Iamgold Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iamgold Bundle

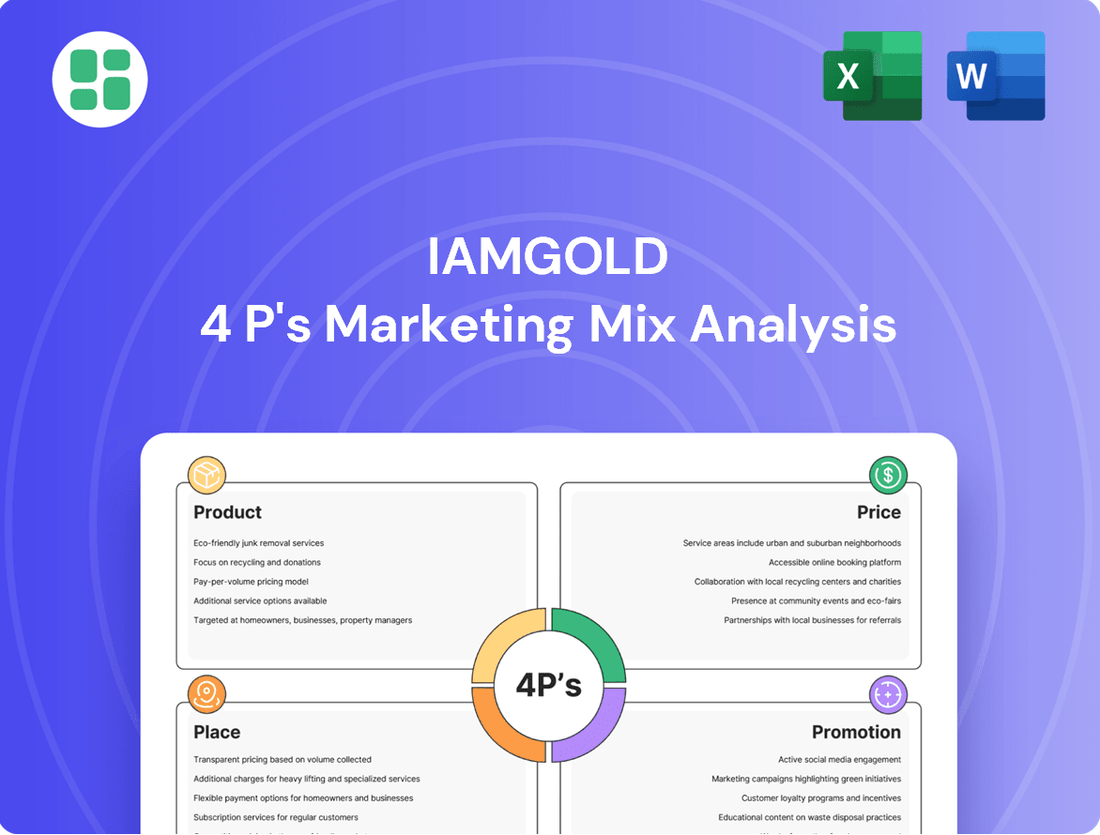

Iamgold's marketing strategy is a carefully orchestrated blend of product innovation, competitive pricing, strategic global placement, and impactful promotion. Understanding these elements is key to grasping their market position and operational success.

Delve deeper into how Iamgold leverages its product portfolio, pricing structures, distribution networks, and promotional campaigns to achieve its business objectives. Get the full, editable analysis to uncover these critical insights.

Save valuable time and gain a competitive edge with our comprehensive 4Ps Marketing Mix Analysis of Iamgold. This professionally written report offers actionable strategies and real-world examples, perfect for business professionals and students alike.

Product

IAMGOLD's core product is gold, a tangible commodity mined from its operations. Key mines include Côté Gold and Westwood in Canada, alongside Essakane in Burkina Faso.

The company is strategically focused on boosting its attributable gold production. Attributable gold production saw significant growth in 2024, with projections indicating continued expansion into 2025, largely fueled by the Côté Gold mine's ramp-up. This physical output is IAMGOLD's primary offering to the international market.

IAMGOLD's product, gold, is significantly enhanced by its dedication to responsible mining, underpinned by a 'Zero Harm' philosophy and robust Environmental, Social, and Governance (ESG) principles. This commitment directly addresses a growing demand for ethically sourced materials.

The company transparently communicates its sustainability efforts through annual Sustainability Reports, which in 2023 highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline. These reports detail advancements in crucial areas such as water stewardship and meaningful community partnerships, demonstrating tangible progress.

