Heartland Express Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heartland Express Bundle

Explore the strategic core of Heartland Express's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their efficient operations, customer relationships, and revenue streams, offering a clear roadmap for understanding their market dominance. Perfect for those seeking to replicate or analyze a winning formula.

Partnerships

Heartland Express collaborates with technology providers like Isaac Instruments for its in-cab telematics systems. This partnership is vital for real-time driver communication and ensuring compliance with electronic logging device (ELD) mandates. In 2024, Heartland Express continued to leverage these advanced solutions to refine route optimization and bolster fleet-wide safety protocols.

Heartland Express’s relationships with truck and trailer manufacturers are crucial for keeping its fleet cutting-edge. These partnerships provide access to the newest vehicle technologies, which directly translate to better fuel efficiency and enhanced safety. For instance, in 2024, Heartland Express continued its strategic investment in modern equipment, aiming to optimize operational costs and driver satisfaction through advanced features.

Heartland Express collaborates with major fuel suppliers to manage a significant operating expense. For instance, in 2023, fuel and fuel taxes represented approximately 26% of Heartland Express's total operating expenses, a figure that underscores the importance of these relationships for cost control and profitability.

These partnerships are crucial for implementing efficient fuel procurement strategies and effective fuel surcharge mechanisms. This approach helps to mitigate the financial impact of fluctuating fuel prices, ensuring greater stability in the company's financial performance.

Financial Institutions

Heartland Express relies on financial institutions for essential debt financing and lines of credit, crucial for funding its operations and strategic growth initiatives. These partnerships enable the company to manage significant capital expenditures, such as fleet modernization or expansion, ensuring it maintains a competitive edge in the trucking industry.

In 2024, Heartland Express continued to focus on strengthening its financial position, a key strategic objective. Access to credit facilities from these institutions is vital for managing working capital, meeting financial obligations, and supporting long-term investments. For instance, robust relationships with banks facilitate the management of debt, including efforts to reduce outstanding balances and improve leverage ratios.

- Debt Financing: Securing loans to fund major purchases like new trucks or trailers.

- Lines of Credit: Accessing flexible funds for day-to-day operational needs and unexpected expenses.

- Capital Expenditure Funding: Partnering to finance large investments in fleet upgrades and technology.

- Liquidity Management: Ensuring sufficient cash flow to meet all financial commitments and operational demands.

Regulatory and Industry Associations

Heartland Express actively partners with organizations like the U.S. EPA SmartWay program, a voluntary program that helps freight shippers and carriers in North America improve energy efficiency and reduce environmental impact. This collaboration underscores their dedication to sustainability, aiming to reduce emissions and fuel consumption across their operations. In 2023, SmartWay partners collectively saved 14.6 million metric tons of carbon dioxide, 62,000 tons of nitrogen oxides, and 500 tons of particulate matter, demonstrating the tangible benefits of such affiliations.

Their involvement with Truckers Against Trafficking further highlights a commitment to social responsibility and ethical operations. This partnership aims to educate and mobilize the trucking industry to combat human trafficking. By engaging with these associations, Heartland Express not only adopts best practices but also contributes to industry-wide advancements in safety and ethical conduct.

- Environmental Commitment: Participation in programs like EPA SmartWay drives efficiency and emission reductions.

- Social Responsibility: Aligning with Truckers Against Trafficking demonstrates a stance against human trafficking.

- Best Practice Adoption: These partnerships facilitate the integration of industry-leading operational standards.

- Enhanced Reputation: Affiliations bolster the company's image as a responsible corporate citizen.

Heartland Express's key partnerships extend to financial institutions, crucial for securing debt financing and lines of credit. These relationships are vital for funding fleet modernization and managing capital expenditures, ensuring operational continuity and competitive positioning. In 2024, Heartland Express continued to leverage these partnerships to maintain a strong financial footing and support strategic growth initiatives.

| Partner Type | Purpose | 2023 Impact/Focus |

|---|---|---|

| Technology Providers (e.g., Isaac Instruments) | In-cab telematics, ELD compliance, route optimization | Refined route optimization and bolstered fleet-wide safety protocols. |

| Truck & Trailer Manufacturers | Access to new vehicle technologies, fuel efficiency, safety | Strategic investment in modern equipment for cost optimization and driver satisfaction. |

| Fuel Suppliers | Fuel procurement, cost control | Fuel and fuel taxes represented ~26% of total operating expenses, highlighting partnership importance. |

| Financial Institutions | Debt financing, lines of credit, capital expenditure funding | Continued focus on strengthening financial position and managing working capital in 2024. |

| EPA SmartWay Program | Energy efficiency, environmental impact reduction | Contributed to collective partner savings of 14.6 million metric tons of CO2 in 2023. |

What is included in the product

A detailed breakdown of Heartland Express's operational strategy, this Business Model Canvas highlights its focus on efficient long-haul trucking, dedicated customer relationships, and a strong emphasis on driver retention to deliver reliable transportation services.

Heartland Express's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operational strategy, allowing for quick identification of inefficiencies and opportunities for cost savings in the trucking industry.

Activities

Heartland Express's primary activity is operating a truckload carrier service, focusing on general commodities throughout North America. This core function supports the efficient movement of goods for a wide range of industries.

The company specializes in regional, medium, and long-haul transportation, specifically for time-sensitive, dry van freight. This ensures that crucial shipments reach their destinations promptly and in optimal condition.

Expanding its capabilities, Heartland Express also provides temperature-controlled transportation and logistics services into and out of Mexico, leveraging acquired brands to broaden its service portfolio and market reach.

Heartland Express’s key activity of fleet management involves the continuous cycle of acquiring, depreciating, and disposing of tractors and trailers. This strategic approach ensures the fleet remains modern and efficient, directly impacting operating performance and driver safety. For instance, in 2023, Heartland Express reported capital expenditures of $259.7 million, a significant portion dedicated to fleet modernization.

