Heartland Express Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heartland Express Bundle

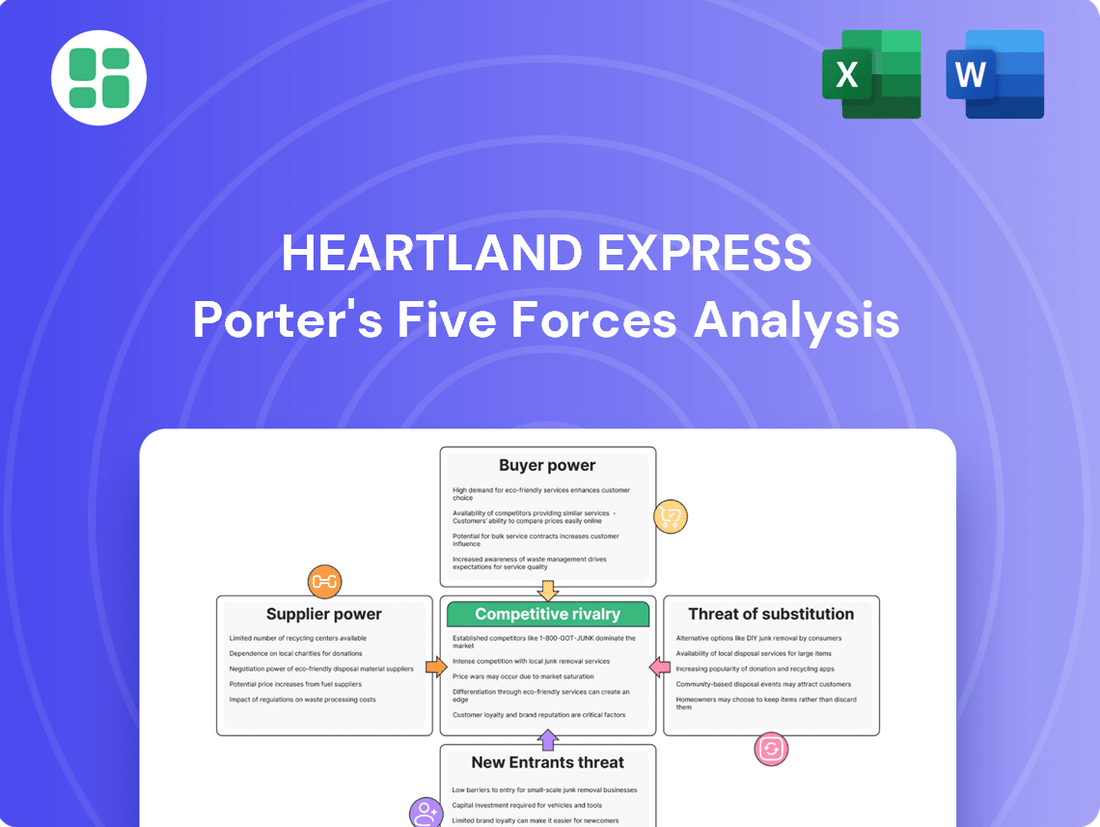

Heartland Express navigates a competitive trucking landscape where buyer power can be significant, and the threat of new entrants is moderate due to capital requirements. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Heartland Express’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Heartland Express's reliance on a concentrated group of suppliers for critical assets like new trucks and trailers significantly influences their bargaining power. The Class 8 truck market, for example, is notably consolidated, with a few major manufacturers holding substantial market share, allowing them to dictate terms and pricing to fleet operators.

The increasing complexity and specialization of trucking technology also bolster supplier leverage. When Heartland Express incorporates unique or proprietary components and systems into its fleet, the costs and disruptions associated with switching suppliers become considerably higher, further strengthening the bargaining position of these specialized providers.

Fuel represents a significant and volatile cost for trucking operations like Heartland Express, with its price heavily influenced by global markets. This inherent dependence grants fuel suppliers considerable leverage, as Heartland's ability to negotiate prices on this critical input is limited by broader economic forces. In 2023, diesel fuel prices averaged around $4.00 per gallon, a substantial portion of a trucking company's operating expenses.

Beyond fuel, specialized components such as high-performance tires and advanced telematics systems can also present switching challenges. If Heartland Express utilizes proprietary systems or specific brand components for its fleet maintenance and operational efficiency, the cost and complexity of transitioning to alternative suppliers can be substantial, further solidifying supplier power in these areas.

