Heartland Express SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heartland Express Bundle

Heartland Express, a leading force in the trucking industry, boasts a strong reputation for reliability and customer service, a significant strength in a competitive market. However, understanding the nuances of their operational efficiencies and potential regulatory impacts is crucial for informed decision-making.

Want the full story behind Heartland Express's competitive advantages, potential vulnerabilities, and future growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Heartland Express boasts a strong financial position, evidenced by total assets surpassing $1.3 billion and stockholders' equity exceeding $800 million as of March 31, 2025. This robust balance sheet underscores the company's financial stability and capacity for growth.

The company maintains excellent liquidity, holding a healthy cash balance and having effectively managed its debt. Notably, borrowings under its unsecured line of credit remain at zero, showcasing prudent financial management and a lack of immediate reliance on external debt financing.

This strong liquidity provides Heartland Express with significant financial flexibility, enabling it to comfortably manage ongoing operations and pursue strategic investment opportunities without undue financial strain.

Heartland Express demonstrates a strong commitment to shareholder returns, evidenced by its consistent dividend payments. Since 2003, the company has distributed over $556 million in cash dividends across 87 consecutive quarters, a testament to its financial discipline and shareholder-centric approach. This includes special dividends, further enhancing shareholder value.

The company's proactive approach to returning capital also includes an active share repurchase program. With an existing authorization to buy back its common stock, Heartland Express signals management's confidence in the company's intrinsic value and its ongoing strategy to boost per-share earnings.

Heartland Express boasts a modern and well-maintained fleet, a significant strength. As of March 31, 2025, the average age of its consolidated tractor fleet stood at a mere 2.6 years. This commitment to a newer fleet directly translates into improved fuel efficiency and lower maintenance expenses, bolstering operational efficiency and safety standards. Such an investment underscores the company's dedication to reliable and timely service.

Established Reputation for Safety and Service

Heartland Express boasts an established reputation for safety and service, a critical strength in the trucking industry. This is evidenced by significant industry recognition, including the PepsiCo 2024 Carrier of the Year (West) award and securing 2nd place in the TCA Fleet Safety Award 2024. These accolades highlight a consistent dedication to operational excellence and customer satisfaction.

The company's specialization in time-sensitive, dry van freight further solidifies its market position. By prioritizing safety protocols and on-time delivery performance, Heartland Express has cultivated trust among its clientele. This strong reputation is a key differentiator, aiding in retaining existing customers and attracting new business opportunities in a highly competitive sector.

- Industry Recognition: Awarded PepsiCo 2024 Carrier of the Year (West) and TCA Fleet Safety Award 2024 (2nd Place).

- Specialization: Focus on time-sensitive, dry van freight.

- Customer Focus: Emphasis on safety and on-time delivery builds trust.

- Market Advantage: Strong reputation drives customer retention and acquisition.

Strategic Acquisitions and Integration Efforts

Heartland Express has demonstrated a strategic approach to growth by integrating key acquisitions like Millis Transfer, Smith Transport, and Contract Freighters, Inc. (CFI). These moves have broadened its service offerings, notably strengthening its capabilities in cross-border freight operations.

The company is actively engaged in consolidating information systems and optimizing cost structures across its acquired brands. For instance, following the acquisition of CFI in 2021, significant efforts were directed towards integrating its operations and systems, a process that continued through 2023 and into 2024.

Successful integration of these entities is crucial for realizing substantial synergies and enhancing overall profitability. By mid-2024, the company reported progress in these integration efforts, aiming to leverage the combined scale and operational efficiencies to improve its competitive position in the freight market.

- Acquisition Scale: Expanded operational footprint through Millis Transfer, Smith Transport, and CFI.

- Service Enhancement: Improved cross-border freight capabilities.

- Integration Focus: Ongoing efforts to consolidate systems and optimize costs across acquired brands.

- Synergy Potential: Aiming for improved profitability through successful integration.

Heartland Express's financial strength is a significant advantage. As of March 31, 2025, the company reported total assets exceeding $1.3 billion and stockholders' equity over $800 million, indicating a stable financial foundation. This is further supported by zero borrowings on its unsecured line of credit, highlighting excellent liquidity and prudent debt management.

