H+H International A/S Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H+H International A/S Bundle

H+H International A/S operates in a market shaped by moderate buyer power and the looming threat of substitutes. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping H+H International A/S’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration for H+H International A/S's key raw materials, such as quartz sand, gypsum, and lime, can be a significant factor. If a limited number of suppliers control these essential inputs for aerated concrete (AAC) production, their ability to dictate terms and prices is amplified. This concentration can lead to increased raw material costs for H+H, directly impacting profitability.

For instance, in 2024, the global market for construction aggregates, including quartz sand, saw continued consolidation among major players. This trend means H+H might face fewer options for sourcing this critical component. Similarly, regional availability and the specialized nature of certain additives like aluminum powder can further concentrate bargaining power with a select few providers, potentially forcing H+H to accept less favorable pricing or supply agreements.

The availability of substitutes for the raw materials H+H International A/S uses significantly impacts supplier bargaining power. If H+H can readily source alternative materials or switch between different grades of inputs without major production disruptions, suppliers have less leverage. For instance, in 2024, the global market for lightweight aggregate, a key input for AAC, saw increased availability of recycled aggregates, potentially offering H+H more flexibility and reducing reliance on single-source traditional materials.

For H+H International A/S, the costs involved in switching suppliers are a critical factor influencing supplier bargaining power. These expenses can encompass reconfiguring production lines, the rigorous process of qualifying new material sources, and the administrative burden of establishing new contractual agreements. For instance, in 2024, many manufacturing companies reported significant capital expenditure requirements for adapting machinery to new material specifications, a cost that directly impacts their flexibility.

These switching costs directly translate into H+H's reliance on its existing supplier base. If the effort and expense to change suppliers are substantial, H+H becomes more entrenched with its current partners. This increased dependence grants those suppliers greater leverage in negotiations over pricing, quality, and delivery terms, as H+H faces a higher barrier to seeking alternative sources.

Importance of Input to H+H's Product

The importance of input materials to H+H International A/S's aircrete products significantly shapes supplier bargaining power. The precise composition of aircrete, crucial for its thermal insulation and lightweight characteristics, means that specialized raw materials can give suppliers considerable leverage. If a particular component is vital for achieving these performance benchmarks, H+H's reliance on that supplier increases.

The quality and cost of these essential inputs directly impact the final product's competitiveness. For instance, the specific types of binders and aggregates used in aircrete manufacturing are not easily substituted without affecting the material's unique properties. This interdependence makes managing supplier relationships critical for H+H's operational efficiency and product quality.

- Criticality of Inputs: The unique properties of aircrete, such as its excellent thermal insulation and lightweight nature, are heavily dependent on the precise chemical and physical characteristics of its raw materials.

- Supplier Specialization: Suppliers providing specialized binders, aggregates like fly ash or silica sand, or foaming agents that are critical for achieving these performance attributes possess higher bargaining power.

- Cost Impact: Fluctuations in the cost of these key inputs can directly affect H+H's production costs and, consequently, the pricing and profitability of its aircrete products.

Threat of Forward Integration by Suppliers

The potential for suppliers to integrate forward into aircrete production represents a significant threat to H+H International A/S. If key raw material providers possess the financial strength and strategic inclination to manufacture aircrete themselves, it could intensify competition and potentially restrict H+H International's access to essential inputs or lead to increased raw material costs. This risk is particularly pronounced in sectors where vertical integration is a feasible and attractive strategy for suppliers.

For instance, in 2024, the global construction materials market saw substantial investment, with companies exploring diversification. Suppliers of critical components like cement and aggregates, which are fundamental to AAC production, might leverage their existing infrastructure and market knowledge to enter the AAC manufacturing space. This would directly challenge H+H International's market position.

- Supplier Forward Integration Risk: Suppliers of raw materials like cement and aggregates could enter AAC production, increasing competition.

- Impact on H+H International: This would potentially limit input access and drive up raw material costs for H+H International A/S.

- Industry Dynamics: The threat is amplified in industries with high potential for vertical integration by suppliers.

- Market Context (2024): Significant investment in construction materials in 2024 suggests suppliers may have the capital and strategic interest to pursue forward integration.

The bargaining power of suppliers for H+H International A/S is influenced by the concentration of raw material providers. A limited number of suppliers for key inputs like quartz sand, gypsum, and lime can increase their leverage, potentially driving up costs for H+H. This was evident in 2024 with continued consolidation in the construction aggregates market, meaning fewer sourcing options for essential components.

