Heartland Express PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heartland Express Bundle

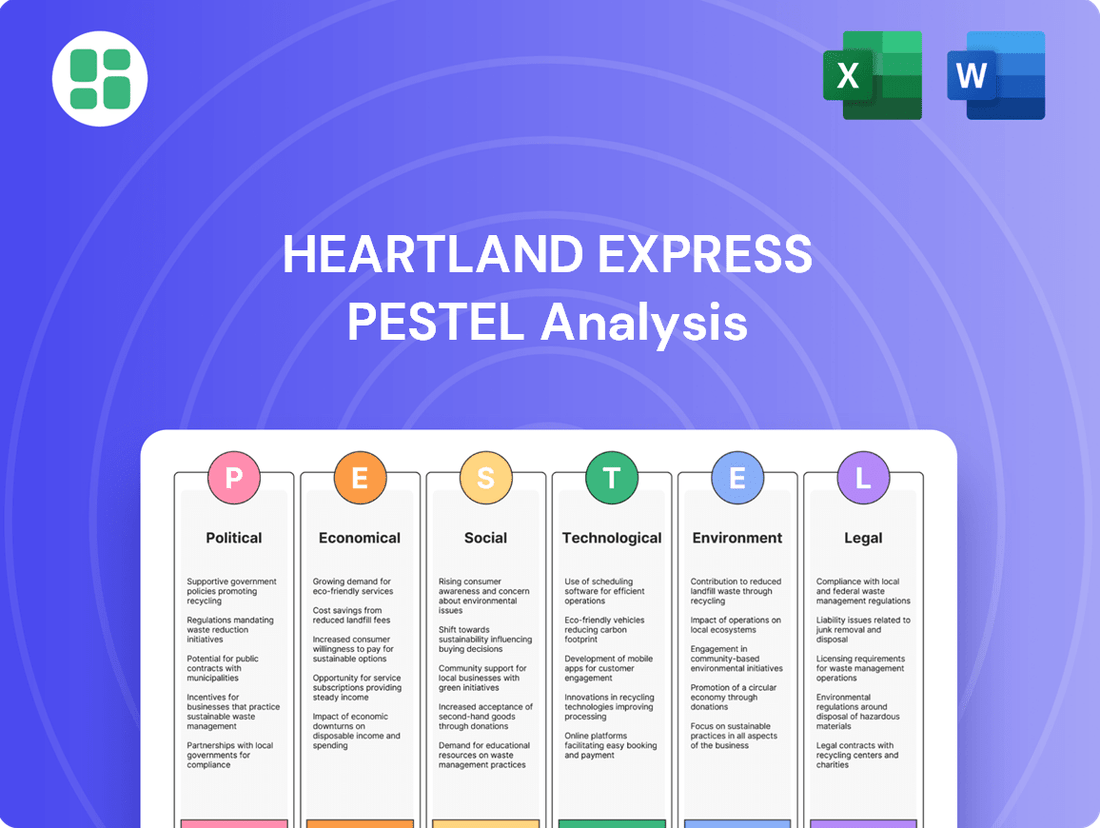

Unlock the strategic advantages Heartland Express holds by understanding its external environment. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors that are shaping the future of this trucking giant. Gain actionable intelligence to inform your own market strategies.

Don't get left behind in the dynamic transportation sector. Our comprehensive PESTLE analysis of Heartland Express provides the critical insights you need to anticipate market shifts and identify opportunities. Purchase the full report now to equip yourself with expert-level understanding.

Political factors

Government regulations significantly shape the trucking sector, and Heartland Express must navigate evolving federal and state laws. Key upcoming changes for 2025 include mandatory Automatic Emergency Braking (AEB) systems for new heavy trucks, the consolidation of Motor Carrier (MC) Numbers into USDOT numbers by October 2025, and a potential federal speed limiter mandate for heavy vehicles.

These regulatory adjustments will likely require capital investment in fleet modernization and administrative process changes to ensure adherence and prevent fines. Compliance with these new rules will be crucial for maintaining operational efficiency and avoiding penalties.

Global and regional trade policies are critical for Heartland Express. The United States-Mexico-Canada Agreement (USMCA), for instance, shapes cross-border freight volumes. In 2023, U.S. goods trade with Canada and Mexico under USMCA reached an estimated $1.3 trillion, highlighting the importance of these agreements.

Shifting trade relations can directly impact Heartland Express's operations. For example, potential new tariffs or changes in U.S.-China trade dynamics might necessitate route diversification, impacting operational costs and transit times for freight moving between these regions.

