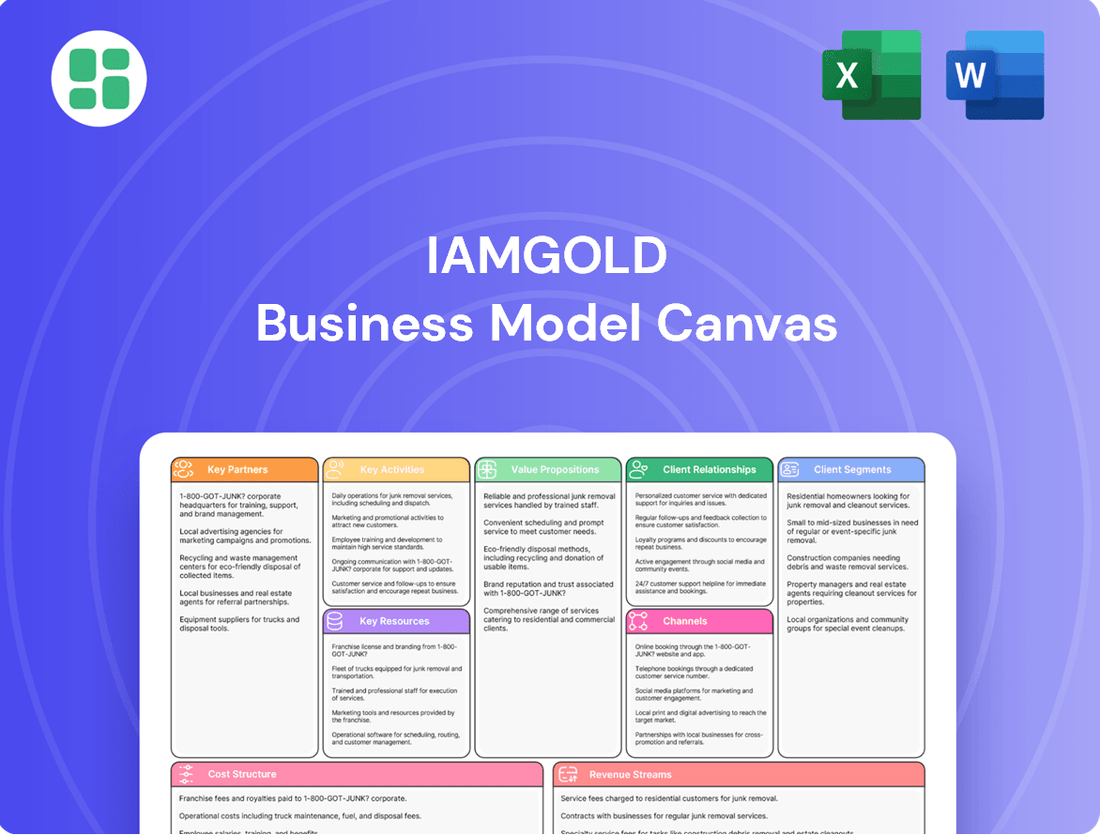

Iamgold Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iamgold Bundle

Unlock the complete strategic blueprint behind Iamgold's operations with our detailed Business Model Canvas. Discover how they create, deliver, and capture value in the competitive mining industry. This comprehensive analysis is your key to understanding their success factors and market positioning.

Ready to dissect Iamgold's winning strategy? Our full Business Model Canvas provides an in-depth look at their customer relationships, revenue streams, and key resources. Download it now to gain actionable insights for your own business ventures.

Partnerships

Iamgold actively pursues joint ventures to advance its mining portfolio, notably the Côté Gold Mine in Canada. This significant project is a 70/30 partnership with Sumitomo Metal Mining Co. Ltd., demonstrating a strategic approach to capital investment and risk sharing.

These collaborations are crucial for developing large-scale, long-life assets, pooling both financial resources and specialized technical expertise. The Côté Gold Mine, for instance, benefits from this combined strength, aiming for efficient project execution and operational success.

Iamgold actively collaborates with government entities and regulators worldwide to ensure smooth and compliant operations. For instance, its partnership with the Government of Burkina Faso, which holds a 10% stake in the Essakane mine, is vital for obtaining and retaining mining permits and licenses.

These collaborations are fundamental for adhering to national mining laws, environmental standards, and social responsibility mandates, ensuring Iamgold's operations align with local and international expectations.

Maintaining robust relationships with regulatory bodies is key to fostering a stable operating environment and mitigating potential risks associated with policy changes or permit issues, thereby supporting predictable business continuity.

IAMGOLD actively cultivates partnerships with local and Indigenous communities, recognizing their vital role in sustainable mining operations. At its Côté Gold project in Canada, the company has established Impact Benefit Agreements (IBAs) with key partners like the Mattagami First Nation, Flying Post First Nation, and the Métis Nation of Ontario, Region 3. These agreements are designed to ensure shared prosperity through dedicated employment, training programs, and opportunities for local businesses, alongside collaborative environmental stewardship.

Suppliers and Contractors

IAMGOLD relies on a diverse global network of suppliers and contractors to maintain its mining operations. These partners are crucial for providing everything from essential equipment and ongoing maintenance to specialized services like drilling, blasting, and ore processing. In 2023, IAMGOLD's commitment to responsible sourcing meant actively managing its supply chain to mitigate risks associated with forced labor and child labor, ensuring ethical practices across its operations.

These key partnerships are fundamental to ensuring IAMGOLD has consistent access to the resources and specialized expertise needed for efficient and uninterrupted production. The company's approach involves rigorous vetting and ongoing collaboration to uphold high standards throughout the value chain.

- Equipment and Maintenance: Securing reliable suppliers for heavy machinery, vehicles, and their ongoing maintenance is paramount.

- Specialized Services: Engaging contractors for critical activities such as exploration, drilling, blasting, and metallurgical processing ensures operational continuity.

- Ethical Sourcing: A strong emphasis is placed on suppliers adhering to IAMGOLD's code of conduct, particularly concerning labor practices.

- Risk Mitigation: Proactive management of the supply chain helps to identify and address potential disruptions or ethical breaches.

