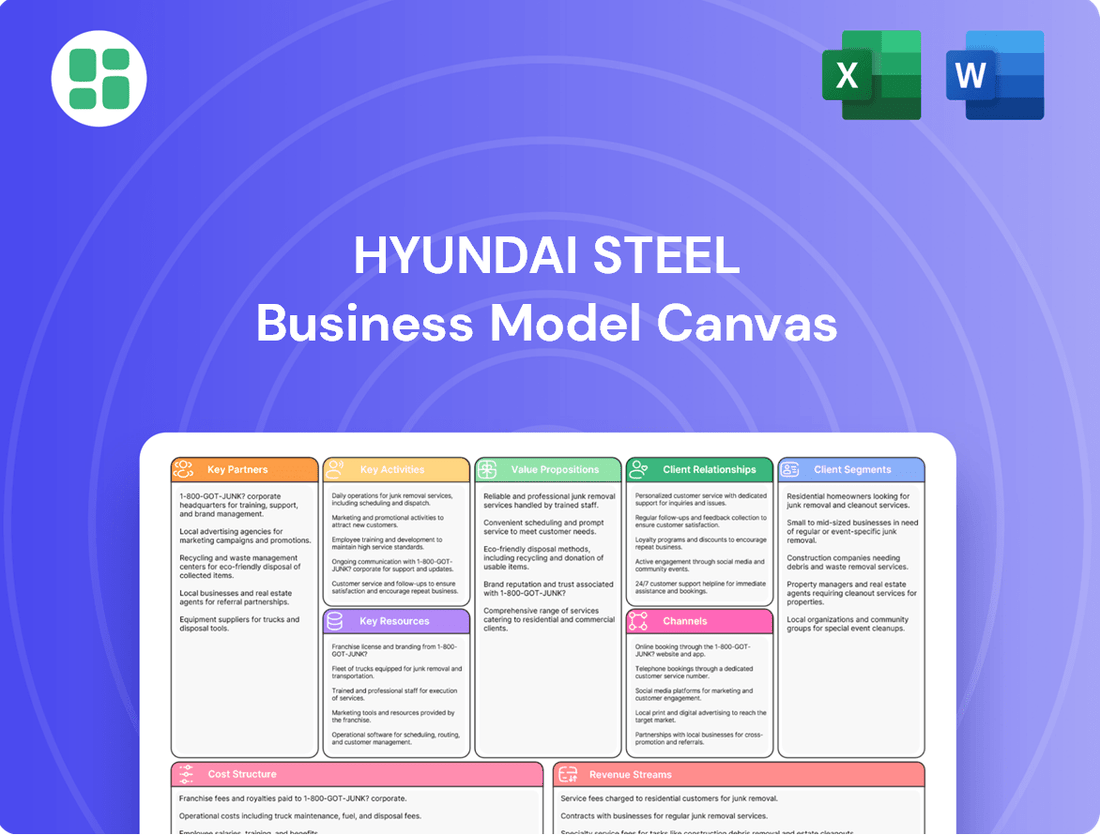

Hyundai Steel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

Unlock the full strategic blueprint behind Hyundai Steel's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Hyundai Steel's strategic automotive alliances with giants like Volkswagen, Stellantis, Volvo, BMW, and Mercedes-Benz are foundational. These partnerships are critical for supplying carbon-reduced steel plates, directly supporting the automotive sector's push toward carbon neutrality.

These collaborations are not just about supply; they often involve joint development and testing of new steel components. This deepens relationships and ensures Hyundai Steel's eco-friendly products are integrated into the next generation of vehicles, solidifying market share.

In 2024, the demand for sustainable automotive materials is accelerating, making these alliances particularly valuable. For instance, Stellantis has set ambitious targets for electric vehicle production, creating a significant opportunity for suppliers like Hyundai Steel who can provide low-carbon steel solutions.

Hyundai Steel actively collaborates with leading research institutions like Singapore's Advanced Remanufacturing and Technology Center (ARTC). These partnerships are crucial for driving innovation in steel manufacturing processes.

Through these collaborations, Hyundai Steel explores cutting-edge applications, such as implementing AI models to significantly improve product quality. They also investigate novel production methodologies to enhance efficiency and sustainability.

These R&D alliances are fundamental to developing next-generation steel solutions and are instrumental in achieving Hyundai Steel's ambitious sustainability goals. For example, advancements in green steel production are a key focus.

Hyundai Steel's operations are heavily dependent on a dependable supply chain for key raw materials such as iron ore and coking coal. In 2024, the company continued to foster strong relationships with its primary suppliers, recognizing that consistent access to these materials is critical for maintaining its production output. These partnerships are often solidified through extended contracts, which provide a degree of predictability in input costs and ensure the smooth flow of materials necessary for Hyundai Steel's integrated steelmaking process.

Logistics and Distribution Partners

Hyundai Steel relies on a robust network of logistics and distribution partners to ensure its diverse steel products reach customers efficiently. These collaborations are vital for timely and dependable delivery, both domestically and across international markets. In 2024, Hyundai Steel continued to optimize its supply chain by leveraging these partnerships to enhance customer satisfaction and expand its market presence.

Key aspects of these partnerships include:

- Global Shipping Networks: Hyundai Steel partners with major international shipping lines to manage the complex logistics of exporting steel products worldwide, ensuring compliance with diverse trade regulations.

- Domestic Transportation: For the Korean market, partnerships with trucking and rail freight companies are crucial for delivering steel to manufacturing hubs and construction sites promptly.

- Warehousing and Storage: Strategic alliances with warehousing providers allow Hyundai Steel to maintain inventory closer to key customer locations, reducing lead times and improving responsiveness.

- Specialized Handling: For certain high-value or specialized steel products, Hyundai Steel collaborates with partners offering specialized handling and transportation services to prevent damage and maintain product integrity.

Joint Ventures for Overseas Expansion

Hyundai Steel actively pursues joint ventures for overseas expansion, exemplified by its significant investment in a new electric arc furnace (EAF) steel mill in Louisiana, USA. This ambitious project, valued at approximately $5.8 billion, involves collaboration with key entities like the Hyundai Motor Group and potentially POSCO.

