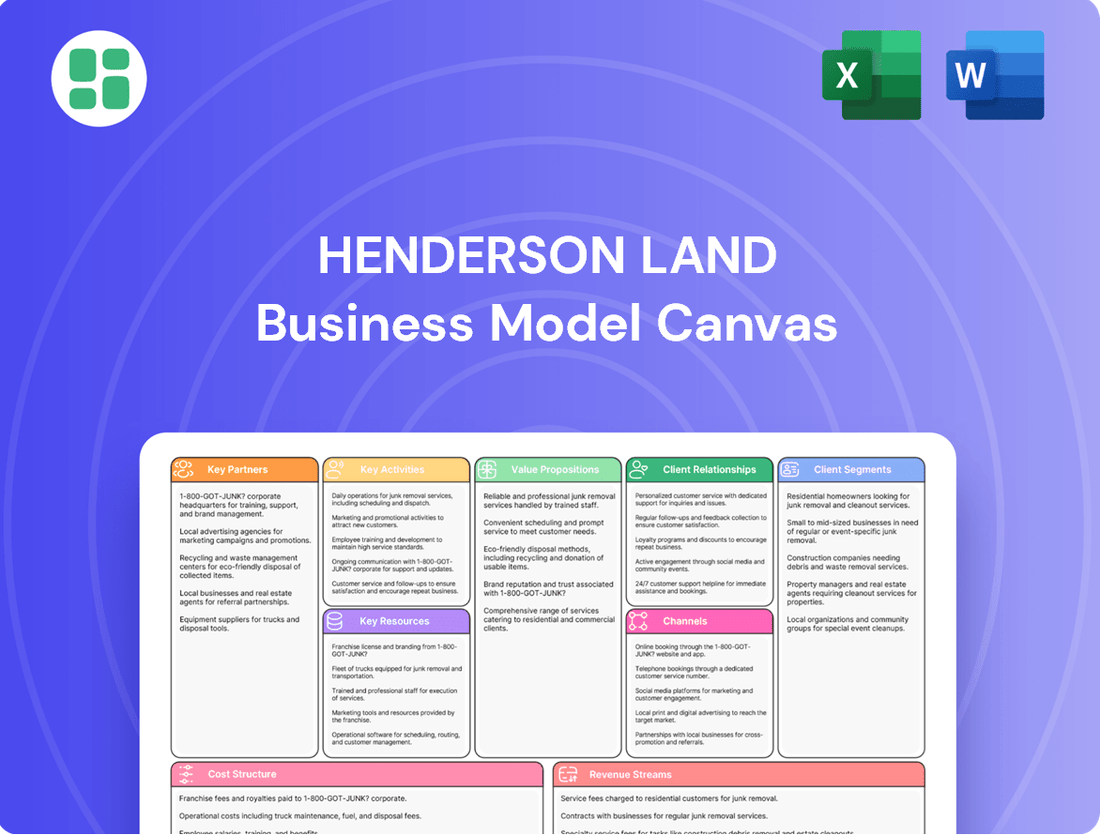

Henderson Land Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

Discover the strategic framework that powers Henderson Land's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. For anyone seeking to understand innovation in real estate, this is an essential tool.

Partnerships

Henderson Land relies heavily on a network of construction contractors and material suppliers to bring its property visions to life. These partnerships are fundamental to the successful execution of its extensive portfolio, which spans residential, commercial, and infrastructure developments.

The company actively cultivates strong cooperative relationships with these key partners. This collaboration is particularly vital for integrating innovative construction techniques and sustainable materials, essential for developing green and smart buildings, a growing focus in the real estate sector.

In 2024, Henderson Land continued to emphasize efficient project delivery, a testament to the strength of these contractor and supplier relationships. For instance, the successful completion of projects like the Henderson Central development in Hong Kong underscores the importance of reliable partners in managing complex construction timelines and quality standards.

Henderson Land actively collaborates with a range of financial institutions, including banks and other lending bodies. These relationships are crucial for securing the necessary funding for its extensive property development projects and managing its substantial land holdings.

A key aspect of these partnerships involves accessing various forms of capital, from traditional project financing to specialized green finance facilities. This strategic financial backing is essential for the company's ongoing growth and its commitment to sustainable development initiatives.

Demonstrating the strength of these ties, Henderson Land has successfully secured over HK$50 billion in green finance facilities. This significant amount underscores the confidence financial partners have in the company's sustainability objectives and its ability to execute environmentally conscious projects.

Henderson Land's relationships with government bodies are foundational, particularly for navigating land acquisition and urban redevelopment projects. These partnerships are crucial for unlocking the potential of its extensive agricultural land holdings in Hong Kong's New Territories, a significant asset for the company.

As Hong Kong's largest agricultural landowner, Henderson Land's ability to convert these vast tracts for residential or other development hinges directly on government policies and the timely acquisition of necessary approvals. This reliance underscores the critical nature of these collaborations for the company's future development pipeline.

Strategic Joint Ventures and Associates

Henderson Land actively cultivates strategic joint ventures and associates, holding significant investments in entities like Henderson Investment Limited and Miramar Hotel and Investment Company Limited. These collaborations are crucial for leveraging shared synergies across varied sectors.

The company's network includes major players such as The Hong Kong and China Gas Company Limited and Hong Kong Ferry (Holdings) Company Limited, alongside Sunlight Real Estate Investment Trust. These partnerships foster an integrated business model by creating cross-sectoral advantages.

These strategic alliances unlock substantial synergies, benefiting areas like gas supply, hotel operations, and retail. For instance, in 2023, Henderson Land's share of profit from associates and joint ventures amounted to HK$3,874 million, highlighting the financial contribution of these partnerships.

