Hess Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hess Bundle

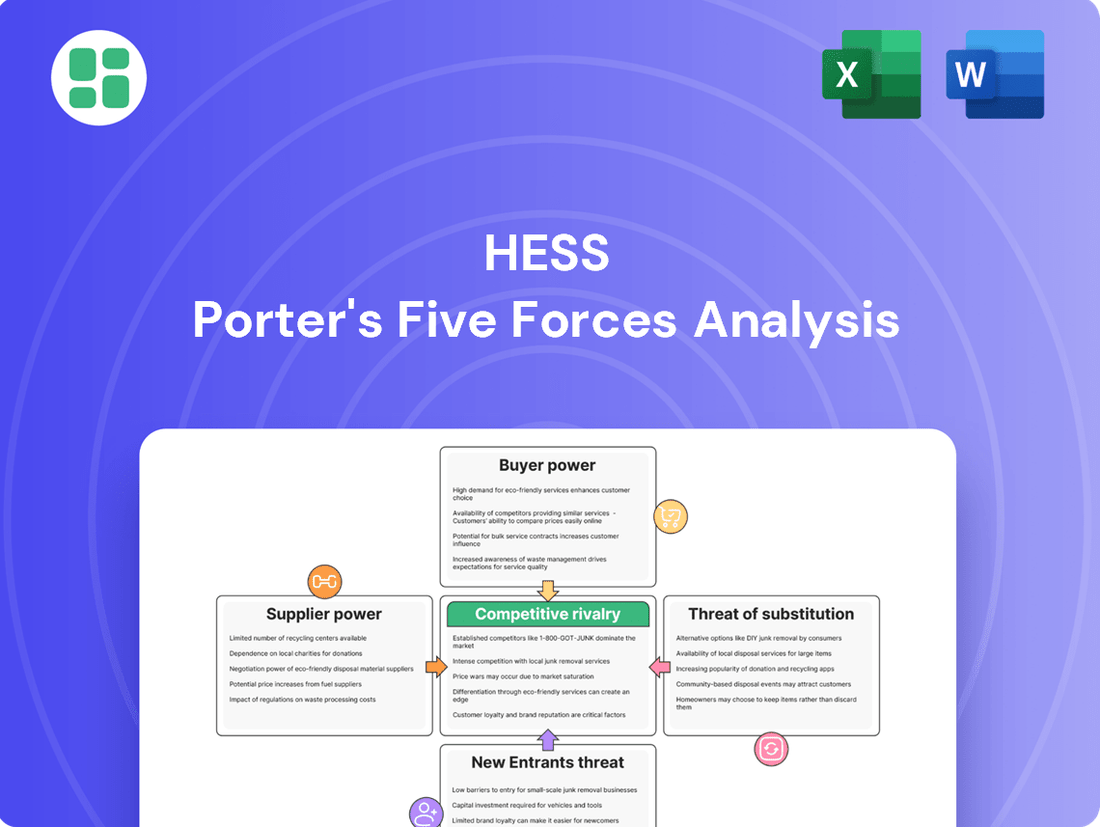

Hess's competitive landscape is shaped by the interplay of five critical forces, revealing both opportunities and challenges within the energy sector. Understanding these dynamics, from the bargaining power of buyers to the threat of new entrants, is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hess’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The oil and gas sector, including companies like Hess, depends on a specialized global supply chain. Key suppliers for crucial elements like drilling equipment, seismic analysis, and cutting-edge technology are often large, consolidated businesses. This means fewer options for essential services and equipment.

For Hess, especially in demanding environments such as the deepwater fields in Guyana or the advanced shale formations in the Bakken, the pool of highly skilled and equipped suppliers is quite small. This limited number of capable providers gives them substantial bargaining power.

This concentration of suppliers can translate into less favorable pricing and contract terms for Hess when procuring essential services and equipment. For instance, in 2024, the cost of specialized offshore drilling rigs saw an increase due to high demand and limited availability of top-tier providers.

