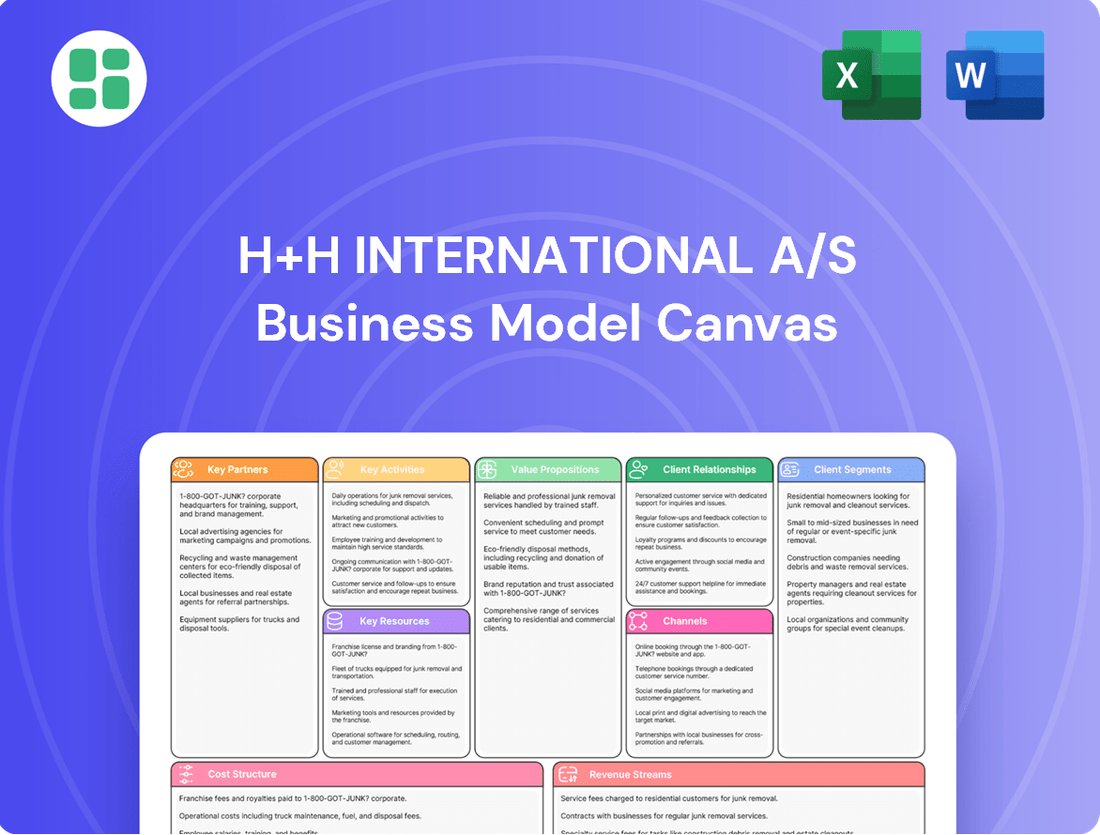

H+H International A/S Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H+H International A/S Bundle

Unlock the full strategic blueprint behind H+H International A/S's business model. This in-depth Business Model Canvas reveals how the company drives value through its innovative AAC solutions, captures market share via strong distribution channels, and stays ahead in a competitive landscape with a focus on sustainability. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a successful building materials company.

Partnerships

H+H International A/S depends on a robust network of raw material suppliers for crucial inputs such as cement, lime, and sand, which are the bedrock of their aircrete production. These partnerships are vital for ensuring consistent product quality and managing production costs effectively.

In 2024, the global cement market saw price fluctuations, with H+H International A/S likely navigating these to secure competitive pricing for its key materials. Strong supplier relationships are paramount for maintaining a reliable and cost-efficient supply chain, directly impacting their manufacturing efficiency and the final cost of their aircrete products.

H+H International A/S relies heavily on partnerships with logistics and transportation providers to ensure its lightweight aerated concrete products reach customers efficiently across Europe. These collaborations are vital for managing the complexities of moving heavy building materials, aiming for timely deliveries to construction sites and distribution hubs. In 2023, H+H International reported that its logistics costs represented a significant portion of its operational expenses, underscoring the importance of these strategic alliances in maintaining competitive pricing and customer service.

H+H International A/S relies heavily on builder's merchants and distributors across Europe as a primary sales channel. These partnerships are crucial for accessing a wide array of customers, from large construction firms to smaller, independent builders, thereby amplifying market penetration.

In 2024, H+H International A/S continued to leverage its extensive network of builder's merchants, which represent a significant portion of its sales volume. This strategy allows the company to efficiently reach a fragmented customer base and maintain strong market presence.

Construction Contractors and Developers

Large construction contractors and residential or industrial developers are crucial partners for H+H International A/S. Their direct customer relationship is amplified by the long-term, project-based nature of these collaborations, fostering repeat business and stable demand for H+H's products. These partnerships are vital for securing a consistent revenue stream.

Forming strategic alliances with these key players offers significant advantages. It can elevate H+H to a preferred supplier status, granting them early access to information and opportunities within major construction projects. This proactive engagement allows for better planning and resource allocation.

For instance, in 2024, H+H International A/S continued to strengthen its ties with major developers in key European markets. These relationships are instrumental in driving sales volumes, with significant portions of their revenue directly attributable to ongoing large-scale housing and commercial developments.

- Project Pipeline Access: Partnerships provide visibility into future construction projects, enabling H+H to align production and supply chains effectively.

- Volume Commitments: Developers and contractors often commit to significant volumes, offering predictability and economies of scale for H+H.

