IG Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IG Group Bundle

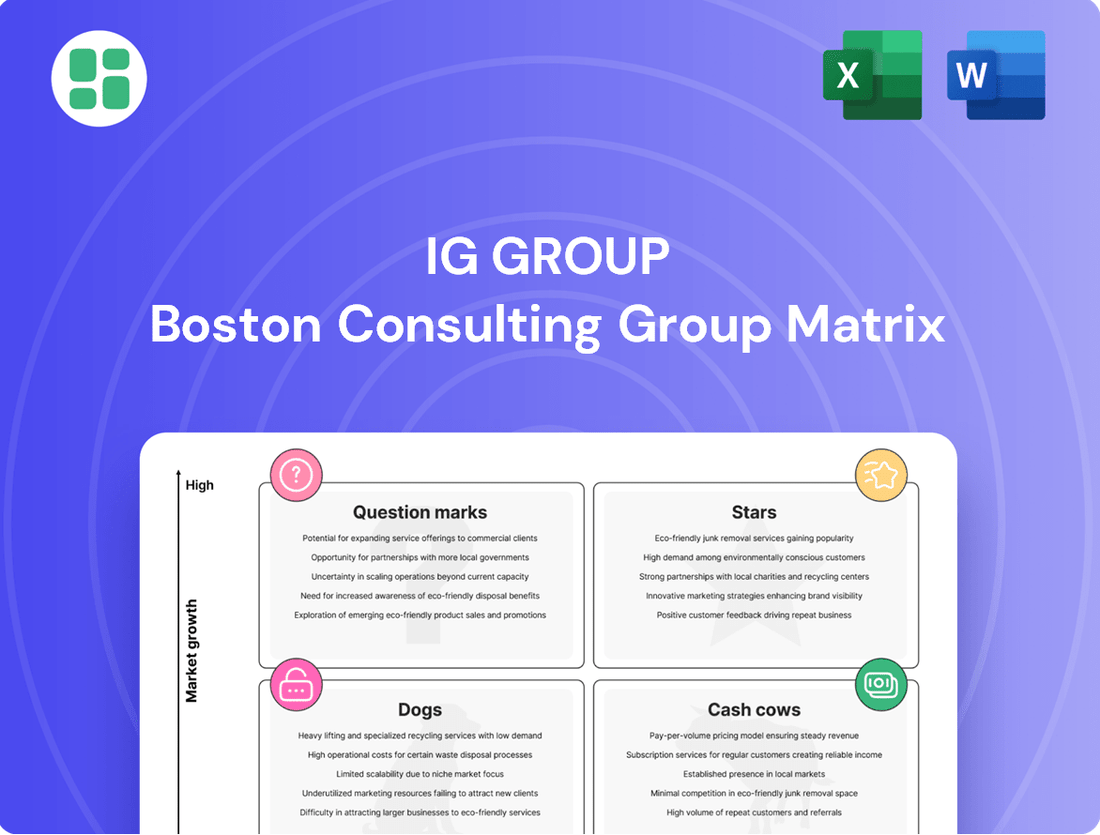

Unlock the strategic potential of IG Group's product portfolio with a comprehensive BCG Matrix analysis. Understand which offerings are driving growth, which are generating stable returns, and which require critical evaluation.

This preview offers a glimpse into the power of BCG analysis for IG Group. Purchase the full BCG Matrix report to gain detailed insights into each quadrant, enabling data-driven decisions for optimizing your investments and product strategy.

Stars

Tastytrade, IG Group's US-based options and futures trading platform, is a shining star in the company's portfolio. In the fiscal year 2025, it saw its net trading revenue jump by an impressive 21% in US dollar terms. This surge highlights its strong footing in the rapidly expanding US derivatives market.

The platform's success is a testament to IG Group's North American expansion strategy. Tastytrade is attracting a growing number of active clients who are keen on sophisticated trading opportunities, further cementing its position as a star performer.

Freetrade's acquisition by IG Group in April 2025 significantly strengthened IG's position in the UK's rapidly expanding direct-to-consumer investment market. This move is expected to place the combined entity in a strong "Star" category within the BCG Matrix, signifying high growth and high market share.

Freetrade's impressive 22% revenue growth in FY25 and the addition of over 457,000 new customers to IG's platform underscore its high-growth potential. This acquisition grants IG access to valuable new customer demographics and advanced platform capabilities, solidifying its status as a leading player.

