Hyundai Steel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

Hyundai Steel's strengths lie in its integrated production system and strong domestic market share, but it faces challenges from global competition and fluctuating raw material prices. Understanding these dynamics is crucial for anyone looking to invest or strategize within the steel industry.

Want the full story behind Hyundai Steel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hyundai Steel offers a broad spectrum of steel products, encompassing hot-rolled and cold-rolled steel, steel plates, and H-beams. This extensive product line enables the company to cater to vital industries like automotive, construction, shipbuilding, and heavy machinery.

This diversification is a significant strength, as it mitigates reliance on any single sector for revenue, providing a more stable financial footing. For instance, in 2023, the automotive sector continued to be a strong performer for steel producers, while construction demand also showed resilience, demonstrating the benefits of Hyundai Steel's varied market reach.

Hyundai Steel's strong affiliation with Hyundai Motor Group is a significant advantage. This close relationship ensures a substantial and stable demand for Hyundai Steel's automotive steel products, particularly advanced high-strength steels (AHSS) and ultra-high-strength steels (UHSS). These materials are vital for contemporary vehicle manufacturing, especially for electric vehicles.

In 2023, Hyundai Motor Group's global vehicle sales reached approximately 4.2 million units, directly translating into consistent orders for Hyundai Steel. This synergy allows Hyundai Steel to benefit from the group's robust sales performance and its strategic focus on lightweight, high-strength materials for future mobility solutions.

Hyundai Steel demonstrates a strong commitment to sustainability, allocating 680 billion won between 2021 and 2025 specifically for environmental improvements and greenhouse gas reduction initiatives. This significant investment underscores their focus on long-term environmental stewardship and operational efficiency.

The company is at the forefront of developing innovative low-carbon steel production systems, such as their proprietary 'Hy-Cube' technology and hybrid electric furnace-blast furnace methods. These advancements position Hyundai Steel to effectively meet the escalating global demand for green steel and proactively comply with increasingly stringent environmental regulations worldwide.

Technological Innovation and High-Value Products

Hyundai Steel is actively integrating cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT) across its manufacturing facilities. This strategic adoption aims to significantly boost operational efficiency and drive down production costs, as seen in their 2024 initiatives to optimize energy consumption in blast furnaces.

The company is also making strides in developing and marketing advanced, high-value steel products. A key focus is on third-generation automotive steel sheets, which offer superior strength and lighter weight, crucial for the evolving automotive industry. In 2024, Hyundai Steel reported a 7% increase in sales for these specialized products, reflecting their growing market demand.

- AI and IoT Integration: Enhancing production efficiency and cost reduction in manufacturing processes.

- High-Value Product Focus: Expanding portfolio with advanced materials like third-generation automotive steel sheets.

- Global Competitiveness: Strengthening market position through technological leadership and specialized product offerings.

- 2024 Performance: Achieved a 7% sales growth in high-value automotive steel products.

Strategic Overseas Investments and Global Sales

Hyundai Steel demonstrates a significant strength in its strategic overseas investments and global sales operations. In 2024, the company successfully sold over 1 million tons of automotive steel sheets to international automakers not affiliated with Hyundai, showcasing its ability to compete on a global scale despite market headwinds.

Further solidifying its international presence, Hyundai Steel is making substantial investments abroad. A prime example is the planned $5.8 billion steel plant in the United States. This strategic move is designed to circumvent existing tariffs and significantly expand the company's global manufacturing and sales footprint.

- Global Automotive Steel Sales: Over 1 million tons sold to non-affiliate international automakers in 2024.

- Strategic U.S. Investment: Planned $5.8 billion steel plant to enhance global market access.

- Tariff Mitigation: Overseas investments like the U.S. plant help bypass trade barriers.

- Expanded Global Footprint: Investments aim to strengthen Hyundai Steel's international market position.