Financial Institutions and Investors

IAMGOLD actively collaborates with a diverse range of financial institutions to secure essential project financing, credit facilities, and gold prepayments. These partnerships are fundamental to funding IAMGOLD's capital-intensive mining projects, ensuring the necessary capital is available for development and expansion.

Maintaining robust relationships with a broad base of investors is paramount for IAMGOLD. This allows the company to effectively raise capital through equity markets and ensures the ongoing liquidity and financial stability required to operate and grow its global mining portfolio.

These strategic alliances with financial institutions and investors provide IAMGOLD with critical financial backing, enabling its growth initiatives and ensuring operational continuity. For instance, in 2023, IAMGOLD completed a significant financing round, raising approximately $500 million through a combination of debt and equity, underscoring the importance of these partnerships.

- Project Financing: IAMGOLD secures loans and credit lines from banks and financial syndicates for large-scale mine construction and development.

- Investor Relations: The company engages with institutional investors, mutual funds, and individual shareholders to maintain market confidence and facilitate capital raising.

- Gold Prepayments: Partnerships with financial entities for gold prepayments provide immediate cash flow, vital for managing operational expenses and funding exploration activities.

- Equity Capital Markets: IAMGOLD utilizes equity offerings, such as secondary offerings or private placements, to bolster its balance sheet and fund strategic opportunities.

Iamgold's key partnerships are vital for project development, operational efficiency, and financial stability. These include joint ventures like the Côté Gold Mine with Sumitomo Metal Mining, crucial for sharing capital and expertise. Collaborations with governments, such as with Burkina Faso for the Essakane mine, ensure regulatory compliance and operational permits. Furthermore, strong relationships with local and Indigenous communities, exemplified by Impact Benefit Agreements at Côté Gold, foster social license and shared prosperity.

Iamgold also relies on a robust network of suppliers and contractors for essential equipment, maintenance, and specialized services. In 2023, the company actively managed its supply chain to ensure ethical sourcing and mitigate risks. Financial partnerships with institutions and investors are fundamental for securing project financing and raising capital. For instance, in 2023, Iamgold raised approximately $500 million through debt and equity, highlighting the critical role of these alliances in funding its growth and operational continuity.

| Partner Type | Example | Purpose | 2023 Relevance/Data |

|---|---|---|---|

| Joint Venture Partner | Sumitomo Metal Mining (Côté Gold) | Capital sharing, technical expertise | Côté Gold ramp-up |

| Government Entity | Government of Burkina Faso (Essakane) | Permits, regulatory compliance | 10% stake in Essakane |

| Local/Indigenous Community | Mattagami First Nation (Côté Gold) | Social license, shared prosperity | Impact Benefit Agreements |

| Financial Institution | Various Banks/Syndicates | Project financing, credit facilities | Secured ~$500M financing in 2023 |

| Supplier/Contractor | Equipment & Service Providers | Operational inputs, specialized services | Ethical sourcing focus in 2023 |

What is included in the product

This Business Model Canvas provides a strategic overview of Iamgold's operations, detailing its key partners, activities, and resources in the gold mining sector.

It outlines Iamgold's customer relationships, cost structure, and revenue streams, offering insights into its approach to value creation and delivery.

IAMGOLD's Business Model Canvas offers a clear, structured approach to identifying and addressing the complex challenges within the mining industry, acting as a pain point reliever by simplifying strategic planning and operational focus.

By visually mapping out key resources, activities, and customer segments, IAMGOLD's Business Model Canvas provides a crucial framework to diagnose and alleviate operational bottlenecks and market uncertainties.

Activities

IAMGOLD's core activities revolve around discovering new gold deposits and progressing existing projects. This encompasses geological mapping, drilling programs, and detailed resource modeling to pinpoint economically viable extraction sites.

The company undertakes rigorous feasibility studies to confirm the financial soundness of potential mines. In 2023, IAMGOLD's exploration efforts focused on advancing its early-stage projects, with a significant portion of its capital expenditure directed towards these vital activities aimed at future reserve replenishment.

Iamgold's core activities revolve around the entire mining process, from digging ore out of the ground, whether through open pits or underground, to refining that ore into doré bars, which is a semi-pure form of gold. This covers the complete journey of getting gold from the earth to a marketable product.

Key operational sites like Côté Gold in Canada and Essakane in Burkina Faso are crucial for this. The focus is on reaching their designed production capacities, known as nameplate throughput rates, and continuously improving how efficiently they extract and process gold. For instance, in the first quarter of 2024, Essakane produced 69,000 ounces of gold, while Westwood contributed 18,000 ounces, demonstrating ongoing operational efforts.

Successfully managing these mines is absolutely vital. It's how Iamgold meets its yearly gold production goals and, consequently, generates the revenue needed to operate and grow. The company's 2024 guidance anticipates total production between 477,000 and 533,000 ounces, with Côté Gold expected to contribute significantly as it ramps up.

IAMGOLD's commitment to responsible mining is central to its operations. This means actively managing environmental footprints, building strong relationships with local communities, and upholding robust governance principles. For instance, in 2023, IAMGOLD reported a 12% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to 2022, demonstrating progress in its environmental stewardship.

Key activities include implementing various sustainability initiatives, such as water management programs and biodiversity conservation efforts. The company also prioritizes transparent reporting on its Environmental, Social, and Governance (ESG) performance, allowing stakeholders to track its progress. This dedication to transparency is crucial for maintaining trust and accountability.

Furthermore, IAMGOLD strives to cultivate a 'Zero Harm' culture, emphasizing health and safety for all employees and contractors. This focus not only protects its workforce but also underpins its broader social license to operate. The company's safety performance in 2023 showed a Total Recordable Injury Frequency Rate of 0.73 per 200,000 hours worked, reflecting its ongoing efforts.

Capital Management and Financing

IAMGOLD actively manages its capital structure to fund significant undertakings, such as the development of the Côté Gold project. This includes strategically securing necessary financing, managing existing debt obligations, and leveraging available credit facilities to maintain financial agility. This approach is crucial for supporting ongoing operational requirements and future growth opportunities.

The company's financial strategy also encompasses the careful management of gold prepay arrangements. These arrangements provide upfront capital in exchange for future gold deliveries, offering a vital source of funding. For instance, in early 2024, IAMGOLD continued to navigate these agreements to ensure liquidity and support its development pipeline.