IG Group experienced a significant surge in active customers during FY25, reaching 820,000, a remarkable 137% increase. This substantial growth was largely fueled by the strategic acquisition of Freetrade.

Even without the acquisition, IG's organic customer base expanded by a healthy 5%, demonstrating strong underlying demand for its services in the online trading and investment sector. This sustained customer acquisition and retention is vital for maintaining its position as a market leader and achieving continued success.

Product Enhancement and Innovation

IG Group is actively pursuing product enhancement and innovation to stay ahead in the competitive financial services landscape. The launch of IG Invest in January 2025 signals a strategic move to broaden its product portfolio and cater to a wider range of investor needs.

This focus on innovation is crucial for meeting evolving customer demands and exploring new financial product categories. For instance, the company reported a 12% increase in active clients in the first half of fiscal year 2024, demonstrating the success of its ongoing platform improvements and new offerings.

Continuous refinement of trading platforms and tools is a cornerstone of IG's strategy. These efforts not only maintain a competitive edge but also enhance client retention and attract new users, contributing to sustained growth. The company’s commitment to innovation is reflected in its consistent investment in technology and user experience.

- Product Expansion: The introduction of IG Invest in January 2025 broadens the company's service offerings beyond traditional trading.

- Client Growth: IG Group saw a 12% rise in active clients during the first half of FY2024, underscoring the positive impact of its innovation efforts.

- Platform Improvement: Ongoing enhancements to trading platforms aim to improve user experience and maintain a competitive advantage.

- Market Responsiveness: These initiatives are designed to adapt to and anticipate changing customer preferences and market trends.

Expansion into High-Growth Geographies

IG Group is actively pursuing expansion into high-growth geographies, a key component of its BCG Matrix strategy. This involves channeling resources into markets identified as having substantial potential for online trading and investment services. The company aims to leverage its established market share in existing territories to build a strong presence in these new, rapidly expanding regions.

This strategic push is designed to cultivate future 'stars' for IG Group. By successfully entering and growing within these dynamic markets, IG seeks to replicate its success and establish leadership positions. For instance, in 2023, IG reported that its revenue from continental Europe, a key growth region, increased by 14% year-on-year, highlighting the early success of such expansion efforts.

- Focus on Emerging Markets: IG identifies and targets regions with significant upward trends in online trading adoption.

- Leveraging Existing Strengths: The company aims to transfer its high market share products and expertise to these new territories.

- Cultivating Future Growth: This expansion is a deliberate strategy to build a pipeline of 'star' products and services in promising geographical areas.

- Data-Driven Approach: Expansion decisions are informed by market analysis and the identification of regions with strong growth indicators for financial services.

Tastytrade and the recent acquisition of Freetrade are IG Group's prime examples of 'Stars' in the BCG Matrix. These entities operate in high-growth markets and have achieved significant market share, demonstrating strong revenue and customer acquisition. Their performance in FY25, with Tastytrade's 21% revenue growth and Freetrade adding over 457,000 customers, solidifies their 'Star' status.

IG Group's strategic focus on product innovation, like the launch of IG Invest in January 2025, and its expansion into high-growth geographies, such as continental Europe which saw a 14% revenue increase in 2023, further support the identification of these 'Stars'. This proactive approach ensures continued momentum and market leadership.

| Business Unit | Market Growth | Market Share | FY25 Revenue Growth | Customer Growth |

|---|---|---|---|---|

| Tastytrade (US) | High | High | 21% | Significant |

| Freetrade (UK) | High | Growing | 22% | 457,000+ new customers |

| IG Group (Continental Europe) | High | Growing | N/A | N/A |

What is included in the product

This BCG Matrix overview for IG Group details strategic recommendations for each business unit.

The IG Group BCG Matrix offers a clear, one-page overview, instantly clarifying each business unit's position to alleviate strategic confusion.

Cash Cows

IG Group's core CFD and spread betting business in the UK and EU markets serves as its primary cash cow. This established segment consistently delivers significant revenue and profit, with net trading revenue for OTC derivatives seeing a healthy 10% increase in FY25.

As a market leader and early innovator in these regions, IG enjoys a substantial market share and robust brand loyalty. This maturity means the business requires less aggressive marketing spend, further solidifying its status as a reliable profit generator.

