Heartland Express Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heartland Express Bundle

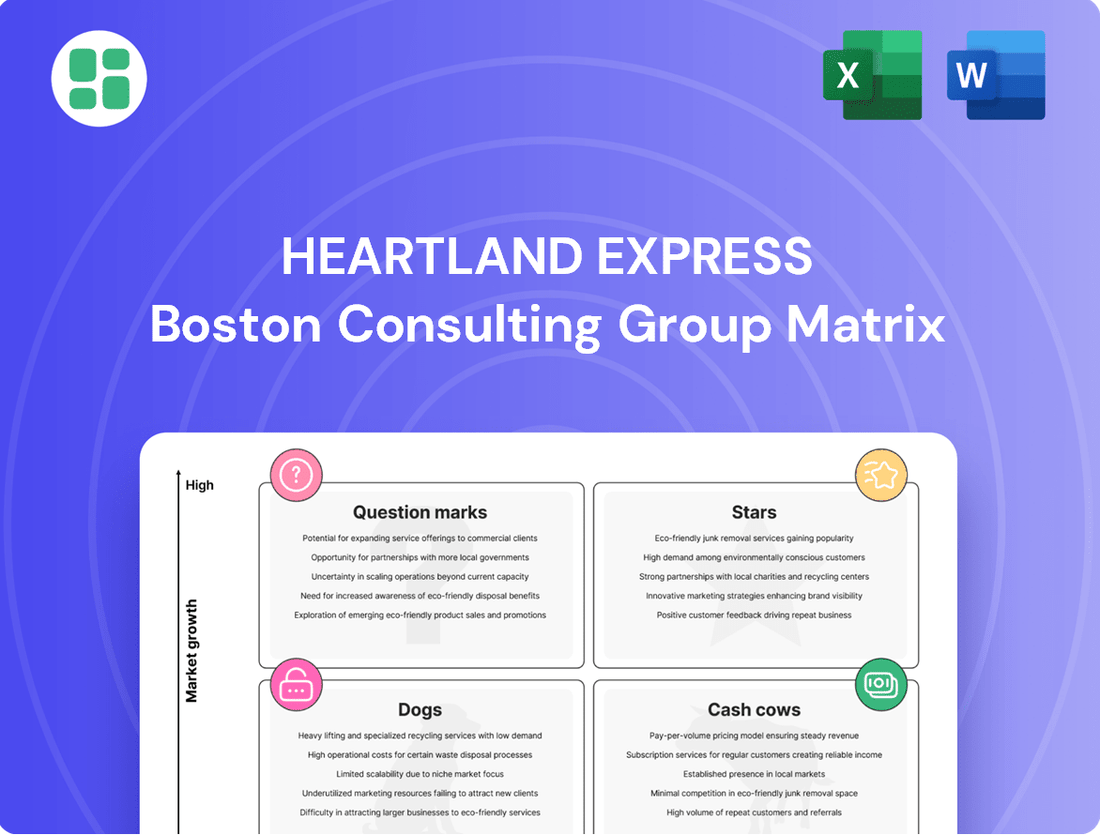

Heartland Express's BCG Matrix reveals a fascinating mix of established strengths and potential growth areas. Understanding which of their services are Stars, Cash Cows, Dogs, or Question Marks is crucial for any investor or industry observer. This preview offers a glimpse, but imagine the power of a full breakdown.

Dive deeper into Heartland Express's BCG Matrix and gain a clear view of where its services stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Heartland Express's emphasis on regional and dedicated services positions these segments as potential Stars within its BCG Matrix. These areas benefit from consistent routes and strong customer relationships, offering a degree of stability even in a fluctuating freight market. For example, in 2024, dedicated contract services have been a key driver for many trucking companies, with some reporting double-digit growth in this segment due to increased demand for predictable supply chains.

