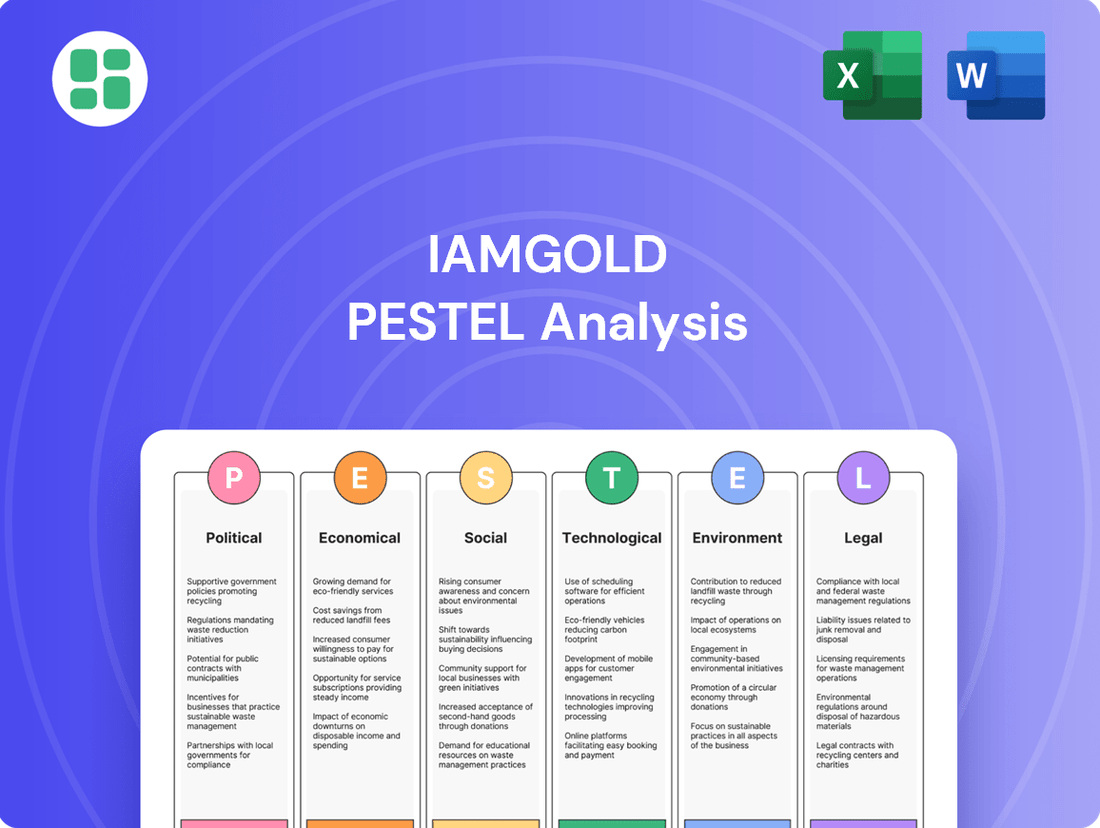

Iamgold PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iamgold Bundle

Discover the critical political, economic, and environmental factors shaping Iamgold's future. Our comprehensive PESTLE analysis provides actionable intelligence to help you understand market dynamics and anticipate challenges. Download the full report to gain a strategic advantage.

Political factors

IAMGOLD's operations, especially its significant stake in the Essakane mine in Burkina Faso, are heavily influenced by the political stability of its operating regions. Political shifts or unrest in West Africa can disrupt operations, leading to increased security costs or temporary shutdowns, impacting production figures. For instance, the political climate in Burkina Faso has seen periods of instability, requiring IAMGOLD to adapt its operational strategies to ensure worker safety and asset protection.

Mining legislation and royalty structures present a dynamic political challenge for IAMGOLD. Fluctuations in Canadian and West African mining laws, permitting processes, and royalty frameworks directly impact profitability and investment strategy. For instance, several West African nations have recently revised their mining codes, often increasing royalty rates or introducing new fiscal obligations, a trend observed in countries like Senegal and Burkina Faso, which host significant mining operations. These changes, sometimes spurred by higher commodity prices, can substantially alter a company's cost base and the economic viability of projects.

