Henderson Land SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

Henderson Land's robust property portfolio and strong brand recognition present significant strengths, but understanding their market vulnerabilities and future opportunities requires a deeper dive. Our comprehensive SWOT analysis reveals the strategic levers they can pull to capitalize on their advantages and mitigate potential threats.

Want the full story behind Henderson Land's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Henderson Land's strength lies in its highly diversified and integrated business model, spanning property development, investment, management, construction, infrastructure, and even energy sectors. This broad operational scope creates multiple, robust revenue streams, significantly lessening the company's dependence on any single market segment and fostering greater financial stability. For instance, in the first half of 2024, the company reported a substantial contribution from its diverse property portfolio, alongside ongoing infrastructure projects, demonstrating this resilience.

Henderson Land boasts an impressive land bank and a diverse property portfolio across Hong Kong and Mainland China, encompassing both residential and commercial assets. This strategic advantage fuels its development pipeline and ensures a consistent stream of rental income from its investment properties.

As of the first half of 2024, Henderson Land reported a substantial land reserve, with approximately 4.1 million square feet of attributable floor area in Hong Kong, primarily for residential development. This robust land bank is a key strength, underpinning the company's long-term growth prospects and its ability to capitalize on market demand.

Henderson Land holds a commanding position in the property sector, underscored by its status as a Hang Seng Index constituent. This deep-rooted presence translates into significant brand equity and trust within both Hong Kong and Mainland China, crucial for securing prime development opportunities and attracting high-value tenants.

Commitment to Sustainability and Innovation

Henderson Land's dedication to sustainability is a significant strength, underscored by its G.I.V.E. Strategy, which prioritizes green initiatives, innovation, value creation for stakeholders, and community engagement. This strategic focus is not just aspirational; it translates into tangible achievements. For instance, the company has actively pursued and secured substantial green finance facilities, demonstrating a clear financial commitment to its sustainability goals.

Furthermore, Henderson Land's portfolio boasts numerous projects that have achieved platinum-level building certifications, a testament to their high environmental performance and design. This commitment resonates strongly with a growing segment of the market. In 2024, for example, the demand for certified green office spaces in Hong Kong saw a notable increase, with tenants increasingly prioritizing ESG credentials when selecting locations. This positions Henderson Land favorably to attract and retain environmentally conscious tenants and investors alike, enhancing its market appeal and long-term value proposition.

- Green Finance: Secured significant green finance facilities, aligning financial strategy with sustainability objectives.

- Building Certifications: Achieved multiple platinum-level building certifications for its projects, signifying high environmental standards.

- Market Appeal: Enhanced attractiveness to environmentally conscious investors and tenants through demonstrated sustainability commitment.

Stable Rental Income from Investment Properties

Henderson Land's portfolio of investment properties, particularly in prime locations like Shanghai and Guangzhou, has demonstrated resilience, offering a dependable stream of rental income. This consistent cash flow acts as a vital buffer against the inherent volatility of the property development sector.

The company's commitment to maintaining high occupancy rates across its commercial and residential rental assets has been a key driver of this stability. For instance, as of late 2024, Henderson Land reported strong leasing performance in its Hong Kong portfolio, with key office buildings achieving over 90% occupancy.

- Stable Recurring Revenue: Rental income from investment properties provides a predictable and consistent cash flow, reducing reliance on cyclical property sales.

- Geographic Diversification: Assets in major cities like Shanghai and Guangzhou contribute to a diversified income base, mitigating localized market risks.

- High Occupancy Rates: Strategic management and prime locations ensure robust leasing, translating to sustained rental yields.

- Financial Cushion: This stable income stream offers financial flexibility and supports ongoing development projects.

Henderson Land's extensive and strategically managed land bank is a cornerstone of its strength, providing a robust pipeline for future development. This is particularly evident in Hong Kong, where the company held approximately 4.1 million square feet of attributable floor area for residential development as of the first half of 2024. This substantial reserve ensures the company's ability to meet market demand and sustain growth over the long term.

The company's integrated business model, encompassing property development, investment, management, and construction, creates significant operational synergies and revenue diversification. This broad scope, as demonstrated by contributions from both property portfolios and infrastructure projects in the first half of 2024, enhances financial stability and resilience against market fluctuations.

Henderson Land's strong brand recognition and established market presence, highlighted by its status as a Hang Seng Index constituent, foster trust and attract prime development opportunities. This deep-rooted reputation in both Hong Kong and Mainland China is crucial for securing high-value tenants and reinforcing its market leadership.