Hyundai Steel's diversified product portfolio, serving key sectors like automotive and construction, provides a stable revenue base. This broad market reach was evident in 2023, where resilience in construction demand complemented strong automotive sector performance, highlighting the benefit of their varied industry exposure.

The company's integration with Hyundai Motor Group is a major asset, ensuring consistent demand for specialized automotive steels, including advanced high-strength steels critical for electric vehicles. In 2023, Hyundai Motor Group's sales of approximately 4.2 million vehicles translated into reliable orders for Hyundai Steel, supporting their focus on lightweight materials.

Hyundai Steel's commitment to sustainability, with a 2021-2025 investment of 680 billion won in environmental initiatives, positions them favorably for the growing demand for green steel. Their development of low-carbon production systems like Hy-Cube aligns with global environmental regulations and market trends.

The company is also enhancing operational efficiency and cost reduction through AI and IoT integration, exemplified by their 2024 energy consumption optimization efforts. Furthermore, their focus on high-value products, such as third-generation automotive steel sheets, saw a 7% sales increase in 2024, demonstrating strong market acceptance.

Hyundai Steel's global competitiveness is bolstered by strategic overseas investments, including over 1 million tons of automotive steel sold to non-affiliated international automakers in 2024. The planned $5.8 billion U.S. steel plant aims to expand their global footprint and mitigate tariff impacts.

| Key Strength | Description | Supporting Data/Fact |

| Product Diversification | Broad spectrum of steel products catering to multiple vital industries. | Serves automotive, construction, shipbuilding, and heavy machinery sectors. |

| Hyundai Motor Group Synergy | Stable demand for specialized automotive steels due to affiliation. | Hyundai Motor Group's 2023 sales of ~4.2 million vehicles provided consistent orders. |

| Sustainability Focus | Investment in low-carbon production and environmental initiatives. | 680 billion won allocated for environmental improvements (2021-2025); development of Hy-Cube technology. |

| Technological Advancement | Integration of AI/IoT and development of high-value steel products. | 7% sales growth in third-generation automotive steel sheets in 2024; AI/IoT for efficiency. |

| Global Market Presence | Strategic overseas investments and international sales. | Over 1 million tons of automotive steel sold to non-affiliate international automakers in 2024; planned $5.8 billion U.S. plant. |

What is included in the product

Analyzes Hyundai Steel’s competitive position through key internal and external factors, highlighting its strengths in production capacity and market share, while also identifying weaknesses in raw material reliance and opportunities in green steel production, alongside threats from global competition and fluctuating demand.

Uncovers critical market vulnerabilities and competitive advantages for Hyundai Steel, enabling proactive risk mitigation and opportunity maximization.

Weaknesses

Hyundai Steel experienced a notable downturn in its financial performance during 2024. The company's net profit saw a substantial drop, reaching KRW 123 billion, a significant decrease from KRW 443 billion reported in the prior year. This decline in profitability was mirrored by a reduction in sales revenue, signaling a challenging market environment.

The financial struggles continued into the first quarter of 2025, with Hyundai Steel reporting an operating and net loss. This negative financial outcome is attributed to a combination of factors, including a general slowdown in the market and increased pressure from import competition, which impacted the company's sales volume and pricing power.

Hyundai Steel's reliance on the domestic construction market presents a significant vulnerability. A substantial portion of its sales, especially for long steel products, is directly linked to this sector. For instance, in the first half of 2024, the downturn in South Korea's construction industry led to a noticeable drop in sales volumes for Hyundai Steel, impacting its overall financial performance.

Hyundai Steel's production is heavily reliant on key raw materials such as iron ore, coking coal, and scrap metal, alongside energy costs. These inputs are subject to considerable price swings in the global market.

For instance, iron ore prices saw significant volatility in 2024, with benchmarks fluctuating throughout the year, impacting steelmakers worldwide. Similarly, coking coal prices have experienced upward pressure due to supply chain disruptions and demand from other industries, directly increasing Hyundai Steel's cost of goods sold.

