Iamgold Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iamgold Bundle

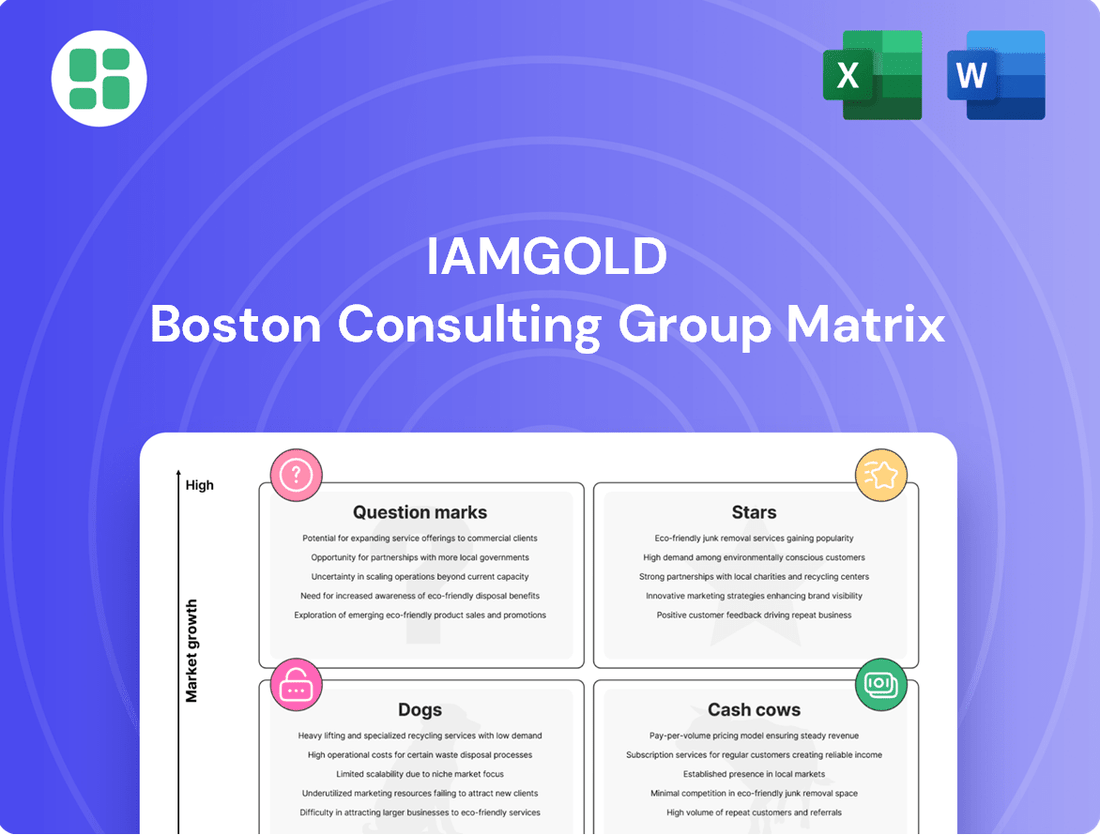

Unlock the strategic potential of Iamgold's portfolio with a glimpse into its BCG Matrix. Understand which of their mining assets are poised for growth and which require careful management. This preview hints at the critical insights waiting to be discovered.

Don't miss the opportunity to gain a comprehensive understanding of Iamgold's market position. Purchase the full BCG Matrix report to reveal the Stars, Cash Cows, Dogs, and Question Marks within their operations, empowering you with actionable intelligence for informed investment decisions.

Stars

The Côté Gold mine, a significant new asset for IAMGOLD, commenced commercial production in March 2024. It is currently in a rapid ramp-up phase, with the expectation of achieving its full nameplate capacity by the close of 2025.

This mine is poised to become a major contributor to IAMGOLD's overall gold output. For 2025, the projected production on a 100% basis is between 360,000 and 400,000 ounces.

The swift and successful commissioning of Côté Gold highlights its role as a primary growth engine for the company, signaling a strong market presence within an expanding production landscape.

The Gosselin zone, situated right next to IAMGOLD's Côté Gold mine, is showing really exciting exploration results. These findings suggest it might actually be connected to the main Côté deposit, hinting at the possibility of a much larger mining operation.

This potential connection could mean a district-scale complex, significantly boosting IAMGOLD's known gold reserves and potentially extending the mine's operational life for many decades into the future.

Current drilling efforts are focused on clearly defining this potential, making the Gosselin zone a key high-growth prospect that could really increase IAMGOLD's market share in the coming years.

