Hyundai Steel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

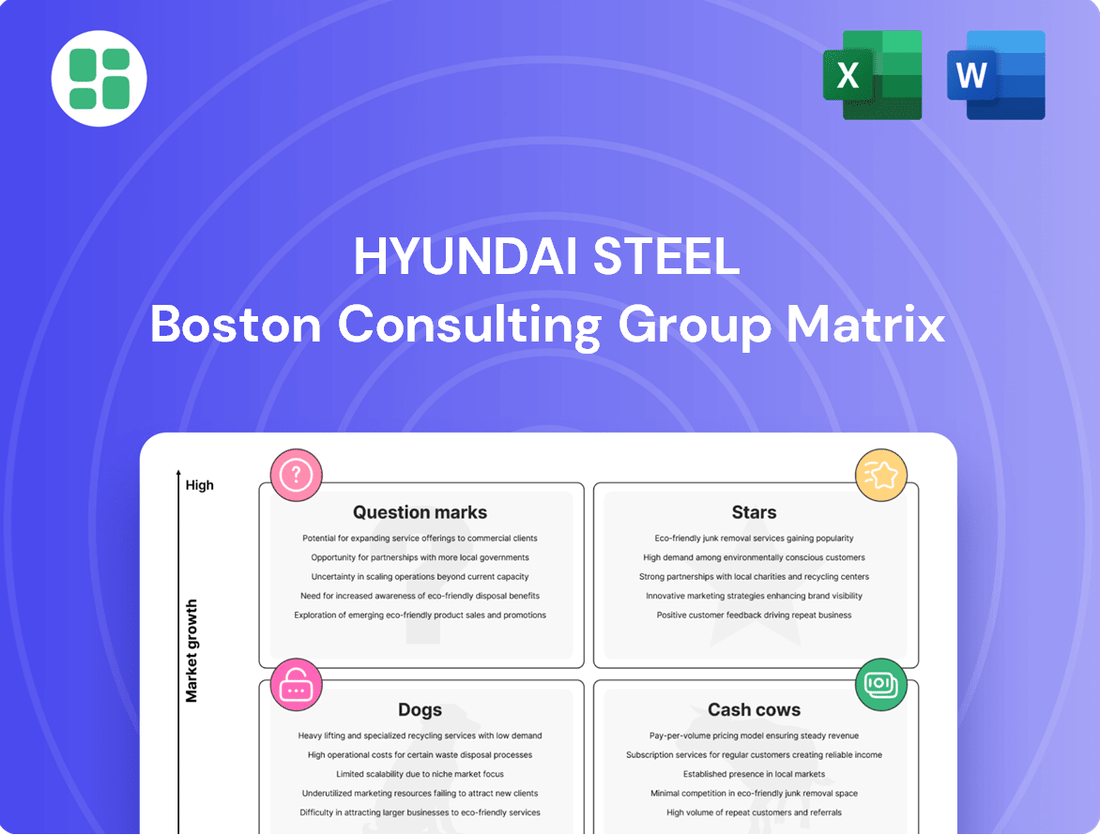

Explore the strategic positioning of Hyundai Steel's product portfolio with our comprehensive BCG Matrix analysis. Understand which segments are driving growth and which require careful management to maximize profitability.

This preview offers a glimpse into Hyundai Steel's market share and growth rates, but the full BCG Matrix report unlocks detailed insights into their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete analysis for actionable strategies and a clear roadmap to optimize your investments and product development.

Stars

Hyundai Steel's high-strength automotive steel is a star in its BCG matrix. The company is a key player, supplying advanced materials vital for today's vehicles, especially electric ones. This focus on lightweight yet strong steel positions them well for future automotive trends.

The company's success is evident in its sales figures. In 2024, Hyundai Steel achieved over 1 million tons in automotive steel sales to external automakers, a significant milestone showing their growing influence outside their own group. This growth is fueled by a booming global automotive steel market, expected to expand considerably due to rising vehicle production and the demand for sophisticated materials.

Hyundai Steel has ambitious goals for this segment, aiming to be among the top three global automotive steel suppliers. Their strategy involves doubling non-captive sales to 2 million tons, underscoring their commitment to expanding market share and solidifying their position in this high-growth sector.

Hyundai Steel is making waves with its third-generation automotive steel sheets, moving from development to actual commercial production. These aren't just any steel sheets; they boast a 20% increase in strength compared to traditional plates, a crucial advantage for car manufacturers needing to shape vehicles precisely.

