H+H International A/S Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H+H International A/S Bundle

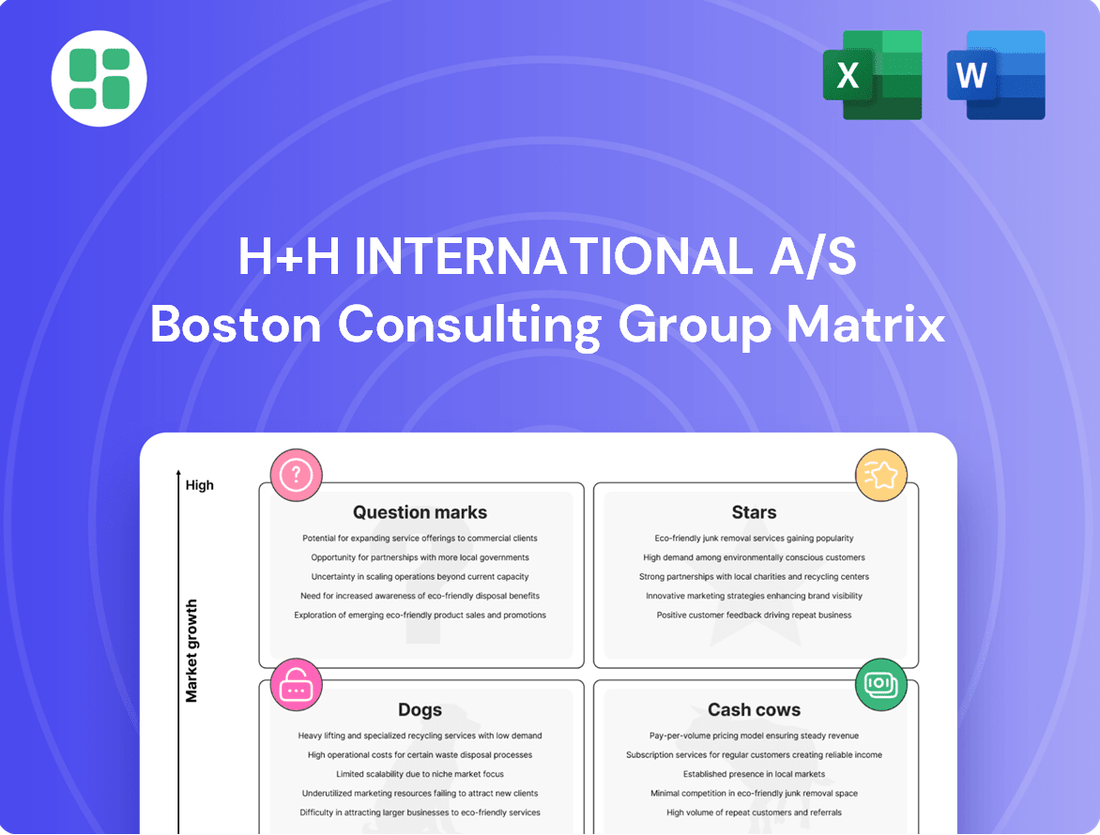

Unlock the strategic potential of H+H International A/S with our comprehensive BCG Matrix analysis. Understand which of their offerings are market leaders (Stars), reliable profit generators (Cash Cows), underperforming assets (Dogs), or emerging opportunities (Question Marks). This preview offers a glimpse into their product portfolio's health.

Don't miss out on the full picture; purchase the complete BCG Matrix report to gain actionable insights and a clear roadmap for optimizing H+H International A/S's product strategy and resource allocation. Make informed decisions that drive growth and profitability.

Stars

H+H International anticipates modest volume growth in the UK for 2025, indicating a market ripe for expansion. Their established aircrete blocks and calcium silicate units for the residential sector likely command a significant market share, positioning them strongly.

The company's leading position in key European markets, including the UK, suggests their products are well-received and competitive. Continued investment in the UK residential AAC solutions segment could further solidify its Star status and future cash-generating potential.

Sustainable Building Solutions, representing H+H International A/S's Autoclaved Aerated Concrete (AAC) products, are poised for significant growth. The global AAC market is projected to reach approximately USD 25 billion by 2028, driven by the escalating demand for eco-friendly construction materials, a trend strongly supported by policies like the European Green Deal. H+H's inherently sustainable AAC offerings, with their excellent thermal insulation properties and reduced embodied carbon, align perfectly with these market drivers.