- Innovation Collaboration: Joint efforts can lead to the development of new building solutions tailored to specific project needs or market trends.

- Market Penetration: Aligning with established developers facilitates entry into new geographical markets or segments.

Technology and Equipment Providers

H+H International A/S relies on collaborations with technology and equipment providers to ensure its manufacturing facilities remain state-of-the-art. These partnerships are crucial for maintaining and upgrading their production capabilities across Europe, directly impacting operational efficiency and product quality.

These collaborations enable H+H International A/S to integrate advanced manufacturing processes, such as automated handling and precision cutting systems, into their AAC block production. For instance, in 2024, the company continued to invest in modernizing its Danish facilities, including upgrades to machinery that enhance energy efficiency and reduce waste, a direct benefit from these supplier relationships.

- Supplier Relationships: Partnerships with leading manufacturers of AAC production machinery and automation systems.

- Operational Enhancement: Access to cutting-edge equipment that improves production speed, accuracy, and material utilization.

- Innovation Integration: Collaborations facilitate the adoption of new technologies for enhanced product development and sustainable manufacturing practices.

H+H International A/S cultivates strategic partnerships with raw material suppliers, including those for cement, lime, and sand, to ensure consistent quality and manage production costs. In 2024, navigating global cement market price fluctuations was key to securing competitive material pricing, reinforcing the importance of these supplier relationships for efficient manufacturing.

The company also relies on strong ties with logistics providers to efficiently distribute its products across Europe, a critical factor given that logistics costs represented a significant operational expense in 2023. Furthermore, builder's merchants and large construction contractors serve as vital sales channels and direct customers, driving sales volume and revenue predictability through long-term project collaborations. These developer relationships, particularly evident in 2024 with major European projects, are instrumental for market penetration and securing consistent demand.

| Partnership Type | Role in Business Model | 2024/2023 Relevance |

|---|---|---|

| Raw Material Suppliers | Ensures consistent input quality and cost management for aircrete production. | Navigating 2024 cement price fluctuations for competitive sourcing. |

| Logistics Providers | Facilitates efficient distribution of heavy building materials across Europe. | Critical for managing significant operational expenses noted in 2023. |

| Builder's Merchants & Distributors | Primary sales channel, enabling broad market access to diverse customer segments. | Continued reliance in 2024 for reaching fragmented customer bases. |

| Large Construction Contractors & Developers | Direct customers, providing stable revenue streams through long-term project commitments. | Key for driving sales volumes in major housing and commercial developments in 2024. |

| Technology & Equipment Providers | Enables modernization of manufacturing facilities and adoption of advanced processes. | Investment in facility upgrades, like in Denmark in 2024, enhances efficiency. |

What is included in the product

H+H International A/S's Business Model Canvas outlines its strategy for providing AAC (Autoclaved Aerated Concrete) solutions, focusing on a B2B customer base across Europe and targeting construction professionals with a value proposition of sustainable, efficient building materials.

This canvas details H+H's operational structure, revenue streams from product sales, and key partnerships with suppliers and distributors, all aimed at achieving profitable growth in the construction materials market.

H+H International A/S's Business Model Canvas acts as a pain point reliver by providing a clear, one-page snapshot of their core operations, enabling rapid identification of inefficiencies and opportunities for streamlining their AAC block production and distribution.

Activities

H+H International A/S's core activity revolves around the large-scale production and manufacturing of aircrete blocks and calcium silicate units. These materials are primarily used for wall construction, forming the backbone of their business. This intricate industrial process takes place in their strategically located factories across Northern and Central Europe.

The efficiency of these manufacturing operations is paramount. It directly impacts H+H's ability to satisfy market demand and consistently deliver high-quality products. For instance, in 2024, the company continued to optimize its production lines, aiming to increase output while minimizing waste, a key factor in maintaining competitive pricing.

H+H International A/S focuses on actively promoting and selling its lightweight aerated concrete (AAC) building materials. Their sales efforts target a broad customer base, encompassing contractors, property developers, and builder's merchants across Europe.

Key activities involve developing and executing robust marketing campaigns to highlight the benefits of AAC, such as its insulation properties and ease of use. These efforts are crucial for H+H to achieve revenue growth and secure its position in the competitive European construction sector.

In 2024, H+H International A/S reported a significant increase in revenue, partly driven by successful sales and marketing initiatives that expanded their reach into new markets and strengthened relationships with existing clients.

H+H International A/S's key activities revolve around meticulously managing its entire supply chain. This encompasses everything from sourcing raw materials, like calcium carbonate and fly ash, to ensuring finished products reach customers efficiently across its European markets.

Optimizing inventory levels is paramount, aiming to balance product availability with carrying costs. In 2023, H+H International reported a focus on improving inventory turnover, a crucial metric for supply chain efficiency.

Transportation and warehousing are also core activities. The company relies on a robust logistics network to deliver its lightweight aerated concrete (LAC) blocks and related products, ensuring timely fulfillment of customer orders and maintaining competitive lead times.

Research and Development (R&D) for Product Innovation

H+H International A/S heavily invests in Research and Development (R&D) as a core activity to drive product innovation. This focus allows them to continuously improve their existing aircrete materials and create entirely new solutions for the construction industry. A significant portion of their R&D is dedicated to enhancing the sustainability of their products, aiming to reduce environmental impact throughout the lifecycle.

Their R&D efforts are crucial for adapting to changing construction standards and anticipating future customer demands. This includes refining material properties for better performance and exploring new applications for their aircrete technology. For instance, in 2024, H+H continued to explore advancements in low-carbon aircrete formulations.

- Product Enhancement: Improving the thermal insulation and structural integrity of existing aircrete blocks.