The company's commitment to shareholder value is evident through consistent dividend payments, with 87 consecutive quarterly distributions totaling over $556 million since 2003. Additionally, an active share repurchase program signals management's confidence in the company's intrinsic value.

A modern fleet, with an average tractor age of just 2.6 years as of March 31, 2025, contributes to operational efficiency through improved fuel economy and reduced maintenance costs. This investment in newer equipment enhances reliability and safety, key factors in customer satisfaction.

Heartland Express has earned a strong reputation for safety and service, recognized with awards like the PepsiCo 2024 Carrier of the Year (West) and a second-place finish in the TCA Fleet Safety Award 2024. Its specialization in time-sensitive, dry van freight, coupled with a focus on on-time delivery, builds customer trust and provides a competitive edge.

Strategic acquisitions, including Millis Transfer, Smith Transport, and CFI, have expanded Heartland Express's operational reach and service capabilities, particularly in cross-border freight. The company is actively working to consolidate systems and optimize costs across these acquired entities, aiming to realize significant synergies and improve overall profitability by mid-2024.

| Metric | Value (as of March 31, 2025) | Significance |

|---|---|---|

| Total Assets | >$1.3 billion | Indicates substantial operational scale and financial backing. |

| Stockholders' Equity | >$800 million | Demonstrates a strong equity base and financial stability. |

| Borrowings on Unsecured Line of Credit | $0 | Highlights excellent liquidity and minimal debt reliance. |

| Average Tractor Fleet Age | 2.6 years | Suggests operational efficiency, lower maintenance costs, and enhanced safety. |

| Consecutive Quarterly Dividends Paid | 87 | Reflects consistent financial discipline and commitment to shareholder returns. |

What is included in the product

This SWOT analysis identifies Heartland Express's strong operational efficiency and dedicated driver base as key strengths, while acknowledging potential weaknesses in fleet modernization and market diversification. It also explores opportunities in expanding specialized services and leveraging technology, alongside threats from rising fuel costs and increased competition.

Offers a clear, actionable SWOT analysis of Heartland Express's competitive landscape, pinpointing areas for growth and mitigating risks.

Identifies key market opportunities and internal capabilities for Heartland Express, enabling strategic adjustments to overcome industry challenges.

Weaknesses

Heartland Express has faced significant financial headwinds, reporting consecutive quarterly net losses. For instance, the company posted a net loss of $13.9 million in the first quarter of 2025 and $10.9 million in the second quarter of 2025. This trend extends to the full year 2024, where Heartland Express recorded a net loss of $29.7 million against operating revenues of $1.0 billion.

These financial results underscore a substantial decline in operating revenues year-over-year. The persistent losses and revenue contraction are symptomatic of broader industry challenges, specifically weak freight demand and an oversupplied market, which continue to pressure the company's profitability.

While Heartland Express’s core operations remained strong, the integration of acquired companies like Millis Transfer, Smith Transport, and CFI presented profitability hurdles. These acquired segments grappled with issues such as underutilized equipment and escalating operational expenses, directly impacting their financial performance.

Driver retention also proved to be a significant challenge for these acquired brands, contributing to increased costs and operational inefficiencies. This underperformance created a drag on Heartland Express's overall financial results, despite the success of the legacy brand.

Heartland Express's operating ratio has notably worsened, climbing to 106.8% in the first quarter of 2025 and 105.9% in the second quarter of 2025. This marks a significant increase from prior periods where the ratio was below 100%.

An operating ratio exceeding 100% is a clear indicator that the company's operational costs are higher than its revenue generated from those operations. This situation directly signals operational inefficiencies and a negative impact on the company's bottom line.

This deteriorating trend underscores the significant pressure on Heartland Express's profit margins. The increased costs are likely driven by ongoing cost inflation, coupled with a persistent weakness in freight rates throughout the 2024 and early 2025 period.

Reliance on Freight Market Recovery

Heartland Express's financial performance is intrinsically tied to the health of the freight market, which has experienced a prolonged downturn. Management has indicated that significant improvements are not anticipated until late 2025 or potentially 2026, highlighting a substantial dependency on external economic factors. This reliance makes the company susceptible to the cyclical nature of the transportation industry.

