Henderson Land PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

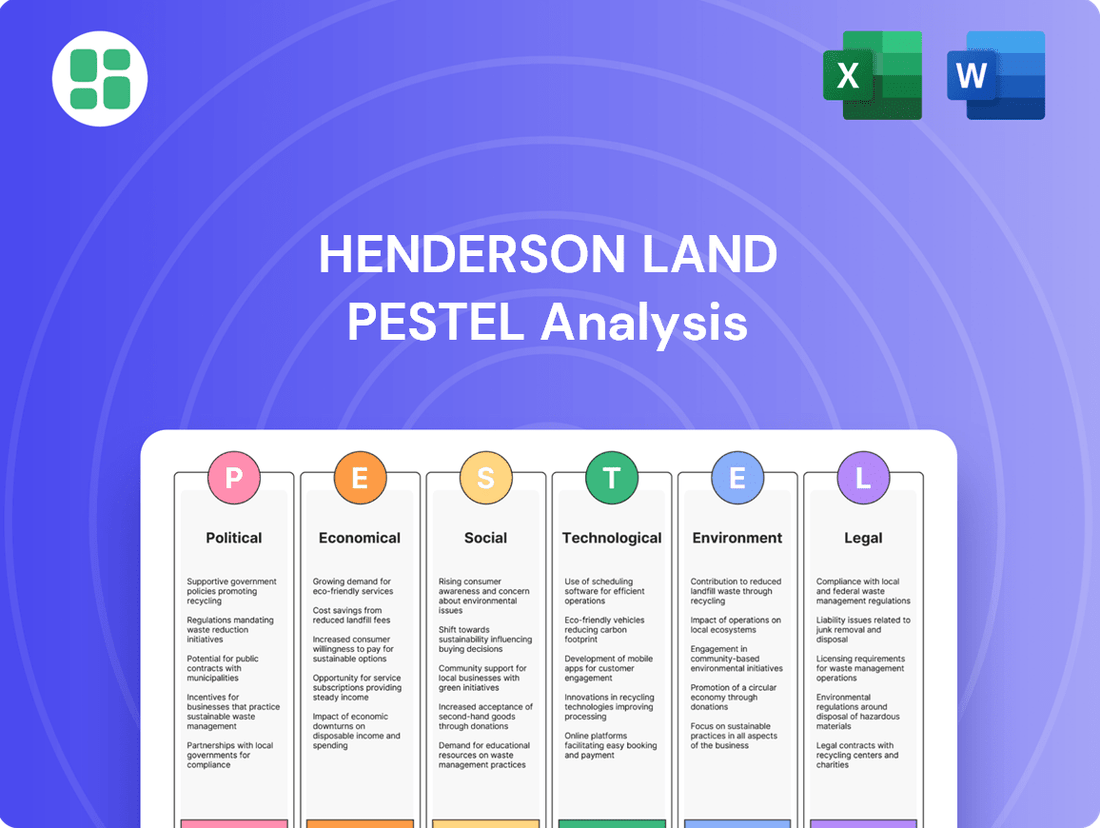

Unlock the secrets to Henderson Land's success with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. Gain a competitive edge by leveraging these critical insights for your own strategic planning. Download the full analysis now and make informed decisions.

Political factors

The Hong Kong SAR government has been proactive in managing the property market. In 2024, they reduced stamp duties and eased purchase restrictions, alongside lowering down payment requirements, all designed to boost housing demand and support homeownership.

Looking ahead, a key policy is the government's land supply strategy. Over the next decade, from 2025 to 2035, they aim to make around 3,000 hectares of land available for development. This significant land infusion is primarily targeted at major projects like the Northern Metropolis and the Kau Yi Chau Artificial Islands, crucial for meeting future housing and economic needs.

Mainland China's commitment to stabilizing its real estate sector in 2025 is a significant political factor. The government is actively promoting a new development model and fast-tracking urban housing renovations. These efforts aim to create a more sustainable and less speculative property market.

Key policy interventions include reducing down payment percentages and lowering mortgage interest rates to boost buyer affordability. Furthermore, purchase restrictions are being eased in many cities. For instance, by early 2025, several major cities had already seen a noticeable uptick in sales following these policy adjustments.

