H+H International A/S SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H+H International A/S Bundle

H+H International A/S demonstrates strong brand recognition and a robust product portfolio, but faces challenges from intense market competition and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind H+H International A/S's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

H+H International A/S commands a leading market position across Northern and Central Europe for its primary offerings: aircrete blocks and calcium silicate units. This robust regional footprint is a substantial competitive edge, allowing the company to cater effectively to various construction sectors.

The company's strong European presence translates into significant market share, particularly in key economies. For instance, in 2024, H+H International reported that its market share in its core European markets remained strong, demonstrating sustained demand and brand loyalty.

H+H International A/S's core business is Autoclaved Aerated Concrete (AAC), a material known for its sustainability and energy efficiency. This focus directly addresses the growing global demand for green building solutions. In 2024, the construction industry continued to see a strong push towards eco-friendly materials, with AAC offering significant advantages in thermal insulation and reduced carbon footprint compared to traditional materials.

H+H International A/S has successfully transformed its operations over the last two years, a significant achievement that has bolstered its market position. This transformation included a strategic focus on streamlining processes and reinforcing its German operations, notably through the implementation of the HOME program.

These proactive measures have significantly enhanced the company's resilience, positioning it more favorably to navigate economic uncertainties and capitalize on future growth opportunities. The emphasis on operational efficiency is a key driver for improving profitability, especially in the face of evolving market dynamics.

Diverse Product Application and Market Reach

H+H International A/S boasts a diverse product portfolio, encompassing aircrete blocks, panels, and reinforced elements. This broad offering caters to a wide spectrum of construction projects, spanning residential, commercial, and industrial sectors across Europe. Their solutions are applicable to walls, floors, and roofs, significantly enhancing market appeal and diversifying revenue streams.

This product versatility translates into a broad market reach. For instance, in 2023, H+H International reported a revenue of DKK 7.4 billion, with a significant portion driven by their ability to serve various construction segments. Their aircrete solutions are particularly well-suited for energy-efficient building, a growing demand in the European market.

- Broad Product Range: Aircrete blocks, panels, and reinforced elements serve diverse construction needs.

- Market Segmentation: Caters to residential, commercial, and industrial building projects.

- Application Versatility: Solutions for walls, floors, and roofs expand market penetration.

- European Presence: Strong market reach across various European countries drives revenue growth.

Commitment to Sustainability and Compliance

H+H International A/S showcases a robust dedication to sustainability, with its sustainability statement becoming a core component of its annual reports starting in 2023. The company has set an ambitious goal of achieving carbon neutrality by 2050, reflecting a forward-thinking approach to environmental responsibility.

This commitment extends to rigorous compliance and ethical operations, underpinned by a comprehensive Code of Conduct. Policies covering health and safety, fair competition, and anti-corruption are actively enforced, demonstrating a strong adherence to responsible business practices.

The emphasis on Environmental, Social, and Governance (ESG) principles not only bolsters H+H's corporate reputation but also solidifies its long-term viability in an increasingly conscious market. For instance, in 2023, the company reported progress in reducing its Scope 1 and 2 emissions, a key metric for its sustainability targets.

- Sustainability Integration: Sustainability statement included in annual reports since 2023.

- Carbon Neutrality Goal: Vision to achieve carbon neutrality by 2050.

- Ethical Framework: Strong emphasis on compliance through a Code of Conduct and specific policies.

- ESG Impact: Enhanced reputation and long-term viability through adherence to ESG principles.

H+H International A/S benefits from a strong market position in Northern and Central Europe, built on its expertise in aircrete blocks and calcium silicate units. This established presence allows the company to effectively serve diverse construction needs across the region.

The company's product portfolio is versatile, encompassing blocks, panels, and reinforced elements suitable for walls, floors, and roofs in residential, commercial, and industrial projects. This broad application range enhances market penetration and diversifies revenue streams.