Ongoing repairs and preventative maintenance are crucial to minimizing costly downtime. By proactively addressing wear and tear, Heartland Express keeps its trucks on the road, maximizing revenue generation and controlling operational expenditures. This commitment to maintenance is vital for maintaining a competitive edge in the trucking industry.

Heartland Express actively addresses the persistent industry-wide shortage of qualified drivers. This involves significant investment in competitive driver compensation packages, comprehensive benefits, and robust training programs, including their own internal training institutes.

Attracting and retaining skilled professionals is paramount, and the company's focus on these areas directly impacts operational efficiency. A low driver turnover rate, a key metric for Heartland Express, ensures consistent service delivery and maintains the stability of their operations.

Acquisition Integration and Optimization

Heartland Express’s key activity of Acquisition Integration and Optimization is crucial for realizing the full potential of strategic mergers. This involves meticulously combining acquired entities, such as the notable acquisitions of CFI and Smith Transport, into the existing operational framework. The process focuses on standardizing IT systems, aligning HR policies, and harmonizing fleet management to ensure seamless transitions and operational synergy. For instance, following the acquisition of CFI in 2023, Heartland Express has been actively working on integrating its extensive network and diverse service capabilities into its own, aiming for enhanced efficiency and broader market reach.

The core objective of this activity is to drive significant improvements in operational efficiency and cost reduction. By consolidating redundant functions and optimizing the utilization of the combined asset base, Heartland Express seeks to unlock cost savings and boost profitability. This strategic approach allows the company to leverage its expanded geographical footprint and enhanced service portfolio, offering a more comprehensive suite of transportation solutions to its customers. The successful integration of acquired businesses is directly linked to the company's ability to achieve its overarching financial goals and sustain its growth trajectory.

Key aspects of this integration process include:

- Operational Consolidation: Merging back-office functions, dispatch systems, and maintenance operations to eliminate redundancies and streamline workflows.

- System Standardization: Implementing unified IT platforms for accounting, customer relationship management, and fleet tracking to improve data accuracy and reporting.

- Asset Utilization Optimization: Reallocating and maximizing the use of trucks, trailers, and other equipment across the combined network to reduce idle time and increase revenue generation.

- Synergy Realization: Actively pursuing cost synergies through bulk purchasing, shared services, and improved route planning to enhance overall financial performance.

Customer Relationship Management

Heartland Express focuses on cultivating enduring partnerships with clients in retail, manufacturing, and food sectors. This involves consistently meeting delivery schedules and upholding stringent safety standards, while proactively adapting to changing client requirements.

The company’s commitment to exceptional service is a cornerstone of its strategy. For instance, in 2024, Heartland Express continued its tradition of receiving industry accolades for service quality, reinforcing its reputation as a trusted and sought-after transportation provider.

- On-Time Performance: Maintaining high on-time delivery rates, a critical factor for clients in just-in-time manufacturing and retail supply chains.

- Safety Excellence: Prioritizing safety in all operations to protect drivers, cargo, and the public, which is a key differentiator.

- Customer Understanding: Actively seeking feedback and analyzing data to anticipate and address evolving customer needs and logistical challenges.

- Award-Winning Service: Leveraging industry recognition for service quality to build brand loyalty and attract new business.

Heartland Express's key activities revolve around operating a truckload carrier service, specializing in dry van freight and expanding into temperature-controlled logistics. This includes meticulous fleet management, focusing on modernization and maintenance to ensure operational efficiency and driver safety. For example, in 2023, capital expenditures reached $259.7 million, largely for fleet upgrades.

A significant focus is placed on driver recruitment and retention, offering competitive compensation and training programs to combat industry shortages. The company also actively integrates acquired businesses, like CFI, to optimize operations and achieve cost synergies, aiming for enhanced efficiency and broader market reach. In 2024, the company continued to be recognized for its service quality.

| Key Activity | Description | 2023 Data/2024 Context |

|---|---|---|

| Truckload Carrier Service | Operating a regional, medium, and long-haul transportation service for dry van freight. | Focus on time-sensitive shipments. |

| Fleet Management | Acquisition, maintenance, and disposal of tractors and trailers. | $259.7 million in capital expenditures in 2023 for fleet modernization. |

| Driver Management | Recruitment, training, and retention of qualified drivers. | Investment in competitive compensation and benefits. |

| Acquisition Integration | Integrating acquired companies to optimize operations and achieve synergies. | Ongoing integration of CFI and Smith Transport. |

| Customer Relationship Management | Cultivating partnerships through on-time performance and safety. | Continued industry accolades for service quality in 2024. |

