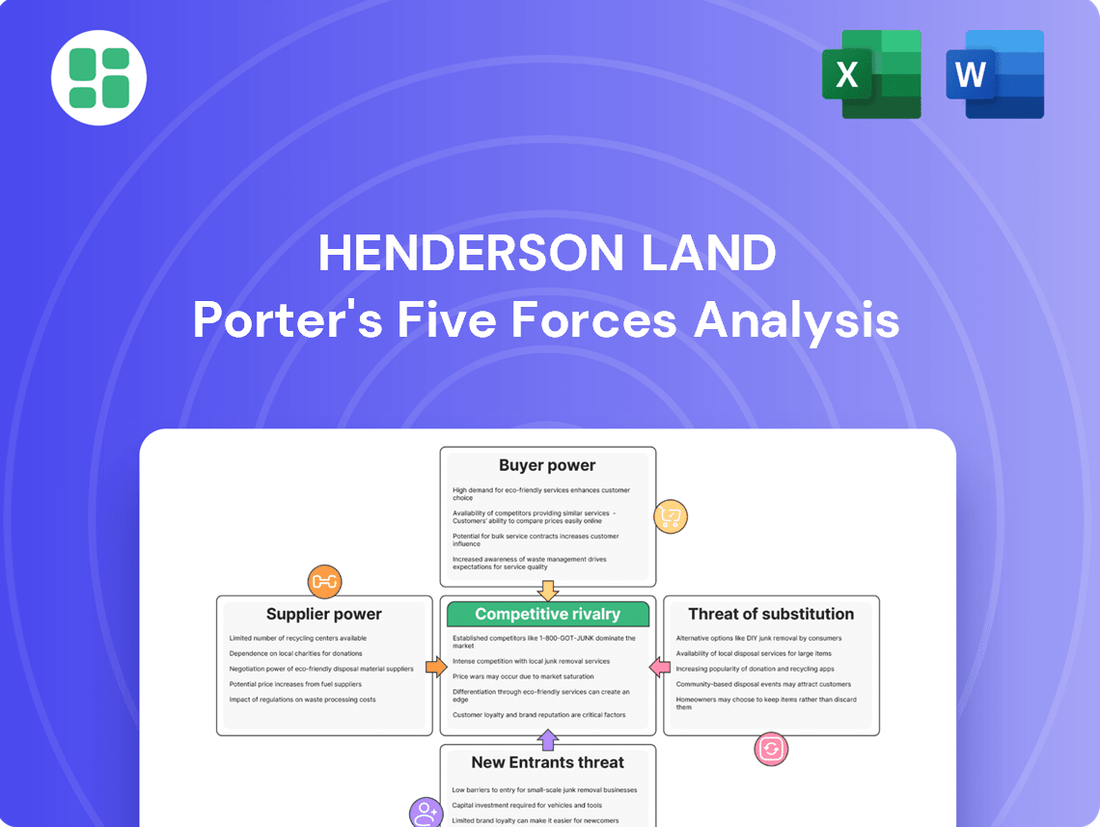

Henderson Land Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

Henderson Land navigates a complex real estate landscape where buyer power is significant due to numerous developers and readily available information. The threat of new entrants, while requiring substantial capital, remains a constant consideration in Hong Kong's dynamic market.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Henderson Land's real business risks and market opportunities.

Suppliers Bargaining Power

The bargaining power of land suppliers, particularly the Hong Kong government, is substantial for developers like Henderson Land. The government's control over land sales, a key factor in the concentrated Hong Kong property market, allows it to dictate terms and land premiums, significantly influencing development costs and feasibility for Henderson Land.

Limited prime land availability in Hong Kong further amplifies the government's leverage. For instance, in 2023, the government offered a total of 15 land sale sites in its land sale program, with an estimated total value of HK$110.6 billion, showcasing its ability to set the market price and conditions for these essential developer inputs.

The bargaining power of construction material suppliers for Henderson Land is influenced by global commodity prices and local supply chain conditions. For instance, the price of steel, a key component, saw significant volatility in 2024, with fluctuations impacting procurement costs. While Henderson Land's substantial size enables it to negotiate favorable terms through bulk purchasing, suppliers of specialized or in-demand materials can exert greater leverage.

