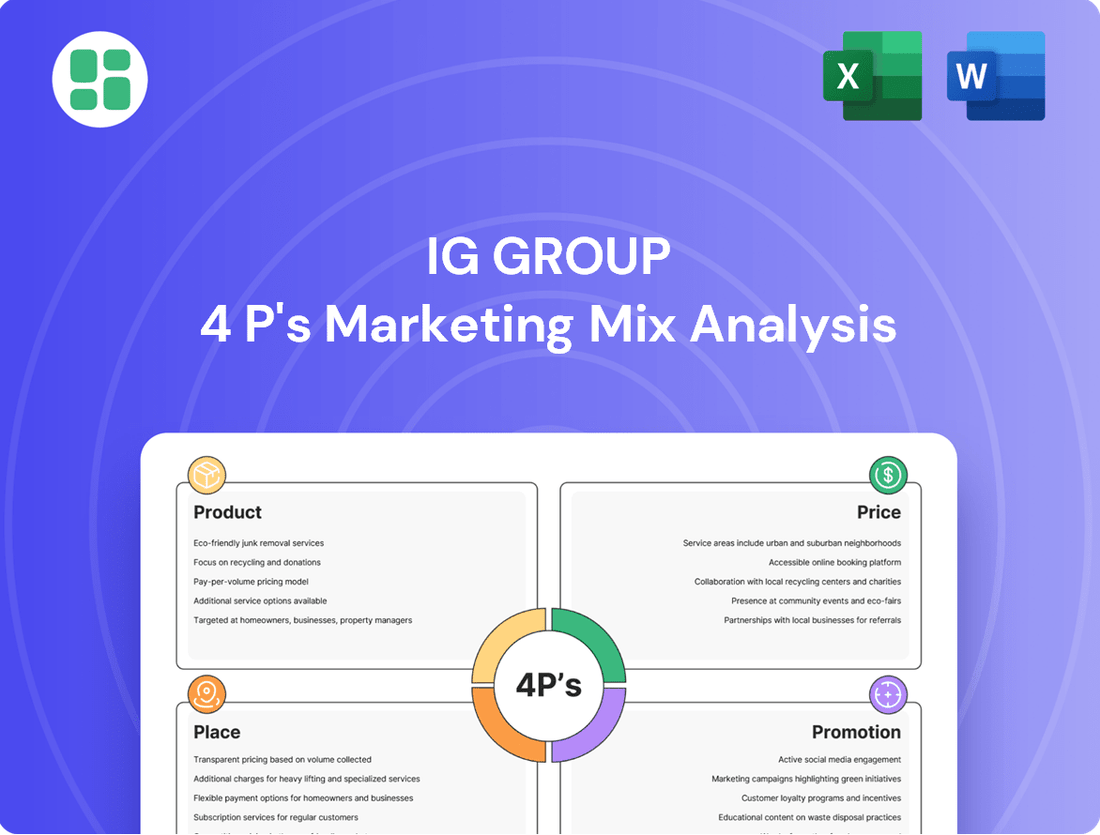

IG Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IG Group Bundle

IG Group expertly crafts its product offerings, from CFDs to spread betting, catering to a diverse trading audience. Their pricing strategy is competitive, with tight spreads and transparent fees, ensuring accessibility for various investor levels.

Discover the intricacies of IG Group's distribution channels and promotional campaigns that drive customer acquisition and retention. This analysis goes beyond the surface, offering a comprehensive understanding of their marketing success.

Save valuable time and gain a competitive edge with our ready-made, editable 4Ps Marketing Mix Analysis for IG Group. It's perfect for students, professionals, and anyone seeking actionable marketing insights.

Product

IG Group provides a broad array of financial instruments, with a core emphasis on Contracts for Difference (CFDs) and spread betting. These products allow traders to profit from price fluctuations without needing to own the actual assets, covering markets like forex, indices, shares, commodities, and cryptocurrencies.

This extensive market access caters to diverse trading strategies and preferences. For instance, as of the first half of fiscal year 2024, IG reported significant trading volumes across these instruments, demonstrating strong client engagement.