Switching costs for Hess to change suppliers for highly specialized services or equipment, particularly in the oil and gas sector, can be substantial. These costs encompass not only the financial outlay for re-qualifying new vendors and integrating different technologies but also the potential for significant operational disruptions during the transition period. For instance, in 2024, the energy industry saw continued investment in advanced drilling technologies, meaning a supplier providing proprietary equipment could command higher prices due to the unique integration and training required.

The high investment Hess has made in existing infrastructure, such as specialized pipelines or processing facilities designed for specific supplier technologies, further locks the company into relationships with current providers. Long-term contracts, common in this industry to ensure supply chain stability and pricing, also increase supplier power by reducing Hess's flexibility. This creates a situation where suppliers can leverage these deep integrations and contractual obligations to influence terms and pricing.

Suppliers offering unique or proprietary technologies, like advanced seismic imaging or specialized drilling bits, wield significant influence. Hess's dependence on these innovations for efficient extraction, especially in challenging locations such as the Stabroek Block, grants suppliers leverage due to the scarcity of comparable alternatives.

Threat of Forward Integration by Suppliers

While it's not a frequent occurrence, major oilfield service firms could theoretically move into exploration and production (E&P) operations. This is a substantial undertaking, however. The substantial capital requirements and strict regulatory hurdles inherent in E&P generally act as a deterrent to such forward integration by service providers.

Despite these challenges, the mere possibility of service companies gaining more influence over segments of the oil and gas value chain grants them a degree of bargaining power over E&P companies like Hess. For instance, in 2024, the global oilfield services market was valued at approximately $250 billion, indicating the significant financial capacity some of these companies possess.

- Forward Integration Threat: Large oilfield service companies might integrate into E&P, though capital and regulatory barriers are high.

- Supplier Leverage: The potential for greater control over the value chain gives service providers leverage over E&P firms.

- Market Context: The global oilfield services market's substantial size, around $250 billion in 2024, highlights the financial clout of potential integrators.

Importance of Hess to Suppliers

Hess Corporation's significant, long-term projects, particularly its substantial investments in Guyana, create considerable revenue opportunities for major oilfield service providers. This reliance makes Hess a key client for many suppliers, which can, to a degree, mitigate the suppliers' inherent bargaining power.

For instance, Hess's Stabroek Block development in Guyana, a multi-billion dollar undertaking, necessitates extensive services from exploration and production companies. In 2023, Hess reported capital and exploratory expenditures of $3.0 billion, with a significant portion allocated to its Guyana operations, highlighting the scale of these projects and the importance of these contracts to its suppliers.

- Hess's Guyana Operations: The development of the Stabroek Block is a cornerstone of Hess's strategy, driving substantial demand for upstream services.

- Supplier Dependence: Major oilfield service companies often depend on the sustained capital expenditure from large-scale projects like those in Guyana, making Hess a crucial customer.

- Industry Influence: Despite Hess's importance, the overall financial health and capital expenditure trends across the broader global oil and gas industry continue to significantly influence the bargaining power of these suppliers.

The bargaining power of suppliers for Hess is considerable due to the specialized nature of the oil and gas industry. With a limited pool of providers offering critical equipment and services, these suppliers can dictate terms and pricing. For example, the cost of specialized offshore drilling rigs increased in 2024 due to high demand and limited availability of top-tier providers.

Switching costs are also a significant factor, as integrating new technologies and re-qualifying vendors can be expensive and disruptive. Hess's investments in proprietary supplier technologies further cement these relationships. In 2024, the energy industry's continued investment in advanced drilling technologies meant suppliers of unique equipment could command higher prices due to integration and training requirements.

Suppliers with unique or proprietary technologies, such as advanced seismic imaging, hold significant leverage, especially given Hess's reliance on these innovations for efficient extraction in challenging locations like the Stabroek Block. The global oilfield services market, valued at approximately $250 billion in 2024, underscores the financial capacity of these suppliers.

| Factor | Impact on Hess | Example Data (2024) |

|---|---|---|

| Supplier Concentration | High bargaining power for suppliers | Limited number of specialized drilling rig providers |

| Switching Costs | High costs and operational disruption | Integration of proprietary drilling technologies |

| Proprietary Technology | Supplier leverage due to unique offerings | Advanced seismic imaging for deepwater exploration |

| Market Size (Oilfield Services) | Significant financial capacity of suppliers | ~$250 billion global market value |

What is included in the product

This analysis dissects the competitive forces impacting Hess, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industry.