The current environment is characterized by weak freight demand, an oversupply of trucking capacity, and persistently low pricing, creating considerable headwinds for Heartland Express. For instance, the Cass Freight Index, a key indicator of freight volumes and expenditures, has shown negative year-over-year comparisons throughout much of 2024. This sustained weakness directly impacts Heartland Express's revenue and profitability.

- Freight Market Dependency: Heartland Express's earnings are vulnerable to fluctuations in freight demand and pricing, with no substantial recovery expected before late 2025 or 2026.

- Industry Headwinds: Persistent issues like excess capacity and unsustainable freight rates continue to pressure the company's operational efficiency and financial results.

- Vulnerability to Downturns: The company's business model is inherently exposed to the cyclical nature of the freight industry, making it susceptible to prolonged periods of economic slowdown.

Aging Trailer Fleet

Heartland Express faces a challenge with its aging trailer fleet. As of March 31, 2025, the average age of its consolidated trailers had risen to 7.4 years, up from 6.7 years in the previous year. This aging equipment could translate into increased repair expenses and more frequent breakdowns, potentially impacting operational efficiency.

An older trailer fleet might also hinder Heartland Express's capacity to satisfy customer demands for the latest equipment. This could create a competitive disadvantage, especially when contrasted with competitors operating with newer, more technologically advanced trailers. Consequently, the benefits derived from their modern tractor fleet might be partially diminished by the less current trailer assets.

- Fleet Age Increase: Average trailer age rose from 6.7 years (March 2024) to 7.4 years (March 2025).

- Maintenance Costs: An aging fleet typically incurs higher maintenance and repair expenditures.

- Downtime Risk: Older trailers are more prone to mechanical failures, leading to increased operational downtime.

- Customer Requirements: Inability to meet customer needs for newer trailer specifications could affect business.

Heartland Express's profitability has been significantly impacted by a challenging freight market, with the company reporting net losses in the first two quarters of 2025, totaling $13.9 million and $10.9 million respectively. This downturn is exacerbated by weak freight demand and an oversupplied market, which management anticipates will persist until late 2025 or 2026.

The integration of acquired companies like Millis Transfer and Smith Transport has presented profitability hurdles, with issues such as underutilized equipment and escalating operational expenses, including driver retention challenges, creating a drag on overall financial performance. This has led to a notable deterioration in the operating ratio, climbing to 106.8% in Q1 2025 and 105.9% in Q2 2025, indicating costs exceeding revenue.

Furthermore, the company's trailer fleet is aging, with the average age increasing from 6.7 years in March 2024 to 7.4 years by March 2025. This could lead to higher maintenance costs, increased downtime, and potential difficulties in meeting customer demands for newer equipment, thereby impacting operational efficiency and competitive positioning.

| Financial Metric | Q1 2025 | Q2 2025 | Full Year 2024 |

| Net Loss | $13.9 million | $10.9 million | $29.7 million |

| Operating Ratio | 106.8% | 105.9% | N/A (Trend worsening) |

| Average Trailer Age (Consolidated) | 7.4 years (as of March 31, 2025) | 6.7 years (as of March 31, 2024) |