The availability of substitutes for H+H's raw materials also plays a role. In 2024, the increased availability of recycled aggregates offered more flexibility for AAC producers, potentially reducing reliance on single-source traditional materials and thus diminishing supplier power.

Switching costs for H+H, including production line reconfiguration and supplier qualification, can further entrench reliance on current suppliers. For instance, in 2024, many manufacturers faced significant capital expenditures to adapt machinery for new material specifications, highlighting these barriers.

The critical nature of certain inputs for aircrete's unique properties, like thermal insulation, grants specialized suppliers higher bargaining power. The interdependence between material quality and product performance makes managing these supplier relationships crucial for H+H's operational efficiency and product competitiveness.

| Factor | Impact on H+H International A/S | 2024 Context |

| Supplier Concentration | Increased costs and reduced sourcing flexibility | Continued consolidation in construction aggregates market |

| Availability of Substitutes | Reduced supplier leverage | Growing availability of recycled aggregates |

| Switching Costs | Increased reliance on existing suppliers | High capital expenditure for machinery adaptation reported by manufacturers |

| Criticality of Inputs | Higher power for specialized input providers | Specific binders and aggregates vital for aircrete properties |

What is included in the product

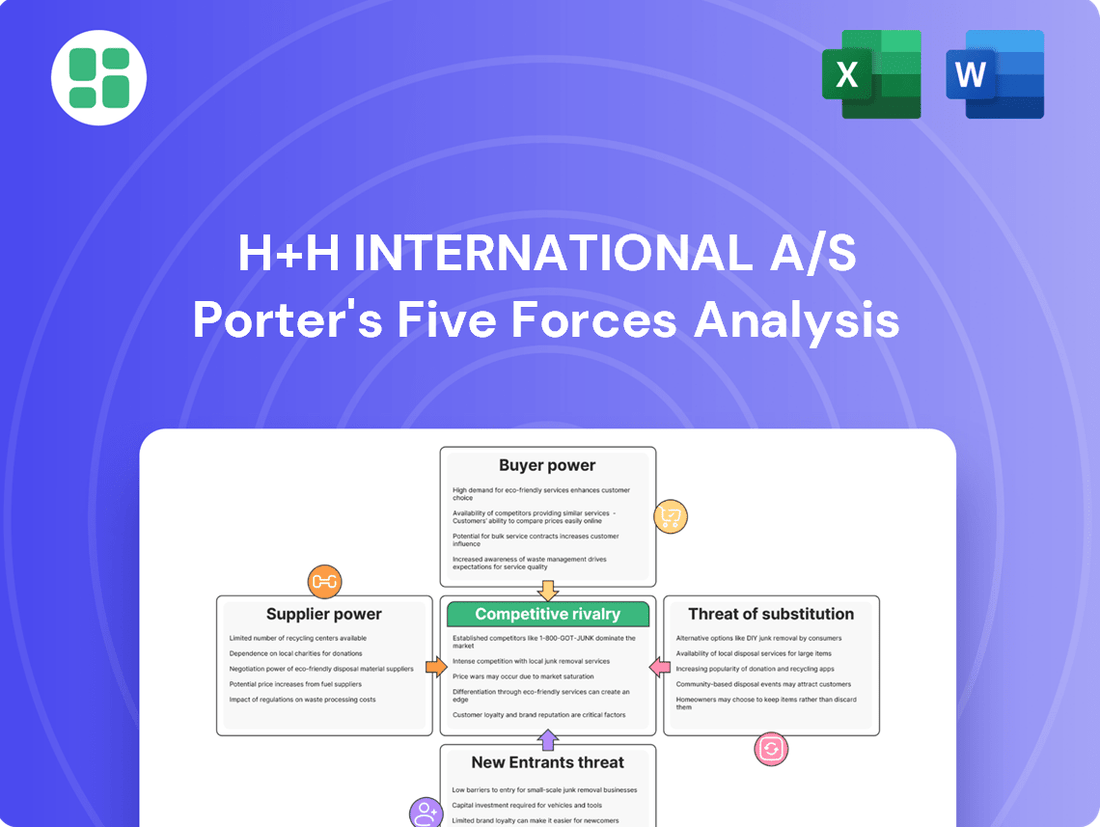

This analysis meticulously examines the competitive forces impacting H+H International A/S, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes within the building materials sector.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, simplifying complex market dynamics for H+H International A/S.

