H+H International A/S PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H+H International A/S Bundle

Gain a strategic advantage by understanding the external forces impacting H+H International A/S. Our PESTLE analysis delves into political stability, economic fluctuations, societal shifts, technological advancements, environmental regulations, and legal frameworks that shape the company's operating landscape. Equip yourself with actionable intelligence to navigate challenges and seize opportunities.

Unlock critical insights into H+H International A/S's market position with our comprehensive PESTLE analysis. Discover how evolving political landscapes, economic trends, and technological disruptions are influencing the building materials sector. Download the full report to gain a deeper understanding and refine your strategic planning.

Political factors

The European Union's updated Energy Performance of Buildings Directive (EPBD), which came into effect in May 2024, is a significant political factor. It mandates that all new constructions achieve zero-emission status by 2030, with public buildings needing to meet this by 2028.

Furthermore, the EPBD sets aggressive renovation goals for existing structures, pushing for substantial energy efficiency improvements by 2030 and 2033. This regulatory shift directly influences the construction materials market, favoring solutions that enhance thermal performance.

H+H International A/S, known for its aircrete products, is strategically positioned to benefit from these stricter energy standards. Their materials are designed to contribute to the energy efficiency required by the EPBD, potentially driving demand for their offerings as the industry adapts to these new regulations.

The European Green Deal, aiming for climate neutrality by 2050, and its 'Fit for 55' package are significantly reshaping the construction sector. These policies mandate a 55% reduction in greenhouse gas emissions by 2030, pushing for greater sustainability across the board.

Central to these efforts is the promotion of a circular economy within construction, encouraging the reuse, recycling, and minimization of waste. This legislative push directly supports businesses like H+H International A/S that prioritize eco-friendly building materials.

H+H International A/S's commitment to sustainable solutions positions it favorably to capitalize on these evolving political landscapes. The company can anticipate new market avenues and potential financial incentives as the EU further integrates green building practices into its regulatory framework, aligning with the 2030 emission reduction targets.

Many European nations are leveraging EU Recovery Funds, channeling significant investment into upgrading digital infrastructure, power grids, and transportation networks. This surge in public infrastructure projects is a key growth catalyst for the construction industry, notably in Spain and Poland, where projects are actively underway.

H+H International A/S is well-positioned to benefit from this governmental focus on infrastructure modernization and expansion by supplying its essential wall building materials to these large-scale developments.

Phasing Out Fossil Fuel Boilers

The European Union's decision to phase out financial incentives for stand-alone fossil fuel boilers starting January 1, 2025, marks a significant policy shift. This move is designed to accelerate the transition towards more sustainable heating systems in buildings across member states. This regulatory change directly supports the adoption of integrated, energy-efficient building systems, such as those incorporating high-performance materials like aircrete, which are better suited for renewable energy sources.

The implication for companies like H+H International A/S is a projected increase in demand for construction solutions that facilitate the integration of renewable energy and reduce dependence on fossil fuels. This aligns with the broader EU Green Deal objectives aiming for climate neutrality by 2050. For instance, the EU aims to renovate 35 million buildings by 2030 to improve energy efficiency, creating a substantial market for sustainable building materials and systems.

- Regulatory Shift: EU phasing out financial incentives for fossil fuel boilers from January 1, 2025.

- Market Driver: Increased demand for sustainable heating and energy-efficient building systems.

- Synergy: Aircrete materials complement integrated, renewable energy-focused building designs.

- Market Opportunity: Growing demand for construction solutions supporting green building initiatives.

Impact of Geopolitical Uncertainties

The persistent uncertainty in Europe's macroeconomic and geopolitical landscape directly impacts market stability and investment strategies within the construction industry. H+H International A/S, in its 2025 outlook, explicitly recognizes how this volatility can hinder market recovery and complicate operational planning.

Navigating these broader political shifts necessitates significant agility and adaptability from companies like H+H International A/S to mitigate potential disruptions. For instance, the ongoing conflict in Eastern Europe and shifting trade policies create unpredictable cost fluctuations for raw materials and energy, directly affecting construction project budgets and timelines.

- Geopolitical Instability: Continued geopolitical tensions in Europe create an unpredictable operating environment, impacting supply chains and demand for construction materials.

- Economic Volatility: Fluctuations in inflation and interest rates, often tied to geopolitical events, influence construction project financing and consumer spending on housing.

- Regulatory Changes: Evolving political landscapes can lead to sudden changes in building regulations, environmental standards, and trade agreements, requiring swift adaptation.