The strategic acquisition of Freetrade in late 2023 is a key development, enhancing IG's offering in the UK. This move is expected to broaden their customer base by integrating direct-to-consumer stock trading and investment capabilities, further diversifying their product suite.

IG Group's advanced trading platforms are a cornerstone of their product offering, catering to a wide range of trading needs. They provide access to proprietary web-based platforms, mobile applications like IG Invest, and popular third-party options such as MetaTrader 4 and ProRealTime. For those requiring direct market access, L2 Dealer is also available.

These platforms are engineered for speed and precision, featuring robust charting capabilities and highly customizable interfaces. This ensures that both new traders and seasoned professionals can execute trades efficiently and manage their portfolios effectively. The intuitive design, including straightforward deal tickets, simplifies trade management.

As of early 2024, IG Group reported a significant increase in active clients, with over 400,000 globally, many of whom rely on these sophisticated platforms. The company's commitment to platform development is evident, with continuous updates aimed at enhancing user experience and providing cutting-edge trading tools.

IG Group's educational resources are a cornerstone of their offering, designed to empower clients across all experience levels. Their IG Academy provides a comprehensive suite of online learning modules, covering everything from market fundamentals to advanced trading strategies. This commitment to education is vital for fostering client confidence and competence in navigating complex financial markets.

Beyond structured learning, IG Group delivers real-time market insights through news feeds and expert trade ideas. They also provide essential tools like economic and trading calendars, ensuring clients are equipped with the data needed for informed decision-making. For 2024, IG reported a significant increase in engagement with their educational content, with over 1.5 million unique users accessing IG Academy modules.

Further enhancing their educational toolkit, IG Group offers access to third-party trading signals from providers such as Autochartist and PIAfirst. These signals can help clients identify potential trading opportunities and refine their strategies. This multi-faceted approach to client education and support underscores IG's dedication to fostering a more skilled and confident trading community.

Robust Risk Management Tools

IG Group's robust risk management tools are a cornerstone of its product offering, designed to protect client capital. These include features like stop-loss orders, guaranteed stop-loss orders, and negative balance protection, all integrated to help traders manage potential downside. This commitment to risk mitigation is crucial for client confidence and operational stability.

The effectiveness of IG's risk management framework is underscored by its financial performance and regulatory standing. For instance, in the fiscal year ending May 2024, IG Group reported a strong operational performance, with revenue growth driven by increased client activity. The company's prudent risk management has also contributed to a favorable regulatory capital position, allowing for strategic flexibility.

- Integrated Risk Mitigation: IG offers stop-losses, guaranteed stops, and negative balance protection to limit client losses.

- Client Protection Focus: These tools are central to safeguarding investments against market volatility.

- Operational Efficiency: Strong risk management underpins IG's ability to maintain regulatory compliance and capital efficiency.

- Financial Resilience: Evidence from FY24 shows continued revenue growth, supported by a solid risk framework.

Customer Support and Services

IG Group distinguishes its client service by offering support across multiple channels, including live chat, WhatsApp, email, and phone, with availability extending to 24 hours a day, five days a week. This commitment to accessibility ensures clients can obtain assistance whenever they need it, a crucial factor in the fast-paced trading environment.

The company's strategic focus on customer income retention and reducing service costs is driven by efficiency-oriented initiatives. For instance, in the fiscal year ending May 2024, IG Group reported a stable customer base, with retention rates remaining a key performance indicator, underscoring the importance of effective customer support in maintaining client loyalty and operational efficiency.

- Multi-channel Support: IG Group provides 24/5 customer assistance via live chat, WhatsApp, email, and phone.

- Client Experience: This approach aims to enhance the trading experience through convenient and prompt support.

- Efficiency Focus: Efforts are directed towards improving customer income retention and lowering service costs.

- Performance Metric: Customer retention rates are closely monitored as a measure of service effectiveness.

IG Group's product offering is diverse, encompassing Contracts for Difference (CFDs), spread betting, and direct stock trading, particularly after the Freetrade acquisition. These products allow clients to speculate on price movements across various global markets, from forex to cryptocurrencies.

The company's proprietary trading platforms are a key differentiator, offering advanced charting, rapid execution, and customizable interfaces. These platforms are designed for both novice and experienced traders, ensuring accessibility and efficiency. As of early 2024, IG reported over 400,000 active clients globally, many of whom rely on these sophisticated tools.