Sound capital management is fundamental to IAMGOLD's stability and its ability to advance key projects. This financial discipline underpins the company's capacity to undertake large-scale mining operations and adapt to market dynamics.

- Financing Major Projects: Securing capital for projects like Côté Gold is a primary activity.

- Debt and Credit Management: Actively managing debt repayment and utilizing credit lines ensures financial flexibility.

- Gold Prepay Arrangements: Utilizing these agreements provides upfront capital for operations and development.

- Financial Flexibility: Maintaining adaptability in capital structure supports growth and operational needs.

Supply Chain Management and Procurement

Iamgold's supply chain management and procurement are pivotal for its global mining operations, ensuring the acquisition of essential goods, equipment, and services. This involves careful navigation of a diverse and often complex international network.

The company places a strong emphasis on rigorous due diligence to identify and mitigate risks within its supply chain, particularly concerning forced labor and child labor. This commitment to ethical sourcing is paramount, alongside achieving cost-efficiency in procurement to maintain financial health.

In 2023, Iamgold reported that its procurement processes are designed to support uninterrupted mining activities, which is critical given the capital-intensive nature of the industry. For instance, managing the acquisition of specialized mining equipment and consumables requires foresight and robust supplier relationships.

- Global Sourcing: Procuring a wide range of materials, from explosives to heavy machinery, from international suppliers.

- Ethical Diligence: Implementing checks to prevent the use of forced or child labor in the supply chain.

- Cost Optimization: Negotiating favorable terms and identifying efficient sourcing channels to manage operational expenses.

- Operational Continuity: Ensuring timely delivery of critical supplies to avoid disruptions in mining and processing activities.

IAMGOLD's key activities center on the responsible discovery, development, and operation of gold mines. This includes geological exploration, resource estimation, and conducting feasibility studies to ensure project viability.

Operational execution involves the efficient extraction and processing of ore, transforming it into saleable gold doré. Maintaining high production levels at key sites like Côté Gold and Essakane is paramount for revenue generation.

The company also prioritizes sustainability and safety, managing environmental impacts and fostering a safe working environment. IAMGOLD's financial activities focus on securing capital for projects, managing debt, and optimizing its capital structure.

Supply chain management is critical for acquiring necessary equipment and materials globally, with a strong emphasis on ethical sourcing and operational continuity.

| Key Activity | Description | 2024 Focus/Data |

| Exploration & Development | Discovering and advancing new gold deposits. | Continued investment in early-stage projects for future reserve growth. |

| Mine Operations | Extracting and processing ore into gold doré. | Targeting 477,000-533,000 ounces of gold production in 2024, with Côté Gold ramping up. |

| Sustainability & Safety | Managing environmental footprint and ensuring worker safety. | Aiming for a 'Zero Harm' culture; reported a 0.73 TRIR in 2023. |

| Financial Management | Securing funding and managing capital structure. | Strategic financing for Côté Gold; managing debt and prepayments. |

| Supply Chain Management | Procuring goods and services globally. | Ensuring timely delivery of critical mining equipment and consumables. |

Full Version Awaits

Business Model Canvas

The Iamgold Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use Business Model Canvas, allowing you to start leveraging its insights without delay.

Resources

IAMGOLD's key resource is its substantial gold mineral reserves and resources, predominantly situated in West Africa and Canada. Notable deposits include Côté Gold, Essakane, and Westwood, forming the bedrock of the company's production capabilities and future value.

These proven and probable reserves are critical for IAMGOLD's operational continuity and long-term strategic planning. The company's ability to access and further define these resources directly influences its production capacity and overall financial health.

As of the end of 2023, IAMGOLD reported total proven and probable gold reserves of 5.0 million ounces, with Côté Gold accounting for a significant portion of this. The company's resource base, including measured and indicated resources, further supports its long-term development pipeline.

IAMGOLD's mining infrastructure and equipment are the backbone of its operations, encompassing everything from heavy-duty mining fleets like trucks and excavators to sophisticated processing plants featuring mills and crushers. These physical assets are fundamental for efficiently extracting and processing ore, directly impacting overall production performance.

Maintaining and upgrading this critical infrastructure requires continuous investment to ensure sustained output and operational efficiency. For instance, IAMGOLD's capital expenditures on sustaining operations, which include maintaining its existing asset base, were approximately $217 million in 2023, highlighting the ongoing commitment to its mining facilities.

IAMGOLD's success hinges on its highly skilled workforce, encompassing geologists, engineers, operators, and administrative professionals. This human capital is fundamental to every stage of their mining operations, from exploration to production.

The management team's expertise in mining operations, project development, and financial management is equally crucial. Their strategic guidance steers the company through complex market conditions and ensures efficient resource allocation.

As of 2024, IAMGOLD employs approximately 3,700 individuals worldwide. This substantial global team brings a wealth of collective knowledge and experience, directly contributing to operational efficiency and fostering innovation within the company.

Financial Capital and Liquidity

Iamgold's business model hinges on robust financial capital and liquidity. This includes maintaining substantial cash reserves, securing favorable credit facilities, and strategically utilizing equity to fund all stages of its operations, from initial exploration to ongoing production. The company's capacity to raise and manage capital effectively is paramount for its financial stability and its ability to pursue growth opportunities.

In 2024, Iamgold demonstrated strong financial performance, achieving record revenues. This financial strength is further bolstered by available credit facilities, providing the necessary liquidity to support its strategic initiatives and day-to-day operations.

- Financial Capital Access: Iamgold secures funding through a mix of cash on hand, credit lines, and equity issuances to finance exploration, development, and operational needs.

- Liquidity Management: Effective management of debt and cash flow ensures the company remains financially healthy and capable of making strategic investments.

- 2024 Performance: The company reported record revenues in 2024, underscoring its strong financial position and operational success.

- Credit Facilities: Access to credit lines provides additional financial flexibility and supports ongoing operational requirements and investment plans.

Permits, Licenses, and Social License to Operate

Iamgold, like all mining companies, requires a complex web of legal and regulatory permits and licenses to conduct its operations. These are secured from various government authorities and cover every stage, from initial exploration and surveying to full-scale production and eventual mine closure. Without these official authorizations, no mining activity can legally commence or continue, underscoring their fundamental importance to the business model.

