Hess Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hess Bundle

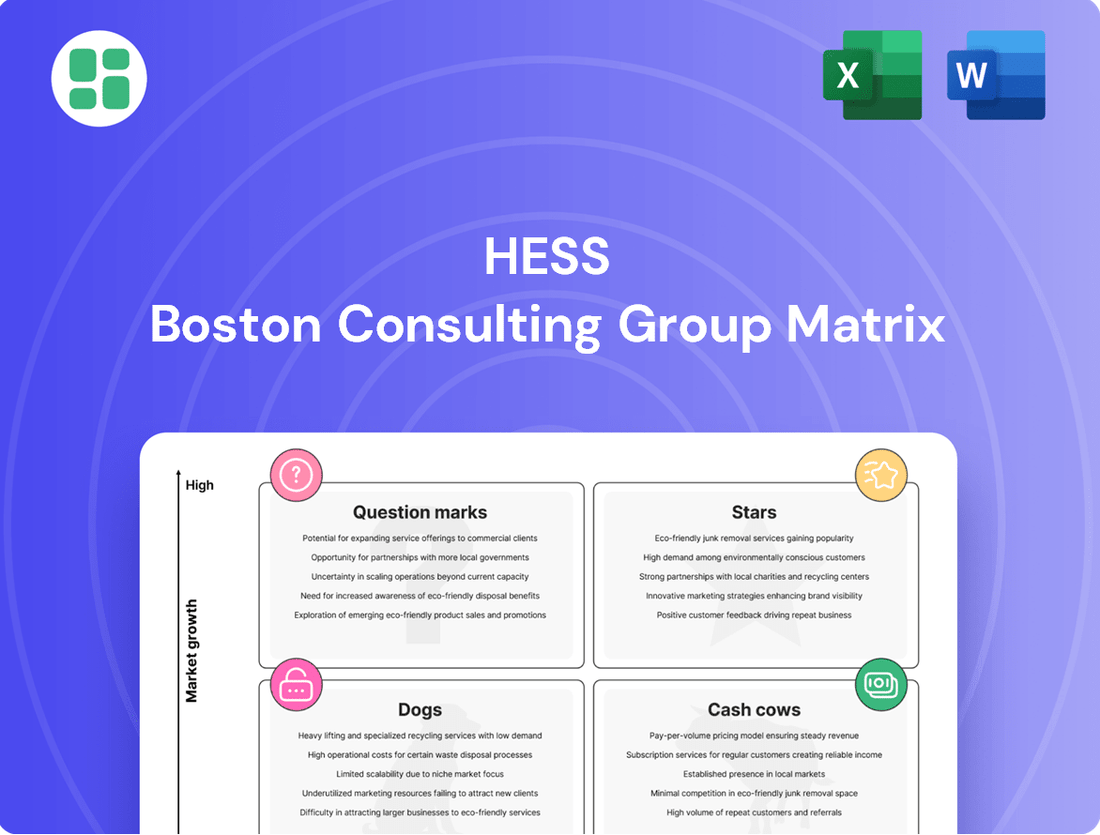

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. This preview offers a glimpse into how these categories can illuminate strategic opportunities and challenges. Ready to transform your product strategy?

Stars

Hess Corporation's 30% stake in Guyana's Stabroek Block represents a cornerstone of its future growth. Production from this block is projected to see a considerable ramp-up in the near term, driven by several key projects.

The Stabroek Block is a star performer, fitting perfectly into the Stars category of the BCG matrix. With multiple developments already sanctioned and progressing, the block is poised to significantly boost Hess's overall production. For instance, the Yellowtail project is slated for startup in the third quarter of 2025, followed by Uaru in 2026 and Whiptail in 2027. These projects are expected to add substantial gross production capacity, reinforcing Guyana's position as a high-growth, high-market share asset for Hess.

Yellowtail, the fourth major development on the Stabroek Block, is a key component of Hess's future growth. Production is slated to begin in the third quarter of 2025, with an initial capacity expected to reach around 250,000 barrels of oil per day.

The project's FPSO vessel, named ONE GUYANA, is crucial for unlocking this output and is anticipated to substantially increase Hess's cash flow from the Stabroek Block.

Beyond the Yellowtail project, Hess's future sanctioned Guyana developments include Uaru and Whiptail. These are slated to commence operations in 2026 and 2027, respectively, each projected to add around 250,000 gross barrels of oil per day to capacity.

