Hyundai Steel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

Hyundai Steel operates within a highly competitive steel industry, where buyer bargaining power is a significant force due to the commoditized nature of many steel products. Understanding the intensity of this and other forces is crucial for strategic planning.

The complete report reveals the real forces shaping Hyundai Steel’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hyundai Steel's dependence on essential raw materials like iron ore, coking coal, and scrap metal significantly influences supplier power. The global market for these commodities is often dominated by a limited number of major mining companies, which naturally grants them considerable bargaining leverage over steel manufacturers like Hyundai Steel.

This concentration means suppliers can dictate terms, and price volatility directly impacts Hyundai Steel's cost structure and overall profitability. For instance, in early 2024, iron ore prices saw considerable fluctuations, with benchmarks like the Singapore iron ore futures trading around $100-$130 per ton, directly affecting production expenses for steelmakers.

Energy costs, especially electricity and natural gas, represent a significant portion of Hyundai Steel's production expenses, particularly for its electric arc furnace operations. The fluctuating nature of global energy markets, coupled with a concentrated supplier base for certain energy sources, amplifies the bargaining power of these suppliers.

This dynamic necessitates that Hyundai Steel actively manages its energy sourcing strategies and investigates renewable energy solutions to mitigate the impact of price swings. For instance, in 2023, global natural gas prices experienced considerable volatility, impacting energy-intensive industries like steel manufacturing.

Technology and equipment providers hold considerable sway in the steel industry, as Hyundai Steel relies on specialized machinery, advanced automation, and proprietary technologies for efficient production. These suppliers, offering unique and high-value capital goods, often command strong bargaining power due to the significant costs and complexities associated with switching to alternative providers.

For instance, the global market for advanced steelmaking equipment, including electric arc furnaces and continuous casting machines, is often dominated by a few key players. These companies can leverage their technological expertise and the critical nature of their offerings to influence pricing and terms. Hyundai Steel's need for cutting-edge solutions means maintaining robust partnerships with these essential technology suppliers is paramount to ensuring operational continuity and competitiveness.

Logistics and Transportation

The bargaining power of suppliers in the logistics and transportation sector significantly impacts Hyundai Steel. Efficient movement of raw materials like iron ore and coal to its plants, and finished steel products to customers globally, is crucial for its operations. When transportation routes are constrained or shipping capacity is limited, logistics providers can command higher prices, directly affecting Hyundai Steel's cost structure. For instance, in 2024, global shipping rates saw fluctuations due to geopolitical events and increased demand for raw materials, potentially increasing these costs for steel producers.

Hyundai Steel's reliance on a vast and complex supply chain necessitates strong relationships with logistics partners. The company must actively manage these relationships to mitigate the suppliers' power. This involves securing long-term contracts and exploring diverse transportation options to ensure supply chain resilience. The ability of logistics firms to charge premium rates can be amplified by factors such as a shortage of specialized vessels or port congestion, which were observed in various regions throughout 2024, impacting the cost and timeliness of deliveries.

- Logistics costs represent a significant portion of Hyundai Steel's operational expenses, directly influenced by supplier power.

- In 2024, disruptions in global supply chains, including port congestion and container shortages, gave logistics providers increased leverage.

- Hyundai Steel's strategy involves diversifying its logistics network to reduce dependence on any single provider or route.

- The company's ability to negotiate favorable terms with shipping companies is critical for managing its cost of goods sold.

Environmental Compliance Inputs

As environmental regulations become more stringent, suppliers of pollution control technologies and specialized waste management services are gaining significant leverage. Hyundai Steel's increasing focus on sustainable production means a greater dependence on these providers, who possess unique expertise and often have few direct competitors.

For instance, the global environmental services market, which includes waste management and pollution control, was projected to reach over $1.5 trillion by 2024. This growth underscores the expanding importance of suppliers in this sector. Hyundai Steel's investments in carbon capture and utilization (CCU) technologies also highlight a reliance on specialized suppliers, whose proprietary solutions can command higher prices and terms.

- Increased Demand for Green Technologies: Suppliers offering solutions for emissions reduction and waste treatment are in higher demand.

- Specialized Knowledge: The technical expertise required for environmental compliance creates a barrier to entry for new suppliers, strengthening the position of existing ones.