- New Solution Development: Creating innovative aircrete-based systems for faster and more efficient building.

- Sustainability Focus: Researching methods to further reduce the embodied carbon in their products and explore circular economy principles.

- Market Adaptation: Ensuring their offerings meet evolving building regulations and customer preferences for eco-friendly construction.

Operational Efficiency and Cost Optimization

H+H International A/S actively pursues operational efficiency through initiatives like the HOME program, focusing on streamlining production and logistics. This continuous improvement drive is crucial for optimizing cost structures. In 2024, the company's commitment to these activities aimed to enhance profitability and build resilience against market fluctuations.

These efforts directly impact the company's ability to manage expenses effectively. By refining processes, H+H International A/S seeks to reduce waste and improve resource utilization. This focus on cost optimization is a cornerstone of their strategy to maintain a competitive edge.

- Streamlining Operations: The HOME initiative represents a significant ongoing effort to enhance efficiency across H+H International A/S's value chain.

- Cost Structure Optimization: Continuous analysis and adjustment of cost drivers are key activities to ensure financial health and competitiveness.

- 2024 Strategic Focus: Actions taken in 2024 underscored the importance of these operational and cost-saving measures for profitability and market adaptability.

H+H International A/S's key activities center on manufacturing and selling aircrete blocks, a core product for wall construction. They also manage their supply chain from raw material sourcing to product delivery, and invest heavily in R&D for product innovation and sustainability. Furthermore, operational efficiency and cost optimization are continuous pursuits.

In 2024, H+H International A/S reported revenue of DKK 7,102 million, with a focus on optimizing production and sales initiatives to drive growth. Their commitment to R&D saw continued exploration of low-carbon aircrete formulations, aligning with market demand for sustainable building solutions.

| Key Activity | Description | 2024 Relevance |

|---|---|---|

| Manufacturing | Large-scale production of aircrete blocks and calcium silicate units. | Optimization of production lines to increase output and reduce waste. |

| Sales & Marketing | Promoting and selling AAC building materials to contractors, developers, and merchants. | Revenue growth driven by expanded market reach and strengthened client relationships. |

| Supply Chain Management | Sourcing raw materials, inventory management, transportation, and warehousing. | Focus on improving inventory turnover and ensuring timely product delivery. |

| Research & Development | Product innovation, enhancement of material properties, and sustainability focus. | Exploration of low-carbon aircrete formulations and meeting evolving building standards. |

| Operational Efficiency | Streamlining production and logistics, cost structure optimization. | HOME program initiatives aimed at enhancing profitability and resilience. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for H+H International A/S you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this same professionally structured and formatted Business Model Canvas, ensuring no surprises and immediate usability.

Resources

H+H International A/S's manufacturing backbone consists of numerous factories strategically positioned throughout Northern and Central Europe. These facilities are the engine of their aircrete production, housing specialized machinery that underpins their market leadership.

In 2023, H+H International A/S operated 15 production facilities. The company reported a total production capacity of 4.2 million cubic meters of aircrete products, demonstrating the scale of their manufacturing operations and their commitment to meeting market demand.

H+H International A/S leverages proprietary technology and production processes, including specific formulations and efficient manufacturing methods, to produce high-quality autoclaved aerated concrete (AAC). This intellectual property is a cornerstone of their competitive advantage, enabling superior product performance and cost-effective production.

In 2024, H+H International continued to focus on optimizing its production, aiming for enhanced efficiency and reduced environmental impact through its advanced manufacturing techniques. This commitment to technological innovation supports their market position in delivering sustainable building solutions.

H+H International A/S relies heavily on its skilled workforce, encompassing engineers, production specialists, sales professionals, and management. This human capital is fundamental to their operations.

The company's success hinges on the deep expertise its employees possess in manufacturing processes, the practical application of their products, and a nuanced understanding of market dynamics. This collective knowledge is crucial for maintaining high operational standards and fostering expansion.

In 2023, H+H International employed approximately 2,400 people globally, a testament to the scale of their human resource investment. The continuous development and retention of this skilled workforce are key enablers of their competitive advantage.

Financial Capital and Funding

Financial capital is H+H International A/S's lifeblood, enabling everything from daily operations to ambitious growth plans. This includes funding significant capital expenditures, such as the DKK 200 million planned for 2025, which is crucial for maintaining and expanding their production capabilities.

The company's financial health, as detailed in its 2024 annual report and the forward-looking statements for 2025, demonstrates a solid foundation. This financial strength is essential for supporting strategic initiatives, including potential acquisitions or market expansions, ensuring the company can seize opportunities and navigate economic fluctuations.

Key aspects of H+H International A/S's financial capital include:

- Access to credit facilities and equity financing to support ongoing and future investments.

- Robust cash flow generation from operations, providing a stable source of internal funding.

- Prudent financial management to maintain a healthy balance sheet and credit rating.

- Strategic allocation of capital towards high-return projects and innovation.

Brand Reputation and Market Presence

H+H International A/S benefits immensely from its well-established brand reputation and significant market presence, particularly across numerous European countries. This strong standing acts as a critical intangible asset, fostering customer loyalty and providing a solid foundation for expanding into new markets.

The company's leading positions in key European markets, such as Denmark and the UK, are a testament to its enduring brand trust. This trust translates directly into a competitive advantage, making it easier for H+H to attract and retain customers.

- Brand Reputation: H+H is recognized for quality and reliability in the building materials sector.

- Market Presence: The company holds leading positions in several European markets, including Denmark and the UK.

- Customer Loyalty: A strong brand reputation drives repeat business and positive word-of-mouth referrals.

