H+H International A/S Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H+H International A/S Bundle

Discover how H+H International A/S leverages its product innovation, strategic pricing, efficient distribution, and impactful promotions to dominate the building materials market. This analysis goes beyond the surface, revealing the interconnectedness of their 4Ps.

Unlock a comprehensive, ready-to-use Marketing Mix Analysis for H+H International A/S. Perfect for professionals and students, this editable report provides actionable insights into their product, price, place, and promotion strategies.

Product

H+H International A/S's specialized aircrete solutions, also known as autoclaved aerated concrete (AAC), are central to their product strategy. These materials are engineered for efficient wall construction across residential, commercial, and industrial sectors. The company's 2023 annual report highlighted a strong performance in its building materials segment, with aircrete products being a key driver of growth.

H+H International A/S's aircrete products boast exceptional material properties, including being lightweight yet structurally sound. These characteristics translate to superior thermal insulation, contributing to significant energy efficiency in buildings, a crucial factor as global energy consumption for buildings remains a substantial concern, with the IEA reporting buildings account for approximately 30% of global final energy consumption.

Furthermore, the aircrete's excellent fire resistance and sound insulation capabilities enhance building safety and occupant comfort. Its freeze/thaw resistance ensures long-term durability, a key consideration in diverse climatic conditions. For instance, in the UK market, H+H's aircrete blocks are recognized for their contribution to achieving high thermal performance standards, helping projects meet stringent building regulations.

The material's inherent versatility supports design flexibility and dimensional stability, allowing architects and builders to achieve complex designs with confidence. This durability and adaptability are vital for modern construction, where longevity and aesthetic freedom are increasingly demanded by clients and developers.

H+H International A/S offers more than just building materials; they provide comprehensive building systems designed for efficiency. Their integrated solutions, like Celcon Blocks and the H+H Thin-Joint System, streamline construction. For 2024, H+H reported a significant focus on their Modern Methods of Construction (MMC) offerings, including Vertical Wall Panels, which aim to reduce build times and costs for structural walls.

These advanced systems are engineered to accelerate construction timelines and improve cost-effectiveness, especially for high-performance structural walls. H+H International actively supports clients from the initial planning stages right through to the completion of the construction phase, ensuring a cohesive and successful project delivery.

Commitment to Sustainability

H+H International A/S is deeply committed to fostering a sustainable future, with a clear objective of achieving net zero carbon emissions by 2050. This ambitious goal is underpinned by the adoption of third-party verified Science-Based Targets, ensuring rigorous measurement and management of their environmental footprint across operations and product lifecycles.

Their aircrete products stand out as a more environmentally conscious choice within the construction sector. For instance, in 2023, H+H's products helped to reduce embodied carbon in construction projects compared to traditional materials. This commitment extends to their operational efficiency, with ongoing investments in technologies aimed at reducing energy consumption and waste.

- Net Zero Target: H+H aims for net zero carbon emissions by 2050.

- Science-Based Targets: Utilizes third-party verified SBTs for environmental impact management.

- Product Advantage: Aircrete products offer a more sustainable alternative in construction.

- 2023 Impact: H+H's products contributed to lower embodied carbon in building projects during 2023.

Adapting to Market Demands

H+H International A/S actively adapts its product portfolio to align with shifting market demands and increasingly stringent regulatory frameworks. A prime example is the upcoming Future Homes Standard, set to be implemented in 2025, which will necessitate higher energy efficiency in new builds.

The company's strategic emphasis on technically advanced aircrete components positions them to effectively address modern construction's challenges. This focus ensures their products remain not only relevant but also competitive in meeting current efficiency mandates and performance requirements.

- Product Development Focus: H+H continuously refines its product offerings to meet evolving market needs and regulatory standards, such as the 2025 Future Homes Standard.

- Innovation in Aircrete: The company prioritizes technically innovative aircrete components to ensure its solutions are competitive and address contemporary construction challenges.

- Market Relevance: This proactive approach ensures H+H's products remain aligned with efficiency requirements and future building regulations.

H+H International A/S offers advanced aircrete building materials known for their lightweight strength, superior thermal insulation, and fire resistance. These products are designed to enhance energy efficiency, contributing to reduced building operational costs and environmental impact, a critical factor given buildings account for about 30% of global energy consumption.

