Hanwha Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

Hanwha Solutions boasts significant strengths in renewable energy and advanced materials, positioning it for growth, but faces challenges from intense competition and evolving global regulations. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on its potential.

Want the full story behind Hanwha Solutions' market position, competitive advantages, and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Hanwha Solutions boasts a diversified business portfolio spanning chemicals, advanced materials, and renewable energy. This broad operational base provides a robust revenue stream, significantly reducing the company's vulnerability to downturns in any single market. For instance, in 2023, the company's Chemical Division reported significant contributions, while its Qcells division continued to solidify its position as a global leader in solar solutions.

Hanwha Solutions, through its prominent Hanwha Qcells brand, stands as a global frontrunner in the solar energy sector. The company has cemented its dominance, especially in the U.S. residential and commercial solar module markets, capturing an impressive market share exceeding 35%.

This strong market position is bolstered by substantial investments in vertically integrated solar manufacturing capabilities. A prime example is the North American 'Solar Hub', which began full-scale module production in 2024, underscoring Hanwha's commitment to localized and advanced manufacturing.

Hanwha Solutions demonstrates a strong commitment to sustainability and innovation, aiming for a cleaner environment through its 2050 Net Zero Roadmap. This dedication is evident in its significant investments in green hydrogen production and circular economy initiatives, positioning the company as a leader in eco-friendly solutions.

The company is actively pushing the boundaries of solar technology by researching next-generation advancements such as perovskite-silicon tandem cells. This focus on enhancing module efficiency is crucial for increasing the competitiveness and adoption of solar energy globally.

Integrated Value Chain in Key Businesses

Hanwha Solutions is building a comprehensive solar value chain, encompassing everything from ingot and wafer manufacturing to cell and module assembly. This is particularly evident in their U.S. operations, which bolsters supply chain resilience and positions them favorably for Advanced Manufacturing Production Tax Credits (AMPC). This integrated approach offers a significant competitive advantage, especially with increasing trade restrictions and the global push for non-China sourced components.

This vertical integration allows Hanwha Solutions to control quality and costs across multiple stages of production. For example, their U.S. facility in Georgia is designed to produce solar ingots, wafers, cells, and modules, creating a localized and robust supply chain. This strategy is crucial in navigating global trade dynamics and meeting demand for domestically manufactured solar products.

The benefits of this integrated value chain are substantial:

- Enhanced Supply Chain Stability: Direct control over raw materials and intermediate products reduces reliance on external suppliers, mitigating risks associated with geopolitical tensions or logistical disruptions.

- Cost Efficiencies: Streamlining production processes from start to finish can lead to lower manufacturing costs per unit.

- Quality Control: Maintaining oversight across the entire value chain ensures consistent product quality and performance.

- Eligibility for Incentives: The U.S. manufacturing footprint, particularly for components like solar cells and modules, makes Hanwha Solutions a strong candidate for government incentives such as the AMPC, potentially boosting profitability and competitiveness.

Strong R&D and Technological Capabilities

Hanwha Solutions demonstrates robust research and development, consistently pouring resources into technological advancements. This commitment fuels progress across its diverse business units, from advanced materials to next-generation solar technology.

This dedication to innovation is crucial for staying ahead. For instance, in 2023, Hanwha Solutions reported a significant portion of its revenue allocated to R&D, enabling breakthroughs in areas like high-efficiency photovoltaic cells and eco-friendly chemical solutions. This proactive approach allows the company to anticipate and meet shifting market needs, solidifying its competitive standing.

- Consistent R&D Investment: Hanwha Solutions prioritizes R&D to foster innovation across its business segments.

- Technological Leadership: The company aims to maintain a competitive edge through advancements in areas like solar cell efficiency and material science.

- Adaptability to Market Trends: A strong R&D focus enables Hanwha Solutions to respond effectively to evolving industry demands and technological shifts.