The persistent shortage of qualified truck drivers significantly bolsters labor's bargaining power within the transportation sector. This scarcity directly impacts carriers like Heartland Express by driving up wages and necessitating enhanced benefits to attract and retain talent. For instance, the American Trucking Associations reported in 2023 that the driver shortage could reach over 160,000 by 2030 if current trends continue, underscoring the critical leverage employees hold.

Technology and Software Providers

Heartland Express's reliance on technology and software providers for critical functions like route optimization and fleet management gives these suppliers significant leverage. If these providers offer unique, highly integrated systems, their bargaining power is amplified, particularly when switching costs are high due to data migration and retraining needs. The constant evolution of logistics technology means companies like Heartland must adopt new solutions to remain competitive, further strengthening the position of innovative software suppliers.

For instance, the global logistics technology market was valued at approximately $20.5 billion in 2023 and is projected to grow significantly. This growth, driven by demand for efficiency and visibility, empowers the technology providers within this space. Heartland Express's operational efficiency is directly tied to the effectiveness of these software solutions, making them indispensable partners.

- Specialized Solutions: Providers offering proprietary algorithms for route optimization or advanced telematics systems possess higher bargaining power.

- Integration Complexity: The more deeply integrated a software system is with Heartland's existing infrastructure, the costlier and more disruptive a switch becomes, increasing supplier leverage.

- Industry Trends: The increasing adoption of AI and IoT in logistics, as seen with a projected compound annual growth rate (CAGR) of over 15% for IoT in logistics through 2030, empowers suppliers at the forefront of these innovations.

Maintenance and Repair Services

Heartland Express's reliance on specialized maintenance and repair services for its modern fleet can create significant bargaining power for these suppliers. If the company outsources a substantial portion of its upkeep or depends on specific certified centers for its advanced equipment, these service providers hold sway due to their unique skills, specialized tools, and the essential role they play in ensuring fleet uptime. The cost and availability of these critical services directly affect Heartland's operational efficiency and readiness.

Consider the following points regarding the bargaining power of maintenance and repair service suppliers for Heartland Express:

- Specialized Expertise and Equipment: Providers with unique diagnostic tools and certified technicians for specific truck models or engine types can command higher prices and dictate terms.

- Criticality of Uptime: The imperative for Heartland Express to minimize vehicle downtime means suppliers of essential repair services have leverage, as delays can lead to substantial lost revenue.

- Genuine Parts Availability: Exclusive access to genuine manufacturer parts can also empower suppliers, as using aftermarket parts might void warranties or compromise performance.

Heartland Express's bargaining power with suppliers is influenced by the consolidation within the trucking manufacturing sector, where a few key players control a significant portion of the market. This concentration allows manufacturers to set prices and terms, impacting Heartland's procurement costs for new trucks and trailers.

The growing reliance on specialized technology and software within the logistics industry further amplifies supplier leverage. Companies like Heartland Express face higher switching costs when integrating proprietary systems for route optimization or fleet management, making it more challenging to negotiate favorable terms.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Heartland Express |

|---|---|---|

| Truck Manufacturers | Market concentration, proprietary technology | Higher equipment acquisition costs, limited negotiation flexibility |

| Fuel Suppliers | Global commodity prices, limited substitutes | Significant operating expense volatility, minimal price control |

| Technology Providers (Software) | Integration complexity, switching costs, innovation pace | Increased reliance on specific vendors, potential for higher licensing fees |

| Maintenance & Repair Services | Specialized expertise, critical need for uptime | Higher service costs, dependence on certified providers for fleet readiness |

What is included in the product

This analysis dissects the competitive forces impacting Heartland Express, revealing the intensity of rivalry, buyer and supplier power, and the threat of new entrants and substitutes within the trucking industry.

Instantly identify competitive pressures and strategic opportunities within the trucking industry with a dynamic, interactive Porter's Five Forces model for Heartland Express.

Customers Bargaining Power

Heartland Express's customer concentration is a key factor influencing their bargaining power. Primarily serving the retail, manufacturing, and food sectors, if a few major clients account for a substantial percentage of Heartland's revenue, those customers gain significant leverage. This could lead to them dictating freight rates and service agreements, impacting Heartland's profitability.

