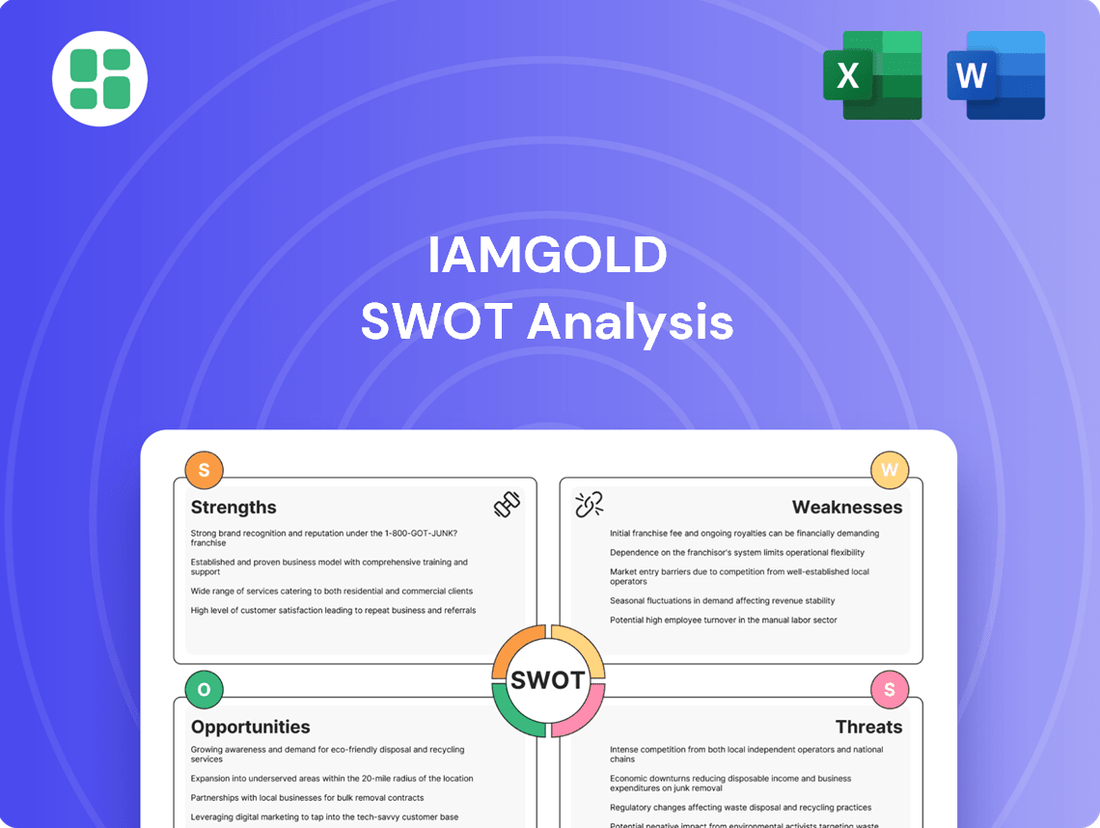

Iamgold SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iamgold Bundle

IAMGOLD's strategic position is shaped by its robust operational capabilities and its focus on key growth regions, but also faces challenges in project execution and market volatility. Understanding these internal strengths and weaknesses, alongside external opportunities and threats, is crucial for navigating the dynamic gold mining sector.

Want the full story behind IAMGOLD's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IAMGOLD boasts a robust operational footprint, strategically diversified across Canada and West Africa. This includes significant assets like the Côté Gold mine and Westwood in Canada, alongside the Essakane mine in Burkina Faso. This geographical spread is crucial for mitigating country-specific operational risks and ensuring a more stable production profile.

The company's production capacity has been notably bolstered by the successful ramp-up of the Côté Gold mine. This development not only strengthens IAMGOLD's position in Canada but also contributes significantly to its overall global output. For instance, Côté Gold is projected to be a major contributor to the company's production going forward, aiming for approximately 490,000 ounces of gold in 2024, with potential for higher figures in subsequent years as it reaches full capacity.

The successful ramp-up of the Côté Gold mine, a joint venture with Sumitomo Metal Mining, is a significant strength for IAMGOLD. Production began in March 2024, with commercial production declared by August 2024, showcasing efficient execution for a major Canadian open-pit operation.