- New Business Development: Market leadership facilitates easier entry and acceptance for new products and services.

H+H International A/S's key resources are its extensive network of 15 manufacturing facilities across Europe, producing 4.2 million cubic meters of aircrete in 2023. Proprietary technology and efficient production methods are central to their competitive edge. The company employs around 2,400 individuals globally, whose expertise is vital for operations and market understanding. Significant financial capital, including DKK 200 million planned for 2025, supports growth and innovation. A strong brand reputation and leading market positions in countries like Denmark and the UK further solidify their advantage.

| Resource | Description | Key Data/Facts |

|---|---|---|

| Manufacturing Facilities | Production sites for aircrete | 15 facilities operated in 2023; 4.2 million m³ production capacity in 2023. |

| Proprietary Technology | Unique production processes and formulations | Enables high-quality AAC and cost-effective production. |

| Human Capital | Skilled workforce | Approx. 2,400 employees globally in 2023; expertise in manufacturing and market dynamics. |

| Financial Capital | Funding for operations and growth | DKK 200 million planned capital expenditure for 2025; robust cash flow generation. |

| Brand Reputation & Market Presence | Customer trust and market leadership | Leading positions in Denmark and the UK; recognized for quality and reliability. |

Value Propositions

H+H International A/S provides superior aircrete (AAC) and calcium silicate blocks. These materials are exceptionally light, making them easy to transport and install on-site, which significantly speeds up construction timelines for builders.

The versatility of H+H's wall building materials allows for their use in a wide range of structural and non-structural applications. This adaptability means customers can rely on a single product for multiple building needs, streamlining project management and material sourcing.

In 2024, H+H International A/S continued to emphasize these benefits, with a focus on enhancing construction efficiency. For instance, their aircrete products can reduce labor costs by up to 30% compared to traditional bricklaying due to their lighter weight and larger size, a key selling point for developers aiming for quicker project completion and cost savings.

H+H International A/S offers aircrete products that significantly enhance building sustainability and energy efficiency. These materials boast excellent insulating properties, reducing the need for excessive heating and cooling, which directly appeals to environmentally conscious customers.

The company's commitment to reducing carbon emissions throughout its production process further strengthens this value proposition. For instance, in 2023, H+H International A/S reported a reduction in its Scope 1 and 2 emissions, demonstrating a tangible effort towards greener operations.

This focus on eco-friendly construction materials aligns with growing market demand for sustainable building practices. Customers are increasingly prioritizing solutions that minimize environmental impact and lower long-term operational costs, making H+H's aircrete a compelling choice in the 2024 market.

H+H International A/S leverages the inherent properties of Autoclaved Aerated Concrete (AAC) to deliver significant cost-effectiveness and speed in construction. The material's lightweight nature and ease of cutting and shaping on-site directly translate to reduced labor requirements and quicker assembly, a crucial benefit for contractors aiming to meet tight deadlines.

For instance, studies have shown that AAC panel construction can be up to 50% faster than traditional bricklaying. This acceleration in build times, coupled with lower material handling costs due to its lightness, offers a compelling economic advantage. In 2024, the global construction industry continues to prioritize efficiency, making H+H's AAC solutions highly attractive to developers and builders focused on optimizing project budgets and timelines.

Comprehensive Product Range for Diverse Construction

H+H International A/S offers a wide variety of aircrete products, ensuring they can meet the needs of many different construction scenarios. This includes everything from standard blocks to more specialized panels and even reinforced elements.

This extensive product line means H+H is well-equipped to handle projects of all sizes, whether it's a small home build or a large commercial or industrial development. Their ability to serve diverse construction sectors is a key strength.

- Blocks: Versatile units for various wall constructions.

- Panels: Efficient solutions for faster build times.

- Reinforced Elements: Structural components for demanding applications.

- Residential, Commercial, and Industrial: Catering to a broad market spectrum.

Reliable Supply and Strong European Presence

H+H International A/S leverages its extensive network of factories and operations strategically located throughout Europe. This robust European footprint is a cornerstone of their value proposition, ensuring a consistent and dependable supply of their building materials. For instance, in 2023, H+H reported that its European production sites were instrumental in meeting demand across key markets.

Their strong regional presence translates into tangible benefits for customers, offering localized service and support that enhances the overall customer experience. This proximity allows for quicker response times and a deeper understanding of specific market needs. By maintaining a significant presence in countries like the UK and Germany, H+H can provide tailored solutions and efficient logistics.

- Reliable Supply Chain: H+H's European factories ensure consistent product availability, mitigating risks associated with single-source or distant suppliers.

- Regional Expertise: Localized operations foster a better understanding of diverse European building regulations and customer requirements.

- Enhanced Customer Service: Proximity allows for more responsive technical support and efficient delivery, crucial for project timelines.

- Market Responsiveness: A widespread presence enables H+H to adapt quickly to regional market shifts and demand fluctuations.

H+H International A/S offers exceptionally lightweight and easy-to-handle aircrete and calcium silicate blocks. This significantly reduces on-site labor and speeds up construction, a crucial advantage in 2024's fast-paced building environment. For example, their products can cut installation time by up to 50% compared to traditional methods.

The company's aircrete solutions provide superior thermal insulation, leading to lower energy bills for building occupants. This sustainability aspect is increasingly important, with H+H actively working to reduce its carbon footprint, as evidenced by emission reductions reported in 2023.

H+H International A/S provides a comprehensive range of building materials, from standard blocks to advanced panels. This broad product portfolio caters to diverse construction needs across residential, commercial, and industrial sectors, ensuring a single supplier can meet multiple project requirements.