This strategic expansion solidifies Hess's production pipeline, ensuring significant high-growth output for the company through the coming years.

Industry-Leading Production Growth

Hess Corporation is poised for significant production and free cash flow expansion, largely thanks to its substantial, cost-effective investments in Guyana. The company's strategic focus is on extracting maximum value from these exceptional offshore resources.

In 2024, Hess anticipates its net production to reach approximately 200,000 barrels of oil equivalent per day (boepd) from its Guyana operations alone. This growth is underpinned by the successful startup of the Payara development, expected in late 2024, which will add substantial capacity.

- Guyana Production Growth: Targeting over 200,000 boepd net in 2024.

- Cost Efficiency: Projects in Guyana are among the lowest cost globally, with breakevens below $30 per barrel.

- Free Cash Flow Generation: Increased production and low costs are projected to significantly boost free cash flow in 2024 and beyond.

- Strategic Focus: Maximizing value from the high-return Stabroek Block assets.

Strategic Importance of Guyana Portfolio

The Guyana portfolio, centered on the Stabroek Block, is unequivocally Hess Corporation's strategic 'Star' in the BCG matrix. These assets are not merely about current output; they represent a robust, low-cost growth engine poised to dominate industry cash generation through the 2020s.

The Stabroek Block's significance is underscored by its substantial reserves and projected production increases. For instance, by the end of 2024, Hess anticipates average daily production from the block to reach approximately 300,000 barrels of oil equivalent, a testament to its rapid development and immense potential. This positions Guyana as the cornerstone of Hess's future financial performance and strategic direction.

- Foundation of Growth: The Stabroek Block is the primary driver of Hess’s long-term production and cash flow growth.

- Industry Leading Cash Generation: Projections indicate Guyana will lead the industry in total cash generation through the remainder of the decade.

- Low-Cost Operations: The cost-effectiveness of the Guyana assets further solidifies their 'Star' status, ensuring high margins and strong returns.

The Stabroek Block in Guyana is Hess Corporation's clear 'Star' asset within the BCG matrix. Its high growth and high market share are driven by substantial production increases and cost-effective operations. This block is the primary engine for Hess's future financial performance and strategic direction, expected to lead industry cash generation through the 2020s.

| Project | Sanctioned | Estimated Startup | Gross Production Capacity (approx.) |

|---|---|---|---|

| Liza Phase 1 | Yes | December 2019 | 120,000 boepd |

| Liza Phase 2 | Yes | February 2022 | 220,000 boepd |

| Payara | Yes | Late 2024 | 250,000 boepd |

| Yellowtail | Yes | Q3 2025 | 250,000 boepd |

| Uaru | Yes | 2026 | 250,000 boepd |

| Whiptail | Yes | 2027 | 250,000 boepd |

What is included in the product

The Hess BCG Matrix offers a strategic overview of a company's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

Visualize your portfolio's health with clear, actionable insights.

Effortlessly identify growth opportunities and resource allocation needs.

Cash Cows

Hess's Bakken Shale operations in North Dakota are a prime example of a Cash Cow. This segment boasts a high market share in a mature industry, consistently delivering strong and predictable cash flows.

While the growth in production from the Bakken is anticipated to stabilize, it continues to be a reliable and significant component of Hess's total output. For instance, in the first quarter of 2024, Hess reported an average daily production of 158,000 barrels of oil equivalent from the Bakken, underscoring its ongoing importance.

Hess's Bakken operations represent a significant Cash Cow, characterized by an established production base. In the first quarter of 2025, net production from the Bakken remained robust, showing a slight increase compared to the same period in 2024, a testament to continuous drilling and completion efforts. This consistent output underpins the region's role as a reliable generator of cash flow for the company.

Hess Midstream LP, with its extensive gathering, processing, and terminaling infrastructure predominantly in the Bakken region, acts as a significant cash cow for Hess Corporation. This segment generates reliable, fee-based revenue streams, offering a stable financial foundation.

The midstream segment is projected to experience sustained growth in throughput volumes. In 2024, Hess Midstream LP reported strong performance, with adjusted EBITDA reaching approximately $1.2 billion, underscoring its consistent contribution to Hess Corporation's overall financial health.

Consistent Cash Generation

Hess's established operations in the Bakken shale play and its midstream segment are prime examples of cash cows. These segments consistently generate more cash than is needed for their own maintenance and modest growth, providing a vital source of funding for the company's more ambitious projects. This robust cash flow allows Hess to reinvest in high-growth areas, such as its significant developments in Guyana, and also to return capital to its shareholders, demonstrating a balanced approach to capital allocation.