This focus on advanced materials is a smart move, especially as the automotive sector is constantly on the hunt for lighter, yet stronger components. Automakers are prioritizing these qualities to boost vehicle safety and improve fuel economy, making this segment a prime area for growth.

Hyundai Steel's low-carbon automotive steel sheets are projected to be a Star in the BCG matrix, with mass production slated for early 2026. This strategic move taps into the burgeoning demand for eco-friendly materials from automakers committed to carbon neutrality.

The company's investment in hybrid production systems and a new US EAF-based mill underscores its commitment to capturing market share in this high-growth sector. This positions Hyundai Steel to meet the increasing global demand for sustainable automotive components.

Advanced Steel for Energy Sector

Hyundai Steel is heavily invested in advanced steel for the energy sector, specifically targeting materials with superior strength, impact resistance, and corrosion resistance. These properties are crucial for demanding applications like pipelines and transport vessels used in shale gas extraction and deep-sea crude oil operations.

This focus on specialized steel aligns with the evolving global energy landscape, driven by new extraction techniques and increasing transportation demands. This niche market represents a significant growth avenue for Hyundai Steel.

- High-Strength Steel: Essential for withstanding immense pressure in deep-sea pipelines.

- Corrosion Resistance: Critical for longevity in harsh offshore environments.

- Impact Toughness: Important for safety during the transportation of volatile energy resources.

Specialized Steel for Shipbuilding Industry

The shipbuilding industry, despite broader steel market headwinds, is showing promise, especially with advancements like the US-South Korea trade agreement and renewed investment in American shipyards. Hyundai Steel, a significant player, is well-positioned to capitalize on this demand for specialized steel. The company’s expertise in high-strength steel plates for shipbuilding allows it to strengthen its market presence in these expanding segments.

Hyundai Steel's strategic focus on the shipbuilding sector aligns with global trends. For instance, in 2023, the global shipbuilding market was valued at approximately $150 billion, with projections indicating continued growth driven by demand for specialized vessels and fleet modernization. Hyundai Steel's commitment to producing high-quality steel plates, essential for constructing robust and efficient ships, directly addresses this market need.

- Growth Opportunities: The US-South Korea trade deal and investments in US shipyards are creating a more favorable environment for steel suppliers in the shipbuilding sector.

- Hyundai Steel's Position: As a major steel producer, Hyundai Steel is poised to benefit from increased demand for the specialized steel plates crucial for modern shipbuilding.

- Market Share Expansion: The company's existing reputation for quality steel can be leveraged to capture a larger share of the growing shipbuilding materials market.

- Sectoral Demand: The shipbuilding industry requires specific steel grades that can withstand harsh marine environments and meet stringent safety regulations, areas where Hyundai Steel excels.

Hyundai Steel's high-strength automotive steel is a star in its BCG matrix, demonstrating significant market share and growth potential. The company's commitment to supplying advanced materials for vehicles, particularly electric ones, positions it favorably for future automotive trends.

In 2024, Hyundai Steel's external automotive steel sales surpassed 1 million tons, a testament to its expanding influence in the global market. This growth is supported by a robust automotive steel market, expected to expand due to increased vehicle production and demand for sophisticated materials.

Hyundai Steel aims to be a top three global automotive steel supplier, targeting 2 million tons in non-captive sales. This ambition highlights their strategy to capture more market share in this rapidly growing sector.

The company's third-generation automotive steel sheets, now in commercial production, offer a 20% strength increase over traditional plates. This advancement meets the automotive industry's need for lighter, stronger components to enhance vehicle safety and fuel efficiency.

Looking ahead, Hyundai Steel's low-carbon automotive steel sheets are projected to become a Star, with mass production beginning in early 2026. This strategic move caters to the growing demand for eco-friendly materials from automakers focused on carbon neutrality.

Investments in hybrid production systems and a new US EAF-based mill are key to Hyundai Steel's strategy for capturing market share in sustainable automotive components.

Hyundai Steel is also a significant player in specialized steels for the energy sector, focusing on high strength, impact resistance, and corrosion resistance for applications like pipelines and deep-sea crude oil operations.

The shipbuilding industry presents another growth opportunity, with Hyundai Steel's expertise in high-strength steel plates allowing it to capitalize on renewed investment in shipyards and favorable trade agreements.