Government investment in transportation infrastructure, such as roads and bridges, directly influences the operational efficiency of trucking companies like Heartland Express. Increased spending on these areas can lead to reduced transit times and lower vehicle maintenance costs, as evidenced by continued federal infrastructure initiatives aimed at improving freight movement.

Political Stability and Geopolitical Events

Geopolitical instability, such as ongoing conflicts in Eastern Europe and the Middle East, directly impacts Heartland Express by disrupting global supply chains. These disruptions can lead to increased operational risks, affecting delivery times and service reliability. For instance, the Red Sea shipping crisis in late 2023 and early 2024 forced many carriers to reroute vessels, significantly extending transit times and increasing costs, a scenario that could impact Heartland Express's international freight operations if they engage in such routes.

Such events also contribute to volatile fuel prices, a major operating expense for trucking companies. Fluctuations in crude oil markets, driven by geopolitical tensions, can rapidly alter fuel costs. In 2024, fuel prices have shown considerable volatility, with Brent crude oil prices fluctuating between $75 and $90 per barrel, directly impacting Heartland Express's profitability and pricing strategies. This necessitates robust contingency planning to manage these price swings and maintain service reliability for customers.

Furthermore, geopolitical instability can lead to increased insurance premiums for transportation companies. Higher risks associated with operating in or through unstable regions can translate into greater costs for cargo and liability insurance. This adds another layer of financial pressure, requiring companies like Heartland Express to carefully manage their risk exposure and potentially pass on some of these increased costs to their clients.

Heartland Express, like other carriers, must maintain agility and contingency plans to navigate these political factors. This includes:

- Diversifying routes and carrier partnerships to mitigate supply chain disruptions.

- Implementing dynamic fuel surcharge mechanisms to account for price volatility.

- Proactively engaging with insurance providers to secure competitive rates despite heightened risks.

- Monitoring geopolitical developments closely to anticipate potential impacts on operations and adjust strategies accordingly.

Driver Welfare and Labor Policies

Government policies significantly influence driver welfare and labor, directly impacting trucking companies like Heartland Express. Regulations concerning driver working conditions, such as hours-of-service rules and updates to the Drug and Alcohol Clearinghouse, are critical. For instance, Phase 2 of the Clearinghouse, implemented in November 2024, mandates automatic CDL downgrades for drivers with unresolved violations, potentially shrinking the available driver pool.

Potential reforms to detention pay are also on the horizon, aiming to compensate drivers for time spent waiting at loading and unloading docks. Such changes could improve driver satisfaction and retention, but also add to operational costs. In 2023, the average truck driver salary in the US was around $67,000, but factors like detention time and efficient routing are key to increasing earnings and job appeal.

- Hours-of-Service Regulations: Continued scrutiny and potential adjustments to HOS rules can affect driver productivity and route planning.

- Drug and Alcohol Clearinghouse Phase 2: As of November 2024, unresolved violations lead to automatic CDL downgrades, impacting workforce availability.

- Detention Pay Reforms: Discussions around mandatory detention pay could improve driver compensation and attract more individuals to the profession.

- Driver Shortage Impact: The ongoing driver shortage, exacerbated by regulatory changes, remains a key challenge for companies like Heartland Express.

Government regulations are a constant factor for Heartland Express, with new mandates like mandatory Automatic Emergency Braking (AEB) systems for heavy trucks in 2025 and the consolidation of MC Numbers into USDOT numbers by October 2025. These changes necessitate fleet upgrades and administrative adjustments, impacting capital expenditure and operational compliance to avoid penalties.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Heartland Express across political, economic, social, technological, environmental, and legal dimensions.

It provides actionable insights for strategic planning by identifying key threats and opportunities within the trucking industry.

This Heartland Express PESTLE analysis offers a clean, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby relieving the pain point of information overload.

Economic factors

Diesel fuel represents a substantial operational expense for trucking firms like Heartland Express. Projections for 2025 indicate a more stable pricing environment for diesel, with the U.S. Energy Information Administration (EIA) forecasting an average of $3.50 to $3.63 per gallon for the year.

While the outlook suggests some easing from previous highs, the trucking industry remains susceptible to sudden price increases. Unforeseen geopolitical developments or decisions by OPEC+ could trigger upward price volatility, directly affecting Heartland Express's bottom line and the rates charged for freight services.

