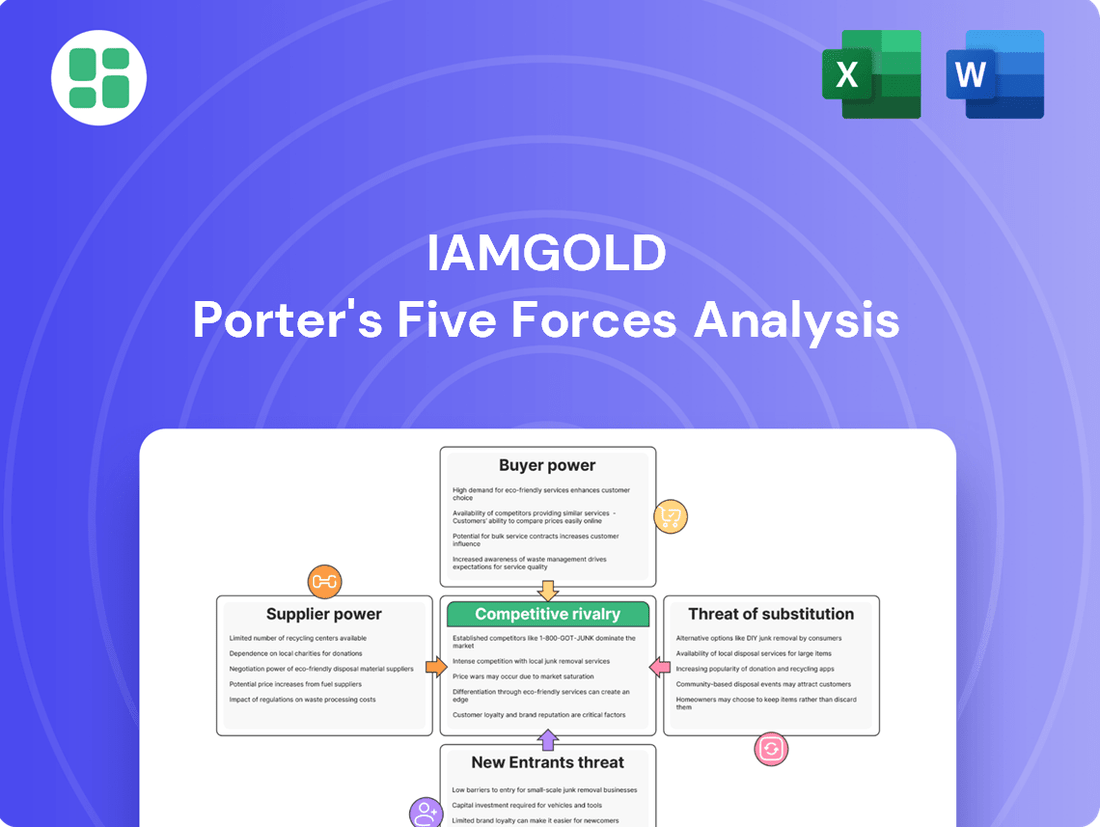

Iamgold Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iamgold Bundle

Iamgold faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers posing notable challenges. Understanding these forces is crucial for any stakeholder in the gold mining sector.

The complete report reveals the real forces shaping Iamgold’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The gold mining sector, including companies like IAMGOLD, depends on specialized equipment and advanced technology for its operations. For instance, the development of large-scale projects often necessitates sophisticated drilling rigs and processing machinery, where the number of capable suppliers can be limited.

While IAMGOLD operates in a competitive landscape, the market for certain high-tech mining solutions, such as advanced geological survey tools or specialized extraction machinery, exhibits a degree of concentration. This means a few key providers might hold significant sway, particularly for proprietary technologies or essential maintenance services. For example, the cost of specialized underground mining equipment can be substantial, and the availability of manufacturers for such niche products is not always widespread.

IAMGOLD's need for continuous access to these critical inputs, especially for its ongoing projects like the Côté Gold mine, means that the bargaining power of these concentrated suppliers can influence IAMGOLD's operational costs and project timelines. The reliance on these specialized providers grants them a degree of leverage in negotiations.

The availability of skilled labor, such as geologists, mining engineers, and seasoned mine operators, is absolutely vital for IAMGOLD's success in its West African and Canadian operations. This access isn't always guaranteed and can shift depending on how busy the mining industry is in specific regions.