H+H International A/S demonstrates a significant commitment to sustainability, aiming for carbon neutrality by 2050 and integrating ESG principles into its operations. This focus on eco-friendly solutions, particularly Autoclaved Aerated Concrete (AAC), aligns with growing market demand for green building materials.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Market Leadership | Leading position in aircrete and calcium silicate units in Northern & Central Europe. | Strong market share in core European markets reported in 2024. |

| Product Versatility | Diverse range including blocks, panels, and reinforced elements. | Solutions applicable to walls, floors, and roofs across various construction sectors. |

| Sustainability Focus | Commitment to eco-friendly materials and carbon neutrality by 2050. | AAC offers advantages in thermal insulation and reduced carbon footprint; sustainability statement included in annual reports since 2023. |

| Operational Transformation | Streamlined processes and reinforced operations, notably in Germany. | Successful implementation of the HOME program enhanced resilience and efficiency. |

What is included in the product

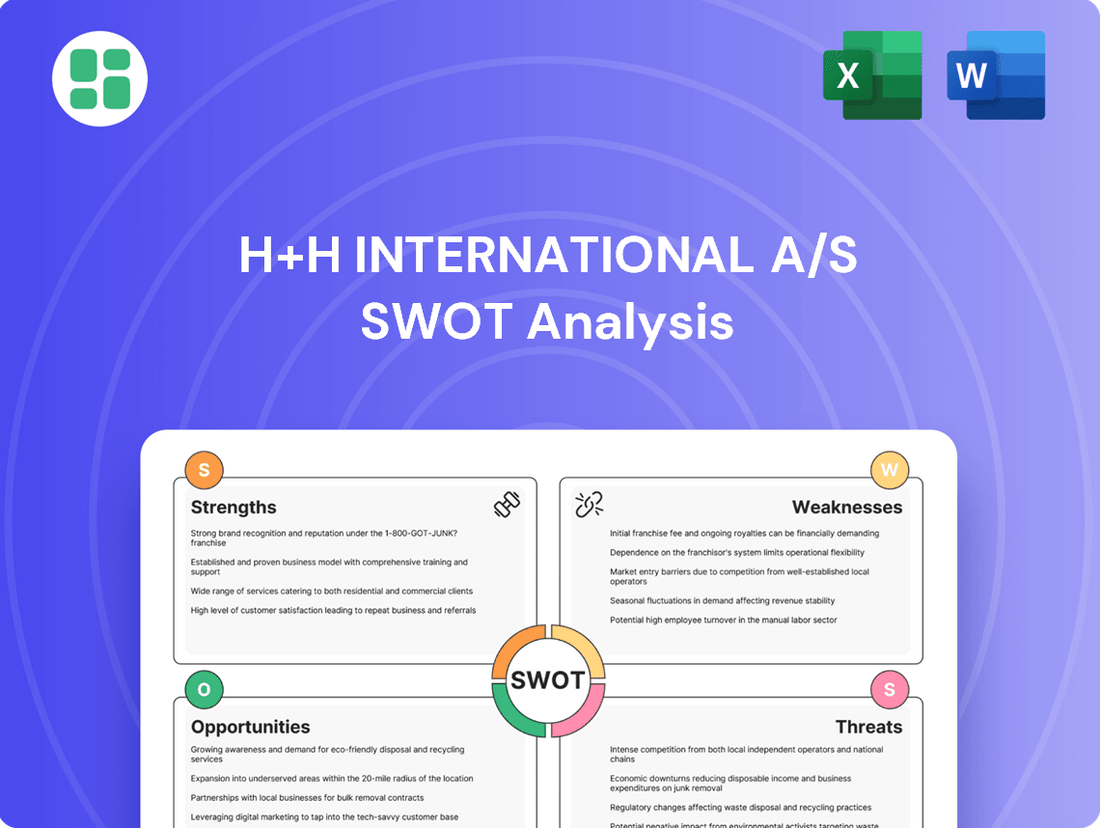

Delivers a strategic overview of H+H International A/S’s internal and external business factors, highlighting its market strengths and potential growth opportunities alongside operational weaknesses and competitive threats.

Offers a clear, actionable SWOT analysis for H+H International A/S, pinpointing key areas for strategic improvement and risk mitigation.

Weaknesses

H+H International A/S faces a significant weakness due to its heavy reliance on the residential newbuild market. In 2023, this dependence became starkly evident as the company witnessed a substantial 34% decrease in sales volumes, directly mirroring a slowdown in new housing construction.

This vulnerability means that any prolonged slump in the residential construction sector poses a considerable risk to H+H International A/S's financial health and overall performance. The company's revenue streams are directly tied to the cyclical nature of new home building.

H+H International A/S faces a significant challenge with its low profit margins, which are a persistent concern. This is compounded by its stock trading at a high earnings multiple. For instance, as of mid-2025, the company's stock is valued at 31.57 times its projected 2025 earnings per share.

