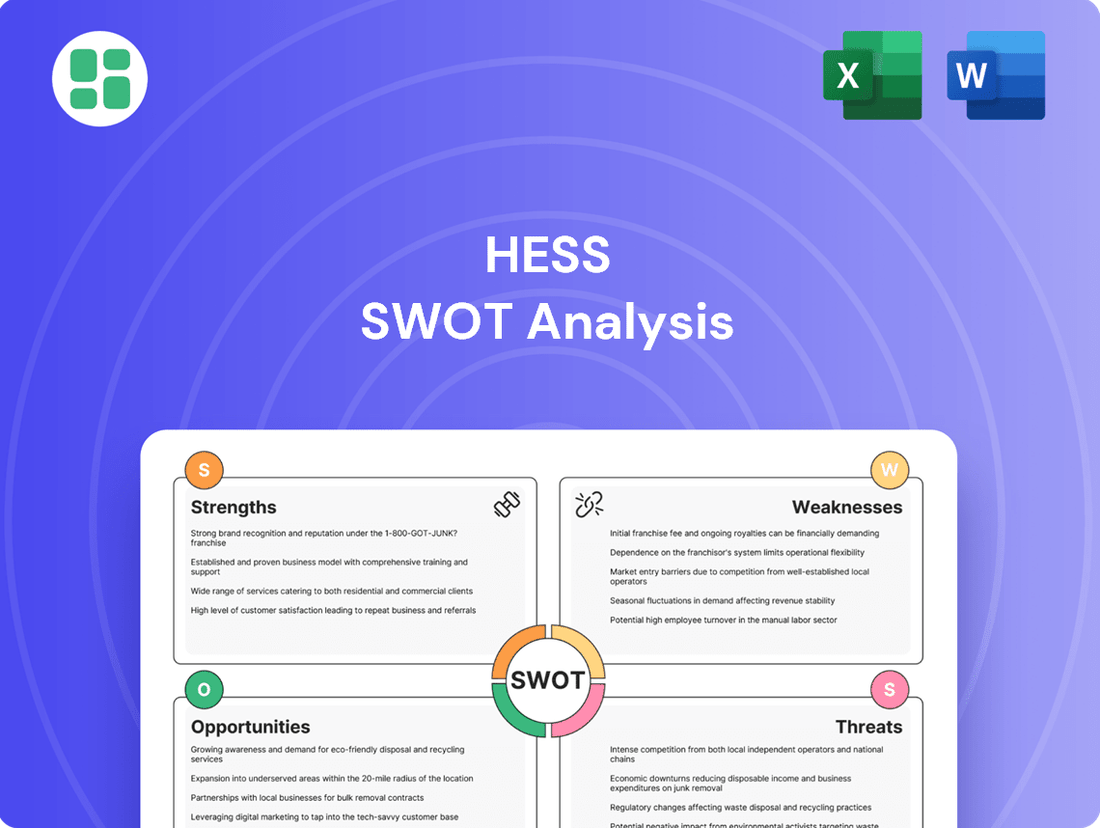

Hess SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hess Bundle

Hess's strengths lie in its integrated operations and strong financial position, but it faces significant threats from volatile oil prices and increasing regulatory pressures.

Want the full story behind Hess's competitive advantages and potential pitfalls? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Hess Corporation boasts a world-class asset portfolio, anchored by its substantial 30% stake in the Stabroek Block offshore Guyana. This venture is a cornerstone, holding over 11 billion barrels of recoverable resources, which is a massive driver for Hess's future production and cash flow generation.

The company also maintains a robust presence in the Bakken Shale region of North Dakota, further solidifying its production capabilities. In 2024, Hess's Guyana operations are expected to contribute significantly to its overall output, with production from the Liza Phase 1 and Phase 2 developments already online and the Payara development progressing towards startup.

Hess Corporation's disciplined capital allocation is a significant strength, prioritizing investments in projects with strong potential for high returns and lower operational costs. This strategic focus is designed to enhance shareholder value and foster long-term, sustainable growth for the company.

This commitment to careful spending is clearly demonstrated by their continued investment in key growth areas like the Stabroek Block in Guyana and the Bakken shale play in North Dakota. For instance, Hess's 2024 capital and exploratory budget was set at $1.0 billion, with a substantial portion directed towards these high-impact assets, underscoring their strategic priorities.