In 2024, Hess's Bakken operations continued to be a strong performer. The company reported significant production levels, with its midstream infrastructure playing a crucial role in efficiently transporting this output. This operational efficiency directly translates into strong, predictable cash generation, bolstering the company's financial flexibility.

- Bakken Production: In the first quarter of 2024, Hess reported average daily production of approximately 171,000 barrels of oil equivalent (boe) from the Bakken.

- Midstream Segment Contribution: The midstream segment, which includes pipelines and processing facilities, generated substantial fee-based revenue, further solidifying its cash cow status.

- Funding Strategic Initiatives: The cash generated from these mature assets is critical for funding Hess's capital expenditures in the high-potential Guyana offshore development.

- Shareholder Returns: Consistent cash flow from these operations supports Hess's commitment to providing returns to its investors through dividends and share repurchases.

Disciplined Capital Allocation

Hess Corporation demonstrates disciplined capital allocation, consistently directing a substantial portion of its budget towards ventures promising high returns. This strategic approach is well-supported by the predictable cash flow generated from its established assets.

Mature assets, such as those in the Bakken formation, serve as reliable sources of steady cash flow. For instance, in 2024, Hess's Bakken operations were projected to contribute significantly to its overall production and cash generation, allowing for strategic reinvestment without undue dependence on external funding.

- Bakken Production: Hess's Bakken assets are a cornerstone of its cash flow generation.

- High-Return Investments: Capital is strategically deployed to projects with strong return profiles.

- Financial Stability: Steady cash flow from mature assets reduces the need for external financing.

- Disciplined Approach: A focused capital allocation strategy underpins Hess's operational and financial health.

Hess's Bakken operations and its midstream segment are quintessential cash cows. These mature businesses, with established infrastructure and market presence, consistently generate substantial, predictable cash flows. The Bakken assets, for example, continue to be a reliable production base, while the midstream segment offers stable, fee-based revenues.

These cash cows are vital for Hess's financial strategy. The strong, consistent cash generated from these operations is crucial for funding the company's more capital-intensive growth projects, particularly its significant investments in Guyana. This internal funding capability reduces reliance on external debt and enhances financial flexibility.

In 2024, Hess's Bakken production remained a significant contributor, with the midstream segment ensuring efficient transportation and processing. This operational synergy directly translates into robust cash generation, supporting Hess's overall financial health and its ability to allocate capital effectively towards high-potential opportunities and shareholder returns.

| Segment | Role in Hess Portfolio | Key Financial Indicator (2024 Data) | Strategic Importance |

|---|---|---|---|

| Bakken Operations | Cash Cow | Average Daily Production: ~171,000 boe (Q1 2024) | Stable production base, funding growth initiatives |

| Hess Midstream LP | Cash Cow | Adjusted EBITDA: ~$1.2 billion (2024) | Reliable fee-based revenue, infrastructure support |

Preview = Final Product

Hess BCG Matrix

The preview you are currently viewing is the identical, fully-prepared Hess BCG Matrix document you will receive immediately after your purchase. This means you get the complete, unwatermarked analysis, ready for immediate integration into your strategic planning sessions. You can trust that this preview accurately represents the professional-grade report that will be delivered, ensuring no discrepancies or hidden limitations.

Dogs

Non-core, low-performing assets in the Hess BCG Matrix represent legacy or non-strategic holdings that aren't significantly contributing to production or profitability. These assets often come with high operating costs, making them inefficient. For instance, in 2024, Hess continued its strategic review of its portfolio, which could include identifying such underperforming assets for potential divestiture to optimize its overall business structure and focus resources on higher-growth areas.

Declining older fields, characterized by increasing water cut and operational complexities, often represent a challenge. These assets, with their dwindling reserves, can see the cost of maintaining production surpass the revenue they generate. Hess's strategy typically involves divesting such assets if they no longer fit its high-return investment criteria.

Underperforming exploration ventures, like Hess's Vancouver-1 well in the Gulf of Mexico which failed to discover commercial quantities of hydrocarbons, are classic examples of 'Dogs' in the BCG matrix. These are ventures that consume resources but generate little to no return, tying up valuable capital that could be deployed elsewhere.