Skilled labor, such as architects, engineers, and construction professionals, possesses moderate bargaining power, especially when the labor market is tight. Henderson Land's substantial project pipeline necessitates a consistent influx of diverse labor, and any scarcity of skilled workers could escalate labor expenses or cause project postponements.

While Henderson Land's considerable operational size may grant it some advantage in securing labor, the company remains vulnerable to broader industry-wide shifts in the labor market. For instance, in 2024, Hong Kong's construction sector faced challenges in attracting and retaining skilled labor, with reports indicating a significant demand for experienced professionals across various trades, potentially driving up wage demands.

Financial Institutions

Banks and other financial institutions providing development loans and mortgages wield considerable influence, particularly due to the substantial capital required for real estate ventures. For instance, in 2024, Hong Kong's benchmark prime rate, a key indicator for mortgage costs, saw adjustments, impacting developers' financing expenses. This financial leverage means that changes in lending policies or interest rate environments can directly affect a developer's profitability and project feasibility.

The bargaining power of these financial entities is amplified when interest rates rise or lending conditions tighten, as observed in the Hong Kong market throughout 2024. Such shifts can escalate the cost of capital for developers like Henderson Land. However, Henderson Land's robust financial health, evidenced by its diversified funding streams including successful bond issuances in early 2024, helps to buffer the impact of this supplier power.

- Increased Financing Costs: Rising interest rates in 2024 directly increased the cost of development loans for real estate firms.

- Tighter Lending Standards: Financial institutions in Hong Kong adopted more stringent criteria for loan approvals in 2024.

- Diversified Funding: Henderson Land's ability to issue bonds, such as its HK$3 billion issuance in March 2024, reduces reliance on traditional bank loans.

- Financial Resilience: A strong balance sheet allows Henderson Land to better absorb potential increases in borrowing costs.

Technology and Service Providers

Suppliers of specialized technology, such as advanced smart building systems and property management software, and professional services like legal and consulting, typically exert moderate bargaining power over Henderson Land. While these offerings are vital for contemporary property development and streamlined operations, the existence of numerous alternative providers grants Henderson Land a degree of selection flexibility.

However, this dynamic can shift. When a supplier provides highly specialized solutions or proprietary technologies, their leverage naturally increases. For instance, in 2024, the demand for sophisticated AI-driven property management platforms saw a significant uptick, potentially strengthening the negotiating position of key technology providers in that niche.

- Moderate Leverage: Multiple providers for standard tech and services keep supplier power in check.

- Specialization Impact: Proprietary or highly specialized solutions can significantly boost a supplier's bargaining power.

- Market Trends: Increased demand for niche technologies, like AI in property management, can empower specific suppliers.

The bargaining power of suppliers for Henderson Land is a multifaceted issue, with the Hong Kong government holding significant sway due to its control over land sales. Material and labor suppliers also exert influence, particularly in specialized areas or during periods of high demand. Financial institutions, while crucial partners, also represent a significant supplier power due to their role in financing, though Henderson Land's financial strength mitigates some of this. Finally, providers of specialized technology and professional services have moderate power, which can increase with niche demand.

| Supplier Type | Key Influence Factors | Impact on Henderson Land (2024/2025 Outlook) | Mitigation Strategies |

|---|---|---|---|

| Government (Land) | Land availability, auction terms, land premiums | High; dictates development costs and feasibility. 2023 land sale value HK$110.6 billion indicates government's pricing power. | Strategic land acquisition, diversified project portfolio. |

| Materials (e.g., Steel) | Global commodity prices, supply chain disruptions | Moderate to High; price volatility impacts procurement costs. Steel prices saw significant fluctuations in 2024. | Bulk purchasing, long-term supplier contracts, exploring alternative materials. |

| Labor (Skilled) | Labor market tightness, demand for expertise | Moderate; scarcity can increase labor expenses and cause delays. Hong Kong's construction sector faced skilled labor shortages in 2024. | Talent development programs, competitive compensation, efficient project planning. |

| Financial Institutions | Interest rates, lending policies, credit availability | Moderate to High; affects financing costs and project viability. Hong Kong's benchmark prime rate adjustments in 2024 influenced borrowing expenses. | Diversified funding (e.g., HK$3bn bond issuance March 2024), strong balance sheet. |

| Technology/Services | Specialization, proprietary solutions, market demand | Moderate; can increase with niche demand (e.g., AI property management in 2024). | Supplier diversification, strategic partnerships, in-house capabilities. |

What is included in the product

This analysis dissects the competitive forces impacting Henderson Land, revealing the intensity of rivalry, the power of buyers and suppliers, and the threat of new entrants and substitutes.