These price volatilities directly translate into higher production expenses for Hyundai Steel. When raw material costs rise sharply, the company faces the challenge of either absorbing these increases, which squeezes profit margins, or passing them on to customers, potentially affecting sales volume.

Debt Levels and Funding Concerns for New Investments

Analysts are increasingly scrutinizing Hyundai Steel's ability to fund significant new ventures, such as its proposed multi-billion dollar U.S. steel plant. The company's current debt levels are a key concern, potentially limiting its financial flexibility for such ambitious projects and raising questions about its capacity to absorb additional borrowing without impacting its financial stability.

This elevated debt could necessitate a more cautious approach to capital allocation, possibly leading to a slower pace of expansion or a reliance on equity financing, which could dilute existing shareholder value.

- Debt-to-equity ratio: As of Q1 2024, Hyundai Steel's debt-to-equity ratio stood at approximately 1.2, indicating a significant reliance on borrowed funds.

- Interest coverage ratio: The company's interest coverage ratio, while healthy, could face pressure with increased debt servicing obligations from new investments.

- Credit rating outlook: Credit rating agencies may review Hyundai Steel's outlook if the debt burden for new projects significantly increases without a clear repayment strategy.

Labor Relations and Production Halts

Hyundai Steel has faced significant hurdles with its labor relations, notably strong union resistance to proposed restructuring initiatives. This friction has unfortunately led to operational disruptions. For instance, a temporary suspension occurred at the Pohang No. 2 plant in June 2025 due to these labor disputes.

These kinds of stoppages directly translate into lost production volume and negatively affect the company's overall operational efficiency. Such labor-related challenges represent a key weakness, potentially impacting output targets and financial performance.

- Union Opposition: Unions have voiced strong objections to restructuring plans, creating friction.

- Production Halts: Incidents like the June 2025 Pohang No. 2 plant suspension disrupt operations.

- Efficiency Impact: Labor disputes lead to production losses and diminished overall efficiency.

Hyundai Steel's substantial debt-to-equity ratio of approximately 1.2 as of Q1 2024 highlights a significant reliance on borrowed funds. This leverage could limit financial flexibility for crucial investments, such as the proposed U.S. steel plant, potentially slowing expansion or necessitating equity financing that dilutes shareholder value.

