Hess Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hess Bundle

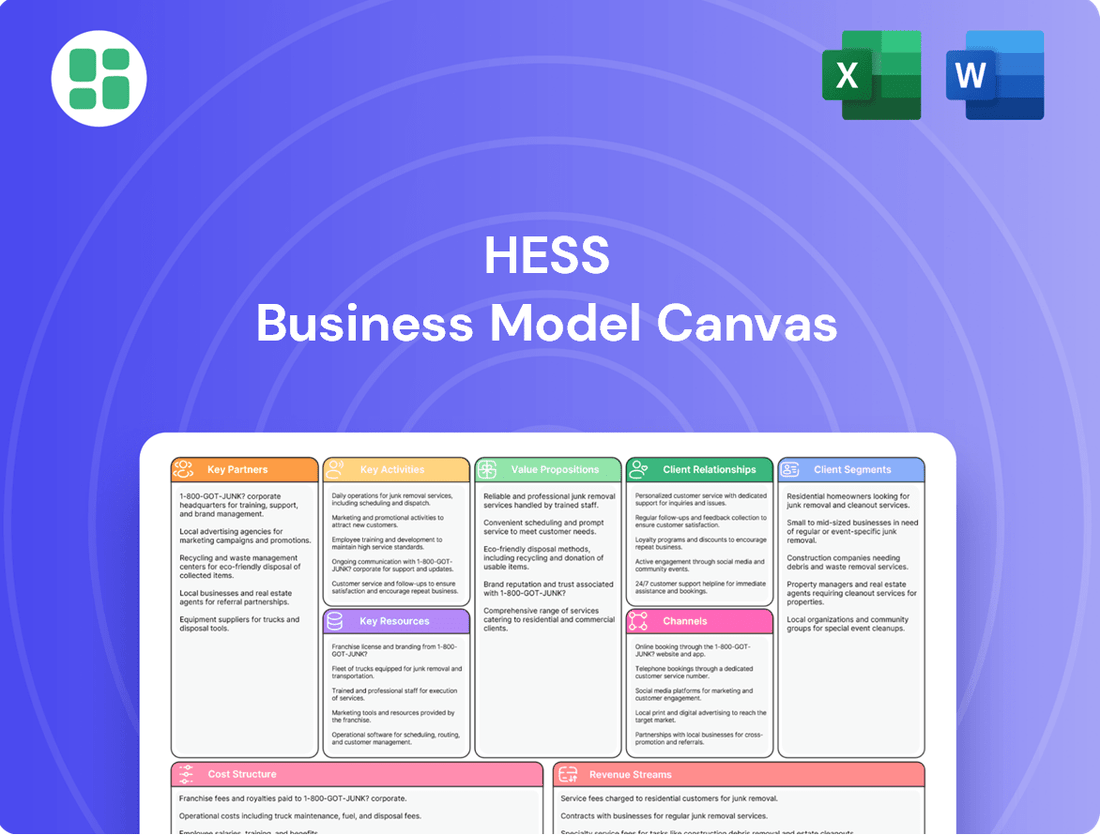

Unlock the core components of Hess's strategic framework with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear roadmap to their success. Dive into the full analysis to understand how Hess effectively delivers value and maintains its competitive edge.

Partnerships

Hess actively engages in joint ventures with industry giants like ExxonMobil and CNOOC, particularly in significant ventures such as the Stabroek Block offshore Guyana. These collaborations are essential for sharing the substantial capital required for exploration and production, thereby reducing individual financial risk.

These strategic alliances enable Hess to pool resources and technical capabilities, crucial for navigating the complexities and high costs associated with developing large-scale, high-reward offshore assets. For instance, Hess's stake in the Stabroek Block, a prolific discovery, highlights the success of such partnerships in unlocking immense value.

Hess Corporation actively collaborates with governmental and regulatory bodies worldwide, recognizing their critical role in operational success. In 2024, the company continued its engagements with agencies like the U.S. Environmental Protection Agency (EPA) and the Bureau of Ocean Energy Management (BOEM) to ensure compliance with environmental regulations and secure necessary permits for offshore operations.

These partnerships are vital for navigating complex legal frameworks and obtaining approvals for exploration and production activities. For instance, Hess's significant operations in Guyana necessitate close coordination with the Guyanese government and its environmental protection agencies, ensuring adherence to national resource management policies and fostering a stable investment climate.

Hess Corporation partners with specialized oilfield service providers for critical operations such as drilling, well completion, and seismic surveying. These collaborations are essential for accessing cutting-edge technology and skilled personnel, enabling efficient and safe resource extraction.

By outsourcing these complex services, Hess maintains a streamlined operational model and benefits from the expertise of leading industry players. For instance, in 2024, the company continued to leverage these partnerships to optimize its operations in key areas like the Bakken and the Stabroek Block.

Midstream and Transportation Partners

Hess's midstream and transportation partnerships are vital for getting its oil and gas to market. This involves working closely with companies that operate pipelines, ships, and terminals. These collaborations are essential for moving products from where they're produced to where they're refined or sold.

Hess Midstream, a significant joint venture with Global Infrastructure Partners, is central to this. It offers services for gathering, processing, and transporting crude oil and natural gas, primarily on a fee-based model. This structure provides Hess with predictable revenue streams and operational efficiency.

These partnerships are key to Hess's ability to deliver products reliably and affordably. For instance, Hess Midstream's infrastructure in the Bakken region is designed for efficient throughput. In 2024, Hess continued to leverage these relationships to optimize its supply chain, ensuring that production volumes translate into delivered sales effectively.

- Pipeline Operators: Crucial for land-based transport of crude oil and natural gas from wellheads to processing facilities and export terminals.

- Shipping Companies: Essential for international and coastal transport of crude oil and refined products, connecting Hess's production to global markets.

- Terminal Operators: Provide storage and loading/unloading facilities for crude oil and natural gas, acting as critical nodes in the transportation network.

- Hess Midstream (JV with Global Infrastructure Partners): Offers integrated midstream services, including gathering, processing, and transportation, providing a stable, fee-based revenue stream.

Technology and Research Collaborators

Hess actively partners with technology firms and leading research institutions to maintain an edge in exploration and production. These collaborations are crucial for developing cutting-edge drilling techniques and enhanced oil recovery (EOR) methods. For instance, in 2024, Hess continued its focus on technological advancements to optimize production from its key assets, including the Bakken and the Stabroek Block offshore Guyana.