Instantly visualize competitive intensity across all five forces, enabling rapid identification of key strategic pressures.

Effortlessly adapt the analysis to new market data or shifts in industry dynamics for ongoing strategic relevance.

Customers Bargaining Power

Residential property buyers in Hong Kong are currently experiencing enhanced bargaining power. This is largely driven by an oversupply of homes, leading developers to adopt more competitive pricing strategies. For instance, in early 2024, the Hong Kong government reported a significant pipeline of new residential units, with tens of thousands expected to be completed in the coming years, creating a buyer's market.

The recent removal of various cooling measures in the housing market, coupled with a prevalent wait-and-see attitude among local investors, further bolsters buyers' leverage. Developers are actively offering discounts and attractive packages to move unsold inventory, a trend clearly visible across major projects aiming to attract cautious buyers.

Commercial property tenants, particularly those seeking Grade A office spaces, currently wield considerable bargaining power. This is largely due to a market characterized by elevated vacancy rates and a significant influx of new supply. For instance, Hong Kong's Grade A office vacancy rate stood at approximately 10% in late 2024, a notable increase from previous years.

Landlords are consequently incentivized to offer concessions, such as rent-free periods or fit-out contributions, to secure and retain tenants. This tenant-favorable environment is expected to persist, with forecasts suggesting a continued downward pressure on office rents, potentially seeing a 2-3% decline in prime markets through 2025.

The bargaining power of hotel guests remains substantial, primarily driven by the intensely competitive hospitality sector. With a plethora of choices ranging from traditional hotels to serviced apartments and emerging platforms like Airbnb, guests can readily compare prices and amenities, forcing providers to remain competitive on value. This high degree of substitutability significantly limits Henderson Land's ability to dictate terms.

Market-wide factors, such as overall tourist spending and prevailing travel trends, exert a considerable influence on hotel demand and pricing power, often overshadowing individual hotel strategies. For instance, the retail market's recovery, which often correlates with hotel occupancy and spending, has faced headwinds due to a slowdown in domestic consumption, impacting the overall spending capacity of potential guests.

Customers of Construction Services

For Henderson Land's construction services, the bargaining power of its customers, such as other developers or government bodies, is influenced by the size and intricacy of construction projects. For instance, in 2024, the Hong Kong construction sector saw a significant number of large-scale infrastructure tenders, which typically grants clients more leverage due to the substantial investment and the need for specialized expertise.

The competitive environment also plays a crucial role. When numerous qualified contractors are available for standard construction work, customers can more easily negotiate terms and pricing. Conversely, for highly specialized or large-scale projects, the pool of capable firms may be smaller, potentially reducing customer bargaining power.

- Project Scale and Complexity: Larger, more complex projects often involve greater client investment and a more concentrated set of potential contractors, influencing the balance of power.

- Industry Competition: A crowded market with many contractors for common services increases customer leverage, allowing for more aggressive negotiation.

- Client Type: Public sector clients, often undertaking massive infrastructure projects, may wield significant bargaining power due to their scale and procurement processes.

- Contractor Specialization: The availability of specialized skills and technologies can shift bargaining power, with clients seeking unique capabilities potentially facing less leverage.

Investors in Infrastructure Projects

Investors in infrastructure projects, including those alongside Henderson Land, wield considerable bargaining power. This stems from the substantial capital commitments and extended investment horizons involved, allowing them to negotiate terms that secure their returns and manage risk effectively. For instance, in 2024, major infrastructure deals often involve syndicates of institutional investors, such as pension funds and sovereign wealth funds, who can dictate project financing structures and profit-sharing arrangements.

Henderson Land, as a developer and investor, must contend with these investor demands. Government entities, often co-investors or regulators in infrastructure, also exert significant influence, prioritizing public benefit and stable, predictable returns. This dynamic was evident in several large-scale transportation and utility projects initiated in 2024, where government bodies stipulated specific performance metrics and revenue-sharing models.

- Large Capital Requirements: Infrastructure projects typically demand billions in funding, giving major investors significant leverage in negotiations.