Inflationary pressures are a significant concern for Heartland Express, directly impacting operational costs such as labor, equipment purchases, and ongoing maintenance. While fuel prices have seen some stability, the outlook for 2025 suggests a notable increase in freight rates, with projections indicating a 4-6% climb due to heightened demand. This trend will necessitate careful adjustments to Heartland Express's pricing strategies to maintain profitability and revenue generation.

The persistent expansion of e-commerce directly fuels the need for transportation, especially for last-mile delivery. As consumers increasingly shop online, their expectations for swift and dependable deliveries shape the logistics landscape, impacting freight volumes for companies like Heartland Express. For instance, the global last-mile delivery market is anticipated to see significant growth from 2025 through 2029, driven by this very trend.

Economic Growth and Industrial Output

Economic growth is a critical driver for Heartland Express, directly impacting the demand for transporting general commodities. A healthy manufacturing and retail sector means more goods need to move, translating into higher freight volumes for trucking companies.

The economic outlook for 2024 and into 2025 suggests potential tailwinds for the transportation sector. Anticipated Federal Reserve rate cuts could stimulate business investment and consumer spending, boosting industrial output and housing starts. Increased manufacturing activity, a key indicator for freight demand, is expected to see moderate growth.

Specifically, projections for US real GDP growth in 2024 are around 2.5%, with a slight moderation anticipated for 2025. This sustained growth environment supports increased freight movement. For instance, the Cass Freight Index, a key industry benchmark, saw a notable increase in shipments throughout late 2023 and early 2024, indicating a rebound in freight demand.

- US Real GDP Growth: Projected around 2.5% for 2024, supporting increased freight volumes.

- Interest Rate Environment: Potential Federal Reserve rate cuts could stimulate economic activity and transportation demand.

- Manufacturing Activity: A rebound in industrial production, evidenced by indices like the ISM Manufacturing PMI, fuels the need for commodity transport.

- Housing Starts: Increased construction activity drives demand for building materials and related freight.

Interest Rates and Access to Capital

Interest rates significantly influence Heartland Express's ability to finance its operations and growth. Fluctuations in these rates directly affect the cost of borrowing for capital expenditures like fleet modernization and expansion. For instance, the Federal Reserve's decision to keep its benchmark interest rate between 5.25% and 5.50% as of mid-2024 means that borrowing for new trucks or technology upgrades will carry a substantial cost, potentially impacting investment decisions.

Higher borrowing costs due to elevated interest rates can deter trucking companies from investing in new equipment or expanding their fleets. This directly impacts Heartland Express's strategic goal of maintaining a modern and efficient fleet. If capital becomes more expensive, the pace at which the company can upgrade its assets might slow down, affecting its competitive edge and operational efficiency.

- Impact on Capital Expenditures: Elevated interest rates increase the cost of financing new equipment and fleet expansions for Heartland Express.

- Investment Deterrence: Higher borrowing costs can lead to a slowdown in investment for fleet modernization and technology adoption.

- Fleet Modernization: This economic factor directly influences Heartland Express's capacity to maintain its emphasis on a contemporary fleet.

- Access to Capital: The general availability and cost of capital are sensitive to prevailing interest rate environments.

Economic growth is a key driver for Heartland Express, with US real GDP projected to grow around 2.5% in 2024, potentially moderating slightly in 2025. This sustained growth supports increased freight demand, as seen in the rebound of indices like the Cass Freight Index. Anticipated Federal Reserve rate cuts could further stimulate business investment and consumer spending, boosting industrial output and housing starts, all of which translate to more goods needing transportation.

| Economic Factor | 2024 Projection | 2025 Outlook | Impact on Heartland Express |

|---|---|---|---|

| US Real GDP Growth | ~2.5% | Slight moderation | Supports increased freight volumes |

| Diesel Fuel Prices | $3.50 - $3.63/gallon (EIA forecast) | Stable to slightly easing | Operational cost management |

| Interest Rates | 5.25% - 5.50% (Federal Reserve benchmark) | Potential for cuts | Affects cost of capital for fleet investment |

| Inflation | Pressures on labor, equipment, maintenance | Continued concern | Necessitates pricing adjustments |

What You See Is What You Get

Heartland Express PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Heartland Express delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

The trucking industry, including companies like Heartland Express, is grappling with a persistent driver shortage, with projections indicating it could reach 82,000 by the close of 2024 and extend into 2025. This critical gap is largely driven by an aging workforce, as many experienced drivers approach retirement, coupled with ongoing challenges in retaining new talent.

To combat these demographic shifts and attract more individuals to the profession, trucking firms are implementing strategies such as raising driver compensation, enhancing working environments, and fostering greater diversity within the ranks. Investments in improved training programs are also a key focus to ensure a skilled and stable driver pool for the foreseeable future.