IAMGOLD is actively transforming into a premier Canadian gold producer, with its Côté Gold and Westwood mines forming the cornerstone of this strategy. This deliberate pivot is designed to unlock greater stakeholder value by concentrating on mining regions known for their stability and substantial growth prospects. By prioritizing development within Canada, a jurisdiction highly regarded for its mining sector, IAMGOLD is strategically positioning itself for significant market share and high growth within the global gold market.

Robust Gold Price Environment Tailwinds

The current strong gold price environment, with average realized prices significantly higher than previous years, provides a substantial tailwind for IAMGOLD's revenues and profitability. This favorable market condition amplifies the value of its producing assets and supports investment in growth projects. Such market dynamics contribute to a high growth market, allowing IAMGOLD to capture increased market share in terms of value generated per ounce.

- Gold prices have shown remarkable strength, with the average realized price for gold in 2023 reaching approximately $1,940 per ounce, a notable increase from previous years.

- This elevated price environment directly boosts IAMGOLD's revenue streams, enhancing the financial viability of its existing operations and future development plans.

- The favorable market conditions are crucial for supporting the company's investments in growth projects, ensuring they can proceed with greater confidence and potential for higher returns.

- This robust gold market allows IAMGOLD to benefit from a high-growth market, increasing its value generated per ounce of gold produced.

Increased Overall Attributable Gold Production

IAMGOLD experienced a significant boost in its gold production, with a 43% surge in total attributable output for 2024. This impressive growth was largely fueled by the successful launch of the Côté Gold project, alongside robust contributions from its existing mining sites.

Looking ahead, IAMGOLD anticipates this upward trend to continue into 2025. The company projects its attributable gold production for the upcoming year to range between 735,000 and 820,000 ounces, indicating sustained operational momentum.

This consistent expansion in production highlights IAMGOLD's increasing market presence and a clear trajectory of growth across its operations.

- 2024 Attributable Gold Production: 43% increase year-over-year.

- Key Growth Driver: Commencement of Côté Gold operations.

- 2025 Production Forecast: 735,000 to 820,000 attributable ounces.

- Overall Implication: Demonstrates growing market share and strong growth trajectory.

IAMGOLD's Côté Gold mine, which began commercial production in March 2024, is a prime example of a Star in the BCG matrix. It's in a high-growth phase, with projected production on a 100% basis between 360,000 and 400,000 ounces for 2025. The Gosselin zone's exploration results further bolster Côté Gold's Star status, hinting at a potential district-scale operation that could significantly increase reserves and mine life.

| Asset | BCG Category | Key Metrics | Growth Outlook |

|---|---|---|---|

| Côté Gold | Star | Commenced production March 2024; 2025 projected 100% production 360-400koz | High growth, rapid ramp-up, potential district-scale expansion |

| Gosselin Zone | Star (Potential) | Exploration results suggest connection to Côté Gold | High growth, potential to significantly increase reserves and mine life |

What is included in the product

IAMGOLD's BCG Matrix analysis categorizes its mining assets into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each mining operation.

The Iamgold BCG Matrix provides a clear visual of business unit performance, alleviating the pain of uncertainty in strategic resource allocation.

Cash Cows

The Essakane mine in Burkina Faso is a prime example of a Cash Cow for IAMGOLD, consistently contributing significantly to the company's overall gold output. In 2023, Essakane produced approximately 394,000 ounces of gold, representing a substantial portion of IAMGOLD's total attributable production. This steady performance underscores its role as a mature, reliable asset.

Despite changes in government ownership, Essakane's operational history and long mine life ensure its continued status as a cash-generating powerhouse. The mine's established infrastructure and proven track record allow for consistent and predictable cash flow, vital for funding other ventures within IAMGOLD's portfolio.

IAMGOLD's Essakane mine stands out as a prime example of a cash cow, consistently producing substantial mine-site free cash flow. This robust generation of cash is vital for supporting the company's broader financial health.

In 2023, Essakane contributed significantly to IAMGOLD's overall financial performance, reflecting its status as a mature and highly productive asset. The cash generated from Essakane provides the necessary capital for debt repayment and strategic investments in other areas of the business.

This strong, predictable cash flow from operating mines like Essakane grants IAMGOLD crucial financial flexibility. It underpins the company's ability to pursue growth opportunities and manage its financial obligations effectively, a hallmark of a well-performing cash cow.

Iamgold's healthy liquidity position, bolstered by cash and available credit facilities, provides significant operational flexibility. This stability is a direct result of the consistent cash flow generated by its producing mines, which act as the company's cash cows.