Local governments are also playing a crucial role by purchasing unsold properties for conversion into social housing. This initiative is bolstered by a 'white list' financing mechanism designed to ensure that ongoing projects receive necessary funding, thereby preventing further debt defaults and ensuring project completion.

Interest rate policy significantly shapes the Hong Kong property market, a key sector for Henderson Land. In 2024, both the US Federal Reserve and the Hong Kong Monetary Authority (HKMA) began cutting key policy rates, with further reductions anticipated throughout 2025. This easing cycle directly influences mortgage costs, potentially making property more accessible for buyers and investors.

Lower borrowing costs can stimulate demand, but the market's recovery is often gradual. Historically, property prices tend to see a more substantial rebound in later stages of rate-cutting cycles, rather than immediately following the initial cuts. This suggests a nuanced impact on Henderson Land's sales and development pipeline in the near term.

Strategic Land Sale Programs and Rezoning

The Hong Kong Special Administrative Region (HKSAR) government's 2024-25 Land Sale Programme outlines a commitment to providing land for various development needs. This includes residential, commercial, and industrial sites, signaling ongoing efforts to support economic growth and housing solutions.

However, the government has placed commercial land sales on hold for the upcoming fiscal year. This decision stems from high office vacancy rates and a substantial pipeline of future commercial supply, suggesting a cautious approach to adding more office space to the market.

In a strategic pivot, several commercial sites are being rezoned for residential use. This rezoning initiative is designed to better align land supply with prevailing market demands, particularly in the housing sector, aiming to strike a balance between different land use needs.

- HKSAR Government Land Sale Programme 2024-25: Focus on residential, commercial, and industrial sites.

- Commercial Land Sales: On hold for 2024-25 due to high vacancy and ample future supply.

- Rezoning Initiatives: Some commercial sites being converted to residential use to manage supply and demand.

- Market Balancing: Strategic adjustments aim to address imbalances in the property market.

Regulatory Scrutiny and Enforcement

Regulatory bodies are increasing their oversight of the property sector. For instance, the government has been actively identifying and recovering public rental housing units occupied by individuals found to have substantial financial means, recovering approximately 9,000 flats in the last three years. This intensified scrutiny aims to ensure public resources are allocated appropriately.

Concurrently, there have been adjustments to financing regulations for property development. The government has raised the financing caps for these projects, a move designed to provide developers with greater financial flexibility while aiming to maintain overall market stability. These regulatory shifts signal a dynamic environment for property firms like Henderson Land.

- Intensified Scrutiny: Government efforts to identify and recover public rental housing from affluent tenants, with 9,000 flats recovered in the past three years.

- Financing Adjustments: Increased financing caps for property development projects to support developers.

- Market Stability Focus: Regulatory actions balancing developer support with the need for market equilibrium.

Government policies continue to shape the Hong Kong property landscape, with a focus on stabilizing the market and addressing housing needs. In 2024, stamp duty reductions and eased purchase restrictions aimed to stimulate demand.

The government's land supply strategy, targeting 3,000 hectares for development between 2025 and 2035, will primarily fuel major projects like the Northern Metropolis, crucial for future growth.

Mainland China's 2025 real estate stabilization efforts, including urban housing renovations and a new development model, aim for a more sustainable market, directly impacting Hong Kong's economic environment.

| Policy Area | 2024/2025 Impact | Future Outlook |

|---|---|---|

| Stamp Duty & Purchase Restrictions | Reduced in 2024 to boost demand | Continued monitoring for market stability |

| Land Supply | 3,000 hectares targeted 2025-2035 | Focus on Northern Metropolis & Kau Yi Chau |

| Mainland China Real Estate Policy | Stabilization efforts in 2025 | Promoting sustainable, less speculative market |

What is included in the product

This Henderson Land PESTLE analysis examines the impact of external macro-environmental factors on the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces shape the company's operating landscape, offering insights for strategic decision-making.

A clear, actionable summary of Henderson Land's PESTLE factors, presented with concise explanations, empowers leadership to proactively address external challenges and capitalize on emerging opportunities.

Economic factors

The Hong Kong property market's outlook for 2025 presents a bifurcated picture. Residential prices are anticipated to see a modest rebound, with projections suggesting growth between 0% and 5%, coupled with an expected uptick in sales activity.