These strategic partnerships are crucial for establishing vital overseas production bases. The goal is to ensure a consistent and high-quality supply of steel to global automakers, particularly in navigating evolving regional trade policies and securing market access.

- Joint Venture Investment: $5.8 billion for the EAF-based integrated steel mill in Louisiana, USA.

- Key Partners: Hyundai Motor Group, with potential involvement from POSCO.

- Strategic Objectives: Establish overseas production, secure stable steel supply for global automakers, and respond to trade policies.

- Focus Areas: Sustainable production and expanding global market presence.

Hyundai Steel's key partnerships extend to research institutions like Singapore's ARTC, fostering innovation in steel manufacturing. These collaborations focus on advancements like AI integration for quality improvement and novel, sustainable production methods, crucial for developing next-generation steel solutions and achieving ambitious green steel goals.

What is included in the product

A comprehensive overview of Hyundai Steel's business model, detailing its key customer segments, value propositions, and revenue streams within the global steel industry.

Hyundai Steel's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and areas for improvement in their complex steel production and distribution.

Activities

Hyundai Steel's primary operations revolve around manufacturing a wide array of steel products. This includes essential items like hot-rolled and cold-rolled steel, robust steel plates, and structural H-beams, catering to diverse industrial needs.

The company manages the complete steelmaking journey, from meticulously processing raw materials to skillfully shaping the final steel components. This comprehensive approach ensures control over quality and production.

Hyundai Steel actively invests in cutting-edge technology and modern facilities. For instance, their adoption of electric arc furnaces and innovative hybrid production systems aims to boost operational efficiency and elevate the quality of their steel output.

Hyundai Steel's core activities heavily rely on Research and Development (R&D). This focus is directed towards creating cutting-edge steel products, such as high-strength steel for the automotive sector and environmentally friendly, low-carbon production methods. A key area of investment is in developing novel material alloys and optimizing designs for lighter weight applications.

The company's R&D efforts are crucial for maintaining its market leadership and advancing its commitment to sustainable steel manufacturing. In 2023, Hyundai Steel continued to invest significantly in these areas, aiming to reduce its environmental footprint and enhance product performance. For instance, their development of advanced high-strength steel (AHSS) contributes to lighter and safer vehicles.

Hyundai Steel's supply chain management is a cornerstone of its operations, encompassing the critical procurement of raw materials like iron ore and coal, meticulous inventory control, and efficient distribution of finished steel products to a diverse customer base. This ensures a consistent supply for production and timely delivery to sectors such as automotive and construction.

In 2024, Hyundai Steel continued to focus on optimizing its logistics network. For instance, the company leveraged advanced tracking systems to monitor shipments, aiming to reduce lead times by an average of 5% across key product lines. This focus on efficiency directly impacts cost control and reinforces operational dependability for its industrial clients.

Sales, Marketing, and Technical Support

Hyundai Steel actively engages in sales and marketing to connect with a broad range of customers, from automotive manufacturers to construction firms. In 2024, the company continued to emphasize digital marketing channels and direct sales strategies to enhance customer reach and engagement. They also provide comprehensive technical support, ensuring clients receive tailored solutions and assistance with product application and integration.

Building robust client relationships is paramount, with technical expertise serving as a cornerstone of their customer service. This focus on direct engagement and problem-solving through technical support is a critical activity for Hyundai Steel. For instance, their commitment to supporting advanced high-strength steel (AHSS) adoption in the automotive sector involves close collaboration with carmakers on material selection and processing.

- Active Sales and Marketing: Reaching diverse customer segments through both digital and direct sales approaches.

- Extensive Technical Support: Offering tailored solutions and assisting with product integration to meet specific client needs.

- Relationship Building: Fostering strong client partnerships through technical expertise and responsive service.

- Product Application Assistance: Guiding customers on the optimal use and integration of Hyundai Steel's product portfolio.

Resource Recycling and Energy Business

Hyundai Steel engages in resource recycling and energy businesses, extending beyond its core steel manufacturing. This strategic move supports its commitment to sustainable steel production and embraces circular economy concepts.

These activities are crucial for achieving environmental management objectives, including carbon neutrality targets. For instance, in 2023, Hyundai Steel's efforts in waste heat recovery and by-product utilization contributed to a reduction in greenhouse gas emissions.

- Resource Recycling: Processing industrial by-products and scrap metal for reuse in steelmaking, reducing reliance on virgin materials.

- Energy Business: Generating and supplying energy, often from waste heat or by-products of steel production, contributing to operational efficiency and revenue diversification.

- Environmental Contribution: These activities directly support Hyundai Steel's sustainability goals, aiming to lower its carbon footprint and promote a more circular industrial model.

Hyundai Steel's key activities encompass the entire steelmaking process, from raw material sourcing to the production of diverse steel products like hot-rolled and cold-rolled steel, plates, and H-beams. The company prioritizes research and development, focusing on advanced high-strength steel (AHSS) for lighter vehicles and sustainable, low-carbon production methods, with significant investments in 2023 and 2024 to enhance efficiency and product quality.

Operational efficiency is bolstered by investments in cutting-edge technology, including electric arc furnaces and hybrid production systems, aiming to improve output and product quality. Furthermore, Hyundai Steel actively manages its supply chain, ensuring efficient procurement, inventory control, and distribution of finished goods to sectors such as automotive and construction, with a 2024 focus on logistics optimization to reduce lead times.

The company's engagement with customers involves robust sales and marketing strategies, including digital channels and direct sales, complemented by extensive technical support to assist with product application and integration. Building strong client relationships through technical expertise is a critical aspect, exemplified by their collaboration with automotive manufacturers on AHSS adoption.

Beyond steel manufacturing, Hyundai Steel is involved in resource recycling and energy businesses, aligning with its sustainability goals and circular economy principles. These activities, such as waste heat recovery and by-product utilization, contributed to greenhouse gas emission reductions in 2023 and support their carbon neutrality targets.

| Key Activity | Focus Area | 2023/2024 Highlight |

|---|---|---|

| Steel Production | Hot-rolled, Cold-rolled, Plates, H-beams | Continued investment in advanced high-strength steel (AHSS) development. |

| Research & Development | Low-carbon methods, new alloys | Significant investment in R&D for sustainable manufacturing and product innovation. |

| Supply Chain Management | Procurement, Inventory, Distribution | Logistics network optimization in 2024, aiming for a 5% reduction in lead times. |

| Sales & Customer Support | Digital Marketing, Technical Assistance | Emphasis on digital channels and direct sales, with strong technical support for product integration. |

| Sustainability Initiatives | Recycling, Energy Business | Waste heat recovery and by-product utilization contributing to emission reduction. |

Full Document Unlocks After Purchase

Business Model Canvas

The Hyundai Steel Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive analysis that will be yours to download and utilize. You can be confident that the insights and structure presented here are precisely what you will gain access to, enabling you to immediately apply this professional framework to your own strategic planning.