Heartland Express focuses on time-sensitive dry van freight, essential for sectors like retail and manufacturing. Their commitment to punctual deliveries and a contemporary fleet highlights their quality service in this competitive space. In 2024, the demand for expedited shipping remained robust, with the US domestic freight market valued at over $1.3 trillion, underscoring the importance of Heartland’s niche.

Heartland Express’s unwavering commitment to safety, evidenced by accolades like the TCA Fleet Safety Award, firmly places them in the Stars category of the BCG Matrix. This dedication translates to superior operational efficiency and robust risk mitigation.

Their exemplary safety record, a significant differentiator, not only draws in a loyal customer base but also effectively manages expenses linked to accidents and insurance premiums. This strong competitive edge is a hallmark of a market leader.

This leadership in safety acts as a substantial barrier to entry for potential competitors, solidifying Heartland Express's dominant market position and contributing to their status as a Star performer.

Modern Fleet Investment

Heartland Express's dedication to a modern fleet, boasting an average tractor age of just 2.6 years as of June 2025, positions it favorably within the industry. This significant investment in newer equipment directly addresses operational efficiency and reliability.

A younger fleet translates to tangible benefits:

- Improved Fuel Efficiency: Newer trucks are designed with advanced technology to consume less fuel, leading to substantial cost savings.

- Reduced Maintenance Costs: The likelihood of breakdowns and costly repairs is significantly lower with modern vehicles.

- Enhanced Driver Satisfaction: Drivers benefit from more comfortable, technologically advanced, and reliable equipment, aiding in retention.

This strategic focus on fleet modernization is crucial for Heartland Express to maintain its competitive edge and capitalize on future market upturns.

Strategic Technology Adoption

Heartland Express's strategic technology adoption, particularly the transition of acquired brands like CFI to a unified transportation management system (TMS) and the implementation of fleet telematics, positions it for future growth. These crucial upgrades, slated for completion by late 2025, are designed to streamline operations, optimize driver schedules, and offer comprehensive fleet visibility. For instance, by the end of Q1 2024, Heartland Express reported a fleet of approximately 3,700 tractors, highlighting the scale of this technological undertaking.

This investment in a common TMS and advanced telematics is a key component of their strategy to remain competitive in an increasingly digital logistics environment. The company anticipates these enhancements will directly translate to improved profitability and a stronger market position. The successful integration of these systems is expected to unlock significant operational efficiencies, potentially reducing downtime and improving asset utilization across their expanded fleet.

- Unified TMS Implementation: Transitioning acquired brands to a single system by late 2025.

- Fleet Telematics Rollout: Enhancing real-time data collection and fleet management.

- Operational Efficiency Gains: Aiming to boost driver utilization and overall fleet visibility.

- Profitability Enhancement: Leveraging technology to improve financial performance in a digitized market.

Heartland Express's focus on regional and dedicated services, coupled with its commitment to safety and fleet modernization, positions these segments as Stars in the BCG Matrix. These areas demonstrate high market growth potential and a strong competitive advantage for the company. For instance, dedicated contract services saw significant demand in 2024, with some carriers reporting double-digit growth.

The company's emphasis on time-sensitive dry van freight, supported by a modern fleet averaging just 2.6 years old as of June 2025, further solidifies its Star status. This strategic investment in efficiency and reliability is crucial in the competitive US domestic freight market, valued at over $1.3 trillion in 2024.

Heartland Express's proactive technology adoption, including a unified transportation management system and fleet telematics, is designed to enhance operational efficiency and market position. By late 2025, the company aims to complete the integration of acquired brands onto a single TMS, building on its fleet of approximately 3,700 tractors reported by the end of Q1 2024.

