial promotions.

The sheer volume of financial discourse on platforms like X (formerly Twitter) and Reddit's WallStreetBets community highlights this trend. For instance, during 2024, discussions on these platforms significantly influenced the volatility of certain meme stocks, demonstrating the power of social media in driving trading activity. IG Group must therefore navigate this landscape by leveraging social media for targeted engagement while implementing robust content moderation to combat misleading financial advice.

- Influence on Market Sentiment: Social media discussions can create herd behavior, amplifying both positive and negative market reactions.

- Information Velocity: News and trading ideas spread almost instantaneously, reducing the time for traditional analysis.

- Regulatory Scrutiny: Financial regulators are increasingly monitoring social media for market manipulation and non-compliant promotions.

- Marketing Adaptation: IG Group needs to develop authentic and compliant social media campaigns to reach younger, digitally-engaged investors.

The demographic shift towards younger, digitally-native traders is a significant sociological factor impacting IG Group. These investors, often in their 20s and 30s, prioritize intuitive platforms and accessible educational content, as evidenced by the substantial user base acquired through the Freetrade acquisition. This trend underscores the need for user-friendly interfaces and robust risk management tools to cater to a generation accustomed to immediate digital experiences.

Technological factors

IG Group's commitment to technological advancement is evident in its continuous development of sophisticated trading platforms. These in-house built systems, including native mobile applications and HTML5 web platforms, are designed to offer an exceptional user experience, a critical factor in retaining and attracting clients in the fast-paced financial markets. This focus on innovation ensures IG remains competitive.

The company prioritizes robust infrastructure to support seamless order execution, real-time market data feeds, and sophisticated risk management capabilities. This technological backbone is essential for providing reliable and efficient trading services, a key differentiator for IG Group. Their investment in these areas directly impacts operational efficiency and client trust.

IG Group is leveraging artificial intelligence (AI) and machine learning (ML) to enhance its online trading platforms, offering real-time market analysis and predictive insights. This integration allows for more sophisticated automated trading strategies, giving users a competitive edge. For instance, AI-powered pattern recognition can identify trading opportunities that might otherwise be missed.

The company's strategic investments in AI and advanced identity solutions are designed to pinpoint and engage specific customer segments more effectively, thereby boosting marketing campaign performance. This focus on data-driven personalization is crucial in the competitive online trading landscape, aiming to improve customer acquisition and retention rates.

IG Group's reliance on digital platforms for trading and client data makes cybersecurity and operational resilience absolutely critical. The company must invest heavily in protecting its systems from evolving cyber threats to maintain client trust and regulatory compliance.

The upcoming Digital Operations Resilience Act (DORA), effective January 2025, will impose stringent requirements on financial entities like IG Group regarding ICT risk management and cyber threat intelligence sharing. Failure to comply could result in significant penalties, underscoring the need for proactive adaptation to these new technological and regulatory landscapes.

Cloud Computing and Infrastructure Flexibility

The financial trading landscape is increasingly prioritizing robust and adaptable IT infrastructure, driving a significant adoption of cloud-based solutions. This trend directly influences IG Group's strategic IT decisions, pushing for greater agility and resilience in its operations.

While major cloud providers remain a key component, there's a noticeable shift towards multi-cloud or hybrid cloud strategies among brokerages. This diversification aims to mitigate risks associated with vendor lock-in and bolster overall system flexibility, a critical consideration for IG Group.

The global cloud computing market is projected to reach $1.3 trillion by 2025, highlighting the scale of this technological transformation. For IG Group, embracing these flexible infrastructures is not just about cost-efficiency but also about ensuring uninterrupted service and the capacity to scale rapidly in response to market demands.

- Increased adoption of cloud services: Financial firms are moving workloads to the cloud for scalability and cost savings.

- Hybrid and multi-cloud strategies: Diversifying cloud providers reduces dependency and enhances operational flexibility.

- Impact on IT infrastructure: This necessitates a re-evaluation of IG Group's IT architecture and vendor relationships.

- Market growth: The cloud market's continued expansion underscores the strategic importance of these technologies for financial services.

Expansion of Product Offerings via Technology

Technological advancements are crucial for IG Group's expansion of product offerings. A prime example is the introduction of cryptocurrency derivatives, a move that directly addresses growing investor interest in digital assets. IG Markets Limited's partnership with an external provider in May 2025 to facilitate this expansion highlights the strategic use of technology to enter new markets.