A key strength is Henderson Land's commitment to sustainability, exemplified by its G.I.V.E. Strategy and the securing of significant green finance facilities. The company's numerous projects achieving platinum-level building certifications, coupled with increasing market demand for green spaces in 2024, positions it favorably with environmentally conscious stakeholders.

What is included in the product

Analyzes Henderson Land’s competitive position through key internal and external factors, highlighting its strengths in property development and potential weaknesses in market diversification, while also identifying opportunities in emerging markets and threats from economic volatility.

Offers a clear, actionable framework to identify and address Henderson Land's strategic challenges and opportunities.

Weaknesses

Henderson Land's substantial exposure to the Hong Kong and Mainland China property markets presents a significant weakness. A considerable portion of its revenue streams are tied to these regions, rendering the company vulnerable to economic downturns, shifts in government policy, and market corrections. For instance, in the first half of 2024, the company reported a 36% drop in attributable revenue to HK$10.1 billion, partly due to the challenging property market in Mainland China.

The company has also faced challenges with property sales and revaluations. In the first half of 2024, Henderson Land recorded revaluation losses on its investment properties amounting to HK$1.74 billion. This indicates a direct impact on the company's asset base and profitability stemming from unfavorable market conditions.

Henderson Land's financial performance has shown a downward trend, with a significant 32% drop in attributable profit and an 8% decrease in revenue for the fiscal year 2024 when compared to 2023. This performance fell short of analyst projections, signaling a challenging market and potential headwinds impacting the company's bottom line.

Henderson Land's substantial net debt of HK$136.3 billion, coupled with a Debt/EBITDA ratio of 7.1x as of its latest reporting, highlights significant leverage concerns. This high level of indebtedness can amplify financial risks, particularly within the unpredictable economic landscape of 2024 and anticipated volatility into 2025.

While financial forecasts suggest a potential improvement in the Debt/EBITDA ratio to around 5.0x by 2027, the current high leverage remains a notable weakness. This situation could strain the company's ability to manage interest expenses and respond to adverse market conditions, potentially impacting its financial flexibility and investment capacity.

Exposure to Fair Value Losses on Investment Properties

Henderson Land's financial results for 2024 were notably impacted by fair value losses on its investment properties, leading to a significant drop in reported profit. This underscores the company's vulnerability to fluctuations in property valuations and broader market sentiment, which can be inherently unpredictable.

The company's reliance on the valuation of its investment property portfolio creates a direct link between market conditions and its profitability. For instance, a downturn in the property market can directly translate into reduced earnings, even if underlying operational performance remains stable.

- Fair Value Impact: In 2024, Henderson Land reported a substantial decrease in profit, largely attributed to fair value adjustments on its extensive investment property holdings.

- Market Sensitivity: This exposes the company to the volatility of the real estate market, where shifts in economic conditions and investor sentiment can rapidly alter asset values.

- Profitability Link: The financial performance is therefore closely tied to external market forces rather than solely internal operational efficiency.

Concentration Risk in Revenue Drivers

Henderson Land, despite its diversified portfolio, faces a notable concentration risk. The 'Property Development - Hong Kong' segment was the primary revenue driver, contributing 46% of total revenue in the last 12 months ending June 30, 2024. This heavy reliance on a single segment means a significant downturn in Hong Kong property development could disproportionately impact the company's overall financial performance.

This concentration presents a vulnerability, as adverse market conditions or regulatory changes specifically affecting Hong Kong's property sector could lead to substantial revenue declines. For instance, a slowdown in property sales or a drop in property values within Hong Kong could directly and severely affect Henderson Land's profitability.

- Revenue Concentration: 46% of total revenue generated from 'Property Development - Hong Kong' as of June 30, 2024.

- Segmental Dependence: High reliance on the performance of the Hong Kong property market.

- Potential Impact: A downturn in this key segment could lead to significant financial repercussions for the company.

Henderson Land's substantial net debt of HK$136.3 billion, with a Debt/EBITDA ratio of 7.1x as of its latest reporting, signifies considerable leverage. This high indebtedness amplifies financial risks, particularly given the economic uncertainties projected for 2024 and into 2025.