Hanwha Solutions holds a leading position in the global solar market, particularly in the U.S. residential and commercial sectors, with over 35% market share. This dominance is reinforced by significant investments in vertically integrated solar manufacturing, exemplified by its North American Solar Hub, which commenced full-scale module production in 2024. The company's commitment to sustainability is evident through its 2050 Net Zero Roadmap and investments in green hydrogen and circular economy initiatives.

Hanwha Solutions' strategic vertical integration, from ingot to module production, enhances supply chain stability and cost efficiencies. This is crucial for navigating global trade dynamics and capitalizing on incentives like the U.S. Advanced Manufacturing Production Tax Credits (AMPC). Their U.S. facilities, designed for localized production of key solar components, underscore this advantage.

The company's robust research and development efforts are a key strength, driving innovation in areas such as high-efficiency photovoltaic cells and advanced materials. This consistent R&D investment, with a significant portion of revenue allocated in 2023, allows Hanwha Solutions to maintain technological leadership and adapt to evolving market demands.

What is included in the product

Hanwha Solutions' SWOT analysis reveals its strong position in renewable energy and advanced materials, while identifying potential challenges in market competition and global economic volatility.

Offers a clear, actionable framework to identify and leverage Hanwha Solutions' competitive advantages while mitigating potential threats.

Weaknesses

Hanwha Solutions' chemicals division, a significant contributor to its revenue, faces considerable risk due to its reliance on basic petrochemicals. This segment is highly sensitive to the unpredictable swings in raw material costs and broader global market dynamics, directly impacting profit margins.

For instance, during periods of weak market conditions within the petrochemical industry, Hanwha Group, including Hanwha Solutions, has experienced noticeable sales declines. This vulnerability was evident in the company's performance, where the cyclical nature of petrochemicals played a role in revenue fluctuations.

Hanwha Solutions faces significant capital expenditures, particularly with its ambitious expansion plans for solar manufacturing. For instance, the development of its U.S. Solar Hub involves substantial upfront investment, directly contributing to an increased borrowing burden.

This growing debt load necessitates vigilant financial management. Maintaining strong credit ratings is crucial for future financing and overall financial stability, making the monitoring of this increased borrowing burden a key concern for the company.

Hanwha Solutions has faced significant operational hurdles, notably production stoppages and reduced operating rates at its U.S. solar module factories stemming from quality control issues. These disruptions directly impact output and can lead to a need for downward revisions in annual shipment forecasts.

These manufacturing quality problems not only hinder production volume but also directly affect the company's financial performance. Such delays and the associated costs of rectifying quality issues can put downward pressure on overall profitability for the fiscal year 2024.

Intense Competition in Solar and Chemical Markets

Hanwha Solutions operates in highly competitive arenas, particularly within the solar panel and chemical industries. The global solar market, for instance, is crowded with many manufacturers, leading to significant pricing pressures and making it challenging to maintain or grow market share. This intense rivalry necessitates constant adaptation and efficiency improvements to stay ahead.

Similarly, the advanced materials and chemical sectors are not immune to fierce competition. Companies in these fields must continuously invest in research and development to innovate and bring new products to market. Simultaneously, effective cost management is crucial to remain competitive against both established players and emerging disruptors. For example, in 2023, the polysilicon price experienced significant volatility, impacting the entire solar value chain and highlighting the cost-sensitive nature of the industry.

The pressure to innovate and manage costs is a constant challenge for Hanwha Solutions in both its key business segments. Success hinges on the ability to differentiate through technology and maintain cost leadership.

- Intense Global Solar Competition: The solar panel market is characterized by a large number of global manufacturers, leading to price wars and market share battles.

- Chemical Sector Rivalry: Advanced materials and chemical markets also face strong competition, demanding continuous innovation and stringent cost control.

- 2023 Polysilicon Price Volatility: Fluctuations in key raw material prices, such as polysilicon in 2023, underscore the cost-sensitive environment Hanwha Solutions navigates.