H+H International A/S's advanced wall building systems, which go beyond basic blocks to include panels, lintels, and other precast elements, represent a promising area within the AAC market. Roof and wall panels, in particular, are anticipated to experience accelerated growth in demand.

These integrated, high-performance systems offer design flexibility and superior properties, positioning them as a high-growth segment for H+H. If the company is successfully capturing a larger share of these advanced applications, these offerings could be classified as Stars in a BCG matrix analysis.

Digitalization in AAC Manufacturing

Digitalization is a significant trend in the autoclaved aerated concrete (AAC) manufacturing sector, with companies like H+H International A/S focusing on improving efficiency and product quality. H+H's ongoing 'HOME initiative' demonstrates a commitment to operational enhancements, potentially positioning their digitally integrated production lines as strong contenders in the market.

These technological advancements are crucial for gaining a competitive edge. For instance, the global AAC market was valued at approximately USD 20 billion in 2023 and is projected to grow steadily. Companies that effectively leverage digitalization can achieve:

- Enhanced production throughput and reduced waste through automated processes.

- Improved product consistency and quality control via real-time data monitoring.

- Greater operational flexibility to adapt to market demands and customize offerings.

Strategic Expansion in Growth Markets

H+H International A/S's strategic expansion into growth markets, particularly within Europe, signifies a move to bolster its position in areas exhibiting strong demand for Autoclaved Aerated Concrete (AAC). This focus aligns with their stated goal of becoming a more resilient company, ready for future expansion. By targeting high-growth European regions or specific application niches that are not yet saturated, H+H aims to increase its market share in these dynamic segments.

This strategic initiative is crucial for H+H's ongoing transformation. The company is actively seeking opportunities to capture a larger portion of markets where AAC adoption is accelerating. For instance, in 2023, H+H reported that its sales in Central and Eastern Europe, a region often characterized by higher growth potential, saw a notable increase, contributing to the company's overall performance.

- Focus on High-Growth European Regions: Identifying and investing in European markets with robust economic development and increasing construction activity where AAC is gaining traction.

- Deepening Penetration in Application Niches: Targeting specific uses of AAC, such as low-carbon building solutions or prefabricated elements, that are experiencing rapid adoption and growth.

- Capturing Market Share: Actively pursuing strategies to increase H+H's percentage of sales within these identified growth areas, moving beyond mature market saturation.

- Contribution to Resilience: These expansion efforts are designed to diversify H+H's revenue streams and reduce reliance on more mature, potentially slower-growing markets, thereby enhancing overall company resilience.

H+H International A/S's advanced wall building systems, including panels and lintels, represent a high-growth segment within the AAC market. These integrated solutions offer enhanced design flexibility and superior performance, positioning them as potential Stars. If the company successfully captures a larger share of these advanced applications, they would be classified as Stars in a BCG matrix.

The company's focus on high-growth European regions and specific application niches, like low-carbon building solutions, is a strategic move to increase market share. This expansion into dynamic segments, where AAC adoption is accelerating, contributes to H+H's overall resilience and future cash-generating potential.

H+H's commitment to digitalization, demonstrated through initiatives like the 'HOME initiative', enhances production efficiency and product quality. This technological edge allows them to achieve greater throughput, improve consistency, and adapt to market demands, further solidifying their Star status in key product categories.

The global AAC market's projected growth, coupled with H+H's strong market position in Europe and investment in advanced solutions, suggests a robust outlook. For instance, the company's sales growth in Central and Eastern Europe in 2023 highlights their success in expanding into promising markets.

| Product/Segment | Market Growth | H+H Market Share | BCG Classification |

|---|---|---|---|

| Advanced Wall Systems (Panels, Lintels) | High | Growing | Star |

| Sustainable AAC Solutions | High | Leading | Star |

| Digitally Integrated Production | High (Efficiency Gain) | Developing | Star |

What is included in the product

This BCG Matrix overview for H+H International A/S details strategic recommendations for each product category, guiding investment and divestment decisions.

A clear BCG Matrix visualizes H+H International A/S's portfolio, easing strategic decision-making by highlighting growth vs. market share.

Cash Cows

H+H International A/S benefits from a strong presence in Northern and Central European markets, often holding leading positions. In mature Central European markets, such as Germany, where significant market recovery isn't anticipated for 2025, their established aircrete block and calcium silicate unit product lines are likely strong cash generators.

These product segments, due to their entrenched market leadership, typically demand minimal additional investment for promotion and placement. This allows them to contribute significantly to the company's overall cash flow, acting as true cash cows within the BCG matrix framework.