Preview Before You Purchase

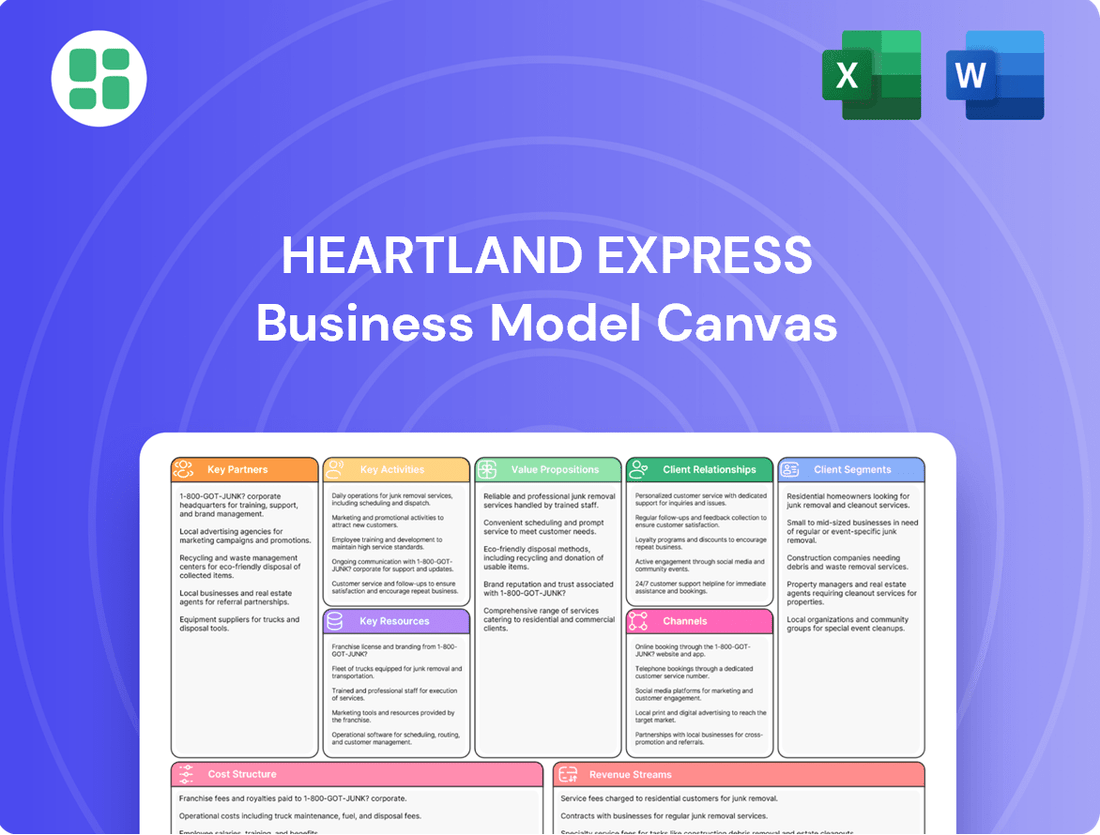

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, showcasing the comprehensive structure and content you can expect. You'll gain immediate access to this exact file, ready for your strategic analysis and customization.

Resources

Heartland Express boasts a modern fleet, a cornerstone of its operations. This includes tractors outfitted with cutting-edge safety and communication systems, alongside both dry van and refrigerated trailers. This commitment to advanced equipment directly supports their service reliability.

The company emphasizes maintaining a young fleet age. In 2024, Heartland Express reported owning and operating approximately 3,500 tractors and over 7,000 trailers, with a significant portion being relatively new. This strategy enhances operational efficiency, improves fuel economy, and contributes to driver comfort and retention.

This robust asset base is crucial for Heartland Express's ability to deliver its core services effectively. The substantial investment in a well-maintained and technologically advanced fleet underpins their capacity to handle diverse freight needs and maintain high service standards across their network.

Skilled professional drivers are the backbone of Heartland Express's operations, directly impacting the safety and timeliness of every freight delivery. Their expertise is paramount to the company's reputation for reliability.

Heartland Express recognizes the critical nature of its drivers by offering competitive compensation and benefits. This strategy is essential for attracting and retaining a high-quality workforce, which in turn ensures consistent service levels and operational capacity. In 2024, the trucking industry faced ongoing driver shortages, making retention efforts even more crucial.

The company's commitment extends to investing in driver training and development programs. These initiatives not only enhance safety and efficiency but also foster loyalty, securing this indispensable human resource for the long term.

Heartland Express leverages advanced technology as a core resource. This includes sophisticated mobile communication systems for drivers, event recorders for safety monitoring, and accident avoidance technology. These systems are crucial for real-time operations and driver safety.

A unified Transportation Management System (TMS) is central to their operations, facilitating efficient dispatch, precise tracking, and optimized routing. This integrated system allows for comprehensive data analysis, which is key to improving service delivery and cost management. For instance, in 2024, Heartland Express continued its strategic transition to a common TMS across its various brands, a move designed to significantly enhance enterprise-wide operational efficiency and data standardization.

Strategic Terminal Network

Heartland Express's strategic terminal network serves as the backbone of its North American operations. This network comprises strategically positioned facilities that function as vital hubs for maintaining their fleet, offering essential support to their drivers, and efficiently managing freight. These physical assets are absolutely critical for ensuring smooth and effective regional and long-haul transportation services.

The extensive terminal network directly contributes to Heartland Express's ability to offer broad geographic coverage and a wide range of service capabilities across the continent. For instance, as of the first quarter of 2024, Heartland Express reported operating a significant number of tractors, underscoring the scale of their fleet that these terminals support.

- Operational Hubs: Terminals provide centralized locations for crucial fleet maintenance and repair, minimizing downtime.

- Driver Support: These facilities offer drivers rest areas, resources, and logistical coordination, enhancing driver retention and efficiency.

- Freight Handling: Terminals facilitate the effective loading, unloading, and temporary storage of goods, optimizing the supply chain.

- Geographic Reach: The strategically placed network allows for extensive coverage, enabling Heartland Express to serve a wider customer base across North America.

Strong Financial Capital and Brand Reputation

Heartland Express's strong financial capital, including substantial cash reserves and robust access to credit, is a cornerstone of its business model. As of the first quarter of 2024, the company reported approximately $342 million in cash and cash equivalents, providing significant flexibility for capital expenditures, strategic acquisitions, and effective debt management. This financial strength allows Heartland to weather industry downturns and invest in operational improvements.

Complementing its financial might is Heartland Express's well-established brand reputation. Known for its commitment to reliability, safety, and exceptional customer service, this intangible asset is crucial in the highly competitive trucking industry. In 2023, Heartland Express maintained a strong safety record, a key differentiator that resonates with shippers seeking dependable transportation partners and drivers prioritizing a secure work environment.

- Financial Strength: Approximately $342 million in cash and cash equivalents as of Q1 2024.

- Credit Access: Proven ability to secure financing for growth and operational needs.

- Brand Reputation: Recognized for reliability, safety, and customer service.

- Market Attraction: Reputation aids in attracting and retaining both customers and drivers.

