Hyundai Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Hyundai Steel's landscape. Our PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on opportunities. Download the full version now to gain a strategic advantage.

Political factors

South Korea's government actively shapes the steel industry through policies like the "Green New Deal" initiative, encouraging sustainable production methods and investment in high-strength steel for eco-friendly vehicles, a key market for Hyundai Steel. Furthermore, export market governments, such as the United States with its infrastructure spending plans, create demand for steel products, directly benefiting Hyundai Steel's international sales.

The increasing trend of trade protectionism worldwide, marked by tariffs and import quotas on steel, presents a significant challenge for Hyundai Steel. For instance, the United States' Section 232 tariffs, implemented in 2018 and partially adjusted in 2022, directly impacted steel imports, including those from South Korea, raising costs and potentially limiting export opportunities. These protectionist measures can directly curb Hyundai Steel's export volumes and affect its international profitability.

Conversely, the presence of favorable trade agreements can significantly benefit Hyundai Steel. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which South Korea is considering joining, could open up new markets and reduce existing trade barriers, thereby enhancing the company's global reach and competitiveness. Such agreements are crucial for mitigating the risks associated with protectionist policies.

Geopolitical stability significantly impacts Hyundai Steel's operations, particularly concerning its global supply chains and export markets. For instance, ongoing tensions in regions like the South China Sea or potential conflicts in Eastern Europe could disrupt shipping routes and affect the availability and cost of key raw materials like iron ore and coking coal. In 2024, the global steel industry is navigating a landscape where regional conflicts, such as those in Ukraine, continue to influence energy prices and logistics, indirectly impacting Hyundai Steel's operational costs and market access.

Regulatory Environment for Manufacturing

Government regulations profoundly shape Hyundai Steel's manufacturing operations, encompassing everything from production standards and environmental protection to worker safety and necessary permits. For instance, in 2024, South Korea continued to emphasize stricter environmental regulations, particularly concerning emissions from heavy industries, potentially requiring Hyundai Steel to invest in advanced pollution control technologies. These compliance costs can directly influence operational expenditures and future capital investments.

A robust and predictable regulatory framework is crucial for smooth operations. Conversely, frequent or ambiguous regulatory changes can introduce uncertainty, leading to increased compliance burdens and potential delays in project execution.

- South Korea's commitment to carbon neutrality targets by 2050 impacts steel production, pushing for greener manufacturing processes.

- Industrial safety regulations, enforced by agencies like the Ministry of Employment and Labor, mandate specific safety protocols and inspections for manufacturing facilities.

- Operational permits, often requiring environmental impact assessments, are essential for plant expansions or new construction, with timelines and requirements varying by local and national government bodies.

International Relations and Alliances

South Korea's strategic alliances, particularly its strong relationship with the United States, significantly influence Hyundai Steel's access to global markets. These diplomatic ties often translate into favorable trade agreements, such as the revised US-Korea Free Trade Agreement (KORUS FTA), which can lower tariffs and reduce non-tariff barriers for steel exports. In 2023, South Korea's total exports to the US reached approximately $115 billion, underscoring the importance of this bilateral economic relationship for Korean industries like steel.

Conversely, geopolitical tensions in the Indo-Pacific region, such as those involving North Korea or trade disputes with China, can create volatility. Hyundai Steel's operations and supply chains are sensitive to these shifts. For instance, disruptions to shipping routes or the imposition of new trade restrictions by major economies could directly impact the company's international sales and raw material procurement, potentially increasing costs and reducing competitiveness.

- KORUS FTA Impact: The KORUS FTA continues to facilitate South Korean steel exports to the US, a key market for Hyundai Steel, by reducing tariff barriers.

- Geopolitical Risk: Strained relations with major trading blocs or regional instability can lead to trade sanctions, import restrictions, or supply chain disruptions, affecting Hyundai Steel's global operations.

- Trade Negotiations: South Korea's active participation in international trade negotiations, often supported by its alliances, can secure more favorable terms for its steel products in emerging markets.

- Supply Chain Resilience: Diplomatic stability is crucial for maintaining resilient global supply chains, ensuring Hyundai Steel can reliably source raw materials like iron ore and coal.

