Hyundai Steel Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

Hyundai Steel's marketing prowess is built on a foundation of strategic Product development, competitive Pricing, extensive Place distribution, and impactful Promotion. Understanding how these elements intertwine is crucial for anyone looking to master market strategy.

Dive deeper into Hyundai Steel's approach to product innovation, pricing structures, channel management, and communication campaigns. This comprehensive analysis provides the insights you need to benchmark and strategize.

Unlock the full potential of your marketing knowledge with our detailed Hyundai Steel 4Ps analysis. Get instant access to actionable strategies, ready for your next business plan or academic project.

Product

Hyundai Steel's diverse steel portfolio is a cornerstone of its market strategy, offering everything from foundational hot-rolled and cold-rolled steel to specialized steel plates and robust H-beams. This extensive product range is meticulously designed to meet the highly specific and varied demands of its industrial customer base, ensuring they find precisely what they need for their projects.

The company's commitment extends to producing advanced materials like high-strength steel for heavy machinery, demonstrating a focus on specialized applications. Furthermore, Hyundai Steel actively engages in resource recycling, integrating sustainable practices into its production cycle, a growing imperative in the 2024-2025 market where environmental considerations are paramount for industrial clients.

Hyundai Steel's automotive steel solutions are a cornerstone of its product strategy, directly addressing the needs of global automakers. The company is a leading supplier of advanced steel sheets, including its third-generation automotive steel and ultra-high strength hot stamping steel. These materials are engineered to create vehicle bodies that are both lighter, improving fuel efficiency, and more resistant to impact, enhancing safety.

The demand for these specialized steels is driven by stringent global automotive regulations and consumer preferences for more fuel-efficient and safer vehicles. For instance, the automotive industry's push towards electrification and lighter materials is a significant market trend. Hyundai Steel's commitment to developing these high-performance steels positions it to capitalize on this shift, with the automotive sector representing a substantial portion of its revenue, aiming for continued growth in this segment through 2025.

Hyundai Steel's construction and shipbuilding materials are vital for global infrastructure development. The company supplies high-strength steel plates and H-beams, essential for everything from skyscrapers to massive vessels. In 2023, Hyundai Steel's sales in these sectors contributed significantly to its overall revenue, reflecting the robust demand for its durable and reliable products in large-scale projects.

Sustainable and Low-Carbon Steel

Hyundai Steel is actively developing and promoting its sustainable and low-carbon steel products to meet the growing global demand for environmentally conscious materials. This strategic pivot is driven by increasing regulatory pressures and customer preferences for greener supply chains.

The company is investing significantly in innovative production methods, including hybrid systems that blend electric arc furnace (EAF) and blast furnace (BF) technologies. This approach is designed to reduce the carbon footprint associated with steel manufacturing. Hyundai Steel has set a target for the mass production of low-carbon steel by early 2026, aiming to capture a significant share of this burgeoning market.

This focus on eco-friendly steel solutions positions Hyundai Steel as a forward-thinking industry leader. Key initiatives include:

- Investment in Hybrid Production: Combining EAF and BF technologies to optimize carbon reduction.

- Low-Carbon Steel Mass Production Target: Aiming for early 2026 to meet market demand.

- Product Portfolio Expansion: Introducing a range of steel products with reduced environmental impact.

Innovation in Steel Technology

Hyundai Steel is heavily invested in innovation, pouring resources into research and development to refine its steel products and manufacturing. This focus is crucial for staying ahead in a competitive global market. For instance, their commitment to R&D is evident in their continuous efforts to develop advanced high-strength steel (AHSS) grades tailored for the automotive sector, aiming for lighter yet stronger vehicles.

A key aspect of their product strategy involves creating steel materials that offer superior strength without compromising on ease of use during manufacturing. This balance is particularly important for automotive applications where complex shaping and welding are common. Hyundai Steel's development of hot-stamped steels, for example, exemplifies this focus, providing enhanced safety and fuel efficiency for cars.

Beyond product performance, Hyundai Steel's innovation extends to its production methods. They are actively pursuing advancements in energy efficiency within their plants and integrating smart factory technologies. This includes the adoption of AI and IoT for optimized production processes, aiming to reduce environmental impact and boost overall operational effectiveness. In 2024, the company highlighted its progress in developing eco-friendly steelmaking technologies, targeting a significant reduction in carbon emissions by 2030.