Heartland Express's modern and well-maintained fleet, comprising approximately 3,500 tractors and over 7,000 trailers in 2024, represents a significant physical asset. This robust fleet, equipped with advanced technology for safety and communication, directly enables their core service of freight transportation.

Skilled professional drivers are indispensable human resources, ensuring the safe and timely delivery of goods. Heartland Express's investment in competitive compensation and ongoing training programs aims to attract and retain this vital workforce, particularly crucial amid industry-wide driver shortages observed in 2024.

The company’s advanced technology, including mobile communication systems and a unified Transportation Management System (TMS), streamlines operations from dispatch to routing. This technological infrastructure, with a strategic transition to a common TMS ongoing in 2024, enhances efficiency and data-driven decision-making.

A strategically located terminal network provides essential operational hubs for fleet maintenance, driver support, and freight handling, facilitating broad geographic coverage across North America.

Heartland Express's strong financial capital, evidenced by approximately $342 million in cash and cash equivalents as of Q1 2024, alongside its respected brand reputation for reliability and safety, forms critical intangible resources that support its market position and operational capabilities.

| Key Resource | Description | 2024 Data/Context |

|---|---|---|

| Physical Assets | Modern, well-maintained fleet of tractors and trailers. | Approx. 3,500 tractors, 7,000+ trailers owned and operated. |

| Human Resources | Skilled and professional drivers. | Focus on competitive compensation and retention due to industry shortages. |

| Intellectual Property | Advanced Transportation Management System (TMS) and safety technology. | Ongoing transition to a common TMS across brands for efficiency. |

| Financial Capital | Strong cash reserves and access to credit. | Approx. $342 million in cash and cash equivalents (Q1 2024). |

| Brand Reputation | Established reputation for reliability, safety, and customer service. | Key differentiator in a competitive market. |

Value Propositions

Heartland Express prioritizes consistent and dependable on-time pickup and delivery, a crucial element for clients with time-sensitive freight. This dedication to punctuality fosters trust and is a key driver for customer loyalty.

In 2024, Heartland Express continued to demonstrate strong operational performance, with their commitment to reliability being a cornerstone of their value proposition. This focus on on-time delivery directly translates into customer satisfaction and retention, a vital aspect of their business model.

Heartland Express's commitment to enhanced safety and security is a cornerstone of its value proposition. This is demonstrated through their best-in-class safety record, a direct result of investing in modern fleet equipment and incorporating advanced safety technologies. For example, in 2024, the company continued its focus on fleet modernization, which directly contributes to fewer accidents and incidents.

Rigorous driver training programs further solidify this commitment, ensuring that all personnel are equipped with the skills to operate safely and responsibly. This meticulous approach not only safeguards the goods entrusted to them but also prioritizes the well-being of their drivers, a critical factor in operational excellence and customer trust.

This unwavering dedication to safety serves as a significant competitive differentiator in the trucking industry. Customers increasingly prioritize carriers with proven safety records, recognizing that it translates to reduced risk, fewer delays, and greater peace of mind for their supply chains.

Heartland Express operates a modern and efficient fleet, a core value proposition ensuring reliable service for its customers. By utilizing late-model tractors and trailers equipped with advanced technology, the company significantly minimizes the risk of unexpected breakdowns, which directly translates to consistent on-time deliveries. This focus on fleet quality is a key differentiator in the competitive transportation landscape.

Furthermore, Heartland Express's commitment to fuel-efficient equipment not only enhances operational efficiency but also underscores a dedication to sustainability. In 2024, the trucking industry is increasingly scrutinized for its environmental impact, and a fuel-efficient fleet positions Heartland Express as a more environmentally conscious choice for shippers. This aligns with growing corporate social responsibility mandates across various sectors.

Comprehensive North American Coverage

Heartland Express's commitment to comprehensive North American coverage is a cornerstone of its business model. Through a combination of organic growth and strategic acquisitions, the company has built an extensive network spanning the United States, Canada, and Mexico.

This broad operational footprint allows Heartland Express to offer a diverse range of transportation services, including regional, medium, and long-haul routes. Their capacity extends to various needs, from dry van to temperature-controlled shipments, ensuring a wide spectrum of customer requirements are met. For instance, in 2024, Heartland Express continued to expand its fleet and service offerings, enhancing its ability to provide flexible and far-reaching logistical solutions across the continent.

- Extensive Network: Operates across the United States, Canada, and Mexico.

- Diverse Service Options: Includes dry van and temperature-controlled transportation.

- Strategic Growth: Achieved through both organic expansion and targeted acquisitions.

- Customer-Centricity: Designed to meet a wide array of logistical demands.

Customer-Centric Service and Flexibility

Heartland Express cultivates strategic partnerships by deeply understanding and proactively addressing customer challenges, moving beyond simple transactions. This customer-centric approach means tailoring services precisely to individual requirements and maintaining clear, prompt communication about shipment status.

Their operational flexibility is a key value proposition. Heartland Express demonstrates this by dynamically adjusting fleet size and optimizing routes to precisely match fluctuating customer demand. For instance, in 2024, the company has highlighted its ability to adapt capacity to meet specific shipper needs, a crucial factor in a dynamic freight market.

- Focus on Partnership: Transitioning from transactional exchanges to collaborative problem-solving.

- Tailored Solutions: Customizing services to meet unique customer logistics requirements.

- Responsive Communication: Providing real-time updates and clear information on shipment progress.

- Adaptive Capacity: Flexibly adjusting fleet operations and routes to align with market demand and customer needs.

Heartland Express's value proposition centers on being a reliable, safe, and efficient transportation partner. They achieve this through a modern fleet, rigorous driver training, and a commitment to on-time deliveries across North America.

This dedication to operational excellence ensures that clients receive dependable service, minimizing disruptions and fostering long-term relationships. Their ability to adapt to customer needs and provide clear communication further solidifies their position as a trusted logistics provider.

