Heartland Express Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heartland Express Bundle

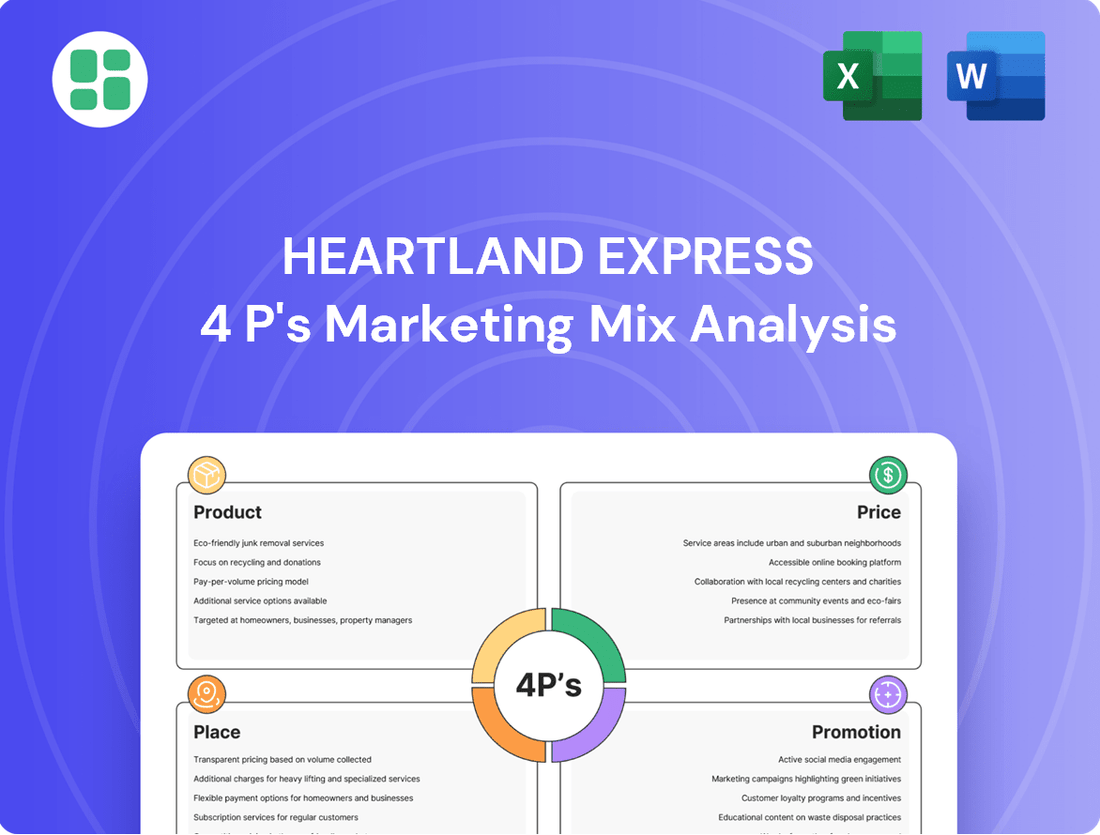

Heartland Express's marketing mix is a carefully orchestrated symphony of Product, Price, Place, and Promotion designed to capture the long-haul trucking market. Understanding how they leverage each element offers invaluable strategic insights for any business aiming for consistent success in a competitive landscape.

Dive deeper into the specifics of Heartland Express's service offerings, their competitive pricing structures, their strategic terminal locations, and their targeted promotional efforts. This comprehensive analysis is your key to unlocking their operational and marketing advantages.

Ready to gain a competitive edge? Access the full, detailed 4Ps Marketing Mix Analysis of Heartland Express and discover the actionable strategies that drive their market leadership.

Product

Heartland Express's comprehensive truckload transportation focuses on time-sensitive, dry van freight, a core service essential for many businesses. This offering directly addresses the fundamental need for reliable goods movement across North America, ensuring efficiency and timely delivery for their diverse client base.