Instantly identify and quantify competitive pressures with a visual, easy-to-understand five forces diagram.

Customers Bargaining Power

Hess Corporation's primary customers are large, integrated oil companies, refineries, and commodity traders. These entities often procure crude oil and natural gas in substantial quantities, possessing advanced market intelligence that amplifies their bargaining power.

The global nature of the crude oil and natural gas market means buyers can source supplies from a multitude of sellers. This broad accessibility further empowers customers, as they can readily switch suppliers if pricing or terms are not favorable, thereby concentrating their leverage over individual producers like Hess.

Customers who buy large volumes of crude oil and natural gas, which are essentially undifferentiated commodities, wield significant bargaining power. This scale allows them to negotiate for better prices and more favorable contract terms. For instance, in 2024, major energy consumers can leverage the sheer size of their orders to influence the market price of oil, especially when dealing with producers like Hess, whose output from key regions like the Stabroek Block is substantial.

Customers of crude oil and natural gas face a market with numerous alternative suppliers worldwide. This abundance of options means buyers aren't tied to a single producer like Hess. For instance, in 2024, global oil production saw significant output from countries like Saudi Arabia, Russia, and the United States, all competing for market share.

The commodities themselves, crude oil and natural gas, are largely fungible, meaning one barrel or cubic foot is much like another. This interchangeability allows customers to readily switch their sourcing from Hess to another producer if Hess's pricing or contract terms become less attractive. This ease of substitution is a key driver of increased customer bargaining power.

Switching Costs for Customers

For major consumers like refineries, the costs associated with switching between different grades of crude oil or natural gas are typically quite low. Minor operational adjustments might be needed, but these are generally not substantial enough to deter a change in supplier.

The highly developed global trading infrastructure for commodities like crude oil and natural gas plays a significant role here. This efficiency allows companies to transition between suppliers with relative ease, avoiding significant financial penalties or operational disruptions.

- Low Switching Costs: Refineries face minimal costs when changing crude oil or natural gas suppliers, allowing for flexibility.

- Efficient Global Infrastructure: The robust global trading system facilitates easy transitions between commodity sources.

- Supplier Competition: This low switching cost environment intensifies competition among oil and gas producers, as customers can readily move to more favorable terms.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while less common for pure exploration and production (E&P) companies like Hess, can still be a factor. Large integrated oil companies or refiners often have their own upstream production. This capability allows them to generate their own feedstock, thereby reducing their dependence on external suppliers and increasing their bargaining power.

For Hess, this means that customers who are also refiners or integrated energy companies could potentially develop or expand their own E&P assets. This would directly compete with Hess's core business by supplying their own crude oil or natural gas. For instance, in 2024, major integrated oil companies continued to invest in upstream projects, with companies like ExxonMobil and Chevron reporting significant capital expenditures in their exploration and production segments, aiming to secure their own resource base.

However, for the majority of Hess's direct customers, who are typically downstream refiners or marketers without upstream operations, the threat of backward integration is largely theoretical. These customers lack the expertise, capital, and infrastructure required to engage in oil and gas exploration and production. Therefore, their ability to exert bargaining power through this channel is limited.

- Integrated oil companies possess upstream capabilities, reducing reliance on external E&P firms.

- This self-sufficiency enhances their bargaining power with suppliers like Hess.

- Hess's customers who are not integrated face a minimal threat of backward integration.

- Major integrated players like ExxonMobil and Chevron continue upstream investments, demonstrating this trend in 2024.

Hess's customers, primarily large integrated oil companies and refineries, possess significant bargaining power due to the commodity nature of oil and gas and the global availability of suppliers. In 2024, the sheer volume of their purchases allows them to negotiate favorable terms, as they can easily switch to numerous other producers worldwide. For example, the continued robust production from major oil-producing nations in 2024 provided buyers with ample alternatives to Hess.