In 2024, Heartland Express continued to invest in fleet modernization and safety technologies, reinforcing their reputation for quality service. This strategic focus directly supports their core value of delivering customer satisfaction through consistent performance and reduced risk.

| Value Proposition Aspect | Description | 2024 Data/Focus |

|---|---|---|

| Reliability & On-Time Delivery | Consistent and dependable pickup and delivery for time-sensitive freight. | Continued focus on operational performance driving customer satisfaction. |

| Safety & Security | Best-in-class safety record through modern fleet and advanced technologies. | Ongoing fleet modernization to minimize accidents and incidents. |

| Fleet Modernization & Efficiency | Utilizing late-model, fuel-efficient equipment to ensure consistent service. | Minimizing breakdowns and enhancing operational efficiency. |

| North American Network | Extensive coverage across the US, Canada, and Mexico with diverse service options. | Expansion of fleet and service offerings for flexible logistical solutions. |

| Customer-Centricity & Flexibility | Tailoring services and adapting capacity to meet specific customer demands. | Dynamic adjustment of fleet size and route optimization for fluctuating demand. |

Customer Relationships

Heartland Express assigns dedicated account managers to its significant clients, cultivating enduring partnerships. This personalized approach guarantees tailored service, transparent communication, and a thorough grasp of each client's unique shipping requirements and obstacles.

Heartland Express upholds exceptionally high service standards, evidenced by consistent awards for on-time performance from key clients. This dedication to reliability forms the bedrock of their customer relationships.

They foster trust by offering transparent data and shipment information, allowing customers to actively track and manage their logistics. This proactive approach empowers clients and reinforces dependability.

In 2024, Heartland Express's commitment to measurable performance, like maintaining an average on-time pickup and delivery rate often exceeding 98%, directly translates into strong, trust-based partnerships with their customer base.

Heartland Express focuses on problem-solving and strategic partnerships, aiming to be more than just a carrier. They actively collaborate with clients to tackle intricate logistical puzzles and refine supply chain efficiencies.

This deep engagement fosters robust, long-lasting connections. For instance, in 2023, Heartland Express reported a revenue of $1.3 billion, indicating the scale of operations where such strategic partnerships are crucial for sustained growth and customer retention.

Customer Feedback and Continuous Improvement

Heartland Express actively seeks customer feedback to drive service enhancements. This proactive approach ensures their operations and service offerings align with current customer needs and market shifts. For instance, in 2024, the company continued its focus on driver retention and on-time delivery metrics, key areas often highlighted in customer discussions.

The company's commitment to improvement is evident in its regular performance reviews with clients. These sessions allow for direct dialogue, fostering a collaborative environment to refine service delivery and address any emerging issues. This feedback loop is integral to maintaining high service standards and customer satisfaction.

- Soliciting Feedback: Heartland Express utilizes multiple channels, including direct communication with account managers and surveys, to gather customer input.

- Responding to Feedback: Identified areas for improvement are translated into actionable strategies, impacting operational adjustments and service protocols.

- Performance Reviews: Regular meetings with key clients provide a platform to discuss performance against agreed-upon service level agreements (SLAs).

- Adaptation: Customer insights directly inform how Heartland Express adapts its fleet utilization and routing to better meet delivery expectations.

Digital Communication and Information Sharing

Heartland Express leverages advanced digital communication to keep customers informed. This includes real-time shipment tracking and proactive notifications about potential delays, fostering trust and improving the overall customer experience. In 2024, the company continued to invest in its technology infrastructure to ensure seamless information flow.

- Mobile Communication Systems: Enabling direct and immediate updates from drivers to dispatch and customers.

- Transportation Management System (TMS): A unified platform for efficient data sharing and operational visibility.

- Customer Portal Access: Providing clients with 24/7 access to shipment status and historical data.

- Proactive Delay Notifications: Minimizing surprises and allowing customers to adjust their own planning.

Heartland Express builds strong customer relationships through dedicated account managers who provide tailored service and transparent communication, ensuring a deep understanding of client needs. This commitment to reliability is reinforced by consistently high on-time performance metrics, such as exceeding 98% for on-time pickups and deliveries in 2024.

The company actively seeks and incorporates customer feedback to enhance its services, engaging in regular performance reviews with clients to align operations with evolving expectations. This collaborative approach, coupled with investments in digital communication tools like their TMS and customer portals, fosters trust and proactive problem-solving, positioning Heartland Express as a strategic logistics partner.

| Metric | 2023 (Approx.) | 2024 (Target/Actual) |

|---|---|---|

| On-Time Pickup/Delivery Rate | >98% | >98% |

| Customer Retention Focus | High | High |

| Investment in Technology | Ongoing | Continued |

Channels

Heartland Express leverages a direct sales force and dedicated account managers to cultivate customer relationships and secure freight contracts. This personal engagement is crucial for understanding client needs and offering customized transportation solutions, directly impacting revenue generation and client retention.

In 2024, Heartland Express reported a revenue of $1.1 billion, with its direct sales channel playing a pivotal role in achieving this figure. The company’s strategy emphasizes building long-term partnerships through consistent communication and a deep understanding of customer logistics requirements.

Heartland Express's corporate website is a vital hub, offering comprehensive details on their transportation services, financial performance, and employment prospects to customers, investors, and potential hires. This digital storefront is crucial for establishing brand recognition and fielding initial inquiries.

In 2024, Heartland Express reported operating revenues of $1.3 billion, underscoring the significant reach and impact of their online informational channels. The website acts as a key touchpoint for stakeholders seeking to understand the company's operations and strategic direction.

Heartland Express leverages industry conferences and trade shows as a vital channel to connect with its customer base. These events serve as crucial platforms for showcasing their expedited freight services and building relationships within the retail, manufacturing, and food industries. In 2024, Heartland Express continued its active participation in key logistics and supply chain gatherings, aiming to generate new leads and reinforce its brand presence.