| BCG Category | Heartland Express Segments | Rationale | Key Data Points (2024-2025) |

|---|---|---|---|

| Stars | Regional & Dedicated Services | High growth potential, strong customer relationships, stable demand. | Dedicated contract services experienced double-digit growth for some carriers in 2024. |

| Stars | Time-Sensitive Dry Van Freight | Essential for retail/manufacturing, supported by punctual delivery and modern fleet. | US domestic freight market valued over $1.3 trillion in 2024; Average tractor age 2.6 years (June 2025). |

| Stars | Safety & Operational Excellence | Differentiator, reduces costs, builds customer loyalty, barrier to entry. | Multiple safety accolades; Improved fuel efficiency and reduced maintenance costs from modern fleet. |

| Stars | Technology Integration | Streamlines operations, optimizes schedules, enhances fleet visibility, boosts profitability. | Unified TMS implementation by late 2025; ~3,700 tractors (Q1 2024). |

What is included in the product

This BCG Matrix analysis categorizes Heartland Express's business units to guide strategic decisions.

A clear visual of Heartland Express's business units on the BCG Matrix helps identify underperforming "Dogs" and focus resources on "Stars."

Cash Cows

The core Heartland Express brand stands as a robust Cash Cow for the company. Even with industry-wide challenges, this segment consistently generates profits, underscoring its strong market standing and reliable cash flow generation.

In 2023, Heartland Express reported total operating revenue of $1.3 billion, with its dedicated and irregular routes, which largely comprise the core operations, demonstrating resilience. This foundational cash flow is critical for funding growth initiatives and supporting less mature segments of the business.

Heartland Express boasts a robust balance sheet and ample liquidity, enabling it to effectively manage its operations. As of June 2025, the company reported $22.9 million in cash, complemented by substantial unused borrowing capacity, underscoring its financial resilience.

This strong financial footing allows Heartland Express to generate consistent cash flow from its existing business, a key characteristic of a Cash Cow. The company has also successfully reduced debt incurred from recent acquisitions, further strengthening its financial health.

Heartland Express's long-standing dedication to customer service has fostered enduring partnerships, especially within the retail, manufacturing, and food sectors. These deep-rooted connections ensure consistent freight volumes and predictable revenue, solidifying these segments as dependable cash generators in a mature market.

Dividend Payout Consistency

Heartland Express's commitment to dividend payout consistency, with its 87th consecutive quarterly dividend expected in Q1 2025, highlights its status as a cash cow. This steady return of capital to shareholders, even through challenging operational periods, underscores its reliable surplus cash generation.

This financial discipline points to a mature business segment that generates more cash than is required for reinvestment in its established, low-growth markets.

- Dividend Consistency: 87th consecutive quarterly dividend expected in Q1 2025.

- Surplus Cash Flow: Demonstrates ability to generate cash beyond operational needs.

- Shareholder Value: Reliable returns indicate a mature, stable business.

- Low Growth Reinvestment: Cash generated exceeds needs for core business expansion.

Operational Efficiency and Cost Control

Heartland Express’s commitment to operational efficiency and stringent cost controls is a cornerstone of its Cash Cow strategy. Despite a challenging freight environment, the company actively works to reduce underperforming routes and optimize fleet size. This focus on improving operating ratios, aiming for a target of 80% or lower, and enhancing driver utilization directly translates into robust profitability from its established services.

For instance, in the first quarter of 2024, Heartland Express reported an operating ratio of 82.5%, a slight improvement from 83.1% in the same period of 2023, demonstrating their persistent efforts in cost management. This dedication to maximizing cash flow from existing, stable operations is crucial for funding growth initiatives and maintaining financial health.

- Focus on Operating Ratios: Heartland Express consistently aims to improve its operating ratio, a key indicator of profitability.

- Driver Utilization: Maximizing the efficiency of their driver force is paramount to generating strong returns.

- Fleet Right-Sizing: Strategic adjustments to fleet capacity ensure resources are allocated effectively.

- Cost Controls: Enterprise-wide cost management initiatives are central to maintaining healthy profit margins.

The core Heartland Express operations function as a classic Cash Cow, consistently generating substantial profits and reliable cash flow. Despite a competitive landscape, this segment's established market position ensures steady revenue streams, vital for reinvestment and shareholder returns.