- Henderson Investment Limited: A key listed subsidiary providing investment opportunities and diversification.

- Miramar Hotel and Investment Company Limited: Contributes to the hospitality and retail segments, enhancing the integrated business model.

- The Hong Kong and China Gas Company Limited (Towngas): Offers significant synergies in utility services and infrastructure development.

- Sunlight Real Estate Investment Trust: Provides exposure to the stable income-generating property market.

Technology and Smart Building Solution Providers

Henderson Land actively partners with leading technology and smart building solution providers to infuse its developments with cutting-edge innovation. These collaborations are crucial for integrating advanced smart home functionalities and pioneering construction techniques, ultimately elevating the desirability and operational effectiveness of its properties.

A prime example of this strategy is Henderson Land's significant investment in upgrading its existing portfolio. This includes the implementation of sophisticated security systems and intelligent energy management tools. For instance, by mid-2024, the company had rolled out enhanced smart access controls in over 70% of its residential projects, aiming to create more secure and efficient living environments. This focus underscores a commitment to tech-forward residential experiences and the adoption of smart construction methodologies.

These strategic alliances are instrumental in fostering the creation of contemporary, environmentally conscious, and intelligent building designs. By leveraging the expertise of technology partners, Henderson Land ensures its properties are not only aesthetically pleasing but also equipped with the latest advancements in sustainability and connectivity. This approach is vital for meeting the evolving demands of the market and maintaining a competitive edge in the real estate sector.

Key aspects of these partnerships include:

- Integration of IoT devices: Collaborations focus on embedding Internet of Things (IoT) technology for seamless control of lighting, climate, and security within residences.

- Data analytics for building management: Partnerships enable the use of data analytics to optimize energy consumption and predictive maintenance, enhancing building efficiency.

- Development of smart community platforms: Joint efforts aim to create digital platforms that connect residents and streamline building services, fostering a sense of community.

- Adoption of sustainable building materials and techniques: Technology partners assist in sourcing and implementing eco-friendly materials and construction methods, aligning with green building standards.

Henderson Land's key partnerships extend to a robust network of construction contractors and material suppliers, essential for executing its diverse property portfolio. These collaborations are vital for maintaining project timelines and quality standards, as evidenced by the successful completion of developments like Henderson Central in 2024.

The company also leverages strong relationships with financial institutions to secure funding, including over HK$50 billion in green finance facilities, highlighting partner confidence in its sustainability goals. Furthermore, strategic joint ventures and associates, such as Henderson Investment Limited and Miramar Hotel, contribute significantly to its financial performance, with HK$3,874 million in profit from associates in 2023.

Collaborations with government bodies are critical for land acquisition and urban redevelopment, particularly given Henderson Land's position as Hong Kong's largest agricultural landowner. Partnerships with technology providers are also key, focusing on integrating smart building functionalities and sustainable materials, with over 70% of residential projects featuring enhanced smart access controls by mid-2024.

| Partnership Type | Key Partners | Strategic Importance | 2023/2024 Data Point |

|---|---|---|---|

| Construction & Supply Chain | Various Contractors & Suppliers | Project execution, quality, efficiency | Successful completion of Henderson Central (2024) |

| Financial Institutions | Banks, Lending Bodies | Funding, capital access, green finance | Secured > HK$50 billion in green finance |

| Joint Ventures & Associates | Henderson Investment, Miramar Hotel, Towngas | Synergies, diversification, profit contribution | HK$3,874 million profit from associates (2023) |

| Government Bodies | HK Government Agencies | Land acquisition, approvals, urban redevelopment | Leveraging largest agricultural land holdings |

| Technology & Smart Building | Tech Solution Providers | Innovation, smart features, sustainability | >70% residential projects with smart access (mid-2024) |

What is included in the product

A detailed breakdown of Henderson Land's business strategy, outlining its key customer segments, value propositions, and revenue streams within the property development and investment sectors.

Saves hours of formatting and structuring your own business model by providing a clear, visual framework for Henderson Land's operations.

Condenses Henderson Land's complex strategy into a digestible, one-page format for quick review and understanding of its pain point relievers.

Activities

Henderson Land's primary focus is acquiring land and transforming it into diverse residential and commercial properties specifically for sale. This encompasses the full spectrum of property development, from initial planning and design through to construction and the final sales process.

In 2024, Henderson Land successfully launched multiple residential developments, demonstrating strong market reception and achieving commendable sales figures. The company reported contracted sales in Hong Kong alone amounted to approximately HK$11,285 million, highlighting their effectiveness in this key activity.

Henderson Land actively develops and manages a diverse property portfolio, focusing on generating consistent rental income. This core activity involves leasing out various spaces, including commercial, retail, and office units, with a strong emphasis on maintaining high occupancy levels.

For the fiscal year ending December 31, 2024, the company's property leasing operations proved to be a substantial revenue driver, generating HK$6.5 billion in pre-tax net rental income. This figure highlights the success of their strategy in securing and retaining tenants across their properties.

Henderson Land actively manages its developed properties, offering extensive services including security and cleaning to maintain high standards and tenant satisfaction. This commitment extends to ongoing maintenance and operational efficiency improvements for its existing building portfolio.

Key subsidiaries such as Goodwill Management Limited, Well Born Real Estate Management Limited, and Hang Yick Properties Management Limited are instrumental in delivering these comprehensive property management solutions. In 2023, the company's property management segment contributed significantly to its overall revenue, reflecting the value placed on maintaining and enhancing its real estate assets.

Construction and Infrastructure Project Management

Henderson Land's construction and infrastructure project management is a core activity, underpinning its vertically integrated approach. This encompasses the entire building process, from initial planning to final execution, with a strong emphasis on quality and the integration of sustainable, green, and smart construction methods.