When there's a shortage of these specialized professionals, their ability to negotiate terms, known as bargaining power, naturally goes up. This can translate into IAMGOLD facing increased wage demands or higher expenses to find and hire the talent they need.

Energy, especially fuel for equipment and electricity for processing, is a major expense for gold miners like IAMGOLD. In 2024, global energy markets continued to show fluctuations. For instance, Brent crude oil prices averaged around $82 per barrel in the first half of 2024, impacting diesel costs, a key input for IAMGOLD's operations.

While IAMGOLD might have some fixed-price contracts, unexpected surges in energy prices can quickly inflate operating expenses. The company's capacity to lock in reliable and affordable energy directly influences its bottom line.

Geopolitical and Regulatory Influence on Local Suppliers

IAMGOLD's operations, particularly in regions like West Africa, are significantly impacted by geopolitical and regulatory landscapes that shape the bargaining power of local suppliers. For instance, in Burkina Faso, where the Essakane mine is located, local content policies are in place, aiming to boost domestic participation in the mining sector. The effectiveness of these policies in influencing supplier power hinges on the development and competitiveness of the local supply market.

Political stability is another critical factor. Regions experiencing instability can lead to supply chain disruptions, inadvertently strengthening the position of dependable, albeit potentially fewer, local suppliers. This dynamic can shift bargaining power, as IAMGOLD might face increased costs or limited options when reliable sourcing is threatened by external events. For example, in 2023, certain African mining jurisdictions saw increased scrutiny and policy changes, impacting operational certainty and supplier relationships.

- Local Content Requirements: Governments in IAMGOLD's operating regions, such as Burkina Faso, often implement local content policies that mandate the use of domestic goods and services.

- Market Maturity: The bargaining power derived from these requirements depends on the competitiveness and capacity of the local supplier base; a less mature market can empower suppliers.

- Geopolitical Stability: Political instability in operating countries can disrupt supply chains, potentially increasing the leverage of reliable local suppliers who can guarantee continuity.

- Supply Chain Resilience: In 2024, many mining companies are focusing on supply chain resilience, which can influence negotiations with suppliers who demonstrate consistent delivery and quality amidst regional uncertainties.

Logistics and Transportation Services

IAMGOLD's reliance on logistics and transportation, particularly for its remote operations in West Africa and northern Canada, means suppliers in these niche markets hold considerable sway. The availability and cost of specialized transport for personnel and heavy materials are critical to maintaining production schedules.

The bargaining power of logistics suppliers is amplified by the limited number of providers capable of navigating challenging terrains and meeting stringent timelines. For instance, in 2024, the cost of shipping raw materials and equipment to IAMGOLD's Essakane mine in Burkina Faso, or to its Canadian operations, is heavily dependent on the availability of specialized trucking or air freight services.

- Limited Specialized Providers: Few companies offer the specific capabilities needed for remote mining logistics.

- Criticality of Service: Disruptions in transport directly impact IAMGOLD's production and costs.

- Geographic Challenges: Remote mine locations increase reliance on and the power of local logistics partners.

- Cost Influence: The price of fuel, vehicle maintenance, and driver availability directly affect logistics costs passed on to IAMGOLD.

Suppliers of specialized mining equipment and advanced technology can exert significant bargaining power over IAMGOLD due to market concentration and the critical nature of their offerings. For instance, the cost of proprietary extraction machinery or essential maintenance services can be substantial, with limited alternative providers available in 2024. This reliance grants these suppliers leverage in pricing and contract negotiations, potentially impacting IAMGOLD's project economics.

Skilled labor shortages, particularly for specialized roles like mining engineers, also elevate supplier bargaining power. In 2024, the demand for experienced professionals in the mining sector remains high, leading to increased wage pressures and recruitment costs for companies like IAMGOLD. This scarcity empowers skilled individuals and recruitment agencies to negotiate more favorable terms.

Energy costs represent a substantial operational expense for IAMGOLD, and fluctuations in global energy markets, such as the average Brent crude oil price of around $82 per barrel in the first half of 2024, directly influence fuel costs. While IAMGOLD may utilize fixed-price contracts, unexpected price surges can amplify the bargaining power of energy suppliers, impacting the company's profitability.