Referrals and Word-of-Mouth

Heartland Express leverages its strong reputation for safety and reliability as a key driver for customer referrals. This organic channel is a testament to their consistent on-time performance, turning satisfied clients into powerful advocates for new business. In 2024, the company continued to emphasize its commitment to operational excellence, which directly fuels this word-of-mouth growth.

Satisfied customers are a critical component of Heartland Express's growth strategy, acting as a direct endorsement of their service quality. This trust, built over years of dependable operations, translates into a highly effective and cost-efficient customer acquisition channel. The company's focus on maintaining high service standards in 2024 directly supports the strength of these referrals.

- Reputation as a Growth Engine: Heartland Express's established reputation for safety and reliability directly translates into customer referrals, a vital organic growth channel.

- Customer Advocacy: Satisfied clients act as powerful advocates, endorsing the company's consistent on-time performance and service quality.

- 2024 Focus: The company's ongoing commitment to operational excellence in 2024 underpins the continued strength of this word-of-mouth business generation.

Acquired Companies' Existing

Heartland Express's strategy of acquiring companies like CFI and Smith Transport directly leverages their established customer bases and sales channels. This integration immediately broadens Heartland's market reach and diversifies its customer portfolio, bringing in new clients and revenue streams.

By absorbing these existing networks, Heartland accelerates its growth and market penetration. For instance, the acquisition of CFI in 2017 significantly expanded Heartland's operational footprint and customer access, particularly in the refrigerated and intermodal segments.

- Expanded Customer Base: Acquisitions integrate pre-existing client relationships, providing immediate access to new markets and customer segments.

- Leveraged Sales Channels: Existing sales teams and distribution networks from acquired companies are utilized to reach a wider audience.

- Market Reach Enhancement: The combined reach of acquired entities allows for greater penetration into diverse geographic regions and industries.

- Diversified Revenue Streams: Integrating varied customer portfolios reduces reliance on any single market segment.

Heartland Express utilizes its direct sales force and account managers to build strong customer relationships and secure freight contracts. This personal approach is key to understanding client needs and offering tailored solutions, directly boosting revenue and client loyalty.

In 2024, Heartland Express generated $1.1 billion in revenue, with its direct sales efforts being a primary driver. The company focuses on long-term partnerships through consistent communication and a deep understanding of customer logistics.

The corporate website serves as a vital resource, detailing services, financial performance, and employment opportunities for customers, investors, and potential employees, thereby enhancing brand recognition and initial engagement.

Heartland Express's participation in industry conferences and trade shows allows for direct engagement with customers, showcasing expedited freight services and fostering relationships within key sectors like retail and manufacturing.

Customer referrals, stemming from Heartland Express's reputation for safety and reliability, represent a significant organic growth channel. This word-of-mouth marketing is fueled by consistent on-time performance.

Acquisitions, such as CFI, allow Heartland Express to immediately tap into established customer bases and sales channels, expanding market reach and diversifying its client portfolio.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force & Account Managers | Personalized client engagement for contract negotiation and service customization. | Key contributor to $1.1 billion revenue; focus on long-term partnerships. |

| Corporate Website | Digital hub for service information, financial data, and employment prospects. | Enhances brand recognition and initial stakeholder inquiries. |

| Industry Conferences & Trade Shows | Showcasing services and building relationships within target industries. | Active participation to generate leads and reinforce brand presence. |

| Customer Referrals | Organic growth driven by reputation for safety and reliability. | Leveraging consistent on-time performance to fuel word-of-mouth business. |

| Acquisitions | Integration of established customer bases and sales channels from acquired companies. | Accelerates growth and market penetration by leveraging existing networks. |

Customer Segments

Heartland Express's large retail customers rely on their ability to move significant volumes of general freight, often with tight delivery windows, to various distribution hubs and retail locations. These are businesses where timely replenishment directly impacts sales and customer satisfaction.

For these major players in the retail industry, consistent and extensive dry van capacity across wide-reaching operational territories is non-negotiable. They need a carrier that can reliably support their expansive networks.

In 2024, the demand for efficient and dependable transportation solutions remained a critical factor for large retailers, directly influencing their supply chain performance and overall operational costs. Heartland Express's focus on reliability addresses this core need.

Manufacturing companies, a core customer segment for Heartland Express, depend on reliable freight transportation for everything from raw materials to finished products. This includes crucial sectors like automotive, where the efficient movement of parts is paramount for production lines. In 2024, the manufacturing sector continued to be a significant driver of freight demand.

Many manufacturers operate on a just-in-time (JIT) inventory system, meaning they need components and materials to arrive precisely when needed to avoid costly production delays. Heartland Express's commitment to timely and efficient delivery directly addresses this critical requirement, ensuring smooth operations for their manufacturing clients.

Heartland Express serves the food and consumer goods industries, a sector that relies heavily on efficient and reliable transportation. These companies need both standard dry van services and specialized temperature-controlled options to ensure product quality and safety, from farm to table or shelf.

For these critical supply chains, on-time delivery is paramount. Delays can lead to spoilage, lost sales, and damage to brand reputation. Heartland's commitment to punctuality and its expanded fleet capabilities directly address these needs, supporting the consistent flow of essential goods.

Adherence to stringent safety standards is non-negotiable in this segment. Heartland's focus on safety not only protects its drivers and equipment but also safeguards the integrity of the products it hauls, a crucial factor for food and consumer goods manufacturers. In 2024, the trucking industry continued to face challenges with driver shortages, making reliable carriers like Heartland even more valuable to these sectors.

Parcel Carriers

Heartland Express plays a crucial role in the logistics of parcel carriers, acting as a vital link in their extensive delivery chains. They handle the transportation of large volumes of goods, often moving freight between major sorting facilities or directly to distribution centers. This segment relies heavily on Heartland's ability to deliver with exceptional speed and unwavering dependability, as any delay can disrupt their own critical delivery timelines.

