Henderson Land Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

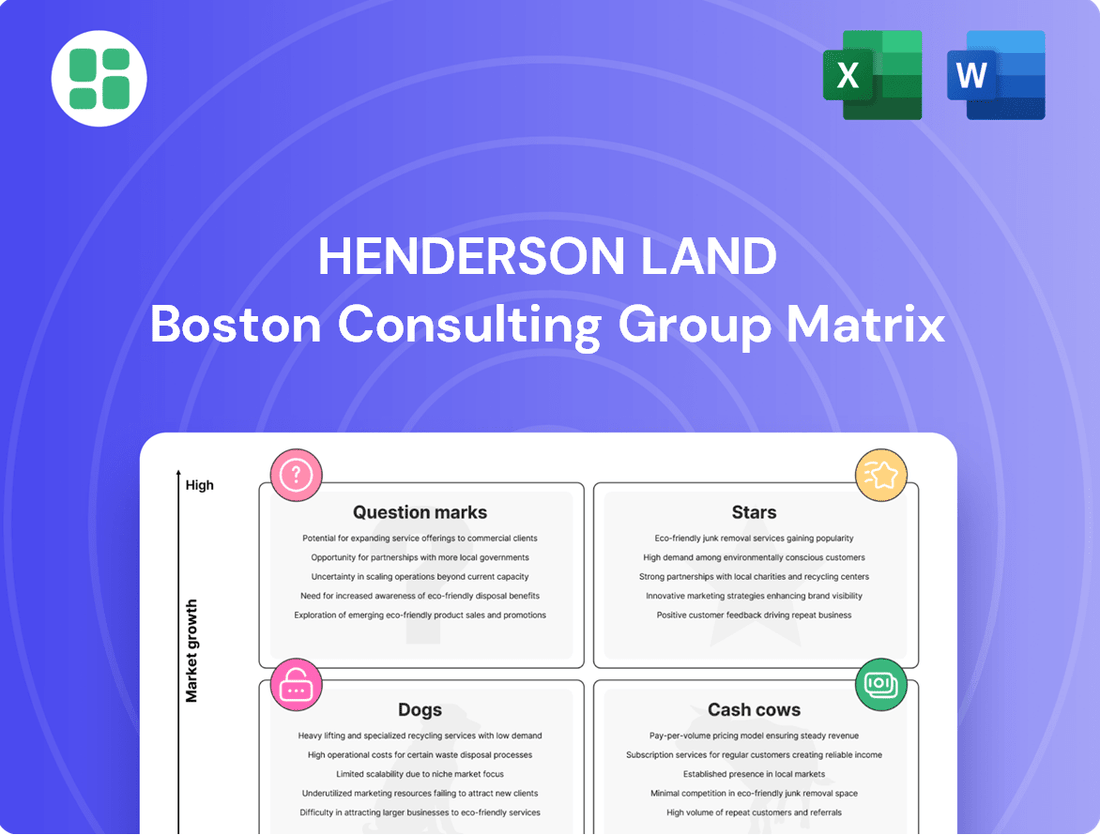

Curious about Henderson Land's strategic positioning? This preview offers a glimpse into their product portfolio's potential, highlighting areas of strength and opportunity. To truly understand their competitive edge and identify where to focus future investments, dive into the complete BCG Matrix.

The full Henderson Land BCG Matrix report provides an in-depth analysis of each product's market share and growth rate, revealing their classification as Stars, Cash Cows, Dogs, or Question Marks. Unlock actionable insights and a clear roadmap for optimizing their business strategy by purchasing the complete report today.

Stars

The Henderson Commercial Tower, a prime Grade-A office building in Hong Kong's Central district, completed in 2024, has rapidly secured an impressive 80% occupancy rate as of March 2025. This swift uptake highlights its strong appeal in a competitive market.

Its distinctive architectural design and numerous green building accolades, including LEED Platinum certification, underscore its status as a premium offering. This positions the tower as a benchmark for sustainable and high-quality commercial spaces.

The tower's success in attracting top-tier tenants, even amidst economic headwinds, showcases Henderson Land's strategic foresight and execution. This achievement points to robust market demand and significant growth prospects for the development.

Henderson Land is strategically investing in urban redevelopment projects, aiming to secure prime land in high-growth or revitalized urban areas. These projects, such as the redevelopment of Kai Tak in Hong Kong, are crucial for expanding their land bank and capturing market share in key locations.