Local content policies in regions like Burkina Faso can bolster the bargaining power of domestic suppliers, especially in less mature markets. Geopolitical instability in operating areas further strengthens the position of reliable local suppliers who can guarantee continuity, as seen in the impact of policy changes in certain African mining jurisdictions in 2023. This dynamic can lead to increased costs or limited sourcing options for IAMGOLD.

| Supplier Category | Factors Influencing Bargaining Power | Impact on IAMGOLD | 2024 Data/Context |

|---|---|---|---|

| Specialized Equipment Manufacturers | Market concentration, proprietary technology, high switching costs | Increased equipment costs, potential delays in project execution | Limited availability of advanced drilling and processing machinery |

| Skilled Labor Providers | Shortage of specialized mining professionals, high industry demand | Higher wage demands, increased recruitment expenses | Continued high demand for experienced geologists and engineers |

| Energy Suppliers | Volatile global energy prices, dependence on fuel for operations | Fluctuating operational costs, potential impact on profit margins | Brent crude averaged ~$82/barrel H1 2024, impacting diesel costs |

| Local Suppliers (West Africa/Canada) | Local content requirements, geopolitical stability, logistics challenges | Potential for higher costs due to limited local capacity or supply chain disruptions | Focus on supply chain resilience amidst regional uncertainties |

What is included in the product

IAMGOLD's Porter's Five Forces analysis reveals the intense competition within the gold mining sector, the significant bargaining power of buyers and suppliers, and the high barriers to entry for new players.

Quickly identify and address the most impactful competitive pressures affecting IAMGOLD's profitability with a clear, actionable overview of all five forces.

Customers Bargaining Power

Gold is fundamentally an undifferentiated commodity. This means that the gold IAMGOLD produces is virtually the same as gold from any other mining company. Customers, such as bullion dealers and institutional investors, don't see significant differences between suppliers.

Because gold is so similar across producers, switching from one supplier to another involves minimal cost or effort for buyers. This low switching cost makes customers very sensitive to price. They can easily shift their business to the supplier offering the best deal.

Consequently, customers hold considerable bargaining power. Their ability to easily switch and their focus on price means they can exert pressure on IAMGOLD to offer competitive pricing. In 2023, the average price of gold fluctuated significantly, with the LBMA Gold Price PM reaching highs of over $2,000 per troy ounce, demonstrating the market's sensitivity to global economic factors and supply dynamics.

The price of gold is a global phenomenon, shaped by supply and demand, inflation, interest rates, and central bank actions. IAMGOLD, as a mid-tier producer, has no sway over these prices; it simply accepts the market rate.

Customer demand for gold is dictated by these broad economic forces, not by IAMGOLD's output. This means IAMGOLD cannot dictate its selling prices, as customers are influenced by larger market trends.

IAMGOLD's raw gold finds its way to a wide array of end-users, from individual investors buying gold bars and coins to large-scale jewelry manufacturers and industrial sectors like electronics and dentistry. This diversity in demand is a key factor in understanding customer bargaining power.

The broad base of end-use applications means that IAMGOLD, and the gold market in general, isn't overly reliant on any single customer. This fragmentation inherently limits the bargaining power of any individual buyer, as they represent a small portion of the overall demand.

However, significant shifts in demand from major segments, such as a surge in gold ETF investments or a slowdown in jewelry sales, can still exert considerable influence. For instance, in 2023, global central bank gold purchases reached record levels, demonstrating how large institutional buying can impact market dynamics and, by extension, influence pricing for producers like IAMGOLD.

High Liquidity of Gold Market

The bargaining power of customers in the gold market is significantly influenced by its high liquidity. This means buyers can readily purchase or sell substantial amounts of gold from a wide array of global suppliers without facing significant price impacts or delays. For instance, in 2024, the average daily trading volume for gold futures on the COMEX exchange often exceeded 400,000 contracts, representing billions of dollars in value, underscoring the ease with which large transactions occur.

This readily available supply across numerous sources diminishes any single producer's leverage. Customers can easily switch between suppliers if pricing or terms are not competitive. IAMGOLD, therefore, faces pressure to maintain efficiency and consistent product quality to secure and keep buyers in this dynamic environment.

- High Liquidity: The gold market allows for easy buying and selling of large volumes globally.

- Numerous Options: Customers can access gold from diverse producers, reducing reliance on any one company.

- Competitive Pressure: IAMGOLD must focus on operational efficiency and reliable delivery to attract and retain customers.

- Customer Choice: In 2024, the sheer volume of gold traded daily highlights the extensive choices available to buyers.