Beyond the formal legal requirements, Iamgold also places significant emphasis on obtaining and maintaining its 'social license to operate.' This crucial element is not granted by any government body but is earned through building and nurturing strong, positive relationships with local communities and Indigenous groups. These relationships are often formalized through Impact Benefit Agreements (IBAs), which outline shared benefits and responsibilities.

- Legal Permits: Essential for exploration, environmental impact assessments, water usage, and operational safety, ensuring compliance with national and regional mining laws.

- Licenses: Cover specific activities such as blasting, hazardous material handling, and transportation, requiring adherence to strict safety and environmental standards.

- Social License: Developed through community engagement, employment opportunities, local procurement, and cultural heritage protection agreements, fostering trust and mutual benefit.

- Risk Mitigation: Both legal and social licenses are critical for mitigating operational risks, preventing costly delays, and ensuring long-term project viability. In 2024, for instance, Iamgold continued to engage with stakeholders regarding its projects, aiming to solidify these essential operating permissions.

Iamgold's intellectual property includes its proprietary exploration techniques, geological models, and operational expertise. These intangible assets, developed over years of experience, provide a competitive edge in identifying and developing new gold deposits. Furthermore, the company's brand reputation and established relationships within the mining industry are invaluable resources that facilitate partnerships and attract investment.

The company's commitment to innovation is reflected in its ongoing research and development efforts aimed at improving extraction efficiency and reducing environmental impact. This focus on technological advancement ensures IAMGOLD remains at the forefront of the mining sector.

As of early 2024, IAMGOLD's strategic focus includes advancing its Côté Gold project, which is expected to significantly boost production and contribute substantially to the company's resource base. The company's ability to leverage its intellectual capital in project development is a key differentiator.

Value Propositions

IAMGOLD is a dependable source of gold for the market, with a production target of 667,000 ounces in 2024. This consistent output provides stability for those who rely on precious metals.

The company anticipates a significant increase in its gold supply, projecting production between 735,000 and 820,000 ounces for 2025. This growth is largely driven by the successful ramp-up of its Côté Gold project.

Iamgold is focused on generating shareholder value by boosting gold production, cutting costs, and advancing key projects. This strategy is supported by strong financial results, including achieving record revenues in 2024.

The company's commitment to value creation is evident in its improved financial performance, with net income seeing a substantial increase. This growth is directly linked to operational successes.

The successful ramp-up of the Côté Gold mine and the positive turnaround at the Westwood operation are critical factors driving this enhanced shareholder value.

IAMGOLD prioritizes responsible and sustainable mining, embedding Environmental, Social, and Governance (ESG) principles into its operations. This commitment is underscored by its 'Zero Harm' safety culture and alignment with the World Gold Council's Responsible Gold Mining Principles.

This focus on ethical practices attracts investors and stakeholders who value sustainability, while simultaneously reducing environmental and social risks for the company. IAMGOLD’s 2024 Sustainability Report details advancements in these critical areas.

Economic Contribution to Host Regions

IAMGOLD's operations are a significant engine for economic growth in the regions where it operates. The company actively contributes to host economies through substantial job creation and by prioritizing local businesses for its supply needs.

The Côté Gold project exemplifies this commitment. During its construction phase, it was projected to create more than 1,000 jobs, with an ongoing operational employment of around 450 individuals. This influx of employment directly benefits local communities, boosting household incomes and stimulating economic activity.

- Job Creation: IAMGOLD's projects generate direct and indirect employment opportunities, providing livelihoods for local residents.

- Local Procurement: The company emphasizes sourcing goods and services from local suppliers, channeling economic benefits back into the host regions.

- Community Investments: Beyond direct economic contributions, IAMGOLD invests in community development initiatives, further strengthening regional economies and fostering positive relationships.

- Economic Multiplier Effect: The wages paid to employees and the revenue generated from local procurement create a ripple effect, supporting a wider range of businesses and services within the host region.

Long-Life and Low-Cost Assets

IAMGOLD's strategic focus on long-life and low-cost assets is a cornerstone of its value proposition. The Côté Gold project, for instance, is projected to have a mine life extending beyond 18 years, offering significant long-term operational stability. This longevity is crucial for sustained revenue generation and investor confidence.

The company is actively pursuing cost optimization across its operations. IAMGOLD targets competitive cash costs and All-in Sustaining Costs (AISC), aiming to be a cost-efficient producer within the gold mining sector. This disciplined approach to cost management is vital for maintaining profitability, especially during periods of fluctuating gold prices.

- Long-Life Assets: Côté Gold project with an expected mine life exceeding 18 years.

- Cost Efficiency: Focus on achieving competitive cash costs and AISC.

- Profitability: Positioned as a cost-efficient producer to ensure long-term profitability.

- Stability: Long-life assets provide a stable foundation for future operations and returns.

IAMGOLD provides a reliable supply of gold, with a 2024 production target of 667,000 ounces, ensuring market stability. The company is poised for significant growth, projecting 735,000 to 820,000 ounces for 2025, driven by the Côté Gold project's ramp-up.

Shareholder value is enhanced through increased production, cost reduction, and project advancement, supported by record revenues in 2024 and a substantial net income increase linked to operational successes like Côté Gold and Westwood.

IAMGOLD champions responsible mining, integrating ESG principles and a Zero Harm safety culture, aligning with the World Gold Council's Responsible Gold Mining Principles. This ethical approach reduces risks and appeals to sustainability-minded investors.

