Henderson Land Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

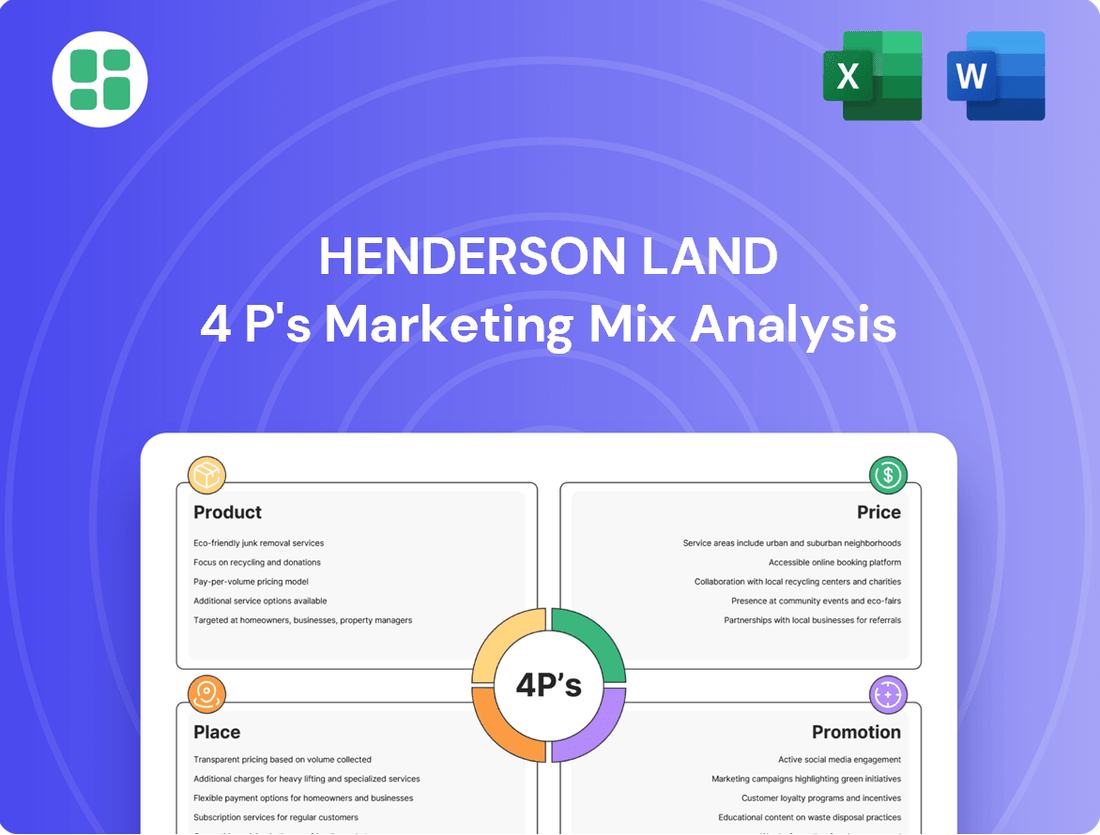

Dive into the strategic brilliance of Henderson Land's marketing with our comprehensive 4Ps analysis. Discover how their innovative product development, competitive pricing, prime distribution, and impactful promotions create market dominance.

Unlock the secrets behind Henderson Land's success. Our full 4Ps analysis provides actionable insights into their product differentiation, pricing strategies, effective place-based marketing, and persuasive promotion tactics.

Ready to elevate your marketing understanding? Get instant access to a professionally crafted, editable 4Ps Marketing Mix Analysis for Henderson Land. It’s the perfect tool for students, professionals, and anyone seeking a competitive edge.

Product

Henderson Land's diverse property development encompasses a broad spectrum of residential and commercial projects in both Hong Kong and mainland China. This product strategy is geared towards capturing demand across various market segments, from high-end luxury residences to more affordable mass-market housing. The company's commitment to innovation is evident in developments like 'The Henderson,' which integrates cutting-edge green and smart building technologies.