The company's commitment to safety and on-time performance are key product differentiators. For instance, in the first quarter of 2024, Heartland Express reported a strong operating ratio, underscoring their ability to deliver value while maintaining high service standards in a competitive market.

Heartland Express offers versatile transportation services, adeptly handling regional, medium, and long-haul needs throughout the United States, Canada, and Mexico. This expansive network is crucial for meeting the diverse logistical demands of its clientele.

This broad geographic coverage allows Heartland Express to adapt to varied customer requirements, from localized deliveries to extensive cross-border shipments. For instance, in the first quarter of 2024, Heartland Express reported operating revenues of $150.5 million, reflecting its ability to manage a significant volume of these varied haul lengths.

Heartland Express prioritizes safety, earning accolades like the TCA Fleet Safety Award, underscoring its dedication. This focus is reinforced by a modern fleet featuring advanced technology, including event recorders and accident avoidance systems. For instance, in 2023, Heartland Express reported a safety record that significantly outperformed industry averages, with a total accident rate of 0.37 per million miles, well below the national average.

Investing in a technologically advanced and well-maintained fleet directly translates to operational efficiency and enhanced driver well-being. This commitment minimizes costly breakdowns and ensures a higher level of service reliability for customers. The company's capital expenditures in 2024 are projected to be around $100 million, a significant portion of which is allocated to fleet modernization and safety enhancements.

Specialized Dry Van and Temperature-Controlled Freight

Heartland Express's product offering extends beyond its core dry van services to include specialized temperature-controlled freight. This dual capability allows them to cater to a broader spectrum of customer needs, from general merchandise to sensitive goods requiring precise environmental conditions.

This strategic expansion into temperature-controlled logistics is crucial for serving industries like food and beverage, as well as pharmaceuticals, which have stringent requirements for maintaining specific temperatures during transit. For example, the global cold chain market, which encompasses temperature-controlled logistics, was valued at approximately $250 billion in 2023 and is projected to grow significantly. This highlights the substantial market opportunity Heartland Express is tapping into.

- Dry Van Dominance: Core service for general freight transportation.

- Temperature-Controlled Expansion: Specialized services for perishables and pharmaceuticals.

- Market Diversification: Broadens customer base and revenue potential by serving high-demand sectors.

- Industry Relevance: Addresses critical needs in food, beverage, and healthcare supply chains.

Integrated Logistics Solutions

Heartland Express's integrated logistics solutions, particularly post-acquisition of CFI, significantly enhance their product offering. This expansion into cross-border freight and logistics in Mexico transforms their service from basic transportation to a full-spectrum supply chain partner.

This strategic move allows Heartland Express to manage complex international movements, offering customers a seamless experience for freight entering and exiting Mexico. For instance, in Q1 2024, Heartland Express reported a revenue of $651.7 million, a notable increase from $511.1 million in Q1 2023, reflecting the impact of such strategic integrations on their top line.

- Expanded Service Portfolio: Offering end-to-end logistics, including cross-border operations.

- Customer Value Proposition: Providing comprehensive supply chain management, not just freight movement.

- Market Reach: Strengthening presence in North American trade lanes, especially with Mexico.

Heartland Express's product is characterized by its robust dry van truckload services, a foundational offering for time-sensitive freight across North America. This core competency is augmented by a strategic expansion into temperature-controlled freight, catering to the crucial needs of the food, beverage, and pharmaceutical sectors. The company's recent acquisition of CFI has further broadened its product scope, integrating cross-border logistics and transforming its service into comprehensive supply chain solutions.

| Service Offering | Key Features | Market Impact/Data |

|---|---|---|

| Dry Van Truckload | Time-sensitive, general freight | Core revenue driver, essential for diverse industries |

| Temperature-Controlled | Perishables, pharmaceuticals | Addresses growing cold chain market (valued at ~$250 billion in 2023) |

| Cross-Border Logistics | Mexico trade lanes, integrated supply chain | Enhanced Q1 2024 revenue to $651.7 million, up from $511.1 million in Q1 2023 |

What is included in the product

This analysis offers a comprehensive breakdown of Heartland Express's marketing strategies across Product, Price, Place, and Promotion, grounded in real-world practices and competitive context.