The company is a key economic driver in its operating regions, creating jobs and prioritizing local procurement. Côté Gold alone is expected to create over 1,000 construction jobs and sustain around 450 operational roles.

| Value Proposition | Description | Key Metrics/Examples |

|---|---|---|

| Reliable Gold Supply | Consistent production of gold for the market. | 2024 Production Target: 667,000 ounces. |

| Growth Potential | Anticipated increase in gold production driven by new projects. | 2025 Production Projection: 735,000 - 820,000 ounces (driven by Côté Gold). |

| Shareholder Value Creation | Focus on boosting production, reducing costs, and advancing projects for improved financial performance. | Record revenues in 2024, substantial net income increase. |

| Responsible & Sustainable Operations | Commitment to ESG principles and safety. | Zero Harm safety culture, alignment with World Gold Council's Responsible Gold Mining Principles. |

| Economic Contribution to Host Regions | Job creation and local business support. | Côté Gold: >1,000 construction jobs, ~450 ongoing operational jobs. Emphasis on local procurement. |

| Long-Life, Low-Cost Assets | Strategic focus on assets with extended operational life and cost efficiency. | Côté Gold expected mine life >18 years. Focus on competitive cash costs and AISC. |

Customer Relationships

IAMGOLD prioritizes clear and consistent communication with its investors. This includes timely dissemination of financial reports, operational updates via news releases, and interactive conference calls. The company also maintains a robust investor relations portal on its website, offering comprehensive information for shareholders and prospective investors alike.

In 2024, IAMGOLD's commitment to transparency was evident in its regular quarterly earnings calls and the detailed information provided in its financial statements. For instance, the company's Q1 2024 report, released in early May, offered insights into production figures and cost management strategies, directly impacting investor understanding of ongoing operations.

Iamgold actively cultivates robust relationships with local and Indigenous communities. This is achieved through continuous dialogue, formal Impact Benefit Agreements, and targeted community investment programs. These efforts are vital for proactively addressing local concerns, generating shared value, and ensuring a sustainable social license to operate.

A prime example of this commitment is the company's support for the Mattagami First Nation Fish Hatchery. Such initiatives underscore Iamgold's dedication to tangible community development and partnership, reflecting a 2024 focus on strengthening these crucial ties.

IAMGOLD actively works with government and regulatory bodies across all levels of operation. This proactive engagement ensures adherence to mining laws, environmental standards, and social responsibility policies, which is crucial for maintaining operating permits. For instance, in 2024, IAMGOLD continued to focus on transparent reporting and consultations with authorities in regions like Quebec, Canada, and Suriname.

Employee Relations and Welfare

IAMGOLD prioritizes its approximately 3,700 employees and contractors, recognizing that strong relationships are key to smooth operations and high productivity. The company actively fosters a 'Zero Harm' safety culture, underscoring its commitment to employee well-being.

Significant investment in employee training and development programs aims to enhance skills and foster growth within the workforce. This focus on nurturing talent directly supports IAMGOLD's operational efficiency and long-term success.

- Employee Count: Approximately 3,700 employees and contractors as of recent reporting.

- Safety Culture: Emphasis on a 'Zero Harm' safety culture to ensure employee well-being.

- Development Investment: Commitment to employee training and development programs.

- Impact: Strong employee relations contribute to a motivated workforce and reduced turnover.

Direct Engagement with Gold Buyers/Refiners

IAMGOLD's customer relationships are primarily with gold refiners and bullion dealers, who purchase its gold doré. These are not typical consumer relationships but rather strategic business-to-business partnerships. The company focuses on establishing robust sales contracts and managing the complex logistics involved in delivering its precious metal products.

Ensuring the consistent quality and purity of the gold doré is paramount in these direct engagements. IAMGOLD's 2024 production figures, for instance, would directly impact the volume and value of transactions with these key buyers. For example, if IAMGOLD reported producing 450,000 ounces of gold in 2023, this would be the basis for negotiations and contracts with its refiner and dealer customers for the subsequent year.

- Direct Sales Channels: IAMGOLD sells its gold doré directly to established refiners and bullion dealers, bypassing intermediaries.

- Contractual Agreements: These relationships are formalized through sales contracts that outline terms, pricing, and delivery schedules.

- Logistical Coordination: Managing the secure and efficient transportation of gold doré from mine sites to refiners is a critical aspect of these relationships.

- Quality Assurance: Maintaining high standards of gold purity and consistency is essential for customer satisfaction and continued business.

IAMGOLD’s customer relationships are centered on its gold doré sales to refiners and bullion dealers, forming key business-to-business partnerships. The company emphasizes strong sales contracts and efficient logistics for its precious metal products.

Maintaining high quality and purity in its gold doré is crucial for these direct customer interactions. For instance, IAMGOLD's 2023 gold production of 450,000 ounces served as the foundation for 2024 contract negotiations with its primary buyers.

| Relationship Type | Key Partners | Focus Areas | 2023 Production Impact on 2024 |

|---|---|---|---|

| B2B Sales | Gold Refiners, Bullion Dealers | Sales Contracts, Logistics, Quality Assurance | 450,000 ounces of gold doré sold |

Channels

IAMGOLD's primary sales avenue involves directly selling gold doré, a semi-pure alloy of gold, to specialized gold refiners and bullion dealers. These key partners are crucial as they transform the doré into the highly pure gold bars demanded by global markets, serving industries, investors, and jewelers alike.

This direct engagement streamlines the sales process and ensures that IAMGOLD's pricing is closely aligned with prevailing international gold prices, reflecting the commodity's real-time market value. For instance, in the first quarter of 2024, IAMGOLD reported total gold sales of 170,000 ounces, with the majority of this volume flowing through these direct channels.

IAMGOLD utilizes stock exchanges like the TSX (IMG) and NYSE (IAG) to access capital through equity and debt offerings. This is crucial for funding its mining operations and growth initiatives. In 2023, IAMGOLD's market capitalization fluctuated, reflecting investor sentiment and operational performance, providing a key indicator of its valuation and access to further funding.

Financial news platforms and investor relations websites serve as vital communication channels, disseminating company updates, financial reports, and strategic developments. These platforms allow IAMGOLD to reach a broad audience of potential and existing investors, fostering transparency and engagement. Investor conference calls and webcasts further enhance this communication, offering direct interaction and clarification on company performance and outlook.

IAMGOLD's official website acts as a primary information conduit, offering detailed corporate data, sustainability reports, and investor relations materials. In 2024, the company continued to leverage its digital presence to communicate operational updates and financial performance, ensuring transparency for stakeholders.

Digital media channels, including social platforms and online news, are crucial for disseminating IAMGOLD's narrative and maintaining a broad public and investor dialogue. This strategy helps to amplify company news and engage with a wider audience, reinforcing its market presence.