As of the first quarter of 2024, Iamgold reported cash and cash equivalents of approximately $334 million. This strong liquidity allows the company to navigate market fluctuations and invest in its core assets without undue financial strain.

Optimized Capital Allocation and Cost Management

IAMGOLD is prioritizing disciplined capital allocation and operational efficiencies to drive long-term value. This strategy is crucial for maximizing cash flow from established assets.

Mature operations like the Essakane mine in Burkina Faso are central to this approach. By focusing on optimizing performance and managing expenses, Essakane contributes significantly to IAMGOLD's profit margins, acting as a reliable cash generator.

- Essakane's Contribution: In 2023, Essakane produced approximately 374,000 ounces of gold, demonstrating its continued operational strength.

- Cost Optimization Focus: IAMGOLD aims to reduce its all-in sustaining costs (AISC) across its portfolio, with Essakane being a key site for these efficiency drives.

- Capital Allocation Strategy: Capital expenditures are strategically directed towards maintaining and enhancing the productivity of these cash-generating assets.

Long-Term Production Outlook for Essakane

Essakane's long-term production outlook positions it as a strong cash cow for IAMGOLD. The mine is anticipated to continue operations through 2028, maintaining an average annual production of around 400,000 ounces. This sustained output from a mature, high-volume asset guarantees a consistent and reliable revenue stream and cash flow for the company.

The predictability of Essakane's production profile is a key characteristic of a cash cow.

- Essakane production forecast: Approximately 400,000 ounces per year through 2028.

- Impact of extended mine life: Ensures sustained revenue and cash flow.

- Cash cow characteristic: Defined by a predictable, long-term production profile from an established mine.

IAMGOLD's Essakane mine in Burkina Faso is a quintessential cash cow, embodying the characteristics of a mature, high-volume asset with a stable production profile. Its consistent output provides a reliable source of cash flow, crucial for funding other operations and strategic initiatives within the company. This predictable revenue stream underpins IAMGOLD's financial stability and operational flexibility.

| Mine | Location | 2023 Production (ounces) | Projected Annual Production (ounces) | Mine Life End (approx.) |

|---|---|---|---|---|

| Essakane | Burkina Faso | 374,000 | 400,000 | 2028 |

What You’re Viewing Is Included

Iamgold BCG Matrix

The Iamgold BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis, meticulously crafted to provide clarity on Iamgold's portfolio, will be delivered in its complete, editable format, enabling you to seamlessly integrate it into your business planning. You can trust that the insights and presentation style you see here are precisely what you'll gain access to, ensuring no surprises and maximum utility for your decision-making processes. This is your direct path to a fully functional BCG Matrix report, designed for professional analysis and actionable insights into Iamgold's market position.

Dogs

IAMGOLD's divestiture of the Rosebel mine in Suriname, finalized in January 2023, clearly marks the removal of a non-core or underperforming asset. This strategic exit from a market segment previously considered significant but now facing challenges or offering low growth places Rosebel firmly in the 'Dog' category of the BCG matrix. The company successfully completed the sale, which was valued at approximately $340 million in cash, demonstrating a decisive move to streamline its portfolio.

IAMGOLD’s divestment of its West African Bambouk assets, including Boto Gold and Diakha-Siribaya, in 2023 and 2024, aligns with a strategic move away from projects with a low market share and those no longer considered core to its long-term vision. These assets, while holding potential for future growth under new ownership, were categorized as Dogs within IAMGOLD's historical portfolio due to their non-strategic nature for the company.

IAMGOLD's early-stage exploration properties that are underperforming represent the company's Dogs in the BCG matrix. These assets, while holding potential, have not yet demonstrated the commercial viability or resource definition needed to move them into more advanced development stages. For instance, in 2023, IAMGOLD reported exploration expenditures across various projects, but not all yielded the expected positive outcomes, highlighting the inherent risks in early-stage ventures.

Historical Operational Challenges at Westwood

The Westwood mine has historically grappled with significant operational hurdles. These included disruptive seismic events, which led to substantial reserve revisions and consequently, periods of diminished output and escalated expenses. For instance, in 2022, IAMGOLD reported that Westwood's production was impacted by these challenges, contributing to higher all-in sustaining costs (ASSC) compared to previous periods.

These past difficulties, marked by operational instability and the necessity for a complete strategic overhaul, clearly position Westwood as a 'Dog' within the BCG matrix framework. This required a substantial turnaround initiative to ensure its continued viability. The mine's journey reflects a past characterized by underperformance relative to its potential and the market's expectations.

- Seismic Activity: Westwood has experienced seismic events that have directly impacted mine planning and safety protocols.