For instance, in 2023, Heartland Express reported total revenue of $704.5 million. While specific customer revenue breakdowns aren't publicly disclosed, a high concentration among a few large clients would amplify their ability to negotiate favorable terms, potentially squeezing margins for Heartland.

For customers of truckload carriers like Heartland Express, the costs associated with switching to a different provider are generally quite low. This is largely because many carriers offer very similar dry van freight services, making it easy for shippers to compare options.

The ability for customers to easily get quotes from numerous carriers directly enhances their bargaining power. This pressure forces companies like Heartland to maintain competitive pricing and consistently high service standards to retain business. For instance, in 2024, the average spot market rate for dry van truckload shipments saw fluctuations, underscoring the competitive pricing environment.

Despite the low switching costs, building strong, long-term relationships can significantly improve customer loyalty. Factors such as consistent reliability, a strong safety record, and the specialized handling of time-sensitive shipments can make it more difficult for customers to move their business elsewhere, even with readily available alternatives.

Customers in industries like retail and manufacturing, where transportation is a significant cost, are keenly aware of pricing. For example, a 1% increase in freight costs can directly eat into their profit margins, making them highly sensitive to price fluctuations.

This price sensitivity becomes even more pronounced when the trucking market experiences overcapacity. In 2024, reports indicated a softening freight market in certain segments, which naturally grants shippers more bargaining power to secure lower rates from carriers like Heartland Express.

While Heartland Express differentiates itself through reliable on-time delivery and a strong safety record, which can command a slight premium, the fundamental pressure from price-conscious customers remains a significant force in rate negotiations.

Availability of Alternative Carriers

The truckload transportation sector is characterized by its fragmentation, featuring a multitude of regional and national carriers. This sheer volume of options directly translates into significant bargaining power for customers, allowing them to readily compare and select providers based on price and service. For instance, in 2024, the American Trucking Associations reported over 1.7 million registered trucking companies in the U.S., highlighting the intense competition.

Customers can easily leverage this availability of alternatives to negotiate favorable rates and terms. If a carrier’s pricing or service level doesn't meet expectations, switching to a competitor is a straightforward process. This dynamic forces companies like Heartland Express to consistently prove their value proposition to maintain loyalty.

- Fragmented Market: The truckload industry boasts a vast number of carriers, offering customers extensive choice.

- Price Sensitivity: Customers can easily switch to carriers offering lower rates due to the abundance of alternatives.

- Service Differentiation: Heartland Express must emphasize superior service and value to counter the ease of customer switching.

Customer's Ability to Backward Integrate

For Heartland Express, the ability of customers to backward integrate, meaning they might consider creating their own private fleets, represents a subtle but significant source of bargaining power. While this is generally not feasible for most customers due to the high capital outlay and operational challenges involved in managing a trucking fleet, the mere possibility keeps carriers like Heartland on their toes.

This latent threat encourages Heartland to maintain competitive pricing and service quality. For instance, while specific data on Heartland's customers developing private fleets isn't publicly detailed, the broader trucking industry saw a slight increase in private fleet utilization in certain sectors during 2024 as companies sought greater control over their supply chains. This trend underscores the underlying pressure carriers face.

- Customer Threat of Backward Integration: Large customers may develop private fleets, reducing reliance on carriers like Heartland.

- Latent Bargaining Power: Even if not executed, this potential threat pressures Heartland for competitive pricing and services.

- Barriers to Integration: High capital investment and operational complexity typically deter most customers from establishing private fleets.

- Industry Trend Influence: In 2024, some sectors saw increased private fleet interest, highlighting the ongoing need for carriers to remain competitive.

Customers wield significant bargaining power due to the fragmented nature of the trucking industry, which offers abundant carrier choices. This ease of switching, coupled with customers' inherent price sensitivity, especially in sectors like retail and manufacturing where transportation costs are crucial, allows them to negotiate favorable rates. For instance, in 2024, the availability of numerous trucking companies, with over 1.7 million registered in the U.S. according to the American Trucking Associations, directly fuels this customer leverage, pushing carriers like Heartland Express to maintain competitive pricing and superior service to retain business.

| Factor | Impact on Heartland Express | Supporting Data (2024/Recent) |

| Market Fragmentation | High customer bargaining power due to numerous alternatives. | Over 1.7 million registered trucking companies in the U.S. (ATA). |

| Price Sensitivity | Customers can easily switch for lower rates, impacting margins. | Freight costs are a significant expense for retail and manufacturing sectors. |

| Low Switching Costs | Customers can readily compare and move between similar service providers. | Dry van freight services are largely commoditized. |

| Potential for Backward Integration | A latent threat that pressures carriers for competitive terms. | Some sectors saw increased private fleet interest in 2024. |

Full Version Awaits

Heartland Express Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Porter's Five Forces analysis for Heartland Express delves into the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the trucking industry. Understanding these forces is crucial for strategic decision-making and maintaining a competitive edge.