Modern workforce dynamics, especially among millennials and Gen Z, increasingly prioritize a healthy work-life balance. This shift directly influences the trucking industry, where drivers are seeking more consistent home time and adaptable schedules. For companies like Heartland Express, failing to meet these evolving expectations can significantly hinder recruitment and retention efforts.

In 2024, industry surveys indicated that over 60% of truck drivers cited work-life balance as a primary factor when considering new employment. Heartland Express, like its competitors, must adapt its operational models and compensation packages to align with these driver preferences. This includes exploring strategies for shorter haul routes or dedicated lanes that allow for more predictable home visits, thereby enhancing its appeal to a broader pool of potential drivers.

Public perception of truck driving significantly impacts Heartland Express's ability to attract and retain drivers. Negative stereotypes can deter potential recruits, exacerbating the ongoing driver shortage. For instance, a 2023 American Trucking Associations (ATA) survey indicated that 80% of Americans view trucking as a vital industry, yet only 40% would encourage their children to pursue it, highlighting a disconnect.

Heartland Express, like others in the sector, benefits from initiatives that reframe trucking as a stable, well-compensated career. Highlighting the industry's essential role in delivering goods, especially during economic fluctuations, can bolster its image. Focusing on improved working conditions, such as better pay structures and more predictable schedules, is crucial for attracting a broader and more diverse talent pool, addressing the 2024 projected deficit of over 70,000 drivers according to the ATA.

Consumer Demand for Speed and Transparency

Consumers today demand swift and clear delivery services, a trend amplified by the booming e-commerce sector. This expectation means logistics firms must adopt cutting-edge technology to ensure timely fulfillment.

Heartland Express, like its peers, faces pressure to enhance its operations. For instance, the rise of same-day delivery expectations, a significant shift in consumer behavior, necessitates robust technological infrastructure.

Key areas influenced by this sociological factor include:

- Investment in Real-Time Tracking: To provide customers with live updates on their shipments, enhancing transparency.

- Route Optimization Software: Utilizing advanced algorithms to ensure the fastest and most efficient delivery routes, meeting speed demands.

- Enhanced Communication Channels: Offering proactive notifications and responsive customer service to manage expectations and build trust.

- Data Analytics for Service Improvement: Leveraging data to understand delivery patterns and identify areas for increased speed and reliability.

Health and Safety Concerns for Drivers

The demanding lifestyle of truck drivers, characterized by long hours and extended periods away from home, presents significant health and safety challenges. These factors can contribute to fatigue, stress, and an increased risk of accidents. For instance, the Federal Motor Carrier Safety Administration (FMCSA) reported that in 2023, large trucks were involved in 136,000 crashes, resulting in 163,000 injuries and 1,000 fatalities, highlighting the critical need for safety improvements.

Heartland Express, like other carriers, must navigate these concerns through various initiatives. These often include strict adherence to mandatory rest periods, robust enforcement of drug and alcohol clearinghouse regulations, and the integration of advanced driver assistance systems (ADAS). These measures are designed to enhance driver well-being and proactively reduce the likelihood of accidents. The FMCSA's Drug and Alcohol Clearinghouse, for instance, processed over 1.2 million queries in 2023, demonstrating its role in keeping unsafe drivers off the road.

- Driver Fatigue: Long-haul trucking inherently leads to fatigue, a major contributor to accidents.

- Mental Health: The isolation and stress of the job can impact drivers' mental well-being.

- Physical Health: Sedentary work and limited access to healthy food options pose physical health risks.

- Safety Regulations: Compliance with FMCSA regulations, including Hours of Service (HOS), is paramount.

The trucking industry faces a significant driver shortage, projected to reach 82,000 by the end of 2024 and continue into 2025, driven by an aging workforce and retention issues. To address this, companies like Heartland Express are increasing pay and improving work environments, with over 60% of drivers prioritizing work-life balance in 2024. Furthermore, societal expectations for rapid delivery, fueled by e-commerce, pressure logistics firms to invest in technology for faster fulfillment.

| Sociological Factor | Impact on Heartland Express | Industry Data/Trend |

|---|---|---|

| Driver Shortage & Demographics | Need for increased recruitment and retention efforts; focus on improved compensation and working conditions. | Projected shortage of 82,000 drivers by end of 2024; aging workforce. |

| Work-Life Balance Expectations | Requirement to offer more flexible schedules and better home time to attract and retain drivers. | Over 60% of drivers cite work-life balance as a key factor in job choice (2024 surveys). |

| Consumer Delivery Expectations | Pressure to adopt technology for faster, more transparent deliveries to meet e-commerce demands. | Rise in same-day delivery expectations. |

| Public Perception of Trucking | Need to reframe trucking as a stable, well-compensated career to attract talent. | 80% view trucking as vital, but only 40% would encourage children to enter the field (2023 ATA survey). |

Technological factors

Autonomous trucking technology is making significant strides, with early commercial deployments anticipated on specific routes between 2024 and 2025. This advancement promises to boost safety and efficiency in freight transport.