- Long-Term Commitments: The multi-decade lifespan of infrastructure assets means investors require robust contractual protections and favorable financial terms.

- Influence of Institutional Investors: Pension funds and sovereign wealth funds, major players in infrastructure financing, often dictate project economics and governance.

- Governmental Stakeholder Power: Public entities involved in infrastructure projects can impose regulatory conditions and demand specific social or economic outcomes.

Customers in the residential property market in Hong Kong currently possess significant bargaining power. This is driven by an oversupply of homes, with tens of thousands of new units expected to be completed in the coming years, creating a buyer's market. Developers are responding with competitive pricing and attractive packages to move inventory, a trend amplified by a wait-and-see attitude among local investors following the removal of cooling measures.

| Market Segment | Customer Bargaining Power Factors | 2024 Data/Trends |

|---|---|---|

| Residential Property | Oversupply, buyer's market, developer incentives | Tens of thousands of new units expected; developers offering discounts. |

| Commercial Property (Grade A Office) | High vacancy rates, new supply influx, tenant concessions | Vacancy rate around 10% in late 2024; rent-free periods and fit-out contributions offered. |

| Hotel Services | Intense competition, numerous substitutes (serviced apartments, Airbnb), price sensitivity | High degree of substitutability limits pricing power; retail market recovery impacts guest spending. |

Full Version Awaits

Henderson Land Porter's Five Forces Analysis

This preview shows the exact Henderson Land Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive forces within its industry. You'll gain detailed insights into buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry. This professionally formatted document is ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

Henderson Land operates in a highly competitive Hong Kong property market, facing formidable rivals like Sun Hung Kai Properties and CK Asset Holdings. These major developers vie intensely for prime land parcels, crucial for future growth, and aggressively pursue market share in residential sales, often leading to price wars.

The battle for commercial tenants also fuels this intense rivalry, with developers offering attractive rental packages and amenities to secure anchor tenants. For instance, in 2024, the Hong Kong property market saw continued robust demand for quality office and retail spaces, intensifying the competition for leasing agreements among these major players.

The Hong Kong property market is grappling with a significant oversupply across both residential and commercial sectors. This situation intensifies price competition among developers, compelling companies like Henderson Land to adopt aggressive pricing and discount strategies to move inventory and maintain sales momentum. For instance, in early 2024, the market saw a notable increase in new property launches, putting further pressure on developers to attract buyers.

Competition in property leasing, especially for prime office spaces, is fierce. In Hong Kong, for instance, vacancy rates for Grade A offices saw an increase, reaching approximately 7.6% in late 2023, up from 6.1% in early 2023, according to JLL data. This elevated vacancy, coupled with new developments adding to the supply, puts significant pressure on landlords.

This intense rivalry directly impacts rental values, which have experienced downward pressure. Landlords are increasingly compelled to offer attractive incentives, such as rent-free periods and fit-out contributions, to secure and retain tenants in this challenging market. Such strategies are crucial for maintaining occupancy levels and mitigating revenue loss.

Diversified Business Segments

Henderson Land operates across a broad spectrum of industries, including property development and investment, management services, construction, infrastructure, energy, and hotels. This diversification exposes the company to a wide array of competitors, from specialized property developers to large hotel groups and infrastructure firms.

The competitive rivalry is intense because Henderson Land doesn't just compete with other conglomerates but also with focused specialists in each of its business segments. For example, in the hotel sector, it contends with global hospitality giants with established brand recognition and extensive loyalty programs.

The company's 2024 financial performance highlights this broad competitive landscape. For instance, Henderson Land Development's revenue for the year ended December 31, 2024, was HKD 27.7 billion, with profits attributable to shareholders reaching HKD 7.8 billion. These figures reflect performance across its diverse operations, each subject to distinct competitive pressures.

- Property Development: Faces competition from major Hong Kong developers like Sun Hung Kai Properties and CK Asset Holdings.

- Hotel Operations: Competes with international brands such as Marriott, Hilton, and Accor, as well as local luxury hotels.

- Infrastructure and Energy: Engages with other utility and infrastructure providers in the region.

- Property Management: Competes with numerous specialized property management firms offering similar services.