Areas with Limited Future Potential

Areas with limited future potential, often classified as Dogs in the BCG Matrix, represent assets or business units that generate low returns and have minimal growth prospects. For Hess Corporation, these might include certain smaller, geographically isolated oil and gas fields that lack the scale for significant expansion or strategic alignment with their core growth objectives. Divesting these assets allows Hess to free up capital and management focus for more promising opportunities.

For instance, if Hess has legacy assets in a mature basin with declining production and high operating costs, these would likely fall into the Dog category. Such assets might have seen their production levels drop significantly, making further investment unattractive. The company's strategic focus in 2024 and beyond is on high-growth areas like the Stabroek Block offshore Guyana, making smaller, less impactful assets less of a priority.

- Low Growth Prospects: Assets with declining production or in mature, non-strategic basins offer limited potential for future revenue growth.

- Capital Reallocation: Divesting these Dog assets allows Hess to redirect capital towards higher-return projects, such as its significant investments in the Stabroek Block.

- Strategic Focus: By shedding underperforming units, Hess can concentrate resources on core operations and markets that align with its long-term vision for growth and profitability.

Assets Not Aligning with Core Strategy

Assets that do not align with Hess Corporation's core strategy of focusing on high-return, low-cost opportunities and supporting the energy transition might be classified as Question Marks or potentially Divestitures. This strategic pruning is crucial for maintaining a lean and efficient operational portfolio.

For instance, if Hess were to divest from certain legacy infrastructure not conducive to lower-emission energy production, it would free up capital. In 2024, Hess continued its strategic focus on the Bakken and Guyana, areas representing significant growth potential. Assets outside these core areas, especially those requiring substantial investment without clear strategic alignment, would be candidates for this evaluation.

- Strategic Misfit: Assets not contributing to Hess's stated goals of low-cost production or energy transition initiatives.

- Capital Reallocation: Divesting non-core assets allows for reinvestment in high-growth areas like Guyana.

- Portfolio Optimization: Maintaining a focused portfolio enhances operational efficiency and shareholder value.

Dogs in the Hess BCG Matrix represent assets with low market share and low growth prospects, often characterized by declining production and high operational costs. These units consume resources without generating significant returns, hindering overall portfolio performance. Hess's strategic review in 2024 aimed to identify and potentially divest such underperforming assets to reallocate capital to more promising ventures.

Examples include mature fields with dwindling reserves or exploration projects that failed to yield commercial discoveries, such as the Vancouver-1 well. These assets drain financial and managerial attention that could be better utilized in high-growth areas like the Stabroek Block offshore Guyana. By shedding these 'Dogs,' Hess can enhance its operational efficiency and focus on strategic priorities.

| Asset Type | BCG Classification | Hess Strategic Relevance | 2024 Focus Areas |

|---|---|---|---|

| Legacy Oil Fields (Mature Basins) | Dog | Low growth, high operating costs | Stabroek Block, Bakken |

| Unsuccessful Exploration Ventures | Dog | No return on investment | Stabroek Block, Bakken |

| Non-core Infrastructure | Dog/Divestiture | Limited alignment with energy transition | Stabroek Block, Bakken |

Question Marks

Hess Corporation's early-stage exploration acreage, like its undeveloped U.S. Gulf of Mexico holdings, represents potential future growth drivers. This category includes assets with unproven reserves, meaning their value is speculative and dependent on successful future exploration and development. For instance, Hess's Gulf of Mexico segment, while not as mature as its Bakken or Guyana operations, offers a chance for significant discoveries that could bolster its long-term portfolio.

New Frontier Basins represent Hess's strategic bets on areas with untapped, significant resource potential where the company currently has minimal production. These ventures, while demanding considerable upfront investment and carrying elevated risk profiles, are positioned for substantial future returns, aligning with the high-growth, high-risk quadrant of the BCG matrix.

In 2024, Hess continued to evaluate opportunities in frontier regions, aiming to diversify its production base beyond established areas like the Bakken and the Gulf of Mexico. While specific financial commitments to new frontier basins are often proprietary, the company's overall capital expenditure for exploration and appraisal activities in 2024 was projected to be in the range of $1.3 to $1.4 billion, reflecting a commitment to future resource acquisition.

Hammerhead, situated within Guyana's prolific Stabroek Block, is currently classified as a Question Mark in the Hess BCG Matrix. While it holds significant promise, its development is awaiting crucial government and regulatory approvals, along with final project sanctioning.

First oil from Hammerhead is projected for 2029, but the project's full potential and definitive timeline remain uncertain until these approvals are secured. This uncertainty places it squarely in the Question Mark category, as its future contribution to Hess's portfolio is not yet guaranteed.