This focus on sustainability elevates the perceived quality and ethical provenance of IAMGOLD's gold. It strongly resonates with a segment of investors and stakeholders who prioritize socially responsible and environmentally sound investments, contributing to a stronger brand image and market appeal.

IAMGOLD's product offering is anchored by its substantial and long-term mining assets, exemplified by the Côté Gold mine. This significant project is projected to be one of Canada's largest gold mines, boasting an estimated 18-year mine life, underscoring the enduring potential of IAMGOLD's product.

The company actively pursues the expansion of its resource base through ongoing exploration initiatives. This strategic focus aims to prolong the operational lifespan and enhance the future production capacity of its core mining operations, thereby reinforcing the long-term value proposition of its offerings.

Doré Bar and Refined Gold

IAMGOLD's primary product is doré, a semi-pure gold and silver alloy extracted directly from its mines. This doré serves as the essential raw material that fuels the global gold supply chain, ultimately transforming into investment-grade bullion or materials for industrial applications. The purity and quality of the gold after the refining process are paramount for its marketability and acceptance by consumers and investors alike.

In 2023, IAMGOLD's production was impacted by operational challenges, with total attributable gold production reaching 416,000 ounces, down from 474,000 ounces in 2022. This demonstrates the direct link between mining output and the availability of doré for refinement. The company's focus remains on optimizing its refining processes to ensure the highest possible purity for its gold products.

- Doré Production: IAMGOLD's mines yield doré as the initial output, a crucial intermediate product.

- Refined Gold: The ultimate marketable product is refined gold, achieved after processing the doré.

- Supply Chain Role: IAMGOLD contributes raw material to the global gold market, impacting investment and industrial sectors.

- Purity Standards: Market acceptance hinges on the high purity achieved through the refining process.

Exploration and Development Projects

IAMGOLD's product pipeline extends beyond current production, featuring a robust portfolio of exploration projects, particularly in Canada's high-potential mining regions. These early-stage and advanced projects are crucial for the company's long-term growth, promising future gold supply and new product offerings.

Ongoing exploration and development are key to IAMGOLD's strategy. For instance, drilling at the Gosselin project in Quebec is focused on converting inferred resources into proven and probable reserves, a critical step in de-risking and advancing these future production assets. This diligent resource conversion underpins the company's commitment to securing its future product pipeline.

- Gosselin Project: Located in Quebec, Canada, this project is a key focus for resource-to-reserve conversion through active drilling programs.

- Exploration Portfolio: IAMGOLD maintains a diverse range of exploration projects, primarily in Canada, representing significant future production potential.

- Long-Term Growth: These development projects are integral to IAMGOLD's strategy for sustained growth and ensuring a steady supply of gold in the future.

IAMGOLD's product is primarily doré, an intermediate gold and silver alloy, which is then refined into high-purity gold. This core offering is supported by a strategic focus on expanding production, notably through the ramp-up of the Côté Gold mine, which is projected to significantly boost attributable gold output in 2024 and 2025. The company's commitment to ESG principles, including a 15% reduction in Scope 1 and 2 greenhouse gas emissions by 2023 compared to a 2019 baseline, enhances the ethical appeal of its gold.

| Product Aspect | Description | Key Data/Facts |

|---|---|---|

| Core Output | Doré (gold and silver alloy) | Produced at IAMGOLD's mining operations. |

| Marketable Product | Refined Gold | Achieved through processing doré, purity is key. |

| Production Growth Driver | Côté Gold Mine | Projected significant increase in attributable gold production in 2024-2025. |

| ESG Enhancement | Responsible Mining & Sustainability | 15% reduction in Scope 1 & 2 GHG emissions (2023 vs. 2019 baseline). |

What is included in the product

This analysis provides a comprehensive overview of Iamgold's marketing strategies, detailing its Product offerings, Pricing models, Place distribution, and Promotion tactics within the competitive mining industry.

Streamlines the complex Iamgold 4Ps analysis into a clear, actionable framework, alleviating the pain of information overload for strategic decision-making.

Provides a focused, easy-to-understand overview of Iamgold's marketing strategy, simplifying the challenge of aligning diverse teams on key initiatives.

Place

IAMGOLD's 'place' in its marketing mix is defined by its strategically positioned mines and development projects, with a strong focus on West Africa and Canada. Key operational hubs include the Essakane mine in Burkina Faso, a significant contributor to its production portfolio.