IG Group stands out with a notably high Average Revenue Per User (ARPU), a key indicator of how effectively it monetizes its client base. This metric reflects strong client loyalty and the success of its value-extraction strategies.

In 2024, IG Group reported an impressive ARPU of $3.24k. This figure is significantly higher than many competitors, underscoring the company's ability to generate substantial revenue from each active trader.

This robust revenue generation per client is a primary driver of IG Group's consistent and strong cash flow. It solidifies the company's position as a cash cow within its portfolio, providing stable financial resources.

IG Group's robust regulatory capital position is a key strength, consistently exceeding minimum requirements. This financial resilience, demonstrated by a capital headroom of £638.3 million as of May 2024, provides a stable foundation for operations and growth.

This substantial capital buffer allows IG Group to navigate market volatility effectively and invest in strategic initiatives. It underpins the company's ability to maintain shareholder returns while pursuing its business objectives.

Consistent Profitability and Cash Generation

IG Group's consistent high profitability and strong cash generation are key characteristics of its cash cow status. In FY25, the company reported adjusted profit before tax of £535.8 million, a significant 17% increase, underscoring its robust financial health. This reliable income stream enables IG Group to effectively fund its strategic growth endeavors, manage day-to-day operations, and reward its investors.

The ability to consistently generate more cash than is needed for its operations is a defining trait of a cash cow. This surplus cash flow provides IG Group with financial flexibility.

- Consistent Profitability: Adjusted profit before tax reached £535.8 million in FY25, up 17%.

- Strong Cash Generation: The company reliably produces more cash than it consumes.

- Funding Growth: Surplus cash fuels strategic initiatives and operational needs.

- Shareholder Returns: Funds available for dividends and share buybacks demonstrate financial strength.

Operational Efficiency and Cost Management Initiatives

IG Group's commitment to operational efficiency is a key driver for its Cash Cows. For instance, in FY25, the company achieved a notable 7% reduction in its organic fixed cost to serve per customer. This focus on streamlining operations directly boosts profit margins and strengthens the cash flow generated by its established, high-market-share business segments.

These initiatives are crucial for maximizing returns from mature products. By maintaining cost discipline and improving customer income retention, IG ensures its core businesses remain robust cash generators. This strategic approach allows for sustained profitability and supports investment in other areas of the business.

- FY25 organic fixed cost to serve per customer reduction: 7%

- Impact on profit margins: Enhanced through efficiency gains.

- Cash flow optimization: Driven by cost discipline in mature segments.

- Customer income retention: A focus to maximize returns from core businesses.

IG Group's established UK and EU CFD and spread betting operations are clear cash cows, consistently generating substantial profits. In FY25, net trading revenue for OTC derivatives rose by 10%, highlighting the segment's strength and market leadership.

The company's high Average Revenue Per User (ARPU), which stood at $3.24k in 2024, is a testament to its effective client monetization. This strong revenue per client directly translates into robust and reliable cash flow, a hallmark of a cash cow.

Operational efficiency further bolsters these cash cows. A 7% reduction in organic fixed cost to serve per customer in FY25 directly improved profit margins, maximizing the cash generated from these mature, high-market-share businesses.

| Metric | FY25 Data | Significance for Cash Cow Status |

|---|---|---|

| Net Trading Revenue (OTC Derivatives) | 10% Increase | Demonstrates strong and growing income from core business. |

| Average Revenue Per User (ARPU) | $3.24k (2024) | Indicates effective client monetization and revenue generation. |

| Adjusted Profit Before Tax | £535.8 million (up 17%) | Highlights consistent and increasing profitability. |

| Organic Fixed Cost to Serve Per Customer | 7% Reduction | Boosts profit margins and strengthens cash flow through efficiency. |

Delivered as Shown

IG Group BCG Matrix

The IG Group BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, is ready for immediate integration into your strategic planning processes. You can confidently expect the full, professionally formatted report to be delivered directly to you, empowering your decision-making with actionable insights into IG Group's product portfolio.

Dogs

IG Group has strategically divested from several 'legacy and sandbox initiatives' during 2024 and into 2025. This includes ventures such as Spectrum, Brightpool, Raydius, BadTrader, and Small Exchange. These exits are part of a broader effort to streamline operations and focus on higher-potential growth areas.

These specific initiatives were characterized by their limited impact and low growth potential, failing to meet IG Group's return expectations. The company identified them as potential cash traps, hindering the efficient allocation of capital.