Annual and Sustainability Reports

Iamgold’s commitment to transparency is clearly demonstrated through its annual and sustainability reports. These documents offer a deep dive into the company's financial health and its dedication to environmental, social, and governance (ESG) principles. For instance, in 2023, Iamgold reported revenues of $1.58 billion, alongside significant investments in community development programs and environmental stewardship initiatives, detailed within these reports.

These reports serve as vital communication tools, ensuring all stakeholders, from shareholders to local communities, have access to accurate information. They highlight not only financial results but also the company's progress on sustainability goals, such as reducing greenhouse gas emissions and improving safety records across its operations. For example, the 2023 sustainability report outlined a 15% reduction in Scope 1 and 2 emissions intensity compared to the previous year.

- Financial Performance: Detailed financial statements and analysis of revenues, costs, and profitability.

- Operational Highlights: Key metrics on production, exploration activities, and project development.

- ESG Initiatives: Comprehensive data on environmental impact, social responsibility, and corporate governance practices.

- Stakeholder Engagement: Information on how the company interacts with and addresses the concerns of its diverse stakeholders.

Community Programs and Local Engagement Initiatives

IAMGOLD actively engages with its local stakeholders through various community development programs and local employment initiatives. These efforts are often formalized through Impact Benefit Agreements, ensuring a structured approach to local collaboration and support. In 2024, IAMGOLD continued to focus on these channels to foster positive relationships and address community needs.

These engagement strategies serve as crucial conduits for information sharing, allowing IAMGOLD to communicate operational updates and future plans directly with communities. By understanding and responding to local needs, the company aims to build and maintain trust, which is essential for the long-term sustainability and social license of its mining operations.

- Community Development Programs: IAMGOLD invests in projects that aim to improve local infrastructure, education, and healthcare, aligning with community priorities.

- Local Employment Initiatives: The company prioritizes hiring from local communities, contributing to economic development and providing sustainable job opportunities. In 2023, IAMGOLD reported that a significant portion of its workforce across its operations was locally sourced.

- Impact Benefit Agreements (IBAs): These agreements establish clear commitments between IAMGOLD and Indigenous communities, outlining mutual benefits and responsibilities, and were a key framework for engagement in 2024.

- Direct Engagement: Regular meetings, consultations, and feedback mechanisms are employed to ensure ongoing dialogue and responsiveness to community concerns.

IAMGOLD's channels are multifaceted, extending from direct sales of gold doré to refiners and bullion dealers, to leveraging stock exchanges for capital. Communication channels are equally diverse, encompassing investor relations websites, financial news platforms, and digital media for broad stakeholder engagement.

The company also prioritizes direct engagement with local communities through development programs and impact benefit agreements, ensuring transparency and responsiveness. These various channels collectively support IAMGOLD's operational needs, financial strategy, and social license to operate.

In Q1 2024, IAMGOLD sold 170,000 ounces of gold, primarily through direct channels. The company's market capitalization on the TSX and NYSE in 2023 provided insights into investor confidence and access to funding.

| Channel Type | Key Activities | 2024 Focus/Data |

|---|---|---|

| Direct Sales | Selling gold doré to refiners/dealers | Majority of 170,000 oz Q1 2024 sales |

| Capital Markets | Equity/debt offerings via TSX, NYSE | Market capitalization fluctuations in 2023 informed strategy |

| Information Dissemination | Investor relations websites, financial news, digital media | Continued use for operational updates and financial performance |

| Stakeholder Engagement | Community programs, IBAs, local employment | Focus on positive relationships and addressing community needs |

Customer Segments

IAMGOLD's customer base encompasses both large institutional investors, such as pension funds and asset managers, and individual retail investors. These shareholders are primarily focused on the company's financial health, its potential for future growth, and the possibility of receiving dividends. For instance, as of the first quarter of 2024, IAMGOLD reported total assets of approximately $3.8 billion, reflecting the scale of investment managed by its institutional partners.

These diverse investor groups are keenly interested in IAMGOLD's operational performance, particularly its gold production figures and cost management. They also evaluate the company's strategic direction, including its exploration activities and project development pipeline, as key drivers for capital appreciation. The company's commitment to Environmental, Social, and Governance (ESG) principles is also a significant factor for many, influencing their investment decisions and the company's overall valuation.

Gold refiners and industrial buyers are IAMGOLD's direct customers, purchasing doré bars to process into various forms for manufacturing, investment, and jewelry. These entities prioritize a reliable supply of high-quality gold from a trusted producer like IAMGOLD. In 2024, IAMGOLD continued its focus on operational efficiency, aiming to deliver consistent production volumes to meet the demands of these key segments.

Governments and regulatory bodies, including national and regional administrations in operating countries like Canada and Burkina Faso, are crucial customer segments for IAMGOLD. Their primary interests revolve around ensuring tax revenues and royalty payments, which are vital for public services and infrastructure development. For instance, in 2023, IAMGOLD's total tax and royalty payments amounted to $139 million, underscoring their significant fiscal contribution.

These entities also prioritize IAMGOLD's adherence to environmental protection standards and labor laws, ensuring responsible mining practices and fair treatment of workers. Compliance with these regulations is paramount for maintaining operational licenses and fostering positive community relations. Furthermore, governments look for contributions to local economic development through job creation and procurement from local suppliers.

Local and Indigenous Communities

IAMGOLD’s local and Indigenous communities are vital partners. Their engagement focuses on tangible benefits like job creation and supporting local enterprises. For instance, in 2024, IAMGOLD continued its commitment to local procurement, with a significant portion of its operational spending directed towards community-based suppliers.

Environmental stewardship and community well-being are paramount. This includes investing in social programs and ensuring the protection of natural resources and cultural heritage. These efforts are designed to foster long-term positive impacts and build trust.

- Employment: Prioritizing local hiring, with specific targets for Indigenous employment at its Canadian operations in 2024.

- Local Business Development: Supporting the growth of local businesses through procurement agreements and capacity-building initiatives.

- Environmental Stewardship: Implementing robust environmental management plans to protect local ecosystems and water resources.

- Social Investment: Funding community projects focused on education, health, and infrastructure development, reflecting community needs identified through ongoing dialogue.

Employees and Contractors

IAMGOLD's employees and contractors represent a crucial internal customer segment. They seek safe working environments, competitive pay, opportunities for growth, and job security. The company's dedication to its Zero Harm policy and overall employee well-being directly addresses these fundamental needs.