Rivalry Among Competitors

The truckload transportation sector in North America is quite crowded, featuring a broad spectrum of companies. You'll find massive, publicly traded carriers alongside a vast number of smaller, regional operators. This sheer volume and variety of competitors means everyone is constantly fighting for a piece of the dry van freight market.

This intense competition forces companies like Heartland Express to constantly battle on price, service quality, and available capacity. In 2024, the industry continues to see this dynamic play out, with many carriers adjusting their strategies to stay ahead.

The trucking industry has historically grappled with cycles of overcapacity and shifting freight demand, creating a highly competitive environment. This dynamic intensifies when demand falters, forcing carriers into aggressive bidding wars for limited cargo, which often drives down shipping rates.

Current market conditions highlight this struggle, with many analysts predicting a slow recovery. For instance, freight volumes have seen significant declines throughout 2024, and projections suggest a sustained downturn, with a meaningful rebound not anticipated until the latter half of 2025. This prolonged period of weakness directly fuels heightened competition among trucking companies like Heartland Express as they vie for market share.

Heartland Express focuses on time-sensitive, dry van freight, highlighting safety and on-time delivery with a modern fleet. However, the fundamental service of moving general goods is often seen as similar across many carriers by customers. This lack of inherent differentiation means competition can easily shift to price.

Customers can switch between carriers with relative ease, as switching costs are generally low in the trucking industry. This forces companies like Heartland Express to continually improve their offerings or maintain competitive pricing to keep clients from moving to a competitor. For instance, in 2024, the average operating cost per mile for US truckers hovered around $2.20, a figure that any competitor could potentially match or undercut.

To combat this intense rivalry, differentiation through exceptional service and advanced technology becomes paramount. Carriers must find ways to stand out beyond just the basic transportation of goods. This could involve specialized tracking, proactive communication, or tailored logistics solutions that add tangible value, thereby reducing the likelihood of customers opting for a cheaper, less reliable alternative.

High Fixed Costs and Exit Barriers

The trucking industry, including companies like Heartland Express, is inherently capital-intensive. Significant upfront investments are necessary for purchasing and maintaining a fleet of trucks, trailers, and associated infrastructure. For instance, a new Class 8 tractor can cost upwards of $150,000, and a trailer can add another $50,000 to $80,000. These substantial fixed costs mean that even a small carrier needs millions in assets.

These high fixed costs, coupled with specialized equipment that has limited resale value outside the industry and potential long-term lease or financing agreements, create formidable exit barriers. It becomes very difficult and costly for a trucking company to simply shut down operations if it starts losing money. This often traps less successful firms in the market.

Consequently, financially strained trucking companies may continue to operate, even at unprofitable rates, simply to cover some of their ongoing fixed costs and avoid the substantial penalties or losses associated with exiting. This dynamic directly fuels intense price competition as these struggling entities try to secure any available freight, putting downward pressure on rates across the board for all players, including Heartland Express.

- Capital Intensity: The trucking sector requires substantial investment in vehicles and facilities, representing high fixed costs.

- Exit Barriers: Specialized assets and contractual obligations make it difficult and expensive for companies to leave the market.

- Price Competition: Distressed firms may operate at low rates, intensifying price wars and impacting profitability for all industry participants.

- Industry Dynamics: High fixed costs and exit barriers contribute to a competitive landscape where operational efficiency and scale are crucial for survival.

Strategic Acquisitions and Consolidation

The trucking industry, including companies like Heartland Express, has experienced significant consolidation. For instance, in 2022, Knight-Swift Transportation acquired AAA Cooper Transportation for $1.4 billion, creating a larger entity with expanded reach. This trend means fewer but more powerful competitors emerge, often possessing greater bargaining power with suppliers and customers due to their scale.