Traditional residential AAC blocks are a cornerstone for H+H International A/S, representing a significant cash cow within their portfolio. This segment benefits from the residential construction boom, where AAC blocks are the dominant product type by market share. H+H's established presence in providing these standard blocks for new builds in mature markets ensures consistent, high demand and leverages well-developed distribution networks.

H+H International A/S has focused on optimizing its operations, leading to highly efficient production facilities. These facilities are key to their success, particularly in mature markets where they consistently produce aircrete and calcium silicate units at a competitive low cost. This efficiency translates directly into strong profit margins and reliable cash flow for the company.

Long-Term Supply Contracts

For H+H International A/S, long-term supply contracts act as significant cash cows. Securing these agreements with major contractors or builder's merchants in established markets guarantees consistent demand for their products. This stability translates directly into predictable revenue streams, allowing the company to capitalize on its existing market share.

These contracts are particularly valuable for H+H's core, high-market-share products. They represent a reliable and passive way to generate cash flow, essentially 'milking' the profits from their established market dominance without requiring extensive new investment. In 2024, H+H continued to focus on strengthening these partnerships, a strategy that underpins their financial stability.

- Consistent Demand: Long-term contracts ensure a steady customer base for H+H's products.

- Predictable Revenue: These agreements provide a reliable income stream, crucial for financial planning.

- Market Dominance Leverage: H+H can maximize returns from its strong position in established markets.

- Reduced Risk: Stable demand minimizes the risk associated with market fluctuations.

Mature Market Dominance in Key Regions

H+H International A/S's strong performance in mature markets positions them as a classic Cash Cow. With a reported revenue of DKK 2.7 billion in 2024 and a positive EBIT outlook for 2025, the company demonstrates robust financial health.

Their significant market share in established regions, where the Autoclaved Aerated Concrete (AAC) market experiences stable, albeit moderate, growth, allows for substantial cash generation. This dominance means less need for aggressive investment in new market penetration, freeing up capital.

- Mature market dominance generates consistent cash flow.

- Stable market growth requires minimal reinvestment.

- Financial stability is supported by strong revenue and EBIT.

- These regions form the company's financial bedrock.

H+H International A/S's established product lines in mature Northern and Central European markets, particularly traditional residential AAC blocks and calcium silicate units, function as significant cash cows. These segments benefit from entrenched market leadership, requiring minimal additional investment for promotion and placement, thereby contributing substantially to the company's overall cash flow. Their operational efficiency, with highly optimized production facilities, ensures competitive low costs and strong profit margins, further solidifying their cash-generating capabilities.

| Product Segment | Market Position | Cash Flow Contribution | Investment Needs |

|---|---|---|---|

| Traditional Residential AAC Blocks | Dominant in mature markets | High, consistent | Low |

| Calcium Silicate Units | Leading positions in Central Europe | High, consistent | Low |

| Long-term Supply Contracts | Secured with major partners | Predictable and stable | Minimal |

What You’re Viewing Is Included

H+H International A/S BCG Matrix

The BCG Matrix for H+H International A/S you are currently previewing is the complete and final document you will receive immediately after purchase. This means no watermarks or sample data will be present in the downloaded file; you'll get the fully formatted, professionally analyzed report ready for your strategic decision-making.

Rest assured, the preview you're examining is the identical H+H International A/S BCG Matrix report that will be delivered to you upon completing your purchase. It has been meticulously prepared with expert analysis, ensuring you receive a high-quality, actionable document directly, without any need for further revisions.

What you see here is the actual, unedited BCG Matrix document for H+H International A/S that you will obtain once your purchase is confirmed. The full version will be instantly accessible for you to edit, print, or incorporate into your business presentations and planning sessions.

You are currently viewing the genuine H+H International A/S BCG Matrix file that will be yours after a single purchase. This is not a mockup; it is a professionally designed, analysis-ready report that you can download and utilize immediately for your business strategy needs.

Dogs

Underperforming regional operations, particularly in markets like Germany where a 2025 recovery is not anticipated, likely fall into the Dogs category for H+H International A/S. These segments, characterized by low market share and low growth prospects, represent areas where the company may be investing resources without commensurate returns.

For instance, if specific German regions continue to experience a construction sector slowdown, H+H’s market position there could stagnate or decline, fitting the profile of a Dog. Such units require careful evaluation to determine if divestment or a turnaround strategy is more appropriate than continued investment.