Companies are actively piloting and integrating self-driving trucks, a move that could lead to improved operational performance and potentially alleviate the ongoing driver shortage within the industry.

AI and machine learning are significantly transforming logistics operations for companies like Heartland Express. These technologies are being deployed to optimize delivery routes, leading to reduced fuel costs and faster transit times. For instance, predictive analytics can forecast demand with greater accuracy, allowing for better resource allocation and inventory management.

The implementation of AI in logistics is projected to drive substantial cost savings and efficiency gains. A report from Statista in 2024 estimated that the global AI in logistics market was valued at approximately $4.5 billion and is expected to grow at a compound annual growth rate (CAGR) of over 20% through 2030. This growth is fueled by the ability of AI to enhance supply chain visibility and enable proactive decision-making.

Furthermore, AI's role in predictive maintenance is crucial for fleet operators. By analyzing sensor data from trucks, AI can anticipate potential mechanical failures, allowing for scheduled maintenance and minimizing costly breakdowns. This proactive approach ensures greater uptime for Heartland Express's fleet, directly impacting operational reliability and customer satisfaction.

Heartland Express leverages advanced telematics systems that go beyond simple GPS tracking. These solutions now provide real-time vehicle diagnostics, detailed driver behavior analytics, and crucial fuel efficiency monitoring, directly impacting operational costs and safety.

The adoption of video telematics, a key component of these systems, offers deeper insights into vehicle performance and driver actions. This enhanced visibility improves safety by actively monitoring driver behavior, thereby reducing accident risks and potentially lowering insurance premiums.

In 2023, Heartland Express reported fuel and fuel tax expenses of $209.8 million, a significant portion of their operating costs. The ongoing enhancement of telematics systems aims to optimize fuel consumption, a critical factor in maintaining profitability within the trucking industry.

Electrification and Alternative Fuel Vehicles

The trucking industry, including companies like Heartland Express, is experiencing a significant shift towards electrification and alternative fuels. This is largely due to increasing environmental concerns and government regulations aimed at reducing carbon emissions. For instance, by 2027, California plans to mandate that 100% of drayage trucks operating in the state must be zero-emission, a trend likely to spread.

While the widespread adoption of fully electric or hydrogen fuel cell trucks is still in its early stages, the market is seeing substantial investment. Companies are exploring and implementing cleaner fuel options such as renewable natural gas (RNG) and biodiesel. In 2023, the U.S. saw a notable increase in the use of renewable diesel, with consumption reaching an estimated 5.7 billion gallons, up from 5.1 billion gallons in 2022, according to the U.S. Energy Information Administration.

The development of charging and refueling infrastructure remains a key challenge. However, progress is being made, with various public and private initiatives focused on building out these networks. This evolving landscape presents both opportunities and challenges for freight carriers in terms of fleet modernization and operational adjustments.

Key developments include:

- Growing regulatory mandates: California's zero-emission drayage truck rule is a prime example of future industry direction.

- Increased investment in cleaner fuels: The U.S. saw a significant rise in renewable diesel consumption in 2023.

- Infrastructure development: Efforts are underway to expand charging and refueling stations for alternative fuel vehicles.

- Fleet adaptation: Trucking companies are evaluating and beginning to integrate alternative fuel vehicles into their operations.

Cybersecurity and Data Management

Heartland Express's increasing reliance on digital systems for operations and customer data management makes robust cybersecurity a critical technological factor. A data breach could compromise sensitive information, leading to significant financial losses and reputational damage. For instance, the transportation sector experienced a 13% increase in cyberattacks in 2023, highlighting the pervasive threat.

Effective data management and cybersecurity are therefore essential for maintaining the integrity and reliability of Heartland Express's logistics operations. This includes safeguarding against ransomware, phishing, and other cyber threats that could disrupt services or compromise proprietary information. Companies in the logistics sector are investing heavily in these areas; for example, cybersecurity spending in the global transportation industry was projected to reach over $10 billion by the end of 2024.