Customers Bargaining Power

Customer concentration significantly impacts H+H International A/S's bargaining power. For instance, in 2023, H+H reported that its largest customer accounted for approximately 10% of its total revenue, highlighting a degree of reliance that can empower key buyers.

The construction sector, where H+H operates, often features large-scale projects and national distributors. These entities, by consolidating purchasing volume, can exert considerable pressure on suppliers like H+H to negotiate more favorable pricing or terms, especially when they represent a substantial share of the company's sales.

The availability of substitute building materials for wall construction significantly impacts customer power for companies like H+H International A/S. Customers have a wide array of choices, including traditional bricks, concrete blocks, timber, and steel framing. This broad range of alternatives means that if AAC (Autoclaved Aerated Concrete) prices become unattractive or if other materials offer better value, customers can easily switch, thereby increasing their bargaining leverage.

For instance, in 2024, the global construction market saw continued demand for diverse materials. While AAC offers benefits like lightweight properties and insulation, the established supply chains and cost-effectiveness of concrete blocks and traditional bricks in many regions provide a strong counterpoint. This readily available competition limits H+H International's ability to dictate terms and pricing, as customers can readily compare and opt for alternatives based on project-specific needs and overall cost considerations.

Customer switching costs are a significant factor in H+H International A/S's competitive landscape. The expense and effort involved for a builder or developer to move from using Aerated Autoclaved Concrete (AAC) to other wall construction materials directly influence customer bargaining power. If these costs are low, customers can more easily demand better pricing or terms.

For H+H International, low switching costs would mean customers can readily adopt alternatives like traditional concrete blocks, timber framing, or steel structures with minimal disruption to their design, construction processes, or supply chains. For instance, if an alternative material requires only minor adjustments to building codes or standard construction techniques, the incentive to switch is higher.

Conversely, high switching costs can anchor customers to H+H's AAC products. These costs might arise if AAC offers unique benefits that are difficult to replicate with other materials. For example, if H+H's AAC significantly reduces construction time or improves a building's energy efficiency, customers switching away would forgo these advantages, effectively increasing the cost of changing suppliers.

Price Sensitivity of Customers

Customers in the construction sector, especially those involved in substantial projects, exhibit significant price sensitivity. This is largely due to stringent budget constraints and the nature of competitive bidding processes. For instance, in 2023, the average profit margin for construction companies in Europe hovered around 2-5%, underscoring the pressure to minimize input costs.

This heightened price sensitivity directly amplifies customer bargaining power. Buyers will actively search for the most economical options for their wall construction requirements, potentially driving down prices for suppliers like H+H International A/S. The global construction market, valued at over $10 trillion in 2023, is highly competitive, making cost a critical factor for many clients.

- Price Sensitivity Impact: High price sensitivity among construction clients directly translates to increased bargaining power.

- Cost-Conscious Market: The construction industry's focus on tight budgets and competitive bidding necessitates cost-effective solutions.

- H+H's Challenge: H+H International A/S must navigate this cost-conscious environment by balancing competitive pricing with profitability and market share maintenance.

- Market Dynamics: The sheer size and competitive nature of the global construction market (over $10 trillion in 2023) amplify the influence of price-sensitive customers.

Customers' Threat of Backward Integration

The threat of customers integrating backward into the production of Autoclaved Aerated Concrete (AAC) blocks is generally low for H+H International A/S. Most of H+H's customers, primarily construction firms and property developers, lack the substantial capital investment, specialized manufacturing know-how, and complex technical expertise inherent in AAC production. This barrier significantly limits their ability to self-supply, thereby diminishing their bargaining power.

For instance, establishing an AAC production facility requires millions in upfront investment for specialized kilns, autoclaves, and precise material handling systems. Furthermore, operating these facilities demands a skilled workforce trained in chemical processes and quality control, which is typically outside the core competencies of construction companies. This high barrier to entry means customers are unlikely to pursue backward integration as a viable strategy to reduce their reliance on H+H International A/S.

- Low Likelihood of Backward Integration: Construction companies and developers generally lack the capital and technical expertise for AAC manufacturing.

- High Barriers to Entry: Significant investment in specialized equipment and skilled labor is required for AAC production.