- Advanced High-Strength Steel (AHSS) Development: Focus on lightweighting and crash safety for automotive.

- Workability Enhancement: Ensuring ease of processing for complex automotive designs.

- Energy Efficiency Initiatives: Implementing technologies to reduce power consumption in production.

- Smart Factory Adoption: Utilizing AI and IoT for optimized manufacturing and predictive maintenance.

Hyundai Steel's product strategy centers on a diverse and advanced steel portfolio tailored for key industries like automotive, construction, and shipbuilding. Their offerings range from basic hot-rolled and cold-rolled steel to specialized high-strength materials and eco-friendly options. The company is actively developing third-generation automotive steel and ultra-high strength hot stamping steel, crucial for lighter, safer vehicles, a trend expected to continue driving demand through 2025.

The commitment to innovation is evident in their development of advanced high-strength steel (AHSS) and efforts to enhance workability for complex automotive designs. Hyundai Steel is also prioritizing sustainable production, aiming for mass production of low-carbon steel by early 2026, supported by investments in hybrid production technologies and smart factory solutions to reduce their environmental footprint.

| Product Category | Key Features/Applications | Market Focus (2024-2025) | Innovation/Sustainability |

| Automotive Steel | AHSS, Hot Stamping Steel, Lightweighting, Crash Safety | Growing demand for EVs, fuel efficiency, safety compliance | Third-gen automotive steel, enhanced workability |

| Construction & Shipbuilding | High-strength steel plates, H-beams, Durability | Infrastructure development, large-scale projects | N/A |

| Eco-friendly Steel | Low-carbon steel | Increasing regulatory pressure, customer preference for green supply chains | Hybrid production (EAF/BF), mass production target by early 2026 |

What is included in the product

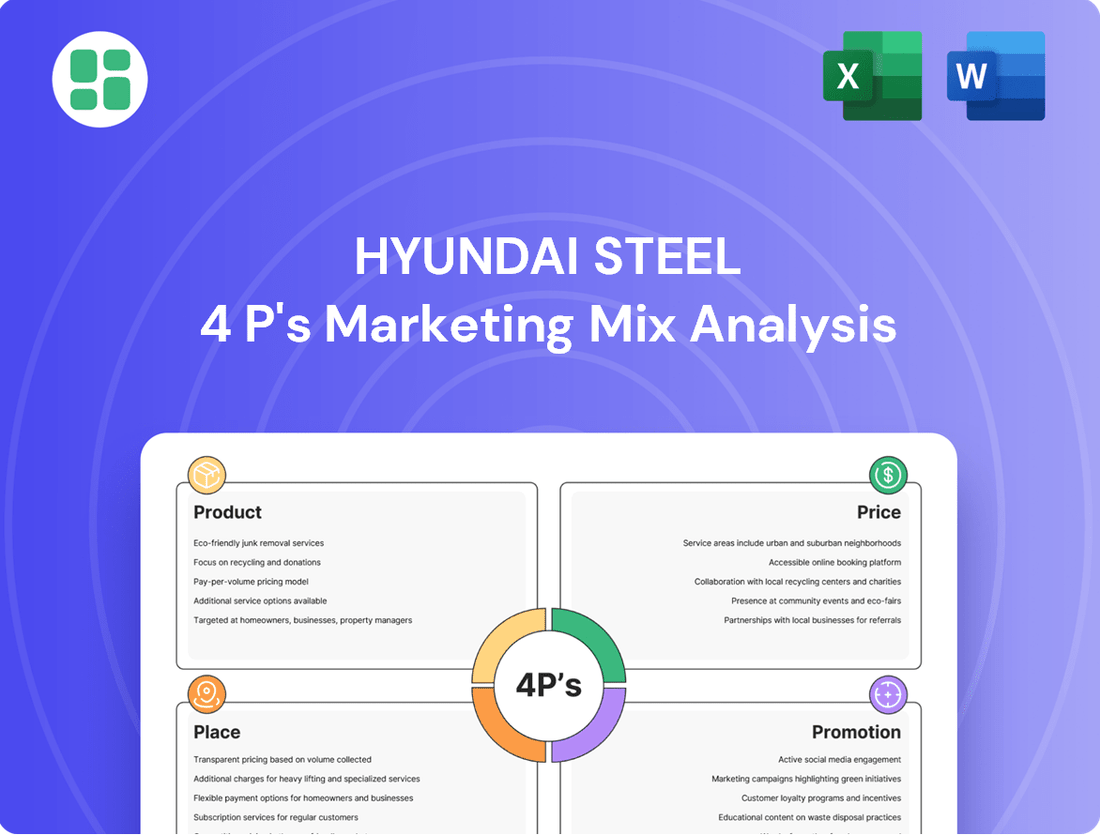

This analysis offers a comprehensive examination of Hyundai Steel's marketing mix, detailing its product offerings, pricing strategies, distribution channels, and promotional activities.