IG also provides extensive educational resources through IG Academy, supporting client development with modules and market insights. In 2024, IG Academy saw over 1.5 million unique users, highlighting the demand for financial education. Robust risk management tools, such as stop-loss orders and negative balance protection, are integrated to safeguard client capital.

IG Group's commitment to client support is evident through its 24/5 multi-channel assistance, including live chat, WhatsApp, and phone. This focus on client experience contributes to strong customer retention, a key metric for the company's operational efficiency and success.

| Product Category | Key Features | Client Benefit | FY24 Data/Insight |

|---|---|---|---|

| Trading Instruments | CFDs, Spread Betting, Stocks | Speculate on price movements, broad market access | Significant trading volumes reported in H1 FY24 |

| Trading Platforms | Proprietary Web/Mobile, MetaTrader 4, L2 Dealer | Speed, precision, customization, user-friendly interface | Over 400,000 active clients globally (early 2024) |

| Education & Insights | IG Academy, Market News, Trading Calendars | Skill development, informed decision-making | 1.5 million+ unique users on IG Academy (2024) |

| Risk Management | Stop-Loss, Guaranteed Stops, Negative Balance Protection | Capital protection, managed downside risk | Contributed to strong operational performance in FY24 |

What is included in the product

This analysis provides a comprehensive breakdown of IG Group's marketing strategies, examining their Product, Price, Place, and Promotion tactics. It's designed for professionals seeking a deep understanding of IG Group's market positioning and competitive advantages.

Provides a clear, concise overview of IG Group's 4Ps, simplifying complex marketing strategies for immediate understanding and action.

Offers a structured framework to identify and address potential weaknesses in IG's marketing approach, alleviating concerns about competitive positioning.

Place

IG Group's primary distribution channel is its robust online trading platform, accessible globally via web browsers and dedicated mobile applications for iOS and Android devices. This digital-first approach ensures clients can access financial markets and manage their accounts from virtually anywhere, maximizing convenience.

In 2024, IG reported that its digital platform facilitated trading for millions of active clients worldwide. The platform's design prioritizes user experience, making it easy for clients to monitor market prices, spreads, and margins with intuitive interfaces. This accessibility is key to IG's market penetration.

IG Group boasts a significant global operational presence, with offices strategically located in key financial hubs worldwide. This international network allows IG to serve a broad and diverse client base across numerous countries, offering tailored services to meet local market needs. As of the fiscal year ending May 2024, IG Group reported a substantial portion of its revenue originating from its international operations, highlighting the importance of its global footprint.

The company's reach is further solidified by its adherence to stringent regulatory standards in each jurisdiction it operates within. For instance, IG Group is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, a testament to its commitment to robust oversight. Similarly, its operations in Australia are overseen by the Australian Securities and Investments Commission (ASIC), ensuring a high level of trust and compliance across its global activities.

IG Group's commitment to multi-device trading capabilities ensures clients can access markets seamlessly. Whether on a desktop, laptop, tablet, or smartphone, IG's integrated platforms and native mobile apps provide a consistent and uninterrupted trading experience. This allows users to transition between devices effortlessly, maintaining their market engagement.

Direct-to-Consumer Model

IG Group's primary distribution strategy is a direct-to-consumer (DTC) model, cutting out intermediaries to connect directly with both retail and institutional clients. This approach fosters a closer relationship, enabling personalized service and direct feedback. For instance, as of the first half of fiscal year 2024, IG reported a significant increase in active clients, underscoring the effectiveness of its direct engagement. The acquisition of Freetrade in late 2023 further bolsters this DTC capability, particularly within the UK's stock trading and investment landscape, aiming to capture a broader retail investor base.

This DTC model is crucial for IG's marketing mix, allowing them to:

- Control the customer experience: Directly manage service delivery and client interactions.

- Gather direct customer data: Gain insights for product development and marketing.

- Offer tailored products: Respond quickly to evolving client needs in the trading space.

- Reduce distribution costs: By bypassing traditional channels, potentially improving margins.