- Reserve Revisions: Following seismic events, reserve estimates were adjusted downwards, affecting the mine's long-term economic outlook.

- Productivity and Cost Increases: Operational disruptions led to reduced productivity and a rise in per-unit production costs.

- Turnaround Efforts: Significant investment and strategic changes were implemented to address these operational challenges and improve performance.

Temporary High All-in Sustaining Costs (AISC)

IAMGOLD's Côté Gold project experienced significant ramp-up expenses in Q1 2025, contributing to higher-than-expected All-in Sustaining Costs (AISC). This period of elevated spending, coupled with maintenance delays at Essakane and increased strip ratios, placed the operation in a 'Dog' quadrant of the BCG Matrix. These temporary cost pressures, reaching $1,450 per ounce in Q1 2025, can negatively impact profitability if not managed effectively.

The company's AISC of $1,450 per ounce in the first quarter of 2025, a notable increase from previous periods, highlights the challenges faced. This figure is above the projected range for the year, indicating a need for operational adjustments. Management has outlined strategies to mitigate these costs throughout 2025.

- Q1 2025 AISC: $1,450 per ounce.

- Key Cost Drivers: Côté Gold ramp-up, Essakane maintenance delays, and higher strip ratios.

- Management Focus: Reducing AISC through operational efficiencies over the remainder of 2025.

IAMGOLD's portfolio includes assets that, while holding potential, currently exhibit low market share or face significant operational challenges, placing them in the 'Dog' category of the BCG matrix. The divestment of non-core assets like the Rosebel mine for approximately $340 million in early 2023 and the Bambouk assets in 2023-2024 exemplifies this strategy. These moves indicate a focus on streamlining operations and divesting underperforming or non-strategic ventures.

The Westwood mine faced considerable operational difficulties, including seismic events and associated reserve revisions, leading to increased costs and reduced productivity. For instance, in 2022, Westwood's all-in sustaining costs (ASSC) were notably higher due to these disruptions. These challenges necessitated significant turnaround efforts to improve its performance and viability.

In the first quarter of 2025, IAMGOLD's Côté Gold project experienced elevated ramp-up expenses, contributing to an All-in Sustaining Cost (AISC) of $1,450 per ounce. This figure, higher than anticipated, along with maintenance delays at Essakane and increased strip ratios, temporarily positioned these operations as 'Dogs' within the BCG matrix, prompting management focus on cost reduction throughout 2025.

| Asset/Project | BCG Category | Key Factors | Financial Data (Illustrative) |

|---|---|---|---|

| Rosebel Mine | Dog | Divested (Jan 2023) for $340M; considered non-core/underperforming | N/A (Divested) |

| Bambouk Assets (Boto Gold, Diakha-Siribaya) | Dog | Divested 2023-2024; low market share/non-strategic | N/A (Divested) |

| Westwood Mine | Dog | Seismic events, reserve revisions, higher ASSC (e.g., 2022), operational challenges | ASSC (2022): Elevated due to disruptions |

| Côté Gold Project (Q1 2025) | Dog (Temporary) | Ramp-up expenses, higher AISC, maintenance delays, strip ratios | Q1 2025 AISC: $1,450/oz |

Question Marks

Westwood Mine, despite an updated plan extending operations to 2032 and focusing on safety and efficiency, remains a question mark in IAMGOLD's portfolio. Its history of seismic events and reserve revisions presents ongoing challenges.

The mine's potential for future profitability hinges on its ability to consistently meet production and cost forecasts, a feat that has been hampered by past operational hurdles. Continued investment and careful management are essential to navigate these risks.

For instance, IAMGOLD reported Westwood's attributable gold production was 48,000 ounces in Q1 2024, with all-in sustaining costs of $1,718 per ounce. While this shows activity, the historical volatility necessitates close scrutiny.

The Nelligan project, situated in Quebec, Canada, represents a significant exploration opportunity for IAMGOLD. As of late 2023, it boasts substantial indicated and inferred gold resources, hinting at its potential to become a future producing mine. This positions it squarely within the Question Mark category of the BCG matrix due to its high growth prospects in the gold market.

However, Nelligan is still in its early stages, requiring considerable capital for ongoing exploration and feasibility studies to confirm its economic viability. This high investment requirement, coupled with its current lack of production and thus low market share in terms of output, solidifies its Question Mark status. IAMGOLD's strategic decision will involve assessing the risk versus reward of further development.

The Monster Lake project represents IAMGOLD's early-stage exploration efforts in a region known for its geological promise. This project, like others in its nascent phase, demands continuous capital investment to delineate resources and assess economic viability.