IAMGOLD's operations are significantly shaped by international trade relations. Canada's trade agreements, such as the Comprehensive Economic and Trade Agreement (CETA) with the European Union, facilitate smoother import of specialized mining equipment and export of refined gold. Conversely, geopolitical tensions or new trade barriers, like potential tariffs on metals, could increase operational expenses and complicate access to crucial international capital for expansion projects. For instance, the World Bank's 2024 Ease of Doing Business report, while not specific to IAMGOLD, highlights that trade facilitation remains a key differentiator for countries, impacting cost and time for businesses like IAMGOLD to move goods across borders.

Geopolitical Risks and Security

IAMGOLD's operations in West Africa, particularly in countries like Burkina Faso and Mali, place it squarely in the path of significant geopolitical risks. These include the persistent threat of regional conflicts, terrorism, and civil unrest, which directly endanger personnel, vital assets, and critical supply chains. For instance, the Sahel region, where many of IAMGOLD's projects are located, has seen a marked increase in extremist activity in recent years, impacting security protocols and operational continuity.

To counter these threats, IAMGOLD must maintain and enhance robust security measures and sophisticated risk mitigation strategies. This involves significant investment in personnel security, site protection, and intelligence gathering to safeguard operations and employees. The company's 2023 annual report highlighted increased security expenditures, reflecting the challenging operating environment.

These geopolitical instabilities not only create direct operational hurdles but also act as deterrents to broader investment in the region. Furthermore, the heightened risk profile inevitably leads to increased insurance premiums, adding to the overall cost of doing business for IAMGOLD.

- Geopolitical Instability: IAMGOLD operates in regions with elevated risks of conflict, terrorism, and civil unrest, particularly in the Sahel.

- Security Investments: The company allocates significant resources to security measures, a trend that continued into 2024, to protect its assets and personnel.

- Deterrent to Investment: Regional instability can negatively impact investor confidence and the willingness to commit capital to mining projects in affected areas.

- Increased Operational Costs: Higher insurance premiums and the need for enhanced security contribute to elevated operating expenses for IAMGOLD.

Corruption and Governance Standards

The prevalence of corruption and the strength of governance standards in countries where IAMGOLD operates directly impact its business environment. Poor governance can lead to unpredictable regulatory enforcement and unfair business practices, increasing operational risks. IAMGOLD's robust anti-corruption policies and commitment to transparency are therefore crucial for maintaining its social license to operate and avoiding significant legal and reputational damage.

- Transparency International's 2023 Corruption Perception Index ranked 180 countries, with many of IAMGOLD's operational regions scoring poorly, highlighting the need for stringent internal controls.

- Adherence to international standards like the Extractive Industries Transparency Initiative (EITI) helps IAMGOLD demonstrate its commitment to ethical operations and build trust with stakeholders.

- IAMGOLD's 2023 sustainability report detailed its ongoing efforts to uphold high ethical standards and combat corruption across its global operations.

Political stability in IAMGOLD's operating regions, particularly Burkina Faso, directly affects its production and security costs. Recent political shifts in West Africa have necessitated adaptive strategies to ensure safety and asset protection, as noted in their 2023 reports which detailed increased security expenditures.

Changes in mining legislation and royalty rates across Canada and West Africa significantly impact IAMGOLD's profitability. For example, revised mining codes in countries like Senegal and Burkina Faso have introduced higher fiscal obligations, a trend that continued to be a key consideration for project economics throughout 2024.

International trade relations and geopolitical tensions influence IAMGOLD's operational expenses and access to capital. While trade agreements facilitate operations, potential tariffs or trade barriers could increase costs, as highlighted by global trade dynamics assessed by organizations like the World Bank in their 2024 reports.

Geopolitical risks, including regional conflicts and terrorism in the Sahel, pose significant threats to IAMGOLD's personnel and assets. The company's 2023 sustainability report underscored its ongoing commitment to robust security measures and risk mitigation in these challenging environments.

Governance standards and corruption levels in operating countries are critical for IAMGOLD. Transparency International's 2023 Corruption Perception Index showed mixed results for regions where IAMGOLD operates, emphasizing the company's need for strong anti-corruption policies and adherence to initiatives like EITI.

| Political Factor | Impact on IAMGOLD | 2023/2024 Data/Trend |

|---|---|---|

| Political Stability (West Africa) | Operational disruptions, increased security costs | Continued focus on security measures in Burkina Faso; reports indicated increased security expenditures in 2023. |

| Mining Legislation & Royalties | Profitability, project viability | Ongoing revisions to mining codes in West African nations, potentially increasing fiscal obligations. |

| Geopolitical Risks (Sahel Region) | Personnel safety, asset protection, supply chain integrity | Persistent security challenges requiring enhanced risk mitigation strategies and intelligence gathering. |

| Governance & Corruption | Operational risks, reputational damage | Need for stringent internal controls given varying corruption perception index scores in operational regions. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Iamgold's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of the forces shaping Iamgold's industry and geography, enabling strategic decision-making.