While forecasts suggest a potential improvement in the Debt/EBITDA ratio to around 5.0x by 2027, the current high leverage remains a key weakness. This situation could strain the company's ability to manage interest expenses and react to adverse market shifts, potentially limiting its financial flexibility.

| Financial Metric | Value (as of latest reporting) | Significance |

|---|---|---|

| Net Debt | HK$136.3 billion | Indicates substantial financial obligations. |

| Debt/EBITDA Ratio | 7.1x | Highlights significant leverage and potential financial strain. |

Full Version Awaits

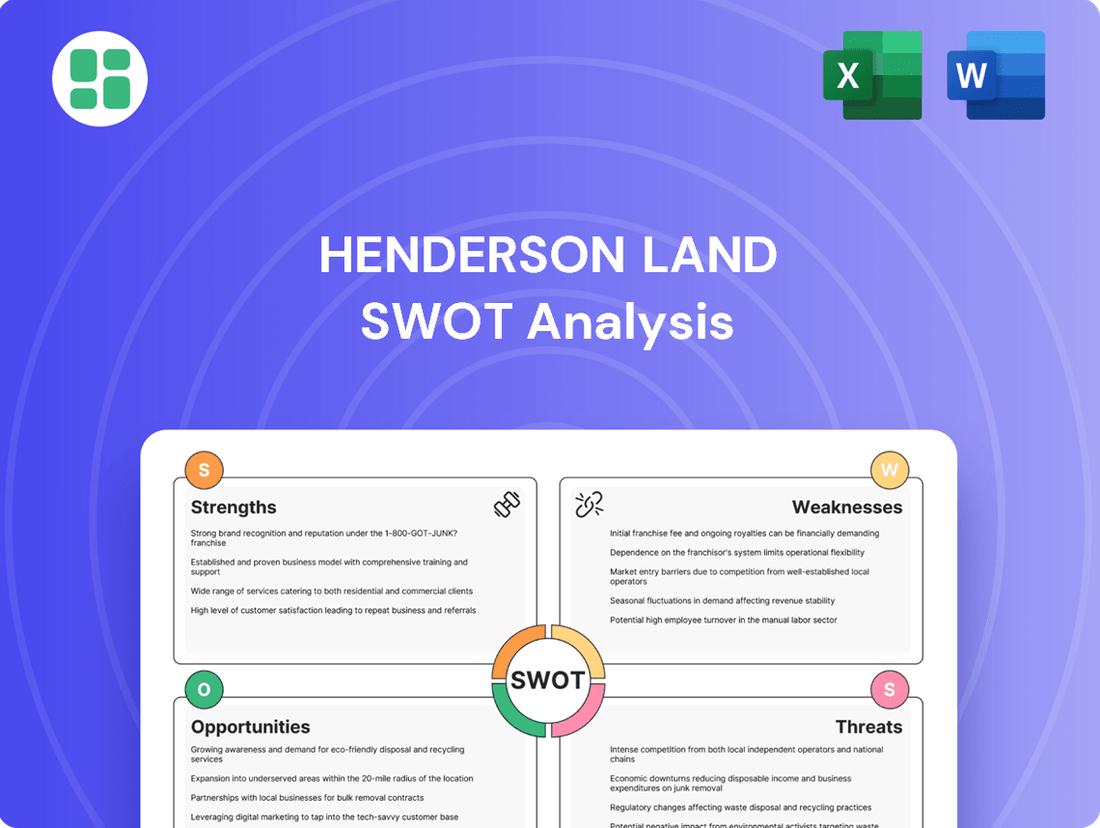

Henderson Land SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Henderson Land's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Henderson Land's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a full breakdown of Henderson Land's competitive landscape.

Opportunities

Henderson Land's commitment to expanding its development land bank, particularly through urban redevelopment projects, offers a significant avenue for growth. This strategy capitalizes on the company's existing strategic land holdings and ongoing projects, positioning it to benefit from the revitalization trends in key urban areas.

Favorable government policies in Hong Kong, such as the relaxation of property cooling measures in late 2023, are a significant opportunity for Henderson Land. These policy shifts aim to stimulate the property market by reducing transaction costs and boosting buyer confidence.

The Northern Metropolis development plan, a key government initiative, presents substantial long-term growth prospects. This ambitious project is expected to create new urban areas and infrastructure, potentially unlocking vast land resources for development and increasing housing demand, benefiting developers like Henderson Land.

Government efforts to address housing scarcity, including potential land supply increases and streamlined approval processes, directly support Henderson Land's core business. These measures are designed to foster economic growth and provide a more stable operating environment for the real estate sector.

The increasing global focus on Environmental, Social, and Governance (ESG) factors is driving substantial growth in the sustainable and smart building sector. This trend presents a prime opportunity for developers like Henderson Land to cater to a market segment prioritizing eco-friendly and technologically advanced properties.