Government policies in South Korea, such as incentives for green steel production and support for the automotive sector, directly influence Hyundai Steel's strategic direction and market opportunities. International trade policies, including tariffs and free trade agreements like the KORUS FTA, significantly impact Hyundai Steel's export volumes and profitability, with the US market remaining a crucial destination. Geopolitical stability and regional tensions, particularly concerning shipping routes and raw material sourcing, pose ongoing risks to Hyundai Steel's global supply chain and operational costs.

| Policy/Factor | Impact on Hyundai Steel | 2024/2025 Relevance |

|---|---|---|

| Green New Deal (South Korea) | Encourages sustainable production, investment in high-strength steel | Drives innovation in eco-friendly steel products for automotive and construction sectors. |

| US Section 232 Tariffs | Increased costs and potential limitations on steel exports to the US | Continued monitoring of tariff adjustments and trade negotiations impacting US market access. |

| CPTPP Consideration (South Korea) | Potential for new market access and reduced trade barriers | Opportunity to diversify export markets and enhance global competitiveness if joined. |

| Geopolitical Tensions (e.g., Eastern Europe) | Disruptions to shipping, raw material availability, and energy prices | Affects operational costs and logistics for raw material procurement (iron ore, coking coal). |

| Environmental Regulations (South Korea) | Requires investment in advanced pollution control technologies | Increases operational expenditures and necessitates capital investment in compliance. |

What is included in the product

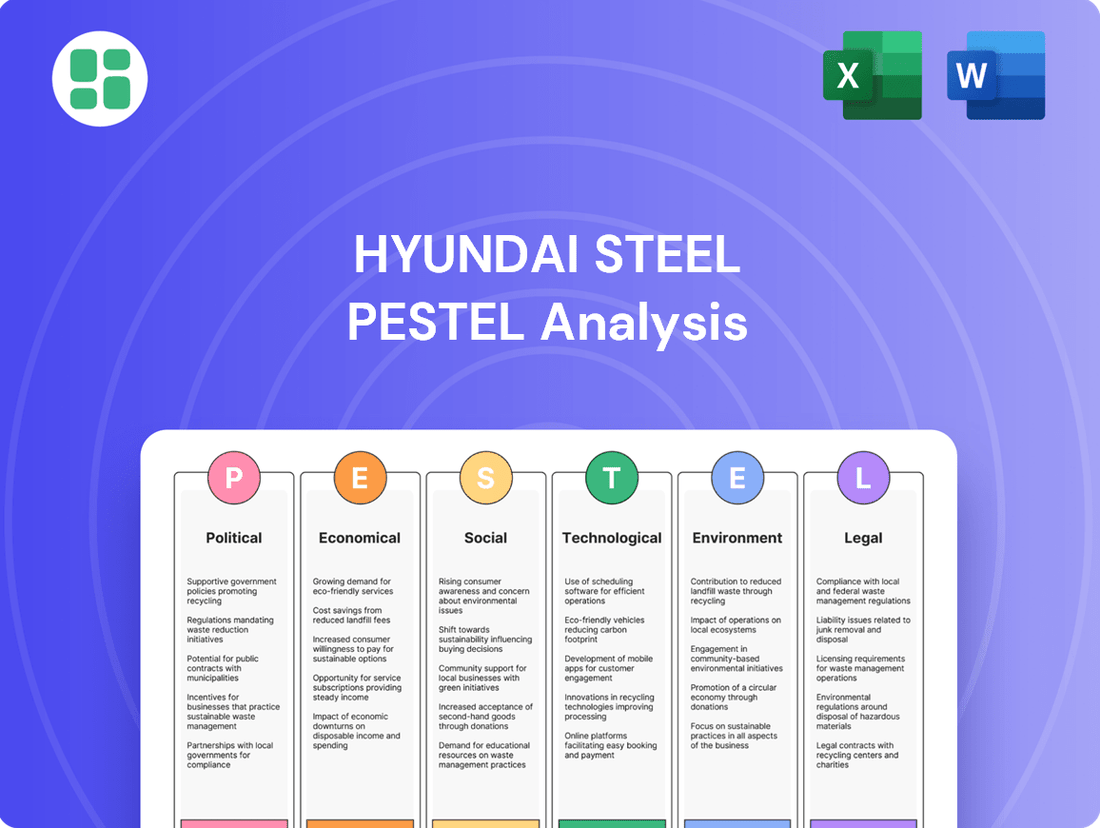

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Hyundai Steel, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A Hyundai Steel PESTLE analysis, presented as a visually segmented report, relieves the pain of sifting through complex data by offering clear insights into political, economic, social, technological, environmental, and legal factors impacting the steel industry.

Economic factors

Global steel demand and prices are critical economic factors for Hyundai Steel. A strong global economy, especially in key sectors like automotive, construction, and shipbuilding, fuels demand and supports higher steel prices. For instance, in 2024, global steel demand was projected to grow by 1.7% according to the World Steel Association, indicating a generally positive, albeit moderate, economic environment for steel producers.

Conversely, economic downturns or an oversupply of steel can significantly impact Hyundai Steel's profitability by driving down prices. The industry experienced price volatility in late 2023 and early 2024, influenced by factors such as production levels in China and geopolitical events, which directly affect Hyundai Steel's revenue streams and market position.

The price of essential inputs like iron ore and coking coal directly shapes Hyundai Steel's manufacturing expenses. For instance, iron ore prices saw fluctuations throughout 2024, with benchmarks like the Singapore benchmark for fines trading in the range of $100-$130 per tonne for much of the year, impacting production costs.