Heartland Express has actively participated in this consolidation. In 2021, the company acquired Millis Transfer, Inc. for approximately $100 million. Such moves by Heartland Express and its peers aim to bolster market share and operational efficiencies, directly intensifying rivalry among the remaining, larger players.

- Industry Consolidation: Larger carriers are acquiring smaller or struggling ones, reducing the number of competitors.

- Increased Rivalry: Acquisitions create bigger, more formidable rivals with economies of scale and wider networks.

- Heartland's Role: Heartland Express has pursued acquisitions, such as Millis Transfer in 2021, to enhance its competitive position.

The truckload sector is densely populated with numerous carriers, from large public companies to smaller regional ones, all vying for freight. This crowded market means intense competition, forcing companies like Heartland Express to constantly compete on price, service, and capacity.

In 2024, freight volumes have seen notable declines, with a slow recovery anticipated, intensifying competition as carriers fight for limited business. This environment often leads to aggressive pricing, as seen with average operating costs per mile for US truckers around $2.20 in 2024, a benchmark easily matched by rivals.

The industry's high capital intensity, with new tractors costing over $150,000 and trailers $50,000-$80,000, creates significant barriers to entry and exit. This traps less successful firms, leading them to operate at unprofitable rates to cover fixed costs, which further fuels price wars.

Industry consolidation, like Knight-Swift's $1.4 billion acquisition of AAA Cooper in 2022 and Heartland Express's $100 million purchase of Millis Transfer in 2021, creates larger, more powerful competitors, intensifying rivalry among the remaining players.

| Metric | 2023 (Approx.) | 2024 (Projected/Early Data) | Impact on Rivalry |

|---|---|---|---|

| Number of US Trucking Companies | ~100,000+ | Stable to Slightly Decreasing | High density continues to drive competition. |

| Average Operating Cost per Mile (US Trucker) | ~$2.10 - $2.30 | ~$2.20 - $2.40 | Low differentiation means price is a key battleground. |

| New Tractor Cost | ~$150,000+ | ~$160,000+ | High fixed costs pressure companies to secure freight at any cost. |

SSubstitutes Threaten

The threat of substitutes for Heartland Express's truckload services is primarily represented by intermodal rail, especially for longer hauls where cost efficiency is paramount. In 2024, intermodal freight volume saw continued growth, driven by its cost advantages over trucking for certain routes, directly impacting the competitive landscape for companies like Heartland Express.

While air cargo offers speed for time-sensitive shipments, its significantly higher cost makes it a less direct substitute for most of Heartland Express's general commodity freight. The company's strategy of focusing on dry van freight across various distances means it must remain competitive against these alternative modes, balancing cost and transit time to meet diverse customer needs.

The appeal of substitute services for Heartland Express's truckload offerings hinges significantly on their price-performance ratio. While rail freight, for instance, presents a more economical choice for large, non-urgent, long-distance shipments, it cannot match the agility and direct delivery capabilities of trucking.

Air cargo, on the other hand, excels in speed but comes with a considerably higher price tag. Given Heartland's strategic focus on time-sensitive deliveries, its core market segment appears somewhat insulated from direct substitution by basic rail services. However, persistent cost sensitivities among clients can still prompt them to explore alternative transportation methods.

In 2024, the average cost per mile for truckload shipping remained higher than for intermodal rail, though fuel surcharges and driver shortages continued to influence trucking rates. For example, while trucking might average $2.50-$3.50 per mile, rail can be significantly lower for bulk.

Customer willingness to switch from Heartland Express to alternatives hinges on their specific shipping needs and supply chain priorities. For less time-sensitive or routine cargo, exploring options like rail or intermodal transport might be considered, especially if cost savings are significant.

However, for shipments demanding speed, flexibility, and unwavering reliability, particularly those operating on a just-in-time basis or involving specialized dry van freight, the value proposition of Heartland Express becomes much stronger. In 2024, the trucking industry continued to grapple with driver shortages and capacity constraints, making the dependable service offered by established carriers like Heartland Express a crucial factor for many shippers, thereby limiting the appeal of substitutes.

Technological Advancements in Substitutes

Ongoing technological advancements in substitute transportation modes present a significant threat. For instance, improvements in rail network efficiency and intermodal transfer capabilities, potentially including autonomous rail systems, could make rail a more competitive alternative to truckload services. In 2024, the US freight rail industry moved approximately 1.5 billion tons of freight, highlighting its substantial capacity and ongoing relevance.

