Hess Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hess Bundle

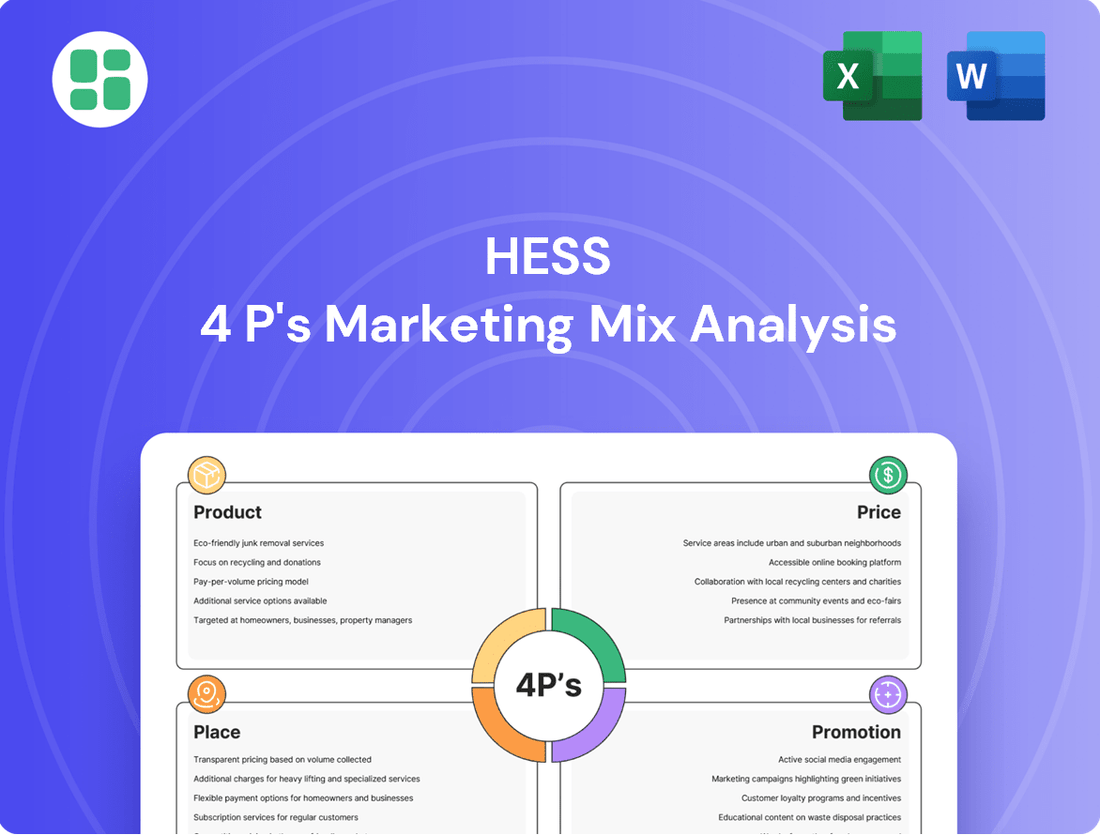

Dive into Hess's strategic brilliance with our 4Ps Marketing Mix Analysis, revealing how their product, price, place, and promotion create a powerful market presence. Understand the core elements that drive their success and gain actionable insights for your own business strategies.

Uncover the secrets behind Hess's winning formula—from their innovative product development and competitive pricing to their strategic distribution and impactful promotions. This comprehensive analysis is your key to unlocking effective marketing strategies.

Ready to elevate your marketing game? Get the full, detailed 4Ps Marketing Mix Analysis for Hess, offering a complete roadmap to their success. Perfect for professionals and students seeking a competitive edge.

Product

Hess Corporation's core products are crude oil and natural gas, sourced from key locations like the Stabroek Block in Guyana and the Bakken Shale in North Dakota. These energy resources are vital to global markets, forming the backbone of Hess's business.