Global commodity market swings create direct volatility in Hyundai Steel's raw material outlays and overall profitability. Coking coal, another critical component, experienced price surges in early 2024, reaching over $200 per tonne for premium hard coking coal at times, which would have squeezed margins for steel producers.

To navigate these price uncertainties, Hyundai Steel relies on robust procurement methods, including securing long-term supply agreements. These strategies are crucial for stabilizing input costs and safeguarding profit margins against unpredictable market movements in 2025.

Exchange rate shifts significantly impact Hyundai Steel. For instance, in early 2024, the Korean Won experienced volatility against the US Dollar, fluctuating around the 1300 KRW/USD mark. This movement directly influences the cost of imported raw materials like iron ore and coking coal, as well as the profitability of steel exports to major markets like the United States and Europe.

A stronger Won, as seen at various points in late 2023 and early 2024, generally makes Hyundai Steel's products more expensive for overseas buyers, potentially dampening export demand. Conversely, it can lower the cost of essential imported inputs, offering some relief on the production side. This dynamic necessitates careful management of currency exposure.

To mitigate these risks, Hyundai Steel employs currency hedging strategies. These financial instruments help lock in exchange rates for future transactions, providing a degree of certainty in revenue and cost projections. For example, forward contracts or options can be used to protect against adverse Won appreciation or depreciation, ensuring greater financial stability amidst global currency market fluctuations.

Interest Rates and Access to Capital

Interest rates significantly impact Hyundai Steel's financial health. For instance, the Bank of Korea's base rate, which influences broader lending costs, remained at 3.50% as of early 2024, a level that has been maintained for some time. Changes here directly affect how much it costs Hyundai Steel to borrow money for new projects or to manage its day-to-day operations.

Higher borrowing costs can squeeze profit margins and make new investments, like upgrading to greener production technologies, less attractive. This is particularly relevant as the company aims to expand its capacity and invest in sustainable practices. Access to readily available and affordable capital is therefore a critical enabler for Hyundai Steel's strategic growth and its commitment to environmental initiatives.

- Interest Rate Impact: The Bank of Korea's base rate was 3.50% in early 2024, affecting Hyundai Steel's borrowing costs.

- Debt Servicing: Increased interest rates would raise the cost of servicing existing debt and new loans.

- Investment Decisions: Higher capital costs can deter Hyundai Steel from undertaking significant capital expenditures for expansion or technological upgrades.

- Access to Capital: The availability of affordable financing is vital for funding growth, innovation, and sustainability projects.

Economic Growth in Key Industries

Hyundai Steel's performance is intrinsically linked to the economic vitality of its core customer industries: automotive, construction, shipbuilding, and heavy machinery. The growth trajectory of these sectors directly dictates the demand for steel, impacting Hyundai Steel's sales volumes and revenue streams.

For instance, the global automotive industry, a major consumer of steel, experienced a rebound in 2024, with projections indicating continued growth driven by new model releases and recovering consumer spending. Similarly, the construction sector, particularly in emerging economies, is expected to see robust expansion through 2025, fueled by infrastructure development and urbanization initiatives. This sustained demand from these key industries underpins Hyundai Steel's market potential.

- Automotive Sector Growth: Global vehicle production is forecast to increase by approximately 3-5% annually through 2025, directly boosting steel demand.

- Construction Activity: Infrastructure spending globally, projected to exceed $3 trillion annually by 2025, will drive significant steel consumption in construction projects.

- Shipbuilding Outlook: While subject to cyclical trends, the shipbuilding sector anticipates a moderate increase in new vessel orders, especially for specialized and eco-friendly ships, by late 2024 and into 2025.

- Heavy Machinery Demand: The need for advanced construction and industrial equipment, driven by manufacturing and infrastructure upgrades, is expected to maintain steady demand for steel in the heavy machinery segment.

Economic factors significantly shape Hyundai Steel's operational landscape, influencing everything from raw material costs to sales volumes. Global steel demand, projected to grow by 1.7% in 2024, provides a baseline for market activity, but price volatility, seen in late 2023 and early 2024, directly impacts profitability.

Fluctuations in key commodity prices, such as iron ore (trading around $100-$130/tonne in 2024) and coking coal (exceeding $200/tonne for premium grades at times in early 2024), directly affect Hyundai Steel's production expenses and profit margins.

Currency exchange rates, with the Korean Won fluctuating around 1300 KRW/USD in early 2024, influence both import costs and export competitiveness, necessitating strategies like currency hedging to manage financial exposure.