Market Share and Strategic Positioning

Competitive rivalry in Hong Kong's property market is intense, with developers constantly seeking to capture market share. This often involves differentiating their offerings through unique product features, strong branding, and securing prime land for future development. Henderson Land, for instance, has built its reputation on delivering high-quality, landmark projects such as the International Finance Centre and The Center, aiming to stand out in a highly competitive landscape.

Despite these efforts, the broader economic climate in Hong Kong presents significant headwinds. Challenging market conditions, including fluctuating demand and economic uncertainties, have a tangible impact on the financial results of all industry players. For example, in 2023, Hong Kong's overall property market experienced a slowdown, with residential property prices seeing a decline, which naturally affects revenue and profitability across developers like Henderson Land.

- Market Share Battles: Competitors aggressively vie for market share through innovative product design, robust brand building, and strategic acquisition of land parcels.

- Differentiation Strategy: Henderson Land differentiates itself by focusing on premium, iconic developments, exemplified by its involvement in projects like the International Finance Centre.

- Industry Impact: The entire property sector in Hong Kong faces pressure from challenging market conditions, affecting the financial performance of all major developers.

- 2023 Market Context: Hong Kong's property market in 2023 saw a general downturn, with residential prices experiencing a notable decrease, impacting industry-wide financial outcomes.

The competitive rivalry within Hong Kong's property sector is exceptionally fierce, with Henderson Land facing off against major developers like Sun Hung Kai Properties and CK Asset Holdings. This intense competition is evident in their aggressive pursuit of prime land and market share, often leading to price wars in residential sales and fierce battles for commercial tenants. For example, in early 2024, the market saw a notable increase in new property launches, intensifying the pressure on developers to attract buyers and secure leasing agreements.

This rivalry extends beyond property development into other segments where Henderson Land operates, such as hotels and infrastructure. In the hotel sector, for instance, the company competes with global giants like Marriott and Hilton, which possess strong brand recognition and extensive loyalty programs. Henderson Land's 2024 revenue of HKD 27.7 billion reflects its performance across these diverse operations, each subject to distinct competitive pressures.

| Competitor | Primary Business Segment | Key Competitive Tactics | 2024 Market Impact |

| Sun Hung Kai Properties | Property Development & Investment | Prime land acquisition, aggressive sales, premium branding | Strong market share in residential and commercial leasing |

| CK Asset Holdings | Property Development & Investment, Infrastructure | Diversified portfolio, strategic acquisitions, efficient operations | Navigating market oversupply with flexible pricing |

| Marriott International | Hotel Operations | Global brand recognition, loyalty programs, extensive network | Competing for premium clientele in Hong Kong's hospitality sector |

SSubstitutes Threaten

The expanding residential rental market poses a notable threat of substitutes for property ownership. As more individuals opt for leasing over purchasing, it directly impacts the demand for Henderson Land's core business. For instance, in 2024, urban rental yields in major cities have shown a steady climb, making renting a more financially viable option for a growing segment of the population.

The increasing adoption of remote work and the growing appeal of co-working spaces present a significant threat of substitutes for Henderson Land's traditional commercial office properties. These alternatives offer flexibility and cost savings, directly challenging the demand for long-term office leases.

This shift is evident in the broader market, with office vacancy rates in major global cities experiencing upward pressure. For instance, in Q1 2024, prime office vacancy rates in Hong Kong, a key market for Henderson Land, remained elevated, reflecting this substitution effect and impacting rental yields.

The hotel industry, including operations associated with Henderson Land, faces significant competition from alternative accommodation options. Serviced apartments, guesthouses, and burgeoning peer-to-peer rental platforms like Airbnb provide consumers with diverse choices that can siphon demand away from traditional hotels.

These substitutes often compete on price and flexibility. For instance, in 2024, the average daily rate for a serviced apartment in major global cities often undercut comparable hotel rooms, while platforms like Airbnb offer unique local experiences that traditional hotels struggle to replicate. This creates pressure on Henderson Land's hotel businesses to maintain competitive pricing and service offerings.

Government-led Infrastructure Projects

Large-scale government-led infrastructure projects can act as a substitute for private development opportunities. For instance, in 2023, Hong Kong's government continued to invest heavily in public transportation networks, such as the ongoing expansion of the MTR system. This can limit the scope for private companies like Henderson Land to develop entirely new, standalone infrastructure ventures, as the government often takes the lead in planning and execution.