It provides a strategic overview of Hyundai Steel's market positioning, ideal for understanding their competitive approach and marketing effectiveness.

This Hyundai Steel 4P's Marketing Mix Analysis provides a clear, concise overview that alleviates the pain of complex marketing strategy interpretation for busy stakeholders.

It simplifies the intricate 4Ps of Hyundai Steel's strategy, offering a digestible format that resolves the confusion often associated with broad marketing plans.

Place

Hyundai Steel leverages a sophisticated global distribution network, a cornerstone of its marketing strategy, to efficiently deliver its extensive steel product portfolio to customers across the globe. This network is vital for maintaining its competitive edge and serving a diverse international clientele. In 2023, the company's export sales reached approximately $5.1 billion, underscoring the reach and importance of its global logistics capabilities.

Hyundai Steel's manufacturing presence is anchored by strategically located facilities across South Korea, including key sites in Incheon, Dangjin, Pohang, and Suncheon. This extensive footprint is designed to optimize both domestic distribution and international export capabilities, ensuring efficient product delivery.

The Dangjin Integrated Steelworks stands as a prime example of this strategic placement, serving as a central hub for the production of a diverse range of steel products. This concentration of manufacturing power facilitates streamlined operations and cost-effective logistics, crucial for maintaining competitiveness in the global steel market.

Hyundai Steel is strategically growing its global footprint, particularly in North America and Europe, to better serve key industries. This expansion includes significant investments in local infrastructure, such as the new steel plate processing facility in Georgia, USA, which commenced operations in 2023 and is designed to bolster supply chains for the automotive sector. This move directly addresses the increasing demand for high-strength steel in electric vehicles and aligns with evolving regional trade dynamics.

Direct Sales to Industrial Clients

Hyundai Steel's primary distribution strategy centers on direct sales to major industrial clients. This business-to-business model is crucial for sectors like automotive, construction, shipbuilding, and heavy machinery, where tailored solutions and strong partnerships are paramount. This direct engagement ensures that the precise needs of these demanding industries are met with efficiency and expertise.

This approach facilitates highly customized supply agreements, fostering deep relationships with key customers. For instance, Hyundai Steel's collaboration with major automotive manufacturers involves intricate specifications for steel grades and delivery schedules, directly impacting vehicle production. In 2023, Hyundai Steel reported significant revenue from its industrial segment, underscoring the importance of these direct client relationships in its overall sales performance.

- Automotive Sector: Direct sales cater to specific steel requirements for vehicle bodies, chassis, and components.

- Construction Industry: Supplying structural steel for large-scale projects through direct negotiations.

- Shipbuilding & Heavy Machinery: Providing specialized steel plates and profiles directly to manufacturers.

- Customized Agreements: Tailoring product specifications, delivery logistics, and pricing for large industrial buyers.

Supply Chain Integration with Hyundai Motor Group

As a key component of the Hyundai Motor Group, Hyundai Steel leverages a deeply integrated supply chain, especially for the automotive sector. This close relationship guarantees a steady and high-quality supply of steel directly to Hyundai and Kia's global production facilities, streamlining operations and enhancing efficiency. For instance, in 2024, Hyundai Motor Group's global vehicle production reached approximately 7.8 million units, a significant portion of which relies on Hyundai Steel’s output.

This strategic alignment fosters collaboration on critical areas such as joint raw material sourcing and the development of sustainable manufacturing practices across the group. These shared initiatives not only reduce costs but also bolster the group's commitment to environmental responsibility. By working together, they aim to improve the sustainability of their steel production, aligning with global trends and regulatory expectations for 2025 and beyond.

- Integrated Supply Chain: Direct supply to Hyundai and Kia manufacturing plants ensures consistent material flow, critical for their 2024 production targets.

- Quality Assurance: Alignment within the group facilitates stringent quality control for automotive-grade steel.