The European Union's push for climate neutrality by 2050, particularly through the 'Fit for 55' package aiming for a 55% emissions reduction by 2030, is a major political driver. This includes the updated Energy Performance of Buildings Directive (EPBD) from May 2024, mandating zero-emission new builds by 2030 and significant renovations, directly boosting demand for energy-efficient materials like H+H's aircrete. The phasing out of fossil fuel boiler incentives from January 1, 2025, further accelerates the need for integrated, sustainable building systems.

Geopolitical instability in Europe continues to create market volatility, impacting supply chains and construction project financing. This uncertainty, coupled with evolving trade policies and energy costs, necessitates significant adaptability from construction firms like H+H International A/S to manage operational planning and cost fluctuations effectively.

Public investment in infrastructure, fueled by EU Recovery Funds, is a key growth area, with significant projects in Spain and Poland creating opportunities for material suppliers. H+H International A/S is positioned to supply its wall building materials to these large-scale developments, aligning with governmental priorities for modernization.

| Policy/Initiative | Target/Impact | H+H Relevance |

| EPBD (effective May 2024) | Zero-emission new builds by 2030; renovation goals | Increased demand for energy-efficient aircrete |

| 'Fit for 55' Package | 55% GHG reduction by 2030 | Supports sustainable building material market |

| Fossil Fuel Boiler Ban (Jan 1, 2025) | Phase-out of incentives | Drives demand for integrated, renewable-ready systems |

| EU Recovery Funds | Infrastructure investment (e.g., Spain, Poland) | Opportunities for supplying large-scale projects |

What is included in the product

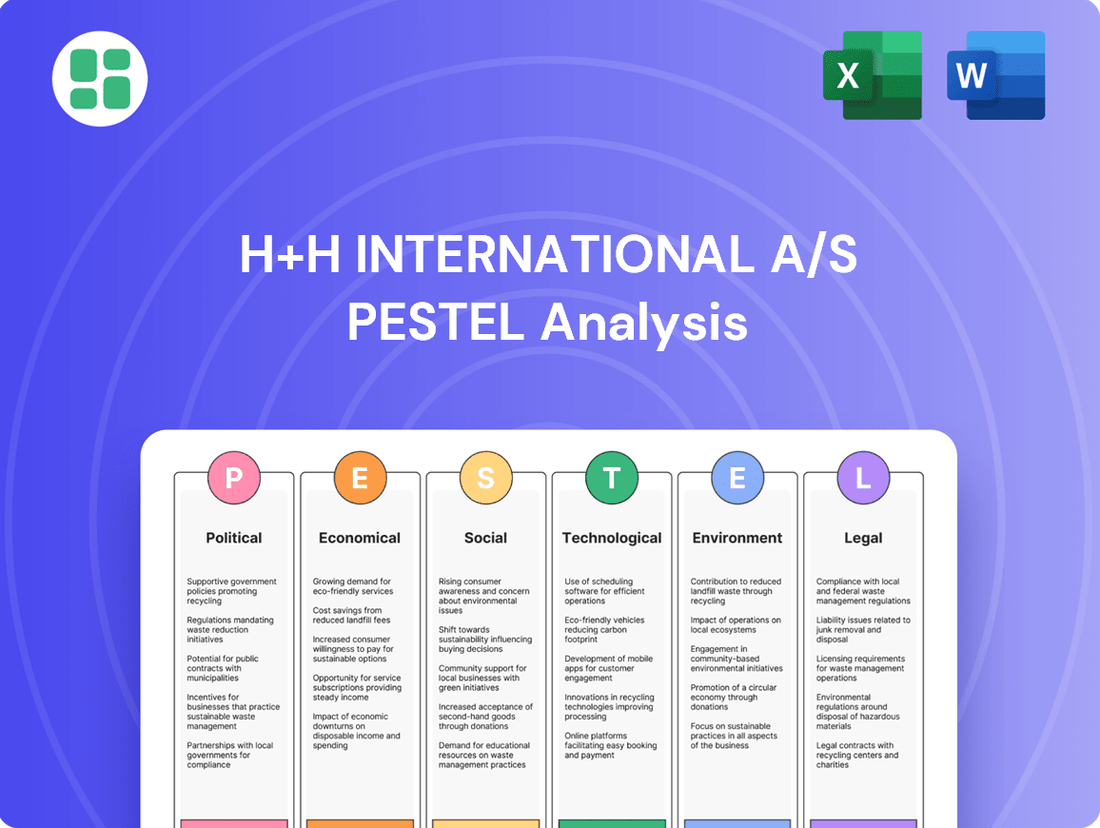

This PESTLE analysis of H+H International A/S examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing its operations, providing a comprehensive overview of the macro-environmental landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of H+H International A/S's external environment to proactively address potential challenges.