Interest rates, with the Bank of Korea's base rate at 3.50% in early 2024, impact borrowing costs for capital expenditures and debt servicing, affecting investment decisions for growth and technological upgrades.

| Economic Factor | 2024/2025 Data/Trend | Impact on Hyundai Steel |

|---|---|---|

| Global Steel Demand | Projected 1.7% growth in 2024 (World Steel Association) | Supports sales volumes and pricing power. |

| Commodity Prices (Iron Ore) | $100-$130/tonne (Singapore benchmark, 2024) | Directly influences raw material costs. |

| Commodity Prices (Coking Coal) | Over $200/tonne (Premium hard coking coal, early 2024) | Increases production expenses, squeezing margins. |

| Exchange Rate (KRW/USD) | Fluctuating around 1300 KRW/USD (early 2024) | Affects cost of imports and competitiveness of exports. |

| Interest Rates (Bank of Korea Base Rate) | 3.50% (early 2024) | Impacts borrowing costs for operations and investments. |

What You See Is What You Get

Hyundai Steel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hyundai Steel PESTLE analysis provides a detailed examination of the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions.

Sociological factors

The availability of skilled labor and prevailing labor costs in South Korea, Hyundai Steel's primary operational base, significantly influence its production efficiency and overall expenses. South Korea's aging population and declining birthrate present a long-term challenge for labor availability. In 2023, the average monthly wage for manufacturing workers in South Korea was approximately 3.7 million KRW (around $2,800 USD), a figure that continues to see upward pressure due to inflation and demand for skilled workers.

Rising wage demands can directly impact Hyundai Steel's operational costs, potentially affecting its competitiveness in the global steel market. To mitigate these risks, the company focuses on investing in robust training programs and employee retention initiatives to ensure a stable and skilled workforce, crucial for maintaining high production standards and adapting to new technologies in the steel industry.

Consumers are increasingly prioritizing sustainable products, and this extends to the materials used in manufacturing. For Hyundai Steel, this means a growing demand for steel produced with a lower environmental impact, pushing the company to invest in greener technologies. For instance, by 2024, the global market for green steel is projected to see significant growth, with companies like Hyundai Steel actively developing low-carbon steelmaking processes.

This shift in consumer preference directly influences Hyundai Steel's strategy, encouraging investments in sustainable production methods to meet these evolving market expectations. Successfully catering to this demand can significantly enhance Hyundai Steel's market positioning and brand reputation in the coming years.

Societal expectations and legal mandates for workforce safety and welfare are paramount for Hyundai Steel. In 2024, global trends show increasing scrutiny on corporate responsibility, with many nations strengthening occupational health and safety regulations. For instance, the EU's framework directives continue to push for higher standards, impacting international operations.

Adhering to robust safety protocols is not merely about accident prevention; it significantly boosts employee morale and overall productivity. Companies with strong safety cultures, like those prioritizing ISO 45001 certification, often report lower absenteeism and higher employee engagement. This focus translates directly to operational efficiency.

Conversely, a subpar safety record can inflict substantial damage. In 2023, several high-profile industrial accidents globally resulted in significant financial penalties and lasting reputational harm, making talent acquisition and retention a considerable challenge for the involved companies. For Hyundai Steel, maintaining exemplary safety standards is therefore a critical business imperative.

Public Perception and Corporate Social Responsibility

Hyundai Steel's public perception, heavily influenced by its corporate social responsibility (CSR) initiatives, directly affects its social license to operate. In 2023, the company reported investing over ₩50 billion in community welfare and environmental protection programs, aiming to bolster its image as a responsible corporate citizen.

Positive engagement in areas like local community development, ethical labor practices, and robust environmental stewardship are crucial for building brand reputation and fostering stakeholder trust. For instance, Hyundai Steel's commitment to reducing its carbon footprint, targeting a 25% reduction in CO2 emissions by 2030 compared to 2020 levels, has been a key focus in its public communication.

Conversely, negative public perception, often stemming from environmental incidents or labor disputes, can trigger significant backlash. A notable example from 2022 involved public protests regarding air quality near one of its major production facilities, which led to increased regulatory scrutiny and temporary operational adjustments.

- Community Investment: Hyundai Steel allocated ₩52.3 billion to CSR activities in 2023, focusing on education and local economic development.

- Environmental Goals: The company aims to achieve a 25% reduction in CO2 emissions by 2030, a target closely monitored by environmental advocacy groups.

- Stakeholder Trust: Maintaining a positive public image is essential, as demonstrated by the reputational damage incurred during the 2022 air quality concerns.

Demographic Shifts

Demographic shifts significantly influence Hyundai Steel's operational landscape. An aging population, a trend observed globally and particularly in key markets like South Korea and Japan, can impact the labor supply by potentially reducing the pool of younger, physically capable workers. For instance, South Korea's median age is projected to reach 52.5 years by 2040, a notable increase from 44.9 in 2023, which could necessitate greater investment in automation and training programs to bridge skill gaps.

Conversely, urbanization trends, especially in developing economies, directly boost demand for construction steel, a core product for Hyundai Steel. As more people move to cities, there's a surge in infrastructure development, including residential buildings, commercial spaces, and transportation networks. For example, China's ongoing urbanization efforts, while moderating, continue to drive substantial demand for steel in construction projects, contributing to global steel consumption figures. In 2024, global steel demand was forecast to grow by 1.7% to 1.8 billion tonnes, with construction being a primary driver.