- Regulatory Compliance Costs: Hyundai Steel's need to meet evolving environmental standards, such as those related to CO2 emissions, directly impacts its reliance on suppliers capable of providing compliant inputs.

- Limited Alternatives: For highly specific environmental solutions, the number of qualified suppliers may be limited, giving them greater bargaining power.

Hyundai Steel faces significant supplier power from providers of essential raw materials like iron ore and coking coal, as the market is often concentrated among a few major global players. This concentration allows suppliers to influence pricing and terms, directly impacting Hyundai Steel's production costs. For example, in 2024, iron ore prices remained a key factor, with benchmarks fluctuating, underscoring the suppliers' leverage.

Energy suppliers, particularly for electricity and natural gas, also wield considerable power due to market concentration and price volatility. Hyundai Steel's reliance on these energy sources for its operations means it must actively manage sourcing to mitigate cost impacts. The company's efforts to integrate renewable energy solutions are a direct response to this supplier influence.

Technology and equipment providers, offering specialized and critical machinery, command strong bargaining power due to the high switching costs and the proprietary nature of their offerings. Similarly, logistics and transportation providers can exert influence, especially during periods of supply chain disruption or capacity constraints, as seen with global shipping rates in 2024.

| Supplier Category | Key Factors Influencing Power | Impact on Hyundai Steel | 2024 Data/Trend Example |

| Raw Materials (Iron Ore, Coal) | Market concentration, global demand | Cost of goods sold, production margins | Iron ore prices trading between $100-$130/ton (benchmark futures) |

| Energy (Electricity, Natural Gas) | Market concentration, geopolitical factors | Operational expenses, profitability | Volatility in global natural gas prices affecting energy-intensive industries |

| Technology & Equipment | Proprietary technology, high switching costs | Capital expenditure, operational efficiency | Dominance of a few key players in advanced steelmaking equipment market |

| Logistics & Transportation | Shipping capacity, port congestion, geopolitical events | Supply chain costs, delivery times | Fluctuations in global shipping rates due to increased demand and disruptions |

What is included in the product

This analysis examines the competitive intensity, buyer and supplier power, threat of new entrants and substitutes impacting Hyundai Steel, providing insights into its market position and strategic considerations.

Instantly visualize competitive pressures on Hyundai Steel, allowing for swift identification of threats and opportunities to mitigate market volatility.

Customers Bargaining Power

Hyundai Steel's key customers, including major automotive makers like Hyundai Motor Group, large construction firms, and shipbuilding companies, are typically significant and concentrated buyers. These entities procure steel in massive volumes, granting them considerable influence in negotiating pricing, delivery schedules, and product standards. This concentration often fuels aggressive price competition within the industry.

For many standard steel products, differentiation is low, making price a critical factor for customers. Industries like construction and shipbuilding often view steel as a commodity, increasing their price sensitivity. This forces Hyundai Steel to maintain competitive pricing and operational efficiency to secure large orders.

For many of Hyundai Steel's products, especially more common steel types, customers face minimal barriers when switching suppliers. This ease of switching means buyers can readily compare prices and terms from various steel producers, putting them in a stronger negotiating position.

While certain specialized steel grades, like those requiring specific automotive certifications or intricate integration into a buyer's manufacturing process, can present higher switching costs, the broader market for generic steel products allows customers significant flexibility. This flexibility directly translates to increased bargaining power for buyers seeking favorable pricing and terms.

Backward Integration Potential

The potential for backward integration by large customers, especially those in the automotive and construction industries, significantly bolsters their bargaining power against steel producers like Hyundai Steel. These major buyers, with substantial financial resources, could explore establishing their own steelmaking facilities or forging deep, long-term supply contracts with several steel manufacturers to mitigate supply chain risks and secure favorable pricing.

This threat, though not always realized, exerts considerable influence. For instance, major automotive manufacturers often have the scale to negotiate aggressively. In 2024, the automotive sector, a key consumer of steel, continued to face production fluctuations, making stable and cost-effective steel sourcing a critical strategic imperative.

- Customer Scale: Large automotive and construction firms operate at a scale that makes backward integration economically feasible.

- Financial Capacity: These industries often possess the capital required to invest in steel production capabilities.

- Supply Chain Control: Diversifying raw material sourcing, including steel, is a common strategy for large manufacturers to enhance control and reduce vulnerability.