Hess is positioned for substantial production increases, primarily driven by its stake in the Stabroek Block in Guyana. The company anticipates having several FPSOs operational by the close of 2027, aiming for a gross production capacity exceeding 1.3 million barrels of oil per day.

This strong growth outlook is projected to generate industry-leading cash flow for Hess. For instance, the Liza Phase 1 project achieved first oil in December 2019, and Liza Phase 2 commenced production in February 2022, demonstrating the company's ability to execute complex offshore projects.

Solid Financial Position and Profitability

Hess Corporation demonstrates a solid financial footing, characterized by consistent revenue generation and a commitment to operational efficiency. Despite market volatility impacting quarterly results, the company reported significant revenue growth through the first half of 2024, bolstered by strategic production increases. This financial strength is further evidenced by their improved free cash flow, a key indicator of financial health and operational success.

Key financial highlights supporting Hess's strong position include:

- Robust Revenue Growth: Hess saw a notable year-over-year increase in revenue for the first two quarters of 2024, driven by higher production volumes and favorable market conditions for their key commodities.

- Improved Free Cash Flow: The company's focus on cost management and efficient operations translated into a substantial improvement in free cash flow generation during 2024, providing greater financial flexibility.

- Healthy Profitability Margins: Despite external price pressures, Hess has managed to maintain healthy profit margins through disciplined capital allocation and a continuous drive for operational excellence.

Commitment to ESG Leadership

Hess Corporation has solidified its position as a leader in environmental, social, and governance (ESG) practices, consistently earning top marks for its commitment to sustainability. This dedication is evident in its proactive approach to managing greenhouse gas emissions and its overall focus on responsible operations, which resonates strongly with the growing investor demand for ethical and sustainable investments. For instance, Hess has been recognized for its efforts to reduce flaring intensity, a key environmental metric. In 2023, the company reported significant progress in its emissions reduction targets, demonstrating tangible results from its ESG strategy.

This strong ESG performance not only bolsters Hess's corporate reputation but also directly appeals to a significant segment of the investment community. As of early 2024, a substantial portion of institutional capital is allocated to ESG-focused funds, making Hess's demonstrated commitment a key differentiator. The company's proactive stance on sustainability positions it favorably amidst evolving regulatory landscapes and market expectations, potentially leading to a lower cost of capital and enhanced long-term value creation.

Key aspects of Hess's ESG leadership include:

- Industry-Leading Emissions Reduction: Hess has set ambitious targets for reducing Scope 1 and Scope 2 greenhouse gas emissions, with ongoing investments in technologies and operational efficiencies to achieve these goals.

- Strong Governance Framework: The company maintains robust corporate governance structures, emphasizing board independence, executive accountability, and transparent stakeholder engagement.

- Social Responsibility Initiatives: Hess actively engages in community development programs and prioritizes the health, safety, and well-being of its employees and the communities where it operates.

- Transparent Reporting: Hess provides comprehensive and transparent reporting on its ESG performance, allowing stakeholders to assess its progress and impact effectively.

Hess Corporation's primary strength lies in its world-class offshore asset in Guyana, specifically its 30% stake in the Stabroek Block. This block is estimated to contain over 11 billion barrels of recoverable resources, positioning Hess for significant future production growth. The company's disciplined capital allocation strategy further enhances its strengths, prioritizing high-return projects like those in Guyana and the Bakken Shale. This focus is reflected in its 2024 capital and exploratory budget of $1.0 billion, with a substantial portion dedicated to these key growth areas.

Hess is on track for substantial production increases, projecting gross production capacity exceeding 1.3 million barrels of oil per day by late 2027 with multiple FPSOs in operation. This growth is expected to drive industry-leading cash flow, as demonstrated by the successful startup of Liza Phase 1 and Phase 2. The company's financial health is robust, with significant revenue growth reported in the first half of 2024 and improved free cash flow generation, underscoring its operational efficiency and financial discipline.

Hess also stands out for its strong commitment to Environmental, Social, and Governance (ESG) practices, earning recognition for its efforts in managing emissions and responsible operations. This dedication appeals to a growing segment of ESG-focused investors, potentially lowering its cost of capital. The company's transparent reporting on its ESG performance further solidifies its reputation and commitment to sustainability.

| Metric | 2023 (Estimated) | 2024 (Guidance) | 2025 (Guidance) |

|---|---|---|---|

| Net Production (Mboepd) | ~350 | ~370-380 | ~400-410 |

| Stabroek Block Production (Gross) (Mbopd) | ~600 | ~650-700 | ~750-800 |

| Capital & Exploratory Budget ($B) | ~1.0 | ~1.0 | ~1.2-1.4 |

What is included in the product

Delivers a strategic overview of Hess’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Streamlines complex SWOT analysis into an actionable, easy-to-understand format for rapid strategic adjustments.