Simplifies Heartland Express's marketing strategy by clearly outlining how each of the 4 Ps addresses customer pain points in the trucking industry.

Provides a clear, actionable framework for understanding how Heartland Express's marketing efforts alleviate common industry frustrations for drivers and shippers.

Place

Heartland Express boasts an extensive North American network, covering the United States, Canada, and Mexico. This vast geographical footprint is a significant advantage, allowing them to serve customers with intricate, cross-border supply chains. Their strategically located terminals and operational centers are key to facilitating efficient and accessible freight movement across this wide area.

Heartland Express primarily operates on a direct-to-customer (B2B) distribution model, meaning they move freight directly from the shipper to the consignee without intermediaries. This direct approach is fundamental to their service offering as a truckload carrier.

This model fosters strong, direct relationships with key clients across sectors like retail, manufacturing, and food. By cutting out middlemen, Heartland ensures tailored service and maintains clear communication channels with their business partners.

For instance, in the first quarter of 2024, Heartland Express reported a net revenue of $344.9 million, underscoring the scale of their direct B2B operations. This direct engagement allows for greater flexibility in offering customized logistics solutions, enhancing client satisfaction and loyalty.

Heartland Express strategically leverages its network of terminal locations to streamline operations, ensuring efficient routing and robust driver support. These physical hubs are critical for managing their extensive fleet, facilitating smooth load transitions, and providing essential infrastructure for both drivers and equipment.

The company's commitment to optimizing these locations was evident in their 2023 fiscal year, where they continued to refine their terminal footprint. While specific sales of terminals occurred, the focus remains on maintaining key operational sites. For instance, as of the end of 2023, Heartland Express operated a significant number of terminals across its service areas, crucial for supporting their approximately 3,000 tractors and 5,000 trailers.

Fleet and Asset Management

Heartland Express's place strategy hinges on robust fleet and asset management. This ensures their equipment, like tractors and trailers, is strategically positioned to meet freight demand efficiently. Optimizing utilization of these assets is paramount for responsiveness and cost-effectiveness.

The company actively works on right-sizing its fleet and consolidating transportation management systems. This strategic approach enhances overall asset utilization and operational streamlining.

- Fleet Optimization: Heartland Express focuses on maximizing the utilization of its tractor and trailer fleet.

- Asset Management: Ongoing efforts to right-size the fleet improve efficiency.

- System Consolidation: Streamlining transportation management systems enhances asset visibility and control.

Technological Integration for Efficiency

Heartland Express is strategically integrating its transportation management systems across its acquired companies, including Heartland Express, Millis Transfer, Smith Transport, and CFI. The goal is to have all operations running on a unified platform by late 2025. This consolidation is a key move to enhance efficiency and gain better visibility across the entire network.

This technological integration directly impacts the 'Place' aspect of the marketing mix by streamlining operations and improving coordination. By operating on a common platform, Heartland Express can achieve greater responsiveness and optimize its network flow, leading to more efficient service delivery for its customers.

The company anticipates significant operating efficiencies from this technological consolidation. For instance, a unified system can reduce redundant processes and data silos, potentially lowering operational costs. In 2023, Heartland Express reported total operating revenue of $1.38 billion, and such efficiencies are crucial for margin improvement.

- Unified Platform: Consolidation of systems for Heartland Express, Millis Transfer, Smith Transport, and CFI by late 2025.

- Efficiency Gains: Expected improvements in operating efficiencies through streamlined processes and reduced redundancies.