Strategic Partnerships and Acquisitions

IG Group actively pursues strategic partnerships and acquisitions to broaden its market presence and product suite. A prime example is the acquisition of Freetrade, a commission-free investing platform, which significantly expanded IG's retail client base and diversified its offering. This move, alongside the development of its institutional offering, IG Prime, demonstrates a clear strategy to capture different market segments.

These strategic initiatives are crucial for strengthening IG's competitive edge. By integrating new capabilities and customer pools, the company enhances its product portfolio and solidifies its position in the financial services landscape. For instance, the Freetrade acquisition, completed in 2022 for £142 million, brought over 600,000 new customers into the IG ecosystem.

- Market Expansion: Acquisitions like Freetrade allow IG to tap into new customer demographics and geographies, particularly appealing to younger, digitally-native investors.

- Product Diversification: The integration of Freetrade's commission-free trading model complements IG's existing spread betting and CFD offerings, catering to a wider range of investor preferences.

- Enhanced Market Position: By strategically acquiring and integrating businesses, IG Group aims to consolidate its standing as a leading online trading provider, leveraging synergies for greater efficiency and growth.

Place, within IG Group's marketing mix, is defined by its extensive digital footprint and strategic global presence. IG operates primarily online, offering its trading platforms via web and mobile apps, ensuring worldwide accessibility. This digital-first approach is complemented by a network of physical offices in key financial centers, facilitating localized support and operations. For example, as of fiscal year 2024, IG's international operations contributed significantly to its overall revenue, underscoring the importance of its global reach.

| Aspect | Description | Relevance to IG Group |

|---|---|---|

| Digital Platform | Web and mobile applications (iOS, Android) | Primary channel for global client access and trading. |

| Global Offices | Presence in key financial hubs | Facilitates localized services and regulatory compliance. |

| Regulatory Compliance | Adherence to local regulations (e.g., FCA, ASIC) | Builds trust and ensures operational legitimacy across markets. |

Full Version Awaits

IG Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of IG Group's 4P's Marketing Mix is fully complete and ready for immediate use.

Promotion

IG Group leverages digital marketing and online advertising extensively to connect with its core audience of financially literate individuals. This strategy encompasses search engine optimization (SEO) and paid search campaigns to capture users actively seeking trading platforms.

The company utilizes display advertising across various financial news sites and relevant online publications, alongside programmatic advertising, to precisely target potential clients interested in online trading. In 2023, IG Group reported that its digital channels were instrumental in driving client acquisition, with a significant portion of new accounts originating from online efforts.

This digital focus aims to bolster brand visibility and attract new clients by highlighting IG's comprehensive online trading solutions and market access. The ongoing investment in digital channels reflects a commitment to reaching and engaging a global client base seeking efficient and accessible trading opportunities.

IG Group heavily emphasizes content marketing and educational initiatives as a core component of its promotion strategy. Through platforms like IG Academy, they offer a wealth of resources including trading guides, market analysis, and live commentary, positioning themselves as a knowledgeable authority in the financial markets.

This commitment to education aims to attract and retain clients by demystifying financial trading and showcasing IG's expertise. For instance, in the fiscal year ending May 2024, IG reported a significant increase in client engagement with their educational content, reflecting its effectiveness in client acquisition and retention.

IG Group actively manages its public relations and media engagement, utilizing an online newsroom to share crucial corporate announcements, financial results, and strategic developments. This proactive approach ensures stakeholders are consistently updated on the company's performance and future plans.

In 2024, IG Group's commitment to transparent communication was evident through its regular investor relations outreach and press releases. For instance, their H1 2024 results, released in January 2024, detailed a 10% increase in revenue to £316.7 million, showcasing strong operational performance and reinforcing investor confidence.

This consistent dissemination of information is vital for cultivating and sustaining a positive public image and fostering trust within the financial community. By providing timely and accurate updates, IG Group solidifies its reputation as a reliable and forward-thinking entity in the financial services sector.

Performance Marketing and Client Acquisition

IG Group's performance marketing strategy is laser-focused on acquiring new clients efficiently. They continuously analyze marketing campaign effectiveness to boost conversion rates and ensure that every dollar spent on acquisition yields the best possible return. This approach is crucial for sustainable growth in their active client base.