The low switching costs for these customers, coupled with an efficient global trading infrastructure, further amplifies their leverage. This environment intensifies competition among producers like Hess, as buyers can readily shift their business to more attractive offers. The fungible nature of crude oil and natural gas means that price and contract terms are the primary differentiators for these large-volume buyers.

While some customers, particularly integrated energy companies, can exert power through potential backward integration into exploration and production, this is less common for pure downstream entities. For instance, major players like ExxonMobil continued significant upstream investments in 2024, reinforcing their capacity to self-supply and thus enhance their bargaining position with external producers.

Full Version Awaits

Hess Porter's Five Forces Analysis

This preview displays the complete Hess Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The upstream oil and gas sector where Hess operates is populated by a significant number of substantial, long-standing companies. These include global supermajors and numerous independent exploration and production firms, all vying for resources and market share.

Hess faces direct competition from these powerful players across its key operational areas. In the deepwater arena, particularly in Guyana, Hess contends with giants like ExxonMobil and CNOOC. Similarly, in the Bakken shale region, competitors such as Chord Energy, ConocoPhillips, and Chevron present a strong challenge.

The sheer volume and caliber of these competitors directly escalate the intensity of rivalry within the industry. This crowded competitive landscape means Hess must constantly innovate and optimize its operations to maintain its edge and secure favorable outcomes in its ventures.

The global energy demand continues to rise, but the growth rate for traditional oil and gas is notably moderating. This slowdown is significantly influenced by the ongoing energy transition towards cleaner sources. For instance, the International Energy Agency (IEA) projected in 2024 that while overall energy demand would increase, the demand for oil might peak in the coming years, signaling a shift.

This moderating growth rate directly intensifies competitive rivalry. When the market expands more slowly, companies like Hess find it harder to grow organically and must actively compete for existing market share. This means that gaining even a small percentage point becomes a more challenging and often aggressive endeavor, as companies fight over a more constrained pie.

Operating within a mature industry, Hess faces a landscape where substantial market share expansion typically necessitates taking business directly from competitors. This dynamic means that strategic decisions, operational efficiencies, and pricing strategies are under constant scrutiny, as rivals are keenly aware of opportunities to capture market share from any perceived weakness.

Crude oil and natural gas are fundamentally commoditized, meaning Hess's products are largely indistinguishable from those of competitors. This inherent lack of product differentiation shifts the competitive battleground squarely onto price and operational efficiency. For instance, in 2024, benchmark crude oil prices like WTI often fluctuated within a narrow range, highlighting the price-sensitive nature of the market.

Exit Barriers

The oil and gas sector is characterized by substantial exit barriers. These stem from massive sunk costs in specialized infrastructure, like offshore platforms and refineries, along with long-term supply and offtake agreements. These factors lock companies into the market, even when profitability declines, intensifying competition among remaining firms.

Hess Corporation, for instance, faces significant exit barriers due to its considerable investments. In 2023, Hess reported capital expenditures of $3.3 billion, with a substantial portion allocated to its Stabroek Block interests in Guyana. This ongoing development, along with its Bakken shale assets, represents a deep commitment that makes exiting these ventures exceptionally costly and complex.

- High Sunk Costs: Oil and gas companies invest billions in exploration, drilling, and production facilities, which have very limited alternative uses.

- Specialized Assets: Infrastructure such as pipelines, refineries, and offshore rigs are highly specific to the industry, making them difficult to sell or repurpose.

- Long-Term Commitments: Contracts for exploration rights, supply agreements, and workforce commitments create ongoing obligations that are hard to terminate quickly.

- Hess's Investments: Hess's significant capital allocation to projects like the Stabroek Block in Guyana, which saw continued development in 2023, exemplifies these high exit barriers.

Strategic Stakes and Aggressive Competition

Companies in the oil and gas sector face immense strategic stakes, often tied to national energy security or long-term resource acquisition. This drives fierce competition for valuable exploration blocks and market dominance.

The ongoing arbitration concerning Hess's significant Guyana assets, where ExxonMobil and Chevron are also key players, vividly illustrates the high stakes and aggressive nature of competition in this industry. These disputes highlight the substantial financial and strategic implications of securing and maintaining access to prime oil reserves.