These strategic alliances are vital for driving operational efficiency and unlocking new resource potential. By integrating advanced technologies, Hess aims to improve recovery rates and reduce the cost per barrel. In 2023, Hess reported significant progress in its EOR projects, which contributed to maintaining production levels despite challenging market conditions.

Furthermore, partnerships extend to environmental performance, focusing on areas like carbon capture technologies. This commitment reflects the industry-wide push for sustainability. Hess's investments in research and development, often in conjunction with academic partners, aim to mitigate environmental impact and align with evolving regulatory landscapes.

- Technology Firms: Collaborations with specialized technology providers to implement advanced seismic imaging and digital oilfield solutions.

- Research Institutions: Partnerships with universities and research centers for joint studies on reservoir characterization and unconventional resource development.

- Environmental Tech Developers: Engagements with companies focused on carbon capture, utilization, and storage (CCUS) and emissions reduction technologies.

- Equipment Manufacturers: Working with leading manufacturers to deploy state-of-the-art drilling and production equipment, enhancing safety and efficiency.

Hess's key partnerships are fundamental to its operational success and risk management, particularly in large-scale projects like the Stabroek Block. These collaborations, often with industry majors such as ExxonMobil and CNOOC, facilitate the sharing of substantial capital expenditures required for exploration and production, thereby mitigating individual financial exposure.

Strategic alliances enable Hess to leverage complementary technical expertise and resources, which is critical for tackling the complexities and high costs associated with developing offshore assets. The company's involvement in the Stabroek Block, a highly productive discovery, exemplifies how these partnerships unlock significant value.

Hess also relies on partnerships with specialized oilfield service providers for essential functions like drilling, well completion, and seismic surveys. These relationships grant access to advanced technologies and skilled personnel, crucial for efficient and safe resource extraction. For example, in 2024, Hess continued to utilize these partnerships to optimize its operations in both the Bakken and the Stabroek Block.

Furthermore, Hess collaborates with pipeline operators, shipping companies, and terminal operators to ensure effective transportation of its oil and gas products to market. The Hess Midstream joint venture with Global Infrastructure Partners is a prime example, providing integrated midstream services and contributing to predictable revenue streams.

| Partner Type | Key Collaborators | Strategic Importance | 2024 Focus/Example |

|---|---|---|---|

| Joint Venture Partners (Exploration & Production) | ExxonMobil, CNOOC | Capital sharing, risk mitigation, technical expertise pooling for large offshore projects. | Continued development of Stabroek Block offshore Guyana. |

| Midstream Infrastructure Providers | Hess Midstream (JV with Global Infrastructure Partners) | Integrated gathering, processing, and transportation services; fee-based revenue. | Optimizing supply chain efficiency in the Bakken region. |

| Oilfield Service Providers | Specialized drilling, completion, and seismic companies | Access to cutting-edge technology and skilled personnel for efficient resource extraction. | Enhancing production optimization in key assets. |

| Technology & Research Partners | Technology firms, Research Institutions | Development of advanced drilling techniques, EOR methods, and environmental technologies. | Focus on technological advancements for production optimization and sustainability initiatives. |

What is included in the product

A detailed breakdown of Hess's strategic approach, mapping out its customer segments, value propositions, and key resources.

Organized into the 9 classic Business Model Canvas blocks, it offers a clear overview of Hess's operational framework and strategic intent.

It streamlines the complex process of understanding and refining business strategies, making it easier to pinpoint and address operational inefficiencies.

Activities

Hess Corporation actively engages in exploration and appraisal, focusing on identifying and confirming new hydrocarbon reserves. This key activity involves extensive geological and geophysical surveys, particularly in promising offshore regions like Guyana, the U.S. Gulf of Mexico, and Suriname. These efforts are crucial for discovering and delineating potential oil and gas fields.

Significant capital is allocated to seismic data acquisition and sophisticated interpretation techniques to pinpoint promising exploration targets. Furthermore, Hess drills appraisal wells to precisely determine the size, quality, and commercial viability of discovered reservoirs, ensuring that future production plans are based on robust data.

In 2023, Hess's exploration and appraisal activities, particularly in Guyana, continued to yield positive results, underpinning the company's future growth trajectory. The success in delineating these offshore assets is fundamental to Hess's long-term production strategy and its ability to meet future energy demands.

Hess Corporation’s Development and Production activities are centered on the exploration, development, and production of crude oil and natural gas. A significant portion of their operations is focused on the prolific Stabroek Block offshore Guyana, where they hold a 30% non-operating interest. In 2024, Hess continued to advance its development plans in Guyana, with the Liza Phase 1 and Liza Phase 2 projects contributing substantial production. The Payara development, targeting first oil in 2024, is also a key focus.

In addition to Guyana, Hess maintains substantial production from the Bakken shale play in North Dakota, where they hold a significant acreage position. Their operations there involve drilling and completing wells to extract oil and gas. In the first quarter of 2024, Hess reported an average daily production of approximately 143,000 boe/d from the Bakken, showcasing their continued commitment to this onshore asset.

Hess Corporation's hydrocarbon transportation involves a comprehensive network to move its crude oil and natural gas from production sites to market. This includes utilizing extensive pipeline systems for efficient land-based transport and chartering crude oil tankers for maritime logistics, ensuring products reach customers safely and reliably.

In 2024, Hess continued to focus on optimizing these transportation assets. For instance, the company's operations in the Bakken shale play rely heavily on pipeline infrastructure to move crude oil to refineries and export terminals, a critical component for generating revenue from its production.

Marketing and Sales

Hess's marketing and sales activities are central to its operations, focusing on the efficient sale of crude oil, natural gas, and natural gas liquids (NGLs). These products are sold to a diverse customer base, including refiners who process them into fuels and energy traders who participate in global commodity markets. This requires sophisticated management of supply contracts, dynamic pricing strategies, and a deep understanding of international energy market fluctuations.

In 2024, Hess continued to leverage its production capabilities to meet market demand. For instance, its Bakken production, a key asset, consistently contributes to its sales volumes. The company's ability to secure favorable pricing and maintain consistent demand is directly tied to its marketing prowess. For example, Hess reported total oil and gas production of approximately 350,000 barrels of oil equivalent per day in early 2024, underscoring the scale of its sales operations.

- Crude Oil Sales: Direct sales to refiners and traders, often involving complex logistics and contract negotiations.

- Natural Gas and NGLs: Marketing these products to utilities, industrial users, and petrochemical companies.

- Market Navigation: Adapting to price volatility and supply/demand dynamics in global energy markets.