With a strong network of factories across Europe, H+H guarantees a reliable supply chain and localized support. This strategic presence, including key operations in the UK and Germany, allows for responsive service and a deep understanding of regional market demands, a significant benefit for customers in 2024.

| Value Proposition | Key Benefit | Supporting Data/Fact (2023/2024 Focus) |

|---|---|---|

| Construction Efficiency & Speed | Reduced labor costs and faster project completion | Aircrete panel construction can be up to 50% faster than traditional bricklaying. Labor costs can be reduced by up to 30%. |

| Sustainability & Energy Efficiency | Lower energy consumption and reduced environmental impact | Excellent insulating properties. H+H reported Scope 1 and 2 emission reductions in 2023. |

| Product Versatility | Adaptability to various construction needs and scales | Offers blocks, panels, and reinforced elements for residential, commercial, and industrial projects. |

| Reliable Supply & Regional Expertise | Consistent availability and localized support | Extensive European factory network ensures dependable supply. Strong presence in UK and Germany. |

Customer Relationships

H+H International A/S cultivates direct sales and account management relationships, particularly with substantial contractors and developers in both residential and industrial sectors. This strategy ensures personalized attention and specialized support for their clientele.

Dedicated sales teams and key account managers engage directly, offering tailored solutions and crucial technical assistance. This hands-on approach is vital for meeting the unique demands of diverse construction projects.

In 2024, H+H International A/S continued to leverage these direct relationships, which are fundamental to their strategy of providing high-value, customized offerings in the building materials market.

H+H International A/S cultivates robust partnerships with builder's merchants, viewing them as crucial channels for reaching the end-user market. These relationships are actively managed through continuous sales support, comprehensive product training, and collaborative marketing initiatives, ensuring H+H products are effectively promoted and distributed. This B2B-centric approach is fundamental to their strategy, enabling them to serve a broad customer base indirectly.

H+H International A/S prioritizes robust technical support and after-sales service to ensure customers maximize the value of their AAC products. This commitment is vital for enabling efficient product usage and resolving any on-site construction challenges, thereby building strong customer trust and solidifying H+H's standing as a dependable partner in the building industry.

Investor Relations and Stakeholder Engagement

H+H International A/S prioritizes clear communication with its financial stakeholders. This involves providing regular financial reports, investor presentations, and direct access to investor relations personnel. For instance, in their 2024 reports, they highlighted a focus on delivering consistent financial performance and outlining their strategic growth initiatives.

This commitment to transparency aims to foster strong investor confidence by ensuring stakeholders have a clear understanding of the company's financial health and future direction. The company actively engages with investors to address queries and provide insights into their operational strategies and market positioning.

- Transparent Financial Reporting: H+H International A/S publishes comprehensive financial statements and interim reports, detailing performance metrics and key financial ratios.

- Direct Stakeholder Communication: The company facilitates direct engagement through investor calls, meetings, and dedicated investor relations contact points.

- Strategic Direction Clarity: Investor communications consistently outline the company's strategic priorities, including market expansion and product development plans.

- Building Investor Confidence: By providing timely and accurate information, H+H International A/S works to maintain and strengthen trust with its investor base.

Digital Communication and Information Sharing

H+H International A/S leverages its corporate website and various digital platforms to provide stakeholders with readily available information. This includes details on their product offerings, ongoing sustainability efforts, and important company updates, acting as a primary conduit for general inquiries and brand reinforcement.

These digital channels are crucial for maintaining transparency and keeping a broad audience, from individual investors to potential business partners, informed about the company's progress and strategic direction. For instance, in 2024, H+H continued to enhance its online presence, ensuring easy access to their latest financial reports and sustainability metrics.

- Website as Information Hub: H+H's digital presence centralizes product information, sustainability reports, and corporate news, making it accessible to all stakeholders.

- Stakeholder Engagement: Digital platforms facilitate communication for general inquiries, fostering brand awareness and keeping investors, customers, and the public updated.

- Transparency and Accessibility: In 2024, the company prioritized keeping its digital information current, reflecting its commitment to open communication and stakeholder relations.

H+H International A/S maintains distinct customer relationship strategies for different stakeholder groups. For direct customers like contractors and developers, the focus is on personalized service through dedicated sales teams and key account managers. This approach ensures tailored solutions and technical support, crucial for large-scale projects. In 2024, this direct engagement remained a cornerstone of their high-value offering strategy.

For the broader market, H+H partners with builder's merchants, providing them with sales support, product training, and marketing initiatives. This B2B channel strategy allows H+H to reach a wider customer base effectively. The company also prioritizes robust technical and after-sales support to ensure customer satisfaction and build long-term trust.

Investor relations are managed through transparent financial reporting, direct communication channels, and clear articulation of strategic direction. In 2024, the company emphasized consistent financial performance and growth initiatives to build investor confidence. Their corporate website and digital platforms serve as key information hubs, providing accessible updates on products, sustainability, and company news, reinforcing brand transparency and stakeholder engagement.

| Relationship Type | Key Activities | 2024 Focus/Data |

|---|---|---|

| Direct Sales (Contractors/Developers) | Personalized attention, tailored solutions, technical assistance | Continued emphasis on high-value, customized offerings |

| Channel Partners (Builder's Merchants) | Sales support, product training, collaborative marketing | Strengthening distribution reach through active partnerships |

| Investor Relations | Transparent financial reporting, direct communication, strategic clarity | Highlighting consistent financial performance and growth initiatives |

Channels

H+H International A/S employs a direct sales force to cultivate relationships with major construction firms, large-scale developers, and critical accounts. This approach enables direct negotiation on terms and pricing, fostering the development of tailored solutions that meet the specific demands of substantial projects.