In contrast, the office and retail segments are likely to remain under pressure. This is attributed to subdued demand and a significant volume of new supply entering the market, which is expected to keep vacancy rates elevated and rents declining.

Anticipated interest rate cuts by the US Federal Reserve and the Hong Kong Monetary Authority (HKMA) in 2025 are poised to significantly reduce mortgage costs. This easing of borrowing expenses is expected to boost housing affordability, a vital catalyst for a potential rebound in Hong Kong's residential property market.

Despite the outlook for rate reductions, the Hong Kong Interbank Offered Rate (HIBOR) has demonstrated resilience, maintaining levels above 4% as of late 2024. This sustained higher HIBOR continues to influence financing costs for developers and buyers alike, presenting a nuanced challenge even amidst anticipated easing.

Henderson Land, like other Hong Kong developers, faces the challenge of a substantial unsold property inventory. This oversupply, particularly evident in the residential market, compels companies to adopt aggressive pricing tactics and offer attractive incentives to move units. For instance, as of early 2024, reports indicated a significant number of unsold residential units, putting downward pressure on market values.

This inventory overhang directly impacts profitability and cash flow for developers. The need to liquidate stock often leads to reduced profit margins as developers offer discounts or enhanced payment terms. Managing these large inventories efficiently is crucial for maintaining financial stability and funding new projects amidst a competitive landscape.

Global Economic Headwinds

Global economic uncertainties, including the lingering effects of trade tensions and a general moderation in worldwide growth, continue to present challenges for the Hong Kong property market. These external forces can dampen investor sentiment, reduce household purchasing power, and create a less stable market environment. This directly affects property values and the volume of transactions.

For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight improvement but still below historical averages, reflecting ongoing geopolitical risks and inflationary pressures. Such conditions can translate into reduced foreign investment in Hong Kong real estate and a more cautious approach from local buyers.

- Trade Tensions: Ongoing US-China trade friction creates uncertainty in global supply chains and investment flows, impacting Hong Kong's role as a financial hub.

- Slowing Growth: A projected global economic growth rate of 3.2% for 2024, as per IMF estimates, indicates a less robust environment for property market expansion.

- Investor Confidence: Economic headwinds can erode confidence, leading to decreased demand for property and potentially lower capital appreciation.

- Consumer Spending: Reduced consumer spending power due to inflation and economic uncertainty directly affects the residential property market's affordability and demand.

Company Financial Performance

Henderson Land Development's financial performance in 2024 saw a notable downturn. Attributable profit plummeted by 32% to HK$6.3 billion, while revenue decreased by 8% to HK$25.3 billion, falling short of analyst forecasts.

Despite the headline profit drop, the company reported an underlying profit attributable to equity shareholders of HKD 9.8 billion for the fiscal year 2024. This figure provides a different perspective on operational profitability.

To bolster its financial position, Henderson Land announced plans to raise HK$8 billion through a bond issuance. These funds are earmarked for general corporate purposes and refinancing existing debt obligations.

- Revenue Decline: 2024 revenue fell 8% to HK$25.3 billion.

- Profit Hit: Attributable profit dropped 32% to HK$6.3 billion in 2024.

- Underlying Profit: Underlying profit attributable to equity shareholders reached HKD 9.8 billion for FY2024.

- Bond Issuance: Plans to raise HK$8 billion via bonds for corporate purposes and refinancing.

Global economic headwinds, including persistent trade tensions and a projected 3.2% global growth rate for 2024 according to the IMF, continue to impact Hong Kong's property market. These factors can dampen investor sentiment and reduce purchasing power, affecting property values and transaction volumes.

Henderson Land's 2024 financial results reflected these challenges, with attributable profit falling 32% to HK$6.3 billion on an 8% revenue decrease to HK$25.3 billion. Despite this, the company reported an underlying profit of HK$9.8 billion for FY2024 and plans to raise HK$8 billion through bond issuance to strengthen its financial position.

| Indicator | 2024 (Actual/Estimate) | Impact on Henderson Land |

|---|---|---|

| Global Economic Growth (IMF) | 3.2% | Moderates demand and investment |

| Henderson Land Revenue | HK$25.3 billion (-8%) | Reduced top-line performance |

| Henderson Land Attributable Profit | HK$6.3 billion (-32%) | Significant impact on profitability |

| Henderson Land Underlying Profit | HK$9.8 billion (FY2024) | Provides operational performance context |

| Bond Issuance Plan | HK$8 billion | Aims to bolster financial stability |

Preview Before You Purchase

Henderson Land PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Henderson Land covers all critical external factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape influencing Henderson Land's market position.