- Contract Management: Ensuring favorable terms and reliable offtake for Hess's production.

Capital Allocation and Portfolio Management

Hess Corporation prioritizes disciplined capital allocation, focusing on high-return resource opportunities to maximize shareholder value. This strategy involves making deliberate choices about where to invest in new projects, such as their significant stake in the Stabroek Block offshore Guyana. In 2024, Hess continued to advance its development plans there, aiming for efficient production and cost management.

Managing its asset portfolio is crucial for Hess. This includes strategic decisions to divest non-core assets that may not align with long-term growth objectives and optimizing the performance of existing operations. This proactive portfolio management aims to enhance profitability and ensure resources are directed towards the most promising ventures.

Prudent financial management is the bedrock of Hess's profitability and growth strategy. The company's approach to capital allocation and portfolio management is underpinned by a commitment to financial discipline, ensuring that investments are made with a clear view toward generating sustainable returns for stakeholders.

- Disciplined Capital Allocation: Focusing investments on high-return opportunities like the Stabroek Block.

- Strategic Portfolio Management: Divesting non-core assets and optimizing existing operations for enhanced value.

- Financial Prudence: Maintaining strong financial management to support profitability and long-term growth.

- Shareholder Value Focus: All capital allocation and portfolio decisions are geared towards creating long-term shareholder value.

Hess's key activities revolve around the exploration, development, and production of oil and gas. A substantial focus is on offshore Guyana, specifically the Stabroek Block, where Hess holds a 30% interest. In 2024, the company continued to progress development projects like Payara, aiming for first oil. Additionally, Hess maintains significant production from the Bakken shale in North Dakota, reporting approximately 143,000 boe/d from this region in Q1 2024.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Exploration & Appraisal | Identifying and confirming new hydrocarbon reserves. | Continued success in Guyana; seismic surveys and appraisal drilling. |

| Development & Production | Bringing discovered fields online and extracting resources. | Advancing Guyana projects (Liza Phase 1 & 2, Payara); Bakken production averaging ~143,000 boe/d (Q1 2024). |

| Transportation | Moving crude oil and natural gas to market. | Optimizing pipeline networks in the Bakken; utilizing crude oil tankers. |

| Marketing & Sales | Selling crude oil, natural gas, and NGLs to diverse customers. | Leveraging production capabilities; navigating market dynamics; total production ~350,000 boe/d (early 2024). |

| Capital Allocation & Portfolio Management | Investing in high-return opportunities and managing assets. | Focus on Guyana; divestment of non-core assets; ensuring financial discipline. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document your customers will receive upon purchase, showcasing its comprehensive structure and professional design. This isn't a sample; it's a direct representation of the final, ready-to-use file, ensuring complete transparency and no surprises. Once your order is confirmed, you'll gain full access to this identical document, allowing you to immediately begin refining your business strategy.

Resources

Hess's core tangible assets are its proved and probable oil and natural gas reserves. The Stabroek Block in Guyana and the Bakken Shale in North Dakota are particularly significant, forming the backbone of its production capacity and future revenue streams.

As of year-end 2023, Hess reported approximately 1.6 billion barrels of proved oil and gas reserves. The company's extensive exploration and appraisal activities in the Stabroek Block have consistently added to this resource base, demonstrating the high quality and growth potential of these key assets.

Hess Corporation’s production infrastructure includes offshore platforms, drilling rigs, and extensive pipeline networks. These are vital for their exploration, development, and production activities, particularly in the Gulf of Mexico and the Bakken shale play. For example, as of the first quarter of 2024, Hess reported a production capacity of approximately 149,000 barrels of oil equivalent per day (boepd) from its U.S. assets, underscoring the operational scale of its infrastructure.

The company’s commitment to maintaining and upgrading this complex infrastructure is substantial, involving significant capital expenditure. In 2023, Hess invested billions in its key assets, including those requiring robust production facilities and transportation systems. This ongoing investment ensures operational efficiency and adherence to stringent safety and environmental standards, which are paramount in the energy sector.

Hess Corporation's business model relies heavily on access to substantial financial capital, encompassing equity, debt, and retained earnings. This financial muscle is critical for funding its capital-intensive operations, such as the extensive exploration and development activities in the Stabroek Block offshore Guyana. For instance, in the first quarter of 2024, Hess reported capital and exploratory expenditures of $598 million, highlighting the ongoing need for significant investment.

This robust financial backing enables Hess to undertake ambitious projects that require substantial upfront investment, including drilling new wells, constructing essential infrastructure like floating, production, storage, and offloading (FPSO) vessels, and acquiring valuable new leases. The company's ability to secure and manage this capital effectively is paramount to its growth trajectory and its capacity to capitalize on high-return opportunities.

Furthermore, maintaining strong financial health is crucial for Hess to navigate the inherent volatility of the oil and gas industry. This financial resilience allows the company to weather commodity price fluctuations and other market uncertainties, ensuring it can continue to invest in its strategic priorities and deliver value to its shareholders even during challenging periods.

Skilled Workforce and Expertise

Hess Corporation's business model hinges on its highly skilled workforce, a critical asset for navigating the complexities of hydrocarbon exploration and production. This team includes specialized geoscientists, engineers, project managers, and operational staff, all possessing deep expertise in the industry. Their collective knowledge is fundamental to driving innovation, ensuring operational efficiency, and maintaining the highest standards of safety in project execution.

The company recognizes that its human capital is paramount. In 2024, Hess continued to invest in talent development, understanding that attracting and retaining top-tier professionals provides a significant competitive edge. This focus on expertise is directly linked to their ability to successfully manage challenging projects and adapt to evolving market dynamics.

Key aspects of Hess's skilled workforce include:

- Deep Domain Expertise: Professionals with specialized knowledge in areas like seismic interpretation, reservoir engineering, and offshore operations.

- Project Management Prowess: Experienced individuals capable of overseeing large-scale, capital-intensive projects from conception to completion.

- Operational Excellence: Staff dedicated to ensuring safe, efficient, and environmentally responsible day-to-day operations.

- Innovation and Adaptability: A workforce equipped to identify and implement new technologies and strategies in a dynamic energy landscape.

Intellectual Property and Technology

Hess Corporation's intellectual property and technology are cornerstones of its operational success. Proprietary knowledge in areas like advanced drilling techniques and seismic interpretation technologies allows for more precise resource identification and extraction. These technological assets are crucial for Hess to operate efficiently, cut costs, and improve safety. For instance, in 2024, Hess continued to leverage its advanced technologies in its Bakken operations, contributing to improved well productivity and reduced drilling times.