The decision to exit these underperforming assets, with a reported total divestment value yet to be fully disclosed but impacting a portfolio of non-core ventures, underscores IG Group's commitment to optimizing its resource allocation. Funds are being redirected towards areas demonstrating stronger market traction and a clearer path to profitability.

IG Group's commercial operations in South Africa were classified as a Dog in the BCG Matrix, leading to their closure in 2024. This strategic divestment was driven by a desire to reallocate resources to markets offering higher growth potential and better strategic alignment.

IG Group's divestment strategy extended to underperforming niche products and platforms that weren't meeting return expectations. These were often experimental ventures or smaller offerings that struggled to gain market traction or become profitable.

For instance, in the 2023 financial year, IG Group reported a disposal of its US options trading platform, which had been a smaller, less impactful part of its global operations. This move aligns with a broader strategy to focus resources on core, high-growth areas, as evidenced by their continued investment in their core CFD and FX trading businesses.

Areas with Limited Impact and Low Growth Potential

IG Group's Dogs quadrant encompasses business units or products with both low market share and minimal market growth. These segments offer little opportunity for competitive advantage or significant return on investment. The company has strategically divested from several such areas, demonstrating a focus on resource optimization.

For instance, IG Group's financial reports for the fiscal year ending May 31, 2024, indicate a deliberate reduction in exposure to certain legacy platforms or niche markets that exhibited these characteristics. While specific segment data is often proprietary, the overall strategy points to a proactive approach in shedding underperforming assets.

- Low Market Share: Units in this category struggle to capture a meaningful portion of their respective markets.

- Stagnant or Declining Growth: The overall market for these products or services is not expanding, or is even shrinking.

- Minimal Investment Returns: Capital allocated to these areas is unlikely to generate substantial profits.

- Strategic Divestment: IG Group has actively exited or scaled back operations in segments fitting this profile to reallocate resources to more promising ventures.

Divested or Wound-Down Business Units

Divested or wound-down business units, such as IG Group's former Spectrum business, are classic examples of Dogs in the BCG Matrix. These segments typically generate minimal revenue or even incur losses, often breaking even at best. IG's decision to divest Spectrum, which was part of its US operations, aligns with a strategy to streamline its portfolio and reallocate resources more effectively.

The divestiture of Spectrum in 2023, for instance, allowed IG Group to exit a market where it faced intense competition and evolving regulatory landscapes. This move frees up capital and management attention that can be redirected to higher-growth areas within the company.

IG Group's approach to managing its portfolio, including the identification and divestment of underperforming units, is crucial for maintaining financial health and shareholder value.

- Divestiture of Spectrum: IG Group completed the sale of its US-based online trading business, Spectrum, in 2023.

- Resource Reallocation: This action enables IG to focus capital and management resources on core, more profitable business lines.

- Portfolio Optimization: Exiting Dog segments like Spectrum is a key component of a disciplined approach to portfolio management.

- Financial Discipline: Such moves demonstrate a commitment to improving overall profitability and return on capital by shedding underperforming assets.

IG Group's "Dogs" represent business segments with low market share and low market growth, offering limited potential for returns. The company has actively divested from several such initiatives during 2024 and into 2025, including Spectrum, Brightpool, and Raydius, to streamline operations and reallocate capital to more promising areas. These exits are driven by a focus on optimizing resource allocation and shedding underperforming assets that do not meet return expectations.

IG Group's commercial operations in South Africa were classified as a Dog and subsequently closed in 2024, a move aimed at redirecting resources to markets with higher growth potential. This proactive approach to portfolio management, exemplified by shedding underperforming niche products and platforms, underscores a commitment to financial discipline and improved profitability.

For instance, the divestment of Spectrum in 2023 allowed IG Group to exit a competitive market, freeing up capital for investment in core, high-growth businesses like CFD and FX trading, which continue to show strong market traction.

The company's strategic exits in 2024, impacting a portfolio of non-core ventures, reflect a clear strategy to focus on areas demonstrating stronger market alignment and a clearer path to profitability, thereby enhancing overall shareholder value.

Question Marks

IG Group's recent foray into spot crypto trading, launched in the UK in June 2025, positions it as a potential 'Star' in the BCG Matrix. This move allows direct buying, selling, and holding of 31 crypto assets, a significant expansion from its prior Contracts for Difference (CFD) offerings.