Same Document Delivered

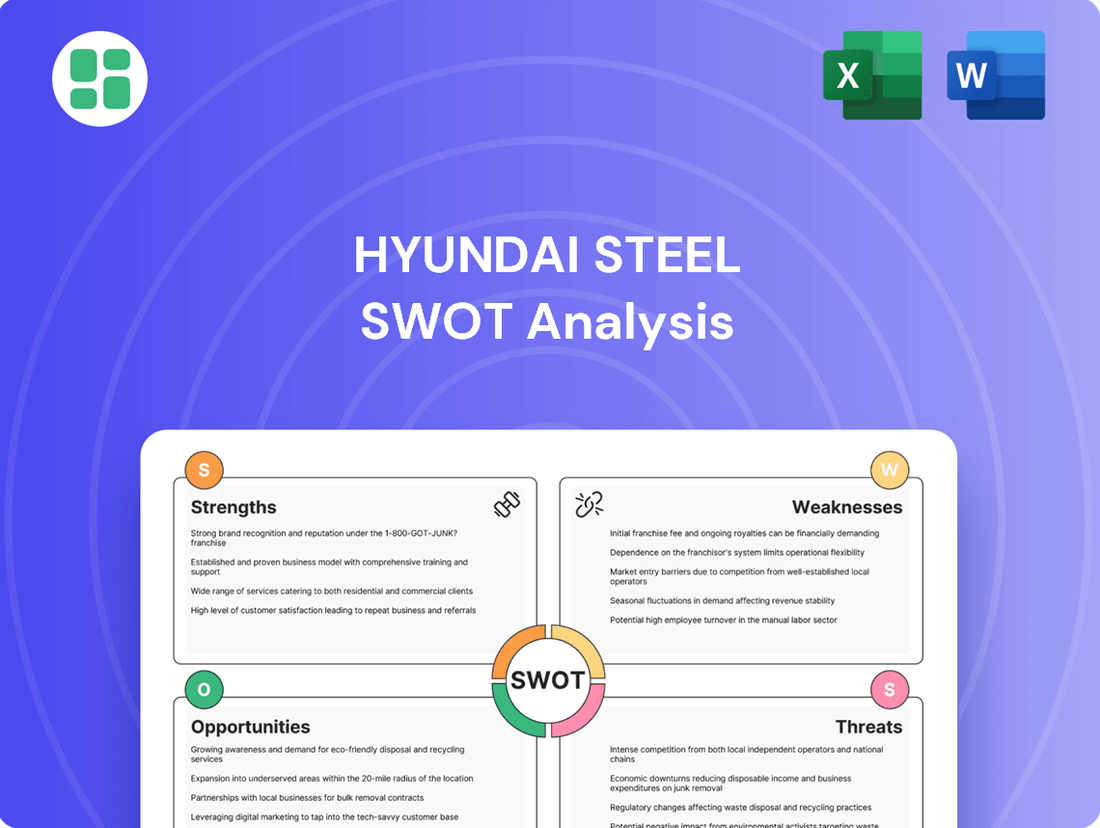

Hyundai Steel SWOT Analysis

This is the actual Hyundai Steel SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive breakdown of Hyundai Steel's internal strengths and weaknesses, alongside external opportunities and threats. This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The global push for sustainability is fueling a significant rise in demand for green steel and other low-carbon steelmaking solutions. This trend is directly linked to ambitious decarbonization targets and increasingly stringent environmental regulations worldwide. Hyundai Steel is strategically positioned to capitalize on this by investing in hybrid production systems and planning the mass production of low-carbon steel from early 2026, aligning with market expectations for environmentally conscious materials.

The global automotive industry's accelerating pivot to electric vehicles (EVs) is a major tailwind for steel manufacturers like Hyundai Steel. This transition necessitates advanced, lightweight, and high-strength steel grades to optimize battery range and vehicle performance. For instance, the global EV market is projected to reach over 30 million units sold annually by 2025, a substantial increase from previous years, directly translating into increased demand for specialized steel products.

Hyundai Steel is well-positioned to capitalize on this trend. Its proven capability in producing third-generation automotive steel sheets, known for their superior strength-to-weight ratio, aligns perfectly with EV manufacturers' requirements. This strategic focus on the automotive sector, particularly the burgeoning EV segment, represents a significant opportunity for expanded market share and revenue growth in the coming years.

South Korea's commitment to infrastructure, including a projected 110 trillion won (approximately $82 billion USD) investment in smart city development by 2030, directly fuels demand for steel. This ongoing government focus on large-scale projects, such as high-speed rail expansions and urban renewal programs, creates a robust domestic market for Hyundai Steel's products.

Strategic Overseas Expansion to Mitigate Trade Barriers

Hyundai Steel's strategic overseas expansion, exemplified by its proposed steel plant in Louisiana, USA, offers a potent avenue to circumvent escalating trade barriers and import tariffs. This proactive approach not only fortifies market access in crucial international territories but also cultivates deeper, more resilient partnerships with global automotive manufacturers who increasingly prioritize localized supply chains.

This direct investment in production capabilities abroad allows Hyundai Steel to mitigate the impact of protectionist policies, ensuring a more stable and predictable revenue stream. For instance, the US International Trade Administration reported that steel tariffs imposed in recent years have significantly altered global trade flows, making localized production a critical competitive advantage.

- Bypass Tariffs: Direct investment in overseas production facilities, like the Louisiana plant, helps avoid costly import duties.

- Enhance Market Access: Localized production strengthens Hyundai Steel's position in key international markets, particularly North America.

- Strengthen Automotive Ties: A physical presence abroad facilitates closer collaboration and supply chain integration with global automotive clients.