Sensitivity to Trade Policies and Tariffs

Hanwha Solutions faces significant headwinds from evolving global trade policies and tariffs. Increases in tariffs on essential raw materials, coupled with strategic efforts to diversify supply chains away from China, are likely to inflate operational costs. For instance, the U.S. tariffs on certain imported goods, while potentially boosting domestic market share for some of Hanwha's products, simultaneously complicate supply chain management and introduce the risk of escalating expenses.

The company's reliance on global sourcing makes it particularly vulnerable to these trade dynamics. A notable example of this sensitivity can be seen in the solar industry, a key sector for Hanwha Solutions. Fluctuations in tariffs on polysilicon, a primary component in solar panels, directly impact production costs and pricing competitiveness. In 2023, for example, the U.S. continued to implement tariffs on goods from China, including solar components, which could indirectly affect Hanwha's sourcing strategies and cost structures, even if its own production is diversified.

- Rising material costs: Tariffs on key inputs like polysilicon and metals directly increase manufacturing expenses.

- Supply chain diversification costs: Shifting production or sourcing away from China to mitigate tariff risks incurs upfront investment and potentially higher ongoing costs.

- Market access complexities: While some tariffs can protect domestic markets, they can also lead to retaliatory measures, impacting export opportunities.

- Unpredictable cost environment: The dynamic nature of trade policy creates an uncertain cost outlook, making long-term financial planning more challenging.

Hanwha Solutions' reliance on basic petrochemicals exposes it to significant price volatility and market downturns. For instance, during 2023, the petrochemical industry experienced a downturn, impacting sales for companies like Hanwha Solutions. This cyclicality means profit margins can be squeezed when raw material costs rise or product prices fall.

The company's ambitious solar expansion, particularly the U.S. Solar Hub, demands substantial capital. This has led to an increased borrowing burden, with debt levels rising to finance these growth initiatives. Maintaining strong credit ratings becomes paramount for future financing needs and overall financial health.

Quality control issues have caused production stoppages and reduced operating rates at U.S. solar module factories. These disruptions not only limit output but also directly impact the company's financial performance, potentially leading to lower annual shipment forecasts and increased costs for rectifying defects, as seen in the fiscal year 2024 projections.

Intense competition in both the solar and chemical sectors creates pricing pressures. The global solar market, for example, saw polysilicon prices fluctuate significantly in 2023, affecting the entire value chain. Hanwha Solutions must continuously innovate and manage costs effectively to remain competitive against numerous global players.