In 2024, Hess projected its average daily production to be between 175,000 and 185,000 barrels of oil equivalent (boe) per day, with a significant portion coming from its offshore Guyana assets. The company's production mix, including light sweet crude and natural gas, is tailored to meet diverse refinery needs and industrial applications, reflecting the varied quality of hydrocarbons extracted from its operational basins.

Hess’s hydrocarbon transportation services are crucial for delivering its energy products to market. These midstream assets, encompassing gas gathering, processing, and crude oil terminaling, ensure efficient and safe delivery from production sites. This integrated logistics capability adds significant value by connecting the wellhead to end consumers.

In 2024, Hess continued to invest in and leverage its midstream infrastructure to support its production growth. For instance, its Bakken operations rely on extensive gathering systems and processing facilities, contributing to the overall cost-effectiveness of its operations. These services are fundamental to Hess's ability to monetize its reserves.

Hess's product extends beyond just oil and gas; it includes their profound expertise in finding and developing new, profitable resource opportunities. This intellectual capital and operational skill are crucial for maintaining and growing their reserves and production.

Their commitment to resource growth is evident in ongoing projects. For instance, the Yellowtail development, a key part of their Stabroek Block operations in Guyana, is progressing, with first oil anticipated in 2025. This, along with the Uaru discovery, highlights their successful exploration strategy, adding significant value to their portfolio.

High-Return Resource Portfolio

Hess's product strategy centers on a high-return resource portfolio, with a strong emphasis on Guyana and the Bakken shale. This focus is geared towards generating consistent, top-tier cash flow growth by prioritizing investments in assets with substantial production capacity and cost-efficient operations.

The company's approach is all about building long-term value through careful and disciplined deployment of capital. This means making smart choices about where to invest to maximize returns.

In 2024, Hess continued to highlight the significant potential of its Stabroek Block in Guyana, projecting substantial production growth. For the Bakken, Hess has been optimizing its operations to enhance efficiency and reduce costs, aiming for continued strong performance.

- Guyana's Stabroek Block: Hess's stake in the Stabroek Block is a cornerstone of its high-return strategy, with production expected to reach approximately 600,000 barrels of oil equivalent per day by the end of 2024.

- Bakken Shale Operations: The Bakken continues to be a key asset, with Hess focusing on high-return wells and operational efficiencies to maintain its competitive edge.

- Disciplined Capital Allocation: Hess's capital expenditure for 2024 was planned to be around $2.7 billion, with a significant portion directed towards the development of these core high-return assets.

- Cash Flow Generation: The strategy is designed to deliver industry-leading cash flow growth, supporting shareholder returns and further investment in high-potential projects.

Value-Added Energy Solutions

Hess Corporation, while predominantly known for its upstream exploration and production activities, also provides value-added energy solutions. This is achieved through its integrated business model, encompassing exploration, production, transportation, and marketing of oil and gas. This holistic approach allows Hess to offer a reliable and scalable supply chain to its key customers, which are typically large-scale refiners and active commodity traders.

The company's strategy in this area focuses on being a dependable energy partner. By managing various stages of the energy value chain, Hess aims to ensure the consistent delivery of essential energy resources. This commitment is crucial for meeting the ongoing and substantial global demand for energy. For instance, in 2024, Hess's production targets, particularly from its significant stake in the Stabroek Block offshore Guyana, are projected to contribute to a substantial increase in its overall output, underscoring its capacity to supply large volumes.

- Integrated Operations: Hess manages exploration, production, transportation, and marketing, offering a comprehensive energy solution.

- Customer Base: Primarily serves large-scale refiners and commodity traders who require reliable and substantial energy supplies.

- Strategic Goal: To be a trusted energy partner, ensuring consistent delivery of vital energy resources to meet global demand.

- Production Capacity: The Stabroek Block in Guyana is a key asset, with projected production increases in 2024-2025 supporting Hess's supply capabilities.