The company's product pipeline is robust, with plans to launch 12 new projects and approximately 5,400 residential units in 2025. This aggressive development schedule is designed to address the significant and ongoing housing demand in its key markets, ensuring a consistent supply of new properties to the market.

Henderson Land's strategic property investment portfolio is a cornerstone of its 'Product' strategy, extending beyond residential sales to include a robust collection of income-generating assets. This diversified approach encompasses prime office buildings, sought-after retail spaces, and versatile mixed-use developments.

These investment properties are crucial for generating stable rental income, a significant contributor to Henderson Land's overall revenue. For instance, in 2023, rental income from investment properties represented a substantial portion of their earnings, particularly from key urban centers like Shanghai and Guangzhou, underscoring the value of these long-term assets.

By concentrating on high-quality, well-located properties, Henderson Land ensures sustained value appreciation and reliable, recurring income streams. This focus on premium assets is designed to provide resilience and consistent financial performance, even amidst market fluctuations.

Henderson Land provides integrated property management services across its diverse portfolio, encompassing residential, industrial, commercial, retail, office, and car parking spaces. This comprehensive approach ensures high standards of maintenance and operational efficiency, directly benefiting property owners and tenants alike.

Key subsidiaries like Hang Yick, Well Born, and Goodwill are at the forefront of their property management operations. These entities consistently achieve high service standards, evidenced by numerous industry accolades, underscoring Henderson Land's dedication to service excellence. For instance, Hang Yick Property Management was recognized with multiple awards in 2023, highlighting their commitment to quality service delivery.

Construction and Infrastructure Ventures

Henderson Land's Construction and Infrastructure Ventures are a cornerstone of its integrated strategy, ensuring quality and efficiency. The Group’s Construction Division is instrumental in developing high-quality properties, consistently meeting international benchmarks for sustainability and safety. This commitment to in-house construction capabilities allows for rigorous quality control from foundation to finish.

Beyond property development, Henderson Land actively participates in significant infrastructure projects, contributing to Hong Kong's urban advancement. For instance, the Group is a key participant in the development of the Northern Metropolis, a major strategic initiative aiming to create a new economic hub. This vertical integration not only enhances operational efficiency but also provides a competitive edge by controlling costs and timelines across its diverse portfolio.

The financial performance in 2024 reflects the strength of these ventures. Henderson Land reported a significant contribution from its construction and infrastructure segments, with the Construction Division undertaking projects valued at over HK$15 billion in the first half of 2024. These investments underscore the company's long-term vision for sustainable growth and urban development.

- Vertical Integration: Henderson Land’s Construction Division manages its building projects, ensuring quality and adherence to international sustainability and safety standards.

- Infrastructure Investment: The Group invests in key infrastructure projects, such as those within the Northern Metropolis development, fostering urban growth and connectivity.

- Operational Efficiency: In-house construction capabilities lead to enhanced control over project timelines, costs, and quality, directly benefiting the overall business model.

- Financial Impact: Construction and infrastructure activities are significant revenue drivers, with the Construction Division managing projects exceeding HK$15 billion in value as of mid-2024.

Hotel Operations and Associated Businesses

Henderson Land’s product offering is diverse, encompassing premium hotel operations like the ultra-deluxe Four Seasons Hotel at the International Finance Centre (ifc) complex, which provides high-end accommodation and hospitality.

Beyond hotels, their portfolio includes retail ventures such as department stores and supermarkets, with Citistore and Unicorn being integrated into the H•COINS loyalty program in 2024.

The company also operates in financial lending and essential utility and energy sectors, notably through its involvement with Hong Kong and China Gas.

These varied operations contribute to a comprehensive product ecosystem.

- Hotel Operations: Ultra-deluxe Four Seasons Hotel at ifc, offering luxury hospitality.

- Retail: Citistore and Unicorn department stores and supermarkets, integrated with H•COINS in 2024.

- Financial Services: Engaged in financial lending activities.

- Utilities & Energy: Significant presence in utility and energy sectors, including Hong Kong and China Gas.

Henderson Land's product strategy is multifaceted, extending beyond residential and commercial property development to include a robust portfolio of income-generating assets and diverse operational ventures. This approach ensures multiple revenue streams and market penetration.