A clear, actionable summary of Iamgold's PESTLE analysis, presented in a digestible format, alleviates the pain of sifting through complex data, enabling faster, more informed strategic decisions.

Economic factors

The price of gold is the main engine for IAMGOLD's earnings, making it very sensitive to global market mood, inflation forecasts, and central bank decisions. For instance, gold prices averaged around $2,300 per ounce in Q2 2025, a significant rise that directly bolsters IAMGOLD's revenue and profit margins.

Conversely, a sharp drop in gold prices, a scenario that could occur if inflation cools faster than expected in late 2025, would severely pressure the company's financial results. This volatility underscores the importance of IAMGOLD's hedging activities and its ability to control operational costs to navigate these fluctuating market conditions effectively.

IAMGOLD's global operations, spanning Canada and West Africa, expose it to significant currency exchange rate risks. Reporting its financials in U.S. dollars means fluctuations between the USD, Canadian Dollar, and local West African currencies directly impact its profitability. For instance, a stronger local currency in West Africa against the USD can inflate operating costs when converted back, squeezing margins.

Consider the impact in 2024: if the Ghanaian Cedi or the Senegalese CFA Franc strengthens considerably against the USD, IAMGOLD's expenses incurred in those local currencies will translate to higher USD-denominated costs. This directly affects its bottom line, making financial planning and hedging strategies crucial for mitigating these volatile effects.

Global inflation significantly pressures IAMGOLD's operating expenses. In 2025, the company has navigated rising costs for energy, materials, and labor, directly impacting its All-in Sustaining Costs (AISC). For instance, IAMGOLD reported higher operational expenses in its Q1 2025 results, partly attributed to increased royalties and the ramp-up of new projects.

These escalating costs, particularly evident in the energy sector and supply chain disruptions, directly affect IAMGOLD's cash costs. Maintaining profitability hinges on the company's ability to implement robust cost control measures and drive operational efficiencies across its mining portfolio. Effective management of these inflationary pressures is critical for preserving margins and ensuring financial resilience.

Access to Capital and Financing Costs

IAMGOLD's ability to secure capital for its mining ventures, from exploration to daily operations, is a critical determinant of its success. Favorable interest rates are paramount in this capital-intensive sector. The company's financial standing, including its liquidity and creditworthiness, directly impacts its ability to borrow and the associated costs.

IAMGOLD's financial health has seen positive developments, as evidenced by a recent credit rating upgrade from Fitch. This upgrade suggests an improved capacity to access financing at potentially more competitive rates.

- Fitch Ratings upgraded IAMGOLD's Issuer Default Rating (IDR) to B+ from B in late 2023, citing improved operational performance and debt reduction.

- This upgrade reflects IAMGOLD's strengthened balance sheet and its ability to manage its debt obligations more effectively.

- Access to capital at reasonable costs is crucial for funding IAMGOLD's development projects, such as the Cote Gold project, and for maintaining its existing operations.

Global Economic Growth and Demand

The global economic outlook significantly shapes demand for gold, particularly influencing industrial applications and investor sentiment. While strong economic growth can sometimes divert investment away from safe-haven assets like gold towards more growth-oriented opportunities, periods of economic uncertainty and volatility typically bolster gold's appeal as a hedge.

For instance, the International Monetary Fund (IMF) projected global growth to moderate to 2.9% in 2024, down from 3.0% in 2023, reflecting a slowdown in major economies. This environment of moderating growth can create a mixed picture for gold demand, with potential headwinds from reduced industrial consumption but tailwinds from continued investor caution.

- Global Growth Forecasts: The IMF's 2024 global growth projection of 2.9% indicates a slightly softer economic environment compared to 2023.

- Impact on Industrial Demand: Slower industrial activity tied to moderated economic growth can lead to reduced demand for gold in sectors like electronics and manufacturing.

- Investor Sentiment: Persistent economic uncertainties, even with moderate growth, often encourage investors to seek the stability of gold, supporting its investment demand.

- Mining Sector Influence: The broader economic climate directly impacts IAMGOLD's operational costs, capital availability, and the overall profitability of its gold mining ventures.