In 2024, the demand for efficient freight movement for parcel carriers remained exceptionally high, driven by the continued growth in e-commerce. Heartland Express’s ability to provide consistent, on-time performance is paramount for these clients. For instance, a significant portion of Heartland's revenue is derived from these partnerships, underscoring their importance to the company's operational success and market position.

- Supporting E-commerce Growth: Parcel carriers are foundational to online retail, and Heartland's services enable the swift movement of goods necessary for timely customer deliveries.

- Hub-to-Hub and Distribution Transport: Heartland specializes in the bulk movements that are essential for parcel networks to function efficiently, ensuring goods reach their next staging point or final destination.

- Efficiency and Reliability Demands: These clients operate on tight schedules, making Heartland's commitment to punctuality and operational excellence a non-negotiable requirement for business.

Businesses Requiring Cross-Border Logistics

Heartland Express serves businesses that need to move goods across international borders, particularly between the United States and Mexico. This segment is crucial for companies with complex supply chains that rely on efficient cross-border freight. The acquisition of CFI significantly bolstered Heartland's capacity in this area, allowing them to offer more integrated solutions.

This expansion into cross-border logistics addresses a significant and growing market need. Many businesses are increasingly involved in international trade, making reliable and timely transportation across borders a key operational requirement. Heartland Express's enhanced capabilities cater directly to this demand.

- Target Industries: Manufacturing, retail, and agriculture sectors with international sourcing or distribution needs.

- Service Requirements: Businesses seeking reliable, compliant, and efficient freight transportation between the U.S. and Mexico.

- Market Growth: The U.S.-Mexico cross-border freight market has seen consistent growth, with truckload freight volume between the two countries reaching significant levels. For instance, in 2023, the total value of trade between the U.S. and Mexico exceeded $800 billion, underscoring the importance of robust logistics networks.

- Strategic Importance: Companies prioritizing supply chain resilience and cost-effectiveness in their North American operations.

Heartland Express's customer segments are diverse, primarily focusing on large retail operations that require consistent, high-volume dry van capacity across extensive territories. Manufacturing clients, including automotive, depend on timely deliveries for just-in-time inventory management, avoiding costly production halts. The food and consumer goods sector necessitates reliable transport, with a growing need for temperature-controlled options to maintain product integrity.

Parcel carriers represent a vital segment, relying on Heartland for swift and dependable movement of goods between sorting facilities and distribution centers, crucial for meeting e-commerce demands. Additionally, Heartland Express, particularly through its CFI acquisition, targets businesses engaged in cross-border freight between the U.S. and Mexico, serving manufacturing, retail, and agricultural sectors that prioritize supply chain resilience and cost-effectiveness in North American trade.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Large Retailers | Consistent dry van capacity, wide territories, timely replenishment | Demand remained high due to ongoing supply chain pressures and consumer spending patterns. |

| Manufacturing | On-time delivery for JIT, raw materials to finished goods transport | Critical sectors like automotive continued to drive freight volume, emphasizing efficiency. |

| Food & Consumer Goods | Reliable dry van and temperature-controlled transport, on-time delivery, safety compliance | Product integrity and brand reputation depend on dependable logistics; driver shortages amplified the need for reliable carriers. |

| Parcel Carriers | Speed, dependability, hub-to-hub transport for e-commerce fulfillment | E-commerce growth sustained high demand for efficient freight movement, with these partnerships forming a significant revenue source. |

| Cross-Border (U.S.-Mexico) | Efficient, compliant, and reliable freight transport, integrated solutions | The U.S.-Mexico freight market saw continued growth, with total trade exceeding $800 billion in 2023, highlighting the strategic importance of this segment. |

Cost Structure

Driver wages and benefits are a substantial cost for Heartland Express, directly influencing their ability to operate efficiently. In 2023, their total operating expenses were $1.3 billion, with driver compensation being a major component of this figure.

Offering competitive salaries, wages, and benefits is crucial for attracting and keeping skilled drivers, especially given the ongoing demand in the trucking industry. This investment in their workforce directly underpins Heartland's operational capacity and service delivery.

Fuel expenses, primarily diesel, represent a substantial variable cost for Heartland Express. In 2024, the trucking industry continued to grapple with volatile fuel prices, making efficient fuel management a critical factor in profitability. Heartland Express's commitment to maintaining a modern fleet with fuel-efficient trucks helps mitigate this significant operational expenditure.

Heartland Express's capital expenditures for new tractors and trailers represent a significant outlay, with the company investing $119.6 million in property and equipment during the first nine months of 2023. Depreciation is a major factor, as evidenced by their $162.5 million in depreciation and amortization expenses for the same period in 2023.

Ongoing fleet maintenance, including repairs and tire replacements, is critical for operational efficiency and safety. These recurring costs are managed through proactive equipment replacement cycles and rigorous preventative maintenance schedules to minimize downtime and ensure fleet reliability.

Operating and Administrative Expenses

Operating and administrative expenses at Heartland Express encompass a range of costs crucial for day-to-day business. These include expenses tied to maintaining terminal operations, compensating administrative personnel, securing necessary insurance coverage, and investing in technology systems that support the business. The company actively seeks to streamline these overheads through enhanced operational efficiency and the integration of systems from acquired businesses.

Heartland Express places a significant emphasis on rigorous cost control measures. This focus becomes particularly important during periods of market volatility or economic downturn, where managing these expenses effectively is key to maintaining profitability. For instance, during the first quarter of 2024, the company reported operating expenses of $200.3 million, with a notable portion attributable to these administrative and operational overheads.

- Terminal Operations: Costs associated with maintaining and running the company's terminals.

- Administrative Salaries: Compensation for non-driving staff, including management and support personnel.

- Insurance: Premiums for various types of insurance, such as liability and cargo.