Environmental management systems also form a significant part of Hess's intellectual property. These systems are designed to mitigate environmental impact, a critical factor in the oil and gas industry. The company's commitment to responsible operations is reflected in its continuous investment in research and development, ensuring it stays at the forefront of technological adoption. This focus on innovation is vital for maintaining a competitive edge in the dynamic energy market.

- Proprietary Knowledge: Advanced drilling and seismic interpretation technologies are key assets.

- Operational Efficiency: These technologies enable Hess to reduce costs and enhance safety.

- Environmental Stewardship: Robust environmental management systems are integral to their IP.

- Competitive Advantage: Continuous R&D and tech adoption are vital for market position.

Hess's key resources include its significant oil and gas reserves, particularly in Guyana and the Bakken. These reserves are backed by substantial production infrastructure and a strong financial position, enabling continued investment in exploration and development.

The company's skilled workforce, possessing deep expertise in geosciences and engineering, alongside proprietary technologies for drilling and seismic analysis, forms a critical intellectual capital base. These elements collectively drive operational efficiency, safety, and competitive advantage in the energy sector.

| Resource Category | Key Components | Significance for Hess |

|---|---|---|

| Physical Assets | Proved & probable reserves (Guyana, Bakken) | Core revenue generation and future growth potential. |

| Infrastructure | Offshore platforms, pipelines, FPSOs | Enables exploration, development, and production operations. |

| Financial Capital | Equity, debt, retained earnings | Funds capital-intensive projects and operational needs. |

| Human Capital | Skilled geoscientists, engineers, operational staff | Drives innovation, efficiency, and safety. |

| Intellectual Property | Proprietary drilling & seismic tech, environmental systems | Enhances resource identification, cost reduction, and competitive edge. |

Value Propositions

Hess Corporation is a key player in ensuring a reliable energy supply, offering a consistent and significant volume of crude oil and natural gas. This commitment directly contributes to global energy security by providing essential hydrocarbon resources.

Their strategic operations in prolific regions such as Guyana and the Bakken shale formation are vital for supplying refiners and consumers globally. In 2024, Hess continued to be a major producer, with its Guyana assets alone contributing substantially to its overall output, underscoring its role in meeting ongoing energy demands.

Hess focuses on building long-term shareholder value by strategically investing in promising resource projects and maintaining operational efficiency. This commitment is reflected in their consistent capital allocation towards high-return opportunities.

The company actively returns capital to shareholders through dividends and share buybacks, aiming for sustainable growth. Financial performance and delivering strong shareholder returns are core to Hess's value proposition.

For instance, in the first quarter of 2024, Hess reported a net loss of $126 million, or $0.40 per share, but highlighted progress in its Bakken and Guyana operations, key drivers for future value creation.

Hess is dedicated to minimizing its environmental impact through responsible operations, including a commitment to reducing greenhouse gas emissions and managing water resources effectively.

The company aims to achieve zero routine flaring by the end of 2025, a significant step in sustainable energy development. For instance, in 2023, Hess reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity compared to 2019 levels.

Adhering to rigorous safety standards is paramount, ensuring the well-being of employees and the communities where Hess operates. This commitment to sustainability not only strengthens Hess's reputation but also aligns with growing stakeholder expectations for environmentally conscious energy production.

High-Quality Hydrocarbon Products

Hess Corporation is a key player in the energy sector, focusing on the production of high-quality crude oil and natural gas. These products are engineered to meet the stringent specifications demanded by refiners and various industrial clients, ensuring broad market appeal and premium pricing. For example, Hess's crude oil from the Stabroek Block in Guyana is particularly valued in global markets for its desirable characteristics, contributing significantly to the company's revenue streams.

The superior quality of Hess's hydrocarbon output directly translates into competitive advantages. This focus on quality ensures that their products are not only readily marketable but also command higher prices on the international stage. This strategic emphasis on product excellence underpins Hess's value proposition in the energy market.

- Premium Marketability: Hess's crude oil and natural gas consistently meet international quality standards.

- Stabroek Block Advantage: High-quality crude from Guyana's Stabroek Block is a prime example of their sought-after output.

- Premium Pricing: Product quality allows Hess to secure better pricing in competitive global markets.

- Customer Specifications: Products are tailored to meet the precise needs of refiners and industrial customers.

Strategic Resource Development

Hess's strategic resource development centers on its ownership of world-class assets, notably the Stabroek Block offshore Guyana and the Bakken Shale in North Dakota. These locations represent significant, economically viable energy reserves, offering a distinct advantage in the global energy landscape.

The company's proficiency in navigating the complexities of developing these resource-rich plays translates into a unique value proposition for energy markets. This specialized expertise allows Hess to unlock substantial production potential from challenging geological formations.

This deliberate focus on high-quality, strategically important assets underpins Hess's robust and resilient asset base, positioning the company for sustained future growth and value creation.

- Stabroek Block (Guyana): Hess holds a 30% non-operating interest in this prolific offshore block, which has seen multiple significant discoveries. As of the first quarter of 2024, gross production from the Liza Phase 1 and Phase 2 projects was averaging over 600,000 barrels of oil per day.

- Bakken Shale (USA): Hess is a leading producer in the Bakken, focusing on efficient development of its extensive acreage. In 2023, Hess's Bakken net production averaged approximately 175,000 barrels of oil equivalent per day.

- Resource Potential: The Stabroek Block alone is estimated to contain more than 11 billion barrels of recoverable oil equivalent, highlighting the immense long-term potential of Hess's core asset portfolio.

Hess offers reliable energy supply through its significant crude oil and natural gas production, contributing to global energy security. Their strategic focus on high-quality assets like the Stabroek Block in Guyana and the Bakken Shale in the US ensures consistent delivery to refiners and consumers. For instance, in the first quarter of 2024, Hess's Guyana operations continued to be a primary driver of its production volumes.

Hess is committed to maximizing shareholder value by investing in high-return projects and maintaining operational efficiency. This is supported by consistent capital allocation towards growth opportunities, aiming for sustainable returns. The company actively returns capital to shareholders through dividends and buybacks, demonstrating a clear focus on financial performance.