Economic factors significantly influence IAMGOLD's performance. Gold prices, averaging around $2,300 per ounce in Q2 2025, directly impact revenue, though a rapid cooling of inflation in late 2025 could pressure prices. Currency fluctuations, particularly between the USD and local currencies in West Africa, also affect operating costs, as seen when the Ghanaian Cedi strengthened against the USD in 2024. Global inflation in 2025 has driven up IAMGOLD's All-in Sustaining Costs (AISC) due to higher energy, materials, and labor expenses.

IAMGOLD's access to capital is crucial, with favorable interest rates being key. Fitch Ratings upgraded IAMGOLD's Issuer Default Rating to B+ from B in late 2023, indicating improved debt management and financial health. The global economic outlook, with a projected 2.9% growth in 2024 according to the IMF, presents a mixed picture: slower industrial demand versus continued investor demand for gold as a safe haven amid economic uncertainties.

| Economic Factor | 2024/2025 Impact | IAMGOLD Relevance |

|---|---|---|

| Gold Price | Averaged ~$2,300/oz in Q2 2025 | Directly drives revenue and profit margins. |

| Currency Exchange Rates | USD vs. CAD, Ghanaian Cedi, CFA Franc | Affects operating costs when converted to USD. |

| Global Inflation | Increased costs for energy, materials, labor | Pressures All-in Sustaining Costs (AISC). |

| Global Economic Growth | IMF projects 2.9% for 2024 | Influences industrial demand and investor sentiment. |

| Interest Rates | Affects cost of capital for projects | Crucial for funding exploration and operations. |

What You See Is What You Get

Iamgold PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Iamgold PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a crucial strategic overview for understanding Iamgold's operating landscape.

Sociological factors

IAMGOLD prioritizes strong community relations, particularly in West Africa and with Canadian Indigenous groups, to secure its social license to operate. In 2023, the company continued its focus on local employment and community development initiatives, aiming to foster mutual benefit and trust. These efforts are crucial for mitigating risks such as operational disruptions stemming from negative community sentiment.

IAMGOLD's commitment to the health and safety of its roughly 5,300 employees and contractors globally is a paramount sociological consideration. This focus directly impacts employee well-being, morale, and the company's operational stability.

Maintaining high safety standards is not just about compliance; it's a strategic imperative that minimizes workplace incidents, thereby reducing potential legal and financial repercussions. A robust safety culture fosters trust and loyalty among the workforce.

The company actively monitors its Total Recordable Injuries Frequency Rate (TRIFR) as a key performance indicator, striving for ongoing reductions. For instance, in 2023, IAMGOLD reported a TRIFR of 1.43, a slight increase from 1.32 in 2022, highlighting the continuous effort required to achieve zero harm.

IAMGOLD's success hinges on robust labor practices, focusing on fostering positive employee relations and ensuring fair compensation. In 2023, the company reported a total workforce of approximately 3,200 employees, with a significant portion being local hires at its various mine sites, demonstrating a commitment to community integration.

Effective workforce management is crucial for operational continuity. IAMGOLD's strategy includes investing in employee development programs to upskill its workforce, enhancing productivity and reducing reliance on external expertise. The company's adherence to international labor standards and local regulations is paramount to avoiding disruptions and maintaining its social license to operate.

The company actively promotes diversity and inclusion, with a stated goal of achieving 40% female representation in leadership roles by 2025. This focus on diverse representation not only strengthens the talent pool but also contributes to a more equitable and productive work environment, mitigating potential social friction.

Indigenous Rights and Partnerships

In Canada, respecting and partnering with Indigenous communities is a significant sociological and legal consideration for mining companies, impacting project development and operational success. This involves thorough consultation processes, the negotiation of Impact Benefit Agreements (IBAs), and a commitment to ensuring projects respect traditional lands and cultural heritage.

IAMGOLD's approach, particularly evident at its Côté Gold mine in Ontario, highlights a proactive stance on these partnerships. The company has entered into agreements with the Abitibiwinni First Nation, aiming to foster mutual benefit and long-term collaboration. These relationships are crucial for social license to operate and can mitigate project risks.

- Côté Gold Project: IAMGOLD's significant investment in the Côté Gold project, which commenced construction in 2021, underscores the importance of Indigenous partnerships. The project is expected to be a major contributor to the Canadian economy, with significant employment opportunities for local and Indigenous communities.