The government's direct involvement in land creation and urban planning also influences the competitive landscape for private developers. When public authorities undertake significant land reclamation or urban renewal projects, they can effectively create their own infrastructure, thereby reducing the reliance on private sector initiatives for such developments. This strategic role of the government can shape the availability and nature of opportunities for companies like Henderson Land in the infrastructure segment.

- Government Infrastructure Investment: In 2023, Hong Kong's Capital Works Reserve Fund saw significant allocations towards infrastructure, potentially reducing reliance on private sector-led projects.

- Public-Private Partnerships (PPPs): While PPPs offer collaboration, the government's dominant role in initiating and structuring these projects can limit the autonomy of private developers.

- Land Supply Strategy: Government land sales and urban planning directly impact the availability of sites for private infrastructure development, acting as a form of substitution.

Modular Construction and Prefabrication

The rise of modular construction and prefabrication presents a significant threat of substitutes to traditional on-site building methods. These off-site manufacturing techniques can deliver projects faster and often at a lower cost, directly challenging the established model. For instance, in 2024, the global modular construction market was valued at approximately USD 115 billion and is projected to grow substantially, indicating a clear shift in industry preferences.

This growing adoption means that developers and clients may increasingly opt for prefabricated components or entire modular units over traditional site-built structures. If Henderson Land's construction division does not actively integrate or compete with these evolving methods, its market share for conventional construction services could erode. The ability of modular construction to reduce waste and improve quality control further enhances its appeal as a substitute.

- Modular construction offers faster project completion times compared to traditional methods.

- Cost efficiencies are a key driver for the adoption of prefabrication.

- The global modular construction market is experiencing robust growth, signaling a trend away from conventional building.

- Adaptation to prefabrication is crucial for traditional construction firms to remain competitive.

The threat of substitutes for Henderson Land's property development business comes from alternative investment vehicles and changing lifestyle preferences. For example, the increasing popularity of Real Estate Investment Trusts (REITs) offers investors a liquid and diversified way to gain exposure to property without direct ownership, potentially diverting capital from traditional property purchases. Furthermore, the growing trend towards flexible living arrangements, such as co-living spaces and short-term rentals, can reduce the demand for long-term residential leases or ownership, impacting Henderson Land's core markets.

| Substitute Type | Impact on Henderson Land | 2024 Market Trend/Data |

|---|---|---|

| REITs | Diversion of investment capital from direct property ownership. | Global REIT market capitalization continued to grow, with an estimated increase of 5-7% in 2024, reflecting sustained investor interest in property as an asset class, albeit through more liquid structures. |

| Co-living/Short-term Rentals | Reduced demand for traditional residential leases and ownership. | The co-living sector saw significant expansion, with occupancy rates in major urban centers averaging 85% in early 2024. Short-term rental platforms reported a 15% year-over-year increase in bookings for unique stays. |

| Alternative Asset Classes | Competition for investor capital with other investment opportunities. | In 2024, alternative assets like private equity and venture capital continued to attract substantial investment, with global AUM expected to reach $20 trillion, presenting a competitive landscape for real estate investment. |

Entrants Threaten

The threat of new entrants in Hong Kong's real estate sector, particularly for companies like Henderson Land, is significantly mitigated by extremely high capital requirements. Acquiring land, funding extensive construction projects, and navigating complex financing structures demand billions in upfront investment, a hurdle few new companies can clear.

For instance, in 2023, the average land premium for residential sites in Hong Kong often ran into the tens of billions of Hong Kong dollars, a testament to the immense capital needed. Henderson Land's robust financial standing and proven track record in securing diverse funding avenues, including substantial bank loans and bond issuances, further solidify its competitive position against nascent competitors who lack such financial muscle.

Hong Kong's famously constrained land availability, primarily allocated through government auctions, forms a significant hurdle for any potential new players in the property development market. This scarcity inherently limits the number of new entrants that can realistically enter the sector.

Established developers, such as Henderson Land, possess substantial land reserves and well-cultivated connections with government authorities. This existing advantage makes it considerably more difficult for emerging companies to secure desirable development plots, effectively creating a barrier to entry.

Navigating Hong Kong's property sector is a labyrinth of intricate regulations, zoning laws, and lengthy approval procedures. Newcomers would face a substantial learning curve and the very real possibility of significant project delays.