Hess Corporation's product offering is centered on crude oil and natural gas, with a strategic focus on high-return assets like the Stabroek Block in Guyana and the Bakken Shale in North Dakota. The company aims to deliver consistent, top-tier cash flow growth by prioritizing investments in these areas, which boast substantial production capacity and cost-efficient operations. This disciplined capital allocation strategy is designed to maximize long-term value for shareholders.

| Asset | 2024 Production Projection (boe/d) | Key Development | Strategic Focus |

|---|---|---|---|

| Stabroek Block, Guyana | ~600,000 (by end of 2024) | Yellowtail development progressing, first oil anticipated 2025. Uaru discovery. | High-return growth driver, significant production increases. |

| Bakken Shale, North Dakota | Part of overall 175,000-185,000 boe/d target | Optimizing operations for efficiency and cost reduction. | Maintaining competitive edge through high-return wells and operational efficiencies. |

What is included in the product

This analysis provides a comprehensive breakdown of Hess's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic confusion.

Place

Hess Corporation leverages a robust network of global distribution channels to deliver its crude oil and natural gas to a diverse customer base. This includes substantial crude oil sales from its significant operations in Guyana, a key growth area for the company.

Domestically, Hess utilizes efficient infrastructure such as pipelines and rail transport to move its production from the Bakken region to market. These varied pathways ensure Hess can reach both international buyers and domestic consumers effectively.

For example, Hess reported selling approximately 380,000 barrels of crude oil per day in the first quarter of 2024, with a significant portion originating from Guyana, highlighting the global reach of its distribution efforts.

Hess Corporation's 'place' in its marketing mix is strategically anchored by its primary production hubs: the Stabroek Block offshore Guyana and the Bakken Shale in North Dakota. These locations are not just operational sites but the very foundation of its supply chain, housing substantial reserves that ensure a consistent output of crude oil and natural gas.

The significance of these hubs is amplified by ongoing development. In Guyana, projects like Yellowtail and Uaru are progressing, with Yellowtail expected to commence production in 2027, adding significant capacity. This strategic focus on expanding output from these core areas underscores their critical role in Hess's overall market presence and future growth trajectory.

Hess Corporation's integrated logistics network, anchored by Hess Midstream, is a critical component of its marketing strategy, ensuring efficient product movement. This network includes gathering systems and processing plants, primarily focused on the Bakken shale play, which is a significant oil-producing region.

In 2023, Hess Midstream reported processing approximately 400,000 barrels of oil equivalent per day, demonstrating the scale of their operations. This robust infrastructure is designed to enhance customer convenience and optimize sales by guaranteeing product availability and timely delivery, thereby supporting Hess's market position.

Direct Sales to Refiners and Buyers

Hess Corporation’s place strategy heavily relies on direct sales of its crude oil and natural gas directly to refiners, chemical plants, and other industrial consumers. This direct channel bypasses intermediaries, fostering closer relationships and enabling more predictable demand for their production.

This direct sales model allows Hess to negotiate tailored sales agreements, ensuring their products meet specific buyer requirements and securing stable off-take. For instance, in 2024, Hess continued to emphasize securing long-term contracts to underpin the consistent sale of its growing production volumes from the Bakken and the U.S. Gulf of Mexico.

- Direct Sales Channels: Hess bypasses traditional wholesale markets by selling directly to end-users like refineries and chemical companies.

- Demand Stability: This approach helps secure consistent demand for Hess's crude oil and natural gas output.

- Tailored Agreements: Direct engagement allows for customized contracts that align with buyer specifications and Hess's production capabilities.

- Long-Term Contracts: The company actively pursues long-term agreements to ensure efficient and predictable off-take of its produced volumes.

Market Accessibility

Hess Corporation focuses on making its energy products readily available by strategically placing its operations and building the necessary infrastructure to link its resources to crucial energy markets. This approach ensures that Hess can effectively serve its customers. For instance, in 2023, Hess's production from the Stabroek Block in Guyana, a key growth area, averaged approximately 121,000 barrels of oil per day, highlighting its increasing global reach and the importance of accessible markets for these high-value resources.

The company's robust midstream network, particularly in the Bakken region, further solidifies its market accessibility. This network is designed for efficient transportation, allowing Hess to deliver its crude oil and natural gas to where demand is highest. This infrastructure is vital for optimizing the supply chain and ensuring timely delivery, which directly impacts customer satisfaction and Hess's competitive positioning.