- Negotiating Leverage: The mere possibility of backward integration empowers customers to demand better terms and pricing from existing suppliers.

Global Sourcing Options

Many of Hyundai Steel's significant customers are multinational corporations with extensive global operations. This allows them to procure steel from a wide array of international suppliers, significantly broadening their sourcing options.

The presence of numerous global suppliers, particularly those located in regions with lower manufacturing costs, empowers these customers. They can leverage this availability to negotiate for more competitive pricing and more favorable contract terms, directly impacting Hyundai Steel's pricing power.

Hyundai Steel must consistently benchmark its offerings against global competitors to remain attractive to these sophisticated buyers. For instance, in 2024, the average price of hot-rolled coil steel on the global market fluctuated, with certain Asian producers offering prices that put pressure on established players.

- Global Customer Base: Major automotive manufacturers and construction firms, key Hyundai Steel clients, source materials worldwide.

- Supplier Diversity: Access to steel from countries like China, India, and Brazil offers customers alternatives.

- Price Sensitivity: Customers can switch suppliers if Hyundai Steel's pricing is not competitive with global benchmarks.

- Negotiating Leverage: The ability to source globally gives customers significant power to demand better terms and conditions.

The bargaining power of Hyundai Steel's customers remains substantial, driven by their significant purchasing volume and the commodity nature of many steel products. This allows them to exert considerable pressure on pricing and terms, especially when switching suppliers is easy.

Major buyers, particularly in the automotive and construction sectors, can leverage their scale and financial capacity to explore backward integration, further enhancing their negotiating position. The global availability of steel also means customers can readily compare prices and seek more competitive offers.

In 2024, fluctuations in global steel prices, influenced by factors like production costs in emerging economies, continued to empower customers to demand better terms from suppliers like Hyundai Steel.

| Factor | Impact on Hyundai Steel | Customer Leverage |

| Customer Concentration & Volume | High dependency on large buyers | Ability to negotiate volume discounts and favorable terms |

| Product Standardization | Low differentiation for many steel types | Price becomes the primary competitive factor |

| Switching Costs | Low for standard steel products | Customers can easily shift to competitors |

| Backward Integration Threat | Potential for major customers to produce steel internally | Customers can demand better pricing or risk losing business |

| Global Sourcing Options | Access to a wide array of international suppliers | Customers can leverage global price differences |