Sociological factors

Hong Kong's demographic landscape is shifting, with a shrinking working-age population (20-59) and a growing elderly segment (60+). This trend presents both challenges and opportunities for the property market.

In response, government efforts to attract talent from overseas and mainland China are creating a new influx of residents. This influx is already stimulating demand for rental properties and is anticipated to fuel increased homeownership in the coming years, benefiting developers like Henderson Land.

Housing affordability continues to be a major societal challenge, with home prices in many urban centers, including Hong Kong where Henderson Land operates, remaining significantly high relative to average incomes. This persistent issue creates barriers for first-time buyers and those on lower incomes.

While recent monetary policy adjustments, such as interest rate cuts by central banks in late 2023 and early 2024, have aimed to ease mortgage burdens, the fundamental problem of elevated property values persists. For instance, in Hong Kong, the price-to-income ratio has historically hovered around 20, indicating that it takes many years of median income to afford a median-priced home, a situation that has seen little fundamental improvement despite policy interventions.

Henderson Land's engagement in developing transitional housing solutions, such as their projects in Yuen Long, reflects a corporate response to this sociological pressure. These initiatives aim to provide more accessible and affordable living spaces for vulnerable communities, acknowledging the broader societal need for housing solutions beyond the conventional market.

The surge in e-commerce is reshaping retail, forcing developers like Henderson Land to rethink commercial property. Online sales are projected to account for over 20% of total retail sales in many developed markets by 2025, a significant jump from pre-pandemic levels. This trend necessitates innovative approaches to physical retail spaces, focusing on experiential retail and omnichannel integration.

In residential development, a clear shift towards smaller, more manageable living spaces is evident. Demand for one and two-bedroom apartments has been steadily increasing, particularly in urban centers. For instance, in Hong Kong, new developments are increasingly featuring compact units, with average sizes continuing to trend downwards to meet affordability and changing household needs.

Furthermore, consumer preferences are increasingly prioritizing wellness and technology integration. Properties offering amenities like gyms, green spaces, and smart home systems are in high demand. By 2024, over 60% of new home buyers expressed interest in smart home features, indicating a strong market pull for technologically advanced and health-conscious living environments.

Urban Redevelopment and Community Enhancement

Urban renewal is a significant sociological driver in Hong Kong and mainland China, with efforts focused on revitalizing older residential districts to enhance living standards and combat urban decay. Henderson Land actively participates in these initiatives, demonstrating a commitment to community improvement.

A prime example of Henderson Land's dedication to community well-being is the transformation of Lambeth Walk Rest Garden into The Henderson Art Garden. This project exemplifies a forward-thinking approach by integrating art, cutting-edge technology, and sustainable practices to elevate urban green spaces.

These urban redevelopment projects not only improve the physical environment but also foster a greater sense of community pride and engagement. Such initiatives are crucial for creating more livable and attractive urban centers.

Henderson Land's investment in projects like The Henderson Art Garden underscores the growing societal expectation for corporations to contribute positively to the social fabric and environmental quality of the cities in which they operate. This aligns with a broader trend of prioritizing social impact alongside economic returns.

Corporate Social Responsibility and Community Engagement

Henderson Land demonstrates a strong commitment to societal well-being, particularly through its focus on youth development. In 2024, the company continued its extensive support for youth programs, recognizing that investing in young people is crucial for Hong Kong's long-term prosperity. This commitment is reflected in their significant contributions to various educational and developmental initiatives aimed at empowering the next generation.

Beyond youth engagement, Henderson Land actively participates in social responsibility programs designed to foster a more equitable society. Initiatives such as providing transitional housing and establishing community living rooms directly address social needs, offering tangible support to vulnerable populations. These efforts underscore the company's dedication to creating positive social impact and strengthening community bonds.

The company's social investments in 2024 also included partnerships with NGOs to deliver essential services. For instance, their transitional housing projects aim to provide stable accommodation for those transitioning from hardship, with a focus on long-term self-sufficiency. These programs are a testament to Henderson Land's belief in corporate citizenship and its role in building a more inclusive Hong Kong.