- Impact Benefit Agreements (IBAs): IAMGOLD has established IBAs with Indigenous communities, outlining commitments related to employment, training, business opportunities, and environmental stewardship. These agreements are dynamic and subject to ongoing review and adaptation.

- Cultural Heritage Protection: A key aspect of these partnerships involves respecting and protecting Indigenous cultural heritage sites and traditional land use. This requires careful planning and ongoing dialogue throughout the project lifecycle.

- Economic Participation: The company aims to ensure Indigenous communities benefit economically from mining operations through direct employment, contracting opportunities, and potential equity participation, fostering shared prosperity.

Social License to Operate (SLO)

Iamgold's Social License to Operate (SLO) hinges on maintaining the acceptance of local communities and stakeholders, built on responsible practices and transparent communication. Failure to secure this can lead to significant social resistance, impacting project timelines and viability, as seen in the challenges faced by mining operations globally.

For instance, in 2024, several mining projects experienced delays or increased operational costs due to community opposition stemming from environmental concerns or perceived lack of local benefit. Iamgold's commitment to community development, as demonstrated by its 2023 sustainability reports detailing investments in local infrastructure and employment initiatives, is crucial for bolstering its SLO.

- Community Engagement: Iamgold actively engages with local communities through dialogue forums and partnerships to address concerns and foster mutual trust.

- Local Economic Impact: The company prioritizes local employment and procurement, aiming to create sustainable economic benefits for host communities, a key factor in building social acceptance.

- Environmental Stewardship: Demonstrating strong environmental management practices is paramount, as community trust is eroded by perceived ecological damage.

IAMGOLD's social license to operate is heavily influenced by its relationships with local communities and Indigenous groups, particularly in West Africa and Canada. The company's commitment to local employment and community development, evident in its 2023 initiatives, aims to build trust and mitigate operational risks. Respect for cultural heritage and ongoing dialogue are critical, as demonstrated by agreements with Indigenous communities for projects like Côté Gold.

Technological factors

IAMGOLD is actively integrating advanced technologies, such as autonomous haul trucks and blasthole drilling rigs, at its Côté Gold Mine. This adoption is a key driver for improving operational efficiency and safety.

Further investment in digitalization and data analytics is crucial for optimizing mining processes. For instance, remote monitoring systems can enhance decision-making and minimize human exposure to hazardous working conditions, a trend that is accelerating across the industry.

Technological advancements in geological surveying and geophysical imaging are significantly boosting the accuracy and efficiency of gold exploration. These innovations allow for better identification of potential gold deposits and help in expanding existing reserves, which is crucial for companies like IAMGOLD.

IAMGOLD's ongoing exploration efforts, particularly at its Côté Gold project in Canada and the Essakane mine in Burkina Faso, are heavily reliant on these cutting-edge technologies. For instance, advanced seismic imaging and drone-based magnetometry are employed to map subsurface geology more precisely. In 2023, IAMGOLD reported that Côté Gold's mineral reserves increased, partly due to successful exploration campaigns utilizing these advanced techniques.

Advancements in comminution, flotation, and leaching are boosting gold recovery. These metallurgical innovations mean more gold can be extracted from the ore, and with less energy and fewer chemicals used. This directly translates to lower operating expenses and a smaller environmental impact.

For instance, IAMGOLD's Côté mine demonstrated this trend, achieving impressive gold recoveries of 91% during the first quarter of 2025. This highlights the tangible benefits of investing in and implementing cutting-edge extraction technologies.

Renewable Energy Integration in Mining

IAMGOLD is actively integrating renewable energy, notably solar power, at its Essakane mine. This strategic move significantly lessens the company's dependence on diesel fuel, a major operating expense and source of emissions. For instance, the solar farm at Essakane, operational since 2018, has demonstrably reduced diesel consumption and associated costs.

This technological adoption directly supports IAMGOLD's sustainability objectives by cutting greenhouse gas emissions. By diversifying its energy mix, the company enhances its long-term energy security and achieves greater predictability in its energy expenditures, a crucial factor for financial stability in the mining sector.

- Reduced Operating Costs: Solar power at Essakane has lowered diesel fuel expenditure, contributing to improved profitability.

- Lower Emissions: The shift to renewables directly addresses environmental concerns by decreasing the carbon footprint of mining operations.

- Energy Security: Diversifying energy sources mitigates risks associated with fossil fuel price volatility and supply chain disruptions.