Preview the Actual Deliverable

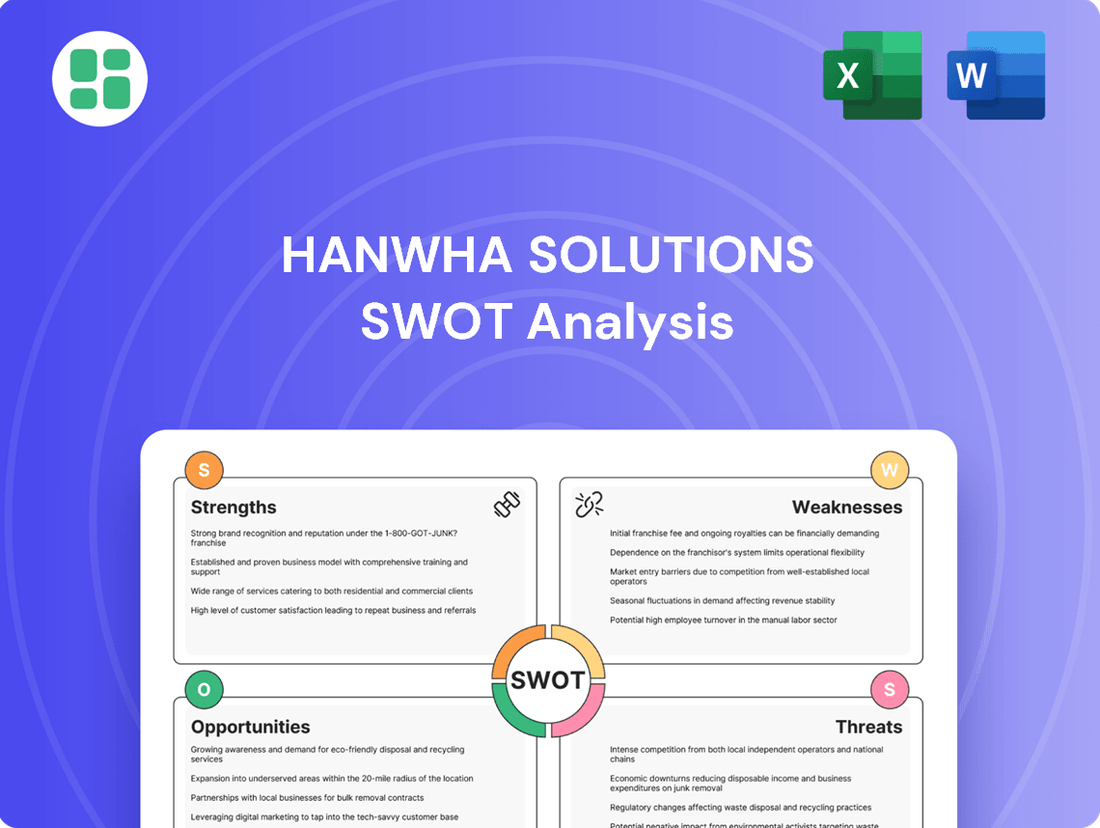

Hanwha Solutions SWOT Analysis

This is the actual Hanwha Solutions SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats here. Purchase unlocks the entire in-depth version for your strategic planning needs.

Opportunities

The intensifying global commitment to combating climate change and facilitating an energy transition is fueling a substantial increase in demand for renewable energy sources, with solar power at the forefront. This powerful global trend creates a prime opportunity for Hanwha Solutions to significantly broaden its solar business operations and its integrated energy solutions across international markets.

For instance, in 2024, the International Energy Agency (IEA) projected that solar PV capacity additions would continue to break records, reaching an estimated 450 GW globally, a notable increase from the 420 GW added in 2023. This expansion underscores the immense market potential for companies like Hanwha Solutions to leverage its expertise.

Hanwha Solutions is making significant moves into emerging sustainable technologies, particularly in green hydrogen production, energy storage systems (ESS), and advanced materials crucial for a circular economy. This strategic pivot taps into the accelerating global demand for environmentally friendly solutions.

The company's investment in green hydrogen, a key component of decarbonization efforts, positions it to capitalize on a market projected to reach hundreds of billions of dollars by 2030. Furthermore, their advancements in ESS are critical as grid modernization and renewable energy integration accelerate, with the global ESS market expected to grow substantially in the coming years.

Hanwha Solutions is actively pursuing strategic investments to bolster its market position. The establishment of the Solar Hub in North America, for instance, signifies a commitment to expanding its renewable energy footprint. This move is designed to capitalize on the growing demand for solar solutions in a key global market.

Furthermore, potential acquisitions, such as the reported interest in Dyna-Mac Holdings, highlight Hanwha's ambition to diversify and strengthen its offshore and marine energy solutions segment. Such strategic moves are crucial for building a comprehensive portfolio that addresses evolving energy needs.

Collaborations are also a cornerstone of Hanwha's strategy. The partnership with Microsoft for solar alliances exemplifies this approach, aiming to leverage technological expertise and market access to accelerate solar project development and deployment. These alliances are vital for enhancing market reach and improving project execution efficiency.

Leveraging Government Incentives and Policies

Government incentives, such as the U.S. Inflation Reduction Act (IRA), present a significant opportunity for Hanwha Solutions. The IRA's Advanced Manufacturing Production Tax Credit (AMPC) offers substantial tax credits for advanced manufacturing, directly benefiting Hanwha Qcells' U.S. solar manufacturing facilities, thereby enhancing profitability and competitiveness.