Henderson Land's proactive approach to sustainability, demonstrated by its portfolio of certified green buildings, including the notable The Henderson, directly aligns with this burgeoning demand. This strategic positioning allows the company to capture a significant share of the market actively seeking environmentally conscious and intelligent building solutions.

Potential for Market Recovery and Rental Growth

The Hong Kong property market is showing signs of a turnaround, with forecasts suggesting improved performance in 2025. Residential rents, in particular, are anticipated to see an increase.

This anticipated mild recovery in property prices and sustained rental growth presents a significant opportunity for Henderson Land. These trends are expected to bolster both its property development and leasing operations, potentially leading to improved revenue streams and profitability.

- Projected Rental Growth: Analysts anticipate residential rental growth in Hong Kong to reach between 3% and 5% in 2025, according to various property consultancies.

- Market Stabilization: Following a period of adjustment, the Hong Kong property market is expected to stabilize, with potential for modest price appreciation in key segments.

- Leasing Segment Boost: Increased occupancy rates and higher rental yields are likely to benefit Henderson Land's extensive portfolio of commercial and residential properties.

- Development Pipeline Advantage: The company's ongoing development projects are well-positioned to capitalize on any resurgence in buyer demand and positive market sentiment.

Strategic Expansion in Mainland China

Henderson Land's strategic expansion in Mainland China, particularly in prime and second-tier cities, presents significant long-term growth opportunities despite current market headwinds. The company's established presence allows it to tap into the vast potential of the Chinese market.

By leveraging its expertise in mixed-use developments and a consistent focus on high-quality projects, Henderson Land is well-positioned to capture demand in key urban centers. This strategy aims to capitalize on China's ongoing urbanization and economic development.

- Prime Location Assets: Henderson Land holds significant land reserves in Tier 1 and emerging Tier 2 cities, providing a foundation for future development and sales.

- Mixed-Use Development Expertise: The company's proven track record in creating integrated developments that combine residential, retail, and office spaces caters to diverse urban needs.

- Brand Reputation: Henderson Land's commitment to quality and design fosters strong brand recognition, which is crucial for attracting buyers and tenants in competitive Chinese markets.

- Market Resilience: While the Chinese property market has faced challenges, the demand for well-located, high-quality properties remains robust, offering a pathway for sustained revenue generation.

The Northern Metropolis initiative is a significant long-term opportunity, aiming to transform a vast area into a new hub with substantial development potential. This ambitious government plan is expected to drive demand for housing and commercial spaces, directly benefiting Henderson Land's development pipeline.

Favorable government policies, such as the relaxation of property cooling measures in late 2023, are creating a more conducive environment for the Hong Kong property market. This includes reduced transaction costs and increased buyer confidence, which are likely to stimulate sales and development activity for Henderson Land.

The growing emphasis on Environmental, Social, and Governance (ESG) factors presents a prime opportunity in the sustainable and smart building sector. Henderson Land's existing portfolio of certified green buildings, like The Henderson, positions it well to capture demand from environmentally conscious consumers.

The Hong Kong property market is showing signs of a turnaround, with residential rents projected to grow between 3% and 5% in 2025. This anticipated mild recovery in property prices and sustained rental growth offers a significant opportunity for Henderson Land's development and leasing segments.

| Opportunity Area | Description | Key Data/Projections |

|---|---|---|

| Northern Metropolis Development | Government-backed plan to create a new urban hub. | Unlocks vast land resources and drives housing demand. |

| Policy Relaxation | Easing of property cooling measures (late 2023). | Reduced transaction costs, boosted buyer confidence. |

| ESG & Smart Buildings | Increasing demand for sustainable properties. | Henderson Land's green building portfolio aligns with market trends. |

| Market Recovery & Rental Growth | Projected stabilization and rental increases. | Residential rents expected to grow 3%-5% in 2025. |

Threats

The Hong Kong and Mainland China property markets are experiencing a significant downturn, marked by sluggish sales and rising vacancies. This prolonged slump directly threatens Henderson Land's development pipeline and the valuation of its existing investment properties, potentially impacting future revenue streams and asset values.

For instance, Hong Kong's residential property price index saw a notable decline in early 2024 compared to its peak. Similarly, mainland China's commercial real estate sector continues to grapple with high vacancy rates in major cities, a trend that could suppress rental income and property valuations for Henderson Land's extensive holdings.

The global economic outlook for 2025 remains subdued, marked by persistent geopolitical friction and a rise in trade protectionism, potentially leading to economic fragmentation. These headwinds can translate into increased market volatility, dampening investor sentiment and impeding the recovery of the property sector, a key area for Henderson Land.