Resources

Hyundai Steel's advanced manufacturing facilities are the backbone of its operations, featuring cutting-edge technology like blast furnaces and electric arc furnaces. These are strategically located at key industrial hubs such as Dangjin, Incheon, and Pohang, ensuring efficient production and distribution.

The company's plants are outfitted with sophisticated machinery for critical processes including hot-rolling, cold-rolling, plate production, and the manufacturing of H-beams. This technological prowess allows for the creation of a diverse range of high-quality steel products.

Hyundai Steel consistently invests in upgrading these facilities, which is crucial for maintaining its production capacity and technological edge. For instance, in 2023, the company announced significant capital expenditures aimed at enhancing automation and sustainability across its manufacturing sites, reinforcing its commitment to innovation and operational excellence.

Hyundai Steel relies heavily on its highly skilled workforce, encompassing engineers, metallurgists, and dedicated R&D personnel, as a cornerstone of its operations. This expertise is fundamental to managing sophisticated steelmaking technologies, creating advanced steel products, and fostering continuous innovation within the company.

In 2023, Hyundai Steel reported a significant investment in its human capital, with approximately 10,000 employees dedicated to production and over 1,000 in research and development roles. This focus on talent development is crucial for maintaining a competitive edge in the global steel market.

Hyundai Steel's business model hinges on its reliable access to essential raw materials like iron ore, coking coal, and scrap metal. In 2024, the company continued to focus on securing these vital inputs to maintain consistent production. This access is a cornerstone of their operational efficiency and cost management strategy.

To ensure stable production volumes and control input costs, Hyundai Steel emphasizes long-term supply agreements and actively explores diversified sourcing strategies. This approach helps mitigate risks associated with market volatility and ensures a steady flow of materials, a critical factor for a large-scale steel producer.

Leveraging its global operational footprint, Hyundai Steel effectively optimizes its raw material procurement processes. This international reach allows the company to tap into various global markets, potentially securing more favorable pricing and supply conditions, thereby enhancing its competitive edge.

Intellectual Property and Proprietary Technologies

Hyundai Steel's intellectual property portfolio is a cornerstone of its competitive strength. This includes a significant number of patents covering advanced steel grades, such as high-strength low-alloy (HSLA) steels and electrical steels, crucial for the automotive and electronics industries. Their proprietary production processes, particularly those related to energy efficiency and waste reduction, also represent a key intangible asset. For instance, in 2024, the company continued to emphasize its advanced high-strength steel (AHSS) technologies, which are vital for lightweighting vehicles and improving fuel efficiency, a key driver in the automotive sector.

This proprietary knowledge directly translates into a competitive edge, enabling Hyundai Steel to develop and market high-performance and environmentally friendly steel products. Their ongoing investment in research and development, which saw substantial allocations in 2023 and projected increases for 2024, fuels the continuous enhancement of this valuable resource. This commitment to innovation ensures they remain at the forefront of steel technology.

Key resources related to Intellectual Property and Proprietary Technologies include:

- Patents for Advanced Steel Grades: Covering materials like AHSS and specialized alloys for various industrial applications.

- Proprietary Production Processes: Including energy-efficient manufacturing techniques and sustainable technology patents.

- R&D Investment: Continuous funding to develop new steel technologies and improve existing ones, ensuring a pipeline of innovation.

- Trade Secrets: Confidential know-how related to steelmaking and material science that provides a unique advantage.

Financial Capital and Strong Balance Sheet

Hyundai Steel's substantial financial capital and robust balance sheet are cornerstones of its business model, enabling significant investments in state-of-the-art facilities and cutting-edge research and development. This financial muscle is crucial for undertaking ambitious global expansion projects and driving the transition towards more sustainable, low-carbon production systems. For instance, as of the first quarter of 2024, Hyundai Steel reported a strong financial position, with total assets exceeding 30 trillion KRW, underscoring its capacity for large-scale capital expenditures.

This financial strength directly supports strategic initiatives, such as the planned construction of new overseas plants aimed at diversifying production bases and capturing new market opportunities. Furthermore, it underpins the company's commitment to investing in green technologies and processes, essential for meeting evolving environmental regulations and customer demands in the 2024 landscape. Access to ample capital ensures Hyundai Steel's long-term operational stability and its ability to pursue sustained growth.

- Financial Capital: Hyundai Steel's considerable financial reserves and creditworthiness facilitate major capital outlays.

- Balance Sheet Strength: A healthy balance sheet, characterized by manageable debt levels and ample liquidity, provides a stable foundation.

- Investment Capacity: This financial robustness allows for substantial, long-term investments in infrastructure, technology, and sustainability initiatives.

- Strategic Enablement: Financial strength is a key enabler for Hyundai Steel's strategic goals, including global expansion and decarbonization efforts.

Hyundai Steel's key resources are its advanced manufacturing facilities, skilled workforce, intellectual property, and strong financial capital. These elements collectively enable the company to produce high-quality steel, innovate, and maintain a competitive edge in the global market.

The company's intellectual property, particularly its patents for advanced steel grades like AHSS and proprietary production processes, is a significant differentiator. In 2024, Hyundai Steel continued to focus on these high-strength steels, critical for the automotive industry's lightweighting initiatives. Their ongoing R&D investments, substantial in 2023 and projected for 2024, are vital for maintaining this technological leadership.