This valuation stands in stark contrast to its industry peers, who are trading at an average multiple of 16.02 times their 2025 earnings per share. Such a substantial difference suggests that H+H International A/S's stock may be considered overvalued when compared to its earnings capacity relative to competitors. This valuation gap could deter investors looking for more reasonably priced opportunities or signal that the market expects higher future growth from H+H than its current performance might justify, potentially increasing perceived risk.

Analysts have consistently lowered their Earnings Per Share (EPS) expectations for H+H International A/S over the past year, with recent revisions also pointing downwards for upcoming periods. This trend signals a growing skepticism regarding the company's short-term financial outlook.

For instance, as of early 2024, the consensus EPS forecast for H+H International A/S for the fiscal year 2024 saw a notable downward adjustment from analysts. This persistent negative revision cycle can significantly undermine investor confidence, potentially leading to a depressed stock valuation and making it harder for the company to attract new capital.

Share Price Volatility

H+H International A/S has experienced notable share price volatility in recent months. Over the past three months, its share price volatility has outpaced the broader Danish market.

Further analysis reveals that while weekly volatility has remained consistent, it is still higher than that of approximately 75% of other Danish listed stocks. This elevated level of fluctuation can be a significant deterrent for investors who prefer a more stable investment profile, potentially signaling underlying market uncertainties or specific company-related concerns that could impact future performance.

- Share Price Volatility: H+H International A/S's share price has shown higher volatility compared to the general Danish market over the last three months.

- Comparative Volatility: Weekly volatility for the company remains elevated, exceeding that of over three-quarters of Danish stocks.

- Investor Impact: This volatility can discourage risk-averse investors and may suggest increased uncertainty about the company's outlook.

Exposure to One-Off Financial Losses

H+H International A/S has encountered significant one-off financial losses, notably a DKK 95 million loss in the first quarter of 2024 stemming from the unwinding of unfavorable gas contracts. While these specific items do not alter the timing of cash flows, they can negatively impact reported earnings. This situation highlights the company's susceptibility to external market dynamics, such as volatile energy prices, and the consequences of past contractual agreements. Such unexpected expenses can erode overall profitability and diminish financial maneuverability.

These events underscore a key weakness:

- Exposure to One-Off Financial Losses: The DKK 95 million loss in Q1 2024 from gas contract unwinding exemplifies this vulnerability.

- Impact on Reported Earnings: Special items like these can distort profitability figures, even if cash flow timing remains unaffected.

- Vulnerability to External Factors: Fluctuations in energy prices and the repercussions of previous contractual decisions pose ongoing risks.

- Reduced Financial Flexibility: Unforeseen costs of this nature can limit the company's capacity for future investments or strategic initiatives.

H+H International A/S's profit margins are notably thin, a persistent issue that is exacerbated by its high earnings multiple. As of mid-2025, the company's stock trades at 31.57 times its projected 2025 earnings per share, significantly higher than the industry average of 16.02 times. This valuation gap suggests potential overvaluation relative to its earnings capacity compared to peers.

Furthermore, analysts have been consistently revising EPS forecasts downwards for H+H International A/S over the past year. For example, early 2024 saw significant downward adjustments to the consensus EPS for the fiscal year 2024. This trend indicates growing skepticism about the company's near-term financial performance.

The company also faces challenges due to its heavy reliance on the new residential construction market. A substantial 34% decrease in sales volumes in 2023 directly reflected a slowdown in this sector, highlighting the vulnerability of its revenue streams to the cyclical nature of new home building.

Additionally, H+H International A/S experienced a DKK 95 million loss in Q1 2024 from unwinding unfavorable gas contracts. This highlights susceptibility to external factors like volatile energy prices and the impact of past contractual decisions on reported earnings.

| Financial Metric | H+H International A/S (Mid-2025 Estimate) | Industry Average (Mid-2025 Estimate) |

|---|---|---|

| P/E Multiple (2025) | 31.57x | 16.02x |

| Q1 2024 One-Off Loss (Gas Contracts) | DKK 95 million | N/A |

| 2023 Sales Volume Change (Residential Newbuild) | -34% | N/A |

What You See Is What You Get

H+H International A/S SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The H+H International A/S SWOT analysis you see here is the complete document you will download after purchasing. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats.

No surprises, just the full, detailed analysis ready for your strategic planning needs.