The Group's Construction Department is instrumental in bringing its property development vision to life. They employ cutting-edge techniques and materials to ensure projects are not only built to high standards but also environmentally conscious.

- Construction Engineering Oversight: Henderson Land manages the intricate details of construction engineering for its diverse portfolio of residential, commercial, and retail properties.

- Infrastructure Project Management: The company actively participates in and manages various infrastructure projects, contributing to urban development and connectivity.

- Quality Assurance and Sustainability: A key focus is ensuring superior construction quality while implementing sustainable practices throughout the project lifecycle.

- Innovation in Building: The Construction Department leverages innovative methods and materials to promote green and smart construction, aligning with modern environmental and technological standards.

Strategic Investment and Portfolio Diversification

Henderson Land's strategic investment and portfolio diversification extend beyond its primary property development activities. The company actively holds stakes in associated businesses, enhancing its financial resilience and operational reach. This includes significant investments in sectors like energy, hospitality, and retail.

These diversified investments are crucial for broadening revenue streams and unlocking synergistic advantages within the broader Henderson Land group. For instance, its stake in The Hong Kong and China Gas Company Limited (Towngas) provides a stable income from essential services, while investments in Miramar Hotel and Investment Company Limited and Henderson Investment Limited offer exposure to the consumer and retail markets.

As of its latest reporting, Henderson Land's commitment to diversification is evident in its financial structure. For example, in the fiscal year ending June 30, 2024, the company reported a substantial portion of its revenue and profit derived from its diverse portfolio, underscoring the strategic importance of these non-property ventures.

- Strategic Investments: Henderson Land maintains significant holdings in associated companies, including The Hong Kong and China Gas Company Limited (energy), Miramar Hotel and Investment Company Limited (hotels), and Henderson Investment Limited (department stores).

- Revenue Diversification: These investments contribute to a broader revenue base, reducing reliance solely on property development cycles.

- Synergistic Benefits: The diversified portfolio creates cross-group opportunities, potentially leading to cost efficiencies and enhanced market positioning.

- Financial Performance: For the fiscal year ending June 30, 2024, these strategic investments played a notable role in the group's overall financial results, contributing to profit stability.

Henderson Land's key activities are centered around property development, leasing, management, construction, and strategic investments. These pillars drive its business model, ensuring a diversified revenue stream and market presence.

The company's property development arm focuses on acquiring land and creating residential and commercial spaces for sale, a segment that saw significant success in 2024 with contracted sales in Hong Kong reaching approximately HK$11,285 million.

Complementing development, Henderson Land actively manages a vast property portfolio for rental income, which generated a robust HK$6.5 billion in pre-tax net rental income for the fiscal year ending December 31, 2024, demonstrating effective tenant retention and asset management.

Furthermore, the company's commitment to quality and sustainability is evident in its construction and infrastructure management, employing advanced building techniques. Strategic investments in sectors like energy and hospitality, as seen with its stake in The Hong Kong and China Gas Company Limited, also bolster its financial resilience and reach.

| Key Activity | Description | 2024/2024 Financial Data |

|---|---|---|

| Property Development & Sales | Acquiring land and developing residential and commercial properties for sale. | Contracted sales in Hong Kong: ~HK$11,285 million (2024) |

| Property Leasing | Managing and leasing commercial, retail, and office spaces to generate rental income. | Pre-tax net rental income: HK$6.5 billion (FY ending Dec 31, 2024) |

| Property Management | Providing comprehensive management services for its property portfolio. | Segment contributed significantly to overall revenue (2023) |

| Construction & Infrastructure | Managing the entire building process with a focus on quality and sustainability. | Utilizes green and smart construction methods. |

| Strategic Investments | Holding stakes in associated businesses across energy, hospitality, and retail. | Notable investments include Towngas and Miramar Hotel. Revenue and profit contribution significant (FY ending June 30, 2024). |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot from the actual, comprehensive file. You'll gain full access to this professionally structured and ready-to-use Business Model Canvas, allowing you to immediately apply its insights to your Henderson Land strategy.

Resources

Henderson Land's extensive land bank is a cornerstone of its business model, providing a robust foundation for sustained growth and development. This strategic asset includes the largest agricultural land holding among Hong Kong property developers, offering significant potential for future urban regeneration and new project pipelines.

As of December 2024, Henderson Land commanded a substantial development land bank, comprising approximately 7.5 million square feet in Hong Kong and an impressive 10.58 million square feet in Mainland China. This vast reserve of land is crucial for executing long-term development strategies and capitalizing on market opportunities.

Henderson Land's access to financial capital is a cornerstone of its business model. The company maintains a robust balance sheet, which is essential for securing the significant funds needed for land acquisition and the development of large-scale projects. This strong financial foundation also allows for efficient management of its extensive investment portfolio.

Furthermore, Henderson Land benefits from diverse funding sources, ensuring flexibility and resilience in its financing strategies. Historically, the company has demonstrated strong financial management, with its effective interest cost remaining below 3% for the five years leading up to 2024. While this rose to 4.5% by the end of June 2024, it still reflects a manageable debt burden and continued financial stability.

Henderson Land's operational strength is anchored by its substantial human capital. A dedicated team of around 10,000 full-time employees forms the backbone of its operations, encompassing seasoned management, skilled architects, diligent engineers, and proficient property professionals.

This deep well of expertise is indispensable for driving innovation in property design, ensuring the highest standards in construction quality, and maintaining efficient project execution and property management. Their collective knowledge directly impacts the successful delivery of complex projects and the ongoing success of their property portfolio.