Hyundai Steel's financial strength, demonstrated by total assets exceeding 30 trillion KRW as of Q1 2024, is crucial. This enables substantial investments in facility upgrades, green technologies, and global expansion, ensuring operational stability and growth. This financial robustness directly supports their strategic goals, including decarbonization efforts.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Manufacturing Facilities | State-of-the-art plants with blast and electric arc furnaces. | Strategically located in Dangjin, Incheon, Pohang for efficient production. |

| Skilled Workforce | Engineers, metallurgists, R&D personnel. | Over 1,000 R&D personnel in 2023, driving innovation. |

| Intellectual Property | Patents for AHSS, proprietary production processes. | Focus on AHSS technologies for automotive lightweighting in 2024. |

| Financial Capital | Strong balance sheet and investment capacity. | Total assets exceeded 30 trillion KRW in Q1 2024, enabling large capital outlays. |

Value Propositions

Hyundai Steel provides a broad selection of top-tier steel products, such as hot-rolled and cold-rolled steel, steel plates, and H-beams, all manufactured to meet rigorous industry specifications. These offerings are built for exceptional performance and dependability in challenging environments.

The company's diverse product lineup is crafted to serve a wide spectrum of industrial sectors, from the automotive industry to construction projects. In 2024, Hyundai Steel reported a significant portion of its revenue derived from its automotive steel segment, highlighting its strength in this area.

Hyundai Steel excels at offering customized steel solutions, especially for the demanding automotive industry. They develop advanced high-strength steel (AHSS) and third-generation steel sheets, crucial for lighter and safer vehicles. In 2024, their focus on these specialized materials directly addresses the automotive sector's drive for fuel efficiency and crashworthiness.

Hyundai Steel champions sustainable steel production, offering carbon-reduced steel plates to meet the increasing market demand for eco-conscious materials. This commitment directly supports customers in achieving their own carbon neutrality objectives.

The company is actively investing in greener production methods, including the implementation of electric arc furnaces and hybrid production systems. These initiatives underscore Hyundai Steel's dedication to minimizing its environmental footprint.

Recognized for its proactive approach to climate change response, Hyundai Steel's sustainability efforts have garnered industry accolades, reinforcing its position as a leader in responsible manufacturing.

Reliable Supply Chain and On-Time Delivery

Hyundai Steel prioritizes a dependable supply chain and consistent on-time delivery, a crucial factor for industrial clients operating with just-in-time inventory systems. This commitment ensures their production lines run smoothly without interruption. For instance, Hyundai Steel's substantial production capacity, reaching approximately 19 million tons of crude steel annually as of recent reports, underpins its ability to meet demand reliably.

The company's expansive global distribution network further bolsters this reliability, guaranteeing product availability across various markets. This logistical strength directly translates to minimized disruptions for customers, fostering stronger, more enduring business relationships built on trust and consistent performance. In 2023, Hyundai Steel reported significant revenue figures, demonstrating its capacity to serve a broad customer base effectively.

- Dependable Production: Extensive capacity ensures consistent product availability.

- Global Reach: A robust distribution network guarantees timely delivery worldwide.

- Customer Focus: Minimizing client disruptions strengthens long-term partnerships.

- Financial Stability: Significant revenue supports operational reliability.

Technical Expertise and Collaborative Development

Hyundai Steel leverages its profound technical expertise to co-create innovative steel solutions with its clients. This deep engagement means working hand-in-hand on everything from initial concept to final application, ensuring optimal material selection and processing.

This collaborative development model is crucial for anticipating evolving industry needs. For instance, in 2024, Hyundai Steel's focus on advanced high-strength steels (AHSS) for the automotive sector saw significant joint development projects aimed at lightweighting vehicles and improving fuel efficiency.

- Customer-Centric Innovation: Hyundai Steel actively partners with customers to refine steel properties and manufacturing processes for specific applications.

- Anticipatory Solutions: The company’s technical teams collaborate with clients to foresee future material requirements and develop solutions proactively.

- Process Optimization: Joint efforts focus on enhancing steel performance through optimized manufacturing and application techniques.

Hyundai Steel delivers a comprehensive range of high-quality steel products, including specialized automotive grades, designed for demanding industrial applications. Their commitment to rigorous quality standards ensures reliability and performance, making them a trusted supplier across various sectors.

The company's value proposition centers on providing tailored steel solutions, particularly advanced high-strength steels (AHSS) crucial for the automotive industry's push towards lighter, safer, and more fuel-efficient vehicles. In 2024, this focus on innovation directly addressed evolving market needs.

Hyundai Steel also strongly emphasizes sustainability, offering carbon-reduced steel products and investing in greener production technologies to support customer environmental goals. This proactive approach to eco-friendly manufacturing positions them as a responsible industry leader.

Furthermore, Hyundai Steel guarantees dependable supply and timely delivery through its substantial production capacity, approximately 19 million tons of crude steel annually, and an extensive global distribution network. This operational excellence minimizes disruptions for clients, fostering robust, long-term partnerships.

| Value Proposition | Description | Key Differentiator | 2024 Focus |

|---|---|---|---|

| High-Quality Steel Products | Broad selection of hot-rolled, cold-rolled steel, plates, and H-beams meeting stringent industry specifications. | Exceptional performance and dependability in challenging environments. | Serving diverse sectors with a significant portion of revenue from automotive steel. |

| Customized Solutions & Innovation | Development of advanced high-strength steel (AHSS) and third-generation steel sheets. | Enabling lighter, safer vehicles and addressing automotive sector efficiency demands. | Joint development projects for lightweighting and improved fuel efficiency. |

| Sustainable Manufacturing | Offering carbon-reduced steel plates and investing in electric arc furnaces and hybrid production systems. | Supporting customer carbon neutrality objectives and minimizing environmental footprint. | Continued investment in greener production methods. |

| Reliable Supply Chain | Substantial production capacity (approx. 19 million tons annually) and a global distribution network. | Ensuring consistent on-time delivery and minimizing client production disruptions. | Maintaining operational reliability to meet broad customer base demand. |

Customer Relationships

Hyundai Steel assigns dedicated account management teams to its major industrial customers, offering tailored service and assistance. These teams serve as the main liaison, ensuring smooth communication and prompt attention to client requirements.

This focused approach cultivates robust and lasting partnerships. For instance, in 2023, Hyundai Steel reported a significant portion of its revenue came from long-term contracts with key automotive and construction clients, underscoring the value of these dedicated relationships.