Opportunities

The European Green Deal and a worldwide push for climate neutrality by 2050 are fueling a strong demand for green buildings and sustainable construction materials, including aircrete. H+H International A/S, with its specialization in aircrete, is well-positioned to benefit from these shifts.

Aircrete's inherent properties, such as contributing to energy efficiency and a lower environmental footprint, align perfectly with growing regulatory and consumer preferences for eco-friendly building solutions. This presents a significant opportunity for H+H to expand its market share as sustainability becomes a key purchasing criterion.

European initiatives, like the EU's Renovation Wave strategy, are driving a significant increase in building renovation activities. This strategy targets the energy-efficient renovation of 35 million buildings by 2030, creating substantial demand for insulation materials. H+H's AAC products, known for their excellent thermal insulation, are ideally positioned to capitalize on this trend.

This surge in renovation presents a prime opportunity for H+H International A/S to broaden its market reach. By focusing on the renovation segment, the company can diversify its revenue streams and capture a larger share of the European building materials market, moving beyond its traditional strength in new construction.

Ongoing technological innovations in AAC manufacturing, such as advancements in autoclaving and quality control, are creating stronger, more durable, and customizable AAC products. H+H can capitalize on these developments to boost its product range and production efficiency, catering to growing customer needs for specialized building materials.

By investing in research and development for new product lines, H+H can solidify its competitive edge. For instance, the company's 2023 annual report highlighted a focus on optimizing production processes, which directly aligns with leveraging these technological opportunities to create higher-value offerings and meet evolving market demands.

Potential for Geographic Expansion and Market Recovery

While H+H International A/S's 2025 outlook doesn't factor in a German market rebound, the company anticipates modest volume increases, particularly in the UK. This suggests opportunities for strategic geographic expansion or capitalizing on recovery trends in specific regions. For instance, in 2023, the UK market represented a significant portion of H+H's revenue, and continued growth there could be a key driver.

Diversifying its market footprint beyond core regions and focusing on areas with robust construction activity can help H+H mitigate the impact of localized economic downturns. Analyzing construction output forecasts for 2024 and 2025 across Europe will be crucial for identifying these high-potential markets. For example, countries like Poland have shown resilience in construction, offering potential avenues for expansion.

- UK Market Focus: H+H anticipates modest volume growth primarily in the UK for 2025, highlighting this as a key area for near-term expansion.

- Geographic Diversification: The company has the potential to expand into markets showing strong construction activity, reducing reliance on any single region.

- Market Recovery: While not assumed in the 2025 outlook, a recovery in the German market could present a significant upside opportunity.

Cost Advantages and Faster Installation of AAC

The lightweight nature of Autoclaved Aerated Concrete (AAC) significantly streamlines the construction process. This inherent property translates directly into reduced labor requirements and faster project completion times, ultimately lowering overall construction costs. For instance, in 2024, the global construction market saw increased demand for efficient building materials, with AAC's installation speed being a key differentiator. H+H International A/S can leverage this by highlighting the economic advantages of its AAC products to potential clients, positioning them as a cost-effective and time-saving solution.

This cost-effectiveness makes AAC a compelling choice for developers and contractors aiming to optimize project budgets and timelines. H+H can capitalize on this by:

- Emphasizing reduced labor costs in marketing materials.

- Showcasing case studies demonstrating faster installation times.

- Highlighting the long-term savings associated with AAC's durability and thermal performance.

H+H International A/S is well-positioned to benefit from the growing demand for sustainable building materials driven by initiatives like the European Green Deal. The company's aircrete products align with the trend towards energy-efficient and eco-friendly construction, presenting an opportunity to increase market share as sustainability becomes a key purchasing factor.

The EU's Renovation Wave strategy, aiming to renovate millions of buildings for energy efficiency by 2030, creates a substantial market for insulation materials. H+H's AAC products, known for their excellent thermal insulation, are ideally suited to capitalize on this renovation boom, offering a chance to expand into this growing segment.

Technological advancements in AAC manufacturing are leading to improved product quality and customization, allowing H+H to enhance its offerings and production efficiency. The company's focus on process optimization in 2023 underscores its commitment to leveraging these innovations to meet evolving customer needs.

While the 2025 outlook anticipates modest growth, primarily in the UK, opportunities exist for strategic geographic expansion into markets with strong construction activity, such as Poland, to diversify revenue streams and mitigate regional economic risks.