Economic factors

The European construction market is expected to see a gentle upturn in 2025, with growth anticipated to be around 0.5% to 0.6%. This follows a tougher year in 2024, which was hampered by factors like higher interest rates and increased building expenses, particularly affecting new homes.

H+H International A/S is looking at revenue growth of 5-10% in 2025. This is largely thanks to modest increases in sales volumes, especially in the UK, though the company doesn't foresee a market recovery in Germany during that period.

Ongoing cost inflation for materials and energy continues to impact profitability across the construction sector. For instance, global construction material prices saw significant increases in 2023, with some categories experiencing double-digit percentage rises year-over-year, a trend expected to persist into early 2024.

H+H International A/S is strategically implementing price increases to offset these rising costs and safeguard its profit margins. This approach is vital as companies in similar sectors are also adjusting their pricing to reflect the elevated input expenses, aiming to maintain financial stability amidst economic volatility.

Effective cost management and adaptive pricing strategies are therefore paramount for H+H International A/S. Navigating the current economic landscape, characterized by persistent inflation, requires robust operational efficiency and a keen eye on market dynamics to protect financial performance and ensure sustained competitiveness.

While interest rates have remained elevated, there are indications of a downward trend emerging in 2024 and projected into 2025. This potential easing of borrowing costs could gradually encourage new residential construction projects, a key market for H+H International. For instance, in some European markets, house prices saw an increase in 2024, suggesting improving affordability and demand for new housing.

H+H International, with its focus on the residential new building sector, is particularly attuned to these dynamics. Shifts in housing demand, influenced by factors like interest rate movements and overall economic sentiment, directly impact the viability and scale of new construction projects. The company's performance will therefore be closely tied to the market's ability to absorb new housing stock at sustainable price points.

Investment in Renovation and Energy Upgrades

The European Energy Performance of Buildings Directive (EPBD) is a significant economic driver, mandating substantial energy upgrades for existing buildings across Europe. This directive is expected to fuel a robust market for renovation activities, creating substantial opportunities for manufacturers of energy-efficient building materials.

H+H International A/S is well-positioned to capitalize on this trend. Their products, such as lightweight aerated concrete blocks, are suitable for renovation projects, helping to meet the EPBD's requirements for reducing primary energy consumption in both residential and non-residential structures. This aligns with the EU's broader goal of achieving climate neutrality by 2050, with buildings accounting for approximately 40% of energy consumption and 36% of CO2 emissions in the EU.

- EPBD Mandates: The directive requires significant energy efficiency improvements in existing buildings, stimulating renovation demand.

- Market Opportunity: This creates a substantial economic opportunity for suppliers of energy-efficient building materials.

- H+H's Role: H+H's products can support these renovations by contributing to reduced primary energy use in buildings.

- EU Energy Goals: The EU aims for climate neutrality by 2050, with buildings being a key sector for energy savings.

Regional Market Disparities

Regional market disparities present a significant economic factor for H+H International A/S. The construction sector's performance is not uniform across Europe, demanding tailored strategies. For instance, the UK anticipates modest volume growth, a positive sign for H+H's operations there.

Conversely, Germany's construction industry is projected to stagnate, with no anticipated recovery in H+H's 2025 outlook. This stark contrast highlights the need for H+H International A/S, which operates in Northern and Central Europe, to adopt a highly localized approach to sales and operations. Understanding and adapting to these specific market conditions and varying recovery trajectories is crucial for success.

- UK Construction Outlook: Modest volume growth anticipated, providing a more favorable environment for H+H.

- German Construction Outlook: Facing stagnation with no projected recovery in the 2025 timeframe, posing a challenge for H+H.

- H+H's Operational Footprint: Operates across Northern and Central Europe, necessitating differentiated market strategies.

- Strategic Imperative: Localized sales and operational approaches are essential to navigate diverse regional economic conditions and recovery speeds.

Economic factors significantly shape H+H International A/S's operating environment. The European construction market is expected to see a modest 0.5% to 0.6% growth in 2025, a slight improvement from the challenges of 2024 marked by higher interest rates and increased building costs. H+H International anticipates revenue growth of 5-10% in 2025, driven by volume increases, particularly in the UK, while Germany's market is expected to remain stagnant.