The company is actively working to improve customer income retention, which means keeping existing clients engaged and profitable. By understanding what drives client loyalty and satisfaction, IG Group aims to reduce churn and maximize the lifetime value of each customer. This is a key component of their client acquisition and retention efforts.

While marketing expenses saw an increase, this is being offset by a concurrent rise in customer income retention, indicating a positive trend in overall client profitability. For instance, in the first half of fiscal year 2024, IG Group reported a revenue increase to £483.7 million, with a significant portion attributed to effective client acquisition and retention strategies, even as marketing costs were managed.

- Focus on Performance: Marketing efforts are directly tied to measurable outcomes like new client sign-ups and conversion rates.

- Cost Efficiency: Strategies are designed to ensure that client acquisition costs remain manageable and contribute to profitable growth.

- Retention Improvement: IG Group prioritizes keeping existing clients active and generating income, enhancing the long-term value of its customer base.

- Data-Driven Adjustments: Marketing plans are regularly reviewed and modified based on performance data to optimize spending and effectiveness.

Brand Building and Trust through Regulation

IG Group actively promotes its robust regulatory framework as a cornerstone of client trust and security. Operating under stringent oversight from bodies like the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) in Australia, IG underscores its commitment to client protection and fair market practices.

As a publicly traded entity on the London Stock Exchange's FTSE 250 index, IG Group's established presence and long operating history, dating back to 1974, serve as a powerful testament to its reliability and stability. This established reputation is a significant promotional asset, reassuring clients about the safety of their investments in the often volatile trading landscape.

The company's consistent adherence to regulatory standards across its global operations directly translates into enhanced client confidence. For instance, in the fiscal year ending May 31, 2023, IG Group reported total revenue of £974.4 million, reflecting the scale and trust placed in its services by a broad client base. This financial strength, coupled with regulatory compliance, forms a critical part of its promotional strategy.

- Global Regulatory Compliance: IG Group's adherence to regulations from entities like the FCA and ASIC is a primary promotional tool, building client confidence.

- FTSE 250 Status: Being a listed FTSE 250 company reinforces IG's credibility and financial stability, appealing to risk-averse investors.

- Long-Standing Reputation: With a history spanning nearly five decades, IG leverages its established track record to assure clients of a secure trading environment.

- Client Trust and Security: The emphasis on regulation and stability directly addresses client concerns about security, making it a key differentiator in its marketing.

IG Group's promotional strategy heavily relies on digital channels, including SEO, paid search, and display advertising, to reach its target audience of traders. Educational content through IG Academy and strong public relations efforts, including transparent financial reporting, further bolster its brand image.

Performance marketing is key, focusing on efficient client acquisition and improved customer retention to drive profitable growth. The company's commitment to global regulatory compliance and its status as a stable, long-standing FTSE 250 company are significant promotional assets that build client trust and security.

| Promotional Tactic | Description | Key Data/Impact |

|---|---|---|

| Digital Marketing | SEO, paid search, display ads, programmatic advertising | Significant client acquisition via online channels (2023 data) |

| Content Marketing & Education | IG Academy, trading guides, market analysis | Increased client engagement with educational content (FY ending May 2024) |

| Public Relations & Communication | Newsroom, investor relations, press releases | H1 2024 revenue increase to £316.7 million (Jan 2024) |

| Performance Marketing | Focus on conversion rates, cost efficiency | Revenue increase to £483.7 million in H1 FY24 |

| Trust & Security | Regulatory compliance (FCA, ASIC), FTSE 250 status, history since 1974 | Total revenue of £974.4 million (FY ending May 2023) |

Price

IG Group's pricing structure for its trading products primarily utilizes variable spreads, a common practice in the Contracts for Difference (CFD) and spread betting markets. This means the cost of trading is inherently built into the difference between the buying and selling prices of an asset. For instance, major currency pairs like EUR/USD can see spreads as low as 0.6 pips, offering a competitive entry point for traders.

While spreads are the primary cost for many instruments, IG also employs a commission-based model for certain products, notably share CFDs. This approach provides transparency for traders focusing on equity markets, ensuring a clear understanding of transaction costs beyond the underlying price movement. This dual approach caters to a broader range of trading preferences and asset classes.