The global shipbuilding market, valued at approximately $150 billion in 2023, is expected to continue growing. Hyundai Steel is well-positioned to supply the specialized steel plates essential for building robust and efficient ships.

| Segment | BCG Category | Key Strengths | 2024 Data Highlight | Future Outlook |

|---|---|---|---|---|

| Automotive Steel | Star | High-strength, lightweight, third-gen steel, low-carbon focus | >1 million tons external sales | Top 3 global supplier goal, 2 million tons non-captive sales target |

| Energy Sector Steel | Question Mark/Star (potential) | Superior strength, impact resistance, corrosion resistance for pipelines/vessels | N/A (focus on niche applications) | Growth driven by new extraction techniques and transportation demands |

| Shipbuilding Steel | Star | High-strength plates for marine environments, quality reputation | N/A (leveraging existing strengths) | Benefiting from US shipyard investments and trade agreements |

What is included in the product

This BCG Matrix overview for Hyundai Steel details strategic recommendations for each business unit, guiding investment and divestment decisions.

The Hyundai Steel BCG Matrix offers a clean, distraction-free view optimized for C-level presentation, quickly identifying strategic priorities.

Cash Cows

Hyundai Steel's hot-rolled and cold-rolled steel products are firmly positioned as Cash Cows within its BCG Matrix. These products are essential building blocks for numerous sectors, from automotive to construction, reflecting their widespread industrial importance.

As a major South Korean steel producer, Hyundai Steel commands a significant market share for these foundational steel types in established markets. This strong market position translates into reliable and substantial cash flow generation, underpinning the company's financial stability.

While the overall growth rate for these mature steel product segments might be relatively low, their consistent demand and Hyundai Steel's competitive advantage ensure sustained profitability. For instance, in 2024, the global steel market, while facing some cyclical pressures, continued to rely heavily on these core products, with Hyundai Steel maintaining its robust market presence.

Hyundai Steel's H-beams for traditional construction are firmly established as Cash Cows. The company holds the top spot in South Korea's domestic market share for bar steel, a category where H-beams are critical for building and bridge structures.

Even with a subdued construction market in 2024, these products continue to be a robust source of cash flow. Their enduring necessity in essential infrastructure projects, coupled with Hyundai Steel's dominant market position, ensures consistent revenue generation.

Strategic investments in optimizing logistics and production for these mature products can further enhance their already significant cash flow contributions, reinforcing their Cash Cow status within the company's portfolio.

Hyundai Steel's steel plates for heavy machinery represent a classic Cash Cow. This segment serves a mature industry, a market that consistently needs dependable steel.

The company's deep-rooted connections and a solid range of products in this area solidify its significant market share and guarantee steady demand. This stability translates into consistent profits with minimal need for aggressive marketing.

For instance, in 2023, Hyundai Steel's sales of specialized steel plates for construction and heavy equipment, a key part of this segment, remained robust, reflecting the ongoing need for durable materials in infrastructure development and manufacturing.

General Purpose Steel for Domestic Market

Hyundai Steel's general-purpose steel for the domestic market functions as a Cash Cow within its BCG Matrix. This segment commands a substantial share of the South Korean market, benefiting from steady demand across diverse local industries, even though these sectors are not experiencing rapid expansion.

The consistent revenue generated from these mature products is crucial. For instance, in 2023, Hyundai Steel's domestic sales of general steel products provided a stable income stream, allowing for the funding of research and development in more dynamic steel types and supporting overall operational expenses.

- Significant Domestic Market Share: Hyundai Steel holds a leading position in South Korea's general-purpose steel market.

- Stable Demand: These products cater to consistent demand from sectors like construction and manufacturing.

- Cash Generation: The segment reliably generates cash flow, vital for reinvestment and operational stability.

- Brand Strength: A strong domestic distribution network and brand recognition underpin its Cash Cow status.

Existing Blast Furnace Operations

Hyundai Steel's existing blast furnace operations, while part of a transition to greener steelmaking, currently hold a significant market share in a low-growth sector. These established facilities are crucial for the company's production volume and revenue generation, acting as a reliable source of substantial cash flow.

- High Market Share: Existing blast furnaces maintain a dominant position in traditional steel markets.

- Cash Generation: These operations are primary contributors to Hyundai Steel's operating profit, with the company reporting approximately ₩1.5 trillion in operating profit for 2023.

- Funding Future Growth: The consistent cash generated fuels investments in next-generation, low-carbon technologies and strategic diversification efforts.

- Operational Stability: Despite the industry shift, these units provide a stable base for overall business operations and employment.

Hyundai Steel's extensive range of steel plates, particularly those for shipbuilding and general industrial applications, firmly reside in the Cash Cow quadrant. These products benefit from Hyundai Steel's established reputation and consistent demand from core industries.