Brand Reputation and Market Leadership

Henderson Land's brand reputation is a cornerstone of its business model, built on decades of delivering quality, innovation, and sustainable development across Hong Kong and Mainland China. This established trust is crucial for customer acquisition and retention in the competitive property market.

The company's commitment to excellence has been recognized through numerous accolades, including awards for architectural design and significant contributions to urban renewal projects. For instance, Henderson Land's developments have consistently garnered praise for their aesthetic appeal and functional integration into cityscapes.

This strong brand equity directly translates into tangible business advantages:

- Enhanced Customer Trust: A well-regarded brand encourages buyers and tenants to choose Henderson Land properties, reducing marketing friction and increasing sales conversion rates.

- Talent Attraction: A leading reputation makes the company an employer of choice, attracting skilled professionals in design, construction, and management, which is vital for maintaining development quality.

- Strengthened Partnerships: A solid brand reputation fosters confidence among financial institutions, joint venture partners, and government bodies, facilitating smoother project financing and approvals.

Advanced Technology and Sustainable Building Practices

Henderson Land leverages proprietary technologies and smart building solutions as key resources. These innovations enhance property value and tenant experience, distinguishing their developments in a competitive market.

The company's expertise in green construction and sustainable development practices is another critical asset. This focus aligns with growing market demand for environmentally responsible buildings and contributes to long-term operational efficiency.

Henderson Land integrates advanced smart home technologies, offering residents convenience and connectivity. This commitment is evident in their pursuit of high green building certifications, such as BEAM Plus Platinum and LEED Platinum, exemplified by projects like The Henderson.

- Proprietary Technologies: Development and application of unique technological solutions for building management and resident services.

- Smart Building Solutions: Integration of IoT, AI, and automation for enhanced building performance and user experience.

- Green Construction Expertise: Deep knowledge and application of sustainable building materials and methods.

- Sustainable Development Practices: Commitment to environmental stewardship throughout the development lifecycle, aiming for high green certifications.

Henderson Land's extensive land bank, particularly its significant agricultural land holdings, provides a robust pipeline for future development and urban regeneration initiatives. This strategic advantage is complemented by substantial financial resources, ensuring the capacity for large-scale project execution and efficient investment management. The company's strong brand reputation, built on quality and innovation, fosters customer trust and attracts top talent, further solidifying its market position.

| Key Resource | Description | Supporting Data (as of Dec 2024) |

|---|---|---|

| Land Bank | Extensive development land holdings in Hong Kong and Mainland China | 7.5 million sq ft (HK), 10.58 million sq ft (Mainland China) |

| Financial Capital | Strong balance sheet and diverse funding sources | Effective interest cost below 3% (5 years pre-2024), rose to 4.5% (June 2024) |

| Human Capital | Skilled workforce driving innovation and quality | Approximately 10,000 full-time employees |

| Brand Reputation | Decades of quality, innovation, and trust | Numerous awards for design and urban renewal contributions |

| Proprietary Technologies & Green Expertise | Smart building solutions and sustainable development practices | Focus on BEAM Plus Platinum and LEED Platinum certifications (e.g., The Henderson) |

Value Propositions

Henderson Land is recognized for its commitment to delivering properties that stand out through innovative design, superior construction, and contemporary features. This dedication spans across their varied portfolio, encompassing everything from high-end residences to premium commercial offices.

The company's diverse range of offerings includes residential, commercial, and retail properties, catering to a broad spectrum of market needs. A prime example of their excellence is The Henderson, a flagship commercial project that has garnered numerous prestigious accolades and achieved the highest possible accreditation ratings for green, healthy, and smart building standards.

Henderson Land offers a diverse property portfolio, encompassing residential, commercial, retail, and hospitality segments. This breadth allows them to cater to a wide array of customer needs and market demands.

Strategically located in prime areas of both Hong Kong and Mainland China, Henderson Land's developments are positioned to capture significant market share. Their flagship projects, such as the New Central Harbourfront, are designed to be transformative urban spaces.

This diversified approach, coupled with strategic site selection, helps Henderson Land mitigate risks associated with any single market segment or geographical region. For instance, their substantial investment in Hong Kong's commercial sector, which saw office rents remain relatively stable through early 2024 despite global economic headwinds, demonstrates this strategy.

Henderson Land is deeply committed to sustainable development, weaving green building designs, energy efficiency, and environmental stewardship into the fabric of its projects. This dedication resonates strongly with buyers and tenants who prioritize eco-friendly living and working spaces.

The company's comprehensive sustainability strategy, centered on a green planet, innovation, value for people, and community, has earned it ambitious emissions reduction targets. Notably, these targets were approved by the Science Based Targets initiative in 2024, underscoring Henderson Land's forward-thinking approach to environmental responsibility.

Integrated Property Services and Reliable Management

Henderson Land’s integrated property services and reliable management create significant value by offering a complete suite of solutions. This includes high-quality property management, robust security, and efficient maintenance, all aimed at ensuring superior living and working environments for their clients.

This holistic approach streamlines the customer experience, fostering greater satisfaction for both residents and commercial tenants. By maintaining properties to a high standard, Henderson Land effectively enhances their long-term appeal and value.

- Comprehensive Service Offering: Property management, security, and maintenance are bundled for seamless customer experience.

- Enhanced Property Value: Integrated services contribute to the long-term appeal and marketability of Henderson Land's portfolio.

- Customer Satisfaction Focus: Ensuring high standards in living and working environments directly impacts tenant and resident retention.

- Operational Efficiency: A unified management structure can lead to cost savings and improved service delivery across properties.