- Reduced Customer Bargaining Power: The inability of customers to self-supply strengthens H+H International A/S's position.

The bargaining power of H+H International A/S's customers is moderate, influenced by factors like customer concentration, availability of substitutes, and price sensitivity. While H+H's largest customer represented about 10% of revenue in 2023, indicating some reliance, the broad availability of alternative building materials like concrete blocks and timber limits customer leverage.

In 2024, the global construction market's demand for diverse materials means customers can readily switch if AAC prices are not competitive. For example, the significant cost-consciousness in the construction sector, where profit margins can be as low as 2-5% (as seen in 2023 European construction), compels buyers to seek the most economical options, thereby increasing their bargaining power against suppliers like H+H.

The threat of backward integration by customers is low due to the substantial capital and technical expertise required for AAC production. This lack of integration capability means customers cannot easily self-supply, which inherently reduces their ability to dictate terms to H+H International A/S.

| Factor | Impact on Customer Bargaining Power | Relevance to H+H International A/S | Data Point/Example |

|---|---|---|---|

| Customer Concentration | High concentration increases power. | Largest customer ~10% of revenue (2023). | Indicates some customer reliance. |

| Availability of Substitutes | Many substitutes increase power. | Alternatives include bricks, concrete, timber, steel. | Global construction market (>$10 trillion in 2023) offers diverse material choices. |

| Switching Costs | Low switching costs increase power. | Minimal disruption for builders to switch materials. | Ease of adopting alternatives limits H+H's pricing flexibility. |

| Price Sensitivity | High sensitivity increases power. | Construction firms operate on tight margins (2-5% profit in 2023). | Drives customers to seek cost-effective AAC solutions. |

| Threat of Backward Integration | Low threat reduces customer power. | High capital and technical barriers for AAC production. | Customers lack ability to self-supply AAC blocks. |

Same Document Delivered

H+H International A/S Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details H+H International A/S's competitive landscape through a rigorous Porter's Five Forces analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products or services. This comprehensive assessment is crucial for understanding the strategic positioning and potential profitability within the building materials sector.

Rivalry Among Competitors

The European market for Autoclaved Aerated Concrete (AAC) is quite busy, with several major companies vying for market share. Beyond H+H International A/S, key players like Xella International GmbH, ACICO Group, and UltraTech Cement Ltd. are actively competing. This presence of multiple significant entities suggests a robust and dynamic competitive environment.

The competitive intensity is further shaped by the varied nature of these players. You have large, global corporations alongside more specialized regional businesses, each bringing different strengths and strategies to the table. This diversity means H+H International A/S not only faces direct competition from other AAC producers but also from companies offering alternative building materials, broadening the competitive front.

The European Autoclaved Aerated Concrete (AAC) market is expected to expand at a compound annual growth rate of 5.50% from 2025 through 2034. This suggests a market that is growing, yet also entering a more mature phase.

While overall market expansion typically eases competitive intensity by offering more opportunities, maturity can intensify rivalry. In established segments, such as residential new builds in countries like Germany, competition for market share can become particularly fierce among existing players.

Product differentiation in the AAC market is a key battleground. While the core benefits of AAC, such as excellent thermal insulation, lightweight construction, and inherent fire resistance, are shared, companies like H+H International A/S actively seek to stand out. This differentiation is achieved through an expanded product portfolio, encompassing not just standard blocks but also specialized panels and calcium silicate units, alongside a strong emphasis on consistent quality and robust sustainability certifications.

H+H International A/S's commitment to product differentiation is evident in their focus on offering a comprehensive range of solutions tailored to diverse construction needs. Their investment in developing specific product lines, like their thin-joint mortar systems which improve build speed and thermal performance, directly addresses customer pain points. This strategic approach aims to move beyond simple price-based competition, fostering customer loyalty based on perceived unique value and superior performance attributes.

Exit Barriers for Competitors

High exit barriers in the Aerated Autoclaved Concrete (AAC) manufacturing sector, including specialized production facilities and substantial capital investments, can trap companies in a competitive landscape. These barriers, coupled with long-term supply contracts, make it difficult for firms to leave the market, even when profitability is low. This reluctance to exit can lead to persistent overcapacity and aggressive pricing strategies within the European market, intensifying rivalry for players like H+H International A/S.