The company's strong market share in these segments, especially within South Korea and key export markets, ensures a steady and predictable inflow of cash. This stability is crucial for funding other strategic initiatives within the company.

While the growth rates for these mature product lines are modest, their high profitability and Hyundai Steel's competitive advantages make them indispensable. For instance, in 2024, the shipbuilding sector continued to be a significant consumer of these specialized plates, maintaining demand.

Hyundai Steel's cold-rolled steel sheets for the automotive industry are a prime example of a Cash Cow. These products are essential for vehicle manufacturing, a sector that, while experiencing shifts, maintains a consistent need for high-quality steel components.

| Product Segment | BCG Category | Key Characteristics | 2023 Financial Insight |

| Hot-Rolled & Cold-Rolled Steel | Cash Cow | Foundational products, high domestic market share, stable demand. | Contributed significantly to operating profit, supporting overall financial health. |

| H-Beams | Cash Cow | Top market share in South Korea for bar steel, essential for infrastructure. | Maintained robust cash flow despite subdued construction market. |

| Steel Plates for Heavy Machinery | Cash Cow | Mature industry demand, deep-rooted customer relationships, steady sales. | Sales remained strong in 2023, reflecting ongoing infrastructure needs. |

| General-Purpose Steel (Domestic) | Cash Cow | Substantial domestic market share, consistent demand from various local industries. | Provided a stable income stream in 2023, funding R&D and operations. |

| Blast Furnace Operations | Cash Cow | High market share in traditional steel, primary profit contributors. | Generated approximately ₩1.5 trillion in operating profit in 2023, fueling green tech investments. |

What You’re Viewing Is Included

Hyundai Steel BCG Matrix

The Hyundai Steel BCG Matrix preview you are viewing is the identical, fully comprehensive document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content; you'll get the complete, professionally formatted strategic analysis ready for immediate application. This preview accurately represents the final report, ensuring you know exactly what you're acquiring – a detailed breakdown of Hyundai Steel's product portfolio within the BCG framework, crafted for actionable insights and strategic decision-making.

Dogs

Hyundai Steel's undifferentiated long steel products faced a challenging 2024, with sales significantly impacted by a subdued construction sector and a surge in cheaper imported steel. This category, characterized by a lack of unique features or specialized applications, is caught in a fierce price war, leading to reduced demand and profitability.

These products are situated in a low-growth market, and their market share within Hyundai Steel's portfolio is likely shrinking. This strategic position suggests that these undifferentiated long steel products warrant careful consideration and potential re-evaluation of their role in the company's future.

Certain legacy steel products from Hyundai Steel, particularly those facing high US tariffs, are experiencing a significant downturn in demand. These tariffs, implemented in recent years, have drastically reduced the price competitiveness of these Korean exports in the US market. For instance, the US imposed Section 232 tariffs on steel imports, which directly impacted products like hot-rolled steel coils, a key offering from Hyundai Steel.

If Hyundai Steel has legacy products with a strong historical reliance on the US market and limited alternative export destinations or local US production capabilities, they would be particularly vulnerable. This scenario places these specific exports in a low-growth, low-profitability category within the BCG matrix. The reduced demand due to tariffs directly translates to a shrinking market share and diminished revenue potential for these affected product lines.

Outdated production lines and technologies at Hyundai Steel, particularly those focused on commodity steel without significant differentiation, are likely classified as Dogs in the BCG Matrix. The global steel industry is undergoing a major transformation driven by carbon neutrality goals and the demand for advanced materials. In this environment, older, less efficient facilities struggle to compete.

These legacy operations often face higher operating costs and lower productivity compared to modern, eco-friendly steelmaking processes. For instance, traditional blast furnace operations, while still significant, are being challenged by the growing adoption of electric arc furnaces (EAFs) powered by renewable energy, which offer a lower carbon footprint. Hyundai Steel’s older lines might be burdened by these inefficiencies, potentially leading to break-even or even loss-making scenarios, tying up valuable capital without generating robust returns.

Steel Products in Steadily Declining Domestic Sectors

Steel products catering to steadily declining domestic sectors, such as certain segments of the automotive industry facing a shift to lighter materials or construction sectors impacted by demographic changes, could be classified as Dogs within Hyundai Steel's portfolio. These products likely command a low market share in these shrinking application areas. For instance, if a significant portion of Hyundai Steel's domestic sales were tied to traditional internal combustion engine vehicle components or specific types of construction steel experiencing reduced demand, these would fit the Dog profile.