Persistent cost inflation for materials and energy continues to pressure profitability, with global construction material prices showing significant year-over-year increases in 2023, a trend expected to continue into early 2024. H+H International is implementing price increases to counter these rising input expenses and protect its profit margins, a strategy mirrored by other sector players. Effective cost management and adaptive pricing are therefore crucial for maintaining financial stability and competitiveness.

While interest rates have remained elevated, a downward trend is anticipated in 2024 and 2025, potentially stimulating new residential construction. This could benefit H+H International, which focuses on the residential new building sector, as improved affordability and demand for new housing, as seen in some European markets with rising house prices in 2024, directly influence project viability.

The European Energy Performance of Buildings Directive (EPBD) is a key economic driver, mandating energy upgrades for existing buildings and creating a strong market for energy-efficient materials. H+H's products are well-suited for these renovation projects, aligning with the EU's climate neutrality goals by 2050, as buildings represent a significant portion of energy consumption and CO2 emissions.

| Economic Factor | 2024/2025 Outlook | Impact on H+H International |

|---|---|---|

| European Construction Market Growth | 0.5% - 0.6% in 2025 | Modest overall market expansion, with regional variations |

| H+H International Revenue Growth Target | 5% - 10% in 2025 | Driven by volume increases, especially in the UK |

| Cost Inflation (Materials & Energy) | Persistent, with significant 2023 increases continuing into 2024 | Necessitates price adjustments and robust cost management |

| Interest Rates | Potential downward trend emerging in 2024/2025 | Could stimulate residential construction and improve affordability |

| EPBD Mandates | Driving demand for energy-efficient renovations | Opportunity for H+H's products in the renovation sector |

| Regional Market Performance | UK: Modest growth; Germany: Stagnation | Requires localized strategies due to differing market recovery speeds |

What You See Is What You Get

H+H International A/S PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of H+H International A/S provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. Dive into detailed insights and strategic considerations without any surprises.

Sociological factors

The European construction industry faced a significant challenge in December 2024, with a quarter of firms reporting worker shortages. This is exacerbated by an aging workforce, a trend impacting many developed economies.

To address these labor constraints, the sector is increasingly adopting innovative construction methods like prefabrication and modular building, which reduce the demand for on-site labor. These shifts highlight a growing need for solutions that streamline the building process.

H+H International A/S's aircrete products are well-positioned to assist. Their inherent ease of handling and installation can directly help construction companies mitigate some of the difficulties associated with labor shortages and an aging workforce.

Societal awareness regarding health and well-being within buildings is on the rise, driving demand for healthier living and working spaces. This trend is directly influencing construction material choices, with a growing emphasis on products that promote better indoor air quality and overall comfort.

The European Union's revised Energy Performance of Buildings Directive (EPBD) exemplifies this shift, explicitly aiming to improve living conditions through enhanced energy performance, which often correlates with better indoor environments. For H+H International A/S, this means an increasing market opportunity for aircrete, a material recognized for its contribution to superior indoor air quality and occupant comfort.

Consumers are increasingly prioritizing homes that are both energy-efficient and environmentally friendly. While this trend persists, there has been a slight dip in clients' willingness to invest more in sustainability in recent years, perhaps due to economic pressures.

This evolving consumer mindset directly fuels demand for sustainable building materials and construction methods. Companies like H+H can capitalize on this by highlighting the inherent eco-friendly advantages of their products, attracting environmentally aware buyers and developers in the 2024-2025 market.

Demand for Affordable and Efficient Housing

Societal pressure for housing that is both budget-friendly and built quickly remains strong, even with fluctuating property values. The high cost of traditional building materials and methods often makes new homes less accessible, emphasizing the importance of innovative and economical construction techniques. H+H International's aircrete technology offers a compelling solution by enabling faster build times and reducing labor expenses, directly addressing this widespread demand.

For instance, in the UK, the average house price in early 2024 reached approximately £280,000, a figure that continues to challenge affordability for many. This economic reality underscores the market's need for construction methods that can deliver homes at a lower cost point. H+H's aircrete blocks, which can be erected up to 50% faster than traditional brickwork, directly contribute to lowering overall construction project costs. This efficiency is crucial for developers aiming to provide more affordable housing options.

- Persistent Demand: A significant portion of the population seeks housing solutions that balance cost-effectiveness with rapid construction.

- Cost Barriers: Elevated construction expenses can hinder the development of new, affordable housing stock.

- H+H's Solution: Aircrete's inherent speed and efficiency in building directly address the market's need for reduced project timelines and labor costs.

- Market Impact: By lowering construction overheads, H+H's products can make new housing more competitive and accessible to a wider demographic.