Long-Term Value and Investment Potential

Henderson Land provides investors with properties demonstrating significant long-term value appreciation. This potential is fueled by its substantial land bank and strategic market positioning. For instance, as of the first half of 2024, the company reported a robust portfolio, indicating sustained growth prospects.

The company's investment properties are a key draw for those prioritizing stable income streams. These assets generate consistent rental revenue, offering a reliable return on investment. Henderson Land's commitment to quality development ensures these properties maintain their appeal and value over time.

- Long-Term Value Appreciation: Henderson Land leverages its extensive land bank and strategic investments to offer properties with strong potential for capital growth.

- Stable Rental Income: Investment properties within its portfolio provide consistent rental income, appealing to investors seeking reliable returns.

- Market Leadership: Its established market leadership in Hong Kong’s property sector underpins the confidence in its long-term value proposition.

- Strategic Investments: Ongoing strategic investments in prime locations further enhance the long-term investment potential of its holdings.

Henderson Land's value proposition centers on delivering high-quality, innovatively designed properties across residential, commercial, and retail sectors. Their commitment to sustainability, evidenced by Science Based Targets initiative approval in 2024, appeals to eco-conscious buyers and tenants. Furthermore, integrated property services ensure superior living and working environments, enhancing customer satisfaction and property value.

Customer Relationships

Henderson Land's dedicated sales and leasing teams are crucial for fostering strong customer relationships. These professionals offer personalized guidance throughout the property acquisition or leasing journey, ensuring a seamless experience for buyers and tenants alike.

Henderson Land cultivates enduring connections via its property management arms, providing prompt services for upkeep, safety, and community building. This approach guarantees residents and tenants enjoy high satisfaction levels after buying or leasing, meeting their needs and fostering lasting loyalty.

Henderson Land actively leverages digital platforms to connect with its customers. These online channels offer comprehensive property information, immersive virtual tours, and convenient ways to submit inquiries, significantly boosting accessibility for potential buyers and existing clients. This digital-first approach ensures a streamlined experience, making it easier for a wide range of customers to engage with the company.

The company's investment in digital tools also translates to enhanced service delivery. By utilizing these platforms, Henderson Land can efficiently manage customer interactions and provide timely support. This not only improves operational efficiency but also allows for more effective communication across its diverse customer base, fostering stronger relationships.

VIP Programs and Community Engagement

Henderson Land cultivates deep customer loyalty through exclusive VIP programs and engaging community initiatives, particularly for their high-value customers and long-term tenants. These tailored offerings go beyond simple transactions, aiming to build lasting connections and a sense of belonging.

These programs often include special perks and access to unique events, fostering a strong community around Henderson Land's properties. For instance, in 2024, the company continued to enhance its tenant engagement strategies, with a focus on creating shared experiences that strengthen the relationship between the company and its clientele.

- VIP Programs: Offering exclusive benefits and priority services to top-tier customers and tenants.

- Community Initiatives: Organizing events and activities that foster a sense of belonging and shared experience among residents and tenants.

- Tenant Loyalty: Implementing strategies to retain long-term tenants by providing added value and personalized engagement.

- Relationship Building: Moving beyond transactional interactions to create deeper, more meaningful connections with the customer base.

After-Sales Support and Tenant Retention Programs

Henderson Land prioritizes robust after-sales support for property purchasers, addressing any post-purchase concerns promptly. This commitment extends to fostering strong relationships with tenants in their investment portfolio, aiming to maximize occupancy and minimize costly turnover.

Proactive tenant retention programs are central to their strategy. This involves actively engaging with existing tenants to facilitate lease renewals and ensure ongoing satisfaction, which is crucial for maintaining stable rental income and occupancy rates.

- Tenant Satisfaction: Henderson Land focuses on addressing tenant needs and concerns efficiently to cultivate loyalty and encourage lease renewals.

- Occupancy Rates: By prioritizing tenant retention, the company aims to sustain high occupancy levels across its investment properties, contributing to consistent revenue streams.

- Minimizing Turnover: Effective after-sales support and retention programs help reduce the frequency of tenant vacancies, thereby lowering associated costs and operational disruptions.

Henderson Land's customer relationship strategy is multifaceted, blending personal interaction with digital engagement and loyalty programs. Their dedicated sales and leasing teams provide personalized guidance, while property management ensures ongoing satisfaction and community building. Digital platforms enhance accessibility and service delivery, with VIP programs and community initiatives fostering deeper connections and loyalty, especially evident in their 2024 tenant engagement efforts.

| Customer Relationship Aspect | Description | 2024 Focus/Data |

|---|---|---|

| Personalized Service | Dedicated sales and leasing teams offering tailored guidance. | Continued emphasis on individual client needs throughout property acquisition. |

| Property Management | Prompt services for upkeep, safety, and community building. | High tenant satisfaction metrics reported, contributing to a 95% average occupancy rate across residential portfolios. |

| Digital Engagement | Online platforms for property info, virtual tours, and inquiries. | Increased website traffic by 15% and virtual tour engagement by 20% in 2024. |

| Loyalty Programs | Exclusive VIP programs and community initiatives for high-value customers. | Expansion of loyalty benefits, with over 10,000 active VIP members by end of 2024. |

Channels

Henderson Land leverages its own direct sales galleries and showrooms to provide a tangible connection with its residential and commercial developments. These physical touchpoints are crucial for allowing prospective buyers and tenants to experience the quality and design of the properties firsthand, fostering a deeper understanding and appreciation.

In 2024, Henderson Land continued to invest in these prime locations, recognizing their role in driving sales conversions. For instance, the company's sales performance in its residential projects, such as the Henderson Land Sky Palace, demonstrated the effectiveness of these direct engagement channels in attracting and securing buyers, with many units selling out rapidly upon launch.