- Technological Advancement: Implementing solar technology showcases IAMGOLD's commitment to innovation and modernizing its operational infrastructure.

Environmental Management Technologies

IAMGOLD is increasingly leveraging innovative technologies to manage its environmental footprint. This includes advanced water management systems, such as sophisticated filtration to reduce effluent discharge, and real-time environmental monitoring to quickly identify and address potential issues. For instance, in 2023, the company reported progress in its water stewardship initiatives, aiming to reduce water intensity across its operations.

Waste management, particularly concerning tailings, is another area where technology plays a vital role. IAMGOLD is exploring and implementing techniques like dry stacking and paste thickening to improve tailings stability and reduce water usage. Biomining, which uses biological processes to extract metals, is also being considered as a more sustainable approach for certain waste streams.

The company's commitment to land rehabilitation is supported by technological advancements in revegetation and soil stabilization. IAMGOLD's sustainability reports consistently emphasize its efforts in biodiversity support, often detailing projects that utilize modern ecological restoration techniques. For example, their 2023 sustainability data indicates specific targets for land disturbed and rehabilitated, showcasing a data-driven approach to environmental recovery.

- Water Management: Implementation of advanced filtration systems and real-time monitoring to minimize water discharge and ensure compliance with environmental standards.

- Waste Management: Exploration of technologies like dry stacking and paste thickening for tailings, alongside potential biomining applications, to enhance safety and reduce environmental impact.

- Land Rehabilitation: Utilizing innovative techniques for revegetation and soil stabilization to restore disturbed land and support biodiversity post-mining.

- Sustainability Reporting: IAMGOLD's 2023 sustainability report details progress in water stewardship and biodiversity support, underscoring a focus on measurable environmental performance.

Technological advancements are significantly enhancing IAMGOLD's operational efficiency and safety, particularly with the integration of autonomous haul trucks and blasthole drilling rigs at its Côté Gold Mine. Further investment in digitalization and data analytics is key for optimizing processes, with remote monitoring systems improving decision-making and minimizing human exposure to hazards.

Innovations in geological surveying and geophysical imaging are boosting gold exploration accuracy, aiding in the identification of new deposits and reserve expansion. For instance, advanced seismic imaging and drone-based magnetometry are employed to map subsurface geology more precisely, contributing to reserve increases as seen at Côté Gold.

Metallurgical advancements in comminution, flotation, and leaching are increasing gold recovery rates while reducing energy and chemical usage, directly lowering operating expenses. IAMGOLD's Côté mine achieved impressive gold recoveries of 91% in Q1 2025, showcasing the tangible benefits of these cutting-edge extraction technologies.

The company is also integrating renewable energy, such as solar power at its Essakane mine, to reduce reliance on diesel fuel and lower emissions. This strategic move enhances energy security and provides greater predictability in energy expenditures.

Legal factors

IAMGOLD must navigate a complex web of mining laws and regulations across its operating regions, particularly in Canada and West Africa. Compliance is paramount, covering everything from initial exploration and resource extraction to processing and eventual mine closure. For instance, in 2024, the Canadian government continued to refine environmental impact assessment processes, potentially adding layers of scrutiny to new project approvals.

Changes in these legal frameworks can significantly impact IAMGOLD's operations and financial performance. For example, shifts in royalty rates or increased environmental remediation requirements, which have been a growing concern in several West African nations, could necessitate substantial capital expenditures or alter the economic viability of existing or planned projects. These regulatory shifts demand constant monitoring and adaptive strategies.

IAMGOLD faces stringent legal requirements for environmental protection, covering emissions, water discharge, waste management, and biodiversity. Failure to comply can lead to significant financial penalties, legal challenges, and damage to its public image.

The company's dedication to Environmental, Social, and Governance (ESG) principles is highlighted in its 2024 Sustainability Report, which details its proactive measures and compliance efforts across these critical environmental areas.

IAMGOLD's operations are significantly shaped by labor and employment laws. Ensuring compliance with regulations on minimum wage, safe working conditions, and employee rights, including unionization, is paramount for effective workforce management. These legal frameworks directly impact operational costs and employee relations.

The company's commitment to ethical labor practices is highlighted by its adherence to legislation like the Fighting Against Forced Labour and Child Labour in Supply Chains Act. IAMGOLD's 2024 report explicitly details its strategies and ongoing efforts to prevent forced and child labor throughout its extensive supply chains, underscoring a key area of legal and ethical responsibility.