Furthermore, shifts in Chinese government policy, aimed at curbing overcapacity and promoting healthier competition within the solar industry, are viewed as positive for Hanwha Solutions. These policy adjustments can lead to a more stable market environment, potentially improving pricing power and operational efficiency for the company's global solar operations.

- IRA's AMPC: Provides significant tax credits for U.S. solar manufacturing, directly boosting Hanwha Qcells' profitability.

- Chinese Policy Shifts: Government measures to reduce excessive competition in China's solar market are expected to create a more favorable operating environment.

- Global Policy Alignment: Increasing global focus on renewable energy and supportive government policies worldwide create a tailwind for Hanwha Solutions' growth.

Increasing Market Share Amidst Competitor Challenges

The financial distress or potential bankruptcy of key U.S. solar competitors creates a significant opening for Hanwha Solutions to capture a larger portion of the market. This disruption allows Hanwha to leverage its robust operational capabilities and integrated value chain to gain market share.

Hanwha Solutions, with its established market leadership, is well-positioned to benefit from these industry shifts. The company’s ability to maintain consistent production and supply, even as competitors falter, is a critical advantage. For instance, in the first quarter of 2024, Hanwha Solutions reported strong performance in its Qcells division, underscoring its operational resilience.

- Seizing Market Gaps: Competitor instability allows Hanwha to fill supply chain voids and secure new customer contracts.

- Leveraging Integrated Value Chain: Hanwha's control over manufacturing from polysilicon to finished modules provides a competitive edge in reliability and cost.

- Strengthening Financial Position: By outperforming struggling rivals, Hanwha can enhance its financial stability and investor confidence.

- Expanding U.S. Footprint: The company can accelerate its expansion plans in the U.S. market, potentially acquiring assets or talent from weaker competitors.

The global surge in demand for renewable energy, particularly solar power, presents a significant growth avenue for Hanwha Solutions. Government incentives, like the U.S. Inflation Reduction Act's Advanced Manufacturing Production Tax Credit (AMPC), directly benefit Hanwha Qcells' U.S. solar manufacturing, enhancing profitability and competitiveness. Furthermore, shifts in Chinese solar industry policies aimed at reducing overcapacity create a more favorable operating environment, potentially improving pricing power for Hanwha’s global operations.

The financial instability of some U.S. solar competitors offers Hanwha Solutions a prime opportunity to capture increased market share by filling supply chain gaps and securing new contracts. Hanwha's integrated value chain, from polysilicon to finished modules, provides a crucial advantage in reliability and cost, allowing it to outperform rivals and strengthen its financial standing.

Hanwha Solutions is also strategically expanding into emerging sustainable technologies such as green hydrogen production and energy storage systems (ESS), tapping into markets projected for substantial growth. The company's investment in its North American Solar Hub and potential acquisitions signal a clear intent to broaden its renewable energy footprint and diversify its portfolio to meet evolving global energy needs.

Threats

The solar market is experiencing a significant increase in price competition, largely driven by Chinese manufacturers. This intense rivalry puts pressure on profit margins for all players, including Hanwha Solutions. For instance, the average selling price for solar modules saw a notable decline throughout 2023 and into early 2024, a trend that is expected to continue.

To navigate this challenging environment, companies must focus on optimizing their production costs and developing unique product offerings that stand out from the competition. Hanwha Solutions' ability to innovate and maintain cost efficiency will be crucial for preserving profitability amidst this escalating price war.

Fluctuations in global energy and raw material prices, especially for petrochemicals, directly affect Hanwha Solutions' operational costs and profitability. For instance, the average Brent crude oil price in 2024 has seen significant swings, impacting the cost of naphtha, a key feedstock. This volatility makes financial forecasting and cost management difficult across its various business units.