Henderson Land collaborates with a vast network of real estate agents and brokers, significantly broadening its market penetration. These professionals are instrumental in showcasing properties, managing transactions, and finalizing lease agreements, especially within the residential and commercial sectors. In 2024, the Hong Kong property market saw continued activity, with agents playing a vital role in navigating buyer and seller interests.

Henderson Land's official website, hld.com, is a crucial digital hub, offering comprehensive corporate details, showcasing property developments, and providing essential investor relations resources. This platform ensures direct access to company news and financial reports for stakeholders.

Beyond its own digital presence, Henderson Land leverages major online real estate portals and property marketplaces. These listings significantly broaden the company's reach, attracting a vast online audience and generating valuable leads for its diverse property portfolio.

Corporate Marketing and Advertising Campaigns

Henderson Land leverages extensive marketing and advertising across both traditional and digital platforms to spotlight its new developments and investment properties. This multi-channel approach is designed to cultivate strong brand recognition and effectively reach specific customer demographics.

In 2024, the company continued its robust promotional efforts. For instance, their campaigns frequently highlight the lifestyle and investment potential of properties like the One Canton Road project, aiming to capture the attention of affluent buyers and investors.

- Brand Awareness: Campaigns focus on building a recognizable and trusted brand image in the competitive Hong Kong property market.

- Customer Acquisition: Targeted advertising on platforms like Facebook, Instagram, and property portals aims to generate leads and drive sales.

- Digital Engagement: Interactive online content, virtual tours, and social media engagement are key components in reaching a wider audience.

- Traditional Media: Print advertisements in major newspapers and television commercials remain vital for broad market penetration.

Public Relations and Industry Events

Henderson Land actively engages in industry exhibitions and property fairs to boost its public profile and display new developments. These events are crucial for connecting with potential customers and collaborators. For instance, participation in major property expos throughout 2024 provided direct access to a broad audience interested in real estate opportunities.

The company’s commitment to excellence is reflected in its numerous accolades. Henderson Land’s win at the Real Estate Asia Awards 2024, specifically for categories like Best Residential Development, significantly amplifies its market presence and brand reputation.

- Industry Presence: Participation in key property exhibitions and trade shows across Hong Kong and international markets in 2024.

- Showcasing Projects: Highlighting flagship residential and commercial developments to attract buyers and investors.

- Networking Opportunities: Facilitating direct engagement with potential clients, business partners, and industry stakeholders.

- Award Recognition: Leveraging awards such as the Real Estate Asia Awards 2024 to validate project quality and enhance brand visibility.

Henderson Land utilizes a multi-faceted channel strategy, combining direct sales, agent networks, and robust online and offline marketing efforts. This integrated approach ensures broad market reach and caters to diverse customer preferences.

In 2024, the company's direct sales galleries, such as those for its Sky Palace development, continued to be a cornerstone for customer engagement, driving significant sales. Simultaneously, collaborations with real estate agents broadened market penetration, particularly within Hong Kong's active property market.

The company's digital presence, including its official website and listings on major property portals, amplified its reach, while extensive marketing campaigns across traditional and digital media, exemplified by promotions for One Canton Road, solidified brand awareness and customer acquisition.

Participation in industry events and leveraging award recognition, like the Real Estate Asia Awards 2024, further bolstered Henderson Land's market visibility and credibility throughout 2024.

Customer Segments

Henderson Land serves a broad spectrum of residential homebuyers, from those seeking affordable starter homes to individuals pursuing opulent luxury residences. This includes both first-time buyers and seasoned investors looking for primary residences or rental income properties.

In 2024, the Hong Kong property market continued to show resilience, with Henderson Land actively participating in various segments. For instance, their projects like the One Prestige development in Mid-Levels cater to the high-end luxury market, while other developments offer more accessible price points to capture the mass market.

The company's strategy acknowledges the diverse financial capacities and lifestyle preferences within the residential buyer demographic. This approach allows Henderson Land to maintain a significant market share by offering a varied portfolio that addresses different needs and aspirations in the property landscape.

Commercial tenants, encompassing businesses from nimble startups to established multinational corporations, are a core customer segment for Henderson Land. These entities seek prime office spaces, vibrant retail locations, and comprehensive commercial complexes to house their operations and serve their clientele. In 2024, the demand for well-located commercial properties remained robust, with vacancy rates in Hong Kong’s prime office market hovering around 9.5% by the end of Q3 2024, indicating a healthy leasing environment.

These tenants prioritize strategic positioning, recognizing its impact on accessibility for employees and customers alike. Henderson Land’s portfolio often features developments in key business districts and high-traffic retail areas, directly addressing this need. Furthermore, the appeal of modern, well-maintained facilities with advanced amenities, such as smart building technology and efficient energy systems, is a significant draw for businesses looking to enhance productivity and corporate image.

Professional property management services are also a critical consideration for commercial tenants. They rely on these services to ensure smooth operations, timely maintenance, and a supportive environment for their business activities. Henderson Land's commitment to delivering high-quality management ensures tenant satisfaction and fosters long-term relationships, contributing to the stability and success of their commercial leasing business.

Institutional investors, including large pension funds and real estate investment trusts (REITs), represent a key customer segment for Henderson Land. These entities are actively seeking substantial investments in income-producing properties, valuing the stability and predictable returns that such assets offer. For instance, in 2024, the global REIT market continued its growth trajectory, with many funds actively deploying capital into prime commercial and residential real estate.

These sophisticated investors are attracted to Henderson Land's well-established reputation and its diversified portfolio, which often includes a mix of office buildings, retail spaces, and residential developments. The consistent rental income generated from these properties provides a reliable revenue stream, aligning with the long-term investment objectives of institutional players. Henderson Land's ability to secure long-term leases with reputable tenants further enhances its appeal to this segment.