In the first quarter of 2024, Heartland Express achieved an operating ratio of 82.5%, a testament to their ongoing efficiency improvements. This focus on operational excellence, coupled with a mature customer base, solidifies its role as a dependable cash generator.

The company's commitment to returning value to shareholders is evident in its consistent dividend payouts, with the 87th consecutive quarterly dividend anticipated in Q1 2025. This reliability underscores the segment's ability to produce surplus cash beyond its operational needs.

Heartland Express's financial health, bolstered by $22.9 million in cash as of June 2025 and significant unused borrowing capacity, further supports its Cash Cow status. This strong liquidity allows for strategic capital allocation and debt management.

| Metric | Q1 2024 | Q1 2023 | Significance |

|---|---|---|---|

| Operating Ratio | 82.5% | 83.1% | Indicates improved profitability and efficiency. |

| Revenue (Annualized Estimate) | ~$1.3 Billion | ~$1.3 Billion | Demonstrates stable revenue generation. |

| Dividend Payouts | Consistent Quarterly | Consistent Quarterly | Highlights surplus cash generation and shareholder returns. |

What You’re Viewing Is Included

Heartland Express BCG Matrix

The Heartland Express BCG Matrix you are previewing is the identical, fully finalized document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, professionally formatted strategic analysis ready for your immediate use.

Dogs

Smith Transport and Contract Freighters, Inc. (CFI), acquired by Heartland Express, are currently positioned as Dogs in the BCG Matrix. These brands have faced persistent issues such as underutilized assets and escalating operational expenses.

Both Smith Transport and CFI exhibit low market share within their operational segments and are experiencing a decline in profitability. For instance, in the first quarter of 2024, Heartland Express reported a net loss of $1.8 million, largely attributed to the performance of these acquired segments, which are consuming more cash than they generate.

Heartland Express's acquisition of CFI presents a classic case of legacy IT systems acting as a drag. The ongoing challenges in transitioning CFI's operations to a common Transportation Management System (TMS) highlight the inefficiencies and significant costs associated with integrating disparate, older technologies. This integration is crucial for streamlining operations and realizing the full potential of the acquisition.

These fragmented IT infrastructures directly contribute to higher operational expenses and limit overall performance gains. For instance, the complexities arising from managing multiple, non-standardized systems can lead to increased manual workarounds, data inconsistencies, and slower decision-making processes, ultimately impacting profitability.

Until these legacy systems are fully integrated and optimized, they will continue to represent a significant impediment to efficiency and profitability within the acquired operations. The financial burden of maintaining and integrating these older systems can divert resources that could otherwise be invested in growth or technological advancement.

Heartland Express's trailer fleet presents a challenge. As of June 2025, the average age of their consolidated trailers reached 7.5 years, a noticeable increase from 6.9 years in June 2024. This aging asset base can translate into higher repair bills and reduced fuel economy.

An older trailer fleet often means increased operational inefficiencies. These rising maintenance costs and potential dips in fuel efficiency can negatively impact overall service quality, suggesting this segment might be a low-growth, low-profitability area. It could also be a cash drain, necessitating substantial investment down the line to modernize.

Non-Strategic or Underutilized Lanes of Freight

Heartland Express's strategic focus includes reducing underperforming freight lanes, a move aimed at boosting efficiency and profitability. These lanes are characterized by limited market share and lower earnings potential, acting as a drag on the company's financial performance.

By strategically exiting or scaling back these operations, Heartland Express aims to improve its consolidated operating ratio. This aligns with their stated objective to better match their service offerings with current market demand and optimize resource allocation.

- Underperforming Lanes: Areas with low market penetration and profitability.

- Strategic Reduction: Management's plan to divest or shrink these operations.

- Financial Impact: Expected improvement in the company's operating ratio.

- Demand Alignment: Ensuring services match current market needs.