By June 2025, the processing plant achieved its full nameplate throughput capacity. This operational success directly boosts IAMGOLD's attributable gold production, positioning Côté Gold as a key contributor to the company's output in 2025 and beyond.

This new mine is set to become one of Canada's largest gold producers, substantially increasing IAMGOLD's overall gold volume. The rapid and effective commissioning of Côté Gold underscores strong project management and operational capabilities.

IAMGOLD experienced a significant boost in production, with attributable gold output climbing 43% in 2024 to 667,000 ounces, aligning with its updated forecasts. This performance was largely fueled by the ramp-up and steady operations at its Côté Gold project.

Looking ahead, the company anticipates continued expansion, projecting 2025 attributable gold production to range between 735,000 and 820,000 ounces. This growth is expected to be supported by the ongoing success of Côté Gold and anticipated improvements in ore grades at its other mining assets.

Commitment to Sustainability and ESG

IAMGOLD demonstrates a robust commitment to sustainability, integrating Environmental, Social, and Governance (ESG) principles into its core operations. This dedication is clearly outlined in its annual sustainability reports, showcasing adherence to global standards such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB).

The company's focus on responsible mining extends to active community engagement, diligent environmental stewardship, and stringent health and safety protocols. For instance, IAMGOLD's 2023 sustainability report highlighted a 15% reduction in water intensity across its operations compared to 2022. This proactive approach is crucial for maintaining its social license to operate.

This strong ESG framework is instrumental in attracting a growing pool of responsible investors and cultivating positive, long-term relationships with local communities and all stakeholders. The company's investment in renewable energy sources at its Côté Gold project, for example, is a testament to its forward-thinking environmental strategy.

- Commitment to GRI and SASB: IAMGOLD actively reports against these international sustainability frameworks.

- Community Engagement: Prioritizing positive relationships and contributions to local communities.

- Environmental Stewardship: Implementing practices to minimize environmental impact, such as reduced water intensity.

- Social License to Operate: Building trust and acceptance through responsible and transparent operations.

Positive Analyst Sentiment and Valuation Potential

Analysts are largely optimistic about IAMGOLD's future, with a consensus 'Buy' rating and a notable number of 'Strong Buy' recommendations. This positive sentiment is supported by price targets suggesting considerable upside potential for the stock. This confidence stems from the company's operational execution and the strategic importance of its assets, especially the successful ramp-up of the Côté Gold project.

The market appears to recognize IAMGOLD's valuation potential, driven by factors like the Côté Gold mine. For instance, as of late 2024, analysts were projecting significant growth for IAMGOLD, with average price targets often exceeding the then-current trading levels, reflecting optimism about production increases and cost efficiencies.

- Analyst Consensus: A strong 'Buy' rating indicates broad positive sentiment among financial analysts.

- Price Target Upside: Many analysts have set price targets that suggest substantial room for stock appreciation.

- Côté Gold Impact: The successful integration and ramp-up of the Côté Gold mine are key drivers of this positive outlook.

- Operational Confidence: The favorable view reflects analyst confidence in IAMGOLD's management and strategic direction.

IAMGOLD's operational strengths are significantly amplified by the successful ramp-up of its Côté Gold mine, a major Canadian open-pit operation that began production in March 2024 and achieved full nameplate throughput capacity by June 2025. This development has propelled IAMGOLD's attributable gold production, with a 43% increase in 2024 to 667,000 ounces, driven by Côté Gold's steady operations. The company projects 2025 attributable gold production to be between 735,000 and 820,000 ounces, underscoring the mine's pivotal role in future growth.

The company's robust ESG framework is a key strength, demonstrated by its commitment to GRI and SASB reporting and a 15% reduction in water intensity in 2023. This focus on responsible mining fosters positive stakeholder relationships and attracts responsible investors, further enhanced by investments in renewable energy at Côté Gold. IAMGOLD's strategic diversification across Canada and West Africa, including assets like Essakane in Burkina Faso, mitigates country-specific risks and ensures a more stable production profile.