Upskilling and Digital Literacy Requirements

The construction sector's rapid digital transformation, evident in the widespread adoption of Building Information Modeling (BIM) and an increasing reliance on data analytics and automation, demands a workforce equipped with advanced digital literacy. For instance, a 2024 report indicated that over 70% of construction firms are now utilizing BIM in some capacity, highlighting the growing need for skilled personnel. This shift necessitates significant investment in upskilling programs to ensure employees can effectively operate new technologies like robotics and interpret complex data sets.

H+H International A/S, like its peers, faces the imperative to proactively address this evolving skill landscape. Failing to do so risks operational inefficiencies and a diminished competitive edge. By implementing targeted training initiatives, companies can bridge the existing digital skills gap, fostering a more adaptable and technologically proficient workforce. This proactive approach is vital for maintaining market relevance and driving future innovation within the construction materials industry.

Key areas for upskilling and digital literacy development include:

- Proficiency in BIM software and workflows.

- Data analysis and interpretation for operational insights.

- Operation and maintenance of automated construction equipment and robotics.

- Cybersecurity awareness for digital project management.

Societal expectations for faster, more affordable housing continue to grow, driven by economic pressures like the average UK house price of approximately £280,000 in early 2024. This demand for cost-effective and rapidly constructed homes directly benefits H+H International A/S, as their aircrete products enable construction up to 50% faster than traditional brickwork, significantly reducing labor costs and overall project expenses.

Technological factors

Digitalization is reshaping the European construction sector, with a notable trend towards integrated digital platforms for project management, design, and collaboration. This digital transformation is enhancing efficiency across the board.

Building Information Modeling (BIM) is advancing beyond initial design, now encompassing the entire building lifecycle. This comprehensive approach significantly boosts efficiency and coordination, with BIM adoption rates in European construction projects steadily increasing, reaching over 60% in some advanced markets by late 2024.

H+H International A/S stands to gain by integrating its products into BIM models. This integration simplifies design and construction workflows, potentially reducing material waste and project timelines, as seen in pilot projects where BIM integration led to an average 15% reduction in construction errors.

Artificial intelligence is a major driver of change in construction by 2025, improving project management with predictive analytics and risk assessment. This technology allows for real-time adjustments, leading to more efficient and cost-effective building processes.

The EU Data Act, which came into effect in March 2025, is a significant development. It promotes greater access to industry data, which is crucial for research and development, ultimately fostering more informed decision-making across the sector.

H+H International A/S can harness these data-driven advancements to refine its operations. By leveraging these insights, the company can achieve better optimization in production, streamline its supply chain, and accelerate the development of new and improved products.

The construction industry is increasingly embracing off-site methods like prefabrication and modular construction. These approaches offer notable benefits such as enhanced efficiency, minimized waste, and accelerated project timelines, directly addressing the demand for cost-effective and sustainable building. For instance, the global modular construction market was valued at approximately USD 100 billion in 2023 and is projected to grow significantly, with some forecasts suggesting it could reach over USD 200 billion by 2030, driven by these advantages.

H+H International A/S's aircrete products are particularly well-suited for these evolving construction techniques. Their lightweight nature and precise manufacturing make them ideal for integration into prefabricated building elements. This synergy allows for faster construction processes and improved material utilization, aligning perfectly with the industry's push towards greater speed and less waste on-site.

Implementation of Digital Product Passports

The upcoming EU Construction Products Regulation, set to take effect in January 2025, mandates the implementation of digital product passports for building materials. This significant regulatory shift will require H+H International A/S to adapt its product information systems to provide detailed, transparent data regarding performance, safety, and environmental impact, including crucial carbon footprint metrics. This move directly supports the EU's push for enhanced traceability and the advancement of circular economy principles within the construction sector.

For H+H, this means ensuring their product portfolio aligns with these new digital traceability standards. The passports will offer a comprehensive view of a product's lifecycle, from sourcing to end-of-life, fostering greater accountability and informed decision-making for specifiers and builders. This aligns with broader industry trends that prioritize sustainability and verifiable environmental credentials.

- Digital Product Passports: Mandatory under the updated EU Construction Products Regulation from January 2025.

- Data Transparency: Passports will detail performance, safety, and environmental impact, including carbon footprint.

- H+H Compliance: Requires adaptation to meet digital traceability and data provision requirements.

- Circular Economy Support: Enhances transparency and facilitates circularity in construction materials.