- Youth Development: Henderson Land's ongoing investment in youth initiatives in 2024 aims to equip young people with the skills and opportunities needed for future success in Hong Kong.

- Social Equity Programs: The company's commitment to social responsibility is evident in its provision of transitional housing and community living rooms, directly addressing societal needs.

- Community Impact: Through strategic partnerships, Henderson Land actively contributes to the social fabric of Hong Kong by supporting vulnerable groups and fostering community resilience.

Societal shifts like an aging population and a growing demand for smaller, tech-integrated living spaces are key factors for Henderson Land. The company's response, including transitional housing and smart home features, directly addresses these evolving needs and affordability challenges in Hong Kong.

Henderson Land's commitment to youth development and social equity programs, such as community living rooms, highlights a broader trend of corporate social responsibility. These initiatives aim to strengthen the community fabric and support vulnerable populations, reflecting a growing societal expectation for positive social impact.

Urban renewal projects, like the transformation of Lambeth Walk Rest Garden into The Henderson Art Garden, showcase Henderson Land's dedication to enhancing urban living standards and community engagement. This focus on improving the physical environment and fostering community pride is crucial for creating more livable cities.

The company's strategic partnerships in 2024 with NGOs to deliver essential services, particularly in transitional housing, underscore its role in building a more inclusive Hong Kong. These efforts provide tangible support and aim for long-term self-sufficiency for those in need.

Technological factors

Henderson Land is actively embracing PropTech and smart building solutions, positioning itself as an innovator in the real estate sector. This strategic adoption aims to boost operational efficiency, promote environmental sustainability, and elevate the overall user experience within its properties.

Flagship developments such as 'The Henderson' exemplify this commitment, having secured prestigious smart building certifications. These accolades underscore Henderson Land's dedication to integrating advanced building management systems and creating intelligent, responsive environments for occupants.

Henderson Land is leveraging advanced big data and intelligent management systems, particularly within its 'The Henderson' development. This technology allows for the precise tracking, analysis, and measurement of tenant ESG performance, fostering a data-driven approach to sustainability.

This digital framework ensures transparent reporting of ESG metrics and actively encourages both tenants and their staff to engage with and contribute to the company's sustainability objectives, creating a collaborative environment for environmental and social progress.

Henderson Land is actively innovating in sustainable construction, aiming for high green building certifications like BEAM Plus Gold for all new office projects. This commitment translates into a strong focus on energy efficiency, resource conservation, and enhancing indoor environmental quality through cutting-edge design and construction techniques.

Building Information Modeling (BIM) Integration

Henderson Land's embrace of advanced architectural concepts, exemplified by Zaha Hadid Architects' design for 'The Henderson', signals a significant reliance on Building Information Modeling (BIM). This technology is crucial for managing the complexity inherent in such projects, enabling seamless collaboration among design teams and facilitating precise clash detection during the planning phases.

The integration of BIM directly contributes to enhanced project efficiency and waste reduction throughout the construction lifecycle. For instance, BIM's capability in detailed lifecycle management can optimize resource allocation and minimize material wastage, a key consideration in large-scale developments.

- BIM's role in complex design: Facilitates the visualization and coordination of intricate architectural elements.

- Efficiency gains: Streamlines collaboration, reducing design conflicts and rework.

- Lifecycle management: Supports planning, construction, operation, and maintenance phases for optimal asset performance.

- Waste reduction: Improves material quantification and planning, leading to less on-site waste.

Enhancing Digital Connectivity and Security

As properties increasingly integrate smart technologies, Henderson Land faces the imperative of fortifying digital connectivity and cybersecurity. This is paramount for safeguarding tenant data and ensuring the seamless operation of smart building features. For instance, a breach could compromise access control systems or disrupt essential services, impacting tenant experience and operational efficiency.

Robust cybersecurity is not just about data protection; it's about maintaining the integrity and functionality of smart systems. In 2024, the global cybersecurity market was valued at approximately $214.1 billion, highlighting the significant investment and focus on this area. Henderson Land's ability to provide secure and reliable digital infrastructure will be a key differentiator.

The company must implement advanced security protocols to protect against evolving cyber threats. This includes measures like regular security audits, encrypted data transmission, and secure network architecture for its smart developments. By prioritizing these technological factors, Henderson Land can build trust and offer a secure, advanced living and working environment for its customers.