The company provides integrated building systems, such as the Thin-Joint System and Vertical Wall Panels, aimed at accelerating construction and improving cost-effectiveness, particularly for high-performance structural walls. H+H actively supports clients throughout the project lifecycle, ensuring efficient and successful building outcomes.

H+H International's product strategy is deeply rooted in sustainability, targeting net zero carbon emissions by 2050 with verified Science-Based Targets. Their aircrete solutions offer a lower embodied carbon alternative, as demonstrated by their contribution to reduced embodied carbon in projects during 2023, aligning with the growing demand for greener construction practices.

The product range is continuously adapted to meet evolving market demands and stringent regulations, such as the 2025 Future Homes Standard, which mandates higher energy efficiency in new builds. This focus on technically advanced aircrete components ensures H+H remains competitive and relevant in addressing contemporary construction challenges.

| Product Feature | Benefit | Market Relevance | 2023/2024 Data Point |

|---|---|---|---|

| Aircrete (AAC) | Lightweight, high thermal insulation, fire resistance, sound insulation | Energy efficiency, occupant comfort, building safety | Products contributed to lower embodied carbon in 2023 projects. |

| Thin-Joint System | Faster construction, reduced waste, improved structural integrity | Cost-effectiveness, project timelines | Focus on Modern Methods of Construction (MMC) in 2024. |

| Vertical Wall Panels | Accelerated build times for structural walls | Efficiency, cost reduction | Key offering within MMC strategy for 2024. |

What is included in the product

This analysis offers a comprehensive examination of H+H International A/S's marketing strategies, detailing their Product offerings, Pricing tactics, Place (distribution) channels, and Promotion activities.

It provides a valuable resource for understanding H+H International A/S's market positioning and competitive approach, grounded in their actual business practices.

Provides a clear, actionable framework to address marketing challenges, simplifying complex strategies into manageable solutions for H+H International A/S.

Offers a structured approach to identify and resolve marketing pain points by systematically evaluating product, price, place, and promotion strategies.

Place

H+H International A/S boasts an extensive European footprint, primarily concentrating its operations in Northern and Central Europe. This strategic geographic focus allows the company to tap into established market demands and optimize its supply chain efficiencies within these key regions.

The company's presence is solidified by a robust network of manufacturing facilities and sales offices strategically positioned across these vital European markets. For instance, in 2023, H+H International A/S reported that its European operations accounted for a substantial majority of its total revenue, underscoring the importance of this geographic concentration for its business model.

H+H International A/S operates a strategic manufacturing network comprising 27 factories strategically located across Northern and Central Europe. This extensive production base is crucial for ensuring efficient supply chains and rapid responses to customer demand in their core markets.

The company's decentralized manufacturing approach allows for optimized logistics, particularly beneficial for heavy building materials like AAC blocks. By producing closer to their key markets, H+H International A/S significantly reduces transportation costs and lead times, enhancing their competitive edge.

For example, in 2023, H+H International A/S reported revenue of DKK 7,748 million, a testament to the operational efficiency and market reach facilitated by their manufacturing footprint.

H+H International A/S caters to a broad spectrum of clients, from large developers and contractors to smaller builders and individual projects. This necessitates a robust distribution strategy that balances direct engagement with indirect reach.

Direct channels likely serve major clients like residential and industrial developers, allowing for tailored solutions and volume-based agreements. In 2023, H+H reported a revenue of DKK 7.5 billion, indicating significant sales volumes that would benefit from direct relationships with large customers.

Indirect distribution through builder's merchants is crucial for accessing a wider market, particularly smaller contractors and housebuilders. These merchants act as intermediaries, stocking H+H products and providing accessibility across various geographic regions.

Regional Sales and Support Offices

H+H International A/S strategically positions regional sales and support offices across key European markets to enhance market access and customer engagement. These offices are vital for tailoring distribution and support to local needs, ensuring strong customer relationships and efficient operations. For instance, in 2023, the UK and Germany represented significant markets for H+H, with their respective offices playing a crucial role in driving sales growth and providing localized technical assistance.

The presence of these regional hubs allows H+H to effectively manage local sales activities and adapt distribution strategies to the unique conditions and customer preferences prevalent in each market. This localized approach is a cornerstone of their customer-centric strategy, fostering deeper connections and responsiveness.