The AAC industry's significant capital requirements, often running into tens of millions of Euros for a single plant, act as a major deterrent to exit. For instance, establishing a new AAC plant can cost upwards of €30 million. This financial commitment means that companies are less likely to cease operations, even in challenging economic conditions, contributing to prolonged periods of intense competition.

- Specialized Assets: AAC manufacturing requires highly specific machinery and production lines that have limited resale value outside the industry.

- Capital Intensity: The initial investment for an AAC plant is substantial, making it difficult to recoup costs if a company decides to exit.

- Long-Term Contracts: Existing supply agreements with builders and distributors create ongoing obligations that hinder a swift departure from the market.

- Workforce Expertise: Skilled labor and specialized knowledge are tied to AAC production, making it challenging to redeploy or divest these assets.

Cost Structure and Capacity Utilization

The cost structure of aerated concrete block (AAC) production is heavily influenced by significant fixed costs, primarily stemming from the capital-intensive nature of manufacturing plants. This means achieving high capacity utilization is absolutely critical for companies like H+H International A/S to ensure profitability. For instance, in 2023, H+H reported a production capacity of approximately 4.5 million cubic meters globally, highlighting the scale of investment in their facilities.

When demand falters or the market experiences overcapacity, companies may resort to aggressive pricing strategies to keep their production lines running and maintain sales volumes. This tactic directly intensifies competitive rivalry within the sector. The pressure to utilize fixed assets efficiently can lead to price wars, impacting margins for all players.

- High Fixed Costs: AAC manufacturing plants require substantial upfront investment, making operational efficiency paramount.

- Capacity Utilization Drive: Companies must run plants at high utilization rates to spread fixed costs and achieve profitability.

- Price Competition: Periods of low demand or oversupply can trigger price reductions as firms seek to maintain production volumes.

- H+H's Operational Focus: H+H's ability to manage its costs and maintain efficient operations is a key factor in navigating this competitive landscape.

The European AAC market is characterized by intense rivalry among established players like Xella and ACICO, alongside H+H International A/S. This competition is amplified by product differentiation efforts, where companies emphasize unique features and sustainability. High exit barriers, due to significant capital investment and specialized assets, mean that firms tend to remain in the market even during downturns, contributing to sustained competitive pressure.

The drive for capacity utilization in the capital-intensive AAC sector often leads to aggressive pricing strategies, especially when demand is weak or overcapacity exists. This cost structure necessitates high operational efficiency for profitability, making price wars a significant factor in competitive dynamics. For H+H, navigating this requires a strong focus on cost management and operational excellence.

| Key Competitors in European AAC Market | Market Presence | Key Differentiators |

| H+H International A/S | Europe-wide | Comprehensive product range, thin-joint mortar systems, sustainability focus |

| Xella International GmbH | Europe-wide | Brand recognition, diverse building material portfolio |

| ACICO Group | Middle East & Europe | Integrated building solutions, rapid expansion |

| UltraTech Cement Ltd. | Global (including Europe) | Strong cement background, broad construction material offerings |

SSubstitutes Threaten

The threat of substitutes for H+H International A/S's Autoclaved Aerated Concrete (AAC) products, such as traditional bricks, concrete blocks, timber, and steel frames, hinges significantly on their price-performance trade-off. While AAC boasts superior thermal insulation and a lighter weight, which can lead to lower transportation and installation costs, alternative materials might present a more attractive initial investment for specific projects or in regions where labor costs are lower.

For instance, while the long-term energy savings from AAC's insulation are a key selling point, a developer focused purely on upfront construction costs might opt for less insulating but cheaper concrete blocks. The choice often boils down to a careful calculation of initial outlay versus the lifecycle benefits, including energy efficiency and construction speed, making the perceived value of AAC's performance critical in mitigating this threat.

Customer willingness to switch to alternatives for H+H International A/S's autoclaved aerated concrete (AAC) products is shaped by several factors. Familiarity with established building methods, perceived simplicity of use, and ingrained local construction customs play a significant role. For instance, in certain European regions, conventional brick or block construction remains a deeply rooted preference, even when AAC presents clear benefits like lighter weight and better insulation.

However, the landscape is shifting. Increased focus on environmental responsibility, spurred by policies such as the European Green Deal, is boosting consumer interest in sustainable and energy-efficient building materials. This growing awareness directly encourages a greater propensity to explore and adopt AAC and other eco-friendly construction solutions, potentially reducing the threat of substitution for H+H International A/S.

