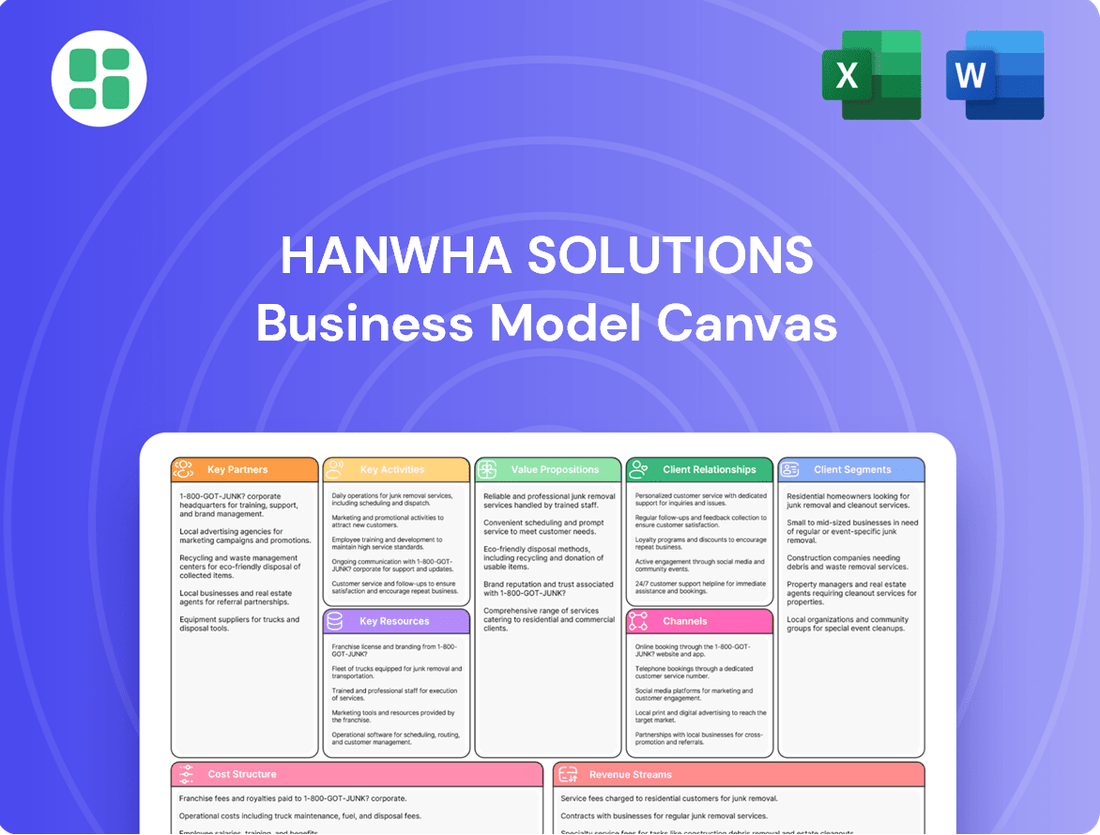

Hanwha Solutions Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

Curious about how Hanwha Solutions masterfully navigates the energy and chemical sectors? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Unlock the strategic brilliance behind Hanwha Solutions’s operations with our full Business Model Canvas. This detailed document reveals their core activities, cost structure, and competitive advantages, providing invaluable insights for your own strategic planning.

Dive into the intricate workings of Hanwha Solutions’s business with our complete Business Model Canvas. Discover their unique value propositions and key partnerships, empowering you to benchmark and innovate your own business strategies.

Partnerships

Hanwha Solutions, via its Hanwha Qcells division, has cemented crucial long-term partnerships, including an eight-year deal with Microsoft. This alliance will see Hanwha supply 12 gigawatts of solar modules and offer comprehensive Engineering, Procurement, and Construction (EPC) services, underscoring a dedication to large-scale renewable energy projects.

This collaboration is instrumental in helping major corporations like Microsoft meet their ambitious sustainability targets, positioning Hanwha Solutions as a key enabler of global decarbonization efforts.

Hanwha Solutions actively collaborates with specialized renewable energy infrastructure firms to bolster its project development capabilities. A prime example is its partnership with True Green Capital Management (TGC) in the United States.

These strategic alliances are crucial for securing substantial contracts, such as the agreement to supply 450 megawatts of solar power. This collaboration also involves providing turnkey Engineering, Procurement, and Construction (EPC) services for the U.S. commercial solar energy market, significantly extending Hanwha's footprint in project development and execution.

Hanwha Solutions actively fortifies its supply chain by investing in and forming joint ventures with key raw material providers. This strategy guarantees a consistent flow of essential components for its diverse operations.

A prime example is Hanwha's increased investment in polysilicon producer REC Silicon. This move is specifically designed to bolster U.S. solar manufacturing capabilities, with the ultimate goal of reconstructing a complete domestic solar supply chain.