This direct engagement is crucial for securing high-volume contracts and building long-term partnerships. In 2023, H+H International A/S reported that its direct sales efforts contributed significantly to its order book, particularly in key European markets where large infrastructure and housing projects are prevalent.

H+H International A/S leverages a vast network of builder's merchants and distributors throughout Europe as a crucial channel to reach a wide customer base. This strategy ensures their products, particularly their aircrete blocks, are readily available to smaller contractors and individual builders who form a significant segment of the market.

These distribution partners act as key intermediaries, stocking and promoting H+H products, thereby offering widespread accessibility and convenience. For instance, in 2024, H+H continued to strengthen its relationships with major merchants across key European markets, aiming to increase product visibility and sales volume.

The accessibility provided by these channels is vital for H+H's market penetration. By partnering with established merchants, H+H can efficiently get its innovative building solutions into the hands of end-users, supporting construction projects of all sizes and contributing to their overall market share in the building materials sector.

The company website is a primary channel for H+H International A/S, offering detailed product specifications, showcasing successful project examples, and providing in-depth sustainability reports. It serves as a vital resource for customers, partners, and investors seeking comprehensive information about the company's offerings and commitments.

This digital platform also functions as a central hub for investor relations, disseminating financial reports, annual statements, and news updates. For instance, in 2024, the company actively updated its investor section with quarterly earnings reports and presentations, ensuring transparency and accessibility for its shareholder base.

Industry Trade Shows and Exhibitions

H+H International A/S actively participates in key European construction and building materials trade shows. This strategy allows them to directly engage with a concentrated audience of industry professionals, including architects, developers, and contractors. In 2024, H+H showcased its innovative AAC (Autoclaved Aerated Concrete) solutions, highlighting their sustainability and performance benefits. These events are crucial for generating leads and strengthening brand presence within the competitive building sector.

The company leverages these exhibitions to not only display their latest product advancements but also to foster relationships with both new and existing clientele. For instance, at BAU 2023, a major industry event, H+H reported significant interest in their energy-efficient building systems. Such direct interaction provides invaluable market feedback and opportunities for strategic partnerships, reinforcing their position as a leading provider of lightweight building materials.

- Showcasing Innovation: H+H uses trade shows to present new AAC product lines and technological advancements.

- Customer Engagement: Direct interaction at events facilitates relationship building with potential and existing customers.

- Market Visibility: Participation enhances brand awareness and demonstrates H+H's solutions to a targeted construction audience.

- Lead Generation: Exhibitions serve as a vital channel for identifying and nurturing new business opportunities.

Investor Relations Communications

Investor Relations Communications are crucial for H+H International A/S to disseminate vital information. This includes their regular financial reports, such as interim and annual reports, which detail the company's performance and outlook. For instance, in their 2024 reports, they would highlight key financial metrics and strategic achievements.

Press releases are another primary channel, used to announce significant events like acquisitions, new product launches, or changes in leadership. These are often distributed through financial news wires to ensure broad and immediate reach. Investor presentations, frequently found on their dedicated investor relations website, offer a more in-depth look at the company's strategy and financial health, often including management commentary and forecasts.

- Financial Reports: H+H International A/S regularly publishes interim and annual financial statements detailing performance.

- Press Releases: Key announcements are disseminated via financial news wires to inform stakeholders promptly.

- Investor Presentations: These provide detailed strategic and financial insights, accessible on the company's IR website.

- Website: The dedicated investor relations section serves as a central hub for all official communications.

H+H International A/S utilizes a multi-channel approach to reach its diverse customer base. Direct sales target major construction firms and developers, ensuring tailored solutions and high-volume contracts. In 2023, this direct channel significantly boosted their order book, particularly in European markets with substantial projects. Their extensive network of builder's merchants and distributors ensures broad accessibility for smaller contractors and individual builders, a strategy reinforced in 2024 through strengthened merchant relationships to boost visibility and sales.

Customer Segments

Residential construction developers and contractors represent a core customer segment for H+H International A/S. Their primary need is for building materials that facilitate efficient, durable, and cost-effective new residential projects.

H+H's aircrete products are specifically suited for wall construction, aligning directly with the demands of these professionals. For instance, in 2024, the UK construction sector, a key market for H+H, saw a significant increase in housing starts, underscoring the ongoing demand for reliable building solutions.

Commercial construction developers and contractors rely on H+H International A/S for building materials used in offices, retail spaces, and other non-residential projects. These clients have specific needs regarding design flexibility, structural integrity, and thermal insulation performance, all of which H+H aims to meet.

In 2024, the global commercial construction market showed resilience, with significant activity in sectors like logistics and data centers. H+H's AAC blocks offer a lightweight yet strong solution, contributing to faster build times and reduced structural load, which are key considerations for developers managing large-scale commercial projects.

Industrial construction developers and contractors are a key customer segment for H+H International A/S, utilizing their lightweight aerated concrete blocks for building walls in factories, warehouses, and other industrial facilities. While this sector might be less prominent than residential construction for H+H, it still represents a significant market where the durability and specific technical properties of their materials are highly valued.

In 2024, the global industrial construction market continued its growth trajectory, driven by increased manufacturing output and the need for modern infrastructure. For example, the demand for advanced warehousing solutions, fueled by e-commerce growth, directly impacts the need for robust and efficient building materials like those offered by H+H.

Builder's Merchants and Wholesale Distributors

Builder's merchants and wholesale distributors represent a vital indirect customer segment for H+H International A/S. These entities procure H+H's AAC (Autoclaved Aerated Concrete) products in substantial quantities, acting as intermediaries to supply smaller contractors, individual self-builders, and local construction firms. Their role is instrumental in extending H+H's market reach and ensuring product availability across varied geographical territories.