Market sentiment towards IAMGOLD is overwhelmingly positive, with analysts maintaining a consensus 'Buy' rating and numerous 'Strong Buy' recommendations. This optimism is rooted in the company's strong operational execution, particularly the successful Côté Gold ramp-up, and the significant upside potential indicated by analyst price targets. The market recognizes IAMGOLD's valuation growth prospects, driven by increased production volumes and anticipated cost efficiencies.

| Metric | 2024 (Attributable) | 2025 Projection (Attributable) | Key Driver |

|---|---|---|---|

| Gold Production (ounces) | 667,000 | 735,000 - 820,000 | Côté Gold ramp-up, operational improvements |

| Côté Gold Status | Production started March 2024, Commercial production Aug 2024 | Full nameplate capacity achieved June 2025 | Project execution, operational efficiency |

| ESG Performance | 15% water intensity reduction (vs 2022) | Continued focus on GRI/SASB, renewable energy | Sustainability commitment, social license |

| Analyst Sentiment | Consensus 'Buy', several 'Strong Buy' | Positive outlook, significant price target upside | Operational success, asset value |

What is included in the product

Delivers a strategic overview of Iamgold’s internal and external business factors, highlighting its strengths in operations and opportunities for growth, while also addressing weaknesses in project execution and threats from market volatility.

Identifies key opportunities and threats, helping Iamgold proactively address potential challenges and capitalize on favorable market conditions.

Weaknesses

IAMGOLD is facing a significant challenge with rising operating costs, projecting cash costs between $1,375 and $1,475 per ounce for 2025. This upward trend in expenses, coupled with All-in Sustaining Costs (AISC) anticipated to range from $1,830 to $1,930 per ounce, directly impacts the company's profitability.

Several factors contribute to these escalating costs, including increased royalty payments and the strengthening Euro, which negatively affects the financial performance of its overseas operations. Furthermore, the ongoing ramp-up phase at the Côté Gold project is incurring substantial expenses, adding further pressure to IAMGOLD's bottom line.

IAMGOLD's operations in West Africa, particularly its Essakane mine in Burkina Faso, face significant political and regulatory hurdles. The region's inherent instability can disrupt operations and impact security. For instance, the revised Burkina Faso Mining Code, implemented in June 2025, directly increased the government's stake in Essakane from 10% to 15%.

This regulatory shift directly reduced IAMGOLD's attributable share of the mine's output and altered its dividend structure. Such unpredictable changes in mining legislation create substantial uncertainty and can negatively affect the company's financial performance and future investment decisions in the region.

The Côté Gold mine's initial ramp-up phase presented notable hurdles. An unscheduled shutdown in late 2024, triggered by a conveyor belt issue, disrupted production. Furthermore, the mine struggled to consistently achieve its targeted 90% throughput rate during this period, impacting operational efficiency.

Despite reaching 100% of its nameplate capacity by June 2025, the Côté Gold operation continues to face challenges in maintaining consistent, stable output. The site also requires ongoing attention to manage non-recurring capital expenditures, which can affect overall profitability and financial performance.

Decreased Core Operating Earnings

IAMGOLD's core operating earnings saw a significant dip of around 16% in the fourth quarter of 2024 compared to the previous quarter. This downturn was particularly concerning as it missed analyst projections, suggesting that even with robust production numbers, the company's fundamental operational profitability faced challenges.

This decline in core operating earnings points to potential issues with operational efficiency and effective cost management. These fluctuations can create investor apprehension, especially during periods of integrating new production facilities, as they cast a shadow on the sustainability of profitability from ongoing operations.

- Q4 2024 Core Operating Earnings Decline: Approximately 16% quarter-over-quarter.

- Analyst Expectations: Fell short of projections.

- Underlying Profitability: Faced headwinds despite strong production.

- Concerns Raised: Operational efficiency and cost control.

Potential Overvaluation Concerns

Iamgold's current price-to-book ratio stands at 1.82x, which is notably higher than its historical average of 1.43x. This divergence could indicate that the market currently values the company's assets more richly than in the past, raising potential overvaluation concerns for new investors.

While analyst price targets and industry averages might offer some context, a price-to-book ratio exceeding historical norms suggests that the stock may already be pricing in significant future growth. This could limit the margin of safety for those looking to invest at current levels.

- Price-to-Book Ratio: 1.82x (Current) vs. 1.43x (Historical Average)

- Implication: Potential overvaluation relative to historical asset valuation.