The European construction market offers a broad spectrum of readily available building materials that serve as direct substitutes for Autoclaved Aerated Concrete (AAC). These include traditional concrete, clay bricks, timber, and steel, alongside specialized insulation materials.

The accessibility of these alternatives is further bolstered by extensive and well-established supply chains and distribution networks across Europe. This ensures that customers have practical and convenient choices if AAC pricing becomes unfavorable or if specific project requirements favor other materials.

Technological Advancements in Substitutes

Technological advancements are significantly reshaping the construction landscape, directly impacting the threat of substitutes for H+H International A/S's AAC products. Innovations in alternative building materials, such as advanced timber composites and high-performance concrete formulations, are making these substitutes more competitive. For instance, engineered wood products have seen substantial growth, with the global engineered wood market projected to reach USD 200 billion by 2027, indicating a rising preference for sustainable and potentially cost-effective alternatives.

The construction industry's continuous evolution means that new solutions are constantly emerging. These include advanced prefabrication techniques that utilize different material sets, potentially offering faster build times and lower labor costs compared to traditional methods involving AAC. The development of novel insulation materials also presents a substitute threat, as they can reduce the need for thicker wall structures, a key benefit of AAC. The global construction market size was estimated at USD 11.7 trillion in 2023, with ongoing innovation driving shifts in material demand.

- Rising adoption of engineered wood products: Growing demand for sustainable and lighter construction materials.

- Advancements in concrete technology: Development of high-strength, lightweight, and self-healing concrete variants.

- Innovations in insulation materials: Enhanced thermal performance reducing reliance on structural insulation properties of AAC.

- Growth in modular and prefabricated construction: Potential for alternative material systems to be integrated into faster building processes.

Regulatory and Environmental Factors Favoring Substitutes

Regulatory shifts and environmental policies can significantly impact the threat of substitutes for H+H International A/S's AAC products. While AAC is recognized for its sustainability and alignment with green building initiatives, any future regulations that specifically promote alternative materials over AAC could intensify this threat.

Conversely, supportive regulations can bolster AAC's position. For example, the European Green Deal and ongoing renovation wave strategies actively encourage the use of energy-efficient building materials. These initiatives, which AAC is well-positioned to meet due to its thermal insulation properties, can effectively mitigate the threat of substitution by making AAC a more attractive and compliant choice for construction projects.

- Regulatory Favoritism for Alternatives: New building codes or environmental standards could emerge that prioritize other materials, potentially increasing the appeal of substitutes.

- Support for Energy Efficiency: Policies like the European Green Deal, which emphasize energy-efficient construction, directly benefit AAC by highlighting its inherent insulation qualities.

- Green Building Certifications: Changes in green building certification criteria could either favor or disfavor AAC, influencing its adoption relative to other materials.

The threat of substitutes for H+H International A/S's AAC products is moderate, influenced by the availability and evolving competitiveness of alternatives like traditional bricks, timber, and steel frames. While AAC offers advantages in insulation and weight, the initial cost and established practices with other materials present a persistent challenge. For instance, the global construction market, valued at approximately USD 11.7 trillion in 2023, showcases the sheer scale of material choices available.

However, growing environmental awareness and supportive regulations, such as the European Green Deal, are increasingly favoring energy-efficient and sustainable materials, which bodes well for AAC. The rising adoption of engineered wood products, with a projected market value of USD 200 billion by 2027, highlights a significant shift towards alternative sustainable options.

| Substitute Material | Key Advantages | Key Disadvantages | H+H AAC Advantage |

| Traditional Bricks | Low initial cost, familiarity | Heavy, poor insulation, slower construction | Lighter, better insulation, faster build |

| Timber Frames | Sustainable, lightweight, fast construction | Fire risk, pest susceptibility, insulation variability | Fire resistance, pest resistance, consistent insulation |

| Steel Frames | High strength, speed of erection | Poor insulation, thermal bridging, higher cost | Inherent insulation, no thermal bridging |

Entrants Threaten

The autoclaved aerated concrete (AAC) manufacturing sector demands significant upfront capital. Establishing production plants, purchasing specialized equipment such as autoclaves, and building robust distribution channels are all costly endeavors. For instance, setting up a new AAC plant can easily run into tens of millions of euros, a substantial hurdle for many aspiring companies.