Corporate Governance and Reporting Requirements

As a publicly traded entity on both the NYSE and TSX, IAMGOLD is bound by rigorous corporate governance and reporting mandates. These regulations cover everything from transparent financial disclosures to robust board oversight, all designed to foster accountability to shareholders and regulatory authorities. For instance, in their 2023 annual report, IAMGOLD detailed their adherence to these standards, including their latest financial performance and sustainability initiatives.

These obligations extend to regular publications of financial statements and sustainability reports, which are crucial for maintaining investor confidence and regulatory compliance. Such reporting ensures that stakeholders have access to accurate and timely information regarding the company's operations and its commitment to environmental, social, and governance (ESG) principles. The company's 2024 interim financial reports, for example, would reflect ongoing compliance with these requirements.

- Compliance with SEC and OSC regulations

- Annual filings including Form 40-F and Annual Information Form

- Adherence to listing standards of NYSE and TSX

- Regular disclosure of material information

Land Tenure and Permitting

Iamgold's operations are heavily reliant on maintaining secure land tenure and obtaining necessary permits, a constant legal undertaking. Disputes over land rights or delays in permit approvals, such as those potentially impacting new exploration licenses in regions like Quebec, Canada, can significantly disrupt operations. The company must adeptly navigate intricate legal systems governing land ownership and the extraction of natural resources, a challenge underscored by evolving environmental regulations and community engagement requirements.

Navigating these legal complexities is crucial for project continuity and financial stability. For instance, in 2024, Iamgold continued to manage its land access and permitting across its portfolio, including its operations in Suriname and Senegal. The company's ability to secure renewals and new permits directly influences its exploration success and production timelines.

- Land Tenure Security: Ensuring clear and undisputed legal rights to operate on mining concessions is paramount.

- Permitting Processes: Compliance with environmental, social, and operational permitting requirements across various jurisdictions.

- Regulatory Compliance: Adherence to national and local laws concerning mining, labor, and taxation.

- Legal Disputes: Proactive management and resolution of any legal challenges related to land use or operational licenses.

IAMGOLD operates under a strict legal framework, requiring adherence to mining laws, environmental regulations, and labor standards across its global operations, particularly in Canada and West Africa.

In 2024, the company continued to focus on compliance with evolving environmental impact assessment processes in Canada and potential shifts in royalty rates in West Africa, which could affect project economics.

IAMGOLD's commitment to ESG principles, detailed in its 2024 Sustainability Report, underscores its efforts in environmental protection, including emissions and waste management, to avoid penalties and reputational damage.

The company also prioritizes ethical labor practices, complying with legislation like the Fighting Against Forced Labour and Child Labour in Supply Chains Act, as highlighted in its 2024 reporting.

Environmental factors

IAMGOLD, like many in the mining sector, faces increasing scrutiny regarding its environmental impact, particularly its contribution to greenhouse gas emissions. The company is under pressure to align its operations with global climate goals, which necessitates a focused effort on reducing its carbon footprint.

Key strategies for IAMGOLD include a shift towards renewable energy sources, enhancing operational energy efficiency, and transparently reporting its Scope 1 and 2 emissions. The company has set an ambitious target to achieve a 30% reduction in emissions by the end of 2024, demonstrating a commitment to environmental stewardship.

Responsible water management is a critical environmental factor for IAMGOLD, particularly concerning water usage, discharge quality, and recycling efforts. The company acknowledges the significant water demands of its mining operations and is actively pursuing improved water stewardship.

IAMGOLD's strategy includes increasing water recycling and reuse rates across its sites. For instance, in 2023, the company reported a focus on optimizing water circuits to minimize freshwater intake, a key aspect of its environmental, social, and governance (ESG) commitments.

Operating in various regions, IAMGOLD must navigate stringent regulatory compliance and evolving community expectations related to water resources. This includes adhering to discharge limits and engaging with local stakeholders to ensure sustainable water practices, especially in areas identified as water-stressed.

The effective management of mining waste, especially tailings, is a critical environmental concern for IAMGOLD, drawing significant regulatory attention. The company's commitment to preventing spills and contamination hinges on maintaining the stability and environmental integrity of its tailings storage facilities.

IAMGOLD demonstrates its dedication to this area by publishing a Tailings Management Report, underscoring its adherence to stringent industry standards and best practices. For instance, in its 2023 Sustainability Report, IAMGOLD detailed its ongoing investments in tailings dam monitoring and upgrades across its operations, reflecting a proactive approach to environmental stewardship.