What You See Is What You Get

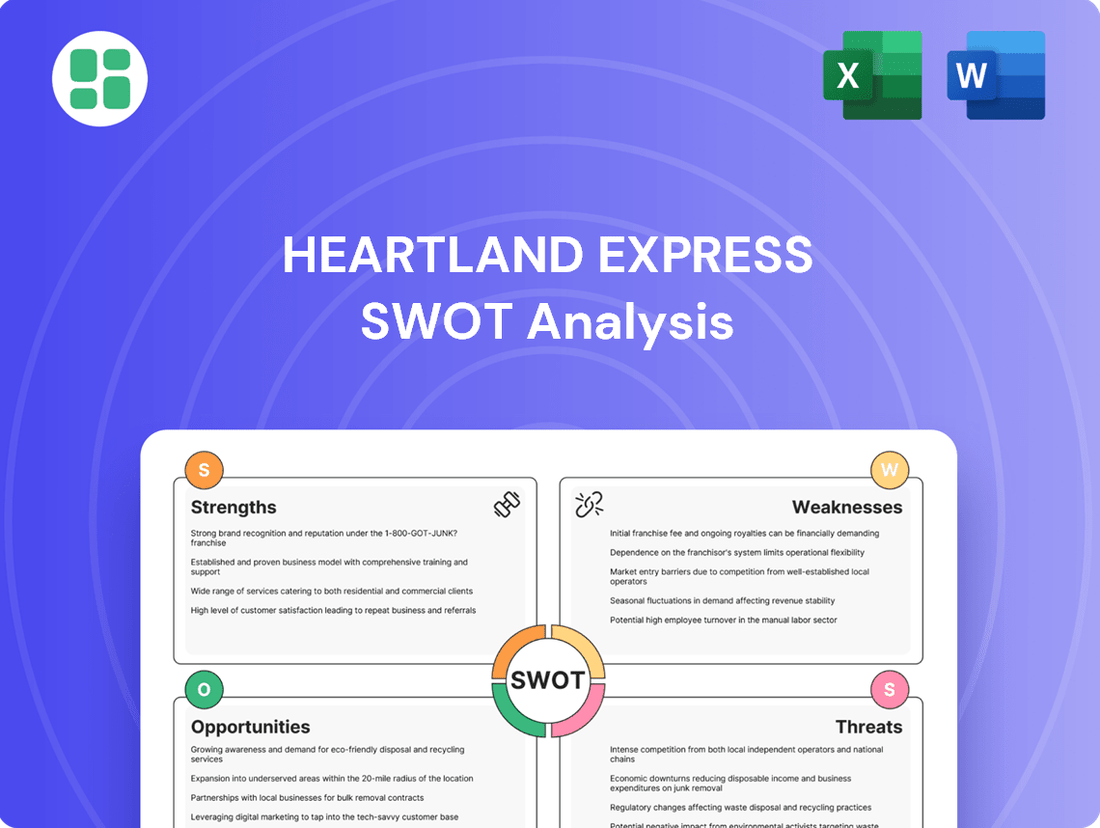

Heartland Express SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file for Heartland Express. The complete version, offering a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout.

This is the same SWOT analysis document included in your download. The full content detailing Heartland Express's strategic position is unlocked after payment, providing you with the complete, ready-to-use report.

Opportunities

Industry experts and Heartland Express management are projecting a gradual freight market recovery, with expectations for improved demand and rates beginning in late 2025 and extending into 2026. This anticipated upturn is expected to be fueled by economic stimulus measures, a rise in industrial production, and a strengthening housing market.

Such a recovery could translate into enhanced pricing power for carriers like Heartland Express and lead to better utilization of their assets. For example, if freight volumes increase by 5% in 2026 as some analysts predict, it could significantly boost revenue per truck for companies with efficient operations.

Heartland Express is strategically optimizing costs by shrinking its fleet to better match current demand, a move that could enhance profitability. The company is also diligently reviewing all cost-saving opportunities across its operations.

By year-end 2025, Heartland Express anticipates completing the integration of information systems across its acquired brands, streamlining operations and potentially unlocking further efficiencies. These focused efforts on cost reduction and operational streamlining are key to improving the company's overall financial performance and operating ratios.

Heartland Express can capitalize on the trucking industry's embrace of technology. Advanced systems like AI-driven Transportation Management Systems (TMS) and digital freight platforms are becoming standard, offering efficiency gains. For instance, by mid-2024, the adoption of AI in logistics was projected to save companies an average of 15% on operational costs through optimized routing and load balancing.

Investing in these digital tools allows for enhanced route planning, better inventory management, and improved driver utilization. This directly translates to reduced empty miles, a key cost driver in trucking. Heartland Express's ongoing telematics transition positions them to leverage these benefits, aiming to boost operational efficiency and customer satisfaction by providing real-time tracking and predictive maintenance insights.

Growth in E-commerce and Specialized Services

The ongoing expansion of e-commerce directly fuels the need for robust and dependable freight transportation, offering Heartland Express a significant avenue for growth. The increasing complexity within supply chains also opens doors for developing specialized logistics services tailored to specific shipper requirements, potentially creating new revenue streams and improving profit margins.