Technological Advancements and Digitalization in Steelmaking

Hyundai Steel can capitalize on the ongoing digital transformation in steelmaking. The integration of artificial intelligence (AI) and the Internet of Things (IoT) presents a significant opportunity to streamline operations, leading to cost reductions and improved steel quality. For instance, in 2024, the global steel industry saw increased investment in smart factory technologies, with companies reporting an average of 15% improvement in production efficiency through AI-driven process optimization.

These technological advancements also pave the way for innovation in product development. Hyundai Steel can leverage these tools to create specialized steel grades tailored to emerging market demands, such as those for electric vehicles or advanced construction. The company's commitment to R&D in areas like high-strength steel, crucial for lightweighting in the automotive sector, aligns perfectly with this trend. By 2025, the demand for advanced high-strength steels (AHSS) is projected to grow by over 8% annually, driven by automotive lightweighting initiatives.

- AI-powered predictive maintenance can reduce unplanned downtime, a major cost factor in steel production.

- IoT sensors enable real-time monitoring of production parameters, allowing for immediate adjustments to enhance quality and yield.

- The development of **new steel alloys** through advanced simulation and testing can open up high-margin niche markets.

- Digitalization can also improve **supply chain visibility and management**, leading to greater resilience and efficiency.

The global shift towards sustainability presents a significant opportunity for Hyundai Steel, with the growing demand for green steel and low-carbon steelmaking solutions driven by decarbonization targets and stricter environmental regulations. The company's investment in hybrid production systems and its plan for mass-producing low-carbon steel from early 2026 positions it to meet this expanding market need.

The accelerating transition to electric vehicles (EVs) by the automotive industry is a key growth driver, requiring advanced, lightweight, and high-strength steel grades. Hyundai Steel's expertise in producing third-generation automotive steel sheets, known for their superior strength-to-weight ratio, directly aligns with EV manufacturers' needs, offering expanded market share potential.

South Korea's substantial investments in infrastructure, including smart city development projected at approximately $82 billion USD by 2030, will boost domestic demand for steel. Large-scale projects like high-speed rail expansions and urban renewal programs provide a robust market for Hyundai Steel's products.

Hyundai Steel's strategic overseas expansion, exemplified by its proposed steel plant in Louisiana, USA, allows it to navigate escalating trade barriers and import tariffs effectively. This localized production strengthens market access in crucial international territories and fosters deeper partnerships with global automotive manufacturers prioritizing localized supply chains.

The digital transformation in steelmaking, integrating AI and IoT, offers opportunities for Hyundai Steel to enhance operational efficiency and product quality. By 2025, advanced high-strength steels (AHSS) are projected to see over 8% annual growth, driven by automotive lightweighting initiatives, a segment where Hyundai Steel is actively innovating.

Threats

Global steel overcapacity, largely fueled by China's substantial production, remains a significant threat. This excess supply actively suppresses international steel prices, creating a highly competitive landscape that directly impacts Hyundai Steel's profitability and market position. For instance, in 2023, China's crude steel output reached a record 1.019 billion tonnes, contributing to a global surplus that pressures margins for all producers.

The rise of trade protectionism, exemplified by the United States' 25% tariffs on imported steel, directly hinders South Korean steel exports, including those from Hyundai Steel. This creates significant challenges in accessing key international markets.

These escalating trade barriers force companies like Hyundai Steel to consider substantial strategic realignments, such as increasing overseas production facilities to mitigate the impact of tariffs and maintain market competitiveness.

Sluggish global demand, exacerbated by economic slowdowns and geopolitical instability, presents a major challenge for Hyundai Steel. Reduced activity in construction and manufacturing sectors directly impacts the volume of steel required, potentially hindering sales and revenue growth for the company. For instance, the IMF projected global growth to slow to 3.2% in 2024, down from 3.5% in 2023, indicating a broad-based economic cooling.