Customer Sophistication and Information Access

IAMGOLD's direct customers, primarily large financial institutions and refiners, possess significant market expertise and advanced analytical capabilities. This customer sophistication allows them to leverage comprehensive data on global gold supply, demand dynamics, and real-time pricing.

Their informed position empowers them to negotiate terms effectively, often securing favorable pricing and contract conditions. For instance, in 2024, the average price of gold experienced fluctuations, influenced by macroeconomic factors, with significant institutional trading volumes impacting price discovery.

- Informed Negotiation: Customers' deep understanding of market trends enables them to negotiate from a position of strength.

- Analytical Tools: Access to sophisticated analytical tools allows for precise valuation and effective price benchmarking.

- Global Data Access: Comprehensive information on global supply and demand empowers customers to anticipate market movements.

- Price Sensitivity: Institutional buyers are highly sensitive to price differentials, driving their demand for competitive sourcing.

The bargaining power of IAMGOLD's customers is substantial due to the undifferentiated nature of gold and the market's high liquidity. Buyers, often sophisticated institutions, can easily switch suppliers based on price and terms, leveraging extensive market data. In 2024, the sheer volume of gold traded daily, often exceeding 400,000 COMEX contracts, underscores the ease of transactions and the wide array of choices available to buyers, putting pressure on producers like IAMGOLD to remain competitive.

| Customer Influence Factor | Description | 2024 Market Data/Implication |

|---|---|---|

| Product Similarity | Gold is a commodity with little differentiation between producers. | Buyers see minimal difference between IAMGOLD's gold and that from competitors. |

| Switching Costs | Minimal costs or effort for buyers to change suppliers. | Customers can easily shift business to the lowest-cost provider. |

| Market Liquidity | High ease of buying/selling large volumes globally. | In 2024, daily COMEX gold futures trading often surpassed 400,000 contracts, indicating robust liquidity and buyer options. |

| Customer Sophistication | Buyers possess market expertise and analytical tools. | Institutions leverage data to negotiate favorable pricing and terms. |

Full Version Awaits

Iamgold Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for Iamgold, offering a detailed examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic decision-making.

Rivalry Among Competitors

The global gold mining landscape is intensely competitive, featuring a multitude of players from multinational giants to smaller, specialized firms. Companies like Newmont Corporation, Barrick Gold, and AngloGold Ashanti operate on a massive scale, influencing market dynamics significantly. IAMGOLD, as a mid-tier producer, navigates this environment by competing directly with these larger entities as well as a broad spectrum of mid-tier and junior miners across various operational regions.

Gold, being a commodity, offers little room for product differentiation, which naturally fuels intense competition centered around price. Miners are constantly striving to be the most cost-efficient producers. IAMGOLD's 2024 performance, with its cost of sales at the lower end of its guidance, highlights the importance of managing these costs effectively to remain competitive in this environment.

The gold mining sector is experiencing significant pressure from escalating production costs. In 2024, average all-in sustaining costs for many gold producers have climbed to record levels, forcing companies to focus intensely on operational efficiency and cost management to maintain profitability. This heightened cost consciousness directly fuels competitive rivalry, as firms vie to optimize their operations and control expenses.

Larger, more established gold mining companies with diversified operations and access to capital are generally in a stronger position to weather these cost increases compared to smaller, less diversified players. Their ability to absorb higher input costs, such as for labor, energy, and consumables, provides a competitive advantage in a challenging cost environment.

Geographical Diversification and Risk Management

Major gold mining companies, including IAMGOLD, strategically diversify their operations across various countries to buffer against geopolitical instability and operational disruptions. This geographical spread is a critical risk management tool in an industry prone to localized challenges.

IAMGOLD's operational footprint spans Canada and West Africa. This dual-region presence helps to mitigate the impact of any single country's political or regulatory shifts, but it also means the company must navigate distinct legal frameworks and economic conditions in each area. For instance, the political landscape in Burkina Faso, a key West African operating region for IAMGOLD, has seen periods of instability, impacting operational continuity and investor confidence.

The intense competition within the gold mining sector means that other major players are also pursuing similar diversification strategies. Companies like Barrick Gold and Newmont Corporation have extensive global portfolios, creating a highly competitive environment where geographic advantage is constantly being sought and defended. This shared approach to risk mitigation intensifies the rivalry as companies vie for access to stable, resource-rich jurisdictions.

- Geographic Spread: IAMGOLD's presence in Canada and West Africa balances regional risks.