Hyundai Steel provides robust technical support, working hand-in-hand with clients, especially in the automotive and heavy machinery industries. This collaboration extends to helping customers select the right materials, refine their designs, and overcome any production challenges.

This deep technical partnership ensures that clients can fully leverage the performance and value of Hyundai Steel's advanced steel products. For instance, in 2023, their efforts contributed to a 7% increase in the adoption of their high-strength steel grades by major automotive manufacturers.

Hyundai Steel cultivates long-term strategic partnerships, exemplified by its agreements with major European automakers and parts suppliers for low-carbon steel. These collaborations, often formalized through memorandums of understanding and joint development, go beyond mere sales to encompass shared objectives and joint investments in emerging technologies and market growth.

After-Sales Service and Quality Assurance

Hyundai Steel places significant emphasis on providing comprehensive after-sales service and robust quality assurance. This commitment is crucial for maintaining strong customer relationships, ensuring any product performance issues are swiftly resolved, and upholding consistent quality standards across their offerings. For instance, in 2023, Hyundai Steel reported a customer satisfaction rate of 92% for its after-sales support services, a testament to their dedication.

This focus on quality and service directly translates into enhanced trust and enduring client loyalty. By proactively addressing concerns and consistently delivering on quality promises, Hyundai Steel cultivates a reliable partnership with its customers. The company's investment in advanced inspection technologies, which reduced product defect rates by 15% in 2023 compared to the previous year, underscores this dedication.

- After-Sales Support: Prompt resolution of customer inquiries and technical assistance.

- Quality Assurance: Rigorous testing and inspection throughout the production process.

- Customer Feedback: Mechanisms for gathering and acting upon client input to improve services.

- Product Guarantees: Offering warranties that reinforce confidence in product durability and performance.

Customer Feedback Integration

Hyundai Steel prioritizes customer feedback, actively seeking input to refine its products and services. This commitment is evident in their structured approach to gathering insights, which directly influences innovation and quality enhancements.

In 2024, Hyundai Steel continued its focus on customer-centric development, with feedback mechanisms playing a crucial role. For instance, their dedicated customer support channels and regular client surveys provide valuable data for operational adjustments and new product conceptualization.

- Feedback Channels: Hyundai Steel utilizes online portals, direct sales interactions, and post-purchase surveys to gather customer opinions.

- Product Development Integration: Feedback directly informs modifications to steel grades, surface treatments, and delivery logistics.

- Service Improvement: Customer suggestions help refine technical support, order processing, and after-sales service offerings.

- Market Responsiveness: This continuous loop ensures Hyundai Steel remains agile in meeting evolving industry needs and client expectations.

Hyundai Steel fosters deep relationships through dedicated account management and extensive technical support, ensuring clients maximize the value of their steel products. Their commitment to quality assurance and responsive after-sales service builds significant trust and loyalty.

The company actively integrates customer feedback into product development and service enhancements, demonstrating a strong market responsiveness. In 2023, Hyundai Steel achieved a 92% customer satisfaction rate for after-sales support, alongside a 15% reduction in product defect rates due to advanced inspection technologies.

Strategic partnerships, such as those with European automakers for low-carbon steel, highlight Hyundai Steel's collaborative approach to shared growth and technological advancement.

| Customer Relationship Aspect | Key Activities | Impact/Data (2023/2024) |

|---|---|---|

| Dedicated Account Management | Tailored service, main liaison for major clients | Drives long-term contracts with key automotive and construction clients |

| Technical Support & Collaboration | Assistance with material selection, design refinement, production challenges | Contributed to a 7% increase in high-strength steel adoption by auto manufacturers |

| After-Sales Service & Quality Assurance | Prompt issue resolution, robust quality checks | 92% customer satisfaction rate for after-sales support; 15% reduction in product defect rates |

| Customer Feedback Integration | Gathering input via portals, surveys, direct interaction | Informs operational adjustments and new product conceptualization; crucial for customer-centric development in 2024 |

Channels

Hyundai Steel's direct sales force is a cornerstone of its customer engagement strategy, focusing on building robust relationships with major industrial clients. This team, made up of key account managers and dedicated sales representatives, ensures a deep dive into customer requirements.

This hands-on approach facilitates the creation of tailored steel solutions, crucial for complex, long-term agreements. For instance, in 2024, Hyundai Steel continued to leverage this channel to secure significant supply contracts with leading automotive manufacturers, a sector that relies heavily on specialized steel grades and just-in-time delivery.

Hyundai Steel's global distribution network is a cornerstone of its business model, enabling efficient delivery of steel products across continents. This network comprises strategic partnerships with logistics providers and, in some cases, the operation of overseas processing facilities to better serve international markets.

The company's commitment to a robust supply chain is evident in its continuous expansion. For instance, the establishment of new plants, such as the one in the United States, significantly bolsters its capacity to meet global demand and ensures timely product availability for its diverse clientele.

Hyundai Steel operates dedicated customer service portals and technical hotlines. These channels are designed to provide comprehensive support, address client inquiries promptly, and streamline the order management process. They represent key touchpoints for ensuring customer satisfaction and offering essential technical assistance.

In 2024, Hyundai Steel's commitment to customer accessibility is evident through these platforms. The company aims to enhance responsiveness, ensuring clients can easily access information and resolve issues efficiently. These portals and hotlines are vital for maintaining strong client relationships and facilitating smooth business operations.

Industry Trade Shows and Exhibitions

Hyundai Steel actively participates in key industry trade shows like the International Metalworking Manufacturing and Engineering Exhibition (IMTEX) and the European Association for Cancer Research (EACR) Congress, though the latter is not directly steel-related, demonstrating a broad engagement. These events are crucial for unveiling advancements in high-strength steel for automotive applications and eco-friendly production methods. In 2023, for instance, the global steel industry saw significant investment in R&D, with major players allocating substantial portions of their revenue to innovation, a trend Hyundai Steel aligns with.

These exhibitions are more than just showcases; they are strategic hubs for fostering relationships. Hyundai Steel leverages these platforms to engage with potential clients, reinforcing existing partnerships, and understanding emerging market demands. For example, at recent events, discussions often centered on the increasing need for lightweight, durable steel solutions in electric vehicles, a key growth area for the company. The global steel market size was estimated to be around USD 950 billion in 2023, highlighting the competitive landscape where visibility at these shows is paramount.