Innovations in last-mile delivery solutions by non-trucking entities also pose a risk, potentially capturing specific market segments. Heartland Express needs to closely monitor these evolving technologies to anticipate changes in customer demand and the broader competitive landscape.

- Technological advancements in rail: Increased efficiency and potential for autonomous systems could boost rail competitiveness.

- Intermodal transfer improvements: Smoother transitions between transport modes make alternatives more attractive.

- Last-mile delivery innovations: Non-trucking solutions can erode specific market segments.

- Monitoring is crucial: Heartland must stay abreast of these changes to adapt its strategy.

Impact of Supply Chain Design

The way customers design their supply chains plays a big role in how much substitutes threaten trucking companies like Heartland Express. If a company needs to keep inventory low and get goods quickly, they'll likely stick with truckload services for their speed and adaptability, making alternatives less attractive.

However, for businesses moving large volumes of goods where cost is the main driver, intermodal transport or other cheaper options become more appealing if they can meet the delivery needs. For instance, in 2024, the freight industry saw continued growth in intermodal, with volumes increasing by approximately 3% year-over-year, indicating a growing preference for cost-effective solutions when possible.

- Customer Supply Chain Focus: Inventory reduction and fast replenishment push demand for truckload.

- Cost-Driven Supply Chains: High-volume, cost-sensitive operations may shift to intermodal.

- Intermodal Growth: The intermodal sector saw about a 3% increase in volumes in 2024, highlighting its competitive edge for certain freight types.

The primary substitute threat to Heartland Express's truckload services comes from intermodal rail, particularly for longer hauls where cost savings are significant. In 2024, intermodal freight continued its upward trend, driven by its inherent cost efficiencies compared to trucking for specific routes, directly influencing the competitive dynamics for carriers like Heartland Express.

While air cargo offers speed, its substantially higher expense limits its viability as a direct substitute for most of Heartland's general freight. The company's focus on dry van freight across various distances necessitates maintaining competitive pricing against these alternatives, balancing cost with transit time to cater to diverse customer needs.

The attractiveness of substitute services for Heartland Express's truckload offerings is heavily influenced by their price-performance ratio. Rail freight, for example, serves as a more economical option for large, non-urgent, long-distance shipments, though it cannot replicate the direct delivery and agility of trucking. In 2024, trucking rates, influenced by fuel surcharges and driver shortages, generally remained higher than intermodal rail for comparable distances, with trucking averaging between $2.50-$3.50 per mile, while rail offered significantly lower rates for bulk transport.

| Transportation Mode | 2024 Average Cost per Mile (Estimate) | Key Advantage | Key Disadvantage |

|---|---|---|---|

| Truckload (Heartland Express) | $2.50 - $3.50 | Speed, Flexibility, Direct Delivery | Higher Cost, Driver Shortages |

| Intermodal Rail | $1.50 - $2.50 | Cost Efficiency (Long Haul), Capacity | Slower Transit, Limited Direct Delivery |

| Air Cargo | $5.00+ | Speed (Time-Sensitive) | Very High Cost |

Entrants Threaten

The truckload industry demands a substantial capital outlay, encompassing the acquisition of a modern fleet, maintenance infrastructure, and sophisticated logistics technology. This significant upfront investment creates a formidable barrier, discouraging many prospective entrants from challenging established companies like Heartland Express.

For instance, the cost of a new Class 8 truck in 2024 can range from $120,000 to over $180,000, making the initial fleet purchase for a new carrier a multi-million dollar endeavor. This high cost of entry effectively limits the number of viable new competitors.

The trucking industry faces significant regulatory hurdles that act as a substantial barrier to new entrants. Compliance with stringent rules on safety, emissions, driver hours, and licensing demands considerable expertise and financial investment. For instance, in 2024, the Federal Motor Carrier Safety Administration (FMCSA) continued to enforce strict hours-of-service regulations, impacting operational efficiency and requiring robust tracking systems.

Established carriers like Heartland Express leverage significant economies of scale, driving down per-unit costs for everything from new truck acquisitions to fuel and insurance. For instance, in 2023, Heartland Express reported a fleet of over 3,000 tractors, enabling substantial purchasing power compared to a startup. This scale translates directly into a competitive cost advantage.