The company prioritizes minimizing environmental impact through responsible operations, including emission reduction targets and effective water management. Hess aims for zero routine flaring by the end of 2025, underscoring its dedication to sustainable energy development. In 2023, Hess reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity compared to 2019 levels.

| Key Performance Indicator | 2023 (Average) | Q1 2024 (Reported) | Outlook |

|---|---|---|---|

| Guyana Production (Net BOE/d) | ~250,000 | ~275,000 | Expected to increase with new FPSOs |

| Bakken Production (Net BOE/d) | ~175,000 | ~170,000 | Stable to moderate growth |

| Shareholder Returns (Dividends & Buybacks) | $1.5 billion | $375 million (Q1) | Ongoing capital return program |

| GHG Emissions Intensity Reduction | Progress reported vs. 2019 | Continued focus on reduction | Targeting zero routine flaring by end of 2025 |

Customer Relationships

Hess secures its revenue streams through long-term supply agreements with a diverse customer base, including refiners, traders, and industrial entities. These crucial contracts ensure a steady demand for their crude oil and natural gas, fostering revenue stability and predictability.

These enduring commercial relationships are foundational in the volatile commodity market, offering Hess a significant competitive advantage. For instance, in 2024, Hess continued to emphasize the importance of these partnerships in its investor communications, highlighting how they mitigate price volatility and guarantee market access for its production.

Hess actively engages its investor base through quarterly earnings calls and detailed investor presentations, ensuring transparency regarding financial performance and strategic initiatives. This consistent communication, including comprehensive annual reports, is vital for building trust and attracting necessary capital for growth.

Hess Corporation actively cultivates robust relationships with governments and communities where it operates. In 2024, the company continued its commitment to transparent communication and community investment, recognizing these as cornerstones for maintaining its social license to operate. This proactive engagement helps mitigate potential operational disruptions and fosters mutual understanding.

The company's community investment programs in 2024 focused on areas such as education, health, and economic development. For instance, in Guyana, Hess has been a significant contributor to local capacity building and infrastructure projects, aiming to ensure that the benefits of its operations are shared broadly within the host nation. These initiatives are crucial for long-term stability and positive stakeholder perception.

Addressing local concerns promptly and effectively is a key element of Hess's strategy. By actively listening to and responding to the needs and feedback from local communities and indigenous populations, Hess aims to build trust and ensure that its operations are conducted in a manner that respects cultural heritage and environmental stewardship. This approach is fundamental to sustainable business practices in the energy sector.

Industry Collaboration and Partnerships

Hess actively cultivates industry collaboration through joint ventures, leveraging shared expertise and resources. For instance, in 2024, their Bakken Shale operations involve significant partnerships, enhancing efficiency and operational safety by pooling knowledge on best practices. This collaborative approach extends to industry associations, where Hess participates in discussions to shape regulatory frameworks and advocate for common interests, contributing to a more stable operating environment.

These strategic alliances are crucial for tackling sector-wide challenges. By engaging with regulatory bodies and peers, Hess influences policy development and promotes higher standards in areas like environmental stewardship and safety protocols. This collective action, evident in ongoing industry-wide safety initiatives throughout 2024, strengthens the overall resilience and sustainability of the energy sector.

- Joint Ventures: Hess’s participation in joint ventures, particularly in key production areas, allows for risk sharing and access to complementary technologies and expertise, optimizing resource development.

- Industry Associations: Active membership in organizations like the American Petroleum Institute (API) enables Hess to contribute to and benefit from industry-wide standards and policy advocacy, influencing the regulatory landscape.

- Regulatory Engagement: Collaboration with regulatory bodies ensures compliance and allows Hess to provide input on evolving environmental and safety regulations, fostering a predictable operating framework.

Supplier and Vendor Management

Hess Corporation prioritizes robust supplier and vendor relationships, recognizing their critical role in maintaining operational efficiency and cost-effectiveness. This involves fostering clear communication channels, adhering to fair contracting principles, and diligently monitoring vendor performance to guarantee the quality and reliability of essential equipment, services, and materials. In 2024, Hess continued to emphasize these partnerships to ensure a stable supply chain, a vital component for upstream oil and gas operations.

- Key Supplier Interactions: Hess engages with a diverse range of suppliers for drilling equipment, exploration technology, and logistical support.

- Performance Metrics: Vendor performance is often evaluated based on delivery timeliness, product quality, and adherence to safety standards.

- Contractual Agreements: Fair and transparent contracts are fundamental to securing long-term, reliable partnerships.

- Operational Impact: Strong supplier relationships directly contribute to minimizing downtime and controlling operational expenditures.

Hess cultivates strong relationships with its customers, primarily refiners and traders, through long-term supply agreements that ensure stable demand for its oil and gas. These partnerships are critical for navigating market volatility, as highlighted by Hess's consistent emphasis on their value in 2024 communications.

Channels

Hess Midstream’s extensive pipeline and gathering systems are the backbone of its onshore operations, particularly in the Bakken Shale. These networks efficiently move crude oil and natural gas from wellheads to processing plants and major transportation points, ensuring cost-effectiveness for large-volume movements. In 2024, Hess Midstream reported significant throughput volumes, underscoring the critical role of this infrastructure in maintaining consistent production flow and supporting Hess Corporation's overall output.

Crude oil tankers are a critical component of Hess's offshore operations, especially for transporting crude from the Stabroek Block. Hess manages the complex logistics of chartering these vessels to deliver oil to global markets and refineries.

The safe and efficient maritime transportation of crude oil via tankers is paramount to Hess's business model. This ensures that valuable production from remote offshore sites reaches its intended destinations worldwide.

In 2024, the tanker market saw fluctuating rates influenced by global demand and geopolitical events. For instance, the average daily rate for a Suezmax tanker, often used for medium-haul crude transport, experienced significant volatility throughout the year, impacting Hess's operational costs and profitability.

Hess Corporation's direct sales channel involves selling crude oil and natural gas straight to refiners, petrochemical facilities, and commodity traders. This approach bypasses intermediaries, fostering more direct and potentially more profitable transactions.

These direct relationships enable Hess to negotiate customized supply agreements tailored to specific customer requirements and market dynamics. This allows for greater flexibility and responsiveness in meeting demand.

In 2024, Hess's focus on direct sales contributed to its ability to optimize pricing by directly responding to fluctuating market conditions and individual customer needs, enhancing its market position.

Investor Relations Platforms

Hess Corporation leverages its corporate website, financial news services, and participation in investor conferences as key channels to engage with its stakeholders. These platforms are crucial for disseminating vital information such as quarterly earnings reports, operational performance updates, and significant strategic developments. For instance, in 2024, Hess continued to provide detailed financial results and outlooks through these avenues, ensuring transparency with its investor base.