- Regulatory Exposure: Operating in multiple countries necessitates navigating diverse legal and political environments.

- Competitive Strategy: Competitors like Barrick Gold and Newmont also employ broad geographical diversification, intensifying rivalry.

- Risk Mitigation: Diversification is a key strategy to mitigate geopolitical and operational risks inherent in the gold mining industry.

Mergers, Acquisitions, and Strategic Alliances

The gold mining industry is characterized by significant consolidation. In 2023, for instance, Newmont completed its acquisition of Newcrest Mining for approximately $19 billion, creating the world's largest gold producer. This trend of mergers and acquisitions (M&A) pressures mid-tier companies like IAMGOLD to either grow their operations or seek strategic alliances to maintain competitiveness and achieve greater economies of scale.

These strategic moves directly impact competitive rivalry by altering market share and production capacities. Larger entities can leverage their expanded reserves and production volumes to negotiate better terms and invest more heavily in exploration and technology. This forces smaller or mid-tier players to consider similar actions to avoid being left behind.

- Mergers and Acquisitions: Ongoing consolidation reshapes the industry landscape.

- Economies of Scale: Larger players gain cost advantages through increased production.

- Competitive Pressure: Mid-tier producers like IAMGOLD face pressure to grow or partner.

- Strategic Alliances: Partnerships can offer a path to enhanced competitiveness for smaller firms.

Competitive rivalry in the gold mining sector is fierce, driven by the commodity nature of gold and escalating production costs. IAMGOLD, as a mid-tier producer, contends with both larger, diversified giants and numerous smaller players, all vying for cost efficiency and market share. The industry's consolidation, exemplified by Newmont's $19 billion acquisition of Newcrest in 2023, further intensifies this rivalry, pushing companies like IAMGOLD to pursue growth or strategic alliances to maintain competitiveness and achieve economies of scale.

| Company | 2024 Estimated All-in Sustaining Costs (USD/oz) | Market Cap (Approx. USD Billion) | Key Operating Regions |

|---|---|---|---|

| Newmont Corporation | $1,000 - $1,100 (Guidance) | $45 - $50 | North America, South America, Australia, Africa |

| Barrick Gold | $1,050 - $1,150 (Guidance) | $25 - $30 | North America, South America, Africa, Australia |

| IAMGOLD | $1,300 - $1,400 (Guidance) | $2 - $3 | Canada, West Africa |

SSubstitutes Threaten

Silver, platinum, and palladium frequently serve as viable substitutes for gold in investment portfolios, especially when economic conditions are volatile. These precious metals often exhibit similar safe-haven qualities and possess industrial uses, making their price fluctuations a key factor in investor choices.

Silver, often seen as a more accessible alternative to gold, benefits from robust industrial demand, particularly in electronics and solar panels. In 2024, silver prices have shown considerable volatility, at times trading around $25-$30 per ounce, influenced by both its precious metal status and its industrial utility, providing a distinct but related investment avenue.

Financial instruments like Gold ETFs and mutual funds offer investors exposure to gold's price without the need for physical possession. For instance, as of early 2024, global ETF holdings in gold saw significant inflows, indicating a strong demand for these accessible gold investment vehicles.

Digital assets such as Bitcoin and Ethereum are increasingly viewed as alternative stores of value and inflation hedges. While more volatile than gold, their growing adoption and ease of transaction present a competitive alternative for capital that might otherwise be allocated to traditional gold investments.

Beyond precious metals, other commodities like oil, gas, and timber, along with real estate, can serve as alternative investments for wealth preservation and inflation hedging. These assets offer intrinsic value and can provide income or appreciation over time, appealing to investors looking to diversify beyond traditional financial markets. For instance, in 2024, while gold prices saw significant gains, reaching new highs, other commodities like oil experienced volatility due to geopolitical factors, influencing investor allocation decisions.

Industrial and Technological Alternatives

In industrial sectors, gold faces a persistent threat from substitutes. For instance, in electronics, palladium and silver are increasingly explored for conductive applications, offering lower price points. While gold's unparalleled conductivity and corrosion resistance are hard to replicate entirely, advancements in material science continually present new alternatives.

The cost-effectiveness of substitutes is a key driver. As of early 2024, gold prices have remained volatile, hovering around $2,000 per ounce, making alternative materials more attractive for large-scale industrial use. This economic pressure encourages research and development into materials that can perform similarly, albeit not identically, to gold.