While these initiatives demand significant capital, they are positioned as future cash cows, promising substantial returns and reinforcing Henderson Land's market leadership in urban regeneration. For instance, in 2024, the company continued to actively participate in government land tenders and explore private sector redevelopment opportunities, underscoring this strategic focus.

Henderson Land's commitment to sustainability, highlighted by its 2030 Sustainability Vision and aiming for BEAM Plus Gold Ratings, positions its new developments as environmentally responsible leaders. This strategic focus resonates with a growing demographic of tenants and buyers who prioritize Environmental, Social, and Governance (ESG) factors.

This dedication to green building isn't just about environmental stewardship; it's a smart business move. By attracting tenants and buyers who value ESG, Henderson Land secures a competitive advantage and a strong market share within the burgeoning high-growth niche of sustainable real estate. For instance, in 2023, Henderson Land reported that approximately 70% of its new residential projects were designed to achieve high green building certifications, reflecting this ongoing commitment.

High-Quality Residential Projects in Emerging Districts

Henderson Land's focus on high-quality residential projects in emerging districts is a key strategy. These developments are often launched with competitive pricing to attract buyers, especially when market sentiment shows signs of improvement.

For instance, Eight Southpark in Aberdeen saw initial pricing that included discounts. This approach is designed to capture market share effectively, particularly if the broader Hong Kong property market continues its upward trend and buyer demand remains robust throughout 2024.

- Strategic Pricing: Projects are priced to capitalize on improving market sentiment, aiming to attract a broad base of buyers.

- Market Responsiveness: Initial discounts, like those seen at Eight Southpark, are tactical moves to secure early sales and market presence.

- Emerging District Potential: Development in emerging districts signifies a long-term investment in areas with anticipated growth and value appreciation.

- 2024 Market Focus: The success of these projects hinges on sustained market warming and consistent buyer demand throughout the year.

Cross-Border Capital Connect Initiatives

Cross-border capital initiatives between Hong Kong and mainland China are expected to solidify Hong Kong's position as a leading financial hub. This will likely stimulate demand for premium commercial and residential properties within the city. Henderson Land, with its substantial real estate holdings and development expertise in both Hong Kong and mainland China, is strategically positioned to benefit from this anticipated surge in cross-border capital flows.

These initiatives are projected to drive significant growth for Henderson Land, particularly in its new development projects. The company's established presence and understanding of both markets provide a distinct advantage in attracting and managing increased cross-border investment. This synergy is anticipated to translate into robust performance for its property portfolio.

- Enhanced Financial Connectivity: Initiatives like the Stock Connect programs have already facilitated significant capital movement. For instance, by the end of 2023, northbound trading under the Shanghai-Hong Kong Stock Connect saw substantial turnover, indicating growing investor interest and integration.

- Property Market Impact: Increased capital inflows often correlate with rising property values. In 2024, Hong Kong's prime office rental values were projected to see a moderate increase, partly driven by renewed investor confidence and potential demand from mainland Chinese entities seeking offshore bases.

- Henderson Land's Position: Henderson Land's extensive portfolio, including landmark projects like the Henderson Centre in Hong Kong, positions it to capture demand from mainland investors and businesses looking to establish or expand their presence in the city.

- Growth Potential: The ongoing development pipeline for Henderson Land, especially in prime Hong Kong locations, is poised to benefit from this cross-border capital flow, potentially leading to higher sales and leasing revenues in new developments.

Henderson Land's prime office developments, like the Henderson Commercial Tower, are performing exceptionally well, achieving an 80% occupancy rate by March 2025 shortly after its 2024 completion. These high-quality, sustainable buildings are attracting premium tenants, demonstrating strong market demand and growth potential. This success underscores Henderson Land's strategic focus on developing landmark properties in key urban locations.

Henderson Land's residential projects in emerging districts, such as Eight Southpark, utilize strategic pricing, including initial discounts, to capture market share. This approach aims to capitalize on improving market sentiment and robust buyer demand anticipated throughout 2024. The company's commitment to sustainability, with a vision for high green building certifications, further enhances the appeal of its developments to ESG-conscious buyers.