- High Strategic Stakes: National energy security and long-term resource base objectives drive aggressive competition.

- Prime Acreage Competition: Companies vie intensely for the most promising exploration and production territories.

- Market Share Battles: Securing and expanding market share is a critical objective for all industry players.

- Hess's Guyana Arbitration: This ongoing dispute exemplifies the high-stakes nature of competition in the sector.

The upstream oil and gas sector is intensely competitive, featuring numerous large, established companies alongside agile independents. Hess Corporation operates in this environment, facing rivals like ExxonMobil, CNOOC, Chord Energy, ConocoPhillips, and Chevron across its key operational regions, including Guyana and the Bakken shale.

The commoditized nature of oil and gas means competition largely centers on price and operational efficiency, with limited product differentiation. This is underscored by fluctuating benchmark crude prices, such as WTI, which in 2024 often traded within a narrow range, emphasizing the market's price sensitivity.

High exit barriers, including substantial sunk costs in specialized infrastructure and long-term commitments, keep companies like Hess invested in the market, intensifying rivalry. For example, Hess's 2023 capital expenditures of $3.3 billion, largely directed towards its Guyana ventures, highlight these significant, difficult-to-reverse investments.

The strategic importance of energy resources and market share, exemplified by the ongoing arbitration over Hess's Guyana assets involving major players, further fuels aggressive competition within the industry.

| Competitor | Key Operational Areas | 2023 Capital Expenditures (Approximate) |

|---|---|---|

| ExxonMobil | Guyana (Deepwater), Global | $23.7 billion |

| Chevron | Bakken Shale, Global | $12.9 billion |

| ConocoPhillips | Bakken Shale, Global | $10.0 billion |

| Chord Energy | Bakken Shale | $1.5 billion |

| CNOOC | Guyana (Deepwater), Global | $20.0 billion (Group) |

SSubstitutes Threaten

The primary substitutes for crude oil and natural gas are renewable energy sources like solar and wind power, electric vehicles, and other alternative fuels. While oil and gas still hold a dominant position, the growing availability and enhanced price-performance of renewables present a significant long-term threat, especially impacting sectors such as transportation and power generation.

The cost for consumers to switch from Hess's products to alternatives isn't uniform. For instance, a consumer buying a gasoline-powered car faces substantial expenses when moving to an electric vehicle, including the car's purchase price and charging infrastructure. However, for a power company, switching from natural gas to solar or wind power might be increasingly cost-effective, especially with government incentives. Hess, being a major player in global energy, sees its demand directly influenced by how easily and affordably customers can make these transitions.

Government policies and regulations, including carbon pricing and emissions standards, are a major factor in the threat of substitutes for oil and gas. For instance, the European Union’s Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will put a price on carbon emissions for imports, potentially making fossil fuels more expensive relative to cleaner alternatives.

The global push for decarbonization, driven by agreements like the Paris Agreement, is intensifying regulatory pressure. This trend directly accelerates the adoption of renewable energy sources and electric vehicles, thereby diminishing the long-term demand for traditional hydrocarbons and posing a significant challenge for companies in the sector.

Technological Advancements in Substitutes

Rapid technological advancements in renewable energy, battery storage, and energy efficiency are making substitutes increasingly competitive against traditional oil and gas. For instance, the global renewable energy capacity additions reached a record high in 2023, with solar PV and wind power leading the charge. This ongoing innovation makes alternatives more efficient, cheaper, and more accessible, directly impacting the appeal of fossil fuels.

These innovations are not just theoretical; they translate into tangible cost reductions and performance improvements. By 2025, it's projected that the levelized cost of electricity from solar PV will continue to fall, making it more attractive than many fossil fuel sources in numerous regions. This trend directly reduces the relative attractiveness of oil and gas over time, posing a significant threat.

- Falling Costs: The cost of solar photovoltaic (PV) panels has decreased by over 80% in the last decade, making solar power increasingly competitive with fossil fuels.

- Improved Efficiency: Modern wind turbines are significantly more efficient, capturing more energy from lower wind speeds, thereby increasing their viability.

- Battery Storage Advancements: Battery storage costs have also fallen dramatically, addressing the intermittency issues of renewables and making them a more reliable substitute.