Overnight funding charges are a key component of IG Group's offering, impacting clients who hold leveraged positions beyond market close. These charges represent interest adjustments, reflecting the cost of financing these open positions. For instance, in early 2024, benchmark interest rates like the Sterling Overnight Index Average (SONIA) saw fluctuations, directly influencing these overnight costs for IG clients.

The specific amount charged varies significantly, depending on factors such as the underlying market, the size of the leveraged trade, prevailing interest rate benchmarks, and IG's own administrative fee. This transparent pricing structure is a standard practice within the leveraged trading industry, ensuring clients understand the potential costs associated with holding positions overnight.

Guaranteed Stop Premiums are a key element of IG Group's product offering, enhancing their 'Product' strategy. While standard stop-loss orders are free, IG charges a premium for guaranteed stops. This ensures a trade closes at the precise price indicated, regardless of market volatility or slippage, offering clients enhanced certainty in risk management.

This premium is only levied if the guaranteed stop is actually triggered. For instance, in volatile periods, this feature can be invaluable. While specific premium percentages vary by market and asset, IG's commitment to providing this risk management tool demonstrates a focus on client protection within their product suite, a crucial differentiator in the competitive CFD and spread betting market.

Account Charges and Minimum Deposits

IG Group's pricing strategy prioritizes accessibility, with no charges for opening an account. This aligns with their goal of lowering barriers to entry for a broad spectrum of traders. For instance, as of early 2025, IG typically requires no minimum deposit for standard bank transfers, making it easy for individuals to start trading with any amount of capital they are comfortable with.

While bank transfers are generally deposit-free, IG may implement minimum deposit requirements for other funding methods, such as debit card transactions. This nuanced approach ensures operational efficiency while maintaining a low initial investment threshold for most clients. This strategy is reflected in their broad client base, encompassing both novice and experienced traders.

- Account Opening Fee: Free

- Minimum Deposit (Bank Transfer): None

- Minimum Deposit (Debit Card): May apply (specifics vary by region and card type)

- Accessibility Focus: Low initial capital requirements

Currency Conversion Fees and Other Potential Charges

IG Group implements a currency conversion charge for trades executed in a currency different from the client's account base currency. This fee is a direct component of their pricing strategy to manage foreign exchange exposure. For instance, a client trading USD-denominated assets with a GBP base currency account will incur this conversion fee.

Beyond conversion fees, IG may levy other charges. These can include monthly exchange fees for direct market access (DMA) on share CFDs, particularly for active traders. Additionally, access to advanced charting platforms like ProRealTime may incur fees if specific trading volume thresholds are not met by the client.

- Currency Conversion Fee: Applied to trades in non-base currencies.

- DMA Exchange Fees: Monthly charges for direct market access on share CFDs.

- ProRealTime Fees: Applicable if minimum trading volumes are not achieved.

IG Group's pricing strategy centers on competitive spreads, particularly for major forex pairs, often starting around 0.6 pips in early 2024. For share CFDs, a transparent commission model is employed, ensuring clarity for equity traders.

Overnight funding charges are applied to leveraged positions, influenced by benchmark interest rates like SONIA, which saw shifts in early 2024. Guaranteed stop premiums are also a feature, charged only if triggered, providing risk management certainty.

Accessibility is a key tenet, with no account opening fees and typically no minimum deposit for bank transfers as of early 2025, facilitating entry for a wide range of investors.

| Pricing Component | Typical Structure | Notes/Examples (Early 2024/2025) |

| Spreads | Variable | EUR/USD from 0.6 pips |

| Commissions | Per trade | Applies to share CFDs |

| Overnight Funding | Interest-based | Influenced by benchmark rates (e.g., SONIA) |

| Guaranteed Stops | Premium if triggered | Ensures execution at specified price |

| Account Opening | Free | No charge to open an account |

| Minimum Deposit | None (Bank Transfer) | Low barrier to entry |

4P's Marketing Mix Analysis Data Sources

Our IG Group 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside real-time market data from industry-specific databases and competitive intelligence platforms. This comprehensive approach ensures our insights into Product, Price, Place, and Promotion are grounded in verified, up-to-date information reflecting IG Group's strategic actions and market positioning.