The effectiveness of these communication channels directly impacts investor confidence and, consequently, the company's market valuation. By consistently delivering timely and accurate information, Hess aims to build trust and demonstrate its commitment to shareholder value. These channels serve as the primary interface for financial analysts to gather data for their valuations and recommendations.

Key communication activities through these channels in 2024 included:

- Dissemination of Quarterly Financial Reports: Providing detailed income statements, balance sheets, and cash flow statements to the investment community.

- Operational Updates: Sharing progress on key projects, such as the development of the Bakken and the Stabroek Block offshore Guyana.

- Strategic Announcements: Communicating significant corporate decisions, including potential mergers, acquisitions, or divestitures, as well as capital allocation strategies.

Industry Conferences and Associations

Hess actively participates in key industry conferences, trade shows, and energy associations. These gatherings are crucial for networking, fostering business development, and highlighting Hess's technological advancements and commitment to sustainability. For instance, in 2024, Hess representatives were prominent at events like the Offshore Technology Conference (OTC) and the American Association of Petroleum Geologists (AAPG) Annual Conference, engaging with industry peers and potential collaborators.

These platforms enable direct interaction with a broad spectrum of stakeholders, including potential partners, customers, and influential policymakers. Such engagement is vital for understanding market trends and shaping regulatory landscapes. In 2024, Hess leveraged these channels to discuss its Guyana offshore developments, a key growth area for the company.

- Networking and Business Development: Participation in events like the International Energy Week provides direct access to potential partners and clients, facilitating new business opportunities.

- Showcasing Capabilities: Conferences allow Hess to demonstrate its expertise in offshore exploration and production, as well as its advancements in environmental, social, and governance (ESG) initiatives.

- Thought Leadership and Advocacy: Hess uses these forums to share insights on industry challenges and advocate for policies that support responsible energy development, contributing to shaping industry best practices.

- Market Intelligence: Attending these events provides valuable real-time information on competitor activities, technological innovations, and evolving market demands, informing strategic decision-making.

Hess’s channels for delivering its products primarily involve its extensive midstream infrastructure and the use of crude oil tankers. The pipeline and gathering systems, especially in the Bakken, are crucial for moving oil and gas from wells to processing facilities. In 2024, Hess Midstream reported substantial throughput volumes, highlighting the efficiency of these networks.

For offshore production, particularly from the Stabroek Block, Hess relies on crude oil tankers to transport its valuable output to global markets. The company manages the logistics of chartering these vessels, ensuring timely delivery. The tanker market in 2024 experienced significant rate fluctuations due to global demand and geopolitical factors, impacting Hess’s transportation costs.

Hess also utilizes direct sales channels, selling crude oil and natural gas directly to refiners, petrochemical companies, and traders. This strategy allows for more profitable transactions and customized supply agreements. In 2024, this direct approach enabled Hess to better optimize pricing in response to market conditions.

Hess communicates with stakeholders through its corporate website, financial news services, and investor conferences. These channels are vital for sharing financial results, operational updates, and strategic developments. In 2024, Hess continued to provide detailed financial information and outlooks, reinforcing transparency with investors.

Participation in industry conferences and associations is another key channel for Hess. These events facilitate networking, business development, and the showcasing of technological advancements and ESG commitments. In 2024, Hess was active at major industry events, discussing its growth projects, particularly in Guyana.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Midstream Infrastructure (Pipelines/Gathering Systems) | Efficiently moves crude oil and natural gas from wellheads to processing and transportation hubs. | Significant throughput volumes reported by Hess Midstream, underscoring operational efficiency. |

| Crude Oil Tankers | Maritime transport of crude oil from offshore production sites to global markets. | Chartering logistics managed by Hess; tanker rates in 2024 were volatile, impacting costs. |

| Direct Sales | Selling products directly to refiners, petrochemical facilities, and traders. | Enabled optimized pricing and customized supply agreements in 2024. |

| Corporate Website/Financial News/Investor Conferences | Dissemination of financial reports, operational updates, and strategic news. | Continued detailed financial reporting and outlooks provided in 2024 to investors. |

| Industry Conferences/Trade Shows/Associations | Networking, business development, showcasing capabilities, and thought leadership. | Active participation in major industry events in 2024, highlighting growth areas like Guyana. |

Customer Segments

Global oil refineries represent a cornerstone customer segment for Hess. These entities rely on a steady influx of crude oil to fuel their complex processing operations, transforming it into essential refined products such as gasoline, diesel, and aviation fuel. For example, in 2023, global refinery utilization rates averaged around 81%, highlighting the consistent demand for crude oil inputs.

Refineries have specific requirements for crude oil grades to optimize their output and maintain operational efficiency. Hess's ability to offer a diverse portfolio of crude oil types, catering to different processing capabilities and desired product slates, positions it as a valuable supplier to this segment. The company's production in 2023 included a mix of light and heavy crudes, providing flexibility for its refinery customers.

Natural gas utilities, power generators, and large industrial facilities represent a key customer segment for Hess. These entities rely on natural gas for essential energy needs and as a crucial feedstock in their operations. For instance, in 2024, the U.S. Energy Information Administration (EIA) reported that natural gas remained the largest source of electricity generation, highlighting the consistent demand from power producers.

Customers in this segment prioritize long-term, dependable supply agreements to ensure operational stability and manage price volatility. Hess's strategic focus on producing natural gas, particularly from prolific plays like the Bakken shale formation, directly addresses this need for reliable, large-volume supply to meet significant industrial and utility demands.

Energy trading houses are crucial partners, buying crude oil and natural gas from Hess to resell in different markets. They capitalize on price differences and their logistics expertise, ensuring Hess's products reach a wider audience.

These traders inject vital liquidity into the market and significantly extend Hess's reach. For instance, in 2024, global energy trading volumes continued to be substantial, with major players facilitating billions of dollars in transactions daily, underscoring their role in connecting Hess's supply with diverse international demand.

Shareholders and Investors

Shareholders and investors are a vital customer segment for Hess, even though they don't directly consume hydrocarbons. Their primary interest lies in achieving financial returns through stock price growth and dividend payouts. Hess's entire business model is structured to generate and sustain long-term value for these crucial stakeholders.

Maintaining a strong level of investor confidence is absolutely essential for Hess, as it directly impacts the company's ability to access the capital markets needed to fund its operations and future projects. For instance, in 2023, Hess reported total revenues of $10.7 billion, underscoring the scale of operations that require consistent financial backing.