Stricter Environmental Regulations and Carbon Costs

Stricter environmental regulations and the increasing likelihood of carbon pricing mechanisms, such as the European Union's Carbon Border Adjustment Mechanism (CBAM), present a significant threat to Hyundai Steel. These measures are designed to level the playing field by imposing costs on carbon-intensive imports, directly impacting steel producers that haven't fully embraced decarbonization. For instance, the CBAM, which fully phased in its reporting requirements in 2024 and will begin financial adjustments in 2026, could add substantial costs if Hyundai Steel's production processes remain carbon-heavy compared to competitors in regions with less stringent climate policies.

Failure to accelerate the decarbonization of its production methods will likely translate into higher operating expenses and a diminished competitive edge. As global pressure mounts for sustainable manufacturing, companies that lag in adopting greener technologies risk not only financial penalties but also reputational damage and loss of market share. The ongoing investment required for green steel production, including hydrogen-based direct reduced iron (DRI) or electric arc furnaces (EAFs) powered by renewable energy, represents a substantial capital challenge.

The financial implications are direct and measurable:

- Increased Compliance Costs: Adhering to new environmental standards and potential carbon taxes will raise the cost of doing business.

- Competitive Disadvantage: Steel producers in regions with lower carbon costs or those who have already invested heavily in decarbonization may offer more competitive pricing.

- Investment Uncertainty: The pace and direction of regulatory changes can create uncertainty for long-term capital investments in new production technologies.

Intense Competition from Domestic and International Players

Hyundai Steel faces a formidable competitive landscape, grappling with established domestic giants like POSCO and a host of international steel producers. This rivalry directly impacts pricing power, compelling Hyundai Steel to constantly innovate and optimize its cost structures to safeguard its market position and profitability.

The global steel market, characterized by overcapacity in certain segments, intensifies this pressure. For instance, in 2023, global crude steel production reached an estimated 1.89 billion metric tons, with significant contributions from China, which often leads to export surges impacting other regional markets.

- Domestic Rivalry: POSCO remains Hyundai Steel's primary domestic competitor, vying for market share in South Korea's robust automotive and construction sectors.

- International Pressure: Major international players, particularly from China and Japan, exert downward price pressure through large-scale production and export strategies.

- Innovation Imperative: To counter competition, Hyundai Steel must invest in advanced steel grades and sustainable production methods, as seen in the growing demand for high-strength steel in the automotive industry.

The persistent threat of global steel overcapacity, heavily influenced by China's production, continues to suppress international prices and challenge Hyundai Steel's profitability. This oversupply dynamic is a constant pressure point in the market.

Escalating trade protectionism, including tariffs imposed by major economies, directly impedes Hyundai Steel's export capabilities, necessitating strategic adjustments to maintain market access and competitiveness.

Stricter environmental regulations and the implementation of carbon pricing mechanisms, such as the EU's CBAM, pose significant cost and competitive risks for Hyundai Steel if decarbonization efforts lag behind global standards.

The company also faces intense competition from both domestic rivals like POSCO and international producers, particularly from China, which can limit pricing power and necessitate ongoing investment in innovation and cost efficiency.

| Threat Category | Specific Challenge | Impact on Hyundai Steel | Relevant Data/Example |

|---|---|---|---|

| Overcapacity | Global steel surplus | Depressed prices, reduced margins | China's 2023 crude steel output: 1.019 billion tonnes |

| Trade Protectionism | Tariffs and trade barriers | Limited export market access | US steel tariffs: 25% |

| Environmental Regulations | Decarbonization costs, carbon pricing | Increased operating expenses, competitive disadvantage | EU CBAM reporting began 2024, financial adjustments 2026 |

| Competition | Domestic and international rivals | Pressure on pricing, need for innovation | Global crude steel production 2023: ~1.89 billion tonnes |

SWOT Analysis Data Sources

This Hyundai Steel SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research reports, and expert industry forecasts, ensuring a data-driven and accurate strategic assessment.