- Guyana Production Growth: Hess's share of production from the Stabroek Block averaged 121,000 net barrels of oil per day in 2023, demonstrating significant output from a key accessible market.

- Bakken Midstream Strength: Hess benefits from extensive midstream infrastructure in the Bakken, facilitating efficient transportation of its oil and gas to market centers.

- Global Sales Network: The company's ability to sell crude oil globally, particularly from its Guyana operations, underscores its commitment to broad market accessibility.

- Supply Chain Efficiency: Strategic infrastructure development enhances Hess's capacity to meet market demand promptly, improving overall supply chain performance and customer relationships.

Hess Corporation's 'place' strategy centers on its prime production assets in Guyana and the Bakken, supported by an integrated logistics network. This ensures efficient delivery to a global customer base, primarily through direct sales to refiners and industrial users.

The company's infrastructure, including Hess Midstream, processed approximately 400,000 barrels of oil equivalent per day in 2023, highlighting its capacity to move products. Hess actively pursues long-term contracts to guarantee consistent off-take.

In 2023, Hess's net production from the Stabroek Block in Guyana averaged around 121,000 barrels of oil per day, showcasing the accessibility of this key growth region to its markets.

| Production Asset | 2023 Net Production (BOE/d) | Key Infrastructure | Market Reach |

|---|---|---|---|

| Stabroek Block, Guyana | 121,000 (Hess Share) | Offshore platforms, global shipping | International Refiners |

| Bakken Shale, USA | ~200,000 (Hess Midstream processed) | Pipelines, rail, gathering systems | Domestic Refiners, Industrial Users |

What You See Is What You Get

Hess 4P's Marketing Mix Analysis

The Hess 4P's Marketing Mix Analysis preview you see is the exact document you will receive instantly after purchase. This means you know precisely what you're getting, with no hidden surprises or altered content. You can confidently proceed with your purchase, knowing this comprehensive analysis is ready for immediate use.

Promotion

Hess Corporation prioritizes robust investor relations, offering detailed financial reports and operational updates. In Q1 2024, Hess reported a net loss of $124 million, a significant shift from its Q1 2023 net income of $352 million, highlighting the importance of clear communication regarding performance drivers and future outlook.

The company's investor website acts as a vital resource, providing easy access to earnings releases, investor presentations, and annual reports. This commitment to transparency is essential for fostering trust and attracting the capital needed for projects like its significant stake in the Guyana offshore development, a key strategic asset.

Hess Corporation actively communicates its dedication to sustainability via annual reports detailing environmental, social, and governance (ESG) performance. These disclosures, a key component of their 'Promotion' strategy, showcase initiatives like emission reduction targets and community development programs. For instance, Hess reported a 2023 reduction in Scope 1 and 2 greenhouse gas emissions intensity by 16% compared to a 2017 baseline, underscoring tangible progress in environmental stewardship.

Hess actively participates in major industry events like the Offshore Technology Conference (OTC) and the Energy Information Administration (EIA) conference, showcasing its technological innovations and operational successes. These engagements are crucial for networking and identifying strategic alliances, reinforcing their market presence.

In 2024, Hess continued to leverage partnerships, such as its joint ventures in the Bakken and offshore Guyana, to share expertise and explore new resource development opportunities. These collaborations are key to accessing capital and mitigating risk, contributing to their growth strategy.

Financial Media Engagement

Hess Corporation actively manages its financial media presence to convey its operational performance and strategic initiatives. This engagement is crucial for reaching a wide array of stakeholders, including individual investors, financial analysts, and business leaders. By providing timely updates, Hess aims to foster transparency and ensure its narrative is accurately represented in the market.

The company utilizes various channels for this communication, such as issuing press releases detailing quarterly earnings and significant operational milestones. Furthermore, Hess executives frequently participate in interviews with prominent financial news outlets, offering insights into the company's outlook and the broader energy market dynamics. For instance, in the first quarter of 2024, Hess reported a net loss of $126 million, or $0.40 per diluted share, a figure widely disseminated through these media channels, alongside discussions about its Bakken and Guyana assets.