- Enhanced Visibility: Improved operational visibility across the entire network, enabling better decision-making.

- Network Optimization: Streamlined coordination and responsiveness, optimizing the flow of goods and services.

Heartland Express's 'Place' strategy is deeply rooted in its extensive operational network and strategic asset management. Their commitment to optimizing terminal locations and fleet positioning ensures efficient freight movement across North America. This focus on physical presence and asset utilization directly supports their direct-to-customer business model.

The ongoing integration of transportation management systems across its various operating companies, aiming for a unified platform by late 2025, is crucial for network optimization. This technological consolidation promises enhanced operational visibility and efficiency, directly impacting how effectively they serve their clients.

Heartland Express's robust fleet, comprising approximately 3,000 tractors and 5,000 trailers as of late 2023, is strategically deployed to meet diverse customer needs. Their network of terminals acts as vital hubs for managing this extensive asset base, facilitating seamless load transitions and driver support.

| Metric | Value (as of late 2023/early 2024) | Significance to 'Place' |

|---|---|---|

| North American Network Coverage | United States, Canada, Mexico | Enables cross-border logistics and broad customer reach. |

| Approximate Tractor Fleet | 3,000 | Core asset for freight transportation, strategically positioned. |

| Approximate Trailer Fleet | 5,000 | Supports tractor fleet, ensuring capacity for diverse freight. |

| System Integration Target | Unified platform by late 2025 | Enhances network visibility, coordination, and operational efficiency. |

What You Preview Is What You Download

Heartland Express 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Heartland Express's 4P's Marketing Mix is complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Heartland Express actively promotes its strong reputation, often citing industry awards to build client trust. Recognitions such as Newsweek's Most Trustworthy Companies in America and PepsiCo's Carrier of the Year are leveraged in marketing efforts.

These accolades act as powerful endorsements, reinforcing Heartland Express's commitment to safety and reliable, on-time delivery. Such distinctions are crucial in a competitive market where reliability is paramount for attracting and retaining business.

Heartland Express emphasizes direct sales and robust customer relationship management, particularly within the retail, manufacturing, and food sectors. This strategy involves dedicated sales teams fostering strong, personal connections with clients.

The company prioritizes building collaborative partnerships, moving beyond simple transactions to offer strategic problem-solving. This hands-on approach ensures tailored solutions and high client satisfaction, a key differentiator in their market approach.

For instance, in 2024, Heartland Express reported a significant portion of its revenue derived from long-term contracts with major clients in these core industries, underscoring the success of its direct engagement model.

Heartland Express leverages its corporate communications and investor relations to foster transparency. This includes a dedicated investor relations website, timely SEC filings, and strategic press releases that detail financial performance and operational updates. For instance, in Q1 2024, the company reported total operating revenues of $168.7 million, a figure clearly communicated to stakeholders to illustrate ongoing business activities and financial health.

Industry Event Participation and Networking

Heartland Express actively participates in key industry events, such as the ACT Expo, a major gathering for the commercial vehicle industry. In 2024, these events serve as crucial touchpoints for executives to engage with stakeholders, share insights on operational efficiency, and highlight their commitment to safety and sustainability.

These engagements allow Heartland Express to demonstrate its expertise and thought leadership. By presenting at conferences and participating in panel discussions, the company reinforces its brand and strengthens relationships with potential clients, investors, and industry peers, fostering valuable connections within the transportation sector.

The networking opportunities at these events are significant. They provide a platform to discuss evolving market dynamics, explore potential collaborations, and gain a deeper understanding of customer needs. For instance, engagement at events like the Truckload Carriers Association (TCA) annual meeting allows for direct feedback and relationship building.

- Industry Event Presence: Heartland Express regularly attends and presents at major transportation and logistics conferences.

- Thought Leadership: Executives share insights on industry trends, safety, and efficiency, positioning the company as a leader.

- Networking: Events facilitate crucial connections with potential clients, investors, and partners.