- Cybersecurity Investments: Heartland Express must allocate resources to advanced threat detection and prevention systems.

- Data Integrity: Implementing strict data validation and backup protocols is crucial for operational continuity.

- Regulatory Compliance: Adhering to data privacy regulations, such as GDPR or CCPA, is paramount for avoiding penalties.

- Employee Training: Regular cybersecurity awareness training for employees can mitigate risks associated with human error.

The trucking industry is rapidly adopting advanced technologies like AI for route optimization and predictive maintenance, aiming to cut costs and improve efficiency. For example, AI in logistics is projected to see significant growth, with the global market valued at approximately $4.5 billion in 2024 and expected to expand rapidly.

Autonomous trucking is progressing, with initial commercial deployments anticipated on select routes between 2024 and 2025, promising enhanced safety and efficiency. Telematics systems are also evolving, offering real-time diagnostics and driver behavior analytics, crucial for managing operational costs and safety, especially considering Heartland Express's 2023 fuel expenses of $209.8 million.

Electrification and alternative fuels are becoming more prevalent due to environmental pressures, with mandates like California's zero-emission drayage truck rule by 2027 signaling a shift. The U.S. saw a notable increase in renewable diesel consumption in 2023, reaching an estimated 5.7 billion gallons.

Cybersecurity is paramount, with the transportation sector experiencing a 13% rise in cyberattacks in 2023. The global transportation industry's cybersecurity spending was projected to exceed $10 billion by the end of 2024, underscoring the need for robust data protection.

| Technology Area | Key Development/Trend | Impact on Heartland Express | Relevant Data/Statistic |

|---|---|---|---|

| AI & Machine Learning | Route optimization, predictive maintenance | Reduced fuel costs, improved uptime, better resource allocation | AI in logistics market ~$4.5B (2024), >20% CAGR |

| Autonomous Trucking | Early commercial deployments | Potential for increased efficiency, driver shortage mitigation | Anticipated 2024-2025 deployment on specific routes |

| Telematics | Advanced diagnostics, driver analytics, fuel monitoring | Enhanced safety, operational cost control, improved fuel efficiency | Heartland Express fuel costs: $209.8M (2023) |

| Electrification & Alternative Fuels | Zero-emission mandates, increased renewable fuel use | Fleet modernization, operational adjustments, potential cost savings | CA zero-emission drayage mandate (2027), US renewable diesel consumption: 5.7B gallons (2023) |

| Cybersecurity | Increased cyber threats, data protection investment | Safeguarding sensitive data, maintaining operational integrity, avoiding financial/reputational damage | Transportation sector cyberattacks +13% (2023), Global transport cybersecurity spend >$10B (2024 est.) |

Legal factors

The Federal Motor Carrier Safety Administration (FMCSA) is continuously refining rules that govern trucking safety, driver qualifications, and overall compliance. For 2025, significant updates are expected, including a mandate for Automatic Emergency Braking (AEB) systems on new heavy-duty trucks, a move aimed at reducing crashes. There's also ongoing discussion and potential implementation of speed limiter rules, which could impact fuel efficiency and operational speeds.

These evolving FMCSA regulations necessitate carriers like Heartland Express to maintain rigorous adherence to safety protocols and equipment standards. The agency's Compliance, Safety, and Accountability (CSA) program also sees ongoing updates, influencing how carriers are evaluated on safety performance. Failure to comply can result in penalties and operational disruptions, underscoring the critical importance of staying ahead of these regulatory changes.

Changes in labor laws, particularly those impacting truck driver hours-of-service and detention pay, directly influence Heartland Express's operational capacity and driver recruitment. The Federal Motor Carrier Safety Administration's (FMCSA) Drug and Alcohol Clearinghouse, which began full enforcement in January 2020, mandates strict compliance, with non-compliant drivers facing automatic CDL downgrades, potentially reducing the available qualified driver pool.

Stricter environmental regulations, including evolving emissions standards and ambitious zero-emission targets, are compelling trucking companies like Heartland Express to accelerate investments in cleaner technologies and more sustainable operational practices. For instance, the U.S. Environmental Protection Agency (EPA) has been progressively tightening emissions standards for heavy-duty vehicles, with significant updates expected to be finalized in 2024 and implemented in subsequent years, pushing for reductions in nitrogen oxides (NOx) and particulate matter.