This technological integration allows IG Group to seamlessly offer new asset classes, broadening its appeal to a wider investor base. By leveraging technology, the company can efficiently manage the complexities associated with novel financial products, ensuring a smooth user experience.

- Cryptocurrency Derivatives: IG Markets Limited partnered in May 2025 to offer crypto derivatives, expanding its product suite.

- Market Responsiveness: Technology enables rapid adaptation to evolving investor demand for new asset classes.

- Seamless Integration: Advanced platforms facilitate the smooth addition and management of new financial products.

Technological factors significantly shape IG Group's competitive edge, driving innovation in trading platforms and operational efficiency. The company's investment in AI and machine learning enhances real-time market analysis and personalized customer engagement, crucial for client acquisition and retention in the dynamic financial sector. IG's proactive adoption of cloud services, including hybrid and multi-cloud strategies, underscores a commitment to scalability, resilience, and mitigating vendor dependency, aligning with the projected $1.3 trillion global cloud computing market by 2025.

The expansion into cryptocurrency derivatives, facilitated by a May 2025 partnership, exemplifies how technology enables IG Group to swiftly integrate new asset classes, catering to evolving investor interests. Furthermore, upcoming regulations like the Digital Operations Resilience Act (DORA) from January 2025 mandate robust ICT risk management, pushing IG Group to continually fortify its cybersecurity and operational resilience.

| Technology Area | IG Group's Focus | Market Trend/Impact (2024-2025) |

|---|---|---|

| Trading Platforms | In-house built, native mobile, HTML5 web | Enhanced user experience, crucial for client retention. |

| AI/Machine Learning | Real-time analysis, predictive insights, automated strategies | Competitive edge through sophisticated pattern recognition and personalized marketing. |

| Cloud Computing | Hybrid/Multi-cloud strategies, scalability, resilience | Global market projected at $1.3 trillion by 2025; crucial for agility and uninterrupted service. |

| Cybersecurity | Protecting systems, client trust, regulatory compliance | Essential due to increasing cyber threats and regulations like DORA (effective Jan 2025). |

| New Product Integration | Cryptocurrency derivatives (May 2025 partnership) | Leveraging technology for rapid expansion into new asset classes and wider investor appeal. |

Legal factors

The Financial Conduct Authority (FCA) maintains rigorous oversight of CFD providers in the UK, enforcing stringent regulations such as leverage caps, essential risk disclosures, and a ban on promotional incentives. A significant directive for 2025 is the strict application of the Consumer Duty, which mandates that firms ensure positive outcomes for retail clients and demonstrate their compliance.

A critical deadline for CFD firm CEOs was January 31, 2025, by which they were required to deliberate and establish a consensus on the subsequent actions concerning identified risks.

The UK is actively shaping its approach to digital assets, with the Property (Digital Assets etc.) Bill proposing to classify them as a distinct category of personal property. This legislative move aims to bolster legal protections for digital asset holders.

Further solidifying this direction, HM Treasury released a draft Cryptoassets Order in April 2025. This order signals the intent to bring cryptoassets within the scope of the Financial Services and Markets Act (FSMA).

Consequently, the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) will be tasked with developing new, comprehensive rulebooks to govern this evolving sector. This regulatory evolution is crucial for market stability and investor confidence.

IG Group, like all financial institutions, faces stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. The UK’s Financial Conduct Authority (FCA) continues to emphasize robust controls, particularly as the financial landscape evolves with digital assets and sophisticated trading methods such as Obfuscated Overseas Aggregated Accounts (OOAAs). Firms are under pressure to enhance their surveillance systems to detect and prevent market abuse more effectively.

In 2024, the FCA fined firms billions for AML and KYC failings, underscoring the significant financial and reputational risks associated with non-compliance. For instance, in early 2024, a major bank was fined £20 million for inadequate AML controls. This ongoing regulatory scrutiny means IG Group must continuously invest in technology and training to ensure its compliance frameworks remain effective and meet evolving supervisory expectations.

Data Protection and Privacy Laws (e.g., GDPR)

Global data protection regulations, like the EU's General Data Protection Regulation (GDPR), continue to be a critical legal framework for IG Group. These laws dictate how the company must collect, process, and store client data, making compliance paramount for maintaining trust and avoiding substantial fines. For instance, GDPR violations can result in penalties of up to 4% of global annual turnover or €20 million, whichever is greater.