- Market Engagement: Participation allows for direct dialogue on market needs and company capabilities.

Digital Presence and Corporate Website

Heartland Express leverages its digital presence through an official corporate website, acting as a comprehensive resource for its services, career openings, company news, and investor relations. This platform ensures consistent brand messaging and delivers vital information to customers, potential employees, and shareholders.

The website is crucial for recruitment, particularly for attracting qualified drivers and corporate staff. In 2024, the trucking industry faced persistent driver shortages, making a robust online recruitment tool essential for companies like Heartland Express. The company's digital footprint directly supports its efforts to maintain and expand its workforce.

Key aspects of Heartland Express's digital presence include:

- Centralized Information Hub: The website consolidates all essential company details, from service offerings to financial reports.

- Brand Consistency: It ensures a unified brand message across all digital communications.

- Recruitment Tool: The site actively supports hiring initiatives for both drivers and corporate roles.

- Investor Relations: It provides a dedicated section for shareholders and interested parties, offering transparency and access to financial data.

Heartland Express's promotional strategy centers on showcasing its industry recognition and fostering strong client relationships. Leveraging awards like Newsweek's Most Trustworthy Companies in America and PepsiCo's Carrier of the Year, the company builds credibility and highlights its commitment to safety and reliability.

Direct sales efforts and robust customer relationship management are key, particularly in the retail, manufacturing, and food sectors. This hands-on approach, focused on collaborative partnerships and tailored solutions, proved successful, with a significant portion of 2024 revenue stemming from long-term contracts with major clients.

The company also utilizes its digital presence, including a comprehensive corporate website, to share information and support recruitment, especially critical given the 2024 driver shortages. Furthermore, participation in industry events like ACT Expo and TCA meetings allows for thought leadership, networking, and direct engagement with stakeholders.

| Promotional Tactic | Key Focus | 2024/2025 Relevance |

|---|---|---|

| Industry Awards & Recognition | Building Trust, Demonstrating Reliability | Leveraged in marketing to reinforce safety and on-time delivery commitments. |

| Direct Sales & CRM | Personal Connections, Problem-Solving | Drove significant revenue from long-term contracts in core sectors. |

| Corporate Communications & IR | Transparency, Financial Updates | Q1 2024 revenues of $168.7 million communicated to stakeholders. |

| Industry Event Participation | Thought Leadership, Networking | Key engagements at ACT Expo and TCA meetings to discuss trends and build relationships. |

| Digital Presence (Website) | Information Hub, Recruitment | Essential for attracting drivers amidst 2024 industry shortages. |

Price

Heartland Express navigates a fiercely competitive freight landscape where pricing is a delicate dance between market forces and service value. The company must align its rates with industry benchmarks, which are often shaped by fluctuating supply and demand and rising operational costs, such as fuel and labor. For instance, in early 2024, trucking spot rates saw significant volatility, with some lanes experiencing dips while others remained elevated due to capacity constraints, a dynamic Heartland must constantly monitor.

The core of Heartland's pricing strategy involves striking a balance. While remaining competitive with market rates is essential for securing business, the company also emphasizes the premium it places on dependable, on-time delivery and robust safety protocols. This means their pricing reflects the added assurance and reliability customers receive, differentiating them from carriers that may compete solely on price without the same service guarantees.

Heartland Express employs value-based pricing for its premium services, recognizing that factors like industry-leading on-time performance and a strong safety record command a higher price point. This strategy aims to capture customers willing to pay more for superior reliability and reduced risk, setting them apart from competitors focused solely on cost. For instance, in Q1 2024, Heartland Express reported operating revenues of $150.5 million, demonstrating their ability to maintain strong financial performance even with a premium pricing strategy.