- Aging Workforce Impact: South Korea's median age rising to 52.5 by 2040 suggests potential labor shortages and increased training costs for Hyundai Steel.

- Urbanization Driven Demand: Continued urbanization in emerging markets fuels demand for construction steel, a key segment for Hyundai Steel.

- Global Steel Demand Trends: In 2024, global steel demand was projected to increase by 1.7%, with construction activities being a major contributor.

Societal expectations regarding corporate responsibility and ethical conduct significantly shape Hyundai Steel's operations and public image. The company's commitment to environmental sustainability and community welfare, evidenced by its ₩52.3 billion investment in CSR activities in 2023, is crucial for maintaining its social license to operate and fostering stakeholder trust.

Furthermore, demographic trends, such as South Korea's aging population and global urbanization, directly influence both labor availability and market demand for steel. The projected rise in South Korea's median age to 52.5 by 2040 highlights potential labor challenges, while urbanization in emerging economies continues to drive demand for construction steel, a key product for Hyundai Steel.

The increasing consumer preference for sustainable products also compels Hyundai Steel to invest in greener technologies and low-carbon steelmaking processes, as indicated by its 2030 target to reduce CO2 emissions by 25% from 2020 levels. Successfully adapting to these evolving societal and demographic landscapes is vital for Hyundai Steel's long-term competitiveness and reputation.

Technological factors

Hyundai Steel is significantly impacted by ongoing technological advancements in steel production. Innovations like smart factory automation, artificial intelligence (AI), and big data analytics are paramount for enhancing operational efficiency and maintaining a competitive edge. These technologies enable streamlined production, lower energy usage, and improved product consistency, directly affecting Hyundai Steel's cost structure and market position.

The integration of AI in quality control, for instance, can identify defects with greater precision than human inspection. In 2024, many steel manufacturers are investing heavily in these areas; for example, POSCO, a major competitor, announced substantial investments in AI-driven predictive maintenance for its rolling mills, aiming to reduce downtime by up to 15%.

Furthermore, the adoption of Industry 4.0 principles, including the Internet of Things (IoT) for real-time monitoring and advanced robotics for hazardous tasks, is transforming production floors. These upgrades are not merely about efficiency; they are about creating a more agile and responsive manufacturing system capable of adapting to evolving market demands and stringent environmental regulations, crucial for Hyundai Steel's long-term viability.

Hyundai Steel is heavily invested in developing advanced steel grades. Their focus on high-strength, lightweight, and specialized steels is particularly vital for the automotive sector, a key market for the company. For instance, in 2024, the automotive industry's demand for advanced high-strength steels (AHSS) is projected to grow, with Hyundai Steel aiming to capture a significant share of this market through its innovative product lines.

These technological advancements directly address the automotive industry's push for safer and more fuel-efficient vehicles. By supplying cutting-edge steel solutions, Hyundai Steel enables car manufacturers to reduce vehicle weight without compromising structural integrity, a crucial factor in meeting increasingly stringent environmental regulations and consumer expectations for better mileage.

Continued investment in research and development is paramount for Hyundai Steel to maintain its position as a preferred supplier for these sophisticated applications. The company's R&D expenditure in 2024 is allocated towards exploring next-generation materials, including those with enhanced corrosion resistance and recyclability, further solidifying its competitive edge.

Technological advancements in resource recycling, like sophisticated scrap metal processing and waste heat recovery, are crucial for Hyundai Steel's sustainability efforts. These innovations directly support the company's commitment to a circular economy and reducing its environmental footprint.

The steel industry is seeing significant progress in energy-efficient production methods. For Hyundai Steel, adopting these technologies, such as improved blast furnace operations and electric arc furnaces powered by renewable energy, can lead to substantial cost savings and lower greenhouse gas emissions, aligning with global decarbonization trends.

Achieving carbon neutrality by 2050 is a major driver for technological adoption in steelmaking. Hyundai Steel's investment in technologies like hydrogen-based steelmaking and carbon capture, utilization, and storage (CCUS) is vital for meeting these ambitious climate targets and maintaining competitiveness in a low-carbon future.

Digitalization of Supply Chain Management

The digitalization of Hyundai Steel's supply chain is a significant technological factor. By integrating technologies like blockchain and the Internet of Things (IoT), the company is boosting transparency, efficiency, and the overall resilience of its operations. This digital transformation is key to navigating the complexities of global trade and material sourcing.

Improved logistics and inventory management are direct benefits of this digitalization. For instance, real-time tracking of materials and finished goods through IoT sensors allows for more precise forecasting and reduced holding costs. This enhanced visibility ensures that raw materials arrive on time and finished products are delivered promptly, directly impacting customer satisfaction and operational smoothness.