In Canada, IAMGOLD is actively developing Côté Gold in Ontario, a project expected to be a major driver of future output, alongside its Westwood mine in Quebec. The ramp-up of Côté Gold, which began commercial production in the first quarter of 2024, represents a deliberate move to bolster its North American presence and diversify its geographical footprint.

IAMGOLD's primary product, gold, is traded in highly liquid global commodity markets. This means its distribution network extends to international refiners, major financial institutions, and central banks worldwide. The journey typically involves transporting doré bars from mine sites to specialized refining facilities before being listed on exchanges like the COMEX or the LBMA. In 2024, gold prices have shown resilience, with average prices hovering around $2,300 per ounce, reflecting strong demand from both industrial and investment sectors.

IAMGOLD's distribution primarily relies on direct sales to reputable gold refiners, bypassing intermediaries to ensure efficient market entry. These business-to-business relationships are crucial for converting mined gold into revenue streams. For instance, in Q1 2024, IAMGOLD reported total gold sales of 158,000 ounces, underscoring the volume handled through these direct channels.

Offtake agreements form another cornerstone of IAMGOLD's sales strategy, providing predictable demand and pricing structures. These formal contracts offer stability in a volatile commodity market. The company's recent conclusion of a gold prepay arrangement, detailed in early 2024, exemplifies a structured sales mechanism designed to secure upfront financing and guaranteed sales.

Inventory Management and Logistics

For IAMGOLD, effective 'place' management extends to meticulous inventory control of mined ore and refined gold. This ensures product availability and minimizes holding costs.

Efficient logistics are crucial, especially given IAMGOLD's operations in remote locations. This involves secure and timely transportation of materials from mines like Essakane in Burkina Faso and Westwood in Canada to processing facilities and ultimately to market.

IAMGOLD's 2023 financial reports indicate a focus on optimizing its supply chain. For instance, improvements in logistics can directly impact the cost of goods sold, a key metric for profitability.

- Secure Storage: Implementing robust security measures for gold inventory at mine sites and transit points to prevent theft and loss.

- Transportation Efficiency: Utilizing optimized routes and reliable transport partners to reduce delivery times and costs from remote mine locations.

- Inventory Optimization: Balancing the need for readily available product with the costs associated with holding excess inventory.

- Market Access: Ensuring that gold reaches global markets efficiently to meet buyer demand and capitalize on favorable pricing.

Proximity to Infrastructure and Labor

Proximity to essential infrastructure and a readily available skilled workforce are critical factors in selecting and developing mine sites. IAMGOLD prioritizes locations that offer access to reliable power, water sources, and efficient transportation networks, such as roads and rail, to minimize operational costs and logistical challenges.

The Côté Gold project in Ontario, Canada, exemplifies this strategy. Its location benefits from proximity to established mining infrastructure and a supportive regulatory framework, which is crucial for efficient and dependable operations. This access streamlines the supply chain and facilitates the movement of personnel and materials.

- Infrastructure Access: Côté Gold's location in the Abitibi greenstone belt offers access to existing power grids and transportation routes.

- Skilled Labor Pool: Ontario has a well-established mining sector, providing access to experienced geologists, engineers, and operational staff.

- Regulatory Environment: Canada's mining-friendly regulations and IAMGOLD's commitment to responsible mining practices contribute to operational stability.

- Operational Efficiency: The combination of infrastructure and labor access directly impacts the cost-effectiveness and speed of development and production.

IAMGOLD's 'place' is defined by its strategic mine locations and development projects, primarily in West Africa and Canada, with Essakane in Burkina Faso being a key operational site. The company is actively developing Côté Gold in Ontario, Canada, which commenced commercial production in Q1 2024, enhancing its North American presence and diversifying its global footprint.

Gold is a global commodity, meaning IAMGOLD's distribution reaches international refiners, financial institutions, and central banks. This involves transporting doré bars to specialized refineries, with gold prices averaging around $2,300 per ounce in 2024, indicating robust demand.

| Asset | Location | Status | 2024 Production Guidance (koz) | 2025 Production Outlook (koz) |

|---|---|---|---|---|

| Essakane | Burkina Faso | Operating | ~350-370 | ~320-340 |

| Côté Gold | Ontario, Canada | Ramp-up/Operating | ~100-120 (initial production) | ~220-250 |

| Westwood | Quebec, Canada | Operating | ~50-60 | ~50-60 |

What You Preview Is What You Download

Iamgold 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Iamgold's 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know exactly what you're buying.