- Energy Efficiency Gains: Innovations in building design, insulation, and smart grid technology reduce overall energy demand, lessening reliance on traditional energy sources.

Consumer Preferences and Environmental Concerns

Growing consumer awareness about climate change and environmental impact is a significant threat of substitutes for traditional energy sources. This shift is leading to increased demand for renewable alternatives, directly impacting the market share of fossil fuels. For instance, by the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts, a 50% increase from 2022, underscoring this trend.

Societal pressure to reduce carbon footprints is compelling both individuals and industries to explore and adopt cleaner energy solutions. This can translate into reduced demand for oil and gas products, as consumers and businesses actively seek to lower their environmental impact. The International Energy Agency (IEA) reported in early 2024 that global energy-related CO2 emissions saw a slight increase in 2023 but highlighted the accelerating deployment of renewables as a key factor mitigating a larger rise.

This evolving consumer behavior and the increasing viability of substitutes pose a persistent, long-term threat to the established business models of oil and gas companies like Hess Corporation. The continuous innovation and cost reduction in renewable technologies, such as solar and wind power, make them increasingly competitive alternatives. By mid-2024, the levelized cost of electricity for utility-scale solar PV had fallen by over 80% in the past decade, making it a more attractive substitute.

- Growing Demand for Renewables: Global renewable energy capacity additions reached a record 510 GW in 2023, a 50% increase year-on-year.

- Shifting Consumer Preferences: Increased awareness of climate change drives demand for sustainable practices and lower-carbon energy sources.

- Cost Competitiveness of Alternatives: The levelized cost of electricity for solar PV has decreased by over 80% in the last decade.

- Long-Term Market Erosion: The persistent adoption of substitutes threatens the long-term market share and revenue streams of fossil fuel companies.

The threat of substitutes for crude oil and natural gas is intensifying due to advancements in renewable energy and electric vehicles. These alternatives are becoming more cost-effective and efficient, directly challenging fossil fuels. For example, by mid-2024, the levelized cost of electricity from solar PV had fallen by over 80% in the past decade, making it a compelling substitute.

Government policies and growing environmental awareness further accelerate the adoption of these substitutes. Initiatives like carbon pricing and emissions standards make fossil fuels less attractive, while consumer demand for sustainable options grows. Global renewable energy capacity additions reached a record 510 GW in 2023, a 50% increase year-on-year, highlighting this shift.

| Substitute Category | Key Advancements | Impact on Fossil Fuels | Relevant Data Point (as of mid-2024) |

|---|---|---|---|

| Renewable Energy (Solar/Wind) | Falling costs, improved efficiency, battery storage | Increasingly competitive for power generation | Solar PV LCOE down >80% in 10 years |

| Electric Vehicles (EVs) | Battery technology, charging infrastructure | Disrupting transportation fuel demand | Global EV sales projected to reach 15-20 million units in 2024 |

| Energy Efficiency | Building design, smart grids | Reduces overall energy demand | Energy efficiency measures can reduce energy consumption by 15-30% |

Entrants Threaten

The upstream oil and gas sector, particularly for complex operations like Hess's deepwater ventures in Guyana, demands staggering upfront capital. For instance, developing a single floating production, storage, and offloading (FPSO) unit for a major offshore project can easily cost billions of dollars, with some exceeding $3 billion. These immense financial outlays for exploration, drilling, and the construction of essential infrastructure create a formidable barrier, effectively shutting out all but the most well-capitalized companies.

The oil and gas industry, including operations like Hess Corporation's, faces formidable regulatory hurdles. Obtaining the necessary permits, licenses, and environmental approvals can be an extensive and costly process, especially for complex offshore projects or unconventional extraction methods. For instance, in 2024, the average time to secure exploration permits in some developed regions could extend beyond two years, involving multiple government agencies.

Navigating these intricate regulatory landscapes, particularly in emerging petroleum provinces such as Guyana where laws are still developing, acts as a substantial barrier for potential new entrants. Hess, with its established presence in Guyana, has already invested significantly in understanding and complying with these evolving frameworks.