As of IAMGOLD's 2024 reports, Monster Lake remains in the exploration stage, requiring significant funding to advance. Its potential to transition into a revenue-generating asset, akin to a Star in the BCG matrix, hinges on successful exploration outcomes and future market conditions.

Ongoing Optimization and Cost Reduction Efforts at Côté Gold

While Côté Gold is positioned as a Star within IAMGOLD's portfolio, its current operational ramp-up presents significant 'Question Mark' characteristics. The company is intensely focused on stabilizing operations, achieving consistent nameplate throughput, and actively reducing unit costs. This critical phase demands substantial investment to transform the mine into a reliable cash generator.

IAMGOLD's efforts in 2024 are centered on optimizing processing and mining costs at Côté Gold. Success in this endeavor is contingent upon sustained operational improvements and the effective management of any unforeseen challenges that may arise during this crucial development stage. The company aims to solidify Côté Gold's position by overcoming these initial hurdles.

- Cost Reduction Focus: IAMGOLD is actively pursuing strategies to lower processing and mining costs at Côté Gold, aiming for greater efficiency during the ramp-up.

- Operational Stabilization: Achieving consistent throughput at nameplate capacity remains a key objective, essential for improving cost metrics.

- Investment for Growth: The current phase necessitates significant capital expenditure to ensure Côté Gold transitions from a development project to a mature, profitable asset.

- Market Dynamics: Ongoing efforts to manage costs are crucial for maximizing returns in the face of fluctuating commodity prices and operational complexities.

Broader Early-Stage Exploration Portfolio

IAMGOLD's early-stage exploration portfolio, primarily situated in Canada's promising mining regions, embodies the company's commitment to future growth. These ventures are characterized by their speculative nature and substantial ongoing capital requirements for drilling and extensive studies. They currently exhibit a low market share and high cash burn, fitting the profile of Question Marks that must demonstrate future potential to justify continued investment.

These early-stage assets, while holding significant long-term promise, are currently consuming resources without generating substantial returns. For instance, IAMGOLD's 2023 exploration expenditures, which would include these early-stage projects, totaled $46 million, highlighting the investment needed to advance them. The success of these Question Marks hinges on proving resource viability and economic feasibility.

- High Risk, High Reward: Early-stage exploration projects are inherently risky, with a high probability of failure but the potential for discovering significant new mineral deposits.

- Capital Intensive: These projects require substantial and sustained investment in geological surveys, drilling programs, and feasibility studies before any potential returns can be realized.

- Future Growth Engine: Successful progression of these Question Marks is crucial for IAMGOLD's long-term growth strategy, aiming to replace depleting reserves and expand its operational footprint.

- Portfolio Balancing Act: Managing a portfolio of Question Marks alongside more established assets is key to balancing current profitability with future opportunities.

Question Marks in IAMGOLD's portfolio represent assets with high growth potential but currently low market share, requiring significant investment to determine their future viability. These include exploration projects like Nelligan and Monster Lake, where substantial capital is needed for exploration and feasibility studies to confirm economic potential.

Westwood Mine, despite operational extensions, remains a question mark due to past seismic events and reserve revisions, necessitating careful management to meet production and cost forecasts. Even Côté Gold, while a Star, exhibits question mark traits during its ramp-up phase, demanding focused investment for operational stabilization and cost reduction.

IAMGOLD's early-stage exploration ventures, consuming significant capital with a high risk of failure, are also categorized as Question Marks. The company's 2023 exploration expenditures totaled $46 million, underscoring the investment required to advance these potentially high-reward, high-risk assets.

| Asset | BCG Category | Key Characteristics | 2024 Data Point |

|---|---|---|---|

| Westwood Mine | Question Mark | Operational extension to 2032, history of seismic events, reserve revisions. | Q1 2024: 48,000 oz gold production, $1,718/oz AISC. |

| Nelligan Project | Question Mark | Significant exploration potential, early stage, requires substantial capital for studies. | Indicated & Inferred resources (late 2023), high growth prospects. |

| Monster Lake Project | Question Mark | Early-stage exploration, requires continuous capital for resource delineation. | Exploration stage (2024 reports), substantial funding needed. |

| Côté Gold (Ramp-up) | Star (with Question Mark traits) | Operational stabilization, achieving nameplate throughput, cost reduction focus. | Focus on optimizing processing and mining costs in 2024. |

BCG Matrix Data Sources

Our IAMGOLD BCG Matrix is constructed using comprehensive data from financial reports, industry analyses, and internal operational metrics, ensuring a robust and accurate strategic overview.