In 2023, IAMGOLD reported a total workforce of approximately 3,500 individuals, encompassing both direct employees and contractors across its global operations. This highlights the significant human capital that drives the company's success.

- Workforce Size: Approximately 3,500 employees and contractors in 2023.

- Key Needs: Safe working conditions, fair compensation, career advancement, and job stability.

- Company Commitment: Focus on Zero Harm policy and employee welfare initiatives.

- Impact: A stable and motivated workforce is essential for operational efficiency and achieving strategic goals.

IAMGOLD's customer segments are diverse, ranging from large institutional and individual investors focused on financial returns and growth to industrial buyers and gold refiners seeking reliable, high-quality supply. Governments are also key customers, prioritizing tax revenues and responsible operations, while local and Indigenous communities expect tangible benefits and environmental stewardship.

Employees and contractors form another vital segment, valuing safety, fair compensation, and career development. IAMGOLD's performance in 2024, including its total assets of approximately $3.8 billion as of Q1 2024, directly impacts investor confidence and its ability to serve these varied customer needs.

| Customer Segment | Key Interests | 2023/2024 Data Point |

|---|---|---|

| Investors (Institutional & Retail) | Financial health, growth potential, dividends, ESG performance | Total Assets: ~$3.8 billion (Q1 2024) |

| Industrial Buyers & Refiners | Reliable supply of high-quality gold | Continued focus on operational efficiency in 2024 |

| Governments & Regulatory Bodies | Tax revenues, royalties, environmental compliance, labor laws | Tax & Royalty Payments: $139 million (2023) |

| Local & Indigenous Communities | Job creation, local business support, environmental protection, social programs | Commitment to local procurement in 2024 |

| Employees & Contractors | Safe working environment, competitive pay, career growth | Workforce size: ~3,500 (2023) |

Cost Structure

Operating costs are a significant component of Iamgold's business model, encompassing the direct expenses of mining and processing gold. These include crucial elements like labor, energy consumption (both fuel and electricity), essential reagents, and various consumables needed for extraction. In 2024, Iamgold reported that its Essakane and Westwood operations achieved cash costs at the lower end of their projected guidance, indicating efficient management of these direct expenditures.

Beyond the direct mining and processing activities, operating costs also include general and administrative (G&A) expenses incurred at the mine sites. These cover essential support functions that keep operations running smoothly. As Iamgold continues to ramp up production at its Côté Gold project, a key focus is on reducing its operating costs, with expectations that these will decrease as the operation matures and achieves greater economies of scale.

Iamgold's cost structure heavily relies on capital expenditures, split between sustaining and expansion efforts. Sustaining capital covers the ongoing maintenance and upkeep of existing mines, ensuring they operate efficiently. Expansion capital, on the other hand, is allocated to developing new mining projects or significantly upgrading current ones to increase production capacity.

A prime example of expansion capital is the significant investment made in the Côté Gold mine. This project represents a major development initiative for Iamgold, aiming to establish a new, substantial source of gold production. The construction and ramp-up phases of such large-scale projects require substantial upfront investment.

Looking ahead, Iamgold has projected capital expenditures of $310 million for 2025. This figure underscores the company's commitment to both maintaining its current operational base and advancing its growth projects. Key sites receiving these investments include Côté Gold, Westwood, and Essakane, indicating a strategic focus on these particular assets for future development and sustained output.

IAMGOLD's commitment to future growth is heavily reliant on its exploration and evaluation costs. These expenditures are essential for identifying and assessing new mineral deposits, which is the lifeblood of any mining operation. This includes vital activities like geological surveys to understand subsurface geology, extensive drilling programs to test promising areas, and detailed resource evaluation to determine the economic viability of any discoveries.

For 2025, IAMGOLD has projected approximately $38 million in attributable exploration expenditures. This significant investment will be strategically allocated across key assets, with a particular focus on advancing the Côté Gold project, bolstering exploration efforts at Essakane, and developing promising opportunities within Quebec.

Environmental and Social Compliance Costs

Iamgold incurs significant expenses to adhere to stringent environmental regulations and actively implement sustainability projects. These costs are fundamental to responsible mining operations.

These expenditures encompass critical areas such as the meticulous management of tailings, comprehensive land rehabilitation efforts post-mining, and strategic investments in community development programs. For instance, in 2023, Iamgold reported total environmental expenditures, including rehabilitation and closure provisions, amounting to approximately $36.8 million.

- Tailings Management: Costs associated with safe storage, monitoring, and eventual closure of tailings facilities.

- Land Rehabilitation: Expenses for restoring mined land to its pre-mining or an agreed-upon post-mining state.

- Community Investments: Funding for social programs, infrastructure, and economic development initiatives in areas surrounding operations.

- Environmental Monitoring and Reporting: Costs for ongoing tracking of environmental impacts and compliance reporting.

Financing Costs (Interest, Debt Repayment, Royalties)

Iamgold's financing costs are a crucial element of its cost structure, directly impacting profitability. These expenses primarily stem from servicing its debt obligations, including interest payments on various loans and the repayment of principal amounts. For instance, as of the first quarter of 2024, Iamgold reported interest expenses related to its debt facilities, which are a direct consequence of its capital structure and ongoing operational investments.

Royalties also represent a significant ongoing cost. These are typically paid to governments or other entities based on a percentage of gold production or profits. A notable example is the 7.5% net profits interest royalty associated with the Côté Gold project. Additionally, the Essakane mine in Burkina Faso involves a 10% government interest, which translates into royalty-like payments that reduce net revenue. Effective management of these financing and royalty costs is paramount for Iamgold to optimize its bottom line and ensure sustainable financial performance.

- Debt Servicing: Interest payments on loans and principal repayments are key components of financing costs.

- Royalty Payments: Royalties, such as the 7.5% net profits interest at Côté Gold and the 10% government interest at Essakane, directly reduce profitability.

- Profitability Impact: Prudent management of these financing and royalty expenses is essential for Iamgold's overall financial health.

Iamgold's cost structure is a complex interplay of direct operational expenses, capital investments, exploration efforts, environmental stewardship, and financial obligations. Efficient management of these diverse cost categories is critical for the company's profitability and long-term sustainability.