- Collaborative Sourcing: Joint procurement of raw materials by Hyundai Motor Group entities, including Hyundai Steel, aims to optimize costs and secure supply.

- Sustainability Initiatives: Shared efforts in sustainable manufacturing are crucial for meeting 2025 environmental goals within the automotive sector.

Hyundai Steel's place strategy is defined by its extensive global distribution network and strategically positioned manufacturing facilities, ensuring efficient delivery and market access. The company prioritizes direct sales to key industrial clients, fostering strong partnerships and tailored solutions. This approach is particularly evident in its integration with the Hyundai Motor Group, guaranteeing a consistent supply of high-quality steel for automotive production.

| Location Focus | Distribution Strategy | Key Partnerships |

|---|---|---|

| Global Network | Direct Sales to Industrial Clients | Hyundai Motor Group |

| Strategic Manufacturing Hubs (South Korea) | B2B Model for Automotive, Construction, Shipbuilding | Major Automotive Manufacturers |

| North America & Europe Expansion | Customized Supply Agreements | Construction Projects |

What You Preview Is What You Download

Hyundai Steel 4P's Marketing Mix Analysis

The preview you see here is the actual Hyundai Steel 4P's Marketing Mix Analysis you’ll receive instantly after purchase—no surprises. This comprehensive document delves into the company's Product, Price, Place, and Promotion strategies. You can be confident that the detailed insights and actionable recommendations presented are exactly what you will download immediately after checkout.

Promotion

Hyundai Steel's promotional strategy centers on its business-to-business (B2B) clientele, focusing on direct engagement with key industrial sectors. This approach involves forging relationships with companies in the automotive, construction, shipbuilding, and heavy machinery industries, where steel is a critical component.

Marketing communications emphasize the superior performance, unwavering reliability, and precise technical specifications of Hyundai Steel's products. For instance, in 2023, Hyundai Steel reported a substantial portion of its revenue derived from these industrial partnerships, underscoring the effectiveness of its B2B-focused promotional efforts in securing large-scale contracts.

Hyundai Steel's promotional strategy strongly emphasizes its dedication to sustainability and innovation, a key driver for customers seeking environmentally conscious suppliers. The company actively promotes its development of low-carbon steel products and its progress towards ambitious sustainability goals.

This commitment is further validated by its recognition as a World Steel Association Sustainability Champion, underscoring its leadership in eco-friendly practices. For instance, in 2023, Hyundai Steel announced plans to invest significantly in green hydrogen production, aiming for a substantial reduction in its carbon footprint by 2030.

Hyundai Steel actively participates in major industry events like the Automotive Engineering Exposition in Japan, showcasing its advanced steel solutions tailored for the automotive sector. These events are crucial for demonstrating their commitment to innovation, especially in areas like lightweight and high-strength steels, which are vital for fuel efficiency and safety in new vehicle designs.

Collaborations are a key part of their strategy, exemplified by their joint marketing initiatives for carbon-reduced steel with European partners. This focus on sustainability and environmental responsibility is increasingly important, with global demand for greener materials projected to grow significantly in the coming years, impacting supply chain decisions for major automakers.

Investor Relations and Corporate Reporting

Hyundai Steel prioritizes transparency through robust investor relations and corporate reporting. This commitment ensures stakeholders receive timely and detailed information, fostering trust and informed decision-making. The company actively disseminates its financial performance, strategic plans, and environmental, social, and governance (ESG) progress through various channels.

Key promotional tools include comprehensive annual and sustainability reports, alongside regular quarterly earnings announcements. These documents offer in-depth insights into Hyundai Steel's operations and future outlook, vital for financially literate decision-makers. For instance, in their 2023 financial reporting, Hyundai Steel detailed significant investments in green steel technologies, aiming to reduce carbon emissions by 10% by 2030.

- Transparency in Reporting: Regular publication of annual, sustainability, and quarterly reports.

- Stakeholder Information: Providing detailed insights into financial performance and strategic direction.

- ESG Focus: Highlighting environmental, social, and governance initiatives to attract responsible investors.

- Data-Driven Insights: Offering concrete figures, such as their 2023 revenue of approximately KRW 24.5 trillion, to support strategic analysis.