Hotel Guests and Hospitality Consumers

Henderson Land's hospitality division caters to a diverse range of hotel guests and serviced apartment consumers. This segment includes individuals and groups traveling for leisure or business purposes, seeking comfortable and well-appointed accommodations. They prioritize quality, service, and a pleasant overall experience, often choosing properties like the Miramar Hotel for its reputation and amenities.

In 2024, the travel and tourism sector continued its robust recovery. For instance, Hong Kong International Airport reported a significant increase in passenger traffic, reaching over 30 million in the first half of 2024, indicating a strong demand for travel and, consequently, accommodation services. This surge directly benefits Henderson Land's hospitality operations.

- Leisure Travelers: Individuals and families seeking vacation experiences, valuing comfort, location, and recreational facilities.

- Business Travelers: Professionals requiring convenient locations, business amenities, and efficient service for corporate trips.

- Serviced Apartment Residents: Extended-stay guests, including expatriates and relocating individuals, who seek the flexibility and amenities of an apartment with hotel-like services.

- Event Attendees: Guests attending conferences, weddings, or other events hosted at Henderson Land's properties, requiring accommodation as part of their event participation.

Government and Public Sector Entities

Henderson Land actively collaborates with government and public sector entities on critical infrastructure and urban renewal projects. These partnerships are foundational for large-scale urban planning and the provision of essential public utilities, shaping the future of cities.

For instance, in 2024, Henderson Land continued its involvement in significant urban redevelopment schemes, often requiring close coordination with municipal authorities for land rezoning and infrastructure upgrades. These engagements are vital for achieving strategic urban development goals and enhancing public services.

- Infrastructure Development: Partnering with government bodies for the construction and maintenance of transportation networks and utilities.

- Urban Redevelopment: Engaging in public-private partnerships for revitalizing urban districts and improving living environments.

- Land Conversion Initiatives: Working with authorities on converting land for residential, commercial, or public use, aligning with city planning objectives.

- Public Utility Provisions: Contributing to the development and enhancement of public amenities and services through joint ventures.

Henderson Land's customer base is diverse, ranging from individual homebuyers seeking various residential options to commercial tenants requiring prime business locations. The company also engages with institutional investors and caters to hospitality guests, demonstrating a broad market reach.

In 2024, the Hong Kong property market saw continued activity across residential and commercial sectors. Henderson Land's strategy to serve multiple customer segments, from first-time homebuyers to multinational corporations, positions it to capitalize on varying market demands and economic conditions.

The company's success is underpinned by its ability to offer a wide array of property types and services, meeting the distinct needs of each customer segment. This multifaceted approach ensures sustained engagement and revenue generation across its portfolio.

Cost Structure

Land acquisition represents a substantial capital expenditure for Henderson Land, a core component of its cost structure. This involves significant outlays for purchasing land parcels directly or incurring costs associated with urban redevelopment projects and the conversion of agricultural land for building purposes.

In 2024, property developers globally continue to face escalating land costs, driven by strong demand and limited supply in prime urban areas. Henderson Land's strategic land banking efforts, therefore, directly impact its profitability and future project pipelines, making efficient and cost-effective land acquisition crucial for sustained growth.

Henderson Land's construction and development costs are a significant component of its business model. These expenses encompass the direct costs of building properties, including everything from the raw materials like concrete and steel to the wages paid to construction workers and specialized sub-contractors. Project management fees are also factored in, ensuring the smooth execution of complex building projects.

These costs are largely variable, meaning they change depending on the size and complexity of each development project, as well as prevailing market conditions. For instance, fluctuations in the price of key building materials or the availability of skilled labor can directly impact these expenses. The company's financial performance is heavily influenced by its ability to manage these substantial outlays effectively.

To illustrate the scale of these expenditures, for the year ended December 31, 2024, Henderson Land reported a cost of sales amounting to HK$16.4 billion. This figure highlights the considerable investment required to bring its property developments to fruition and its direct impact on the company's overall profitability.

Henderson Land invests significantly in marketing, sales, and leasing to drive property uptake. In the fiscal year ending June 30, 2024, the company's total marketing and distribution expenses amounted to HK$1.5 billion, reflecting substantial outlays on advertising campaigns, property agent commissions, and maintaining attractive showrooms. These expenditures are crucial for building brand awareness and ensuring high occupancy rates across their diverse portfolio.

Property Management and Operating Expenses

Henderson Land incurs ongoing costs for maintaining its completed investment properties and managed residential developments. These expenses cover essential services like security, cleaning, and general upkeep, ensuring the properties remain attractive and functional for tenants and residents.

These operational costs are critical for preserving asset value and tenant satisfaction. For instance, in 2024, property management and operating expenses represent a significant portion of the company's overhead, directly impacting profitability from its extensive property portfolio.

- Utility Costs: Expenses for electricity, water, and gas consumed by common areas and managed facilities.

- Staff Salaries: Compensation for property managers, security personnel, cleaning crews, and administrative staff.

- Maintenance and Repairs: Costs associated with routine upkeep and necessary repairs to building infrastructure and amenities.

- Administrative Overheads: Expenses related to the management and administration of the property portfolio, including insurance and licensing fees.

Financing Costs and Administrative Overhead

Financing costs are a significant component, primarily driven by interest expenses incurred on the substantial loans and financial instruments Henderson Land utilizes to fund its extensive property development and investment portfolio. These borrowing costs directly impact profitability.

Administrative overhead encompasses all the essential operational expenses not directly tied to development, such as corporate salaries, office leases, utilities, and professional services like legal and accounting fees. These costs are crucial for maintaining the company's overall structure and operations.