Weaknesses

Hess's reliance on crude oil and natural gas exploration and production makes it inherently vulnerable to the wild swings in global energy prices. This sensitivity was starkly evident in the first quarter of 2024, where lower realized oil selling prices directly contributed to a net loss of $120 million, underscoring the significant impact of commodity price volatility on its financial results.

Hess Corporation's significant reliance on the Stabroek Block in Guyana for its future production and growth, projected to contribute over 90% of its production by 2028, presents a notable weakness. This concentration exposes the company to substantial geopolitical risks, including potential political instability, adverse regulatory shifts, or unforeseen operational disruptions within that specific region.

Hess Corporation grappled with increasing operational expenses, notably in the first quarter of 2025. A significant factor was heightened maintenance activity within its North Dakota operations, which directly translated to elevated cash operating costs for the period.

The company also faced substantial capital expenditure demands. These were primarily driven by ongoing development initiatives, with a particular focus on its crucial projects in Guyana. Such significant investment requirements can place a strain on Hess's immediate cash flow.

Integration Challenges with Chevron Merger

The recent acquisition by Chevron, valued at approximately $53 billion as of early 2024, introduces significant integration hurdles for Hess. While promising long-term benefits, the immediate focus shifts to merging workforces, harmonizing supply chains, and aligning distinct operational strategies. These complexities could cause temporary disruptions and inefficiencies.

Key integration challenges include:

- Workforce Consolidation: Aligning corporate cultures and potentially reducing redundant roles across both organizations.

- Supply Chain Optimization: Integrating disparate procurement, logistics, and inventory management systems.

- Operational Strategy Alignment: Merging exploration, production, and refining strategies to maximize synergies.

- Regulatory Approvals: Navigating the final stages of regulatory review and approval processes, which could impact the timeline and terms of the integration.

Competitive Market Landscape

The petroleum industry is intensely competitive and requires significant capital. Hess faces established national and international oil companies that often have greater financial and operational resources. This competition affects Hess's ability to secure exploration opportunities, gain market share, and attract skilled personnel, potentially influencing its cost structure and strategic flexibility.

- Competition for Resources: Hess contends with larger players for prime exploration acreage and production assets, which can drive up acquisition costs.

- Talent Acquisition: The fight for experienced geoscientists, engineers, and other industry professionals is fierce, potentially increasing labor costs and impacting project execution timelines.

- Market Share Dynamics: In established markets, gaining or maintaining market share requires competitive pricing and efficient operations, areas where larger competitors may have an advantage.

Hess's significant concentration of future production in Guyana's Stabroek Block, projected to be over 90% by 2028, creates a substantial single-region risk. This dependency exposes the company to potential geopolitical instability, adverse regulatory changes, or unforeseen operational disruptions in Guyana, which could severely impact its output and financial performance.

The company's financial performance is highly sensitive to fluctuations in global energy prices. For instance, in Q1 2024, lower realized oil prices led to a net loss of $120 million, highlighting the direct impact of commodity price volatility on Hess's profitability.

Hess faces considerable integration challenges following Chevron's acquisition offer, valued at approximately $53 billion in early 2024. Merging workforces, supply chains, and operational strategies presents complexities that could lead to temporary inefficiencies and disruptions during the transition period.

Full Version Awaits

Hess SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Hess SWOT analysis, ensuring you know exactly what you're getting. Purchase unlocks the complete, in-depth report.

Opportunities

The Stabroek Block in Guyana remains a powerhouse for Hess, with ongoing discoveries pointing to extensive future development. Beyond the already approved projects like Liza Phase 1 and 2, and the recently sanctioned Yellowtail, several other discoveries such as Uaru, Pacora, and Tripletail are slated for development, extending production well into the 2030s.

This continuous stream of finds offers a robust pipeline for sustained production growth. For instance, Hess’s share of recoverable resources in the Stabroek Block is estimated at approximately 1.3 billion barrels of oil equivalent, with ongoing exploration expected to further increase this figure, providing a significant long-term value creation opportunity.

The completed merger with Chevron is poised to unlock substantial annual cost synergies, with a target of $1 billion by the close of 2025. These savings are anticipated to stem from workforce consolidation and streamlined operational efficiencies across both organizations.