Key opportunities stemming from this trend include:

- Expanding dedicated fleet services to support e-commerce fulfillment centers.

- Developing specialized transportation solutions for high-value or time-sensitive goods.

- Leveraging technology to offer enhanced visibility and tracking for e-commerce shipments.

- Targeting niche markets within e-commerce that require specialized handling or delivery.

Consolidation and M&A in a Fragmented Market

The logistics industry is ripe for consolidation, with a projected increase in mergers and acquisitions throughout 2025. Companies are actively seeking to bolster their technology, expand their operational footprint, and create more robust supply chains. This trend presents a significant opportunity for well-positioned players.

Heartland Express's established track record of successful acquisitions, coupled with its robust financial standing, positions it advantageously to capitalize on this consolidation wave. The company's strong balance sheet provides the necessary capital to pursue strategic, value-adding deals.

- Market Consolidation: The trucking industry, a key segment of logistics, has seen ongoing consolidation. For instance, in 2023, the Cass Freight Index showed a continued need for efficiency gains, often achieved through scale.

- Technological Advancement: Acquisitions can provide access to advanced fleet management software and real-time tracking, crucial for competing in 2025's data-driven logistics environment.

- Geographic Expansion: Strategic M&A allows Heartland Express to enter new regions or strengthen its presence in existing ones, increasing its overall market share and customer base.

- Diversification of Services: Acquiring companies with complementary services, such as specialized freight or warehousing, can broaden Heartland Express's revenue streams and reduce reliance on any single market segment.

The ongoing freight market recovery, projected to gain momentum in late 2025 and into 2026, presents a significant opportunity for Heartland Express to benefit from increased demand and improved freight rates.

Heartland Express can leverage the trucking industry's increasing adoption of technology, such as AI-driven Transportation Management Systems, to boost operational efficiency and reduce costs. By mid-2024, AI in logistics was estimated to save companies around 15% on operational costs.

The expansion of e-commerce and the growing complexity of supply chains offer avenues for Heartland Express to develop specialized logistics services and expand its dedicated fleet operations, potentially creating new revenue streams.

The trend of market consolidation in the logistics sector, expected to continue through 2025, provides Heartland Express with opportunities to acquire complementary businesses, enhancing its technological capabilities, geographic reach, and service offerings.

Threats

The North American truckload market is still dealing with too many trucks chasing too little freight. This oversupply means carriers are constantly competing on price, which keeps rates low. For Heartland Express, this translates to a tough environment where raising prices is a challenge, especially when their own operating expenses, like fuel and labor, are climbing.

This persistent excess capacity directly impacts Heartland Express's ability to secure profitable contracts. For instance, freight rates in the dry van segment, a key area for many carriers, saw declines throughout much of 2023 and early 2024, with some industry reports indicating year-over-year drops of 10-15% in certain lanes. This makes it harder for Heartland to achieve its target operating ratios, even with efficient operations.

The trucking sector, including Heartland Express, is grappling with escalating operating expenses. Fuel price fluctuations, elevated interest rates impacting financing, and pricier equipment due to tariffs and new emissions technology are significant burdens. For instance, the Producer Price Index for trucking services saw a notable increase throughout 2023, reflecting these cost pressures.

These inflationary forces are proving difficult to offset with freight rate increases alone. Carriers often find that the gains from higher rates are eroded by the persistent rise in costs for fuel, maintenance, and labor, leading to compressed profit margins for companies like Heartland Express.

The trucking industry continues to grapple with a significant driver shortage, a challenge that intensified in recent years. For Heartland Express, this means ongoing difficulty in finding and keeping skilled drivers, a situation exacerbated by an aging workforce. This scarcity directly translates to higher wages and training expenses, potentially leading to more trucks sitting idle and impacting overall operational efficiency and profitability.

Regulatory Changes and Environmental Mandates

Heightened regulatory scrutiny, particularly concerning driver training standards and safety compliance, presents a significant challenge. For instance, the Federal Motor Carrier Safety Administration's (FMCSA) Compliance, Safety, Accountability (CSA) program continues to evolve, potentially increasing compliance burdens and associated costs for carriers like Heartland Express.