Furthermore, this technological shift enables Hyundai Steel to be more agile and responsive to dynamic market conditions. The ability to quickly adapt to changes in demand or disruptions in supply routes, facilitated by digital platforms, is crucial for maintaining a competitive edge in the steel industry. This adaptability is becoming increasingly vital as global supply chains face ongoing volatility.

- Enhanced Transparency: Blockchain technology provides an immutable ledger for tracking materials from origin to destination, reducing fraud and disputes.

- Increased Efficiency: IoT sensors enable real-time monitoring of inventory levels and shipment progress, optimizing logistics and reducing lead times.

- Improved Resilience: Digitalization allows for quicker identification and mitigation of supply chain disruptions, ensuring continuity of operations.

- Cost Reduction: Better inventory management and optimized logistics through digital tools can lead to significant cost savings for Hyundai Steel.

Green Steel Production Technologies

The push for green steel production technologies, like hydrogen-based direct reduced iron (DRI) and carbon capture, utilization, and storage (CCUS), is fundamentally reshaping the industry. Hyundai Steel's strategic investments in these areas are crucial for its future, aligning the company with evolving environmental regulations and growing consumer demand for sustainable materials.

These advancements allow for significantly reduced carbon footprints in steel manufacturing. For instance, pilot projects utilizing hydrogen DRI aim to cut CO2 emissions by up to 95% compared to traditional blast furnace methods. Hyundai Steel's commitment to exploring these pathways, including its participation in initiatives like the Hydrogen Council, signals a proactive stance in a sector facing increasing pressure to decarbonize.

- Hydrogen DRI: Aims to replace coal with hydrogen as the reducing agent, drastically cutting CO2.

- CCUS: Technologies that capture CO2 emissions from industrial processes for storage or reuse.

- Market Demand: Growing preference from automotive and construction sectors for low-carbon steel products.

- Regulatory Landscape: Anticipation of stricter carbon pricing and emissions standards globally.

Technological factors are pivotal for Hyundai Steel, driving efficiency and innovation. The company is actively integrating smart factory automation, AI, and big data analytics to optimize production, reduce energy consumption, and enhance product quality, mirroring industry trends where competitors like POSCO invested heavily in AI for predictive maintenance in 2024, targeting a 15% reduction in mill downtime.

The adoption of Industry 4.0 principles, including IoT for real-time monitoring and robotics, is transforming Hyundai Steel's manufacturing floor, creating a more agile system capable of meeting evolving market needs and environmental standards.

Hyundai Steel's focus on advanced steel grades, such as high-strength, lightweight steels, is directly responding to the automotive sector's demand for safer, more fuel-efficient vehicles, a market segment projected for significant growth in 2024, with Hyundai Steel aiming to capture a substantial share.

Legal factors

Hyundai Steel navigates a complex web of environmental regulations, impacting everything from air emissions and waste disposal to water consumption. Failure to adhere to these stringent laws, which include evolving carbon emission targets and pollution control standards, can result in substantial financial penalties and operational disruptions. For instance, South Korea's commitment to reducing greenhouse gas emissions, aiming for a 40% reduction from 2018 levels by 2030, directly influences steel production processes.

Meeting these legal requirements necessitates ongoing and significant investment in advanced environmental protection technologies. This proactive approach is vital for Hyundai Steel to not only avoid penalties but also to maintain its social license to operate and adapt to increasingly demanding global environmental mandates.

Labor laws in South Korea, where Hyundai Steel is headquartered, dictate minimum wages, standard working hours, and mandatory employee benefits, directly influencing operational costs and HR strategies. For instance, the minimum wage in South Korea saw an increase to 9,860 KRW per hour in 2024, impacting the company's payroll expenses.

Maintaining robust industrial relations is crucial for Hyundai Steel to prevent disruptions. The company must navigate regulations concerning union activities and collective bargaining, as outlined in the Trade Union and Labor Relations Adjustment Act. Successful management of these relationships is key to avoiding costly strikes and ensuring operational continuity.

Compliance with these labor statutes is not just a legal obligation but also a strategic imperative. Adherence to fair labor practices, including safe working conditions and equitable treatment, fosters employee morale and productivity, contributing to Hyundai Steel's overall stability and reputation.

International anti-dumping laws and trade remedy measures can significantly impact Hyundai Steel's export operations. For instance, in 2023, the United States International Trade Commission (USITC) continued to review anti-dumping and countervailing duty orders on steel products, potentially affecting Korean exporters.

The imposition of duties, such as those seen in past cases in the EU or North America, directly curtails Hyundai Steel's price competitiveness in these vital markets. Such measures can lead to substantial drops in export volumes and revenue, as seen when specific steel products faced tariffs of over 20% in certain jurisdictions.