While specific new legislation impacting IG Group's data handling wasn't a prominent feature in 2024-2025 reporting, the ongoing enforcement and evolution of existing privacy laws remain a fundamental legal consideration. Businesses operating online, especially in financial services, must continuously adapt their practices to align with these stringent requirements.

- GDPR Fines: Potential penalties can reach 4% of annual global turnover or €20 million.

- Client Trust: Adherence to data protection laws is crucial for maintaining customer confidence.

- Global Reach: IG Group's international operations necessitate compliance with multiple data privacy regimes.

- Evolving Landscape: The legal environment surrounding data privacy is constantly changing, requiring ongoing vigilance.

Class Action Lawsuits and Legal Challenges

IG Group is navigating significant legal headwinds, including a class action lawsuit filed in Australia. This suit specifically targets the sale of over-the-counter (OTC) derivatives to retail clients between May 2017 and August 2023. While the case is in its early stages, it underscores the persistent litigation risks inherent in the heavily regulated financial services sector.

These legal challenges necessitate substantial investment in robust legal defense and stringent compliance measures. The potential financial and reputational impact of such lawsuits, regardless of their current phase, remains a critical consideration for IG Group's operational strategy and risk management framework.

- Class Action Lawsuit: IG Group faces a class action in Australia concerning OTC derivative sales to retail investors from May 2017 to August 2023.

- Litigation Risk: Such legal actions highlight the ongoing exposure to litigation in the financial services industry.

- Compliance Focus: The need for strong legal defense and adherence to regulatory compliance is paramount.

IG Group operates under strict UK financial regulations, with the FCA enforcing leverage caps and risk disclosures, and the Consumer Duty for 2025 emphasizing positive retail client outcomes. The UK's evolving stance on digital assets, with proposed legislation classifying them as personal property and HM Treasury's draft Cryptoassets Order in April 2025 aiming to bring them under FSMA, means IG must adapt to new FCA and PRA rulebooks. Furthermore, the company faces significant AML/KYC compliance demands, underscored by the FCA's substantial fines in 2024 for failings, and must navigate global data protection laws like GDPR, which carry penalties up to 4% of global annual turnover.

IG Group is also confronting litigation, including an Australian class action lawsuit concerning OTC derivative sales to retail clients between May 2017 and August 2023, highlighting the inherent litigation risks in financial services.

| Regulatory Area | Key Requirement/Action | Impact/Risk | Date/Period |

|---|---|---|---|

| UK Financial Services | FCA Consumer Duty | Mandates positive retail client outcomes; requires demonstrable compliance. | Effective 2025 |

| Digital Assets | Property (Digital Assets etc.) Bill & Draft Cryptoassets Order | Classifies digital assets as property, brings them under FSMA; requires new FCA/PRA rules. | Proposed/April 2025 |

| AML/KYC | Enhanced surveillance and controls | FCA fines in 2024 for failings; risk of significant financial and reputational damage. | Ongoing, noted in 2024 |

| Data Protection | GDPR compliance | Penalties up to 4% of global annual turnover or €20 million for violations. | Ongoing enforcement |

| Litigation | Australian Class Action Lawsuit | Concerns OTC derivative sales to retail clients (May 2017-Aug 2023); litigation risk. | Filed in Australia |

Environmental factors

The financial sector is experiencing a significant shift towards robust Environmental, Social, and Governance (ESG) management and reporting. This global trend is driven by investor demand and regulatory pressures, pushing companies like IG Group to integrate sustainability into their core strategies. IG Group's commitment to the Science Based Target initiative by 2024, aimed at defining a net-zero pathway, and its inclusion of Taskforce on Climate-related Financial Disclosures (TCFD) in annual reports, demonstrates this proactive approach.

Further reinforcing this movement, new European Union regulations concerning ESG rating activities commenced in January 2025. These regulations are designed to increase transparency and reliability in ESG assessments, impacting how financial firms like IG Group are evaluated and how they communicate their sustainability performance to stakeholders.

IG Group's reliance on extensive IT infrastructure, including data centers, inherently contributes to its operational carbon footprint. While precise figures for IG's direct emissions aren't readily available, the company’s stated commitment to net-zero pathways signals an active effort to monitor and reduce energy consumption across its digital operations.