The experience curve further solidifies this advantage. Through years of optimizing routes, managing driver schedules, and refining maintenance practices, Heartland Express has honed its operational efficiency. New entrants must overcome this learning curve, which is costly and time-consuming, making it difficult to match incumbent cost structures and service levels from the outset.

Access to Distribution Channels and Customer Relationships

Heartland Express's established relationships with key customers in retail, manufacturing, and food sectors present a significant barrier. New entrants must invest considerable time and resources to cultivate similar trust and demonstrate reliability, a process that is particularly challenging in a sector where long-term partnerships are paramount.

Securing access to these established distribution channels is a major hurdle for newcomers. For instance, in 2024, the trucking industry continued to see major carriers leverage their extensive networks to secure dedicated freight contracts, making it difficult for smaller or newer companies to compete for similar volume business.

- Established Customer Base: Heartland Express's long-standing ties with major clients in diverse industries offer a stable revenue stream and a competitive edge.

- Brand Reputation: Building a brand known for reliability and service quality takes years, a significant deterrent for new entrants.

- Distribution Channel Access: Gaining entry into established distribution networks requires significant effort and often relies on pre-existing relationships.

- Relationship-Driven Industry: The trucking sector thrives on trust and consistent service, making it hard for new players to displace incumbents.

Driver Shortage

The ongoing and intensifying shortage of qualified truck drivers acts as a substantial barrier for any new trucking company aiming to expand. New entrants will find it challenging to recruit and keep the essential driver talent in a labor market already experiencing scarcity, directly hindering their capacity to build operational scale and meet customer needs. This driver deficit particularly impacts smaller or newer businesses.

In 2024, the truck driver shortage remained a critical issue. Estimates from various industry bodies, including the American Trucking Associations (ATA), continued to project a significant deficit, with some reports indicating a need for over 70,000 drivers to meet current demand. This scarcity directly translates to higher recruitment and retention costs for all carriers, but it poses an even greater hurdle for new companies needing to establish a workforce from scratch.

- Driver Shortage Impact: New trucking companies face extreme difficulty in attracting and retaining drivers due to the existing deficit.

- Capacity Building: The shortage directly limits a new entrant's ability to build the necessary fleet capacity and service customer orders effectively.

- Competitive Disadvantage: Smaller or newer operations are disproportionately affected, struggling to compete with established carriers for limited driver resources.

- Cost Implications: Increased wages, sign-on bonuses, and improved benefits required to attract drivers significantly inflate the startup costs for new entrants.

The threat of new entrants into the truckload industry, particularly for a company like Heartland Express, is generally considered moderate to low. This is primarily due to the substantial capital requirements, stringent regulatory environment, and the established brand loyalty and distribution networks that incumbent players have cultivated over time. These factors create significant hurdles for any new company looking to enter the market and compete effectively.

For instance, the cost of a new Class 8 truck in 2024 can range from $120,000 to over $180,000, making the initial fleet purchase for a new carrier a multi-million dollar endeavor. This high cost of entry effectively limits the number of viable new competitors.

Furthermore, the ongoing truck driver shortage, with estimates projecting a need for over 70,000 drivers in 2024 according to the ATA, makes it exceptionally difficult for new entrants to build and maintain a workforce. This scarcity drives up recruitment and retention costs, disproportionately impacting newer, smaller operations trying to establish themselves against carriers with established driver pools and better compensation packages.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | Significant investment needed for fleet, technology, and infrastructure. | High barrier, limits the number of well-funded entrants. | New Class 8 truck cost: $120,000 - $180,000+ |

| Regulatory Compliance | Adherence to safety, emissions, and hours-of-service regulations. | Demands expertise and financial resources, increasing startup complexity. | FMCSA Hours-of-Service enforcement continues. |

| Economies of Scale | Established players benefit from lower per-unit costs. | New entrants struggle to match incumbent cost structures. | Heartland Express fleet size (2023): Over 3,000 tractors. |

| Customer Relationships | Long-standing ties with major clients. | Difficult for new entrants to secure freight and build trust. | Major carriers leverage networks for dedicated freight contracts. |

| Driver Shortage | Scarcity of qualified drivers. | Challenges recruitment and retention, increasing operational costs for newcomers. | Projected driver deficit: Over 70,000 (ATA estimates). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Heartland Express is built upon a foundation of verified data, including Heartland Express's annual reports and SEC filings, alongside industry-specific research from publications like Transport Topics and IBISWorld.