- UK Office: Critical for the significant British market, contributing to a substantial portion of H+H's European revenue.

- German Office: Serves a major industrial base, facilitating direct sales and technical support for AAC products.

- Polish Office: Supports expansion into Eastern European markets, adapting to growing construction demands.

- Benelux Office: Covers Belgium, Netherlands, and Luxembourg, offering streamlined access and support for these connected economies.

Supply Chain Resilience

H+H International A/S leverages its operational structure, featuring a network of factories and localized distribution, to build supply chain resilience. This distributed manufacturing approach allows for greater flexibility in sourcing and production.

Recent events, such as the temporary cessation and subsequent resumption of production at a UK facility in early 2024, underscored the value of these distributed capabilities. The company's ability to quickly restore supply from other locations demonstrates a robust strategy for mitigating disruptions.

For instance, in 2023, H+H International reported that its production sites across Europe and Asia contributed to a stable supply, even amidst global logistical challenges. This decentralized model is crucial for maintaining consistent product availability for their diverse customer base.

- Distributed Manufacturing: H+H International operates multiple production facilities, reducing reliance on a single location.

- Localized Distribution: Proximity to markets through localized distribution networks minimizes transit times and risks.

- Operational Flexibility: The company demonstrated swift action in resuming UK production, showcasing adaptability.

- Global Supply Chain Management: H+H's 2023 performance highlighted the effectiveness of managing a geographically dispersed supply chain.

H+H International A/S strategically places its manufacturing and distribution network across Northern and Central Europe, emphasizing proximity to its core customer base. This geographic concentration, with 27 factories in 2023, enhances supply chain efficiency and responsiveness for heavy building materials like AAC blocks. The company's presence is further strengthened by regional sales and support offices in key markets such as the UK and Germany, facilitating tailored customer engagement and efficient logistics.

This localized approach is critical for managing transportation costs and lead times, as evidenced by H+H's substantial European revenue contribution in 2023. The decentralized manufacturing model ensures supply chain resilience, allowing for quick adaptation to disruptions, as demonstrated by the swift resumption of UK production in early 2024.

H+H International A/S utilizes a dual distribution strategy, combining direct sales to large developers with indirect sales through builder's merchants to reach a broader market. This approach balances volume-based agreements with widespread product accessibility, crucial for serving diverse customer segments from major construction firms to smaller builders.

The company's operational flexibility, highlighted by its ability to manage a geographically dispersed supply chain and adapt to market demands, underpins its consistent product availability. For instance, H+H's 2023 performance, with revenue reaching DKK 7,748 million, reflects the success of this strategy in maintaining stable supply amidst global logistical challenges.

| Key Market Presence | Number of Factories (2023) | Key Distribution Channels | 2023 Revenue (DKK million) |

| Northern & Central Europe | 27 | Direct Sales, Builder's Merchants | 7,748 |

| UK | Multiple | Direct, Merchants | Significant Portion of European Revenue |

| Germany | Multiple | Direct, Merchants | Significant Portion of European Revenue |