- Electronics: Palladium and silver are emerging as cost-effective substitutes for gold in certain conductive applications, driven by price differentials.

- Dentistry: While gold remains a premium material, advancements in ceramics and composite resins offer durable and aesthetically pleasing alternatives, reducing reliance on gold.

- Material Science: Ongoing research into novel alloys and conductive polymers poses a long-term threat, potentially offering functional replacements for gold in specialized high-tech uses.

Changing Investor Sentiment and Economic Outlook

The perception of gold as a safe-haven asset is directly linked to macroeconomic conditions and geopolitical stability. As of early 2024, while inflation concerns persist in some regions, a general trend towards stabilizing or slightly declining inflation rates in major economies could reduce the allure of gold as a primary inflation hedge. This shift in investor sentiment, driven by a more optimistic economic outlook, can lead to a decrease in demand for gold, impacting IAMGOLD's revenue.

Furthermore, rising interest rates, a potential consequence of economic stabilization or proactive monetary policy, significantly increase the opportunity cost of holding non-yielding assets like gold. For example, if benchmark interest rates in the US were to climb to 5-6% or higher in 2024, investors might find fixed-income securities or even equities more attractive, diverting capital away from gold. This dynamic directly affects IAMGOLD's market position, as its financial performance is intrinsically tied to the global demand for gold as an investment vehicle.

- Investor sentiment towards gold is heavily influenced by economic uncertainty; a decrease in global instability could lessen gold's appeal.

- Rising interest rates increase the opportunity cost of holding gold, potentially shifting investor preference to yield-bearing assets.

- IAMGOLD's revenue is directly correlated with the global demand for gold, making it vulnerable to changes in investor sentiment.

- For instance, if the US Federal Reserve maintains or increases its target interest rate range in 2024, it could put downward pressure on gold prices and demand.

The threat of substitutes for gold is significant, impacting IAMGOLD's market position. Precious metals like silver and platinum, along with financial instruments such as Gold ETFs, offer alternative investment avenues. Digital assets, including Bitcoin, are also gaining traction as stores of value. In industrial applications, materials like palladium and silver are increasingly used due to their lower costs.

| Substitute Category | Example Substitutes | Key Drivers for Substitution | 2024 Relevance/Data Point |

|---|---|---|---|

| Precious Metals | Silver, Platinum, Palladium | Safe-haven qualities, industrial demand, price accessibility | Silver prices fluctuated around $25-$30/oz in early 2024, driven by industrial and investment demand. |

| Financial Instruments | Gold ETFs, Mutual Funds | Ease of access, diversification without physical holding | Global ETF holdings saw significant inflows in early 2024, indicating strong demand for accessible gold investments. |

| Digital Assets | Bitcoin, Ethereum | Alternative store of value, inflation hedge, ease of transaction | Bitcoin's volatility continues, but its growing adoption presents a competitive alternative for capital. |

| Industrial Materials | Palladium, Silver, Ceramics, Composite Resins | Cost-effectiveness, functional advancements | Gold prices around $2,000/oz in early 2024 made alternatives like palladium more attractive for industrial use. |

Entrants Threaten

The gold mining sector is characterized by extremely high capital intensity. Establishing a new gold mine demands significant upfront investment, often running into hundreds of millions or even billions of dollars for exploration, mine development, and infrastructure construction. For instance, IAMGOLD's Côté Gold project in Canada had an estimated initial capital cost exceeding $1 billion, illustrating the scale of financial commitment required.

This substantial capital requirement acts as a major deterrent for potential new entrants. Securing the necessary financing for such large-scale projects is a formidable challenge, particularly for smaller or less established companies. The sheer financial barrier limits the pool of viable competitors capable of entering the market and challenging existing players.

The mining industry, including companies like IAMGOLD, is heavily burdened by a complex web of regulations. New entrants must navigate a labyrinth of permits, environmental impact assessments, and safety standards, a process that can take years and significant capital. For instance, in 2024, the average time to secure major mining permits in several key jurisdictions remained well over two years, often extending to five or more, significantly raising the barrier to entry.

Adherence to increasingly stringent Environmental, Social, and Governance (ESG) standards is paramount. Failure to meet these expectations can lead to project delays, reputational damage, and difficulty securing financing. In 2023, a significant percentage of mining projects faced scrutiny or delays due to ESG non-compliance, highlighting its critical role in deterring potential new competitors.