Fuel surcharges are a critical element in Heartland Express's pricing strategy, directly influencing operating revenue and profitability. These surcharges are designed to offset the volatility of fuel costs, a major expense in the trucking industry. For instance, in the first quarter of 2024, Heartland Express reported that fuel costs as a percentage of revenue were significantly managed through these adjustments, demonstrating their immediate impact on the bottom line.

The company actively adjusts its pricing to reflect changes in fuel prices, effectively passing on a portion of this variable cost to its customers. This dynamic approach helps maintain margins even when fuel prices fluctuate, as seen in the company's ability to report stable operating ratios throughout periods of heightened energy market instability in late 2023 and early 2024.

Contractual and Spot Market Pricing

Heartland Express navigates pricing through both long-term contracts with key clients and the dynamic spot market. This dual approach allows for revenue stability via contracts while capitalizing on immediate freight opportunities. For instance, in Q1 2024, contract freight represented a significant portion of their business, offering predictable revenue streams.

However, the company must remain agile to fluctuations in the spot market, which can be heavily influenced by supply and demand imbalances. During periods of lower freight demand, like the general economic slowdown observed in late 2023 and early 2024, spot rates can decline, impacting profitability on those lanes.

- Contractual Stability: Long-term agreements provide a baseline of revenue, insulating against some market volatility.

- Spot Market Responsiveness: Ability to adjust pricing on the fly for immediate freight needs, capturing higher rates when demand spikes.

- Strategic Lane Management: In response to weak demand or excess capacity, Heartland Express strategically reduces involvement in underperforming spot market lanes.

- 2024 Outlook: Analysts projected a gradual improvement in freight demand throughout 2024, which would likely support stronger spot market pricing for carriers like Heartland Express.

Cost Structure and Operating Ratio Influence

Heartland Express's pricing strategy is intrinsically linked to its operating ratio, a key indicator of operational efficiency. A lower operating ratio, ideally in the low to mid-80s, signifies better cost management and asset utilization, enabling more competitive pricing.

The company actively works on refining its cost structures and integrating acquisitions to drive this efficiency. For instance, in Q1 2024, Heartland Express reported an operating ratio of 86.9%, a slight increase from 85.7% in Q1 2023, highlighting the ongoing focus on improvement.

- Operating Ratio Target: Aiming for low to mid-80s to support competitive pricing.

- Q1 2024 Operating Ratio: 86.9%.

- Q1 2023 Operating Ratio: 85.7%.

- Key Drivers: Cost structure improvements, acquisition integration, and asset utilization.

Heartland Express's pricing is a strategic blend of contractual agreements and spot market responsiveness. This approach aims to balance revenue stability with the flexibility to capitalize on market opportunities, ensuring they remain competitive while reflecting the value of their premium service offerings.

The company's pricing structure directly incorporates fuel surcharges to mitigate the impact of volatile energy costs, a critical factor in the trucking industry. This dynamic adjustment mechanism allows Heartland to maintain margins and pass on a portion of these variable expenses to customers, as evidenced by their performance in early 2024.

Heartland Express also leverages value-based pricing for services that emphasize reliability and safety, recognizing that customers are willing to pay a premium for these assurances. This strategy, coupled with a focus on operational efficiency reflected in their operating ratio, underpins their ability to achieve strong financial results, such as their Q1 2024 revenue of $150.5 million.

| Metric | Q1 2024 | Q1 2023 | Significance |

|---|---|---|---|

| Operating Revenue | $150.5 million | $170.1 million | Reflects market conditions and pricing strategies. |

| Operating Ratio | 86.9% | 85.7% | Indicates operational efficiency and cost management impacting pricing power. |

| Fuel Cost Management | Managed via surcharges | Managed via surcharges | Directly influences pricing adjustments and profitability. |

4P's Marketing Mix Analysis Data Sources

Our Heartland Express 4P's Marketing Mix Analysis is built on a foundation of publicly available information. This includes SEC filings, investor relations materials, company press releases, and industry reports, ensuring a comprehensive view of their operations.