What You Preview Is What You Download

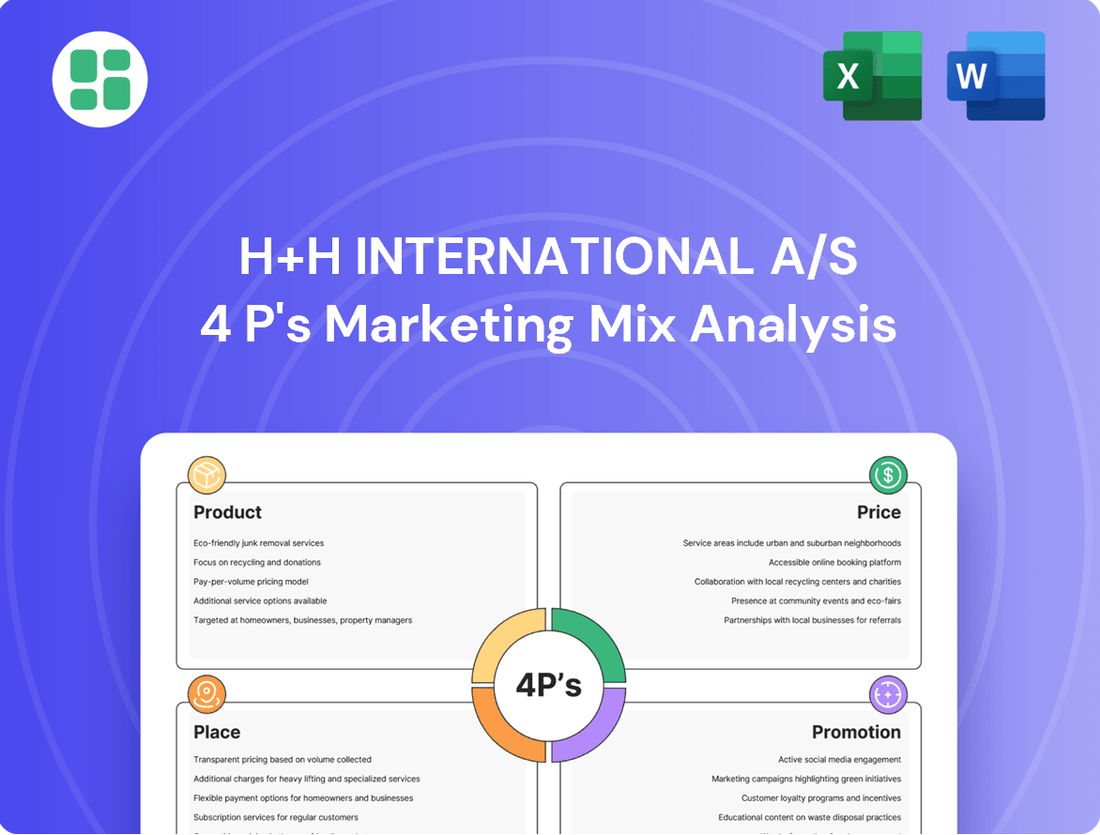

H+H International A/S 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive H+H International A/S 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You are viewing the exact version of the analysis you'll download, ensuring you get all the detailed insights you need.

Promotion

H+H International A/S prioritizes clear and consistent communication with investors and financial analysts. This commitment is evident in their regular publication of annual and interim financial reports, alongside detailed investor presentations. For instance, their 2023 annual report provided a comprehensive overview of their performance, with revenue reaching DKK 7,525 million.

To further facilitate engagement, the company actively conducts conference calls and webcasts. These sessions allow stakeholders to directly discuss financial results and future prospects with management. In 2024, H+H International A/S continued this practice, ensuring timely access to crucial company information and fostering investor confidence.

H+H International A/S leverages its official website as a primary digital presence, functioning as a comprehensive information hub. This platform is crucial for disseminating details on sustainability initiatives, product offerings, investor relations, and media communications, directly addressing the needs of a financially-literate audience seeking transparency and performance data.

The website's structure, featuring dedicated sections for sustainability, products, investor relations, and media, ensures that key stakeholders can easily access vital corporate information. For instance, as of early 2024, H+H International reported a strong emphasis on its sustainable AAC block production, a key selling point communicated through this digital channel, aligning with growing investor and consumer demand for ESG-focused businesses.

H+H International A/S champions a 'Partners in Wall Building' philosophy, extending technical support and collaborative engagement across the entire customer journey. This approach, evident in their 2024 marketing, focuses on providing expertise from project conception and design through to distribution and on-site construction, fostering deep customer loyalty.

This commitment to partnership translates into value-added services that bolster customer confidence and project success. For instance, in 2024, H+H's technical support teams actively assisted over 1,500 construction projects, directly contributing to enhanced efficiency and reduced material waste, a key differentiator in the competitive building materials market.

Industry Engagement and Thought Leadership

H+H International A/S actively participates in industry events, demonstrating its commitment to engagement and thought leadership within the B2B construction sector. This includes presence at trade shows and technical seminars, crucial for showcasing their innovative aircrete solutions and discussing future building standards.

Their proactive approach in pioneering sustainable and efficient construction methods, particularly with aircrete, positions them as key influencers. For instance, in 2023, H+H reported a revenue of DKK 7.4 billion, reflecting their significant market presence and the growing demand for advanced building materials.

The company's strategy likely involves a robust direct sales force, essential for building relationships and conveying the technical advantages of their products to a professional audience. This direct engagement reinforces their image as experts and innovators.