Biodiversity and Land Use Impacts

Mining activities inherently pose risks to biodiversity and can significantly alter land use patterns. IAMGOLD acknowledges these challenges and is actively implementing strategies to minimize its environmental footprint.

The company's approach includes developing comprehensive biodiversity management plans designed to protect and, where possible, enhance local ecosystems. These plans are crucial for addressing the potential habitat destruction and species loss associated with resource extraction.

IAMGOLD is also heavily invested in land rehabilitation efforts, aiming to restore mined areas to a state that supports ecological recovery and beneficial land use post-operation. A key objective is to achieve a net-positive impact on biodiversity at its operational sites, demonstrating a commitment to environmental stewardship beyond mere mitigation.

- Habitat Protection: IAMGOLD's biodiversity management plans focus on safeguarding critical habitats and sensitive ecosystems near its operations.

- Land Rehabilitation: Post-mining, the company undertakes extensive land rehabilitation projects to restore disturbed areas.

- Net-Positive Impact Goal: IAMGOLD strives to leave a positive ecological legacy, enhancing biodiversity at its sites.

- Operational Planning: Careful site selection and operational planning are employed to reduce initial land disturbance.

Environmental Regulations and Compliance Costs

Environmental regulations are becoming more stringent globally, directly impacting mining operations like IAMGOLD. For instance, Canada's omnibus Bill C-59, passed in late 2023, introduces updated environmental protection measures that mining companies must adhere to. This can translate into increased capital expenditures for IAMGOLD, potentially affecting project economics.

These evolving regulations necessitate significant investments in areas such as advanced emission control technologies, comprehensive environmental monitoring systems, and robust remediation plans. For example, in 2023, IAMGOLD reported expenditures related to environmental compliance and sustainability initiatives, though specific figures for new legislative impacts are still being integrated into financial reporting.

The financial implications of non-compliance are substantial, including potential fines and reputational damage. Proactive environmental stewardship, therefore, is not just a matter of regulatory adherence but a critical component of IAMGOLD's long-term operational viability and social license to operate. Companies that effectively manage these environmental factors often see improved investor confidence and reduced operational risks.

Key areas of focus for IAMGOLD's environmental compliance include:

- Water management and discharge quality

- Air emissions control and greenhouse gas reduction targets

- Biodiversity protection and land reclamation

- Waste management and tailings facility safety

IAMGOLD faces significant environmental challenges, including managing greenhouse gas emissions and water resources. The company is actively working to reduce its carbon footprint, aiming for a 30% emission reduction by the end of 2024, and enhancing its water stewardship through increased recycling and reuse.

Effective waste management, particularly concerning tailings, is a critical focus, with IAMGOLD investing in monitoring and upgrades. The company also prioritizes biodiversity protection and land rehabilitation, striving for a net-positive ecological impact at its operational sites.

Stringent and evolving environmental regulations, such as Canada's Bill C-59, require substantial investment from IAMGOLD in emission controls, monitoring, and remediation, impacting project economics and operational viability.

IAMGOLD's key environmental compliance areas encompass water management, emissions control, biodiversity, and waste safety, all crucial for maintaining its social license to operate and investor confidence.

| Environmental Factor | IAMGOLD's Focus/Action | Data/Target (as of latest reporting) |

|---|---|---|

| Greenhouse Gas Emissions | Reducing carbon footprint, shifting to renewables, improving energy efficiency | Target: 30% reduction by end of 2024 (Scope 1 & 2) |

| Water Management | Responsible usage, discharge quality, recycling, minimizing freshwater intake | Focus on optimizing water circuits; reported efforts in 2023 |

| Waste Management (Tailings) | Ensuring stability and integrity of tailings facilities, preventing spills | Publishes Tailings Management Report; investments in monitoring and upgrades (2023) |

| Biodiversity & Land Use | Protecting habitats, managing land alteration, rehabilitation efforts | Developing biodiversity management plans, aiming for net-positive impact |

| Regulatory Compliance | Adhering to evolving environmental laws (e.g., Canada's Bill C-59) | Increased capital expenditures for compliance technologies and systems (ongoing) |

PESTLE Analysis Data Sources

Our PESTLE analysis for IAMGOLD is built on a robust foundation of data from official government publications, respected financial institutions, and leading industry analysis firms. This ensures that every aspect, from political stability in mining regions to global economic forecasts, is supported by credible and current information.