For instance, the IMF's April 2024 World Economic Outlook projected global growth to be 3.2% in 2024 and 2025, a slight slowdown from previous forecasts, highlighting the ongoing economic fragility. Such conditions directly threaten real estate demand and development pipelines, impacting Henderson Land's revenue streams and project profitability.

Rising interest rates and tighter lending conditions present a significant threat by increasing financing costs for property developers like Henderson Land. This directly impacts the financial viability and profitability of their projects. For instance, in early 2024, Henderson Land raised approximately HK$3.8 billion through convertible bonds, partly to manage its existing debt, underscoring its awareness of and sensitivity to prevailing funding costs in the current economic climate.

Oversupply and Increased Competition

The Hong Kong property market is grappling with a significant oversupply, especially in the office and retail segments. This surplus is driving down rents and forcing landlords, like Henderson Land, to offer more incentives to attract and retain tenants. For instance, vacancy rates in Hong Kong's Grade A office market reached approximately 10% in early 2024, a notable increase from previous years.

This intensified competition, fueled by ongoing new project launches, is expected to further suppress property prices and rental yields. The retail sector, in particular, has seen average retail rents decline by an estimated 5-8% in 2023, a trend likely to continue as more supply enters the market.

- Oversupply in Office and Retail: Leading to downward pressure on rents and increased landlord incentives.

- Competitive Landscape: New project launches exacerbate competition, potentially depressing prices.

- Declining Rental Yields: The combination of oversupply and competition negatively impacts profitability.

Regulatory Changes and Government Policies

Henderson Land, like all players in the Hong Kong property market, faces inherent risks from evolving government policies. Changes in property transaction taxes, such as stamp duties, or adjustments to land supply strategies can directly affect sales volumes and profit margins. While some past cooling measures have been eased, the potential for future, unpredictable policy shifts remains a significant threat to the company's operational stability and financial performance.

For instance, the Hong Kong government's approach to property market regulation is dynamic. Any reintroduction or modification of measures like the Buyer's Stamp Duty or Special Stamp Duty, which were previously used to curb speculation, could dampen demand and impact Henderson Land's sales pipeline. Furthermore, shifts in urban planning and land development policies could alter the availability and cost of future development sites, directly influencing the company's long-term growth prospects.

- Policy Uncertainty: The possibility of unexpected government interventions in the property market presents a constant risk.

- Taxation Impact: Changes to property-related taxes could directly reduce Henderson Land's revenue and profitability.

- Land Supply Dynamics: Government decisions on land availability and development zoning can significantly affect future project viability.

The ongoing slowdown in both Hong Kong and mainland China's property markets poses a substantial threat to Henderson Land's revenue and asset valuations. High vacancy rates in commercial real estate and sluggish residential sales, as seen with Hong Kong's property price index declining in early 2024, directly impact rental income and development profitability.

Global economic headwinds, including geopolitical friction and trade protectionism, projected to keep global growth at 3.2% for 2024-2025 by the IMF, further dampen investor sentiment and real estate demand. Rising interest rates and tighter lending conditions also increase financing costs, as evidenced by Henderson Land's HK$3.8 billion convertible bond issuance in early 2024 to manage debt, directly affecting project viability.

Intensified competition, particularly in Hong Kong's office and retail sectors with vacancy rates around 10% in early 2024, leads to downward pressure on rents and yields, with retail rents seeing an estimated 5-8% decline in 2023. Policy uncertainty, including potential changes to property taxes like stamp duties, also presents a significant risk to sales volumes and profit margins.

| Threat Category | Specific Impact on Henderson Land | Supporting Data/Trend |

|---|---|---|

| Market Downturn | Reduced sales and rental income, lower property valuations | Hong Kong residential property price index decline (early 2024); Mainland China commercial property high vacancies |

| Economic Headwinds | Decreased investor sentiment, suppressed real estate demand | IMF Global Growth Projection: 3.2% (2024-2025) |

| Financing Costs | Increased cost of capital for development and debt management | Henderson Land's HK$3.8 billion convertible bond issuance (early 2024) |

| Market Competition | Downward pressure on rents and yields, increased landlord incentives | Hong Kong Grade A office vacancy ~10% (early 2024); Retail rents down 5-8% (2023) |

| Policy Uncertainty | Potential impact on sales volumes and profit margins | Risk of reintroduction/modification of property transaction taxes |

SWOT Analysis Data Sources

This Henderson Land SWOT analysis is built upon a foundation of credible data, incorporating official financial statements, comprehensive market research reports, and expert industry commentary to ensure a robust and insightful assessment.