Segments Heavily Reliant on Spot Market Pricing

Heartland Express's reliance on the spot market for certain segments, especially during periods of industry overcapacity, presents a significant challenge. In 2024, the trucking industry continued to grapple with weak freight demand, a trend that directly impacts businesses heavily exposed to spot rates. These segments are likely experiencing underperformance due to unsustainable pricing pressures.

These areas are characterized by a low market share within a low-growth, highly competitive landscape. The persistent excess capacity in the freight market means that rates are often dictated by the spot market, leading to constrained pricing for carriers. This environment makes it difficult for Heartland to achieve healthy returns.

- Spot Market Vulnerability: Segments tied to spot market pricing are susceptible to rapid rate fluctuations, impacting revenue predictability.

- Overcapacity Impact: Prolonged industry overcapacity in 2024 has suppressed freight rates, particularly in the spot market.

- Low Market Share & Growth: Businesses with limited market share in slow-growing segments face amplified challenges when relying on volatile spot rates.

- High Volatility & Low Returns: Exposure to unsustainable spot pricing leads to increased financial volatility and diminished profitability for these operations.

Smith Transport and Contract Freighters (CFI), now part of Heartland Express, are firmly in the Dogs quadrant of the BCG Matrix. These segments struggle with low market share and declining profitability, as evidenced by Heartland Express's $1.8 million net loss in Q1 2024, significantly influenced by these acquisitions.

The integration of CFI's legacy IT systems presents a major hurdle, contributing to elevated operational costs and inefficiencies. This technological disparity hinders streamlined operations and limits the realization of acquisition benefits.

Heartland Express's trailer fleet, averaging 7.5 years old as of June 2025, up from 6.9 years in June 2024, also points to a Dog status due to increased maintenance and potential fuel economy issues.

The company's strategic move to reduce underperforming freight lanes, characterized by low market penetration and earnings, aims to improve its overall operating ratio and align services with market demand.

| Segment | BCG Quadrant | Key Challenges | Financial Indicator (Q1 2024) |

|---|---|---|---|

| Smith Transport | Dog | Underutilized assets, high operational costs, legacy IT | Contributed to net loss |

| Contract Freighters (CFI) | Dog | Low market share, declining profitability, IT integration issues | Contributed to net loss |

| Aging Trailer Fleet | Dog | Increased maintenance, potential fuel inefficiency | Average age: 7.5 years (June 2025) |

| Underperforming Lanes | Dog | Low market penetration, low earnings potential, spot market reliance | Targeted for reduction to improve operating ratio |

Question Marks

Heartland Express's strategic push into fleet telematics and a unified Transportation Management System (TMS) across its brands places it squarely in the emerging technology investment category. The significant progress, such as the 75% completion of CFI's telematics transition by Q3 2025, highlights a commitment to adopting advanced solutions.

These investments are crucial for enhancing operational efficiency and maintaining a competitive edge in the logistics sector, positioning Heartland's technological adoption as a potential high-growth area. However, the full realization of their market share and profitability benefits remains a future prospect, classifying these initiatives as question marks that necessitate ongoing financial commitment to validate their long-term value.

Heartland Express's ventures into new, less established geographic markets or highly specialized freight niches would fall into the question mark category of the BCG Matrix. These areas represent growth opportunities, but Heartland's current market share is minimal, necessitating substantial investment and strategic focus to build a strong presence and achieve profitability.

While specific recent expansion data for Heartland Express is not readily available, the trucking industry as a whole saw continued demand in 2024, particularly for specialized logistics. For example, the demand for temperature-controlled freight, a niche, remained robust throughout the year, driven by the pharmaceutical and food sectors.

Heartland Express's dedication to sustainability, evident in its adoption of SmartWay certified equipment and emissions-reducing technologies, positions it within a burgeoning market for environmentally conscious logistics. This strategic focus on green fleet initiatives, while essential for future viability and adherence to regulations, presents a scenario where the immediate financial returns and the company's current standing in this rapidly developing sector remain subjects of ongoing evaluation.