- Product and Technology Showcase: Displaying innovations like advanced high-strength steel (AHSS) for automotive lightweighting.

- Customer Engagement: Building and strengthening relationships with existing and prospective clients.

- Market Intelligence: Gathering insights into industry trends, competitor activities, and customer needs.

- Brand Building and Networking: Enhancing brand visibility and fostering connections within the global steel community.

Strategic Alliances and Joint Development Programs

Hyundai Steel leverages strategic alliances, notably with its parent Hyundai Motor Group and major automakers like General Motors, to integrate its advanced steel products directly into the design phase of new vehicle platforms. This proactive engagement ensures its materials are specified from the outset, fostering deep customer relationships and securing substantial, long-term supply contracts. For instance, collaborations on electric vehicle (EV) platforms are critical, as the demand for lightweight, high-strength steels in EVs continues to surge.

These partnerships are instrumental in driving innovation and market penetration. By working closely with automotive giants, Hyundai Steel gains invaluable insights into future material requirements, allowing for tailored product development. This collaborative approach not only streamlines the supply chain but also solidifies Hyundai Steel's position as a preferred supplier, especially in high-growth segments like electric mobility. In 2024, the automotive industry's focus on sustainability and lightweighting further amplified the importance of these strategic material collaborations.

The benefits extend to joint development programs, where shared R&D efforts can accelerate the creation of next-generation steel solutions. This synergy allows Hyundai Steel to align its production capabilities with the evolving needs of the global automotive market, ensuring a competitive edge. Such alliances are crucial for navigating the complexities of the modern automotive supply chain, where early material specification is paramount.

- Strategic Integration: Alliances with Hyundai Motor Group and General Motors embed Hyundai Steel's materials into future vehicle designs.

- Market Penetration: Co-development programs facilitate entry into new vehicle platforms and secure large-volume orders.

- Innovation Driver: Direct customer collaboration fuels the development of advanced steel solutions tailored for emerging automotive trends, such as EV lightweighting.

- Supply Chain Efficiency: Early material specification through partnerships streamlines the supply process and strengthens customer relationships.

Hyundai Steel utilizes a multi-faceted channel strategy, blending direct sales with a robust global distribution network. This approach ensures efficient product delivery and deep engagement with key industrial clients, particularly in the automotive sector. The company also leverages digital platforms and industry events to enhance customer accessibility and market intelligence.

These channels are critical for Hyundai Steel's market presence and customer relationship management. For instance, in 2024, the company's direct sales force secured substantial contracts with automotive manufacturers by offering tailored steel solutions. Simultaneously, its global distribution network, bolstered by investments in overseas facilities, ensured timely supply to international markets, supporting a global steel market valued at approximately USD 950 billion in 2023.

| Channel | Description | Key Activities | 2024 Focus/Impact |

|---|---|---|---|

| Direct Sales Force | Dedicated team for major industrial clients | Relationship building, tailored solutions | Securing long-term automotive contracts |

| Global Distribution Network | Logistics partnerships and overseas facilities | Efficient delivery, market access | Expanding capacity to meet global demand |

| Customer Service Portals/Hotlines | Digital and phone support | Inquiry resolution, order management | Enhancing responsiveness and client satisfaction |

| Industry Trade Shows | Participation in global exhibitions | Product showcase, networking, market intelligence | Highlighting AHSS and eco-friendly production |

| Strategic Alliances | Partnerships with automakers (e.g., GM) | Co-development, early material specification | Driving innovation in EV lightweighting |

Customer Segments

Hyundai Steel serves a broad spectrum of automotive manufacturers, encompassing both its affiliated companies, Hyundai Motor and Kia, and major global players like Volkswagen, Stellantis, BMW, and General Motors. The company supplies essential steel products, including advanced high-strength steel (AHSS) and increasingly, carbon-reduced steel plates, crucial for vehicle body structures and various components.

A key strategic objective for Hyundai Steel is to expand its market share among non-captive foreign automakers. This focus reflects the growing demand for specialized steel solutions that enhance vehicle safety and fuel efficiency, with the global automotive industry's steel consumption projected to remain robust in the coming years.

Hyundai Steel is a key supplier for construction companies, providing essential steel plates and H-beams crucial for building everything from towering skyscrapers and sprawling infrastructure projects to homes. These companies depend on Hyundai Steel for materials that ensure structural soundness and longevity in their developments. Despite some market fluctuations, the construction sector continues to be a significant driver for Hyundai Steel's long product sales, underscoring its importance to the industry.

Major shipyards, including global giants like Hyundai Heavy Industries and Samsung Heavy Industries, are central to Hyundai Steel's customer base. These shipbuilders rely heavily on Hyundai Steel's high-strength steel plates for constructing a wide array of vessels, from massive container ships to specialized offshore structures. The demand from this segment is directly tied to global trade volumes and energy exploration activities.

The structural integrity and safety of these marine vessels are paramount, making the quality and precise specifications of Hyundai Steel's heavy plates non-negotiable. In 2023, global shipbuilding orders reached approximately 35 million compensated gross tons (CGT), indicating robust activity and a sustained need for advanced steel materials.

This sector specifically requires materials that can withstand harsh marine environments and immense structural stress. Hyundai Steel's ability to consistently deliver high-performance, certified steel plates ensures its critical role in supporting the operational efficiency and safety standards demanded by the shipbuilding industry.

Heavy Machinery Producers

Heavy machinery producers are a key customer base for Hyundai Steel. These manufacturers, creating everything from excavators to industrial cranes, rely on steel that can withstand intense use and demanding environments. Hyundai Steel's ability to supply specialized, high-strength steel products is crucial for meeting the rigorous specifications of this sector.

In 2024, the global construction equipment market was valued at approximately $200 billion, with a projected compound annual growth rate of around 4.5% through 2030. This growth directly translates to increased demand for robust steel components.

- Demand for Durability: Heavy machinery requires steel with excellent tensile strength and wear resistance to ensure longevity and operational reliability.

- Specialized Steel Grades: Hyundai Steel offers various steel grades, including high-tensile steel and abrasion-resistant plates, tailored for the construction of heavy equipment.

- Market Growth Impact: The expanding infrastructure projects worldwide, particularly in emerging economies, are a significant driver for this customer segment's demand.