While the crypto market is experiencing robust growth, IG's direct market share in spot trading is still in its early stages. This initiative requires substantial investment to capture market share, characteristic of a business consuming cash to fuel future growth.

The IG Invest platform, particularly its expansion beyond the Freetrade acquisition, represents a Question Mark within IG Group's BCG Matrix. This strategic move targets new client segments eager for a wider array of investment products and services, tapping into a market with significant growth potential.

IG is actively investing in its product roadmap to scale IG Invest within the UK market. This indicates a belief in high growth prospects, but the platform's market share is still developing, characteristic of a Question Mark seeking to solidify its position.

IG Group's strategic focus on expanding into larger, fast-growing markets beyond its core regions signals a deliberate push into "new, emerging markets" within the BCG matrix framework. This move acknowledges the potential for significant future revenue streams, even as it necessitates substantial initial outlays for market entry. For instance, in 2023, IG Group reported that its international operations outside of Europe and North America, which include emerging markets, contributed 17% of its total revenue, highlighting both the existing opportunity and the room for growth.

Early-stage Product Enhancements for future growth

Early-stage product enhancements at IG Group, aligning with the Stars quadrant of the BCG Matrix, represent crucial investments for future expansion. These initiatives, driven by a focus on improving product velocity and client centricity as highlighted by IG's CEO, aim to capture emerging market opportunities and attract new customer segments.

These strategic shifts are designed to foster innovation and build a pipeline of offerings that can achieve significant market share. For instance, IG's ongoing development in areas like digital asset trading platforms or enhanced mobile trading experiences exemplify this approach. Such investments are vital for maintaining a competitive edge in the rapidly evolving financial technology landscape.

- Focus on Product Velocity: IG Group's commitment to accelerating product development cycles is key to quickly bringing innovative solutions to market.

- Client Centricity: Enhancements are tailored to meet evolving client needs and preferences, aiming to deepen engagement and satisfaction.

- Investment in High-Growth Areas: Resources are directed towards developing capabilities in sectors with strong potential for future market share gains.

- Uncertain Market Success: While these early-stage products consume resources, their ultimate market penetration and profitability are still being determined, characteristic of Star quadrant investments.

Targeted New Customer Segments beyond traditional CFD traders

IG Group's expansion into new customer segments, particularly those drawn to commission-free trading and a wider array of investment products, positions these efforts as a Question Mark within the BCG framework. The acquisition of Freetrade, which notably attracted a younger demographic, highlights IG's strategic push to tap into high-growth areas.

These new customer bases often prioritize accessibility and lower costs, necessitating tailored product development and marketing strategies from IG. For instance, as of early 2024, the retail investment market continues to see significant engagement from younger investors, with platforms offering fractional shares and zero commissions gaining substantial traction.

- Broadening Addressable Market: IG aims to capture a larger share of the retail investment pie beyond its traditional, more experienced CFD trading clientele.

- Freetrade Acquisition Impact: This move brought in a younger, often less experienced, investor base, seeking different product offerings and fee structures.

- High-Growth Potential: The targeted segments represent areas of rapid expansion in financial services, offering significant future revenue opportunities.

- Strategic Investment: IG is actively investing in adapting its platform and marketing to effectively engage and retain these new customer groups.

IG Invest, particularly its expansion beyond the Freetrade acquisition, represents a Question Mark within IG Group's BCG Matrix. This strategic move targets new client segments eager for a wider array of investment products and services, tapping into a market with significant growth potential.

IG is actively investing in its product roadmap to scale IG Invest within the UK market. This indicates a belief in high growth prospects, but the platform's market share is still developing, characteristic of a Question Mark seeking to solidify its position.

These new customer bases often prioritize accessibility and lower costs, necessitating tailored product development and marketing strategies from IG. For instance, as of early 2024, the retail investment market continues to see significant engagement from younger investors, with platforms offering fractional shares and zero commissions gaining substantial traction.

IG aims to capture a larger share of the retail investment pie beyond its traditional, more experienced CFD trading clientele, with the Freetrade acquisition bringing in a younger investor base seeking different product offerings and fee structures.

BCG Matrix Data Sources

Our IG Group BCG Matrix leverages comprehensive data from financial disclosures, market research reports, and internal performance metrics to provide strategic insights.