- Financial Returns: Investors expect Hess to deliver competitive returns on their investment through stock appreciation and dividends.

- Capital Access: Positive investor sentiment is critical for Hess to raise capital for exploration, development, and operational needs.

- Long-Term Value Creation: Hess's strategy focuses on creating sustainable value that benefits shareholders over the long haul.

- Dividend History: Hess has a history of paying dividends, which is a key attraction for income-focused investors.

Governments and Regulatory Bodies (as stakeholders)

Governments in Hess's operating regions, such as Guyana and the United States, are critical stakeholders. They act as regulators, license providers, and major recipients of revenue through royalties and taxes. For instance, Guyana's government plays a pivotal role in the Stabroek Block development, where Hess holds a significant stake, influencing production levels and revenue sharing.

These governmental entities set the operational and fiscal frameworks that directly impact Hess's profitability and strategic planning. Their policies, including environmental regulations and tax structures, are paramount for Hess's long-term viability and expansion. Hess's 2023 financial reports indicate substantial royalty and tax payments to host governments, underscoring their financial impact.

- Regulatory Frameworks: Governments establish the rules and standards under which Hess operates, covering exploration, production, safety, and environmental protection.

- Fiscal Contributions: Hess contributes significantly to government revenues through royalties, production sharing agreements, and various taxes. In 2023, Hess's tax and royalty payments to Guyana were a substantial portion of the nation's GDP.

- Licensing and Permits: Government approval is essential for Hess to acquire and maintain exploration and production licenses, directly enabling their core business activities.

- National Interest Alignment: Hess's operations must often align with national development goals and local content requirements, necessitating close collaboration with government bodies.

Hess's customer segments are diverse, ranging from global oil refineries and natural gas utilities to energy trading houses and, crucially, shareholders. Each segment has distinct needs, from reliable supply and operational efficiency to financial returns and capital access.

Refineries require specific crude oil grades, and Hess's varied production caters to this. Utilities and power generators depend on consistent natural gas supply, a need Hess addresses through its production in key plays. Energy traders facilitate market liquidity and expand Hess's reach, while shareholders are focused on the company's overall financial performance and long-term value creation.

Governments are also key stakeholders, setting regulatory and fiscal frameworks that directly influence Hess's operations and profitability. Their role in licensing and revenue collection is paramount.

| Customer Segment | Key Needs | Hess's Offering/Relevance | 2023/2024 Data Point |

|---|---|---|---|

| Global Oil Refineries | Steady crude oil supply, specific grades | Diverse crude oil portfolio | Global refinery utilization averaged ~81% in 2023. |

| Natural Gas Utilities & Power Generators | Dependable, long-term natural gas supply | Production from prolific plays (e.g., Bakken) | Natural gas was largest source of U.S. electricity generation in 2024. |

| Energy Trading Houses | Liquidity, market access, price arbitrage | Facilitate wider market reach for Hess's products | Global energy trading volumes remain substantial in 2024. |

| Shareholders/Investors | Financial returns (stock growth, dividends), capital access | Focus on long-term value creation and financial performance | Hess reported total revenues of $10.7 billion in 2023. |

| Governments (Host Nations) | Royalties, taxes, regulatory compliance, alignment with national interests | Operates within government-defined frameworks, contributes revenue | Hess's tax and royalty payments to Guyana were a substantial portion of its GDP in 2023. |

Cost Structure

Hess invests heavily in exploration and development, a core part of its cost structure. This involves significant capital for seismic surveys, drilling exploration and appraisal wells, and building new production facilities like platforms and pipelines. These are crucial, long-term investments to find and access new oil and gas reserves.

In 2024, Hess's capital and exploratory expenditures were projected to be around $3.0 billion, highlighting the substantial financial commitment required for these upstream activities. These expenditures are fundamental to the company's strategy of growing its reserve base and future production volumes.

Hess Corporation's production operating expenses are the recurring costs essential for keeping its oil and gas fields running daily. These include everything from paying the people who work the fields to maintaining the machinery, covering utility bills, and using chemicals for extraction. For instance, in 2023, Hess reported total production and operating expenses of approximately $2.1 billion, a significant portion of their overall cost base.

These operational expenditures directly influence the netback price Hess receives for each barrel of oil or cubic foot of natural gas it produces. Efficient management of these costs is therefore paramount for ensuring the company's profitability and competitiveness in the energy market. The company's focus on optimizing these expenses is a key driver in its financial performance.

Hess Corporation incurs significant costs to transport its crude oil and natural gas from production sites to customers. These include pipeline tariffs, which can vary based on volume and distance, as well as shipping fees for any seaborne transport. Terminal charges for storage and handling also add to the overall expense.

Marketing overhead, encompassing sales teams and promotional activities, further contributes to these costs. For instance, in 2024, Hess's transportation and marketing expenses are a critical component of its operational budget, directly influencing the net realized price of its hydrocarbons. Efficient logistics and securing favorable transportation contracts are therefore paramount to maintaining profitability.

Taxes, Royalties, and Lease Operating Expenses

Hess Corporation faces substantial costs related to taxes, royalties, and lease operating expenses. These are fundamental components of their cost structure in the oil and gas sector. Royalties, for instance, are payments made to mineral rights holders, often a percentage of production or revenue, directly impacting profitability. Lease operating expenses cover the day-to-day costs of running oil and gas wells, including labor, maintenance, and materials.

In 2024, Hess's financial performance is significantly influenced by these expenditures. Effective tax planning and management of operational costs are crucial for maintaining competitive margins. These costs can fluctuate based on production levels, commodity prices, and regulatory environments.

- Taxes: Hess is subject to various income and production taxes, which can be a significant expense.

- Royalties: Payments to governments and landowners for the right to extract resources are a direct cost tied to production volume.

- Lease Operating Expenses (LOE): These are the ongoing costs to maintain producing wells and facilities, including labor, repairs, and supplies.

- Impact on Profitability: Managing these costs effectively is vital for Hess to maximize its net revenue and ensure financial health in the volatile energy market.

Decommissioning and Environmental Liabilities

Hess Corporation faces significant future costs related to decommissioning and environmental liabilities. These involve dismantling and abandoning oil and gas facilities once they are no longer productive, alongside expenses for environmental cleanup and remediation. For example, in 2024, Hess continued to incur costs for asset retirement obligations, a crucial component of its long-term financial planning.

These are substantial, long-term financial commitments that necessitate careful budgeting and the establishment of adequate financial provisions. Responsible closure practices are fundamental to Hess's commitment to sustainable operations and maintaining its social license to operate.