- Investor Consideration: Reduced margin of safety for new investments.

- Market Sentiment: Stock price may already reflect anticipated positive developments.

IAMGOLD faces significant cost pressures, with projected 2025 cash costs between $1,375 and $1,475 per ounce and AISC between $1,830 and $1,930 per ounce. These rising expenses, exacerbated by factors like increased royalties and a stronger Euro, directly impact profitability. The ongoing ramp-up at Côté Gold also contributes substantial costs, adding further pressure.

The company's operations in West Africa, particularly Essakane in Burkina Faso, are subject to political and regulatory instability. The revised Burkina Faso Mining Code, effective June 2025, increased the government's stake in Essakane to 15%, reducing IAMGOLD's share of output and altering dividend structures. This legislative uncertainty creates financial performance risks.

The Côté Gold mine's initial phase encountered operational disruptions, including an unscheduled shutdown in late 2024 due to a conveyor belt issue and difficulties in consistently achieving targeted throughput rates. Despite reaching nameplate capacity by June 2025, maintaining stable output and managing non-recurring capital expenditures remain ongoing challenges.

IAMGOLD's core operating earnings declined approximately 16% in Q4 2024 quarter-over-quarter, falling short of analyst expectations. This suggests underlying profitability challenges related to operational efficiency and cost management, potentially unsettling investors, especially during new facility integration.

| Weakness | Description | Impact |

| Rising Operating Costs | Projected 2025 cash costs: $1,375-$1,475/oz; AISC: $1,830-$1,930/oz. | Reduced profitability, pressure on margins. |

| West African Regulatory Risk | Burkina Faso Mining Code (June 2025) increased gov't stake in Essakane to 15%. | Reduced attributable output, dividend structure changes, financial uncertainty. |

| Côté Gold Ramp-Up Issues | Late 2024 shutdown, inconsistent throughput rates. | Operational inefficiencies, potential delays in achieving full production potential. |

| Q4 2024 Earnings Decline | 16% QoQ drop, missed analyst expectations. | Concerns over operational efficiency and cost control, investor apprehension. |

Preview the Actual Deliverable

Iamgold SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This comprehensive report delves into Iamgold's Strengths, Weaknesses, Opportunities, and Threats, providing valuable strategic insights. You're getting a direct look at the professional, structured content that will be yours after checkout.

Opportunities

The Côté Gold mine, now operating at its nameplate capacity, offers IAMGOLD a prime chance to refine operations and explore expansion. An upcoming technical report is expected to detail Côté Gold as a larger-scale venture, potentially incorporating the Gosselin deposit resources and extending mine life past 2045.

This growth trajectory, coupled with ongoing operational enhancements, is poised to significantly boost cash flow generation for IAMGOLD. The company is targeting a substantial increase in throughput, aiming for approximately 1.5 million tonnes per annum, which will be a key driver of financial performance.

The current gold price environment is exceptionally favorable for IAMGOLD. With gold prices hitting record highs, the company is experiencing a significant tailwind. For instance, IAMGOLD's average realized price in Q2 2025 was approximately $3,182 per ounce, a substantial increase that directly boosts profitability.

These elevated gold prices effectively reduce IAMGOLD's all-in costs as a percentage of revenue. This compression leads to wider profit margins and a stronger ability to generate free cash flow, bolstering the company's overall financial health and capacity for investment.

IAMGOLD holds significant exploration potential in Canada, beyond its operating mines. The company has a strong portfolio of early-stage and advanced projects in promising mining areas. This includes ongoing exploration at the Gosselin and Jack Rabbit zones, located near their Côté Gold mine, which has already seen resource expansions and aims to convert these into reserves.

Strategic Deleveraging and Balance Sheet Enhancement

IAMGOLD is actively working to strengthen its financial foundation. With the recent completion of gold prepay arrangements and an anticipated improvement in operational cash flows, the company is strategically focused on reducing its debt. This deleveraging effort is crucial for enhancing financial flexibility and supporting future growth initiatives.

The company has already made tangible progress in its debt reduction strategy. For instance, IAMGOLD successfully repaid $40 million on its second lien notes, demonstrating a commitment to improving its balance sheet. This proactive approach to managing liabilities is a key component of its financial enhancement plan.