The growing investor appetite for Environmental, Social, and Governance (ESG) compliant investments presents a subtle but significant environmental factor. While IG Group's core business revolves around derivatives like CFDs, the broader market's shift towards sustainability, evidenced by a projected 20% compound annual growth rate for ESG funds globally through 2027, could indirectly shape strategic considerations.

This increasing demand for sustainable products may prompt IG Group to explore how ESG principles can be integrated into its operations or even consider offering new investment avenues that cater to this evolving investor preference. For instance, by 2025, it's anticipated that ESG-focused assets under management will surpass $50 trillion worldwide, highlighting the scale of this market shift.

Corporate Social Responsibility (CSR) Initiatives

IG Group's commitment to corporate social responsibility (CSR) extends beyond environmental concerns, encompassing ethical conduct and societal contributions. This aligns with their regulatory duty to protect clients and foster a robust culture of integrity.

In 2024, IG Group continued to emphasize its dedication to responsible business practices. Their efforts often involve supporting educational programs and promoting financial literacy, aiming to empower individuals and communities.

The company's CSR strategy is intrinsically linked to its governance framework, ensuring transparency and accountability in all operations. This focus on good governance is crucial for maintaining client trust and meeting evolving stakeholder expectations.

- Ethical Conduct: IG Group prioritizes fair treatment of clients and employees, with clear codes of conduct in place.

- Community Engagement: Initiatives often focus on financial education and support for local communities.

- Governance: Strong oversight mechanisms are central to ensuring responsible business operations and client protection.

- Regulatory Alignment: CSR activities are designed to complement and uphold stringent regulatory requirements within the financial services sector.

Climate-Related Financial Disclosures

Regulatory frameworks and investor expectations are increasingly pushing companies to disclose climate-related financial risks and opportunities. This trend is driven by a growing awareness of the potential financial impacts of climate change on businesses.

IG Group, aligning with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, incorporates material climate-related information into its annual reports. This demonstrates a commitment to transparency regarding identified risks and their ongoing management strategies.

- Increased Regulatory Scrutiny: By 2024, a significant number of global stock exchanges and regulators had implemented or were planning to implement mandatory climate disclosure rules, impacting companies like IG Group.

- Investor Demand for ESG Data: In 2024, institutional investors managing trillions of dollars continued to prioritize Environmental, Social, and Governance (ESG) factors, directly influencing corporate reporting practices.

- TCFD Adoption Growth: The number of organizations supporting the TCFD recommendations steadily grew through 2024 and into early 2025, signaling a broad industry shift towards standardized climate risk reporting.

- Financial Impact Assessment: Companies are increasingly expected to quantify the financial implications of climate risks, such as physical damage to assets or transition risks associated with policy changes, as part of their disclosures.

The financial sector's increasing focus on Environmental, Social, and Governance (ESG) factors is a significant environmental consideration for IG Group. Investor demand for sustainable investments is growing, with ESG-focused assets projected to exceed $50 trillion globally by 2025, influencing strategic decisions.

IG Group's operational carbon footprint, stemming from its IT infrastructure, is also under scrutiny. The company's commitment to a net-zero pathway, as evidenced by its Science Based Target initiative by 2024, indicates efforts to monitor and reduce energy consumption in its digital operations.

New EU regulations on ESG rating activities, effective January 2025, will enhance transparency and impact how firms like IG Group are evaluated and communicate their sustainability performance.

The growing market for ESG investments, with global ESG funds expected to grow at a 20% CAGR through 2027, could indirectly shape IG Group's offerings and operational considerations.

| Environmental Factor | Impact on IG Group | Data/Trend |

|---|---|---|

| Climate Change Awareness & Regulation | Increased reporting requirements, focus on carbon footprint reduction. | TCFD adoption growing through 2024-2025; many stock exchanges implementing mandatory climate disclosure rules by 2024. |

| ESG Investment Growth | Potential for new product development, influence on client preferences. | ESG assets under management to surpass $50 trillion by 2025; ESG funds projected 20% CAGR globally through 2027. |

| Operational Energy Consumption | Need to monitor and reduce emissions from IT infrastructure. | Commitment to net-zero pathways signals active monitoring and reduction efforts. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for IG Group is built on a robust foundation of data from official financial regulatory bodies, global economic trend reports, and reputable industry analysis firms. We meticulously gather insights on political stability, economic indicators, technological advancements, and social shifts to ensure comprehensive and accurate assessments.