- Supplier Reliability: Consistent quality and timely delivery of steel are paramount for these manufacturers to maintain their production schedules.

Energy Sector Companies

Hyundai Steel is actively expanding its reach into the energy sector, with a particular emphasis on supporting the growth of offshore wind power and other renewable energy infrastructure. This strategic pivot recognizes the increasing demand for high-performance steel solutions in building the foundations, towers, and other critical components for these sustainable energy projects.

The company's commitment to developing and supplying specialized steel products tailored for the demanding environments of offshore installations is a key differentiator. For instance, the need for robust, corrosion-resistant steel in offshore wind turbine foundations is paramount, and Hyundai Steel is positioning itself to meet these stringent requirements. In 2023, global investment in offshore wind alone reached approximately $80 billion, highlighting the significant market opportunity.

- Targeting offshore wind: Supplying specialized steel for foundations, towers, and subsea structures.

- Renewable infrastructure focus: Providing steel for solar farm components, hydrogen production facilities, and energy storage systems.

- Sustainable production alignment: Meeting the energy sector's growing demand for eco-friendly materials and processes.

- Market growth: Capitalizing on the projected expansion of the global renewable energy market, which is expected to see substantial growth through 2030 and beyond.

Hyundai Steel's customer base is diverse, spanning automotive giants like Volkswagen and GM, construction firms, major shipyards, and heavy machinery producers. The company also actively targets the burgeoning energy sector, particularly offshore wind power. This broad reach is supported by the delivery of specialized steel products, including advanced high-strength steel and carbon-reduced plates, crucial for safety, efficiency, and durability across these varied industries.

| Customer Segment | Key Products Supplied | 2023/2024 Data Point |

|---|---|---|

| Automotive | Advanced High-Strength Steel (AHSS), Carbon-Reduced Steel Plates | Global automotive steel consumption remains robust. |

| Construction | Steel Plates, H-beams | Construction sector is a significant driver for long product sales. |

| Shipbuilding | High-Strength Steel Plates | Global shipbuilding orders reached ~35 million CGT in 2023. |

| Heavy Machinery | High-Tensile Steel, Abrasion-Resistant Plates | Global construction equipment market valued at ~$200 billion in 2024. |

| Energy (Renewables) | Specialized Steel for Offshore Wind Foundations and Towers | Global investment in offshore wind reached ~$80 billion in 2023. |

Cost Structure

Raw material procurement is a significant expense for Hyundai Steel, with iron ore, coking coal, and scrap metal forming the bulk of these costs. In 2023, global commodity prices saw considerable volatility, directly influencing Hyundai Steel's input expenses. Effective purchasing and hedging are therefore paramount to controlling these fluctuating costs and safeguarding profitability.

Operating massive steel plants, like those run by Hyundai Steel, inherently demands a huge amount of energy, making energy consumption a significant chunk of their expenses. This covers everything from the electricity powering their electric arc furnaces to the natural gas fueling their blast furnaces.

In 2023, the global steel industry saw energy costs fluctuate, with electricity prices in many regions seeing increases due to supply chain pressures and geopolitical events. For companies like Hyundai Steel, managing these volatile energy expenses is crucial for maintaining profitability and competitive pricing.

Hyundai Steel is actively pursuing strategies to tackle these costs head-on. This includes investing in energy-efficient technologies to reduce overall consumption and exploring a transition to renewable energy sources. These moves are not only aimed at cost mitigation but are also vital steps towards their goal of achieving carbon neutrality in their operations.

Labor costs are a significant component of Hyundai Steel's expenses. This includes wages, comprehensive benefits packages, and ongoing training for its extensive workforce, which spans production line workers, skilled engineers, and essential administrative staff across its numerous facilities and research divisions.

In 2023, Hyundai Steel's total employee-related expenses, encompassing salaries, wages, and benefits, represented a substantial portion of its operating costs, reflecting the large scale of its manufacturing operations. For instance, the company's commitment to employee development through training programs is crucial for maintaining operational efficiency and fostering innovation within its engineering and R&D departments.

Capital Expenditure (CapEx)

Hyundai Steel's cost structure heavily relies on significant capital expenditure (CapEx) for its manufacturing operations. This involves substantial investments in maintaining, upgrading, and expanding its production facilities, machinery, and technological capabilities. For example, the company has committed to substantial investments in areas like new electric arc furnace (EAF) facilities and advanced research and development infrastructure to stay competitive and grow capacity.

These strategic investments are vital for Hyundai Steel's long-term viability and market position. A notable instance of this is the planned $5.8 billion investment in a new US plant, underscoring the scale of CapEx required to bolster its global manufacturing footprint and meet growing demand.

- Maintenance and Upgrades: Ongoing costs for keeping existing plants and machinery in optimal condition.

- Expansion Projects: Investments in new facilities, like electric arc furnaces, to increase production capacity.

- Technology Advancement: Spending on R&D and new technologies to improve efficiency and product offerings.

- Strategic Investments: Large-scale projects, such as the $5.8 billion US plant, to enhance global competitiveness.

Research and Development (R&D) Expenses

Hyundai Steel dedicates significant resources to Research and Development (R&D), a critical component of its cost structure. These investments are channeled into advancing material science, refining manufacturing processes, and pioneering sustainable steel technologies. For example, in 2023, Hyundai Steel announced plans to invest approximately 1 trillion Korean Won (KRW) in eco-friendly technologies, a substantial portion of which would be allocated to R&D for carbon reduction and hydrogen-based steelmaking.

- Material Science Advancement: Costs include experimentation with new alloys and advanced steel grades to enhance performance and durability.

- Process Innovation: Funding is allocated to developing more efficient and environmentally friendly production methods, such as those for hydrogen direct reduction.

- Sustainable Technologies: Investments support research into carbon capture, utilization, and storage (CCUS) and the development of green hydrogen production.

- New Product Development: R&D expenditure drives the creation of next-generation steel products tailored for emerging industries like electric vehicles and renewable energy infrastructure.