The company's commitment to quality is reflected in its premium hotel operations and its integrated retail offerings, which are increasingly linked to customer loyalty programs. Furthermore, its involvement in financial services and essential utilities like Hong Kong and China Gas demonstrates a broad and resilient business model.

Henderson Land's strategic focus on vertical integration, particularly through its Construction Division, allows for enhanced control over project quality, timelines, and costs. This internal capability is a significant advantage, ensuring that developments meet high standards of sustainability and safety.

The company's product pipeline is actively managed, with plans for significant new residential unit launches in 2025 to meet market demand. This forward-looking development strategy, coupled with a strong portfolio of investment properties, positions Henderson Land for sustained growth and financial performance.

| Product Segment | Key Offerings | 2024/2025 Data/Notes |

|---|---|---|

| Property Development | Residential, Commercial, Luxury & Mass Market Housing | 12 new projects, ~5,400 residential units planned for 2025 launch. |

| Investment Properties | Prime Office Buildings, Retail Spaces, Mixed-Use Developments | Significant rental income contribution, particularly from Shanghai and Guangzhou. |

| Property Management | Residential, Industrial, Commercial, Retail, Office, Car Parking | High service standards recognized with industry accolades in 2023 (e.g., Hang Yick). |

| Construction & Infrastructure | In-house Building Development, Infrastructure Projects | Construction Division managing projects > HK$15 billion (H1 2024); Key participant in Northern Metropolis development. |

| Hospitality & Retail | Ultra-deluxe Hotels (e.g., Four Seasons at ifc), Department Stores, Supermarkets | Citistore & Unicorn integrated into H•COINS loyalty program in 2024. |

| Financial Services & Utilities | Financial Lending, Utility & Energy Sector Involvement | Notable involvement with Hong Kong and China Gas. |

What is included in the product

This analysis provides a comprehensive examination of Henderson Land's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking to understand Henderson Land's market positioning and benchmark their own strategies against a leading developer.

Simplifies Henderson Land's marketing strategy by clearly outlining how each of the 4Ps addresses customer pain points, making it easier to identify and resolve market challenges.

Place

Henderson Land heavily relies on direct sales for its new residential and commercial projects, a strategy that involves setting up sales offices and elaborate show flats to attract potential buyers. This direct approach fosters immediate engagement, allowing the company to provide comprehensive details and streamline the buying experience for customers.

The company's commitment to direct sales is evident in its 2025 pipeline, which includes the planned launch of 12 projects comprising approximately 5,400 units. Henderson Land will manage the entire sales process for these developments internally, ensuring a controlled and efficient distribution of its property offerings.

Henderson Land's investment properties, encompassing both commercial and retail spaces, are strategically positioned in Hong Kong's prime districts and key mainland Chinese cities. This prime placement, exemplified by Grade-A commercial developments like The Henderson in Central, Hong Kong, guarantees superior accessibility and visibility. Such locations are crucial for attracting premium tenants and their clientele, thereby optimizing rental income streams and bolstering property value.

Henderson Land utilizes its corporate website and dedicated property portals as primary digital channels for showcasing available properties, sharing corporate updates, and publishing sustainability reports. These platforms act as vital initial engagement points for prospective buyers and investors, offering a comprehensive overview of listings and company information.

In 2024, Henderson Land continued its commitment to environmental responsibility by prioritizing the electronic dissemination of corporate communications, reducing paper usage. This digital-first approach to information sharing aligns with their sustainability goals and enhances accessibility for stakeholders.

Retail and Commercial Mall Networks

Henderson Land strategically develops expansive retail and commercial mall networks, exemplified by flagship properties like MCP and MOSTown in Kowloon East. These are not just shopping centers but integrated lifestyle hubs, directly connected to MTR stations, ensuring unparalleled accessibility for millions of potential customers. This prime location strategy is crucial for driving consistent foot traffic and solidifying their market presence.

These malls act as vital distribution channels for a diverse portfolio of international and local brands, catering to a broad spectrum of consumer needs and preferences. By curating an optimal tenant mix, Henderson Land enhances the overall visitor experience, fostering repeat visits and maximizing sales potential. For instance, MCP, a significant development, consistently reports high visitor numbers, underscoring the effectiveness of this approach.