The company's strategic investments in urban redevelopment, including projects in Kai Tak, are designed to expand its land bank and secure prime locations. These initiatives, funded by significant capital, are positioned as future cash cows, promising substantial returns and reinforcing Henderson Land's leadership in urban regeneration. In 2024, Henderson Land actively pursued government land tenders and private redevelopment opportunities, reflecting this ongoing strategy.

Cross-border capital initiatives between Hong Kong and mainland China are expected to boost Hong Kong's financial hub status, driving demand for premium properties. Henderson Land, with its extensive presence in both markets, is well-positioned to benefit from these capital flows, potentially increasing sales and leasing revenues for its new developments.

| Business Unit | Market Attractiveness | Competitive Strength | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Prime Office Development (e.g., Henderson Commercial Tower) | High (Strong demand, premium positioning) | High (High occupancy, LEED Platinum) | Star | Continue investment, maintain leadership. |

| Residential in Emerging Districts (e.g., Eight Southpark) | Medium to High (Improving sentiment, growth potential) | Medium to High (Strategic pricing, ESG focus) | Question Mark / Star | Monitor market response, optimize pricing. |

| Urban Redevelopment Projects (e.g., Kai Tak) | High (Long-term growth, market share capture) | High (Land bank expansion, regeneration expertise) | Star | Sustain capital investment, focus on future returns. |

| Cross-border Capital Initiatives Impact | High (Financial hub growth, property demand) | High (Established presence in HK & China) | Star | Leverage capital flows for portfolio growth. |

What is included in the product

This BCG Matrix overview for Henderson Land analyzes their property portfolio by market share and growth.

It identifies which business units to invest in, hold, or divest for optimal resource allocation.

The Henderson Land BCG Matrix streamlines portfolio analysis, relieving the pain of complex data interpretation for strategic decision-making.

Cash Cows

Henderson Land's established investment property portfolio acts as a classic cash cow. This segment, boasting a substantial presence in both Hong Kong and key mainland Chinese cities such as Shanghai and Guangzhou, consistently delivers strong rental income. In fiscal year 2024, this segment alone contributed HK$6.5 billion in pre-tax net rental income, underscoring its role as a reliable generator of substantial cash flow.

The mature nature of these properties means they operate in a stable, albeit low-growth, market. However, their high market share and consistent operational efficiency ensure dependable returns, making them a cornerstone of Henderson Land's financial stability.

The Hong Kong and China Gas Company Limited (Towngas) is a cornerstone of Henderson Land's portfolio, firmly positioned as a cash cow. Its significant contribution to the group's after-tax net profit underscores its stability and maturity. In fiscal year 2024, Towngas delivered a substantial HK$3.0 billion in profit, a testament to its reliable and consistent performance in the utility and energy sector.

Henderson Land's prime commercial property holdings, exemplified by the International Finance Centre (IFC), represent significant cash cows. These iconic assets generate consistent, long-term rental income, acting as reliable pillars of the company's financial stability.

The IFC, a prime example, consistently demonstrates market leadership with high occupancy rates and premium rental yields, even during periods of economic uncertainty. This resilience translates into a dependable cash flow, underscoring its status as a cash cow within Henderson Land's portfolio.

Property Management Services

Henderson Land's property management services function as a classic Cash Cow within its BCG Matrix. This division consistently generates predictable revenue by overseeing its extensive residential and commercial property holdings.

The stability of this segment is a key advantage. Unlike the more volatile property development sector, property management offers a more resilient profit margin, even during economic slowdowns. This dependable income stream significantly bolsters the group's overall cash flow.

For instance, in the fiscal year ending June 30, 2024, Henderson Land reported that its property investment segment, which encompasses rental income from managed properties, contributed substantially to its financial health. While specific segment breakdowns for property management alone are often integrated, the consistent performance of its investment properties underscores the reliable cash generation of this business unit.

- Consistent Revenue: Property management provides a steady, recurring income stream, unlike project-based development.

- Market Resilience: This service is less vulnerable to property market fluctuations, ensuring stable profitability.

- Cash Flow Support: The reliable profits from management services are crucial for funding other business ventures and maintaining overall financial stability.

Residential Properties Converted to Rental Units

Henderson Land's strategy of converting unsold residential units into rental properties, exemplified by developments like Baker Circle Dover, positions these assets as cash cows within its portfolio. This approach capitalizes on Hong Kong's robust rental demand, generating predictable income streams. In 2024, Hong Kong's rental market continued to show resilience, with average rents for private residential properties experiencing a steady increase, underscoring the viability of this strategy.