Hyundai Steel's cost structure is dominated by raw material procurement, energy consumption, and substantial capital expenditures for plant maintenance and expansion. In 2023, volatile commodity prices and rising energy costs significantly impacted their input expenses, making efficient purchasing and energy management critical for profitability. The company's commitment to R&D, particularly in sustainable technologies, also represents a significant investment.

| Cost Category | Key Components | 2023 Impact/Focus |

|---|---|---|

| Raw Materials | Iron ore, coking coal, scrap metal | Volatility in global commodity prices increased input expenses. |

| Energy Consumption | Electricity, natural gas for furnaces | Rising energy costs due to supply chain and geopolitical factors. |

| Capital Expenditure (CapEx) | Plant maintenance, upgrades, new facilities (e.g., US plant) | Significant investments like the $5.8 billion US plant to expand global footprint. |

| Research & Development (R&D) | Material science, process innovation, sustainable tech | Approx. 1 trillion KRW investment planned for eco-friendly technologies. |

Revenue Streams

Revenue streams are primarily built upon the sale of hot-rolled steel products, a core offering for Hyundai Steel. These products, including coils and sheets, are essential raw materials for a wide array of industries such as construction, automotive, and shipbuilding.

In 2024, Hyundai Steel reported significant revenue from its steel segment, with hot-rolled products forming a substantial portion. For instance, the company's overall steel sales in the first half of 2024 demonstrated robust demand, reflecting the critical role of these foundational materials in global manufacturing and infrastructure development.

The sale of cold-rolled steel products represents a significant revenue source for Hyundai Steel, capitalizing on the material's superior finish and precise dimensions. This segment is particularly vital for industries requiring high-quality inputs, such as automotive manufacturing, home appliance production, and intricate precision engineering. In 2023, Hyundai Steel reported that its automotive sector accounted for a substantial portion of its overall steel sales, underscoring the demand for specialized cold-rolled steel in this area.

Hyundai Steel generates revenue primarily through the sale of heavy steel plates and coils. These are essential materials for industries like shipbuilding, construction, and heavy machinery manufacturing. The demand for these products is closely tied to the activity levels in these large-scale industrial sectors.

The company often fulfills custom orders, tailoring steel plate and coil specifications to meet the precise needs of individual projects. This customization means revenue can fluctuate based on the volume and complexity of specific client requirements.

In 2024, the global steel market experienced a notable recovery, with demand from infrastructure and automotive sectors driving growth. For instance, Hyundai Steel reported a significant increase in its order book for shipbuilding plates, a direct reflection of the robust activity in that industry during the year.

Sales of H-Beams and Structural Steel

The sale of H-beams and other structural steel products forms a core revenue stream for Hyundai Steel. These are fundamental materials for construction, providing the backbone for buildings and infrastructure projects. The demand for these products is closely tied to the performance of the construction industry.

In 2024, the global construction market showed resilience, with significant infrastructure spending in various regions. Hyundai Steel's structural steel sales directly benefit from this activity. For instance, major infrastructure projects, like the expansion of transportation networks or new commercial developments, require substantial quantities of these steel products.

- Primary Revenue Source: Sales of H-beams and structural steel for construction and civil engineering.

- Market Driver: Directly influenced by the health and activity levels of the global construction sector.

- 2024 Performance Indicator: Strong infrastructure investment in key markets supports consistent demand for structural steel.

- Product Importance: Essential for creating robust frameworks and supporting structures in diverse building projects.

Revenue from Resource Recycling and Energy Solutions

Hyundai Steel diversifies its income beyond core steel manufacturing by engaging in resource recycling and energy solutions. This segment focuses on processing and selling recycled materials, contributing to environmental sustainability and generating additional revenue. For instance, in 2023, Hyundai Steel's efforts in resource circulation, including the sale of by-products and recycled materials, played a role in enhancing its operational efficiency and financial results.

The company's commitment to a circular economy is evident in its resource recycling activities. These operations not only reduce waste but also create value by transforming by-products into saleable commodities. This strategic approach to resource management is a key component of Hyundai Steel's long-term vision for sustainable growth and financial resilience.

Hyundai Steel's energy solutions also represent a growing revenue stream. This can include the generation and sale of energy from its manufacturing processes, often utilizing waste heat or by-product gases. This integration of energy management into its business model supports its environmental goals while creating new avenues for profit.

Key aspects of these revenue streams include:

- Sale of recycled materials: Processing and selling ferrous and non-ferrous scrap metals and other industrial by-products.

- Energy generation and sales: Utilizing waste heat and gases from steelmaking processes to produce and sell electricity or steam.

- Environmental services: Potentially offering waste management and recycling services to other industries.

- Contribution to sustainability targets: Aligning financial performance with environmental, social, and governance (ESG) objectives.

Hyundai Steel's revenue streams are predominantly anchored in the sale of various steel products, including hot-rolled, cold-rolled, and heavy steel plates and coils. These materials are fundamental to numerous sectors, such as automotive, construction, and shipbuilding, with the company's 2024 performance reflecting strong demand across these industries. For example, Hyundai Steel's sales of automotive-grade steel in the first half of 2024 saw a notable increase, driven by global production recovery.

Additionally, the company generates income from structural steel products like H-beams, crucial for infrastructure development, and from resource recycling and energy solutions. These diversified streams, including the sale of recycled by-products and energy generated from waste heat, contribute to both financial resilience and sustainability. In 2023, Hyundai Steel reported that its recycling operations, which convert industrial by-products into saleable materials, significantly boosted operational efficiency.

| Revenue Stream | Key Products/Services | Primary Industries Served | 2024 Market Trend Impact |

|---|---|---|---|

| Steel Product Sales | Hot-rolled coils/sheets, Cold-rolled steel, Heavy steel plates/coils | Automotive, Construction, Shipbuilding, Home Appliances | Strong demand due to global manufacturing and infrastructure recovery. |

| Structural Steel | H-beams, other structural steel products | Construction, Civil Engineering | Benefited from increased infrastructure spending and construction activity. |

| Resource Recycling & Energy | Recycled materials, By-products, Generated electricity/steam | Various industries (as suppliers), Internal operations | Enhanced operational efficiency and contributed to ESG goals. |

Business Model Canvas Data Sources

The Hyundai Steel Business Model Canvas is built upon a foundation of comprehensive market research, internal financial reports, and competitor analysis. These diverse data sources ensure that each component of the canvas accurately reflects the company's strategic positioning and operational realities.