Threats

H+H International A/S navigates a landscape marked by economic unpredictability and global tensions, directly influencing construction demand and consumer spending across its core European markets. Persistent inflation and rising interest rates, as seen with the European Central Bank's continued monetary policy adjustments throughout 2024, can dampen new construction investments. This volatile backdrop presents a considerable challenge to H+H's revenue projections and overall profitability.

The Autoclaved Aerated Concrete (AAC) market is characterized by fierce competition, with a crowded landscape of global manufacturers, regional specialists, and smaller, specialized suppliers all striving for market dominance. This intense rivalry often translates into significant pricing pressures for industry participants.

H+H International A/S faces the challenge of navigating this highly competitive environment, where maintaining market share requires constant attention to cost-effectiveness and a commitment to continuous product development and differentiation. Rivals are actively seeking to gain an edge through innovation and strategic pricing.

In 2023, the global AAC market was valued at approximately USD 20 billion, with significant growth projected. However, this expansion attracts new entrants and intensifies existing competition, potentially impacting H+H's profit margins if pricing strategies are not carefully managed.

The company's financial projections for 2025 do not anticipate a rebound in the German market, which represents a crucial sales region for H+H International A/S. This cautious stance highlights the potential for continued challenges.

A sluggish or stagnant recovery in significant markets like Germany could directly suppress H+H's sales volumes and overall revenue growth. This economic dependency on specific regions presents a notable risk.

The reliance on key economies means that if large markets, such as Germany, fail to demonstrate robust economic expansion, it could significantly impede the company's ability to achieve its performance targets.

Volatility in Raw Material Prices and Cost Inflation

H+H International A/S is exposed to the significant threat of fluctuating raw material prices and persistent cost inflation. This volatility can directly impact the company's gross margins, particularly if the ability to pass on increased input costs to customers is limited by market dynamics. For instance, in 2024, rising energy prices and supply chain disruptions continued to put upward pressure on key inputs for the building materials sector.

While H+H aims to implement price adjustments that mirror cost inflation, market conditions and competitive pressures may prevent a complete pass-through. This inability to fully recover higher expenses can lead to a tangible erosion of profitability. The company's financial performance in early 2025 will likely continue to reflect these challenges as it navigates these economic headwinds.

- Volatile input costs: Raw material prices, such as cement and aggregates, are subject to market fluctuations, impacting production expenses.

- Cost inflation pressure: Rising energy, transportation, and labor costs in 2024 and projected for 2025 squeeze profit margins.

- Limited price pass-through: Market competition may restrict H+H's ability to fully pass on increased costs to customers, affecting gross margins.

- Profitability erosion: Persistent cost pressures without commensurate price increases can directly reduce the company's overall profitability.

Emergence of Substitute Materials and Construction Methods

The construction sector is constantly evolving, with new materials and building techniques emerging. This innovation could lead to the development of substitutes that challenge the market position of Aerated Autoclaved Concrete (AAC). For instance, advancements in engineered wood products or precast concrete systems might offer competitive alternatives in terms of cost, speed of construction, or sustainability metrics.

H+H International A/S needs to stay vigilant regarding these industry shifts. The company must actively track emerging materials and construction methods that could potentially displace AAC. A proactive approach to research and development is crucial to ensure AAC continues to be a preferred option for builders and developers.

- Emerging Competitors: Innovations in engineered timber, such as cross-laminated timber (CLT), are gaining traction, offering strong structural properties and appealing sustainability credentials.

- Cost Pressures: Fluctuations in raw material costs for AAC production, such as cement and lime, could make competing materials more economically viable.

- Technological Advancements: New modular construction techniques or advanced insulation materials might reduce the reliance on traditional walling systems like AAC, impacting demand.

- Regulatory Landscape: Evolving building codes and environmental regulations could favor alternative materials if they offer perceived advantages in energy efficiency or embodied carbon.

H+H International A/S faces significant threats from intense competition within the Autoclaved Aerated Concrete (AAC) market. The global AAC market, valued at approximately USD 20 billion in 2023, is projected for growth, which attracts new players and intensifies rivalry. This competitive pressure can lead to pricing challenges, potentially impacting H+H's profit margins if cost increases cannot be fully passed on. Furthermore, the company's reliance on key European markets, particularly Germany, presents a risk, as a sluggish economic recovery in these regions could suppress sales volumes and hinder revenue growth targets for 2025.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including H+H International A/S's official financial reports, comprehensive market research, and expert industry commentary to ensure a thorough and accurate assessment.