This conversion tactic effectively transforms dormant inventory into a source of consistent cash flow. By leveraging existing assets, Henderson Land can achieve stable recurring rental income, even in a market characterized by lower growth but high demand for leasing. This operational efficiency enhances the company's ability to generate reliable returns.

- Stable Income Generation: Rental income provides a predictable revenue stream, mitigating market volatility.

- Asset Utilization: Unsold inventory is repurposed to generate returns, optimizing asset management.

- Market Responsiveness: The strategy directly addresses high leasing demand in Hong Kong.

Henderson Land's established investment property portfolio, including prime commercial spaces like the International Finance Centre, functions as a significant cash cow. These assets consistently generate substantial rental income, contributing HK$6.5 billion in pre-tax net rental income in fiscal year 2024. Their high occupancy and market share in stable, low-growth markets ensure dependable returns, bolstering the company's financial stability.

The Hong Kong and China Gas Company Limited (Towngas) is a prime example of a cash cow, contributing HK$3.0 billion in profit after tax in fiscal year 2024. This mature utility business offers stability and consistent performance, acting as a reliable generator of cash flow for Henderson Land.

Henderson Land's property management services also operate as a cash cow, providing predictable recurring revenue from its extensive property holdings. This segment's resilience to market fluctuations ensures stable profitability, significantly supporting the group's overall financial health.

Furthermore, the conversion of unsold residential units into rental properties, as seen with Baker Circle Dover, creates new cash cows. This strategy leverages Hong Kong's strong rental demand, generating stable, recurring income streams and optimizing asset utilization.

| Business Unit | BCG Category | FY2024 Contribution (HK$ Billion) | Key Characteristics |

|---|---|---|---|

| Investment Property Portfolio | Cash Cow | 6.5 (Pre-tax Net Rental Income) | Stable rental income, low growth, high market share |

| Towngas | Cash Cow | 3.0 (After-tax Net Profit) | Mature utility, consistent performance, reliable cash flow |

| Property Management Services | Cash Cow | (Integrated within Property Investment) | Predictable recurring revenue, market resilience |

| Converted Residential Units (Rental) | Cash Cow | (N/A - Ongoing Strategy) | Stable recurring rental income, asset optimization |

Full Transparency, Always

Henderson Land BCG Matrix

The Henderson Land BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed and analysis-ready report ready for your strategic planning. You can trust that the insights and structure presented here are precisely what you'll be able to edit, print, or present to your stakeholders. This is the complete, polished BCG Matrix for Henderson Land, designed to provide immediate value and actionable insights for your business.

Dogs

Henderson Investment, a subsidiary managing department stores, experienced a substantial downturn, with losses in the first half of 2024 nearly quadrupling compared to the prior year. This financial performance underscores the difficulties faced by older retail properties within the current market landscape.

The challenging retail environment in Hong Kong, exacerbated by a surge in outbound tourism and cross-border consumption, directly impacts these assets. This situation suggests a diminishing market share and limited growth potential for these specific Henderson Land properties.

Legacy commercial assets in declining districts, under Henderson Land's BCG Matrix, represent the 'Dogs' category. These properties, often older or in less desirable locations, are experiencing heightened vacancy and falling rental income. For instance, in 2024, certain sub-markets in Hong Kong saw a notable increase in vacant office space, impacting the rental yields of these legacy assets.

These underperforming assets contribute to fair value losses on Henderson Land's investment property portfolio. In the first half of 2024, the company reported a decrease in the fair value of its investment properties, partly attributable to the challenges faced by these older commercial buildings in softer market conditions.

The lack of clear recovery prospects or market share gains for these legacy properties means they are a drain on resources and profitability. Henderson Land's strategy likely involves managing these assets to minimize further losses, potentially through divestment or repurposing, rather than investing in their growth.

Henderson Land's mainland China development projects, particularly those experiencing stalled progress or slow sales, likely fall into the Dogs quadrant of the BCG Matrix. Despite a stable rental income stream from its investment properties, the company's contracted sales in mainland China plummeted by 48% in 2024. This sharp decline indicates a challenging market environment where certain development projects may be underperforming significantly.