These high capital requirements serve as a formidable barrier, effectively deterring a large number of potential new competitors from entering the market. H+H International A/S, with its established network of manufacturing facilities strategically located across Europe, already possesses a significant advantage due to its existing infrastructure and scale.

Established players in the building materials sector, like H+H International A/S, leverage significant economies of scale. This means they can produce and distribute their products more cheaply per unit than a newcomer could. For instance, H+H International's extensive production facilities and global supply chain allow for optimized procurement of raw materials and efficient logistics, driving down overall costs.

New entrants face a substantial hurdle in matching these cost efficiencies. Without the same production volume, they cannot negotiate bulk discounts on raw materials or spread fixed production and distribution costs across as many units. This initial cost disadvantage makes it challenging for new companies to compete on price with established, large-scale manufacturers.

The ability to achieve lower per-unit costs through large-scale operations is a key barrier. In 2024, the global construction materials market is characterized by intense price competition. Companies like H+H International, with their established infrastructure, can absorb market fluctuations and maintain competitive pricing, making it exceedingly difficult for smaller, less capitalized entrants to gain market share.

New companies entering the European building materials sector face significant hurdles in securing access to established distribution channels. H+H International A/S benefits from its long-standing relationships with key players like builders' merchants, contractors, and developers, which are crucial for reaching end customers.

For any new entrant, establishing a comparable distribution network would necessitate substantial investment in sales infrastructure and logistics. Alternatively, they would need to negotiate agreements with existing distributors, a process that is often lengthy and expensive, potentially limiting their market penetration speed and initial sales volume.

Proprietary Technology and Expertise

While the fundamental technology behind Autoclaved Aerated Concrete (AAC) is not entirely novel, established players like H+H International A/S possess proprietary manufacturing processes, unique material formulations, and optimized operational efficiencies honed over years of experience. This accumulated specialized know-how represents a significant hurdle for potential new entrants. For instance, H+H International has invested in advanced automation and quality control systems, which are not easily replicated.

Newcomers would face substantial upfront investment in research and development to match these existing technological advantages or would need to acquire the specialized expertise, making market entry costly and time-consuming. The company's focus on continuous improvement in its production lines, as evidenced by its ongoing capital expenditure programs aimed at enhancing efficiency and capacity, further solidifies this barrier.

- Proprietary Manufacturing Processes: H+H International's specific methods for curing and finishing AAC blocks can offer superior product consistency and reduced waste, requiring significant R&D investment to replicate.

- Formulation Expertise: Subtle variations in the chemical composition of AAC mixes, developed through extensive testing by H+H, can lead to enhanced durability or thermal performance, a key differentiator.

- Operational Efficiencies: Years of optimizing logistics, energy consumption in production, and supply chain management contribute to cost advantages that new entrants would struggle to achieve quickly.

Regulatory and Environmental Hurdles

The building materials sector, especially within Europe, faces stringent regulatory and environmental requirements. These cover aspects like manufacturing emissions, material safety, and adherence to evolving building codes. For instance, the EU's Green Deal initiatives are pushing for more sustainable construction practices, impacting material sourcing and lifecycle assessments.

New companies entering this market must invest heavily to understand and comply with these intricate regulations. The process can involve lengthy approval timelines and substantial upfront costs for environmental impact assessments and certifications, effectively raising the barrier to entry.

- Compliance Costs: Navigating EU building regulations can add 5-15% to initial capital expenditure for new entrants.

- Environmental Standards: Regulations on embodied carbon and recycled content are becoming increasingly critical, requiring significant R&D investment.

- Permitting Delays: Obtaining necessary environmental and building permits can extend market entry by 12-24 months.

The threat of new entrants for H+H International A/S is moderate, primarily due to the substantial capital investment required to establish AAC manufacturing facilities. Setting up a new plant can cost tens of millions of euros, a significant financial barrier. Furthermore, established players benefit from economies of scale, making it difficult for newcomers to compete on price.

Access to established distribution channels and proprietary manufacturing know-how also pose challenges for potential entrants. Navigating complex regulatory environments and obtaining necessary permits adds further layers of difficulty and cost. These combined factors create a relatively high barrier to entry in the AAC market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for H+H International A/S is built upon a foundation of diverse and credible data sources. These include H+H International's own annual reports and investor presentations, alongside industry-specific market research reports from firms like Statista and IBISWorld. We also incorporate relevant trade publications and economic data to provide a comprehensive view of the competitive landscape.