This integration is expected to bolster profitability and enhance free cash flow generation for the combined entity, creating a more robust financial profile.

Technological leaps in exploration and production are a significant opportunity for Hess. The company's successful deployment of 4-mile lateral wells in the Bakken, for instance, demonstrates how advanced drilling techniques can drastically improve efficiency and reduce per-barrel costs. This innovation not only maximizes output from current fields but also holds the potential to unlock previously uneconomical reserves, thereby boosting overall recovery rates and operational optimization.

Growing Global Energy Demand

Despite the ongoing energy transition, global demand for oil and gas is projected to remain robust, especially from rapidly developing economies. By 2025, the International Energy Agency (IEA) anticipates global oil demand to reach approximately 103.5 million barrels per day, a notable increase from previous years. This sustained demand presents a significant opportunity for companies like Hess.

Hess is strategically positioned to capitalize on this trend. Their portfolio features low-cost, high-return assets, particularly in the Bakken and the Stabroek Block offshore Guyana. These assets are efficient and can generate strong cash flow even in fluctuating market conditions.

- Sustained Demand: Developing nations are expected to drive continued demand for crude oil and natural gas through 2025 and beyond.

- Cost Advantage: Hess's focus on low-cost production assets allows for competitive pricing and higher margins.

- Asset Quality: High-return assets, such as those in the Stabroek Block, offer significant potential for growth and profitability.

- Market Position: Hess's operational efficiency enables it to meet market needs effectively while maintaining profitability.

Expansion of Midstream Operations

Hess Midstream, a crucial part of Hess's operations, is positioned for ongoing growth in its oil and gas throughput volumes. This expansion is fueled by Hess's own development projects and the addition of third-party customers, particularly in the prolific Bakken region.

Planned investments in expanding gas gathering and processing infrastructure are expected to generate stable cash flows and unlock further growth avenues. For instance, Hess Midstream's 2024 guidance projected significant increases in throughput, with management highlighting the potential for continued volume growth beyond 2025 driven by new facilities and customer contracts.

- Throughput Growth: Anticipated increases in oil and gas volumes through Hess Midstream's systems.

- Infrastructure Expansion: Investments in gas gathering and processing facilities to support growth.

- Stable Cash Flow: Midstream operations provide a reliable source of income.

- Third-Party Demand: Growing reliance on Hess Midstream by external customers in the Bakken.

Hess's strategic positioning in the Stabroek Block, Guyana, offers substantial growth opportunities through ongoing discoveries and development projects extending production into the 2030s. The company's recoverable resources in the block are estimated at around 1.3 billion barrels of oil equivalent, with exploration likely to increase this figure.

The merger with Chevron is expected to yield significant annual cost synergies, targeted at $1 billion by the end of 2025, enhancing profitability and cash flow. Technological advancements in exploration and production, such as advanced drilling techniques in the Bakken, are improving efficiency and reducing costs.

Global oil and gas demand is projected to remain strong through 2025, with the IEA forecasting demand to reach approximately 103.5 million barrels per day, benefiting Hess's low-cost, high-return assets. Hess Midstream is also poised for growth in throughput volumes, supported by infrastructure expansion and third-party demand.

| Opportunity | Description | Key Data/Insight |

| Stabroek Block Development | Continued exploration and development of discoveries in Guyana. | Estimated 1.3 billion barrels of oil equivalent recoverable resources; production extending into 2030s. |

| Chevron Merger Synergies | Cost savings from operational integration. | Target of $1 billion in annual cost synergies by end of 2025. |

| Technological Innovation | Adoption of advanced drilling and production techniques. | Improved efficiency and reduced per-barrel costs in Bakken operations. |

| Robust Global Demand | Sustained demand for oil and gas, particularly from developing economies. | IEA projects global oil demand to reach ~103.5 million bpd by 2025. |

| Midstream Growth | Expansion of Hess Midstream's infrastructure and throughput. | Anticipated increases in oil and gas throughput volumes; infrastructure investments supporting growth. |

Threats

Volatile global energy prices present a substantial threat to Hess's financial performance. Sustained periods of low crude oil and natural gas prices, stemming from oversupply, geopolitical instability, or diminished demand, directly impact profitability and the return on investments. For instance, while forecasts for 2025 suggest a degree of price recovery, continued caution regarding crude price volatility remains a key concern for the sector.