Preview Before You Purchase

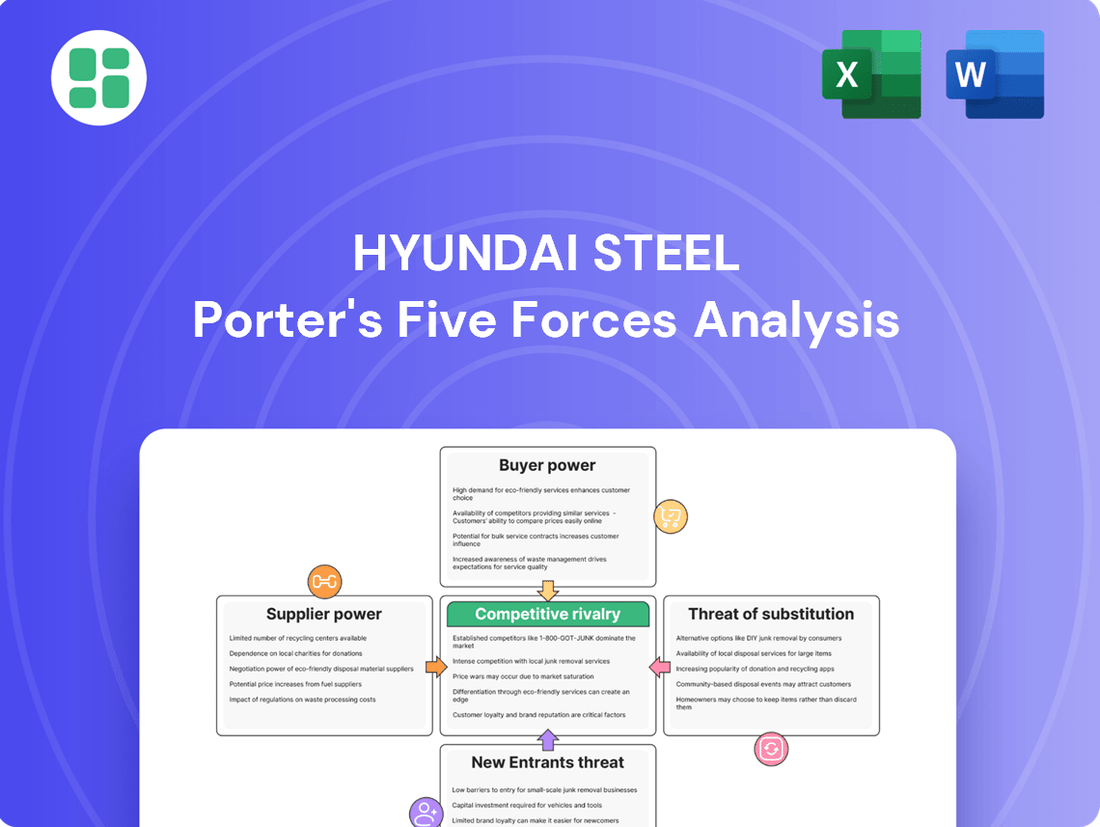

Hyundai Steel Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Hyundai Steel, detailing the competitive landscape and strategic implications for the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and substitute products. Rest assured, there are no placeholders or mockups; what you preview is precisely what you'll be able to download and utilize for your strategic planning.

Rivalry Among Competitors

The steel industry, including players like Hyundai Steel, operates with substantial fixed costs due to massive investments in infrastructure like blast furnaces and rolling mills. These capital-intensive assets require high operating rates to spread costs and achieve profitability. For instance, major steel producers often aim for capacity utilization rates exceeding 80% to break even.

This pressure to maintain high capacity utilization can significantly fuel competitive rivalry. When demand softens, as seen during economic slowdowns, steel companies might engage in price competition to keep their plants running and cover these considerable fixed expenses. This can lead to a situation where even unprofitable sales are preferable to idle capacity, intensifying price wars among competitors.

The global steel industry is often characterized by a persistent oversupply, with major producers like China contributing significantly to this imbalance. This excess capacity fuels intense price competition among international players, putting pressure on profit margins for companies like Hyundai Steel. For instance, in 2023, global crude steel production reached an estimated 1.88 billion tonnes, a slight increase from the previous year, underscoring the ongoing supply dynamics.

Trade barriers, including tariffs and anti-dumping duties, further complicate the competitive landscape. These measures, implemented by various countries to protect domestic industries, can disrupt global trade flows and create regional market advantages or disadvantages. Such policies can lead to retaliatory actions, intensifying rivalry and forcing companies to navigate complex and often volatile international trade regulations.

While Hyundai Steel, like other major players, can differentiate through specialized products, a substantial segment of the steel market operates with commodity-grade materials. This inherent characteristic means competition often hinges on factors beyond just product features, such as competitive pricing, reliable delivery schedules, and superior customer service. For instance, the global steel market, valued at approximately $900 billion in 2023, sees significant price sensitivity in its bulk segments.

Numerous Competitors and Market Share Focus

Hyundai Steel faces fierce competition from major global players like POSCO, Nippon Steel, Baosteel, and ArcelorMittal. This crowded landscape intensifies the battle for market share, particularly within lucrative sectors such as automotive and construction.

The drive to capture and maintain market share often results in aggressive pricing strategies, extensive promotional campaigns, and the formation of strategic partnerships. For instance, in 2023, the global steel market saw significant price fluctuations driven by supply-demand dynamics and geopolitical events, impacting competitive positioning.

- Key Competitors: POSCO, Nippon Steel, Baosteel, ArcelorMittal

- Key Customer Segments: Automotive, Construction

- Competitive Tactics: Aggressive pricing, promotions, strategic alliances

- Market Dynamics: Intense focus on market share acquisition

Exit Barriers and Industry Consolidation

The steel industry is characterized by substantial exit barriers, largely due to high fixed costs associated with massive production facilities and specialized equipment. These sunk costs make it incredibly difficult for companies to cease operations without incurring significant financial losses. For instance, building a new integrated steel mill can cost billions of dollars, and these investments are not easily repurposed.