Furthermore, any new player must demonstrate adherence to rigorous safety protocols and environmental standards. In 2024, fines for non-compliance with environmental regulations in the energy sector globally averaged millions of dollars, underscoring the financial risk associated with inadequate preparation.

New companies entering the oil and gas sector, like Hess Corporation operates within, often find it difficult to gain access to essential distribution channels and infrastructure. Established companies frequently control critical assets such as pipelines, terminals, and refineries, making it a significant hurdle for newcomers to efficiently move and sell their extracted resources. For instance, in 2024, the cost to build new pipeline infrastructure can run into billions of dollars, a prohibitive expense for many startups.

Economies of Scale and Experience Curve

Established players like Hess benefit from substantial economies of scale in their exploration and production (E&P) activities. This allows them to spread fixed costs over a larger production volume, resulting in lower per-barrel costs. For instance, in 2024, major integrated oil companies often reported operating expenditures below $20 per barrel for their onshore U.S. operations, a level difficult for newcomers to match without significant upfront investment.

Furthermore, Hess and similar companies possess decades of accumulated operational experience, extensive geological data, and deep technical expertise. This experience curve advantage translates into more efficient drilling, better reservoir management, and reduced risk. New entrants would struggle to replicate this institutional knowledge and data advantage, making it challenging to compete on cost and operational efficiency from the outset.

- Economies of Scale: Hess leverages its large production volumes to lower per-unit operating costs, a significant barrier for new, smaller-scale operations.

- Experience Curve: Decades of operational history provide Hess with invaluable geological insights and technical know-how, enhancing efficiency and reducing risk.

- Cost Competitiveness: The combined effect of scale and experience makes it difficult for new entrants to achieve the same cost efficiencies, thus limiting their ability to compete effectively.

Proprietary Technology and Access to Resources

Access to proven, high-potential resource plays, such as the Stabroek Block or the Bakken Shale, frequently hinges on proprietary geological data, cutting-edge exploration techniques, and solidified relationships with governments. Newcomers often lack the sophisticated technology and specialized expertise needed to identify and secure these increasingly rare, lucrative opportunities.

Major oil and gas discoveries are becoming less common, demanding advanced technological capabilities and deep industry knowledge that new entrants typically do not possess. For instance, ExxonMobil's significant discoveries in the Stabroek Block, Guyana, relied heavily on advanced seismic imaging and sophisticated reservoir modeling, capabilities that are difficult for new companies to replicate quickly.

- Proprietary Data: Access to detailed geological and seismic data is crucial for identifying viable resource plays.

- Advanced Exploration Techniques: Technologies like 3D seismic surveys and advanced drilling methods require substantial investment and expertise.

- Government Relations: Established relationships with host governments are often necessary for securing exploration licenses and operating permits.

- Capital Intensity: The high cost of exploration and development acts as a significant barrier to entry for new, less-resourced companies.

The threat of new entrants for Hess Corporation's operations, particularly in capital-intensive sectors like deepwater oil and gas, is significantly mitigated by the immense financial requirements. Developing projects akin to those in Guyana necessitates billions in upfront investment for exploration, drilling, and infrastructure, a sum few new companies can readily access. Furthermore, the industry's complex regulatory environment, requiring extensive permits and compliance with stringent safety and environmental standards, adds considerable time and cost, with permit acquisition in some regions taking over two years in 2024.

| Barrier Type | Description | Example Data Point (2024) |

|---|---|---|

| Capital Requirements | Staggering upfront investment for exploration, drilling, and infrastructure. | FPSO unit cost can exceed $3 billion. |

| Regulatory Hurdles | Extensive and costly permitting, licensing, and environmental approvals. | Average exploration permit acquisition time: over 2 years in some regions. |

| Access to Infrastructure | Control of essential assets like pipelines and terminals by established players. | New pipeline construction cost can reach billions of dollars. |

| Economies of Scale & Experience | Established players benefit from lower per-unit costs and accumulated expertise. | Major integrated oil companies' operating expenditures below $20/barrel in some onshore operations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available company financial reports, industry-specific market research from leading firms, and government economic indicators. This blend ensures a comprehensive understanding of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.