Obsolete product variants, particularly older AAC blocks that don't meet current energy efficiency standards, represent a challenge for H+H International A/S. In 2024, with the increasing regulatory push towards greener building materials, these less efficient products are likely to see a significant drop in demand.

These legacy offerings would struggle against H+H's own advanced, sustainable product lines, resulting in a low market share and potentially negative profit margins. For instance, if an older variant consumes 15% more energy in production compared to newer models, its cost competitiveness will be severely impacted.

The strategic path forward for such obsolete variants would likely involve a careful evaluation for potential divestiture or complete discontinuation to streamline operations and focus resources on more profitable and future-proof product categories.

Despite ongoing efforts to streamline operations, certain H+H International A/S production lines, particularly older or less automated ones, may be struggling with higher operating costs and reduced output. These units, especially when catering to markets with limited growth, can result in a low market share and diminished profitability, positioning them as potential question marks in the BCG matrix.

These less efficient assets can tie up valuable capital without generating significant returns, impacting the company's overall financial performance. For instance, if a specific production line's cost per unit significantly exceeds the industry average, it directly erodes profit margins, a scenario that H+H actively seeks to mitigate through continuous improvement initiatives.

Niche Products with Limited Demand

Niche products with limited demand represent a potential challenge within H+H International A/S's portfolio, particularly if they are specialized Aerated Autoclaved Concrete (AAC) applications that haven't achieved broad market acceptance. These offerings, even within an expanding overall AAC market, would likely exhibit low market share due to their limited appeal.

Such products can become resource drains, consuming capital and operational focus without generating substantial revenue. For instance, if H+H invested in developing custom AAC solutions for a very specific, small-scale industrial application that has seen minimal uptake, this would fit the description. In 2024, the global AAC market continued its growth, but niche segments within it might not mirror this expansion, leading to a situation where these products operate as cash cows with declining potential or question marks needing careful evaluation.

- Limited Market Appeal: Specialized AAC products designed for very specific uses may struggle to gain traction beyond a small customer base.

- Low Market Share: Even in a growing overall AAC market, these niche items would likely hold a negligible share due to their restricted demand.

- Resource Consumption: Continued investment in these products without significant sales can divert resources from more promising areas of the business.

- Potential for Divestment: Companies often evaluate divesting or discontinuing niche products that consistently underperform and fail to scale.

Segments Affected by Intense Local Competition

In certain highly fragmented European markets, H+H International A/S may struggle to gain significant traction. This intense local competition, even in growing sectors, can limit their market share. For instance, in 2024, some smaller regional markets in France and Germany saw H+H facing established local players with strong brand loyalty, impacting their ability to scale efficiently.

Segments where H+H holds a low market share and faces limited growth due to formidable local competitors can be considered Dogs within the BCG Matrix. Attempting extensive turnaround strategies in these specific areas might not yield a positive return on investment, given the entrenched nature of the competition.

- Intense Local Rivalry: Markets with numerous small, agile competitors can dilute H+H's market share.

- Limited Growth Potential: Even if the overall market expands, H+H's specific segment within it might not grow due to competitive pressures.

- Resource Allocation Challenges: Focusing significant resources on these "Dog" segments might detract from more promising opportunities.

- Strategic Divestment Consideration: In some cases, exiting these low-performing segments may be a more prudent strategy.

Underperforming regional operations, such as those in specific German territories with anticipated low construction sector growth through 2025, likely represent H+H International A/S's Dogs. These areas are characterized by a low market share and limited future expansion prospects, meaning resources invested may not generate adequate returns.

Obsolete product lines, like older AAC blocks that do not meet current energy efficiency regulations, are also classified as Dogs. In 2024, demand for these less efficient materials declined significantly due to the increasing focus on sustainable building practices, making them less competitive against newer, eco-friendly alternatives.

Niche AAC applications with minimal market acceptance, even within a growing overall market, can also fall into the Dog category. These specialized products may have a low market share and consume resources without substantial revenue generation, presenting a challenge for H+H's portfolio optimization.

Markets with intense local competition where H+H struggles to gain significant traction, even in growing sectors, can also be considered Dogs. In 2024, markets like certain regions in France and Germany saw H+H facing established local competitors, impacting their ability to increase market share efficiently.

| Category | Characteristics | Example for H+H International A/S | Strategic Implication |

| Dogs | Low Market Share, Low Growth | Underperforming German regional operations; Obsolete AAC product variants; Niche AAC applications with limited demand; Markets with intense local competition. | Divestment or discontinuation to reallocate resources. |

Question Marks

Emerging green construction technologies, particularly those enhancing energy efficiency, are a major catalyst for the Autoclaved Aerated Concrete (AAC) market. H+H International A/S is likely exploring next-generation AAC products or novel construction methods that tap into these rapidly expanding trends. These innovative solutions, while holding significant future promise, currently represent a small portion of H+H's market presence.