The intensifying global focus on climate change means companies like Hess face a growing number of environmental regulations. These can include stricter emissions standards and the potential for carbon pricing mechanisms. For instance, by the end of 2024, many jurisdictions are expected to have implemented or strengthened carbon taxes, directly impacting the cost of operations for fossil fuel producers.

These evolving policies, such as the push for net-zero emissions by 2050, could impose significant compliance costs on Hess. Furthermore, operational restrictions might arise as governments aim to curb greenhouse gas output, potentially affecting exploration and production activities. The risk of certain assets becoming economically unviable due to climate policies, known as stranded assets, is also a growing concern.

Hess Corporation's operations, particularly its significant stake in Guyana's Stabroek Block, face considerable geopolitical risks. Border disputes, such as the ongoing territorial claims by Venezuela over the Essequibo region, could potentially disrupt exploration, production, or impact existing contractual agreements. Such instability could lead to unforeseen operational challenges and affect Hess's production forecasts.

Broader global conflicts and political shifts also pose a threat by impacting international supply chains and overall market stability. For instance, disruptions in key shipping lanes or trade routes due to geopolitical tensions can increase operational costs and create uncertainty in commodity prices. This wider instability could indirectly affect Hess's access to necessary equipment and the timely delivery of its products, potentially impacting its financial performance.

Intense Competition and Market Share Erosion

The oil and gas sector is notoriously competitive, with Hess contending against global giants and national oil companies. This intense rivalry directly impacts its ability to secure valuable exploration acreage and can lead to a steady erosion of its market share. For instance, in 2024, the average cost for offshore exploration blocks in prime regions saw a significant uptick, driven by these competitive pressures, directly affecting Hess's acquisition strategies and potential for future growth.

This environment forces Hess to constantly optimize its operations and exploration strategies to maintain profitability. The pressure to outbid competitors for new reserves and maintain production levels in existing fields is a constant challenge.

- Market Share Pressure: Larger, well-capitalized competitors can leverage economies of scale, potentially outbidding Hess for prime exploration opportunities.

- Cost of Acquisition: Increased competition for exploration rights, particularly in high-demand basins, drives up the cost of acquiring new reserves, impacting Hess's capital allocation.

- Margin Squeeze: Intense competition can lead to price wars or reduced pricing power, potentially squeezing profit margins on Hess's production.

Operational Risks and Accidents

The oil and gas sector, by its very nature, faces significant operational risks. These can range from drilling accidents and equipment malfunctions to the potential for environmental spills, all of which carry substantial financial and reputational consequences. For instance, in 2023, the industry saw several high-profile incidents that underscored these dangers, leading to increased regulatory scrutiny and operational adjustments.

Such events can trigger severe financial penalties and extensive environmental remediation costs, directly impacting a company's bottom line. Chevron, in its forward-looking statements regarding its merger with Hess, explicitly noted operational risks as a factor that could affect future results, highlighting the pervasive nature of these threats across the industry.

- Drilling Accidents: Incidents during the exploration and extraction phases can lead to costly downtime and safety breaches.

- Equipment Failure: Malfunctions in critical machinery, from pumps to pipelines, pose a constant threat to continuous operations.

- Environmental Spills: Accidental releases of oil or gas can result in massive cleanup expenses and long-term ecological damage.

- Reputational Damage: Operational failures often lead to negative public perception, affecting investor confidence and market standing.

The competitive landscape for exploration acreage is intensifying, with average costs for offshore blocks in prime regions seeing a significant uptick in 2024. This increased competition puts pressure on Hess to outbid rivals for new reserves, potentially impacting its capital allocation and future growth strategies.

Operational risks, including drilling accidents and equipment failures, remain a constant threat. The industry experienced several high-profile incidents in 2023, underscoring the potential for costly downtime, financial penalties, and reputational damage. These risks can directly impact a company's bottom line and operational continuity.

Geopolitical instability, such as border disputes like the one involving Venezuela and the Essequibo region, poses a direct threat to Hess's significant investments, particularly in Guyana. Such conflicts can disrupt exploration, production, and existing contractual agreements, leading to unforeseen operational challenges and impacting production forecasts.

The increasing global focus on climate change is leading to stricter environmental regulations and potential carbon pricing mechanisms. By the end of 2024, many jurisdictions are expected to have strengthened carbon taxes, directly impacting the cost of operations for fossil fuel producers like Hess and raising concerns about stranded assets.

SWOT Analysis Data Sources

This Hess SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a thorough and accurate assessment of Hess's strategic position.