- Press Releases: Dissemination of financial results and operational updates to a broad audience.

- Executive Interviews: Direct communication of strategic direction and market insights to financial media.

- News Updates: Providing ongoing information on company performance and industry trends.

- Investor Communications: Ensuring accurate information flow to analysts and the investment community.

Government and Regulatory Affairs

Hess Corporation actively manages its government and regulatory affairs, a critical component given the energy sector's stringent oversight. The company communicates its operational strategies, environmental commitments, and economic impact to government entities and local stakeholders. This proactive engagement is vital for securing permits and navigating complex regulations, ensuring Hess maintains its operational license.

In 2024, Hess continued to emphasize its commitment to responsible energy development, highlighting its contributions to local economies through job creation and tax revenues. For instance, its operations in the Bakken region are projected to contribute significantly to North Dakota's economy in 2024-2025, supporting thousands of jobs and generating substantial tax income, which is a key part of its regulatory dialogue.

- Proactive Engagement: Hess actively communicates its operational plans and environmental stewardship to government bodies and communities to foster a supportive operating environment.

- Regulatory Navigation: The company focuses on securing necessary permits and adhering to regulatory frameworks to maintain its 'license to operate' in key regions.

- Economic Contributions: Hess highlights its economic impact, including job creation and tax revenues, as part of its government and regulatory affairs strategy, particularly noting its significant role in North Dakota's economy in 2024-2025.

Hess Corporation's promotional efforts focus on transparent communication with investors and stakeholders. This includes detailed financial reporting, active participation in industry events, and leveraging partnerships to showcase operational successes and strategic growth, particularly in Guyana.

The company emphasizes its commitment to environmental, social, and governance (ESG) principles through annual reports, highlighting initiatives like emission reductions, with a 16% decrease in Scope 1 and 2 GHG emissions intensity reported for 2023 against a 2017 baseline.

Hess also actively engages with government and regulatory bodies, emphasizing its economic contributions, such as job creation and tax revenues, which are significant in regions like the Bakken, supporting thousands of jobs in 2024-2025.

| Communication Channel | Key Focus | 2024/2025 Data/Activity |

|---|---|---|

| Investor Relations | Financial performance, operational updates, Guyana development | Q1 2024 net loss of $124 million; ongoing updates on Guyana assets. |

| ESG Reporting | Sustainability initiatives, emission reduction | 16% reduction in Scope 1 & 2 GHG emissions intensity (2023 vs. 2017 baseline). |

| Industry Events | Technological innovation, operational success, networking | Active participation in conferences like OTC. |

| Government/Regulatory Affairs | Economic impact, job creation, environmental commitments | Highlighting Bakken economic contributions and job support for 2024-2025. |

Price

Hess Corporation's pricing strategy for crude oil and natural gas is intrinsically tied to global commodity benchmarks. For instance, WTI crude oil prices, a key benchmark, averaged around $77.50 per barrel in early 2024, while Brent crude hovered near $82.50 per barrel. These figures illustrate the market's sensitivity to supply and demand, with geopolitical tensions and economic forecasts significantly impacting daily price movements.

The company's realized selling prices for its oil and gas products directly reflect these fluctuating global benchmarks. For example, in Q1 2024, Hess reported an average realized crude oil price of approximately $75 per barrel, closely mirroring the WTI benchmark. Similarly, natural gas prices, often benchmarked against Henry Hub in the US, experienced volatility, with prices averaging around $2.00 per MMBtu in early 2024, directly impacting Hess's revenue streams.

Hess's pricing strategy is deeply intertwined with the fluctuating forces of supply and demand in the global oil and gas markets. For instance, in the first quarter of 2024, Hess reported an average realized crude oil price of $78.80 per barrel, a figure directly influenced by broader market conditions and production levels.

The company's significant production growth in its prime locations, such as Guyana, where it's a key partner in substantial offshore discoveries, and the Bakken shale play, directly affects the available supply. These increases, when contrasted with evolving global energy consumption patterns, dictate the market clearing price for Hess's oil and gas products.