These underperforming projects, characterized by slow sales or substantial value depreciation, represent a considerable drain on Henderson Land's capital. They are not generating sufficient returns to justify the investment, thus fitting the low growth, low market share profile of a Dog. This situation necessitates a strategic review to potentially divest or restructure these assets to free up capital for more promising ventures.

Non-Core, Low-Value Land Holdings

Henderson Land's portfolio might include non-core, low-value land holdings. These are parcels that, due to their location or development challenges, offer limited potential for profitable sale or development. They represent assets with low growth prospects and a minimal contribution to the company's overall market share.

These holdings could represent a drag on resources, potentially incurring holding costs without generating significant returns. Identifying and strategically managing these assets is key to optimizing Henderson Land's land bank efficiency.

- Low Monetization Potential: Certain land parcels may be in less accessible areas or face zoning restrictions, making them difficult to sell or develop profitably.

- Minimal Revenue Contribution: These holdings likely contribute very little to overall revenue streams. For instance, if a company has a large land bank, a small percentage of undeveloped, less desirable parcels might represent a minimal portion of its total asset value.

- Holding Costs: Even if not actively developed, these land parcels can still incur costs such as property taxes and maintenance, impacting profitability.

- Low Growth Prospects: The market conditions or inherent characteristics of these land holdings suggest a low likelihood of significant future value appreciation.

Highly Leveraged or Older Residential Inventory

Highly leveraged or older residential inventory, particularly units that have sat on the market for a long time and require significant price reductions to sell, can be categorized as dogs within Henderson Land's portfolio. These properties often represent a drag on capital, incurring ongoing holding expenses without generating substantial returns. Their limited appeal in the current sales environment means they capture minimal market share.

These "dog" properties contribute to a decline in overall revenue from the property development segment. For instance, in 2024, Henderson Land, like many developers, faced challenges with unsold inventory. While specific figures for "dog" inventory are not publicly itemized, the company's financial reports often highlight the impact of extended sales periods on project profitability. High carrying costs, including property taxes and maintenance, further erode potential profits.

- Tied-up Capital: Properties remaining unsold for extended periods immobilize significant capital.

- Carrying Costs: Ongoing expenses like property taxes, insurance, and maintenance reduce net returns.

- Market Share Erosion: Older or less desirable inventory struggles to compete in the new sales market.

- Revenue Decline: These assets negatively impact the overall revenue generated from property development.

Henderson Land's legacy commercial assets, particularly older department store properties and those in less desirable districts, firmly reside in the Dogs quadrant of the BCG Matrix. These assets are characterized by their low market share and low growth prospects, often facing declining rental income and increasing vacancies. For example, Henderson Investment, a subsidiary managing department stores, saw its losses in the first half of 2024 nearly quadruple year-on-year, reflecting the struggles of these legacy retail spaces in a challenging Hong Kong market influenced by outbound tourism.

Similarly, stalled or slow-selling development projects in mainland China, where contracted sales plummeted by 48% in 2024, also fit the Dogs profile. These projects tie up capital and do not generate sufficient returns, representing a drain on resources. Additionally, non-core, low-value land holdings with limited development potential and minimal revenue contribution further exemplify these low-growth, low-market-share assets within Henderson Land's portfolio.

Highly leveraged or older residential inventory that remains unsold for extended periods, requiring significant price reductions, also falls into the Dogs category. These properties immobilize capital and incur carrying costs, such as property taxes and maintenance, further eroding profitability and contributing to a decline in overall revenue from the property development segment. The company's strategy for these assets likely focuses on minimizing losses, potentially through divestment or repurposing, rather than growth investment.

| Asset Type | BCG Quadrant | Key Characteristics | 2024 Performance Indicators |

|---|---|---|---|

| Legacy Department Stores | Dogs | Low market share, low growth, declining revenue, increasing vacancies | Henderson Investment losses quadrupled in H1 2024 |

| Stalled Mainland China Projects | Dogs | Low market share, low growth, capital drain, slow sales | Contracted sales down 48% in 2024 |

| Non-core Land Holdings | Dogs | Low market share, low growth, minimal revenue, holding costs | Limited public data, but represent low contribution to asset value |

| Unsold Older Residential Inventory | Dogs | Low market share, low growth, tied-up capital, carrying costs | Extended sales periods impacting project profitability |

Question Marks

Henderson Land's strategy of launching new residential projects like Eight Southpark with discounted pricing reflects a move to capture market share in a competitive Hong Kong environment. This approach, placing these projects in the question mark quadrant of the BCG matrix, signals a high-growth potential market but with uncertain future profitability. The company is investing heavily in marketing to drive sales, a crucial step for these ventures to transition into stars.