- Asset Retirement Obligations: Costs associated with the physical dismantling and removal of offshore platforms and onshore facilities.

- Environmental Remediation: Expenses for cleaning up any environmental impact from past or present operations, such as soil or water contamination.

- Financial Provisioning: Setting aside funds over the life of an asset to cover these future decommissioning and environmental costs.

- Regulatory Compliance: Ensuring all closure activities meet stringent environmental and safety regulations to avoid penalties and reputational damage.

Hess's cost structure is heavily influenced by its upstream activities, including exploration and development, which require substantial capital. Production operating expenses are the recurring costs to keep fields running, while transportation and marketing costs ensure product delivery. Additionally, taxes, royalties, and lease operating expenses are fundamental, alongside long-term commitments for decommissioning and environmental liabilities.

| Cost Category | 2023 (Approximate) | 2024 Projection |

| Capital & Exploratory Expenditures | N/A | $3.0 billion |

| Production & Operating Expenses | $2.1 billion | N/A |

| Transportation & Marketing Expenses | N/A | Critical Component |

| Asset Retirement Obligations | Ongoing Costs | Ongoing Costs |

Revenue Streams

Hess Corporation's primary revenue source is the sale of crude oil, directly impacting its financial performance. This revenue is driven by the quantity of oil sold and fluctuating global market prices, making it a dynamic income stream.

The Stabroek Block in Guyana has become a pivotal contributor to Hess's crude oil sales. In the first quarter of 2024, Hess reported net oil production of 122,000 barrels per day from this block, with its share of sales directly feeding into this revenue stream.

Hess generates revenue from selling natural gas, mainly from its onshore Bakken Shale operations. This gas is sold to utilities and industrial clients, with the income directly tied to the volume of gas produced and prevailing market prices. For instance, in the first quarter of 2024, Hess reported a significant portion of its revenue from natural gas sales, underscoring its importance as a diversified income source alongside oil.

Hess Corporation generates revenue through the sale of Natural Gas Liquids (NGLs), including ethane, propane, and butane, which are extracted from natural gas. These NGLs represent a distinct revenue stream, with their market prices fluctuating based on supply and demand dynamics.

In 2024, Hess's NGL sales contributed to the overall value derived from its natural gas production, enhancing the profitability of its midstream operations. The company's ability to capture and market these valuable byproducts diversifies its income sources beyond just crude oil and natural gas.

Farm-out Agreements and Asset Sales

Hess Corporation can generate revenue through farm-out agreements, a common practice in the oil and gas industry. In these deals, Hess sells a stake in a specific exploration block or producing asset to another energy company. This transaction often involves an upfront cash payment and the buyer agreeing to cover a portion of Hess's future exploration and development expenses, effectively carrying those costs.

These farm-out agreements serve a dual purpose: they provide immediate capital and reduce Hess's financial exposure in high-risk exploration ventures. For instance, in 2023, Hess continued to manage its portfolio, which can involve such strategic asset dispositions to optimize its asset base and focus on core growth areas.

Beyond farm-outs, Hess also generates revenue or recycles capital through the periodic sale of non-core assets. These divestitures allow the company to streamline operations, exit less strategic business segments, and reinvest proceeds into more promising opportunities.

- Farm-out Revenue: Selling partial interests in exploration blocks or assets to other companies.

- Cost Carry: Receiving financial support from partners to cover future exploration and development costs.

- Non-Core Asset Sales: Divesting underperforming or non-strategic assets to improve portfolio efficiency.

- Capital Recycling: Using proceeds from asset sales to fund new growth initiatives.

Hedging Gains (Financial Instruments)

Hess Corporation utilizes financial instruments, such as futures and options contracts, to manage the inherent price volatility of crude oil and natural gas. While not a direct operational revenue source, successful hedging strategies can generate gains, thereby contributing to the company's overall financial performance and providing a degree of cash flow predictability. This approach is fundamentally about mitigating market risk rather than generating primary income.

For instance, in 2023, Hess reported realized gains and losses from its commodity derivative activities. While specific figures for hedging gains as a distinct revenue stream are often embedded within broader financial reporting, the company's disclosures indicate active management of price exposure. A significant portion of their hedging activity aims to lock in prices for a portion of their expected production, thereby reducing the impact of adverse price movements.

- Hedging Strategy: Utilizes futures and options to manage exposure to oil and natural gas price fluctuations.

- Impact on Revenue: Gains from hedging can offset potential losses, contributing to more stable financial results.

- Risk Mitigation: Primarily a tool to reduce financial risk and enhance cash flow predictability.

- 2023 Context: Hess actively managed commodity price risk through derivative instruments throughout 2023, as reflected in its financial reporting.

Hess Corporation's revenue primarily stems from the sale of crude oil and natural gas, with significant contributions from its operations in the Stabroek Block, Guyana. The company also generates income from the sale of Natural Gas Liquids (NGLs), which are byproducts of natural gas processing.

Strategic financial maneuvers, such as farm-out agreements and the sale of non-core assets, provide additional capital infusions and optimize the company's portfolio. Hedging activities, while primarily risk mitigation tools, can also result in realized gains that bolster overall financial performance.

| Revenue Stream | Primary Source | 2024 Data Point (Q1 unless specified) | Notes |

|---|---|---|---|

| Crude Oil Sales | Production from Stabroek Block, Guyana and Bakken Shale | 122,000 bpd net oil production from Stabroek Block | Highly sensitive to global market prices. |

| Natural Gas Sales | Onshore Bakken Shale operations | Significant revenue contribution reported | Sold to utilities and industrial clients. |

| Natural Gas Liquids (NGLs) Sales | Extracted from natural gas (e.g., ethane, propane) | Contributed to overall value in 2024 | Market prices fluctuate based on supply and demand. |

| Farm-out Agreements | Selling stakes in exploration blocks/assets | Ongoing portfolio management in 2023 | Provides upfront capital and reduces exploration risk. |

| Non-Core Asset Sales | Divesting underperforming or non-strategic assets | Periodic capital recycling | Streamlines operations and funds growth. |

| Hedging Gains | Gains from commodity derivative instruments | Realized gains/losses reported in 2023 | Mitigates price volatility and enhances cash flow predictability. |

Business Model Canvas Data Sources

The Business Model Canvas is built using comprehensive market research, customer feedback, and internal operational data. These diverse sources ensure a holistic and accurate representation of the business strategy.