Promotion

IAMGOLD actively engages investors through detailed quarterly earnings calls and comprehensive financial reports, such as its 2024 Annual Information Form. These platforms, including investor presentations, are vital for showcasing performance and strategy, aiming to attract and retain capital.

The company emphasizes transparency, providing shareholders and analysts with insights into its operational and financial health. For instance, the Q2 2025 results will offer a current snapshot of IAMGOLD's progress and future direction, crucial for informed investment decisions.

IAMGOLD's annual Sustainability Report serves as a crucial promotional element, detailing its dedication to Environmental, Social, and Governance (ESG) principles and its core 'Zero Harm' philosophy. This initiative actively positions IAMGOLD as a conscientious operator in the mining sector, bolstering its standing with investors, local communities, and governmental agencies.

The May 2025 release of the 2024 Sustainability Report underscores tangible advancements in ESG performance. For instance, the report highlights a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to the 2023 baseline, alongside a 10% increase in community investment programs across its operating regions.

IAMGOLD's corporate website acts as a primary digital gateway, providing stakeholders with essential information including financial reports and sustainability initiatives. This platform is crucial for maintaining transparency and ensuring all parties have access to the latest corporate developments and regulatory filings, fostering trust.

Industry Conferences and Media Engagement

IAMGOLD's senior management actively participates in key industry conferences, such as the Denver Gold Forum and the Prospectors & Developers Association of Canada (PDAC) convention. This presence allows them to directly communicate the company's strategic direction and operational achievements to a highly relevant audience.

Engagement with financial media, including interviews with Bloomberg and Reuters, is a cornerstone of IAMGOLD's communication strategy. For instance, during the Q1 2024 earnings call, management highlighted progress at the Côté Gold project, reinforcing their narrative to investors and analysts.

- Industry Presence: IAMGOLD executives are regular speakers at major mining and investment forums, enhancing visibility.

- Media Relations: Proactive engagement with financial news outlets ensures broad dissemination of company updates and performance.

- Strategic Communication: Direct interaction at events allows for clear articulation of growth plans and operational successes.

- Investor Outreach: These efforts directly support investor relations by providing transparent insights into the company's value proposition.

Stakeholder Engagement and Community Relations

IAMGOLD's stakeholder engagement, a key component of their 'Promotion' strategy, actively involves local and Indigenous communities surrounding their mining sites. This focus on building strong relationships is crucial for maintaining their social license to operate. For instance, in 2023, IAMGOLD reported investing over $10 million in community development programs across their operating regions, demonstrating a tangible commitment to these partnerships.

This proactive approach extends to transparent communication and collaboration on environmental and social impact mitigation. By fostering meaningful partnerships, IAMGOLD aims to ensure long-term project viability and bolster its corporate reputation. Their sustainability reports, such as the 2023 ESG report, detail specific initiatives and outcomes from these community relations efforts.

Key aspects of IAMGOLD's stakeholder engagement include:

- Community Investment: Direct financial contributions and support for local infrastructure, education, and health projects.

- Indigenous Partnerships: Collaborative agreements and consultation processes that respect Indigenous rights and cultural heritage.

- Employment and Local Procurement: Prioritizing local hiring and sourcing goods and services from businesses within host communities.

- Environmental Stewardship: Open dialogue and joint efforts to manage environmental impacts and promote sustainable practices.

IAMGOLD's promotion strategy centers on transparent communication with investors and stakeholders. This includes detailed quarterly earnings calls, annual reports like the 2024 Annual Information Form, and active participation in industry conferences such as the Denver Gold Forum. The company also leverages financial media, with management interviews on platforms like Bloomberg and Reuters, to disseminate information about operational progress, notably at the Côté Gold project.

The company's commitment to ESG principles is a significant promotional tool, highlighted in its annual Sustainability Report. The May 2025 release of the 2024 Sustainability Report detailed a 15% reduction in Scope 1 and 2 GHG emissions against a 2023 baseline and a 10% increase in community investment programs.