Smart Building Technologies and IoT

The increasing adoption of smart building technologies, driven by the Internet of Things (IoT), is revolutionizing building management. These systems automate lighting, climate control, and security, leading to greater efficiency and responsiveness. For instance, the global smart building market was valued at approximately $80.2 billion in 2023 and is projected to reach $215.5 billion by 2030, showing a compound annual growth rate of 15.2%.

Digital twins, virtual replicas of physical assets, are also playing a crucial role. They enable advanced simulations for optimizing building performance and facilitate predictive maintenance, reducing downtime and operational costs. This technology is becoming integral to the lifecycle management of modern infrastructure.

While H+H International A/S primarily manufactures building materials, their aircrete products inherently contribute to the energy efficiency and structural integrity demanded by smart building ecosystems. Aircrete's thermal insulation properties can reduce the energy load for climate control systems, a key component of smart building automation.

- Smart Building Market Growth: Projected to reach $215.5 billion by 2030 from $80.2 billion in 2023.

- IoT Integration: Enhances efficiency through automated lighting, climate, and security.

- Digital Twins: Used for simulation and predictive maintenance in smart buildings.

- Aircrete's Role: Contributes to energy efficiency and structural integrity for smart building compatibility.

Technological advancements are rapidly transforming the construction landscape, with digital tools like BIM becoming standard, with adoption rates exceeding 60% in leading European markets by late 2024. Artificial intelligence is set to enhance project management through predictive analytics, while the EU Data Act, effective March 2025, will unlock valuable industry data for R&D. H+H International A/S can leverage these trends by integrating its products into digital workflows and utilizing data for operational improvements.

The industry's shift towards off-site construction methods, such as prefabrication, is gaining momentum, with the global modular construction market projected to grow substantially. H+H's aircrete products are well-suited for these methods due to their lightweight properties, facilitating faster assembly and reduced waste. This aligns with the industry's increasing focus on efficiency and sustainability.

The upcoming EU Construction Products Regulation, effective January 2025, mandates digital product passports for building materials, requiring H+H to provide detailed lifecycle data, including carbon footprints. This regulatory change will enhance transparency and support the circular economy, necessitating H+H's adaptation to digital traceability standards for its product portfolio.

Smart building technologies, powered by IoT, are expanding rapidly, with the global market expected to reach $215.5 billion by 2030. Digital twins are also becoming crucial for optimizing building performance and maintenance. H+H's aircrete products contribute to the energy efficiency of smart buildings, reducing the load on automated climate control systems.

| Key Technological Trend | Impact on Construction | H+H International A/S Relevance | Data Point/Projection |

| BIM Adoption | Enhanced design, collaboration, and efficiency | Integration of aircrete products into BIM models | >60% adoption in advanced European markets (late 2024) |

| AI in Project Management | Predictive analytics, risk assessment, cost optimization | Leveraging AI for production and supply chain efficiency | Driving real-time adjustments in building processes |

| Off-site/Modular Construction | Increased speed, reduced waste, cost-effectiveness | Aircrete suitability for prefabricated elements | Global modular market projected to exceed $200 billion by 2030 |

| Digital Product Passports (EU CPR) | Mandatory data transparency on performance and sustainability | Compliance with digital traceability and data provision | Effective January 2025 |

| Smart Building Technologies (IoT) | Automated building management, energy efficiency | Aircrete's thermal insulation properties | Smart building market to reach $215.5 billion by 2030 |

Legal factors

The Revised Energy Performance of Buildings Directive (EPBD), EU/2024/1275, effective from May 2024, introduces rigorous legal mandates for building energy efficiency and decarbonization across the European Union. This directive requires all new buildings to achieve zero-emission standards by 2030, with a significant focus on the deep renovation of existing building stock to improve their energy performance.

For H+H International A/S, this translates into a critical need to align its product offerings with these escalating energy performance benchmarks. Failure to meet these evolving standards could impede market access and diminish competitiveness within the EU construction sector, where compliance is paramount.

The upcoming EU Construction Products Regulation (CPR), set to take effect in January 2025, will significantly impact how building materials are marketed within the European Union. This revised regulation, Regulation 3110/2024, is designed to bolster the sustainability, safety, and traceability of construction products.

A key change introduced by the CPR is the requirement for digital product passports. These passports will mandate manufacturers to furnish comprehensive data concerning the environmental impact and performance characteristics of their materials. For H+H International A/S, this means a need to adapt its processes to accurately report this detailed information.

Compliance with these new data reporting obligations and product characteristic requirements will be crucial for H+H to continue selling its aircrete products in the EU market. The regulation aims to provide greater transparency for users and specifiers, influencing purchasing decisions based on verified sustainability and performance metrics.