Stricter environmental mandates, such as those pushing for fleet electrification and decarbonization, could force substantial capital outlays. While the EPA's Clean Trucks Program and similar initiatives aim for sustainability, the upfront investment in electric or alternative-fuel vehicles can be a considerable threat if not strategically managed, impacting operational budgets and potentially hindering competitiveness if competitors adapt more rapidly.

- Driver Training & Safety: Increased FMCSA oversight on Hours of Service (HOS) and driver qualifications can lead to operational adjustments and potential penalties for non-compliance.

- Environmental Regulations: Mandates for reduced emissions and the adoption of cleaner technologies, like those being explored by the Biden administration's focus on sustainable transportation, require significant investment in new fleets.

- Compliance Costs: Adapting to new safety protocols and environmental standards directly translates to higher operational expenses, potentially impacting profit margins if not offset by efficiency gains or price adjustments.

- Capital Investment: Transitioning to a greener fleet, a likely future trend, demands considerable upfront capital, posing a financial risk if market adoption or government incentives do not align with investment timelines.

Geopolitical Factors and Trade Uncertainties

Geopolitical instability and evolving trade policies represent a significant threat to Heartland Express. Global events, such as ongoing conflicts and political realignments, can disrupt international trade routes, impacting the volume of goods transported. For instance, the ongoing trade tensions between major economic blocs, which have seen fluctuating tariff impositions, directly affect the cost of equipment and parts, as well as the predictability of cross-border freight movement.

The threat of tariffs on key trading partners could increase operational expenses for Heartland Express. These tariffs might raise the cost of acquiring new trucks, trailers, and other essential equipment, directly impacting capital expenditure plans and potentially leading to higher maintenance costs. Furthermore, the imposition of tariffs can lead to retaliatory measures, creating uncertainty around cross-border shipping agreements and potentially reducing the demand for freight services as businesses adjust their supply chains.

Shifting trade policies and trade uncertainties can also dampen consumer confidence, which in turn affects freight demand. When businesses and consumers are uncertain about the future economic landscape due to trade disputes, they tend to reduce spending and investment. This slowdown in economic activity directly translates to lower volumes of goods needing transportation, impacting Heartland Express's revenue streams and overall profitability. For example, a slowdown in manufacturing output due to trade disruptions can mean fewer raw materials to transport and fewer finished goods to deliver.

- Tariff Impact: Increased equipment costs due to tariffs on imported components or vehicles.

- Trade Flow Disruption: Uncertainty in cross-border routes and potential slowdowns in international freight volumes.

- Demand Reduction: Lower consumer and business confidence stemming from trade policy shifts, leading to reduced freight demand.

- Supply Chain Volatility: Geopolitical events can cause unpredictable fluctuations in fuel prices and availability, impacting operational costs.

Persistent oversupply in the North American truckload market continues to suppress freight rates, making it difficult for Heartland Express to achieve profitable growth, especially as operating costs like fuel and labor climb. For instance, average dry van rates saw year-over-year declines in the range of 10-15% through much of 2023 and early 2024, directly impacting Heartland's ability to improve its operating ratio.

Escalating operating expenses, including fuel, maintenance, and labor, are squeezing profit margins. The Producer Price Index for trucking services reflected these inflationary pressures with notable increases throughout 2023, making it challenging for carriers to pass these costs onto customers through rate hikes.

The ongoing driver shortage, coupled with stricter regulatory compliance and the potential need for significant capital investment in greener fleets due to environmental mandates, presents substantial financial and operational hurdles. For example, the FMCSA's evolving CSA program and the push for fleet electrification require continuous adaptation and investment, potentially increasing costs.

Geopolitical instability and shifting trade policies pose risks through increased equipment costs due to tariffs and potential disruptions to freight volumes. Trade uncertainties can also reduce consumer and business confidence, leading to lower freight demand, as seen in the impact of trade disputes on manufacturing output.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry forecasts, ensuring a robust and accurate assessment of Heartland Express's strategic position.