These partners are essential for H+H's strategy of deep market penetration. By leveraging the established networks of builders' merchants, H+H can efficiently access a broad customer base without direct engagement with every end-user. This model allows for scaled distribution and supports H+H's objective of becoming a preferred supplier in numerous local construction ecosystems.

For instance, in 2024, the UK construction sector, a key market for H+H, saw continued demand, with the Builders Merchants Building Index (BMBI) reporting sales growth. This growth underscores the importance of these wholesale channels in facilitating the flow of building materials like AAC blocks to the project sites.

- Wholesale Procurement: Builders' merchants and wholesale distributors are key bulk purchasers of H+H AAC products.

- Market Reach: They are critical for H+H's expansion into diverse geographical markets by serving smaller, localized construction businesses.

- Intermediary Role: These partners act as essential links, connecting H+H's manufacturing capabilities with a wide array of end-users, including contractors and self-builders.

- Sector Contribution: In 2024, the UK builders' merchant sector, a significant channel for H+H, demonstrated resilience and growth, highlighting the channel's importance.

Public Sector Construction Projects

Public sector construction projects, encompassing vital infrastructure like schools, hospitals, and affordable housing, form a crucial customer segment for H+H International A/S. While H+H often engages with these projects indirectly through construction firms, the ultimate demand stems from government bodies and public entities. These clients prioritize building materials that offer long-term value, focusing on sustainability, cost-effectiveness over the project lifecycle, and inherent durability. For instance, in 2023, the UK government's commitment to building new schools and upgrading existing ones, alongside significant investment in healthcare facilities, directly influences the demand for materials like those H+H provides. The emphasis on energy efficiency and reduced maintenance costs aligns perfectly with the product attributes of H+H’s aircrete blocks.

Key drivers for H+H’s involvement in this segment include:

- Sustainability Mandates: Public sector tenders increasingly require materials with a low environmental impact, a characteristic of H+H's aircrete, which contributes to energy efficiency in buildings.

- Cost-Efficiency and Lifecycle Value: Public bodies are focused on the total cost of ownership, valuing durable and low-maintenance materials that reduce long-term operational expenses.

- Durability and Longevity: The requirement for robust and long-lasting structures in public infrastructure means that materials with proven resilience are highly sought after.

- Regulatory Compliance: Adherence to stringent building codes and energy performance standards in public projects often favors innovative and efficient building solutions.

Self-builders and individual homeowners represent a distinct customer segment for H+H International A/S, particularly those undertaking smaller-scale projects or renovations. These customers often seek reliable, easy-to-use building materials that can contribute to energy efficiency and a comfortable living environment. They may not have the same bulk purchasing power as large developers but are crucial for market diversification and brand recognition at the consumer level.

In 2024, the trend of home improvement and extensions remained strong, driven by evolving living needs and a desire for increased energy efficiency. H+H's aircrete blocks offer a lightweight and manageable solution for self-builders, simplifying the construction process and contributing to better thermal performance, which is a key consideration for homeowners looking to reduce energy bills.

Cost Structure

H+H International A/S's cost structure is heavily influenced by the procurement of essential raw materials, including cement, lime, and sand. These are the building blocks for their aircrete products, making their availability and price critical. For instance, in 2023, cement prices saw volatility due to energy costs and supply chain pressures, directly affecting H+H's raw material expenditure.

Production and manufacturing expenses are a significant part of H+H International A/S's cost structure. These include the substantial energy required for their kilns and machinery, as well as the wages paid to their dedicated factory workers. For instance, in 2023, H+H reported that energy costs represented a notable portion of their operational expenditures.

To combat these costs, H+H International A/S actively pursues operational efficiency. Their HOME program is a key initiative designed to streamline processes and reduce waste. This focus on optimization is crucial for managing expenses related to the maintenance of their production facilities and ensuring competitive pricing in the market.

H+H International A/S faces significant logistics and distribution costs due to its extensive European operations. These expenses encompass the movement of raw materials, such as calcium silicate, to their manufacturing facilities and the subsequent delivery of finished AAC blocks and panels to a broad customer base across the continent.

Key components of these costs include freight charges for road, rail, and potentially sea transport, warehousing expenses for storing both raw materials and finished goods, and the operational costs of managing their delivery networks. In 2023, H+H International reported that its cost of sales, which includes many of these direct logistics expenses, amounted to DKK 3,484 million.

Sales, Marketing, and Administrative Overheads

H+H International A/S incurs costs for its sales force, advertising efforts, and general corporate management. These expenses are vital for establishing and expanding its market footprint.

Research and development (R&D) is also a significant overhead component, driving innovation and future product development. These investments are crucial for maintaining a competitive edge in the building materials sector.

For 2024, H+H International A/S reported that its selling, general, and administrative expenses represented a substantial portion of its overall operational costs, reflecting the investment in market penetration and ongoing business operations.

- Sales Costs: Expenses related to sales personnel, commissions, and sales support functions.

- Marketing Expenses: Investment in advertising, promotions, and brand building activities.

- Administrative Overheads: Costs associated with corporate governance, finance, HR, and legal departments.

- Research & Development: Funding for innovation, new product development, and process improvements.

Capital Expenditures (Capex)

Capital Expenditures (Capex) are crucial for H+H International A/S's growth and operational efficiency. These investments primarily involve property, plant, and equipment, encompassing both enhancements to current manufacturing sites and the establishment of new facilities. For 2025, the company anticipates capital expenditures to be approximately DKK 200 million.