Changes in international trade policies, such as the imposition of tariffs and anti-dumping investigations, directly threaten Hanwha Solutions' global supply chains and market access, particularly for its solar products. For instance, ongoing trade disputes, like those involving solar panels from Southeast Asian nations, could increase costs and limit export opportunities.

Geopolitical tensions worldwide can significantly disrupt global trade flows, impacting Hanwha Solutions' international operations and potentially affecting the availability and cost of raw materials. The ongoing conflicts and shifting alliances create an unpredictable operating environment, necessitating robust risk management strategies.

Technological Disruption and Rapid Innovation by Competitors

The relentless pace of technological change in sectors like solar energy and advanced materials presents a significant threat. Competitors might unveil more efficient or cheaper alternatives, potentially eroding Hanwha Solutions' market share if the company doesn't keep pace. For instance, advancements in perovskite solar cell technology, which promises higher efficiency at lower costs, could disrupt the established silicon-based solar market where Hanwha is a major player.

Hanwha Solutions faces the critical challenge of continuously investing in research and development to counter disruptive innovations. Failing to do so risks falling behind competitors who are quicker to adopt and commercialize new technologies. The company's R&D expenditure in 2023 was approximately KRW 700 billion, a figure that needs to remain robust to maintain its competitive edge in these fast-evolving fields.

- Threat: Competitors introducing superior, cost-effective renewable energy or advanced material solutions due to rapid technological advancements.

- Impact: Potential loss of market share and reduced profitability if Hanwha Solutions is outpaced by disruptive innovations.

- Mitigation: Sustained and increased investment in R&D is crucial to develop and adopt cutting-edge technologies, ensuring Hanwha Solutions remains competitive.

- Example: The emergence of highly efficient perovskite solar cells could challenge Hanwha's dominance in the silicon solar panel market.

Regulatory and Environmental Compliance Burden

Hanwha Solutions faces a growing threat from increasingly stringent environmental regulations and mandatory ESG disclosures, particularly in key markets like the European Union and South Korea. These evolving standards necessitate significant capital allocation towards compliance measures and the adoption of more sustainable operational practices. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will impact carbon-intensive imports, requiring companies like Hanwha to account for embedded carbon in their supply chains.

Failure to adapt to these evolving environmental mandates can lead to substantial financial penalties and significant reputational damage. As global pressure mounts for corporate environmental responsibility, non-compliance risks alienating customers, investors, and regulatory bodies. Hanwha's commitment to sustainability is therefore not just an ethical consideration but a critical business imperative to mitigate these compliance threats.

- EU's CBAM implementation in 2026

- Increased scrutiny on ESG reporting

- Potential for fines and reputational damage

- Need for investment in sustainable technologies

Intense price competition, particularly from Chinese manufacturers, continues to pressure solar module pricing, with average selling prices declining through 2023 and into early 2024. This trend necessitates ongoing cost optimization and product differentiation for Hanwha Solutions to maintain profitability. Furthermore, volatility in global energy and raw material costs, such as naphtha, directly impacts operational expenses and financial planning across its diverse business segments.

Shifting international trade policies, including tariffs and anti-dumping measures, pose a significant risk to Hanwha Solutions' global supply chains and market access, especially for its solar products. Geopolitical instability exacerbates these trade risks, disrupting global commerce and potentially affecting raw material availability and costs. The rapid pace of technological advancement, such as in perovskite solar cells, also presents a threat if the company cannot keep pace with innovation, potentially eroding market share.

The company must also contend with increasingly stringent environmental regulations and ESG disclosure requirements, exemplified by the EU's Carbon Border Adjustment Mechanism (CBAM) slated for full implementation in 2026. Non-compliance with these evolving standards risks financial penalties and reputational damage, underscoring the critical need for sustained investment in sustainable technologies and practices to mitigate these threats.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert industry analysis to provide a robust and actionable strategic overview.