- Digital Connectivity: Ensuring high-speed, reliable internet access across all properties is foundational for smart building functionality.

- Cybersecurity Measures: Implementing multi-layered security to protect against data breaches, ransomware, and unauthorized access to building systems.

- Data Privacy: Adhering to strict data privacy regulations to safeguard occupant information and build tenant confidence.

- System Resilience: Designing smart systems with redundancy and fail-safe mechanisms to ensure continuous operation even during cyber incidents.

Henderson Land's technological strategy focuses on integrating PropTech for enhanced efficiency and sustainability, as seen in 'The Henderson' development which boasts smart building certifications.

The company leverages big data and intelligent management systems to monitor tenant ESG performance, promoting transparency and engagement in sustainability goals.

Advanced technologies like Building Information Modeling (BIM) are crucial for managing complex designs, improving collaboration, and reducing waste in construction, exemplified by projects designed by Zaha Hadid Architects.

Ensuring robust cybersecurity and digital connectivity is paramount to protect tenant data and maintain the functionality of smart building systems, a critical factor in the growing cybersecurity market valued at approximately $214.1 billion in 2024.

| Technology Area | Henderson Land's Focus | Key Benefits | Industry Trend/Data |

|---|---|---|---|

| PropTech & Smart Buildings | Adoption for efficiency, sustainability, user experience | Operational improvements, environmental focus | Smart building market growth |

| Big Data & AI | Tenant ESG performance tracking, intelligent management | Data-driven sustainability, transparency | Increasing use in property management |

| BIM (Building Information Modeling) | Complex design management, collaboration, waste reduction | Project efficiency, cost savings | Standard for modern construction |

| Cybersecurity & Digital Connectivity | Protecting data, ensuring system integrity | Tenant trust, operational reliability | Global cybersecurity market ~$214.1B (2024) |

Legal factors

Henderson Land's development strategies in Hong Kong are significantly shaped by the city's stringent land use and zoning regulations. The government's ongoing initiatives to unlock new developable land, such as those planned for the Northern Metropolis, directly impact the availability and cost of sites for future projects.

Recent policy shifts, including a temporary pause on commercial land sales, highlight the government's active management of the property market. Furthermore, the rezoning of certain commercial sites to residential use reflects an effort to balance supply and demand, influencing Henderson Land's project pipeline and investment decisions.

Recent legal adjustments in Hong Kong's property sector are significantly influencing Henderson Land's operations. The Hong Kong Monetary Authority (HKMA) has notably relaxed loan-to-value (LTV) ratios, with adjustments effective from February 2024, allowing for higher mortgage amounts on certain property types. This, coupled with the government's removal of various property cooling measures, such as the Buyer's Stamp Duty and Special Stamp Duty, aims to invigorate the market.

These legislative changes directly impact Henderson Land's sales volume and the financing capabilities of its potential buyers. For instance, the revised LTV ratios can make it easier for a broader range of purchasers to secure mortgages, potentially boosting demand for Henderson Land's residential projects. The removal of stamp duties further reduces the upfront cost for buyers, making property acquisitions more accessible.

Henderson Land must navigate Hong Kong's rigorous building codes and construction standards, which are continuously updated to include environmental sustainability and smart building features. These regulations are crucial for ensuring safety and quality in all developments.

The company actively pursues high green building certifications, such as BEAM Plus Gold and various platinum-level accreditations for its projects. This demonstrates Henderson Land's proactive approach to meeting and exceeding these evolving legal and industry benchmarks, often setting a precedent for sustainable construction practices.

Environmental Protection Laws and Disclosure Requirements

Henderson Land navigates a complex web of environmental protection laws, with a notable focus on nature-related risk disclosures and Scope 3 emissions. This proactive stance aligns with evolving global recommendations, such as those from the Taskforce on Nature-related Financial Disclosures (TNFD), aiming to provide investors with a clearer picture of environmental impact. For instance, in its 2024 sustainability reporting, the company detailed its approach to managing biodiversity impacts across its development pipeline.

Compliance with federal environmental standards and specific local sustainability mandates, particularly concerning water usage and landscaping practices, remains a critical operational factor. These regulations directly influence project planning and execution, impacting development timelines and costs. Henderson Land's commitment to meeting these requirements is evident in its ongoing investments in eco-friendly building materials and water-saving technologies, as highlighted in its 2024 annual report.