Compliance with these increasingly stringent environmental mandates is not merely a matter of avoiding substantial fines and legal repercussions, which can run into millions of dollars for non-compliance, but also a strategic imperative to align with global and national environmental objectives. This proactive approach helps maintain operational continuity and reputation in a market increasingly sensitive to corporate environmental responsibility.

Cross-Border Shipping Protocols

Changes in cross-border shipping protocols significantly impact trucking companies like Heartland Express. For instance, the USMCA (United States-Mexico-Canada Agreement), which came into effect in 2020, aimed to streamline trade, potentially reducing customs delays for carriers operating between these nations. However, evolving geopolitical situations and new trade policies can introduce complexities, requiring constant adaptation.

These shifts can affect operational costs and efficiency. For example, new tariffs imposed on goods or stricter customs clearance procedures can add to compliance burdens and transit times. Companies must stay informed about regulatory updates to manage these challenges effectively.

- USMCA Implementation: Facilitated smoother trade between the US, Mexico, and Canada, potentially reducing border friction.

- Tariff Impact: New tariffs can increase the cost of cross-border freight, affecting pricing and demand.

- Geopolitical Influence: International relations can lead to sudden changes in trade regulations and shipping routes.

- Customs Modernization: Efforts to digitize and simplify customs processes can improve efficiency for carriers.

Data Privacy and Security Laws

As Heartland Express increasingly relies on digitized logistics, navigating data privacy and security laws becomes paramount. Regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which went into full effect in 2023, set stringent standards for how companies handle personal information. Failure to comply can result in significant penalties, impacting operational costs and brand reputation.

Robust cybersecurity measures are essential to protect sensitive operational and customer data. This includes safeguarding information related to shipments, driver activities, and customer preferences, ensuring compliance with evolving legal frameworks. The global data protection landscape continues to evolve, with new regulations anticipated and existing ones being strengthened, requiring ongoing vigilance and adaptation from companies like Heartland Express.

- CCPA/CPRA Compliance: Adherence to California's comprehensive privacy laws impacts data collection, storage, and usage policies for customer and operational data.

- GDPR Impact: For any cross-border data flows, compliance with the General Data Protection Regulation (GDPR) remains critical, even if operations are primarily domestic.

- Cybersecurity Investment: Companies are investing heavily in cybersecurity, with global spending projected to reach over $260 billion in 2024, according to Cybersecurity Ventures.

- Data Breach Penalties: Fines for data breaches can be substantial, with some regulations allowing for penalties of up to 4% of a company's global annual revenue.

Federal regulations continue to shape the trucking industry, with the FMCSA's focus on safety and compliance. For 2024 and 2025, expect continued emphasis on driver qualifications and updated safety mandates, potentially including further advancements in autonomous driving technology integration and stricter enforcement of hours-of-service rules. These evolving legal frameworks demand constant adaptation to avoid penalties and ensure operational efficiency.

Environmental factors

The trucking industry faces mounting pressure to cut carbon emissions, with a significant push towards sustainability. This involves adopting advanced fuel-efficient technologies, exploring alternative fuels such as renewable natural gas and electric powertrains, and implementing route optimization strategies to reduce environmental impact.

Heartland Express, like its peers, is navigating these changes. For instance, the U.S. Environmental Protection Agency (EPA) has set stringent emissions standards, aiming for a 25% reduction in greenhouse gas emissions from heavy-duty trucks by 2032 compared to 2027 levels. This regulatory landscape necessitates investments in newer, cleaner fleets.

Companies are increasingly participating in carbon offset programs and enhancing their Environmental, Social, and Governance (ESG) reporting to demonstrate commitment to sustainability. For example, by 2024, many major carriers are expected to have integrated a percentage of electric or alternative fuel vehicles into their fleets, responding to both regulatory demands and growing investor interest in sustainable operations.

Climate change is increasingly impacting transportation, a core component of Heartland Express's operations. More frequent extreme weather events, such as the record-breaking Atlantic hurricane season in 2024 which saw 20 named storms, directly disrupt trucking routes, leading to delays and increased operational costs. These weather-related disruptions can also affect the availability of raw materials and finished goods, forcing a greater emphasis on building more resilient supply chain strategies.

Heartland Express is actively investing in fuel-efficient engines, aerodynamic enhancements, and low-resistance tires for its fleet. These upgrades are crucial for reducing fuel consumption, a significant operating cost, and minimizing the company's environmental footprint. Driver training programs also emphasize eco-friendly driving techniques to further optimize fuel usage.