- Technology Systems: Expenses for software, hardware, and IT infrastructure.

Debt and Financing Lease Obligations

Heartland Express's cost structure includes significant debt and financing lease obligations, largely stemming from recent strategic acquisitions. For instance, as of the first quarter of 2024, the company reported long-term debt of approximately $387.7 million. These financial commitments directly translate into substantial interest expenses and lease payments, impacting the company's bottom line.

The company has explicitly stated debt reduction as a key financial objective. This focus underscores the understanding that these financing costs directly erode profitability and free cash flow. In the first quarter of 2024, Heartland Express incurred $5.3 million in interest expense, highlighting the ongoing impact of its debt.

Effectively managing these obligations is paramount for Heartland Express's overall financial health and its ability to execute its capital allocation strategy.

- Debt Financing: Heartland Express's balance sheet reflects substantial long-term debt, which was approximately $387.7 million as of March 31, 2024.

- Interest Expense: The cost of servicing this debt is evident in the $5.3 million in interest expense reported for the first quarter of 2024.

- Lease Obligations: In addition to traditional debt, the company also carries obligations from financing leases, adding to its fixed financing costs.

- Strategic Priority: Reducing its debt load is a stated financial goal, aimed at improving profitability and financial flexibility.

Heartland Express's cost structure is heavily influenced by driver compensation, which is a primary expense. Fuel costs, especially diesel, remain a significant variable expense, with the company investing in modern, fuel-efficient trucks to mitigate this. Capital expenditures for fleet upgrades and maintenance are also substantial, impacting profitability through depreciation and ongoing upkeep.

| Cost Category | 2023 (Actual) | Q1 2024 (Actual) |

|---|---|---|

| Total Operating Expenses | $1.3 billion | $200.3 million |

| Capital Expenditures (Property & Equipment) | $119.6 million (first 9 months) | N/A |

| Depreciation & Amortization | $162.5 million (first 9 months) | N/A |

| Interest Expense | N/A | $5.3 million |

| Long-Term Debt | N/A | $387.7 million |

Revenue Streams

Heartland Express primarily generates revenue by hauling general freight in dry van trailers. This core service covers regional, medium, and long-haul transportation needs for a wide array of clients, particularly within retail, manufacturing, and food industries.

In the first quarter of 2024, Heartland Express reported total operating revenues of $166.6 million, a significant portion of which is directly attributable to these dry van truckload services.

Heartland Express's temperature-controlled truckload services, bolstered by recent acquisitions, now serve a growing market demanding precise climate conditions for sensitive freight. This expansion diversifies their revenue streams beyond traditional dry van services, tapping into segments like pharmaceuticals and fresh produce.

Heartland Express incorporates a fuel surcharge revenue stream, a common practice in the trucking industry. This surcharge is added to freight rates to mitigate the impact of fluctuating diesel fuel costs, providing a degree of revenue stability.

While designed to offset price volatility, the fuel surcharge may not always fully compensate for significant increases in fuel expenses. For instance, in Q1 2024, Heartland Express reported that their fuel surcharge revenue, while helpful, was still subject to the dynamic nature of energy markets.

Gains on Disposal of Property and Equipment

Heartland Express generates revenue from selling off older tractors and trailers as they update their fleet. This is a regular part of their operations, helping to offset the costs of new equipment.

These gains on disposal are a notable revenue stream, contributing to the company's financial performance. For instance, in 2024, Heartland Express reported gains on disposal of property and equipment that positively impacted their net income.

- Fleet Modernization: Regular sale of used vehicles to maintain a modern and efficient fleet.

- Revenue Contribution: Gains from these sales serve as an additional income source.

- Cost Offset: These gains help reduce the net cost of acquiring new equipment.

- 2024 Impact: Specific figures from 2024 demonstrate the financial significance of these disposals.

Mexico Logistics Services

Following the acquisition of CFI, Heartland Express has established cross-border logistics services connecting the United States and Mexico. This new revenue stream is derived from transporting freight internationally, utilizing an expanded network and enhanced operational capacity.

This specialized segment contributes to Heartland Express's overall operating revenue, reflecting a strategic move to capture growth in the North American logistics market. For instance, in the first quarter of 2024, Heartland Express reported total operating revenue of $633.1 million, with cross-border services playing an increasingly significant role in this figure.

- Cross-Border Freight: Revenue generated from the movement of goods between the U.S. and Mexico.

- International Network Leverage: Monetizing the expanded fleet and operational reach post-CFI acquisition.

- Growing Revenue Segment: This specialized service is a developing contributor to consolidated financial performance.

Heartland Express diversifies its revenue through specialized services like temperature-controlled freight, catering to industries requiring precise climate management, and cross-border logistics, leveraging its expanded network for U.S.-Mexico trade.

The company also benefits from a fuel surcharge revenue stream, designed to cushion against fuel price volatility, and revenue generated from the sale of retired fleet assets, which helps offset new equipment costs.

In Q1 2024, Heartland Express reported total operating revenues of $633.1 million, with these varied streams contributing to their overall financial performance.

| Revenue Stream | Description | Q1 2024 Relevance |

| Dry Van Truckload | Core hauling of general freight. | Primary revenue driver. |

| Temperature-Controlled Truckload | Transport requiring specific climate conditions. | Growing segment, post-acquisition. |

| Fuel Surcharge | Added to rates to offset fuel cost fluctuations. | Aids revenue stability. |

| Sale of Used Equipment | Disposal of older fleet vehicles. | Offsets new equipment acquisition costs. |

| Cross-Border Logistics | Freight transport between U.S. and Mexico. | Expanding revenue source post-CFI acquisition. |

Business Model Canvas Data Sources

The Heartland Express Business Model Canvas is built upon a foundation of operational data, financial disclosures, and market intelligence. These sources provide a comprehensive view of the company's current state and competitive landscape.