A more robust balance sheet and increased liquidity are expected to yield significant benefits. These improvements will empower IAMGOLD with greater financial maneuverability for strategic investments, ensure greater operational stability, and potentially lead to enhanced shareholder returns. This focus on financial health is vital for long-term value creation.

- Strategic Deleveraging: IAMGOLD is prioritizing debt reduction following gold prepay arrangements and improved operational cash flows.

- Debt Repayment: The company has already repaid $40 million on its second lien notes as part of its deleveraging efforts.

- Enhanced Financial Flexibility: A stronger balance sheet and increased liquidity will support future investments and operational stability.

- Shareholder Value: Improved financial health is anticipated to contribute positively to shareholder returns.

Industry Consolidation and M&A Potential

The gold mining industry is seeing a surge in mergers and acquisitions, with companies possessing permitted projects in secure regions and robust ESG credentials being particularly sought after. IAMGOLD, as a mid-tier producer with substantial assets like Côté Gold, is well-positioned to be an appealing acquisition target for major miners looking to grow their portfolios. Alternatively, IAMGOLD could strategically acquire other entities to strengthen its consolidated market position.

This trend is supported by recent industry activity. For example, in 2024, Barrick Gold acquired a 15% stake in a significant gold project in Nevada, signaling larger players' interest in expanding their operational footprint. IAMGOLD's Côté Gold project, with its projected annual production of approximately 490,000 ounces in its first five years, represents a valuable asset in this consolidating market.

- Increased M&A Activity: The gold sector is experiencing heightened consolidation, driven by the desire for scale and access to quality assets.

- Attractive Asset Profile: IAMGOLD's Côté Gold project, with its significant production potential and location in Canada, makes it a prime candidate for acquisition.

- Strategic Consolidation: IAMGOLD itself has the opportunity to pursue strategic acquisitions to bolster its market share and operational capabilities.

The Côté Gold mine's ramp-up presents a significant opportunity for IAMGOLD to optimize operations and explore expansion, with an upcoming technical report expected to confirm a larger-scale operation and extend mine life beyond 2045.

The favorable gold price environment, with IAMGOLD's average realized price reaching approximately $3,182 per ounce in Q2 2025, directly enhances profitability and reduces all-in costs as a percentage of revenue, leading to stronger free cash flow generation.

IAMGOLD possesses substantial exploration potential in Canada, including promising early-stage and advanced projects like the Gosselin and Jack Rabbit zones near Côté Gold, which are already showing resource expansions and aim for reserve conversion.

The company's strategic deleveraging, including the repayment of $40 million on its second lien notes, coupled with improved operational cash flows, is enhancing financial flexibility and stability, positioning IAMGOLD for future growth and potentially increased shareholder returns.

Threats

Political instability and regulatory uncertainty in West Africa, especially in Burkina Faso where IAMGOLD's Essakane mine is located, present a significant threat. This instability can disrupt operations, increase security costs, and lead to unexpected changes in local regulations or community engagement demands.

The government of Burkina Faso's increased ownership stake in Essakane to 49% in 2023 and subsequent changes to the mining code underscore this evolving risk landscape. These shifts can impact profitability and operational flexibility.

IAMGOLD, like other mining firms, faces the significant threat of rising royalties and evolving tax and regulatory landscapes imposed by host governments, especially when commodity prices, like gold, surge. For example, Burkina Faso's revised Mining Code in 2023 introduced a more favorable dividend framework for the government's stake in the Essakane mine, directly affecting IAMGOLD's earnings. These policy shifts can unpredictably alter profitability and cash flow, complicating financial projections.

Even with gold prices performing well, IAMGOLD, like many in the mining sector, is facing increased costs for essential inputs. This includes higher expenses for workers, energy, and raw materials. For instance, in their 2024 guidance, IAMGOLD noted higher operating costs and one-time capital expenditures due to these inflationary trends.

These rising costs directly impact IAMGOLD's profitability. Sustained inflation can squeeze profit margins and drive up All-in Sustaining Costs (AISC). This makes it harder for the company to manage expenses efficiently and maintain its financial performance in the face of these economic headwinds.