This lengthy and costly permitting and compliance process acts as a substantial deterrent for new entrants. Established players, with their existing expertise and resources to manage these complexities, often have a distinct advantage, effectively limiting the threat of new competition in the gold mining sector.

The scarcity of economically viable gold deposits presents a significant barrier to entry for new companies in the mining sector. Finding new, large-scale, and profitable gold deposits is becoming increasingly difficult and expensive. For instance, global gold exploration expenditure in 2023 was estimated to be around $10 billion, reflecting the high costs involved.

Most of the readily accessible and high-grade gold deposits have already been discovered and mined. This means that any new entrant would face substantial hurdles in identifying and securing promising exploration sites.

Consequently, new players must either undertake costly and high-risk exploration ventures or acquire existing reserves. These reserves are often controlled by established mining giants like IAMGOLD, making market entry through acquisition a challenging and capital-intensive proposition.

Need for Specialized Expertise and Infrastructure

The gold mining sector demands a significant investment in specialized knowledge and infrastructure, acting as a substantial barrier for new entrants. Success hinges on deep expertise in geology, mining engineering, metallurgy, and intricate project management. For instance, developing a new mine often involves capital expenditures in the hundreds of millions, if not billions, of dollars, a figure that can be prohibitive for smaller, less established firms.

Building the necessary infrastructure in remote mining locations, including access roads, reliable power sources, and water management systems, further escalates the cost and complexity. Newcomers often lack the established operational capabilities and vital industry networks that seasoned players like IAMGOLD possess. In 2024, the average cost to develop a new underground gold mine can range from $500 million to over $1 billion, depending on scale and location.

- Specialized Expertise: Geology, mining engineering, metallurgy, and project management are critical skill sets.

- Infrastructure Demands: Roads, power, and water supply in remote areas require significant capital investment.

- Capital Intensity: Developing new gold mines in 2024 can cost between $500 million and over $1 billion.

- Established Networks: New entrants often lack the experience and connections of incumbent operators.

Established Supply Chains and Market Access

Established gold mining companies benefit from deeply entrenched supply chains and market access. These incumbents have cultivated long-standing relationships with key suppliers, logistics partners, and global buyers, ensuring reliable input sourcing and efficient product distribution. For instance, in 2024, major gold producers continued to leverage these networks, often securing preferential pricing and delivery terms that would be challenging for new entrants to replicate.

Newcomers face a significant hurdle in building these essential connections from the ground up. This often translates to higher initial costs for raw materials and equipment, and potentially less favorable terms when seeking to sell their gold. The established market presence and proven track record of existing players, demonstrated by their consistent ability to deliver gold to market, create a substantial barrier to entry.

- Established relationships with suppliers and logistics providers create cost advantages for incumbents.

- Proven track record of market access allows established firms to secure better sales terms.

- New entrants must invest heavily in building new supply chain and market access networks.

- In 2024, the gold mining sector saw continued consolidation, reinforcing the strength of established players' market access.

The threat of new entrants in the gold mining sector is significantly mitigated by the immense capital required for exploration, development, and infrastructure, often exceeding $1 billion for a single project as seen with IAMGOLD's Côté Gold. Navigating a complex and lengthy regulatory and permitting process, which can take over two years in many jurisdictions in 2024, further erects a substantial barrier.

The scarcity of easily accessible, high-grade gold deposits means new players must undertake costly, high-risk exploration or acquire reserves from established entities. Furthermore, the need for specialized expertise in geology, engineering, and metallurgy, coupled with the challenge of building essential infrastructure and supply chain networks, reinforces the advantage held by incumbents.

| Barrier Type | Description | 2024 Data/Example |

|---|---|---|

| Capital Intensity | High upfront investment for exploration and mine development. | New gold mine development costs range from $500 million to over $1 billion. |

| Regulatory Hurdles | Complex permitting and compliance processes. | Average time to secure major mining permits exceeds 2 years, often reaching 5+. |

| Resource Scarcity | Difficulty in finding new, economically viable gold deposits. | Global gold exploration expenditure in 2023 was approximately $10 billion. |

| Expertise & Infrastructure | Need for specialized skills and extensive infrastructure development. | Remote mining infrastructure development adds significant cost and complexity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for IAMGOLD leverages a comprehensive dataset including IAMGOLD's annual reports, SEC filings, and industry-specific market research from reputable firms like S&P Global Market Intelligence and Wood Mackenzie. This ensures a robust understanding of the competitive landscape.