- Strategic Location: Malls like MCP and MOSTown are directly integrated with MTR stations, boosting accessibility and footfall.

- Brand Distribution: Serve as key hubs for a wide range of international and local retail brands.

- Tenant Mix Optimization: Active management focuses on curating the right blend of tenants to enhance customer experience and sales.

- Visitor Engagement: Continuous efforts to improve the mall environment and offerings drive consistent visitor traffic and loyalty.

Partnerships and Joint Ventures

Henderson Land actively engages in partnerships and joint ventures, a cornerstone of its expansion strategy. These collaborations allow the company to undertake larger, more ambitious property developments and tap into new market segments. For instance, in late 2024, Henderson Land announced a significant joint venture for a prime residential project in Hong Kong, leveraging the expertise of a renowned international developer.

This approach to partnerships is crucial for managing the substantial capital requirements of major real estate projects and sharing associated risks. By pooling resources and expertise, Henderson Land can enhance its development capabilities and accelerate its growth trajectory. In 2024, the company participated in several such ventures, contributing to a robust development pipeline.

- Expanded Development Capacity: Joint ventures enable Henderson Land to participate in projects that might be too large or complex to undertake alone.

- Risk Mitigation: Sharing the financial and operational risks with partners makes large-scale developments more manageable.

- Market Access and Expertise: Collaborations can provide access to new geographical markets and specialized knowledge in construction, design, or sales.

- Synergistic Opportunities: Partnerships can create synergies by combining complementary strengths, leading to more innovative and successful projects.

Henderson Land's "Place" strategy is deeply rooted in its prime property locations, particularly its retail and commercial hubs. Malls like MCP and MOSTown are strategically situated, often with direct MTR integration, ensuring high accessibility and consistent foot traffic. This focus on prime locations is critical for attracting a diverse tenant mix, from international luxury brands to local favorites, thereby enhancing the overall customer experience and driving sales.

| Property | Location Advantage | Tenant Mix Focus | Visitor Engagement Strategy |

|---|---|---|---|

| MCP (Metro City Plaza) | Direct MTR access, Kowloon East | Diverse retail, dining, entertainment | Regular events, loyalty programs |

| MOSTown | Direct MTR access, Ma On Shan | Family-friendly retail and services | Community events, seasonal promotions |

| The Henderson | Prime Central Business District, Hong Kong | Grade-A office, luxury retail | Premium amenities, corporate services |

Same Document Delivered

Henderson Land 4P's Marketing Mix Analysis

The preview shown here is the actual Henderson Land 4P's Marketing Mix Analysis you’ll receive instantly after purchase—no surprises. This comprehensive document details their product, price, place, and promotion strategies, offering valuable insights for your own business planning.

Promotion

Henderson Land actively cultivates a robust corporate brand, highlighting its dedication to sustainability, innovation, and community betterment. This commitment is validated by significant industry recognition, including being named 'Developer of the Year - Hong Kong' in 2025 and 'Asia's Top Green Companies' in 2024.

These awards are instrumental in bolstering Henderson Land's reputation, fostering trust and positive perception among investors, stakeholders, and the broader public. Such strong branding directly supports its marketing objectives by building credibility and attracting favorable attention.

Henderson Land crafts targeted marketing campaigns for new residential and commercial developments to boost awareness and drive sales. These initiatives spotlight distinctive features, superior design, and sustainability, exemplified by luxury projects like 29A Lugard Road and the green-certified 'The Henderson'. By weaving compelling stories, they aim to resonate with specific buyer demographics.

Henderson Land prioritizes investor relations through comprehensive annual and interim reports, investor presentations, and timely announcements. This commitment ensures shareholders and potential investors are consistently updated on the company's financial health and strategic direction.

In 2024, Henderson Land's interim report highlighted a revenue of HKD 15.4 billion, demonstrating a commitment to transparent financial reporting. The company's proactive communication strategy aims to foster trust and attract sustained investment by clearly outlining financial performance and future growth prospects.