Key aspects of their industry engagement and thought leadership include:

- Participation in industry trade shows and technical seminars to showcase aircrete solutions and future building standards.

- Focus on pioneering sustainable and efficient construction methods, establishing them as thought leaders.

- Leveraging a direct sales force to communicate technical expertise and build client relationships.

- Demonstrating market leadership, as evidenced by their 2023 revenue of DKK 7.4 billion.

Strategic Messaging of Value and Innovation

H+H International A/S's strategic messaging focuses on the inherent value and innovative nature of its aircrete products. Communications will emphasize the superior thermal insulation, acoustic performance, and structural integrity that aircrete provides, directly addressing key concerns for contractors, developers, and builders.

The company's promotional efforts aim to educate the market on aircrete's role in creating more sustainable and energy-efficient buildings. By highlighting these tangible benefits and the long-term cost savings, H+H seeks to position its products as a superior choice offering a distinct competitive advantage in the construction sector.

For instance, in 2023, H+H reported a significant increase in demand for sustainable building solutions, with their aircrete products playing a key role in achieving higher energy performance ratings for new builds. This trend is expected to continue into 2024 and 2025 as regulatory pressures and consumer preferences increasingly favor eco-friendly construction materials.

- Enhanced Thermal Performance: Aircrete's inherent properties contribute to significant energy savings in buildings, reducing heating and cooling costs.

- Superior Acoustic Insulation: The material’s structure offers excellent sound dampening, improving occupant comfort and privacy.

- Sustainable Building Contribution: Aircrete supports green building certifications and reduces the environmental footprint of construction projects.

- Long-Term Value Proposition: H+H communicates the lifecycle cost benefits and durability of aircrete, appealing to value-conscious stakeholders.

H+H International A/S's promotional strategy centers on educating the market about the distinct advantages of its aircrete products. This includes highlighting superior thermal insulation, acoustic performance, and structural integrity to contractors, developers, and builders. Their communications emphasize how aircrete contributes to more sustainable and energy-efficient buildings, positioning it as a premium choice offering long-term cost savings and a competitive edge.

The company actively participates in industry events and leverages a direct sales force to convey technical expertise and build strong client relationships. This engagement reinforces their image as innovators and thought leaders in sustainable construction methods. For instance, H+H reported a 2023 revenue of DKK 7.4 billion, showcasing their significant market presence and the growing demand for their advanced building materials.

Their promotional efforts also focus on the value-added services and collaborative approach embodied by their 'Partners in Wall Building' philosophy. This commitment was demonstrated in 2024 when H+H's technical support teams assisted over 1,500 construction projects, directly improving efficiency and reducing waste, a key differentiator in the competitive building materials sector.

H+H International A/S's digital presence, particularly its website, serves as a crucial channel for disseminating information on sustainability, product offerings, and investor relations. As of early 2024, the company highlighted its sustainable AAC block production, aligning with investor and consumer demand for ESG-focused businesses.

| Promotional Focus Area | Key Message | Supporting Evidence/Data |

|---|---|---|

| Product Benefits | Superior thermal insulation, acoustic performance, structural integrity | Aircrete contributes to energy savings and occupant comfort |

| Sustainability & Efficiency | Enabling sustainable and energy-efficient buildings | Supports green building certifications, reduces environmental footprint |

| Industry Engagement | Thought leadership in construction methods | Participation in trade shows and technical seminars |

| Customer Partnership | Value-added services and technical support | Assisted over 1,500 construction projects in 2024 |

Price

H+H International A/S's 2025 pricing strategy focuses on adjusting prices to mirror cost inflation, a vital move to protect profit margins amidst rising input expenses. This proactive stance is essential for navigating the current economic landscape where material and energy costs can be volatile.

The company is committed to maintaining price discipline across its European markets, ensuring consistent and fair pricing for its AAC blocks and panels. This approach aims to balance the need for revenue generation with customer value perception, especially considering that inflation in the Eurozone averaged 2.4% in 2024, with projections for 2025 remaining a key consideration for pricing adjustments.

H+H International A/S likely utilizes value-based pricing for its autoclaved aerated concrete (AAC) products, reflecting the significant performance advantages. This strategy aligns with the material's superior thermal insulation, fire resistance, and sound reduction capabilities, which translate into tangible long-term cost savings for builders and end-users through reduced energy consumption and enhanced safety.