These expenditures are vital for maintaining a competitive edge and expanding production capacity to meet market demand. The focus on upgrades and new developments ensures that H+H International A/S can leverage the latest technology in its manufacturing processes.

- Investment in Property, Plant, and Equipment: Covers upgrades to existing factories and the development of new facilities.

- 2025 Capex Forecast: Projected to be around DKK 200 million.

- Strategic Importance: Essential for enhancing production capacity and technological advancement.

H+H International A/S's cost structure is dominated by raw material procurement, primarily cement, lime, and sand, with their prices directly impacting expenditures. Production and manufacturing expenses, including significant energy consumption and labor costs, are also major components. The company actively works to mitigate these costs through operational efficiency programs like HOME, focusing on streamlining processes and reducing waste.

| Cost Category | Key Drivers | 2023 Data/Notes |

|---|---|---|

| Raw Materials | Cement, lime, sand procurement | Volatility in cement prices impacted costs in 2023. |

| Production & Manufacturing | Energy consumption, labor wages | Energy costs represented a notable portion of operational expenditures in 2023. |

| Logistics & Distribution | Freight, warehousing, network management | Cost of sales (including logistics) was DKK 3,484 million in 2023. |

| Sales, General & Administrative (SG&A) | Sales force, marketing, corporate management, R&D | SG&A represented a substantial portion of overall costs in 2024. |

| Capital Expenditures (Capex) | Property, plant, and equipment upgrades/new facilities | Projected Capex for 2025 is approximately DKK 200 million. |

Revenue Streams

H+H International A/S's main source of income comes from selling autoclaved aerated concrete, or aircrete, in the form of blocks and larger panels. These products are primarily used in building walls, forming the backbone of their sales strategy.

In 2024, H+H International reported that the sale of their aircrete blocks and panels continued to be their most significant revenue driver. This core product line accounted for the majority of their total sales, reflecting its widespread adoption in the construction industry for its lightweight and insulating properties.

H+H International A/S generates revenue not only from its primary aircrete products but also through the sale of calcium silicate units. This dual offering diversifies their presence in the construction materials sector, providing customers with a broader range of solutions for wall construction.

In 2023, H+H International reported a total revenue of DKK 7,230 million. While specific breakdowns for calcium silicate unit sales are not individually detailed in their public reports, this complementary product line plays a role in their overall market strategy and revenue generation.

H+H International A/S generates a substantial portion of its revenue from the residential new building sector, highlighting the company's strong market position in European housing development. This segment represents a primary focus for their sales and marketing strategies.

In 2024, the demand for new homes across Europe remained robust, directly benefiting H+H International A/S. The company's AAC products are a key component in meeting this demand, contributing significantly to their overall financial performance.

Revenue from Commercial and Industrial Construction

H+H International A/S secures revenue not only from residential building projects but also from the commercial and industrial construction sectors. This diversification allows them to serve a wider range of clients and project types, thereby broadening their market presence.

Their offerings are utilized in various non-residential structures, demonstrating the versatility of their AAC (Autoclaved Aerated Concrete) solutions. This segment contributes significantly to their overall sales volume and market penetration.

- Commercial Construction: Revenue generated from supplying AAC products for office buildings, retail spaces, and other commercial establishments.

- Industrial Construction: Income derived from sales for factories, warehouses, and other industrial facilities requiring durable and efficient building materials.

- Market Reach: Expansion into these sectors diversifies H+H's customer base beyond the residential market, increasing overall sales potential.

Sales Across European Markets

H+H International A/S generates revenue through sales across its primary European markets, notably Denmark, Germany, the United Kingdom, Poland, and Switzerland. This broad geographical footprint is crucial for diversifying income and mitigating risks associated with any single market's performance.

The company's extensive network of sales operations across these key European countries directly translates into its revenue streams. For instance, in 2024, H+H International A/S reported a significant portion of its turnover originating from these core regions, reflecting their strategic importance.

- Denmark: A foundational market with consistent sales performance.

- Germany: A major contributor to revenue, driven by strong demand for H+H products.

- United Kingdom: A significant market, showing resilience and growth potential.

- Poland: An expanding market, reflecting increasing construction activity.

- Switzerland: A valuable market contributing to the company's European sales diversity.

Beyond core product sales, H+H International A/S also generates revenue from ancillary services and complementary product offerings. These can include technical support, delivery services, and potentially smaller construction accessories that support the primary use of their aircrete and calcium silicate units.

In 2024, the company continued to emphasize its integrated approach, offering solutions that extend beyond just material supply. While specific figures for these ancillary services are often bundled within broader revenue categories, their contribution enhances overall customer value and revenue diversification.

H+H International A/S's revenue streams are predominantly driven by the sale of autoclaved aerated concrete (AAC) blocks and panels, a core offering for wall construction. They also generate income from calcium silicate units, diversifying their product portfolio within the building materials sector.

The company's sales are heavily influenced by the residential new building market, particularly across key European geographies like Denmark, Germany, the UK, Poland, and Switzerland. They also serve the commercial and industrial construction sectors, broadening their market reach.

| Revenue Stream | Primary Products | Key Markets | 2023 Revenue (DKK million) |

|---|---|---|---|

| Product Sales | AAC Blocks & Panels, Calcium Silicate Units | Denmark, Germany, UK, Poland, Switzerland | 7,230 |

| Ancillary Services | Technical Support, Delivery | All operational markets | Included in overall sales |

Business Model Canvas Data Sources

The H+H International A/S Business Model Canvas is built using a blend of internal financial data, extensive market research on the building materials sector, and strategic insights derived from competitor analysis and industry trends. These diverse sources ensure each component of the canvas accurately reflects the company's current operations and future potential.