Consequently, Hyundai Steel must actively monitor global trade regulations and engage in legal responses to trade investigations. This proactive approach is crucial for safeguarding its market share and ensuring continued access to key international markets, which are vital for its overall business strategy and financial performance.

Product Liability and Safety Standards

Hyundai Steel faces significant legal obligations regarding product liability and safety. For instance, in the automotive sector, stringent safety regulations, such as those mandated by the UNECE WP.29, require steel manufacturers to guarantee the integrity and performance of their materials. Failure to meet these standards can result in substantial financial penalties and legal challenges, as seen in past automotive recalls where material defects were a contributing factor, costing billions globally.

The company must adhere to diverse international safety certifications and standards, like ISO 9001 for quality management and specific material standards from organizations such as ASTM or JIS. These certifications are crucial for market access, especially in developed economies. In 2024, regulatory bodies continued to emphasize material traceability and defect prevention, with potential fines for non-compliance escalating.

- Product Liability: Hyundai Steel is legally responsible for any harm caused by defective steel products, particularly in high-risk industries.

- Safety Standards: Compliance with global and regional safety standards, such as those for construction materials and automotive components, is mandatory.

- Reputational Risk: Product defects can lead to expensive recalls, lawsuits, and significant damage to Hyundai Steel's brand reputation.

- Certification Requirements: Maintaining certifications like ISO 9001 and adherence to specific material grading systems are essential for market credibility and access.

Corporate Governance and Disclosure Requirements

As a publicly traded entity, Hyundai Steel operates under stringent corporate governance and disclosure mandates. These regulations, designed to foster transparency and safeguard shareholder rights, are critical for maintaining market trust. For instance, South Korea's Capital Markets Act, enforced by the Financial Services Commission (FSC), dictates extensive financial reporting and corporate behavior standards. Failure to adhere can result in significant penalties, impacting investor confidence and stock valuation.

Hyundai Steel's commitment to these legal frameworks is evident in its regular filings and adherence to best practices in corporate oversight. For the fiscal year ending December 31, 2023, the company reported total assets of approximately 40.7 trillion KRW (roughly $30 billion USD), underscoring the scale of its operations and the importance of robust governance. Key disclosure areas include:

- Financial Reporting: Adherence to International Financial Reporting Standards (IFRS) and local accounting regulations.

- Shareholder Rights: Ensuring fair treatment and access to information for all shareholders.

- Board Independence: Maintaining a board structure with independent directors to oversee management.

- Anti-Corruption Measures: Implementing policies to prevent bribery and illicit financial activities.

Hyundai Steel must navigate a complex landscape of environmental legislation, including South Korea's goal to cut greenhouse gas emissions by 40% from 2018 levels by 2030. This directly impacts steel production and requires ongoing investment in advanced environmental technologies to avoid penalties and maintain operational continuity.

Labor laws in South Korea, such as the 2024 minimum wage increase to 9,860 KRW per hour, directly affect Hyundai Steel's payroll costs. The company must also manage industrial relations under the Trade Union and Labor Relations Adjustment Act to prevent disruptions like strikes.

International trade laws, including anti-dumping measures, pose a significant risk to Hyundai Steel's export markets. For example, ongoing reviews of duty orders by bodies like the USITC in 2023 can lead to tariffs that reduce price competitiveness and export volumes.

Product liability and safety standards are critical, especially for automotive components regulated by entities like UNECE WP.29. Non-compliance with material integrity and performance standards can result in substantial fines and legal challenges, impacting brand reputation and market access.

| Legal Factor | Impact on Hyundai Steel | Relevant Data/Regulation |

| Environmental Regulations | Compliance costs, operational adjustments | South Korea's 2030 GHG reduction target (40% from 2018) |

| Labor Laws | Increased payroll expenses, need for strong industrial relations | 2024 Minimum Wage: 9,860 KRW/hour |

| Trade Laws | Reduced export competitiveness, potential market access restrictions | USITC anti-dumping reviews (2023) |

| Product Liability & Safety | Risk of fines, recalls, reputational damage | UNECE WP.29 automotive safety standards |

Environmental factors

Global and national climate change policies, such as the EU's Carbon Border Adjustment Mechanism (CBAM) and South Korea's strengthened Nationally Determined Contributions (NDCs) aiming for a 40% reduction in emissions by 2030 compared to 2018 levels, directly influence Hyundai Steel's operational costs and strategic direction. These regulations are pushing the company to invest heavily in green steel technologies, like hydrogen-based direct reduction, which saw significant pilot project advancements in 2024.

Growing concerns about the availability of key raw materials like iron ore and coking coal are compelling Hyundai Steel to embrace a circular economy. This strategic shift focuses on maximizing the recycling of resources and increasing the use of scrap steel in its production processes.

By optimizing material usage, Hyundai Steel aims to bolster its operational resilience against the backdrop of tightening resource supplies. For instance, the global steel industry's reliance on scrap is projected to grow, with estimates suggesting that by 2030, around 30% of global steel production could come from recycled materials, a trend Hyundai Steel is actively aligning with.