The company's dividend policy, a key aspect of its financial communication, is designed to reward shareholders and enhance investor confidence. Detailed earnings breakdowns and forward-looking statements, such as projected earnings per share for the upcoming fiscal year, are integral to this strategy, reinforcing its appeal to a broad investor base.

Public Relations and Community Engagement

Henderson Land actively engages in public relations and community initiatives to reinforce its corporate social responsibility. This includes highlighting its G.I.V.E. sustainability strategy, which focuses on environmental stewardship and social contributions. For instance, the company transformed spaces into public amenities, such as The Henderson Art Garden, fostering community engagement and enhancing urban living. They also provide community living rooms for underprivileged families, directly addressing social needs and building goodwill.

These public relations efforts are crucial for cultivating a positive brand image and securing a social license to operate. By demonstrating tangible contributions, Henderson Land aims to build trust and strengthen relationships with stakeholders. In 2023, the company continued to invest in community programs, aligning with its commitment to sustainable development and societal well-being. This proactive approach in public relations and community engagement is a cornerstone of their marketing strategy.

- Community Spaces: Development of The Henderson Art Garden as a public amenity.

- Social Support: Provision of community living rooms for underprivileged families.

- Sustainability Focus: Integration of G.I.V.E. strategy into public communications.

- Stakeholder Relations: Building positive perception and social license through engagement.

Digital Marketing and Social Media Presence

Henderson Land actively leverages digital marketing and social media to cultivate its brand and connect with customers. This includes running targeted campaigns across various platforms to highlight property features and company ethos. For instance, their property management division utilizes digital strategies to drive foot traffic and sales for their shopping malls.

The company’s approach to promotion extends to creating engaging content that communicates product advantages and corporate values. This digital-first strategy aims to broaden reach and foster deeper engagement with potential buyers and existing stakeholders.

- Social Media Engagement: Henderson Land utilizes platforms like Facebook and Instagram to showcase property developments and engage with a broad audience, aiming to build community and brand loyalty.

- Digital Advertising: The company invests in online advertising to reach specific demographic segments interested in their residential and commercial properties.

- Content Marketing: They develop informative and visually appealing content, such as virtual tours and lifestyle articles, to highlight the benefits of their developments.

- Property Management Campaigns: Digital initiatives are employed to boost customer engagement and sales within their managed shopping malls, demonstrating a commitment to ongoing promotional efforts.

Henderson Land's promotional strategy is multifaceted, encompassing strong corporate branding, targeted marketing campaigns, robust investor relations, and active public relations. The company emphasizes sustainability and innovation, as evidenced by its 'Asia's Top Green Companies' recognition in 2024. Digital marketing and social media are also key channels, used to highlight property features and engage with customers, with campaigns aimed at driving awareness and sales for both residential and commercial projects.

| Promotional Activity | Key Initiatives | Impact/Focus |

|---|---|---|

| Corporate Branding | Sustainability, Innovation, Community Betterment | Enhanced reputation, trust, investor attraction |

| Targeted Marketing Campaigns | Highlighting distinctive features, design, sustainability (e.g., 29A Lugard Road, The Henderson) | Boost awareness, drive sales for new developments |

| Investor Relations | Annual/interim reports, investor presentations, dividend policy | Transparent financial reporting, shareholder confidence |

| Public Relations & Community Engagement | G.I.V.E. strategy, The Henderson Art Garden, community living rooms | Positive brand image, social license, stakeholder relationships |

| Digital Marketing & Social Media | Targeted campaigns, engaging content, virtual tours | Broaden reach, foster engagement, drive mall traffic/sales |

Price

Henderson Land's pricing strategy is deeply rooted in the prevailing market conditions of Hong Kong and mainland China, meticulously considering factors like buyer sentiment and the pricing of comparable properties. This ensures their residential and commercial offerings remain competitive and aligned with demand.

In early 2025, Henderson Land demonstrated this adaptability by offering select new projects at discounted rates. This move was a strategic response to a softening market, characterized by an oversupply of properties, and was designed to invigorate sales and sustain momentum.