Henderson Land, however, has spent decades cultivating deep local market understanding and has honed robust, established operational frameworks. This experience is a formidable barrier, as evidenced by the significant capital and time investment required to successfully launch new developments in this competitive landscape.

Brand Recognition and Trust

Existing major developers like Henderson Land benefit from strong brand recognition and established customer trust, built over years of delivering quality projects. This deep-seated trust, coupled with extensive sales networks, makes it challenging for newcomers to quickly gain market acceptance and attract buyers or tenants.

Building a reputation for reliability and quality in the property development sector is a lengthy and capital-intensive process. For instance, Henderson Land, a prominent player in Hong Kong, has cultivated a brand that signifies stability and value, a perception that new entrants would struggle to replicate overnight.

- Brand Loyalty: Established developers often enjoy repeat business and referrals due to prior positive experiences, creating a barrier for new competitors.

- Marketing Investment: New entrants must invest heavily in marketing and advertising to build awareness and overcome the established brand equity of incumbents.

- Reputational Risk: A single misstep by a new developer can severely damage their nascent reputation, whereas established firms have a buffer of goodwill.

- Sales Channels: Henderson Land's established relationships with agents and a strong customer database provide a significant advantage in reaching potential buyers efficiently.

Integrated Business Model

Henderson Land's vertically integrated business model, spanning development, investment, management, and construction, presents a significant barrier to new entrants. This integration fosters considerable efficiencies and cost advantages that are challenging for specialized newcomers to match. For instance, by controlling multiple stages of the value chain, Henderson Land can streamline operations and potentially reduce overheads compared to a new entrant needing to outsource or build these capabilities from scratch.

New companies entering the market would face the daunting task of replicating Henderson Land's extensive integrated capabilities. Alternatively, they might need to rely heavily on external partners for various functions. This reliance can lead to increased operational costs and a diminished competitive edge, as they may not achieve the same economies of scale or control over the process that an integrated player like Henderson Land enjoys. In 2023, Henderson Land reported a revenue of HK$21.4 billion, showcasing the scale of operations that a new entrant would need to contend with.

- Significant Capital Investment: Replicating Henderson Land's integrated model requires substantial capital for land acquisition, construction, and establishing management and development arms, deterring many potential new entrants.

- Operational Synergies: The company leverages internal synergies across its diverse operations, creating cost efficiencies that are difficult for fragmented or specialized competitors to overcome.

- Brand Reputation and Track Record: Henderson Land's long-standing presence and successful project delivery build a strong brand reputation, offering a competitive advantage over unproven new entrants.

- Access to Financing: Established players like Henderson Land often have better access to financing and more favorable terms due to their proven financial performance and market standing, further disadvantaging new, less capitalized firms.

The threat of new entrants in Hong Kong's property market is considerably low due to immense capital requirements, with land premiums often reaching tens of billions of Hong Kong dollars, as seen in 2023. Henderson Land's established financial strength and access to diverse funding sources create a significant barrier for any aspiring competitors.

Scarcity of land, primarily allocated through government auctions, further restricts new players, while Henderson Land's substantial land reserves and government connections provide a distinct advantage. Navigating Hong Kong's complex regulatory environment and lengthy approval processes requires deep local knowledge, an area where Henderson Land's decades of experience offer a formidable competitive edge.

| Barrier Type | Description | Example for Henderson Land |

|---|---|---|

| Capital Requirements | High upfront investment for land acquisition and construction. | 2023 land premiums in Hong Kong often exceeded HK$10 billion. |

| Land Availability | Limited supply and government allocation processes. | Established developers hold significant land reserves. |

| Regulatory Complexity | Intricate laws and lengthy approval procedures. | Decades of experience in navigating Hong Kong's property laws. |

| Brand Reputation | Customer trust and loyalty built over time. | Strong brand recognition signifies stability and value. |

| Integrated Operations | Synergies across development, investment, and management. | 2023 revenue of HK$21.4 billion reflects operational scale. |

Porter's Five Forces Analysis Data Sources

Our Henderson Land Porter's Five Forces analysis is built upon a foundation of publicly available data, including the company's annual reports, stock exchange filings, and reputable real estate industry publications. We also incorporate insights from market research reports and economic indicators to provide a comprehensive view of the competitive landscape.