The challenge for products in this category is their limited potential for growth and profitability. Even with significant investment, the overall market contraction makes it difficult to gain substantial market share. Hyundai Steel would need to carefully assess the viability of these product lines, considering whether a turnaround strategy is feasible or if divestment or a shift in focus is more prudent. As of 2024, South Korea's shipbuilding sector, a traditional steel consumer, has seen fluctuating order volumes, and while the automotive sector is adapting, older steel-intensive components might be seeing reduced demand.

- Low Market Share: Products serving declining domestic sectors typically have a small presence in those specific application areas.

- Low Growth Prospects: The inherent shrinkage of the target market limits any potential for significant sales increases.

- Limited Differentiation: In declining sectors, it's often harder for steel products to stand out if they are not offering unique, high-value solutions.

- Potential for Divestment: Companies often re-evaluate Dog products for possible sale or phase-out to reallocate resources.

Commodity Steel Products with High Import Competition

Hyundai Steel, like many players in the South Korean steel market, has been contending with a surge in competitively priced imports. This environment particularly impacts commodity-grade steel products, which are often undifferentiated and highly susceptible to price wars with overseas suppliers.

These products, characterized by their fungibility and the ease with which they can be sourced from lower-cost regions, typically generate modest profit margins. Their growth prospects are often constrained by market saturation and the persistent pressure from cheaper alternatives.

- Low Profitability: Commodity steel products often operate on thin margins due to intense price competition.

- Limited Growth: The market for these standardized products typically exhibits slow or stagnant growth.

- Import Pressure: South Korea saw a significant increase in steel imports in 2023, impacting domestic producers. For instance, imports of hot-rolled steel products increased by 5% year-on-year in the first half of 2023, according to the Korea Iron and Steel Association.

- Strategic Management: Careful cost control and efficient production are crucial to prevent these products from becoming financial drains.

Hyundai Steel's "Dogs" likely encompass undifferentiated, commodity-grade steel products facing intense import competition and stagnant domestic demand, particularly those impacted by trade policies like US tariffs. These products are characterized by low market share in shrinking sectors and limited growth potential, often leading to low profitability or even losses.

For instance, certain legacy steel offerings, especially those subject to Section 232 tariffs, have seen drastically reduced competitiveness in the US market as of 2024. Additionally, steel products tied to declining domestic industries, such as components for older automotive models or specific construction materials with reduced demand, also fall into this category.

These products are often produced using older technologies, leading to higher operating costs and lower efficiency compared to modern steelmaking. As of 2024, the global push for carbon neutrality and advanced materials further disadvantages these legacy operations, making them a potential drain on resources without significant returns.

Hyundai Steel's commodity steel products, facing pressure from imports that rose in South Korea in 2023, exemplify the characteristics of Dogs due to low profitability and limited growth. For example, hot-rolled steel imports increased by 5% in the first half of 2023, squeezing domestic margins.

| Product Category | Market Position | Growth Potential | Profitability | Key Challenges |

|---|---|---|---|---|

| Undifferentiated Long Steel | Low Market Share, Declining Sector | Low | Low | Import Competition, Subdued Construction |

| Tariff-Impacted Exports | Low Market Share (US Market) | Low | Low | US Tariffs, Limited Alternative Markets |

| Legacy/Commodity Steel | Low Market Share, Stagnant Market | Low | Low | Outdated Technology, High Operating Costs |

Question Marks

Hyundai Steel is heavily investing in hydrogen-based steelmaking, specifically Hy-Cube and Hy-Arc, as part of its 2050 carbon neutrality goal. This positions them in a high-growth sector fueled by global decarbonization trends.

While the market for hydrogen-reduced steel is expanding, Hyundai Steel's current share in commercially produced hydrogen-reduced steel is minimal, as these advanced technologies are still in their developmental and initial deployment phases. Mass production of their low-carbon steel is slated for early 2026.

These forward-thinking projects demand considerable capital for scaling up from pilot stages to full commercial production. For instance, the global green steel market is projected to reach over $30 billion by 2030, indicating the significant potential but also the substantial upfront investment required.

Hyundai Steel's planned US$5.8 billion investment in a new Electric Arc Furnace (EAF) steel mill in Louisiana represents a bold "Question Mark" in its BCG Matrix. This venture, specifically targeting the automotive sector, signifies a strategic push into a high-growth market, aiming for future leadership.