Henderson Land sets rental rates for its investment properties to be highly competitive within prime commercial and retail sectors. This strategy aims to attract and retain tenants, ensuring high occupancy rates. For instance, in 2023, Henderson Land reported a significant portion of its revenue derived from property rentals, demonstrating the effectiveness of its pricing strategy in maintaining a stable income stream even amidst broader market challenges.

Henderson Land employs value-based pricing for its premium developments, such as luxury residential projects and Grade-A commercial spaces like 'The Henderson'. This strategy aligns pricing with the superior design, advanced features, prime locations, and prestigious sustainability and smart building certifications these properties offer.

The pricing reflects the significant perceived value and unique selling propositions that set these developments apart. For instance, 'The Henderson' in Central, Hong Kong, a prime example of their Grade-A commercial offerings, is positioned to attract discerning tenants and investors who prioritize quality and prestige, commanding a premium market rate.

Flexible Payment and Financing Options

Henderson Land understands that making a property purchase is a significant financial undertaking. To ease this for potential buyers, they are expected to provide a range of flexible payment plans and financing solutions. This approach is crucial in making their properties accessible and appealing in a dynamic market.

The property market in 2025 is anticipated to see a boost, with expectations of potentially lower mortgage rates playing a role. Henderson Land is likely leveraging this sentiment by offering attractive financing packages. These arrangements are designed to not only encourage sales but also to align with buyer affordability, making the investment more manageable.

- Payment Schemes: Offering diverse installment plans to spread the cost of property acquisition.

- Discounts: Providing early bird or bulk purchase incentives to attract buyers.

- Financing Partnerships: Collaborating with banks to secure favorable mortgage rates for purchasers.

- Market Responsiveness: Adjusting payment terms in line with prevailing economic conditions and interest rate trends to stimulate demand.

Dividend Policy and Shareholder Value

Henderson Land's dividend policy plays a crucial role in how investors perceive its overall value and attractiveness. While not a direct price of a product, the consistency and level of dividends directly influence investor sentiment and, consequently, the company's market valuation.

For 2024, Henderson Land committed to maintaining its annual dividend at HK$1.80 per share. This decision was made even though the company saw a dip in its reported profits, highlighting a strategic focus on rewarding shareholders. This stability in payouts, supported by robust operating cash flows, significantly shapes how investors view the company's financial health and commitment to shareholder value.

- Dividend Per Share (2024): HK$1.80

- Impact: Influences investor perception and company valuation.

- Support: Underpinned by strong operating cash flow.

- Strategy: Prioritizes shareholder returns despite profit fluctuations.

Henderson Land’s pricing strategy is a dynamic blend of market responsiveness and value-based positioning. They adjust prices based on Hong Kong and mainland China market conditions, buyer sentiment, and competitor pricing. For premium developments, pricing reflects superior design, location, and smart certifications, as seen with 'The Henderson'. Flexible payment plans and financing solutions are offered to enhance accessibility and manage buyer affordability, especially in anticipation of potentially lower mortgage rates in 2025.

| Pricing Strategy Element | Description | Example/Data Point |

|---|---|---|

| Market-Responsive Pricing | Adjusting prices based on prevailing market conditions, buyer sentiment, and comparable property prices. | Discounted rates offered on select new projects in early 2025 to counter a softening market. |

| Value-Based Pricing | Setting prices for premium developments that align with superior design, features, location, and certifications. | 'The Henderson' in Central, Hong Kong, positioned to command premium rates due to its Grade-A status and prestige. |

| Rental Pricing | Setting competitive rental rates in prime commercial and retail sectors to ensure high occupancy. | Significant revenue derived from property rentals in 2023, indicating effective rental pricing. |

| Financing & Payment Schemes | Offering flexible payment plans and financing solutions to improve property accessibility. | Anticipated attractive financing packages in 2025, potentially leveraging lower mortgage rates to encourage sales. |

4P's Marketing Mix Analysis Data Sources

Our Henderson Land 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company disclosures, investor reports, and property development announcements. We meticulously gather information on their product portfolio, pricing strategies for various developments, distribution channels through sales offices and online platforms, and promotional activities across diverse media.