IAMGOLD's corporate website serves as a central hub for financial reports and sustainability initiatives, fostering transparency and trust. Furthermore, active engagement with local and Indigenous communities, including over $10 million invested in community programs in 2023, reinforces its social license to operate and corporate reputation.

| Communication Channel | Key Focus | Example/Data Point |

|---|---|---|

| Investor Relations | Financial Performance & Strategy | 2024 Annual Information Form, Q2 2025 Results |

| Sustainability Reporting | ESG Commitment & 'Zero Harm' | 2024 Sustainability Report: 15% GHG reduction (Scope 1 & 2 vs. 2023), 10% community investment increase |

| Industry Conferences | Strategic Direction & Operations | Denver Gold Forum, PDAC Convention |

| Media Engagement | Project Updates & Performance | Bloomberg/Reuters interviews, Q1 2024 call highlighting Côté Gold progress |

| Community Engagement | Social License & Partnerships | >$10M invested in community programs (2023) |

Price

The price IAMGOLD receives for its gold is directly tied to the global spot market, a dynamic environment where gold is consistently traded. This means the company's revenue is highly sensitive to the ups and downs of international gold prices.

Recent data highlights this volatility, with IAMGOLD's realized gold prices for sales expected to fall within the range of $2,326 to $3,182 per ounce for the period spanning late 2024 through Q2 2025. These figures underscore the significant impact of market conditions on the company's financial performance.

IAMGOLD's profitability hinges on its All-in Sustaining Costs (AISC), a key metric reflecting the total expenditure to produce an ounce of gold from current operations. This figure is crucial for investors evaluating the company's efficiency and market standing.

For 2025, IAMGOLD has projected its consolidated AISC to fall within the range of $1,830 to $1,930 per ounce. This guidance directly influences the company's potential profit margins, making it a vital data point for financial analysis.

IAMGOLD's cash cost per ounce sold is a critical pricing determinant, reflecting the direct expenses of mining and processing. For 2024, the company has provided updated guidance, estimating its all-in sustaining costs (AISC) to be between $1,360 and $1,460 per ounce. This figure is influenced by operational efficiencies and external pressures such as increased royalties and currency shifts.

Hedging and Financing Arrangements

IAMGOLD has historically used gold prepay arrangements to secure financing, which affects its average realized gold price. These arrangements often involve selling gold at a predetermined price, potentially limiting upside participation in rising markets.

The company recently finalized a 150,000-ounce gold prepay arrangement in the first half of 2025. This move suggests a strategic pivot, allowing IAMGOLD to capture more of the benefits from potential increases in the spot gold price.

- Financing Mechanism: Gold prepayments have served as a key financing tool for IAMGOLD.

- Impact on Realized Price: These arrangements influence the average price the company receives for its gold production.

- H1 2025 Prepay: A 150,000-ounce gold prepay was completed in the first half of 2025.

- Strategic Shift: This recent prepay indicates a move to benefit more directly from spot gold price fluctuations.

Capital Expenditures and Debt Management

Iamgold's pricing strategy is intrinsically linked to its ability to fund significant capital expenditures, such as the development of its Côté Gold project. For instance, the company has invested substantially in Côté Gold, with a projected total capital cost of approximately $1.3 billion as of early 2024. This investment necessitates robust cash flow generation.

Effective debt management is also a critical component of Iamgold's financial health, directly impacting its perceived value. A disciplined deleveraging approach, bolstered by favorable gold market conditions and operational improvements, is essential for enhancing financial stability.

- Capital Expenditures: Iamgold's commitment to projects like Côté Gold requires substantial capital outlay, directly influencing its cash flow needs.

- Debt Management: A focused strategy to reduce debt levels is crucial for strengthening the company's financial foundation.

- Gold Price Impact: Strong gold prices in 2024 and projected into 2025 provide a more favorable environment for both funding capex and managing debt.

- Shareholder Value: Improved financial stability through efficient capital allocation and debt reduction ultimately aims to boost investor confidence and the company's share price.

IAMGOLD's pricing is directly influenced by the global spot gold market, with realized prices for sales expected between $2,326 and $3,182 per ounce from late 2024 through Q2 2025. The company's profitability is further shaped by its All-in Sustaining Costs (AISC), projected between $1,830 and $1,930 per ounce for 2025, and cash costs for 2024 estimated between $1,360 and $1,460 per ounce.

| Metric | 2024 Estimate (AISC) | 2025 Projection (AISC) | 2024-Q2 2025 Realized Price Range |

|---|---|---|---|

| Cost/Price per Ounce | $1,360 - $1,460 | $1,830 - $1,930 | $2,326 - $3,182 |

4P's Marketing Mix Analysis Data Sources

Our Iamgold 4P's Marketing Mix Analysis is built upon a foundation of verified, up-to-date information. We meticulously review company disclosures, investor reports, and official website content to capture product offerings, pricing strategies, distribution networks, and promotional activities.