Operating costs, including labor, energy, and reagents, are directly tied to the mining and processing of gold. Capital expenditures are divided between maintaining existing operations and expanding production capacity, with significant investments planned for projects like Côté Gold. Exploration and evaluation costs are vital for future resource discovery, with a substantial budget allocated for 2025.

Furthermore, environmental compliance and community investments represent ongoing expenses necessary for responsible mining practices. Financing costs, primarily debt servicing, and royalty payments, such as the 7.5% net profits interest at Côté Gold, directly impact the company's net revenue.

| Cost Category | Key Components | 2024/2025 Data Points |

|---|---|---|

| Operating Costs | Labor, Energy, Reagents, Consumables, G&A | Essakane & Westwood cash costs at lower end of 2024 guidance. Focus on reducing costs at Côté Gold as it matures. |

| Capital Expenditures | Sustaining Capital, Expansion Capital | Projected $310 million for 2025, focusing on Côté Gold, Westwood, and Essakane. |

| Exploration & Evaluation | Geological Surveys, Drilling, Resource Evaluation | Projected $38 million attributable exploration expenditures for 2025, targeting Côté Gold, Essakane, and Quebec opportunities. |

| Environmental & Social | Tailings Management, Land Rehabilitation, Community Investments | Approx. $36.8 million in total environmental expenditures (incl. provisions) in 2023. |

| Financing & Royalties | Debt Servicing (Interest), Royalty Payments | 7.5% net profits interest royalty at Côté Gold; 10% government interest at Essakane. |

Revenue Streams

The primary way IAMGOLD makes money is by selling the gold it mines. This is their main source of income.

In 2024, IAMGOLD achieved significant success, reporting record revenues totaling $1,633.0 million. This impressive figure came from selling 699,000 ounces of gold at an average price of $2,330 per ounce.

While IAMGOLD's primary revenue driver is gold, some of its mining operations, like the Côté Gold project, have the potential to generate by-product revenue. For instance, Côté Gold is expected to produce copper as a significant by-product. In 2024, IAMGOLD reported that Côté Gold's copper by-product credits are anticipated to reduce the overall gold cost of sales, contributing to the company's financial performance.

IAMGOLD historically leveraged gold prepay arrangements as a key financing tool, securing immediate cash infusions by committing to future gold sales. This strategy provided crucial liquidity, allowing the company to fund operations and development projects. For instance, these arrangements have been instrumental in managing capital expenditures across its portfolio.

The company successfully concluded its final gold prepay arrangement in June 2025, marking the end of this financing chapter. This final delivery generated a significant cash inflow, contributing positively to IAMGOLD's overall financial position and bolstering its liquidity for upcoming initiatives.

Royalties and Stream Agreements (as a recipient)

While IAMGOLD primarily pays royalties, the company has the potential to receive them from other parties on specific properties. This is not a significant revenue source for IAMGOLD currently, but the sale of a royalty on its Côté Gold project to Franco-Nevada in 2023 for $505 million highlights the substantial value these types of agreements can hold. This transaction demonstrates how such financial arrangements can unlock capital and provide liquidity.

The value of royalty streams is underscored by deals like the one involving Côté Gold. IAMGOLD's strategic decision to monetize a portion of its future gold production through this royalty sale provided immediate financial flexibility. This type of agreement allows IAMGOLD to potentially generate income from its assets without directly engaging in mining operations for those specific royalty interests.

- Potential to Receive Royalties: IAMGOLD may receive royalties from other entities on certain mineral properties.

- Côté Gold Royalty Sale: In 2023, IAMGOLD sold a royalty on its Côté Gold project to Franco-Nevada for $505 million.

- Strategic Financial Tool: Royalty agreements represent a mechanism to generate revenue or secure funding by selling a portion of future production rights.

- Not a Primary Revenue Driver: While valuable, receiving royalties is not IAMGOLD's main source of income.

Investment Income

Investment income for IAMGOLD, while not a primary driver, can contribute to its financial health. This typically includes interest earned on the company's cash reserves and any short-term investments it holds. For instance, in 2023, IAMGOLD reported interest income from its financial assets, though it was a minor portion of their total revenue, which is dominated by gold sales.

These ancillary income sources, though small, provide a degree of financial flexibility. They can help offset operational costs or provide additional capital for exploration and development activities.

- Interest Income: Earnings from cash and cash equivalents held by the company.

- Short-Term Investments: Gains realized from the sale or maturity of short-term financial instruments.

- Dividend Income: Potential income from any equity investments IAMGOLD may hold in other entities.

IAMGOLD's revenue streams are primarily centered around the sale of gold, supplemented by by-product credits, strategic financial arrangements, and minor investment income.

In 2024, the company achieved $1,633.0 million in revenue from selling 699,000 ounces of gold at an average price of $2,330 per ounce, demonstrating the dominance of its core product. The Côté Gold project's copper by-product credits also contribute to reducing costs of sales, thereby indirectly enhancing financial performance.

Historically, IAMGOLD utilized gold prepay arrangements for liquidity, with the final such arrangement concluding in June 2025, providing a significant cash inflow. Furthermore, the sale of a royalty on Côté Gold to Franco-Nevada in 2023 for $505 million illustrates the potential value of monetizing future production rights, though receiving royalties is not a primary income source.

| Revenue Stream | 2024 Data/Notes | Significance |

| Gold Sales | $1,633.0 million (699,000 oz at $2,330/oz) | Primary revenue driver |

| By-product Credits (e.g., Copper) | Expected to reduce cost of sales at Côté Gold | Indirectly enhances financial performance |

| Gold Prepay Arrangements | Final arrangement concluded June 2025 | Historically provided liquidity |

| Royalty Sales/Receipts | $505 million royalty sale (Côté Gold, 2023) | Strategic financing tool, not primary income |

| Investment Income | Interest on cash reserves, short-term investments | Minor contribution to overall revenue |

Business Model Canvas Data Sources

The IAMGOLD Business Model Canvas is built upon a foundation of robust financial disclosures, comprehensive market research, and detailed operational reports. These diverse data sources ensure each component, from value propositions to cost structures, is grounded in accurate and actionable information.