Furthermore, social considerations, such as the impact on employment in regions heavily reliant on steel production, can act as a powerful deterrent to closure. Even when facing profitability challenges, companies may continue to operate to mitigate widespread job losses. This persistence of less efficient players contributes to industry overcapacity and intensifies the competitive rivalry among all participants.

While the global steel industry has undergone periods of consolidation, with major players acquiring smaller or struggling entities, the competitive landscape remains fierce. For example, by the end of 2023, the top 10 global steel producers accounted for approximately 35% of global crude steel output, indicating that while consolidation has occurred, a significant number of large, competitive firms still exist, driving ongoing rivalry.

- High Fixed Costs: Steel production involves massive capital investments in plant and machinery, making it expensive to exit.

- Specialized Assets: Steelmaking equipment is highly specialized and has limited alternative uses, increasing exit costs.

- Social and Employment Factors: Local communities often depend on steel mills for employment, creating pressure against closures.

- Continued Rivalry: Despite consolidation, the remaining large players fiercely compete, often leading to price wars and overcapacity.

Competitive rivalry within the steel sector, impacting Hyundai Steel, is intense due to high fixed costs and persistent oversupply. Companies strive for high capacity utilization, often leading to price wars when demand falters. For instance, in 2023, global crude steel production neared 1.88 billion tonnes, highlighting the scale of output and potential for excess capacity.

Major global players like POSCO, Nippon Steel, Baosteel, and ArcelorMittal vigorously compete for market share, particularly in key segments like automotive and construction. This rivalry manifests through aggressive pricing, extensive promotions, and strategic alliances, as seen in the market's reaction to supply-demand shifts and geopolitical events throughout 2023.

The steel industry also faces high exit barriers, with significant investments in specialized, capital-intensive facilities making it difficult for firms to withdraw, even during downturns. This persistence of players, coupled with social considerations like employment, contributes to ongoing overcapacity and fuels the fierce competition that characterizes the market.

| Metric | Value (Approx. 2023) | Impact on Rivalry |

|---|---|---|

| Global Crude Steel Production | 1.88 billion tonnes | Contributes to oversupply and price pressure. |

| Key Competitors | POSCO, Nippon Steel, Baosteel, ArcelorMittal | Intensifies competition for market share. |

| Key Customer Segments | Automotive, Construction | Highlights critical battlegrounds for sales. |

| Exit Barriers | High (due to capital-intensive assets) | Keeps firms operating, sustaining rivalry. |

SSubstitutes Threaten

Aluminum's growing adoption in the automotive sector, driven by its lighter weight for better fuel efficiency and reduced emissions, presents a substantial threat. For instance, by 2024, the average weight of vehicles is expected to continue its downward trend, with aluminum components playing a key role in achieving these targets.

Similarly, in construction, aluminum's use in facades, window frames, and select structural applications due to its weight and corrosion resistance directly challenges steel's traditional dominance. This substitution trend directly impacts Hyundai Steel's potential market share in these vital industries.

The rise of advanced composites and plastics presents a significant threat of substitution for traditional steel products. Materials like carbon fiber reinforced polymers (CFRPs) offer exceptional strength-to-weight ratios, making them increasingly attractive in sectors like automotive and aerospace where weight reduction is paramount. For instance, the automotive industry's push for fuel efficiency and electric vehicle range enhancement is driving adoption of these lighter materials; by 2024, the global advanced composites market is projected to reach over $20 billion, indicating a growing competitive landscape for steel.

Engineered timber products, such as cross-laminated timber (CLT) and glulam, are increasingly seen as viable substitutes for steel in certain construction segments, particularly residential and some commercial projects. This shift is fueled by growing environmental consciousness and a desire for sustainable building materials. The global engineered wood market was valued at approximately USD 15.5 billion in 2023 and is projected to grow significantly, indicating a tangible threat to traditional steel demand in these applications.

Concrete and Other Traditional Materials

Concrete continues to be a significant threat of substitute for steel, especially in construction projects where it's commonly used for foundations, floors, and various structural elements. Its widespread availability and established use make it a persistent competitor.

Advancements in concrete technology are enhancing its capabilities. For instance, ultra-high-performance concrete (UHPC) offers superior strength and durability, potentially allowing it to replace steel in more demanding applications where steel traditionally held an advantage.