The Corporate Sustainability Reporting Directive (CSRD) will significantly impact H+H International A/S starting in 2025. This directive mandates comprehensive disclosure of environmental, social, and governance (ESG) performance and strategies, increasing legal obligations for publicly traded entities like H+H. For instance, companies will need to report on Scope 1, 2, and 3 greenhouse gas emissions, a crucial area for H+H's operations in the building materials sector.

Compliance with CSRD requires H+H International A/S to establish and maintain sophisticated internal systems for data collection, verification, and reporting of ESG metrics. This means investing in processes to accurately track and communicate their environmental footprint, social impact, and governance practices to stakeholders, ensuring transparency and accountability in line with evolving European Union regulations.

EU Data Act Implementation

The EU Data Act, set to become effective in March 2025, will introduce significant legal changes impacting how industrial data is accessed and utilized. This legislation is designed to cultivate a unified European data market, encouraging businesses to harness data for innovation and operational enhancements.

For H+H International A/S, compliance and strategic adaptation to this act are crucial. The company must thoroughly assess its responsibilities and potential advantages stemming from the regulation, especially concerning data generated by its manufacturing operations and product lifecycle.

- New Data Access Frameworks: The EU Data Act establishes new legal structures for accessing and using industrial data, effective March 2025.

- Market Harmonization Goal: The act aims to create a single market for data, promoting innovation and efficiency across businesses.

- H+H's Data Focus: H+H needs to understand its obligations regarding data generated from manufacturing processes and product usage.

Phasing Out of Fossil Fuel Heating Systems

The European Union's directive to phase out financial incentives for new stand-alone fossil fuel boilers, effective January 1, 2025, represents a significant legal shift. This legislation directly influences building design and material selection for new constructions and renovations, promoting materials that contribute to highly insulated building envelopes.

H+H International A/S's aircrete products are well-positioned to benefit from this regulatory trend. Their inherent insulation capabilities align with the EU's push for energy-efficient heating solutions, making them a suitable choice for buildings designed to meet these new standards.

- EU Legislation: Discontinuation of financial incentives for new fossil fuel boilers from January 2025.

- Impact on Building: Encourages materials supporting highly insulated building envelopes.

- H+H Alignment: Aircrete's insulation properties match regulatory direction.

- Market Shift: Anticipated increase in demand for energy-efficient building materials.

The evolving legal landscape in the EU significantly impacts H+H International A/S, particularly concerning building energy performance and product transparency. The Revised Energy Performance of Buildings Directive (EPBD), effective May 2024, mandates zero-emission standards for new buildings by 2030 and emphasizes deep renovations, directly influencing demand for energy-efficient materials like H+H's aircrete.

Furthermore, the upcoming EU Construction Products Regulation (CPR) in January 2025 will require digital product passports detailing environmental impact and performance, necessitating robust data reporting from H+H. The Corporate Sustainability Reporting Directive (CSRD), also starting in 2025, will mandate detailed ESG disclosures, including greenhouse gas emissions, requiring H+H to enhance its data collection and reporting systems.

The EU Data Act, effective March 2025, introduces new frameworks for industrial data access, which H+H must navigate for its operational data. Additionally, the phasing out of financial incentives for new fossil fuel boilers from January 2025 favors materials that support highly insulated building envelopes, aligning with H+H's product strengths.

Environmental factors

The European Union's Energy Performance of Buildings Directive (EPBD) is a significant environmental driver, mandating that all new buildings achieve zero-emission status by 2030, with public buildings needing to comply even sooner, by 2028. This directive also requires a comprehensive calculation of a building's carbon footprint across its entire lifecycle, not just operational emissions.

This regulatory push directly fuels a substantial demand for building materials that are both low-carbon and highly energy-efficient. As the construction sector adapts to these stricter requirements, companies offering sustainable solutions are poised for growth.

H+H International A/S's aircrete products are well-positioned to meet these evolving market needs. As a lightweight and inherently insulating material, aircrete can play a crucial role in helping developers and builders reach the stringent zero-emission targets set by the EPBD, contributing to a more sustainable built environment.

The European construction industry is strongly embracing the circular economy, focusing on minimizing waste and boosting resource efficiency. This involves prioritizing the reuse and recycling of building materials, a trend highlighted by initiatives like the EU's Green Deal. For instance, the European Commission's target is to increase the recycling rate of construction and demolition waste to 70% by 2030.

New regulations, such as the updated Construction Products Regulation, are actively pushing this transition towards sustainability. H+H International A/S must therefore enhance the recyclability of its aircrete products and investigate methods for recovering and reusing its materials to align with these evolving environmental standards.