Hyundai Steel faces stringent environmental regulations, demanding significant investment in pollution control. For instance, the company must adhere to South Korea's increasingly strict air quality standards, which limit sulfur dioxide and nitrogen oxide emissions from its production facilities. This requires ongoing upgrades to emission control systems, impacting operational costs.

Managing greenhouse gas emissions is a critical challenge. In 2023, the steel industry globally accounted for approximately 7% of direct CO2 emissions, and Hyundai Steel is under pressure to decarbonize its operations. This involves exploring technologies like carbon capture and utilization, alongside improving energy efficiency to meet climate targets.

Effective waste management is also paramount. Hyundai Steel must responsibly handle industrial byproducts, such as slag and dust, often seeking ways to repurpose them into valuable materials for construction or other industries. This not only aids environmental compliance but can also create new revenue streams, as seen with the growing market for recycled steel byproducts.

Biodiversity and Ecosystem Protection

Hyundai Steel, like other major industrial players, faces growing scrutiny regarding its impact on local biodiversity and ecosystems. The company must actively manage its land use, water discharge quality, and air emissions to mitigate potential harm to surrounding natural environments. This focus on minimizing ecological footprints is a critical aspect of responsible corporate citizenship.

In 2023, Hyundai Steel reported on its ongoing efforts to protect biodiversity, including initiatives aimed at restoring habitats near its production facilities. The company is increasingly integrating sustainable practices into its environmental strategies, recognizing that ecosystem health is vital for long-term operational sustainability and social license to operate. For instance, specific projects in 2024 focused on improving water quality in rivers adjacent to its plants, aiming to support aquatic life.

- Land Use Management: Implementing plans to minimize habitat disruption during expansion or operational changes.

- Water Discharge Monitoring: Adhering to strict regulations for wastewater treatment to protect aquatic ecosystems.

- Emission Control Technologies: Investing in advanced technologies to reduce air pollutants that can affect plant and animal life.

- Ecosystem Restoration Projects: Engaging in initiatives to restore or enhance biodiversity in areas impacted by industrial activities.

Water Stress and Management

Water scarcity is a growing concern for heavy industries like steel manufacturing, and Hyundai Steel is no exception. Regions where its facilities operate might face increasing water stress, directly impacting production continuity. Steelmaking is inherently water-intensive, requiring significant volumes for cooling, dust suppression, and other processes.

To mitigate these risks, Hyundai Steel's environmental strategy must prioritize efficient water management. This involves investing in advanced water recycling technologies to minimize reliance on freshwater sources and reduce overall consumption. For instance, many steel plants are implementing closed-loop cooling systems, which can reduce freshwater intake by up to 90% compared to once-through systems.

Compliance with stringent water discharge regulations is also paramount. Hyundai Steel needs to ensure that any water released back into the environment meets strict quality standards to prevent pollution. Responsible sourcing of water, considering local availability and community needs, further solidifies its commitment to environmental stewardship. By 2024, global water scarcity is projected to affect 3.5 billion people at least once a month, highlighting the urgency of these measures for companies like Hyundai Steel.

- Water-Intensive Operations: Steel production requires substantial water for cooling and processing, making water availability a key operational factor for Hyundai Steel.

- Recycling and Efficiency: Implementing advanced water recycling and conservation technologies is crucial for reducing freshwater dependency and operational costs.

- Regulatory Compliance: Adhering to strict water discharge regulations and ensuring responsible water sourcing are essential for environmental and social license to operate.

- Global Water Stress: With billions facing water scarcity, proactive water management is a critical risk mitigation strategy for Hyundai Steel's long-term sustainability.

Hyundai Steel's environmental strategy is heavily influenced by global climate change policies, such as the EU's Carbon Border Adjustment Mechanism, and South Korea's ambitious 2030 emission reduction targets. These regulations are driving significant investment in green steel technologies, including hydrogen-based direct reduction, with pilot projects showing promise in 2024.

The company is also adapting to increasing concerns about raw material scarcity by focusing on a circular economy, emphasizing scrap steel recycling. This aligns with industry trends, where recycled materials are projected to account for a larger share of global steel production by 2030.

Stringent environmental regulations, particularly concerning air quality and greenhouse gas emissions, necessitate ongoing investment in pollution control and decarbonization technologies like carbon capture. Effective waste management and minimizing ecological impact, including biodiversity protection and responsible water usage, are also critical for Hyundai Steel's long-term sustainability and social license to operate.

PESTLE Analysis Data Sources

Our Hyundai Steel PESTLE Analysis is built on a robust foundation of data sourced from official government publications, reputable financial institutions, and leading industry analysis firms. We incorporate economic indicators, environmental regulations, technological advancements, and socio-political trends from reliable global and regional sources.