H+H International A/S, while a dominant player in Northern and Central Europe, is strategically eyeing expansion into burgeoning global markets. The AAC sector in North America and Asia-Pacific, in particular, is experiencing robust growth, presenting significant opportunities for market share acquisition. These ventures are considered Stars, demanding substantial capital investment to establish a foothold and capture market potential.

H+H International A/S is exploring innovative applications for Aerated Autoclaved Concrete (AAC) that extend beyond traditional wall systems. This versatile material can be shaped into various components for floors and roofs, offering a lightweight yet robust alternative in construction. The company's potential development of reinforced AAC elements for these structural applications signifies a move into a market with significant growth potential.

While the market for AAC in flooring and roofing is expanding, H+H's current market share in these specific segments might still be nascent. This presents an opportunity for the company to establish a stronger foothold by leveraging AAC's inherent advantages, such as its thermal insulation properties and ease of installation, in these new product categories. For instance, the global AAC market was valued at approximately USD 15 billion in 2023 and is projected to grow significantly, with flooring and roofing applications contributing to this expansion.

Strategic Acquisitions in Developing Markets

H+H International A/S might consider acquiring smaller AAC producers or related businesses in developing markets. These markets often exhibit high growth potential but are less mature, meaning the acquired entities might not yet have significant market share or profitability. This positions them as potential Stars or Question Marks within H+H's BCG Matrix, requiring strategic investment to foster growth and improve their standing.

For instance, in 2024, the global AAC market was projected to reach approximately USD 20 billion, with developing regions showing the highest compound annual growth rates. Acquisitions in these areas, such as Southeast Asia or parts of Africa, could offer H+H a chance to establish a strong foothold early on.

- Strategic Rationale: These acquisitions align with a strategy to capture future market share in rapidly expanding economies.

- Investment Requirement: Significant capital will be needed for integration, operational improvements, and market development to transform these entities.

- Potential for Growth: Successful integration could lead to these acquired businesses becoming Stars, contributing significantly to H+H's overall revenue and profitability.

- Risk Mitigation: Diversifying into developing markets can also mitigate risks associated with saturation in more established regions.

Premium or Specialized AAC Solutions

H+H International A/S may be focusing on premium or specialized Autoclaved Aerated Concrete (AAC) solutions. These advanced offerings could target niche markets like high-end residential construction or specialized industrial uses where enhanced performance characteristics are paramount.

These specialized AAC products, while potentially commanding higher prices and addressing a growing demand for tailored building materials, would likely represent a smaller portion of H+H's overall market share initially. Significant investment in targeted marketing and sales initiatives would be crucial to drive adoption and build brand recognition within these specialized segments.

- Niche Market Focus: Development of premium AAC for bespoke architectural projects or demanding industrial applications.

- Market Share Dynamics: Likely low initial market share due to specialization and higher price points.

- Growth Potential: Addresses a growing demand for specialized construction solutions.

- Strategic Investment: Requires substantial marketing and sales efforts for market penetration.

Question Marks in H+H International A/S's BCG Matrix likely represent emerging markets or new product lines with uncertain futures. These ventures, while holding potential, require careful observation and strategic investment to determine their trajectory. For instance, H+H's exploration into novel AAC applications or acquisitions in nascent developing markets could fall into this category.

These segments demand significant capital to nurture growth and build market share, mirroring the characteristics of Question Marks. The company must diligently assess the competitive landscape and market demand to decide whether to invest further or divest.

The global AAC market's projected growth, reaching approximately USD 20 billion in 2024, highlights the potential for these Question Mark initiatives to evolve into Stars. However, their current low market share and uncertain demand necessitate a cautious yet strategic approach.

The success of these ventures hinges on H+H's ability to adapt to evolving market needs and effectively allocate resources. For example, if H+H’s investments in specialized AAC for niche markets gain traction, they could transition from Question Marks to Stars.

BCG Matrix Data Sources

Our BCG Matrix for H+H International A/S is built upon a foundation of robust market data, encompassing financial disclosures, industry growth rates, and competitor performance analyses.