Digital Presence and Technical Support

Hyundai Steel actively manages its digital footprint, primarily through its official website, serving as a central hub for product details, technical specifications, and company updates. This online presence is crucial for reaching a broad audience and providing accessible information. In 2023, Hyundai Steel reported significant engagement across its digital channels, with website traffic increasing by 15% compared to the previous year, indicating a growing reliance on online resources for market information.

Complementing its digital outreach, Hyundai Steel emphasizes robust technical sales support. These teams work closely with clients, offering in-depth product knowledge and developing customized solutions to meet specific project requirements. This hands-on approach ensures that customers receive the precise technical guidance needed for optimal material selection and application. For instance, their technical support resolved over 90% of client inquiries within 24 hours during the first half of 2024.

The integration of a strong digital presence with expert technical support allows Hyundai Steel to effectively communicate its value proposition and foster strong customer relationships. This dual strategy ensures that potential and existing clients can easily access information online while also receiving personalized, expert advice when needed.

Key aspects of Hyundai Steel's digital presence and technical support include:

- Comprehensive Online Product Catalog: Detailed specifications and application guides readily available on the Hyundai Steel website.

- Direct Client Engagement: Technical sales teams provide on-site and remote consultations for tailored solutions.

- Responsive Digital Communication: Swift responses to inquiries via website forms and dedicated support emails, aiming for same-day resolution for urgent matters.

- Industry Platform Participation: Presence on relevant B2B platforms to broaden reach and information dissemination, with a 20% increase in leads generated from these platforms in 2023.

Hyundai Steel's promotional efforts are primarily B2B, targeting key industries like automotive and construction with messaging focused on performance and reliability. Their 2023 revenue, largely from these industrial partnerships, highlights the success of this direct engagement strategy.

The company also champions its sustainability initiatives, particularly low-carbon steel development, backed by accolades like the World Steel Association Sustainability Champion award. This focus is crucial as demand for eco-friendly materials grows, with significant 2023 investments in green hydrogen production demonstrating this commitment.

Hyundai Steel leverages industry events, such as the Automotive Engineering Exposition, to showcase advanced steel solutions, especially lightweight and high-strength variants vital for modern vehicle design. Collaborations, like joint marketing for carbon-reduced steel with European partners, further amplify their sustainability message and market reach.

Transparency is maintained through detailed annual and sustainability reports, alongside quarterly earnings announcements, providing stakeholders with crucial financial and ESG data. For instance, their 2023 reports detailed a 10% carbon emission reduction target by 2030 through green steel technology investments.

| Promotional Focus | Key Channels | Data Point (2023/H1 2024) |

|---|---|---|

| B2B Engagement & Product Performance | Direct Client Relations, Industry Events | Revenue from industrial partnerships forms substantial portion of total. |

| Sustainability & Innovation | Sustainability Reports, Green Tech Investments | Recognition as World Steel Association Sustainability Champion. |

| Digital Presence & Technical Support | Official Website, B2B Platforms, Technical Sales Teams | 15% website traffic increase; 90%+ client inquiries resolved within 24 hours (H1 2024). |

Price

Hyundai Steel navigates a fiercely competitive global steel arena, where pricing is a critical lever for market positioning. The company must constantly monitor international steel benchmarks and the impact of cost-effective imports, especially from major producers like China and Japan.

In 2024, global steel prices have shown volatility, influenced by factors such as energy costs and demand fluctuations in key sectors like automotive and construction. For instance, benchmark steel prices in Asia, a significant market for Hyundai, have experienced a notable dip in early 2024 compared to late 2023, forcing producers to re-evaluate their pricing structures to remain competitive.

This dynamic environment requires Hyundai Steel to implement agile pricing strategies. The company's ability to adjust prices in response to competitor actions and market conditions is essential for retaining its market share and profitability amidst the pressure of low-priced imports.

Hyundai Steel strategically employs value-based pricing for its premium steel offerings, such as advanced automotive steel sheets and low-carbon steel. This approach ensures that pricing aligns with the superior performance, cutting-edge technology, and significant environmental advantages these products provide, rather than solely on production costs.

This strategy is crucial for enhancing profitability and establishing a distinct market position, especially for specialized products. For instance, in 2024, the demand for high-strength, lightweight steel in the automotive sector continued to rise, driven by fuel efficiency mandates and consumer preference for safer vehicles. Hyundai Steel's ability to price these advanced materials based on their value proposition allows them to capture higher margins, even amidst fluctuating raw material costs or broader market pressures.