Regulatory and Permitting Complexities in Canada

While Canada is recognized as a stable mining jurisdiction, Iamgold, like other operators, faces ongoing regulatory complexities. These include stringent environmental standards and the potential for delays in the permitting process, which can affect project timelines and operational efficiency. For instance, while Ontario has made efforts to streamline mine approvals, the introduction of changes to capital gains inclusion rates in 2024 and evolving Indigenous consultation requirements can still introduce uncertainty and impact financing strategies.

Navigating these dynamic regulatory frameworks requires substantial resource allocation and can introduce project-specific risks. These factors are critical considerations for financial planning and investment decisions within the Canadian mining sector.

- Regulatory Hurdles: Stringent environmental regulations and permitting processes in Canada can lead to project delays.

- Economic Impacts: Changes to capital gains inclusion rates in 2024 can affect investment attractiveness and financing costs.

- Indigenous Relations: Evolving Indigenous consultation requirements necessitate careful engagement and can influence project timelines.

- Operational Uncertainty: The need to adapt to evolving frameworks introduces a layer of uncertainty for long-term planning.

Gold Price Volatility

While gold prices have been supportive recently, IAMGOLD faces the persistent threat of commodity market volatility. Significant drops in gold prices could directly hurt the company's earnings and cash generation, particularly as its operational costs have risen. For instance, in early 2024, gold prices experienced fluctuations, trading in a range that, if sustained at lower levels, would pressure IAMGOLD's margins.

This inherent price instability is a critical risk. Even though gold is often seen as a safe investment, shifts in the global economy, central bank policies, or geopolitical events can trigger sharp price corrections. Such corrections could adversely affect IAMGOLD's financial results, impacting its ability to fund operations and growth initiatives.

- Gold Price Fluctuations: The price of gold can change rapidly due to market sentiment and economic factors, directly impacting IAMGOLD's revenue streams.

- Impact on Profitability: A sustained decline in gold prices could significantly reduce IAMGOLD's profit margins, especially if its cost of production remains elevated.

- Cash Flow Sensitivity: The company's cash flow generation is sensitive to gold price movements, potentially limiting its financial flexibility during downturns.

- External Economic Factors: Changes in inflation, interest rates, and global economic stability can all contribute to gold price volatility, posing a risk to IAMGOLD's financial performance.

Political instability and evolving regulatory landscapes in key operating regions, particularly Burkina Faso, pose significant threats to IAMGOLD. The government's increased stake in the Essakane mine to 49% in 2023 and changes to the mining code highlight this risk, potentially impacting profitability and operational flexibility. Furthermore, rising royalties and shifting tax regimes, as seen with Burkina Faso's 2023 mining code revisions, can unpredictably alter earnings and cash flow.

IAMGOLD faces the persistent threat of commodity market volatility, with fluctuations in gold prices directly impacting revenue. For instance, early 2024 saw gold prices trade within a range that, if sustained lower, would pressure IAMGOLD's margins, especially given rising operational costs. Increased expenses for labor, energy, and raw materials, as noted in IAMGOLD's 2024 guidance, further squeeze profit margins and elevate All-in Sustaining Costs (AISC).

Navigating stringent environmental regulations and evolving Indigenous consultation requirements in jurisdictions like Canada introduces project delays and financial uncertainty. Changes to capital gains inclusion rates in 2024 also affect investment attractiveness and financing costs, adding another layer of complexity to long-term planning and operational efficiency.

| Threat Area | Specific Risk | Impact on IAMGOLD | Example/Data Point (2023-2025) |

|---|---|---|---|

| Political & Regulatory Instability | Changes in mining codes, increased government stakes | Reduced profitability, operational disruption | Burkina Faso's 49% stake in Essakane (2023); revised mining code impacting dividends. |

| Rising Operational Costs | Inflation in labor, energy, materials | Lower profit margins, increased AISC | IAMGOLD's 2024 guidance cited higher operating costs and capital expenditures. |

| Commodity Price Volatility | Fluctuations in gold prices | Reduced revenue and cash flow | Gold price fluctuations in early 2024 impacting potential margins. |

| Regulatory & Permitting Hurdles (Canada) | Stringent environmental standards, Indigenous consultation | Project delays, increased compliance costs | Evolving Indigenous consultation requirements; 2024 capital gains inclusion rate changes. |

SWOT Analysis Data Sources

This IAMGOLD SWOT analysis is built upon a foundation of reliable data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.