- Construction Sector Dominance: In 2023, the global concrete market was valued at approximately $380 billion, highlighting its substantial presence in the construction industry, a key market for steel.

- Material Cost Comparison: While prices fluctuate, the base cost of concrete materials often remains lower than that of steel, making it an attractive option for cost-sensitive projects.

- Innovation in Composites: The development of fiber-reinforced polymers (FRPs) as concrete reinforcement also presents a substitute threat to traditional steel rebar.

Recycled Materials and Circular Economy

The growing movement towards a circular economy presents a significant threat of substitution for primary steel producers like Hyundai Steel. As industries increasingly prioritize material reuse and extend product lifecycles, the demand for newly manufactured steel from virgin resources could diminish. For example, by 2024, the global market for recycled steel is projected to reach hundreds of billions of dollars, indicating a substantial shift away from primary material sourcing.

While Hyundai Steel actively participates in steel recycling through its subsidiary, Hyundai Steel Recycling, the broader market trend itself poses a challenge. This trend means that even as Hyundai Steel recycles, the overall demand for its primary steel products could be indirectly impacted by the increased availability and preference for recycled content across various manufacturing sectors. This could lead to a gradual reduction in the need for new steel production from iron ore and coal.

- Circular Economy Growth: The global circular economy market is expanding rapidly, with projections indicating significant growth by 2024, potentially impacting demand for virgin materials.

- Recycled Steel Market: The market for recycled steel is a substantial and growing segment, offering a direct substitute for newly produced steel.

- Extended Product Lifecycles: Initiatives promoting longer product lifespans reduce the frequency of replacement, thereby lowering the overall demand for new steel inputs.

- Hyundai Steel's Role: While Hyundai Steel is involved in recycling, the overarching market shift towards material reuse represents a competitive force affecting primary steel demand.

The threat of substitutes for steel is multifaceted, encompassing materials like aluminum, advanced composites, plastics, engineered timber, and even concrete in certain applications. These alternatives often offer advantages such as lighter weight, corrosion resistance, or environmental sustainability, directly challenging steel's market share. For instance, by 2024, the automotive industry's continued focus on fuel efficiency is expected to drive further adoption of aluminum, with its use in vehicle structures projected to increase significantly.

| Substitute Material | Key Advantages | Relevant Market Data (approximate 2023/2024) |

|---|---|---|

| Aluminum | Lighter weight, corrosion resistance | Global aluminum market projected to exceed $200 billion by 2024; automotive sector is a major consumer. |

| Advanced Composites (e.g., CFRPs) | High strength-to-weight ratio, stiffness | Global advanced composites market projected to reach over $20 billion by 2024. |

| Engineered Timber (e.g., CLT) | Sustainability, aesthetic appeal | Global engineered wood market valued at approx. USD 15.5 billion in 2023. |

| Concrete | Cost-effectiveness, availability, durability (UHPC) | Global concrete market valued at approx. $380 billion in 2023. |

Entrants Threaten

The steel industry demands substantial upfront capital for facilities like blast furnaces and rolling mills, creating a significant hurdle for newcomers. For instance, building a new integrated steel plant can easily cost billions of dollars, a figure that deters most potential entrants.

Existing steel manufacturers like Hyundai Steel leverage substantial economies of scale in production, raw material procurement, and logistics. This means they can produce steel much more cheaply per ton than a smaller operation. For instance, in 2024, major integrated steel mills often operate at capacity utilization rates exceeding 80%, a level difficult for newcomers to match without massive upfront investment.

New entrants would find it incredibly challenging to achieve similar cost efficiencies without matching this existing volume, placing them at a significant disadvantage from the outset. The steel industry also features a steep learning curve; mastering the complex processes of steelmaking, quality control, and operational efficiency takes years of experience, further deterring potential new competitors.

Newcomers face a steep climb in securing consistent and affordable access to essential raw materials like iron ore and coking coal. Hyundai Steel, for instance, benefits from established, long-term supply contracts, a significant hurdle for any new steel producer aiming to enter the market.

Furthermore, building out the necessary distribution networks to reach customers efficiently is a costly and time-consuming endeavor. Established players like Hyundai Steel have already invested heavily in logistics and sales channels, giving them a considerable advantage in market penetration and customer service.