New EU directives, like the Energy Performance of Buildings Directive (EPBD), are set to mandate Global Warming Potential (GWP) calculations and life cycle analyses (LCA) for new buildings starting in 2028. This signifies a significant shift, moving the industry's focus from just the energy used during a building's operation to the carbon emissions embedded within its materials themselves.

H+H International A/S will need to adapt by providing clear environmental product declarations (EPDs) for its aircrete. These EPDs will be crucial for demonstrating the inherently low embodied carbon footprint of their products, a key requirement under the new regulatory landscape.

Resource Scarcity and Sustainable Sourcing

Growing global awareness of resource limitations and the environmental impact of waste are significantly pushing the construction materials sector towards sustainable sourcing and production methods. This trend is fostering greater adoption of recycled materials and the implementation of more efficient manufacturing techniques across the industry.

H+H International A/S, as a manufacturer of aircrete, benefits from the inherent use of abundant raw materials in its production process. The company can further strengthen its market position by emphasizing its resource efficiency and actively pursuing sustainable sourcing strategies to align with increasing environmental demands from consumers and regulators.

In 2024, the global construction market is increasingly scrutinizing the lifecycle impact of materials. For instance, the European Union's Green Deal initiatives are setting ambitious targets for circular economy principles, impacting material procurement. H+H's aircrete, with its composition of sand, lime, cement, and water, presents an opportunity to showcase its low-impact raw material base.

- Resource Efficiency: Aircrete production relies on widely available natural resources, offering a lower dependency on finite materials compared to some traditional construction products.

- Recycled Content Potential: H+H can explore and increase the incorporation of recycled aggregates or other waste materials into its aircrete formulations, further enhancing its sustainability profile.

- Sustainable Sourcing Initiatives: Demonstrating commitment to responsible quarrying and supplier engagement for raw materials like lime and cement will be crucial for meeting evolving environmental standards.

- Circular Economy Alignment: By optimizing production processes to minimize waste and considering end-of-life scenarios for its products, H+H can align with the broader circular economy objectives gaining traction in 2025.

Climate Change Mitigation Targets

The European Union's commitment to reducing greenhouse gas emissions by 55% by 2030, compared to 1990 levels, significantly influences the construction industry, a major contributor to energy use and emissions. This overarching goal fuels a growing demand for sustainable building materials and methods that minimize environmental footprints across a structure's entire lifespan.

H+H International A/S, as a producer of aircrete building materials, is well-positioned to capitalize on this trend. Their products facilitate the construction of highly energy-efficient buildings, directly supporting the EU's climate change mitigation objectives.

- EU Emissions Reduction Target: 55% by 2030 (compared to 1990 levels).

- Construction Sector Impact: Significant energy consumption and emissions necessitate greener solutions.

- Market Driver: Increased demand for innovative, low-environmental-impact building materials.

- H+H's Role: Providing energy-efficient construction solutions aligned with climate goals.

Environmental regulations are increasingly shaping the construction industry, with directives like the EU's Energy Performance of Buildings Directive (EPBD) pushing for zero-emission buildings by 2030. This includes mandatory lifecycle carbon footprint calculations for new constructions.

The push towards a circular economy, aiming for a 70% recycling rate of construction and demolition waste by 2030, is also a major environmental factor. H+H International A/S must adapt by enhancing product recyclability and exploring material recovery.

Growing awareness of resource limitations is driving demand for sustainable sourcing and efficient manufacturing. H+H's aircrete, utilizing abundant raw materials, can leverage this by emphasizing resource efficiency and responsible sourcing.

The EU's target of a 55% greenhouse gas emission reduction by 2030 directly impacts the construction sector, creating a market demand for energy-efficient building materials like H+H's aircrete.

| Environmental Factor | Impact on H+H International A/S | Key Data/Target |

|---|---|---|

| EPBD Mandates | Increased demand for low-carbon, energy-efficient materials. | Zero-emission buildings by 2030; mandatory GWP/LCA from 2028. |

| Circular Economy | Need to improve product recyclability and explore material reuse. | EU target: 70% recycling of construction waste by 2030. |

| Resource Efficiency & Sourcing | Opportunity to highlight low-impact raw materials and sustainable sourcing. | Growing consumer and regulatory demand for sustainable practices. |

| Climate Change Mitigation | Aircrete supports energy-efficient building, aligning with climate goals. | EU target: 55% GHG reduction by 2030 (vs. 1990). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for H+H International A/S is built on a robust foundation of data from official government publications, reputable economic institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.