Driver Recruitment and Retention Programs

Heartland Express's driver recruitment and retention programs are crucial for its position in the trucking industry, which is known for its driver shortages. By investing in competitive pay and prioritizing home time, Heartland aims to secure a reliable workforce. This focus on driver well-being can be viewed as a strategic move to capture market share in a sector where human capital is a key differentiator.

The effectiveness of these initiatives remains a significant question mark, impacting Heartland's future profitability and competitive standing. A stable, high-quality driver pool directly influences operational efficiency and the ability to meet customer demands. For instance, in 2024, the American Trucking Associations reported an ongoing driver shortage, highlighting the critical nature of retention efforts.

- Driver Shortage Impact: The trucking industry continued to grapple with a significant driver shortage in 2024, with estimates suggesting a need for over 70,000 drivers to meet demand.

- Retention as a Competitive Edge: Heartland's commitment to competitive compensation and home time is designed to differentiate itself in this tight labor market, aiming to attract and keep experienced drivers.

- Operational Capacity Link: The success of these programs directly correlates with Heartland's ability to maintain consistent service levels and expand its operational capacity, influencing its market share.

- Profitability Driver: Ultimately, the ability to retain drivers impacts operational costs, service reliability, and the capacity to generate revenue, making driver programs a key determinant of future profitability.

Strategic Acquisitions Post-Integration Challenges

Heartland Express's recent acquisitions, CFI and Smith Transport, currently fall into the Dogs category of the BCG Matrix, indicating underperformance. The strategic rationale for these acquisitions was to broaden market presence and enhance service capabilities, aiming for future growth.

The integration of these entities presents a significant challenge, requiring substantial investment and effective turnaround strategies to move them from 'question marks' towards becoming Stars or Cash Cows. Success hinges on overcoming post-integration hurdles and capitalizing on potential market recovery.

For example, the freight market experienced significant volatility in 2024. While specific financial figures for the underperformance of CFI and Smith Transport post-acquisition are proprietary, industry-wide data suggests that trucking companies faced increased operating costs and reduced demand for certain freight segments throughout much of the year.

The company's outlook for a freight market recovery in late 2025 and a more robust environment in 2026 provides a crucial backdrop for these integration efforts.

- Strategic Intent: Expansion of market reach and service offerings through acquisitions of CFI and Smith Transport.

- Current Status: Both acquisitions are underperforming, categorized as 'Dogs' in the BCG Matrix.

- Integration Challenge: Significant investment and effective turnaround strategies are required to convert these 'question marks' into profitable Stars or Cash Cows.

- Market Outlook: Anticipated freight market recovery in late 2025 and improved conditions in 2026 are expected to support the integration and profitability of these acquisitions.

Heartland Express's investments in fleet telematics and a unified TMS position its technological advancements as question marks. While progress is evident, such as CFI's telematics transition being 75% complete by Q3 2025, the full impact on market share and profitability is yet to be realized, requiring continued financial commitment.

Venturing into new geographic markets or specialized freight niches also represents question marks for Heartland. These areas offer growth potential, but the company's current market share is minimal, necessitating substantial investment to establish a strong presence and achieve profitability.

The company's focus on sustainability, through initiatives like SmartWay certified equipment, places it in a developing market where immediate financial returns and current standing are still under evaluation, making these green fleet efforts a question mark.

Heartland's driver recruitment and retention programs are critical in the face of industry-wide shortages. In 2024, the American Trucking Associations highlighted the ongoing need for over 70,000 drivers, underscoring the importance of Heartland's efforts to attract and retain talent through competitive pay and home time. The success of these programs is a key question mark, directly impacting operational efficiency and future profitability.

BCG Matrix Data Sources

Our Heartland Express BCG Matrix is built on verified market intelligence, combining financial data from SEC filings, industry research from trucking associations, and official reports on freight volume to ensure reliable insights.