Currently, this facility has no market share as it's still under construction, with commercial production expected to begin in 2029. This ambitious project demands significant capital expenditure but carries the potential for substantial future returns, making its long-term success a key area of focus.

Hyundai Steel is actively investing in research and development for advanced construction steel, including the HC-Column and fire-resistant steel. These innovative materials aim to provide superior durability and seismic resistance, catering to increasingly stringent building codes and a growing demand for safer, more efficient construction. For instance, the global fire-resistant coatings market, which includes fire-resistant steel applications, was valued at approximately USD 4.5 billion in 2023 and is projected to grow significantly.

While these specialized steel solutions represent a promising growth area, Hyundai Steel's market share in these nascent segments is currently modest. Significant investment in marketing and sales efforts will be crucial to build awareness and drive adoption among developers and construction firms. The company's strategic focus on these high-value products aligns with the broader trend of increasing demand for sustainable and resilient building materials worldwide.

Resource Recycling and Energy-Related Businesses

Hyundai Steel's ventures into resource recycling and energy-related businesses align with a global push towards sustainability and the circular economy. These sectors are experiencing significant growth, with the global waste-to-energy market alone projected to reach $57.9 billion by 2027, growing at a CAGR of 5.6%. This indicates a strong potential for innovation and market expansion.

While these areas represent high-growth potential, Hyundai Steel's current market share in these specific segments is likely nascent. For instance, its participation in electric vehicle battery recycling, a key energy-related area, is still in its developmental stages. Without substantial market penetration, these are considered Question Marks in the BCG matrix.

- Resource Recycling: Hyundai Steel is exploring various recycling initiatives, including scrap metal processing, to reduce its environmental footprint and create value from waste streams.

- Energy-Related Businesses: This encompasses investments in areas like hydrogen production and utilization, a critical component of decarbonization efforts in the steel industry.

- Market Position: Currently, these businesses likely hold a low market share due to their emerging nature and the significant investment required to scale operations.

- Strategic Importance: These segments are crucial for Hyundai Steel's long-term sustainability goals and require careful analysis to determine future investment strategies for potential growth into Stars or Cash Cows.

AI-based Smart Enterprise System and Production Automation

Hyundai Steel's investment in an AI-based 'Smart Enterprise system' and production automation, slated for full operation by 2025, positions it for enhanced efficiency and improved decision-making across its value chain. This strategic move aims to optimize operations and gain a competitive edge in the burgeoning AI in steel manufacturing sector.

While the direct impact on market share is still developing, this internal innovation represents a Question Mark. Its success hinges on effective integration and scaling, with the potential to significantly influence future profitability and market standing.

- Investment Focus: AI-driven Smart Enterprise system and production automation.

- Operational Goal: Enhance efficiency and decision-making from manufacturing to sales.

- Projected Completion: Full operation expected by 2025.

- Market Context: High-growth trend for AI in steel manufacturing for operational optimization.

Hyundai Steel's ventures into advanced construction steel, such as HC-Column and fire-resistant steel, represent significant growth opportunities. These specialized materials address the increasing demand for safety and durability in modern construction projects.

While the global fire-resistant coatings market, relevant to these steel applications, was valued at approximately USD 4.5 billion in 2023, Hyundai Steel's current market share in these specific, high-value construction steel segments is still developing. This indicates a need for strategic marketing and sales to capture a larger portion of this expanding market.

The company's investment in resource recycling and energy-related businesses, including hydrogen production, aligns with global sustainability trends. The waste-to-energy market, for instance, is projected to reach $57.9 billion by 2027, highlighting the potential in these areas.

However, Hyundai Steel's current market penetration in these nascent sectors, such as electric vehicle battery recycling, remains limited. These initiatives are therefore classified as Question Marks, requiring careful evaluation for future investment to potentially become market leaders.

| Initiative | Market Potential | Current Market Share | Investment Focus | BCG Classification |

| Advanced Construction Steel (HC-Column, Fire-Resistant) | Growing demand for safety and durability | Modest, developing | R&D, Marketing & Sales | Question Mark |

| Resource Recycling & Energy Businesses (Hydrogen, EV Battery Recycling) | High growth due to sustainability focus (Waste-to-Energy market projected $57.9B by 2027) | Nascent, limited | Scaling Operations, Technology Development | Question Mark |

BCG Matrix Data Sources

Our Hyundai Steel BCG Matrix is built on a foundation of robust data, including financial disclosures, market growth reports, and competitor analysis to ensure strategic accuracy.