- Environmental Disclosure: Henderson Land is actively disclosing nature-related risks and Scope 3 emissions, mirroring TNFD recommendations.

- Regulatory Compliance: Adherence to federal environmental standards and local sustainability rules for water and landscaping is paramount for development projects.

- Sustainability Investment: The company is investing in eco-friendly materials and water-saving technologies to meet environmental regulations.

Labor Laws and Occupational Safety

As a significant player in construction and property management, Henderson Land is legally bound to adhere to stringent labor laws, with a particular focus on occupational health and safety (OHS) for its construction sites. These regulations are critical for protecting workers and avoiding legal penalties. The company's public commitment to minimizing construction site accidents reflects both its legal obligations and its ethical responsibility towards employee welfare.

In Hong Kong, where Henderson Land primarily operates, the Occupational Safety and Health Ordinance mandates employers to ensure the safety and health of their employees at work. For instance, in 2023, the Labour Department reported a total of 3,000 industrial accidents, with construction sites accounting for a significant portion. Henderson Land's proactive approach, including investments in safety training and equipment, is therefore essential to maintain compliance and reduce the likelihood of incidents that could lead to fines or legal action.

- Compliance with Hong Kong's Occupational Safety and Health Ordinance (Cap. 509).

- Mandatory implementation of safety protocols on all construction sites to prevent accidents.

- Legal repercussions for non-compliance include fines and potential prosecution.

- Commitment to worker well-being as a legal and ethical imperative, impacting operational continuity.

Henderson Land's operational landscape is heavily influenced by Hong Kong's property market regulations, including recent relaxations on loan-to-value ratios by the HKMA in February 2024 and the removal of stamp duties. These legal adjustments directly impact buyer affordability and, consequently, demand for Henderson Land's residential offerings.

The company must also comply with evolving building codes and environmental standards, which increasingly emphasize sustainability and smart features. Henderson Land's commitment to green building certifications, such as BEAM Plus, demonstrates its proactive approach to meeting these stringent legal requirements.

Furthermore, Henderson Land is legally obligated to uphold rigorous labor laws, particularly concerning occupational health and safety (OHS) on construction sites, as mandated by Hong Kong's Occupational Safety and Health Ordinance. The company's investments in safety training and equipment are crucial for compliance and mitigating risks of accidents, which can lead to significant legal and financial penalties.

| Legal Factor | Impact on Henderson Land | Relevant Data/Regulations (2024/2025) |

|---|---|---|

| Property Market Regulations | Influences sales volume and buyer financing capabilities. | HKMA relaxed LTV ratios (Feb 2024); Removal of Buyer's Stamp Duty & Special Stamp Duty. |

| Building Codes & Environmental Standards | Dictates construction practices and sustainability requirements. | Increasing emphasis on green building certifications (e.g., BEAM Plus Gold/Platinum). |

| Labor Laws (OHS) | Ensures worker safety and compliance, avoiding penalties. | Hong Kong's Occupational Safety and Health Ordinance (Cap. 509); Focus on minimizing construction site accidents. |

Environmental factors

Henderson Land recognizes climate change as a significant environmental factor, actively incorporating climate-resilient designs into new projects to address physical risks and lower its carbon footprint. This proactive approach is crucial, especially considering that Hong Kong, where Henderson Land is a major developer, is particularly vulnerable to rising sea levels and extreme weather events.

The company has conducted climate scenario analysis to understand potential impacts on its assets and operations. This commitment to sustainability is reflected in their ongoing efforts to pivot towards more environmentally conscious practices across their business, aiming to enhance long-term resilience and reduce operational risks.

Henderson Land prioritizes environmental responsibility by aiming for high green building standards, with a target of achieving BEAM Plus Gold Rating for all new office developments. This commitment is evident in their successful acquisition of multiple platinum-level certifications for flagship projects.

The company's dedication to sustainable design and construction is exemplified by projects like 'The Henderson', which has secured platinum-level certifications, underscoring Henderson Land's leadership in this domain. This focus not only aligns with growing environmental awareness but also enhances the long-term value and marketability of their properties.