The trucking industry is witnessing a significant shift towards greener technologies, with many new truck models now incorporating these advancements as standard features. This trend means that maintaining a modern fleet is increasingly synonymous with improved fuel efficiency and reduced emissions, aligning with both regulatory pressures and customer expectations for sustainable operations.

Waste Reduction and Recycling Programs

Heartland Express, like many in the trucking sector, is increasingly focused on waste reduction and recycling. Initiatives include recycling used tires and vehicle parts, a significant waste stream for the industry. The company is also exploring the use of more sustainable packaging materials for its operations.

These efforts are part of a broader industry trend to lessen the environmental footprint of trucking. For instance, the U.S. recycling rate for tires reached approximately 70% in 2023, with a substantial portion being reprocessed for various applications. This highlights the potential for companies like Heartland Express to contribute to circular economy principles.

The company's commitment to sustainability extends to operational efficiency, which can indirectly reduce waste. For example, optimizing routes and improving fuel efficiency not only cuts emissions but also minimizes wear and tear on equipment, potentially extending its lifespan and reducing replacement waste.

- Tire Recycling: Trucking operations generate a significant volume of used tires, making their recycling a key environmental focus.

- Parts Reclamation: Efforts are underway to recycle or repurpose used truck parts, diverting them from landfills.

- Eco-Friendly Packaging: The adoption of sustainable materials for shipping and internal operations is a growing practice.

- Operational Efficiency: Enhanced route planning and fuel management contribute to reduced waste through better resource utilization.

Infrastructure for Alternative Fuels

The expansion of charging and fueling stations for electric and hydrogen trucks is a key environmental factor impacting the trucking industry, including companies like Heartland Express. Widespread adoption of these cleaner technologies hinges on robust infrastructure development.

Despite government incentives, the current scarcity of charging and fueling points presents a significant logistical hurdle. For instance, by late 2024, the number of publicly available DC fast chargers for electric vehicles in the US, while growing, still lags behind the needs of a rapidly expanding electric truck fleet. This limited availability directly affects route planning and operational efficiency for carriers transitioning to alternative fuels.

- Infrastructure Gap: Limited charging and fueling stations for electric and hydrogen trucks remain a primary obstacle to widespread adoption.

- Government Support: While incentives exist, the pace of infrastructure build-out needs to accelerate to meet demand.

- Operational Challenges: Insufficient infrastructure creates logistical complexities for carriers integrating alternative fuel vehicles into their operations.

Environmental regulations are increasingly shaping the trucking industry, pushing companies like Heartland Express towards sustainability. Stricter emissions standards, such as the EPA's goal for a 25% greenhouse gas reduction in heavy-duty trucks by 2032, necessitate investments in cleaner fleets and alternative fuels. This focus on ESG reporting and participation in carbon offset programs is becoming standard practice for carriers.

Climate change impacts operations through extreme weather events, disrupting routes and increasing costs, as seen with the 2024 hurricane season. Heartland Express is responding by investing in fuel-efficient technologies and eco-friendly driving practices to mitigate these effects and reduce its environmental footprint.

The industry is also prioritizing waste reduction, with initiatives like tire and parts recycling gaining traction. For instance, the U.S. tire recycling rate neared 70% in 2023, demonstrating a move towards circular economy principles within the sector.

The development of charging and fueling infrastructure for electric and hydrogen trucks remains a critical environmental factor, with the current scarcity posing logistical challenges for fleet transitions. By late 2024, the U.S. still faced an infrastructure gap for the growing electric truck fleet.

| Environmental Factor | Impact on Heartland Express | Industry Trend/Data |

|---|---|---|

| Emissions Standards | Requires investment in cleaner fleets and technologies. | EPA aims for 25% GHG reduction in heavy-duty trucks by 2032. |

| Climate Change & Extreme Weather | Disrupts routes, increases operational costs. | 2024 Atlantic hurricane season had 20 named storms, impacting logistics. |

| Fuel Efficiency & Alternative Fuels | Drives investment in upgrades and driver training. | New truck models increasingly feature standard fuel-efficient advancements. |

| Waste Reduction & Recycling | Focus on tire and parts recycling, sustainable packaging. | U.S. tire recycling rate reached ~70% in 2023. |

| Infrastructure for Alternative Fuels | Challenges fleet transition due to limited stations. | U.S. public EV fast charger availability lags behind fleet needs as of late 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Heartland Express is built on a robust foundation of data from official government transportation and economic agencies, industry-specific trade publications, and reputable market research firms. This ensures comprehensive coverage of regulatory changes, economic shifts, and technological advancements impacting the trucking sector.