Investments in Emerging Technologies

Investments in emerging technologies, such as nascent new energy solutions, carbon capture, or other energy transition projects in their research or pilot stages, represent the Question Marks in the Hess BCG Matrix. These ventures typically involve substantial upfront capital expenditures and face considerable uncertainty regarding their future commercial success and market adoption.

For instance, companies exploring advanced battery technologies or green hydrogen production often fall into this category. The global investment in clean energy technologies reached an estimated $1.7 trillion in 2023, with a significant portion allocated to early-stage research and development, highlighting the high-risk, high-reward nature of these emerging sectors.

- High Upfront Costs: Development of novel technologies requires significant R&D spending and infrastructure investment before revenue generation begins.

- Uncertain Commercial Viability: Market acceptance, scalability, and competitive landscape are often unclear, leading to a high probability of failure.

- Potential for High Growth: Successful navigation of these challenges can lead to substantial market share and significant returns if the technology gains traction.

- Strategic Importance: These investments are crucial for long-term competitiveness and positioning in evolving markets, even with their inherent risks.

Smaller, Unsanctioned Discoveries

Smaller, unsanctioned discoveries represent a crucial element within Hess's strategic portfolio, offering significant upside potential often overlooked in broader market analyses. These are typically recent finds within established exploration blocks or entirely new successes that are still in the early stages of appraisal and development planning. For Hess, these represent opportunities for future growth where their current market share is minimal, allowing for substantial gains as these projects mature.

A prime example is the Bluefin-1 discovery in Guyana. While still undergoing full appraisal, this find exemplifies the high-growth potential inherent in these smaller, unsanctioned assets. Discoveries like Bluefin-1, even before formal development sanctioning, can contribute to a company's future production profile and cash flow, making them vital for long-term strategic planning.

The strategic importance of these discoveries lies in their ability to fuel future expansion without the immediate capital outlay and associated risks of fully sanctioned, large-scale projects. They allow Hess to maintain a pipeline of potential growth opportunities, adapting to market conditions and optimizing capital allocation over time. This approach diversifies the company's risk and provides flexibility in its development strategy.

- High-Growth Potential: These discoveries, like Bluefin-1, offer substantial future production and revenue streams.

- Low Current Market Share: Hess has minimal market presence in these specific discoveries, allowing for significant expansion.

- Early Stage Appraisal: They are typically not yet fully appraised or sanctioned for development, indicating potential for future investment.

- Strategic Flexibility: These assets provide Hess with options for future growth, adapting to market dynamics and capital availability.

Question Marks in Hess's portfolio represent ventures with high growth potential but also high uncertainty regarding their future success. These are often early-stage exploration projects or new technologies where significant investment is required before any returns are realized. The key characteristic is the unknown outcome, making them speculative but potentially very rewarding if they mature successfully.

Hammerhead in Guyana serves as a prime example of a Question Mark, awaiting regulatory approvals and final sanctioning before its development can proceed. Similarly, emerging energy transition projects, still in research or pilot phases, fall into this category due to their unproven commercial viability and substantial upfront costs. These assets require careful monitoring and strategic decision-making to navigate their inherent risks.

The company's strategic approach involves investing in these areas to secure future growth opportunities, even with the inherent risks. This diversification is crucial for long-term sustainability and competitiveness in a dynamic energy landscape. Hess's capital allocation in 2024, with projections between $1.3 to $1.4 billion for exploration and appraisal, underscores this commitment to exploring potential future drivers.

The success of these Question Marks is contingent on factors like regulatory approvals, technological advancements, and market acceptance. For instance, the global investment in clean energy technologies reached an estimated $1.7 trillion in 2023, highlighting the scale of capital being deployed into areas with similar uncertainties.

| Asset/Venture | Status | Potential | Risk | Key Factors |

|---|---|---|---|---|

| Hammerhead (Guyana) | Awaiting approvals & sanctioning | High | High | Regulatory, final project sanction |

| New Frontier Basins | Exploration/Appraisal | High | High | Resource potential, exploration success |

| Emerging Energy Tech | R&D/Pilot Stage | High | High | Commercial viability, market adoption |

| Unsanctioned Discoveries (e.g., Bluefin-1) | Early Appraisal | High | Medium | Further appraisal, development planning |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial statements, market research, and industry growth forecasts to provide a comprehensive view of product portfolio performance.