Henderson Land's exploration into smart city infrastructure and advanced energy solutions positions these ventures as potential Stars within its BCG Matrix. While these innovative areas offer significant growth prospects, they are currently in their nascent stages, reflecting a low market share. For instance, in 2024, the global smart city market was valued at approximately $1.5 trillion, with projections indicating robust compound annual growth rates, presenting a substantial opportunity for Henderson Land to capture market share.

These early-stage smart city and infrastructure projects demand considerable initial capital outlay and often involve lengthy pilot programs to prove their efficacy and market demand. This investment profile is characteristic of ventures that, while promising, have not yet achieved widespread adoption or profitability, placing them firmly in the Question Mark category. The success of these ventures hinges on navigating technological hurdles and securing early adoption, which are key determinants for their future progression within the BCG framework.

Exploring new regional markets outside of Hong Kong and mainland China would place Henderson Land's ventures in the question mark category of the BCG Matrix. These markets offer significant growth potential, but the company currently holds a low market share. For instance, if Henderson Land were to consider expansion into Southeast Asia, a region with a projected compound annual growth rate of 7.5% for real estate development through 2027, these new ventures would represent high risk due to unfamiliar market dynamics and regulatory landscapes.

High-End Residential Projects Targeting Mainland Chinese Demand

Henderson Land's strategy of converting some high-end residential units to rentals specifically for mainland Chinese professionals and students taps into a burgeoning demand. This approach targets a segment experiencing significant growth, potentially offering a strong revenue stream. For instance, in 2024, Hong Kong saw a notable increase in mainland Chinese students enrolling in universities, coupled with a rise in skilled professionals seeking opportunities, creating a sustained need for quality accommodation.

However, the long-term viability and scalability of this rental conversion strategy remain a question mark. While the immediate demand is evident, the sustainability of rental yields and the potential for market saturation require careful observation. Henderson Land must continue to invest in market research and adapt its offerings to maintain a competitive edge and secure a larger market share in this evolving segment.

- Target Market Growth: Mainland Chinese professionals and students represent a high-growth segment for Hong Kong's residential market.

- Rental Strategy: Converting residential units to rentals addresses surging demand from this specific demographic.

- Sustainability Concerns: The long-term scalability and consistent demand for this rental strategy require ongoing monitoring.

- Investment Focus: Continued investment is crucial to secure a higher market share and adapt to changing market dynamics.

Innovative Construction Technologies Adoption

Henderson Land's exploration of innovative construction technologies, like modular building, positions them in a strategic "Question Mark" category within the BCG framework. These investments, while promising future efficiencies and faster project completion, are currently in early adoption phases. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow significantly, with some reports suggesting a compound annual growth rate (CAGR) of over 6% through 2030. This indicates a high-potential growth area, but the immediate impact on Henderson Land's market share and return on investment remains uncertain.

- High Growth Potential: Investments in new technologies like prefabrication and 3D printing offer the possibility of a substantial competitive edge.

- Uncertain ROI: The immediate financial returns and market share gains from these nascent technologies are not yet fully established.

- Nascent Adoption: Widespread industry acceptance and integration of these advanced construction methods are still developing.

- Future Efficiency Driver: Successful adoption could lead to significant long-term benefits in development speed and cost reduction.

Henderson Land's ventures into new regional markets, such as potential expansion into Southeast Asia, are classified as Question Marks. These markets exhibit high growth potential, with Southeast Asia's real estate development projected to grow at a CAGR of 7.5% through 2027. However, Henderson Land's current market share in these regions is low, making the success of these ventures uncertain due to unfamiliar market dynamics and regulatory environments.

| Venture Category | Market Growth Potential | Current Market Share | Key Considerations |

|---|---|---|---|

| New Regional Markets (e.g., Southeast Asia) | High (e.g., 7.5% CAGR for SEA real estate through 2027) | Low | Unfamiliar market dynamics, regulatory landscapes, higher risk profile. |

BCG Matrix Data Sources

Our Henderson Land BCG Matrix leverages comprehensive data, including financial disclosures, property market analytics, and expert industry forecasts to ensure strategic accuracy.