Hess actively monitors these supply and demand dynamics to refine its sales strategies and production forecasts. This vigilance allows them to better anticipate market shifts and optimize their revenue streams in response to real-time market signals.

Hess Corporation frequently employs long-term offtake agreements for its hydrocarbon sales, a strategy that significantly bolsters price stability and revenue predictability. These crucial contracts lock in buyers for large quantities of Hess's production, thereby mitigating the impact of short-term market fluctuations. For instance, as Hess advances its major projects, such as those in the prolific Stabroek Block offshore Guyana, these agreements become even more vital for securing the sale of substantial output volumes.

Capital Allocation and Cost Efficiency

Hess's pricing strategy is deeply intertwined with its commitment to disciplined capital allocation and a low cost of supply. By prioritizing investments in projects that promise high returns and minimal costs, Hess aims to remain profitable even when oil and gas prices are subdued. This focus on cost efficiency is a cornerstone of their ability to offer competitive pricing while safeguarding their profit margins.

This approach is evident in their operational execution. For instance, Hess reported a realized oil price of $78.75 per barrel in the first quarter of 2024, demonstrating their ability to achieve strong pricing even amidst fluctuating market conditions, a direct result of their cost-conscious operations.

- Disciplined Capital Allocation: Hess prioritizes investments in high-return, low-cost opportunities to ensure profitability across market cycles.

- Cost Efficiency: Maintaining a low cost of supply allows for competitive pricing and robust margins.

- 2024 Q1 Performance: Hess achieved a realized oil price of $78.75 per barrel, reflecting the success of their cost-focused strategy.

Hedging Strategies

Hess Corporation likely utilizes hedging strategies to buffer its financial performance against the inherent volatility of crude oil prices. These strategies aim to secure more predictable revenue streams and stable cash flows, crucial for long-term planning and investment. By locking in prices for a portion of future production, Hess can shield itself from significant downturns in the market.

The effectiveness of these hedging activities is typically reflected in the company's reported realized crude oil selling prices, which often differ from the benchmark market prices due to these financial arrangements. For instance, during periods of price decline, hedging can result in Hess achieving a higher realized price than the prevailing spot market rate. Conversely, in a rising price environment, hedging might cap potential upside gains.

- Hedging Instruments: Hess may employ futures contracts, options, or swaps to manage price risk.

- Revenue Stabilization: Hedging aims to provide a floor for revenue, offering greater certainty in financial forecasting.

- Realized Prices: The impact of hedging is directly observable in Hess's realized crude oil prices, which may deviate from market benchmarks.

- Market Conditions: The company's hedging approach will likely adapt based on its outlook for oil price trends and market volatility.

Hess's pricing is fundamentally linked to global commodity benchmarks like WTI and Brent crude, alongside domestic natural gas prices such as Henry Hub. For example, in Q1 2024, Hess reported an average realized crude oil price of $78.80 per barrel, closely mirroring market trends.

The company leverages long-term offtake agreements, particularly for its significant production from Guyana, to ensure price stability and predictable revenue streams, mitigating short-term market volatility.

Hess's focus on disciplined capital allocation and maintaining a low cost of supply allows for competitive pricing and robust profit margins, even during periods of subdued commodity prices, as evidenced by their Q1 2024 realized oil price of $78.75 per barrel.

Hedging strategies are employed to further stabilize revenue and cash flows, meaning Hess's realized prices can differ from market benchmarks due to these financial arrangements.

| Metric | Q1 2024 Value | Benchmark Influence |

|---|---|---|

| Average Realized Crude Oil Price | $78.80 per barrel | WTI, Brent Crude |

| Average Realized Natural Gas Price | ~ $2.00 per MMBtu | Henry Hub |

| Cost of Supply Focus | Low Cost | Profitability across cycles |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is powered by a comprehensive review of official company announcements, product portfolios, pricing structures, and distribution channels. We leverage data from investor relations materials, public filings, and reputable industry publications to ensure accuracy and relevance.