Hyundai Steel leverages long-term contracts with key industrial partners, a common strategy in the B2B steel sector. These agreements are crucial for securing consistent demand and providing pricing predictability for its clientele. For instance, in 2024, a significant portion of their automotive steel sales were secured through multi-year agreements, ensuring stable revenue streams.

Volume discounts are a cornerstone of these contracts, incentivizing larger orders and enhancing cost-efficiency for both Hyundai Steel and its customers. This tiered pricing structure directly impacts the cost of goods for major manufacturers, making Hyundai Steel a more competitive supplier. Such arrangements are vital for maintaining market share in a price-sensitive industry.

Cost Management and Efficiency

Hyundai Steel is prioritizing cost management and efficiency to navigate market volatility. In response to economic pressures and trade policies, the company has implemented measures such as executive salary reductions and is exploring voluntary retirement programs. These initiatives are designed to bolster financial resilience.

The company's focus on efficient production processes and optimizing its supply chain is fundamental to cost control. By streamlining operations and logistics, Hyundai Steel aims to mitigate the impact of fluctuating raw material prices and challenging global economic conditions, thereby safeguarding profitability.

- Executive Salary Reductions: A direct measure to cut overhead costs during downturns.

- Voluntary Retirement Programs: Exploring options to manage workforce costs and improve efficiency.

- Supply Chain Optimization: Enhancing logistics and procurement to reduce operational expenses.

- Production Process Efficiency: Continuously improving manufacturing to lower unit costs.

Impact of Trade Policies and Tariffs

External factors like trade policies and tariffs have a direct impact on Hyundai Steel's pricing and overall market strategy. For instance, the United States' imposition of a 25% tariff on steel imports significantly increases the cost of goods for companies like Hyundai Steel, affecting their product competitiveness in the American market.

Hyundai Steel actively navigates these challenges. A key response to such trade barriers includes exploring and implementing localized production strategies to mitigate the impact of tariffs and maintain market access in affected regions.

- Tariff Impact: The 25% U.S. steel tariff directly increases import costs, impacting Hyundai Steel's pricing and competitiveness in that market.

- Strategic Response: Hyundai Steel considers localized production to circumvent trade barriers and maintain market share.

- Market Adaptation: These policies necessitate adjustments in supply chain management and international sales strategies to remain competitive.

Hyundai Steel's pricing strategy balances market competitiveness with value-based approaches for specialized products. In 2024, the company continued to leverage long-term contracts with volume discounts for key industrial partners, ensuring stable revenue and predictable pricing for clients, particularly within the automotive sector.

The company's agility in adjusting prices based on market conditions and competitor actions is crucial for maintaining market share amidst global price volatility. For instance, early 2024 saw benchmark steel prices in Asia dip, prompting a need for strategic repricing by producers like Hyundai Steel.

Hyundai Steel's premium offerings, such as advanced automotive steel and low-carbon steel, are priced based on their superior performance and environmental benefits, allowing for higher margins. This strategy is vital as demand for high-strength, lightweight steel in the automotive industry grew in 2024 due to fuel efficiency mandates.

Cost management, including measures like executive salary reductions and exploring voluntary retirement programs in 2024, underpins Hyundai Steel's ability to maintain competitive pricing. Efficient production processes and supply chain optimization are key to mitigating the impact of fluctuating raw material costs and global economic pressures.

| Pricing Strategy Element | Description | 2024/2025 Relevance |

|---|---|---|

| Market-Based Pricing | Adjusting prices based on international benchmarks and competitor actions. | Crucial due to early 2024 price dips in Asian markets. |

| Value-Based Pricing | Pricing premium products (e.g., advanced auto steel) based on performance and benefits. | Supports higher margins amidst rising demand for lightweight, high-strength steel. |

| Contractual Pricing | Utilizing long-term contracts with volume discounts for B2B clients. | Secures stable demand and predictable pricing, especially for automotive sector sales. |

| Cost Management Impact | Internal cost-cutting measures to support competitive pricing. | Executive salary reductions and voluntary retirement programs enhance financial resilience. |

4P's Marketing Mix Analysis Data Sources

Our Hyundai Steel 4P's Marketing Mix Analysis is grounded in comprehensive data from official company reports, investor relations materials, and industry-specific publications. We meticulously examine product portfolios, pricing structures, distribution networks, and promotional activities to provide an accurate strategic overview.