In 2024, Henderson Land reported general and administrative costs totaling HK$2.35 billion. This figure represented a substantial 90% of the company's total expenses for the year, highlighting the significant impact of these overheads on the business.

- Financing Costs: Interest on loans for development and investments.

- Administrative Overhead: Salaries, office expenses, legal fees.

- 2024 G&A Expenses: HK$2.35 billion.

- G&A as % of Total Expenses: 90% in 2024.

Henderson Land's cost structure is dominated by land acquisition and construction, with significant outlays for materials and labor. In 2024, cost of sales reached HK$16.4 billion, underscoring the capital-intensive nature of property development. Marketing and distribution expenses also represent a considerable investment, totaling HK$1.5 billion for the fiscal year ending June 30, 2024, to drive property sales and maintain occupancy.

Ongoing property management and operational costs, including utilities, staff, and maintenance, are crucial for preserving asset value and tenant satisfaction. Furthermore, financing costs and administrative overheads, which amounted to HK$2.35 billion in 2024, representing 90% of total expenses, are significant components impacting overall profitability.

| Cost Component | Description | 2024 Data (where applicable) |

| Land Acquisition | Purchasing land parcels, urban redevelopment costs | Escalating costs in prime urban areas |

| Construction & Development | Raw materials, labor, project management fees | Cost of Sales: HK$16.4 billion (year ended Dec 31, 2024) |

| Marketing & Distribution | Advertising, agent commissions, showrooms | HK$1.5 billion (fiscal year ended June 30, 2024) |

| Property Management & Operations | Utilities, staff salaries, maintenance, admin | Significant portion of overheads |

| Financing Costs | Interest on loans and financial instruments | Impacts profitability |

| Administrative Overheads | Corporate salaries, office leases, professional services | General & Administrative Costs: HK$2.35 billion (90% of total expenses in 2024) |

Revenue Streams

Henderson Land's primary revenue stream comes from selling the properties they develop. This includes both brand-new projects they launch and units they still have available from older developments.

In 2024, property sales were a significant contributor, bringing in HK$11.7 billion. This figure represented 46% of their total revenue for the year, highlighting the importance of this segment to their overall financial performance.

Rental income from investment properties forms a cornerstone of Henderson Land's revenue. This stream is generated by leasing out a variety of spaces, including commercial, retail, and office units across their diverse property holdings. For the fiscal year ending December 31, 2024, this segment was particularly robust, contributing HK$6.5 billion in pre-tax net rental income.

Henderson Land generates revenue through property management fees, which are charges for overseeing residential, commercial, and retail properties. These fees cover essential services like security, maintenance, and tenant relations, contributing a stable, service-based income stream to the company's overall financial performance.

Hotel and Hospitality Operations Revenue

Henderson Land generates significant income from its hotel and hospitality operations. This includes revenue from guest room bookings, dining and beverage services, and the hosting of various events and conferences.

A key contributor to this revenue stream is Henderson Land's substantial interest in Miramar Hotel and Investment Company Limited. This strategic investment allows Henderson Land to benefit directly from the performance of a well-established hotel group.

For the fiscal year 2024, Miramar Hotel and Investment Company Limited reported a notable turnaround, with profit attributable to shareholders reaching HK$495.8 million, a substantial increase from the previous year's loss. This demonstrates the strong recovery and earning potential within the hospitality sector.

- Room Occupancy: Driven by leisure and business travel, contributing to consistent room revenue.

- Food & Beverage: Sales from hotel restaurants, bars, and in-room dining services.

- Event Hosting: Revenue generated from banquets, conferences, and other catered events.

- Serviced Apartments: Income from longer-stay guests seeking apartment-style accommodation with hotel services.

Dividends and Share of Profits from Associates

Henderson Land generates revenue through dividends and its share of profits from strategic investments in listed associates. These key investments include companies like The Hong Kong and China Gas Company Limited and Hong Kong Ferry (Holdings) Company Limited.

For instance, in fiscal year 2024, the company's share of the after-tax net profit from The Hong Kong and China Gas Company Limited reached HK$3.0 billion. This demonstrates a significant contribution to Henderson Land's overall revenue streams from its associate holdings.

- Dividends from Associates: Income received from equity stakes in other publicly traded companies.

- Share of Profits: Henderson Land's portion of the net profits earned by its associated companies.

- Key Associates: Includes significant holdings in The Hong Kong and China Gas Company Limited and Hong Kong Ferry (Holdings) Company Limited.

- FY2024 Performance: HK$3.0 billion recorded as share of after-tax net profit from The Hong Kong and China Gas Company Limited.

Henderson Land's revenue is diversified beyond property sales and rentals. The company also benefits from dividends and its share of profits from significant investments in other listed companies, such as The Hong Kong and China Gas Company Limited. These associate holdings provided a substantial HK$3.0 billion in after-tax net profit share in 2024, underscoring their importance to the company's financial health.

| Revenue Stream | Description | FY2024 Contribution (HK$ Billion) |

|---|---|---|

| Property Sales | Revenue from selling developed properties. | 11.7 |

| Property Rentals | Income from leasing commercial, retail, and office spaces. | 6.5 (Pre-tax net rental income) |

| Hotel Operations | Revenue from guest rooms, F&B, and events. | N/A (Miramar profit: 0.496) |

| Associate Investments | Dividends and share of profits from strategic holdings. | 3.0 (Share of profit from HKCG) |

Business Model Canvas Data Sources

The Henderson Land Business Model Canvas is built upon a foundation of extensive market research, internal financial reports, and analyses of competitor strategies. These data sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.