In 2023, global iron ore prices saw fluctuations, with benchmarks like the Singapore benchmark for 62% Fe fines averaging around $110-$130 per tonne, illustrating the cost pressures new entrants would immediately face. Similarly, coking coal prices, crucial for steel production, remained volatile, impacting the initial capital outlay for new operations.

Regulatory Hurdles and Environmental Compliance

The steel industry is heavily regulated, particularly concerning environmental impact. New companies must navigate a complex web of permits and standards, demanding significant upfront investment in pollution control. For instance, in 2024, the European Union continued to strengthen its Emissions Trading System (ETS) for heavy industries, including steel, with allowances becoming more expensive, directly impacting the cost of new entrants.

Compliance costs are a major deterrent. These include not only the capital expenditure for advanced environmental technologies but also ongoing operational expenses for monitoring and reporting. Hyundai Steel, like other major players, has invested billions in upgrading facilities to meet these evolving standards, a barrier that new, smaller competitors find difficult to surmount.

- Stringent Environmental Regulations: Steel production is a carbon-intensive process, leading to strict regulations on emissions and waste management globally.

- High Capital Investment for Compliance: New entrants need substantial capital for advanced pollution abatement technologies to meet standards like those set by the EPA or EU directives.

- Escalating Compliance Costs: Beyond initial investment, ongoing operational costs for monitoring, reporting, and potential carbon taxes add significant financial pressure.

- Permitting and Approval Delays: Obtaining the necessary environmental and operational permits can be a lengthy and complex process, delaying market entry and increasing initial costs.

Brand Loyalty and Customer Relationships

While steel might seem like a basic commodity, established companies like Hyundai Steel have cultivated deep, enduring relationships with major clients in demanding industries such as automotive and shipbuilding. These partnerships are founded on a bedrock of trust, a proven track record of quality, and dependable supply chains.

For any new competitor, penetrating these entrenched networks presents a significant hurdle. Building the reputation and securing the trust necessary to displace existing, reliable suppliers is a lengthy and resource-intensive endeavor.

- Customer Retention: Hyundai Steel's strong customer ties mean that switching costs for buyers are often high, not just in terms of contract penalties but also in the disruption to production and quality assurance.

- Reputation Capital: Decades of consistent performance have built a brand reputation that new entrants would struggle to replicate quickly. For example, in 2023, the automotive sector, a key market for steel, saw continued demand for high-strength, specialized steel grades, a segment where established players like Hyundai Steel have proven expertise.

- Supply Chain Integration: New entrants face the challenge of not only matching product quality but also integrating seamlessly into sophisticated, just-in-time manufacturing processes that automotive and shipbuilding clients rely on.

The threat of new entrants in the steel industry, including for companies like Hyundai Steel, is generally considered low. This is primarily due to the immense capital required to establish a steel plant, with integrated facilities costing billions of dollars. Furthermore, existing players benefit from significant economies of scale, making it difficult for newcomers to compete on cost. For instance, in 2024, high capacity utilization rates among established mills underscore this advantage.

New entrants also face challenges in securing raw materials and establishing distribution networks. Hyundai Steel, for example, benefits from long-term supply contracts and existing logistics infrastructure. The industry also demands specialized knowledge and faces stringent environmental regulations, which add further layers of complexity and cost for any potential new competitor.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing a new integrated steel plant can cost billions of dollars. | Extremely high, requiring substantial external financing. |

| Economies of Scale | Existing players operate at high capacity utilization (e.g., >80% in 2024), lowering per-unit costs. | New entrants struggle to achieve comparable cost efficiencies. |

| Raw Material Access | Securing long-term, affordable supply contracts for iron ore and coking coal is difficult. | Newcomers face volatile input costs and potential supply disruptions. |

| Distribution Networks | Building efficient logistics and sales channels is costly and time-consuming. | Challenging market penetration against established players. |

| Environmental Regulations | Strict compliance with emissions and waste management standards requires significant investment. | Increases upfront capital and ongoing operational costs. |

Porter's Five Forces Analysis Data Sources

Our Hyundai Steel Porter's Five Forces analysis is built upon a foundation of robust data, including the company's annual reports, investor presentations, and publicly available financial statements. We also incorporate insights from reputable industry research firms and macroeconomic data providers to capture the broader market landscape.