H+H International A/S anticipates its financial outlook for 2025, including pricing, will be heavily influenced by ongoing market conditions. While modest volume growth is projected, particularly in the UK market, the company does not foresee a significant market recovery in Germany during this period.

This divergence in market performance across key European regions directly impacts H+H International A/S's pricing flexibility and competitive strategy. The anticipated 2024 revenue for the company was around DKK 6.5 billion, with expectations for continued market dynamics to play a crucial role in 2025's pricing structures.

Revenue Growth and Profitability Targets

H+H International A/S is targeting robust revenue growth for 2025, projecting an increase of 5% to 10% when measured in local currencies. This growth is underpinned by profitability targets, with an expected EBIT before special items to fall between DKK 120 million and DKK 180 million.

These financial objectives suggest that H+H's pricing strategies are carefully calibrated to foster expansion while ensuring healthy profit margins, even when faced with fluctuating market conditions. The company aims to balance competitive pricing with the need to achieve its financial performance goals.

- Revenue Growth Forecast (2025): 5% to 10% (local currencies)

- EBIT Target (2025): DKK 120 million to DKK 180 million (before special items)

- Pricing Strategy Implication: Supports growth and profitability amidst market variability.

Competitive Market Considerations

H+H International A/S operates within a competitive building materials sector where Autoclaved Aerated Concrete (AAC) often commands a higher price point than conventional options like bricks or concrete blocks. This necessitates a careful balancing act in their pricing strategies. They must closely monitor competitor pricing, particularly for comparable materials, while simultaneously underscoring the long-term value proposition of their high-performance AAC products, which offer benefits like superior insulation and lighter weight.

Maintaining strategic price discipline is paramount for H+H to solidify and defend its leading market position. This involves not just reacting to market fluctuations but proactively setting prices that reflect the inherent quality and operational efficiencies their AAC provides. For instance, in 2024, the global construction market saw material cost volatility, with some traditional materials experiencing price increases. H+H's ability to maintain competitive pricing for AAC, even with its premium attributes, will be crucial for market share retention and growth.

- Price Sensitivity: H+H must assess how price-sensitive different market segments are to AAC compared to traditional alternatives.

- Value-Based Pricing: Emphasizing the total cost of ownership, including energy savings and faster construction times, justifies a potentially higher upfront price for AAC.

- Competitor Benchmarking: Regularly analyzing the pricing strategies of competitors offering both AAC and alternative building materials is essential.

- Market Demand Alignment: Pricing needs to be calibrated with current construction project demand and the overall economic climate influencing building activity.

H+H International A/S's 2025 pricing strategy is a delicate balance, aimed at absorbing cost inflation while remaining competitive. The company's commitment to price discipline across Europe, acknowledging the Eurozone's 2.4% average inflation in 2024, underpins this approach.

Value-based pricing is central, highlighting AAC's superior thermal insulation and fire resistance, which offer long-term savings to customers. This strategy supports the company's 2025 revenue growth target of 5% to 10% in local currencies, with an EBIT expectation between DKK 120 million and DKK 180 million.

The company must navigate differing market dynamics, such as projected modest growth in the UK versus a slower recovery in Germany for 2025. This requires flexible pricing that reflects local demand and competitive landscapes, especially against traditional materials like bricks.

| Pricing Factor | 2024 Context | 2025 Outlook |

|---|---|---|

| Cost Inflation Impact | Significant input cost volatility | Strategy to mirror cost inflation |

| Value Proposition | Superior insulation, fire resistance | Continued emphasis on long-term savings |

| Market Competitiveness | Higher price point than traditional materials | Balancing premium attributes with market demand |

| Revenue Target Support | DKK 6.5 billion (approx. 2024 revenue) | 5%-10% local currency growth |

| Profitability Target | N/A | DKK 120-180 million EBIT |

4P's Marketing Mix Analysis Data Sources

Our H+H International A/S 4P's Marketing Mix Analysis is grounded in comprehensive data from official company reports, investor relations materials, and industry-specific publications. We meticulously gather information on their product portfolio, pricing strategies, distribution networks, and promotional activities to provide an accurate and insightful overview.