Henderson Land is actively pursuing enhanced energy efficiency across its extensive property portfolio, a key environmental consideration. The company has established ambitious emissions reduction targets that have earned approval from the Science Based Targets initiative (SBTi), aligning its strategy with global climate action goals.

This commitment translates into tangible actions, such as the integration of advanced energy-saving technologies and sustainable practices throughout its developments. For instance, in 2023, Henderson Land reported a 16% reduction in energy intensity across its office portfolio compared to its 2019 baseline, demonstrating progress towards its science-based targets.

Waste Management and Resource Conservation

Henderson Land places a significant emphasis on environmental stewardship, particularly in waste management and resource conservation. Their commitment is evident in the design and construction phases of their properties, aiming to minimize waste generation and maximize recycling efforts. This approach extends throughout the entire lifecycle of their developments.

The company actively implements strategies to conserve resources, such as water and energy, within their building projects. This focus on efficiency not only reduces environmental impact but also contributes to operational cost savings. For instance, in 2023, Henderson Land reported a 15% reduction in construction waste sent to landfill across its major projects compared to the previous year.

- Waste Minimization: Implementing on-site sorting and recycling programs for construction debris.

- Resource Efficiency: Utilizing water-saving fixtures and energy-efficient building materials in new developments.

- Circular Economy Principles: Exploring opportunities to reuse or repurpose materials where feasible.

- Sustainable Sourcing: Prioritizing the use of recycled content in building materials, with a target of 30% recycled content in new concrete mixes by the end of 2025.

Biodiversity and Green Space Enhancement

Henderson Land is actively integrating biodiversity and green space enhancements into its projects, recognizing their importance for urban ecological health. A prime example is the redevelopment of Lambeth Walk Rest Garden into The Henderson Art Garden.

This transformation showcases a commitment to enriching urban environments by incorporating a variety of flora and nectar-rich plants. These selections are specifically chosen to attract and support local wildlife, thereby boosting the area's ecological value and contributing to the city's green infrastructure.

This initiative aligns with growing urban planning trends that prioritize sustainable development and the creation of more livable, nature-integrated cities.

- Project Focus: Transformation of Lambeth Walk Rest Garden into The Henderson Art Garden.

- Ecological Aim: Increase urban biodiversity by planting diverse flora and nectar plants.

- Wildlife Support: Enhance the habitat for local wildlife, attracting insects and birds.

- Urban Integration: Contribute to the expansion of green infrastructure within the city.

Henderson Land is actively addressing environmental challenges by focusing on climate resilience and reducing its carbon footprint. The company's commitment to sustainability is evident in its pursuit of high green building standards, aiming for BEAM Plus Gold Rating for new office developments and achieving platinum-level certifications for flagship projects like 'The Henderson'.

The company has set ambitious emissions reduction targets, approved by the Science Based Targets initiative (SBTi), and has already made significant progress. In 2023, Henderson Land reported a 16% reduction in energy intensity across its office portfolio compared to its 2019 baseline, demonstrating a tangible commitment to energy efficiency.

Waste management and resource conservation are key priorities, with strategies in place to minimize waste and maximize recycling. In 2023, the company achieved a 15% reduction in construction waste sent to landfill across its major projects compared to the previous year, showcasing effective implementation of these principles.

Henderson Land is also enhancing urban biodiversity through projects like The Henderson Art Garden, which incorporates diverse flora and nectar-rich plants to support local wildlife and contribute to the city's green infrastructure.

| Environmental Focus | Action/Target | 2023 Data/Progress |

|---|---|---|

| Climate Resilience | Incorporate climate-resilient designs | Ongoing across new projects |

| Green Building Standards | BEAM Plus Gold Rating for new offices | Multiple platinum-level certifications achieved |

| Emissions Reduction | SBTi-approved targets | 16% reduction in office energy intensity (vs. 2019 baseline) |

| Waste Management | Minimize construction waste | 15% reduction in landfill waste (vs. prior year) |

| Biodiversity | Enhance urban green spaces | Transformation of Lambeth Walk Rest Garden into The Henderson Art Garden |

PESTLE Analysis Data Sources

Our Henderson Land PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, financial reports from institutions like the IMF and World Bank, and leading industry analysis firms. We meticulously gather information on economic trends, political stability, environmental regulations, technological advancements, and social shifts to provide a comprehensive overview.