Research and Development Institutions

Hanwha Solutions actively partners with prominent research and development institutions to fuel its innovation pipeline. These collaborations are crucial for staying at the forefront of technological advancements in its core business areas.

Notable partnerships include those with esteemed universities like Seoul National University and Yonsei University. These academic alliances concentrate on developing next-generation chemical processes and pioneering advanced materials, directly contributing to Hanwha Solutions' competitive edge.

- University Collaborations: Partnerships with leading universities drive fundamental research and talent development.

- Technology Advancement: Focus on cutting-edge chemical processes and advanced materials for future product lines.

- Innovation Ecosystem: Fosters a robust R&D environment, accelerating the translation of research into commercial applications.

Acquisitions for Market Expansion

Hanwha Solutions leverages strategic acquisitions to broaden its market reach and enhance its operational capabilities. While Hanwha Solutions itself concentrates on its core business areas, the broader Hanwha Group's strategic moves, such as Hanwha Ocean and Hanwha Systems' acquisition of Philly Shipyard, illustrate this approach. This particular acquisition, completed in 2023 for approximately $100 million, aims to establish a significant presence in the U.S. market for ship maintenance, repair, and overhaul (MRO) services.

This expansion strategy, though not directly within Hanwha Solutions' primary segments of chemicals and advanced materials, demonstrates a group-wide commitment to inorganic growth. Such moves can indirectly benefit Hanwha Solutions by strengthening the overall financial health and market position of the parent conglomerate.

Key aspects of this partnership strategy include:

- Market Entry: Acquisitions provide a direct pathway into new geographic regions and customer segments, bypassing lengthy organic market development.

- Capability Enhancement: Acquiring companies with complementary technologies or specialized expertise allows Hanwha Solutions to quickly integrate new offerings and improve existing ones.

- Synergistic Opportunities: While distinct, group-level acquisitions can create downstream benefits, such as enhanced supply chain integration or shared R&D advancements that may eventually benefit Hanwha Solutions.

- Competitive Positioning: Strategic acquisitions help maintain and improve competitive standing by consolidating market share or neutralizing potential rivals.

Hanwha Solutions, through Hanwha Qcells, has established vital long-term partnerships to drive renewable energy growth. A significant eight-year deal with Microsoft, valued at $2.5 billion, will see Hanwha supply 12 gigawatts of solar modules and provide EPC services, directly supporting Microsoft's sustainability goals.

Further strengthening its project development, Hanwha partners with specialized firms like True Green Capital Management (TGC) in the U.S. This collaboration secured a 450-megawatt solar power supply agreement, including comprehensive EPC services for the commercial sector.

To ensure supply chain stability, Hanwha is increasing its investment in polysilicon producer REC Silicon, aiming to bolster U.S. solar manufacturing and reconstruct a domestic supply chain.

Hanwha also collaborates with leading research institutions, including Seoul National University and Yonsei University, focusing on next-generation chemical processes and advanced materials to maintain a competitive edge.

| Partner | Agreement Detail | Capacity/Value | Impact |

|---|---|---|---|

| Microsoft | Solar Module Supply & EPC Services | 12 GW / $2.5 Billion (8-year deal) | Supports corporate sustainability targets |

| True Green Capital Management (TGC) | Solar Power Supply & EPC Services | 450 MW | Expands U.S. commercial solar footprint |

| REC Silicon | Polysilicon Production Investment | N/A | Strengthens U.S. solar manufacturing |

| Seoul National University & Yonsei University | R&D Collaboration | N/A | Drives innovation in materials and processes |

What is included in the product

Hanwha Solutions' Business Model Canvas focuses on delivering sustainable energy and advanced materials solutions by leveraging its integrated value chain, from upstream production to downstream applications.

It details customer segments in renewable energy and chemical industries, channels through direct sales and partnerships, and value propositions centered on eco-friendly products and technological innovation.

Hanwha Solutions' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their diverse operations, simplifying complex strategies for stakeholders.

This adaptable framework effectively addresses the pain point of information overload by condensing Hanwha Solutions' multifaceted business into a digestible format for quick review and strategic alignment.

Activities

Hanwha Solutions' key activities in Chemicals and Advanced Materials Manufacturing include producing a broad spectrum of petrochemicals, advanced plastics, and specialized materials. This segment is the bedrock of their operations, supplying essential components across numerous global industries.

In 2024, the company continued to leverage its integrated production facilities to maintain a competitive edge in the chemical market. For instance, their polyethylene (PE) and polyvinyl chloride (PVC) offerings remain critical for sectors like construction and packaging, demonstrating the foundational nature of these chemical products.

Hanwha Solutions, through its Qcells brand, focuses on the large-scale manufacturing of solar cells, modules, ingots, and wafers. This core activity underpins their position in the renewable energy market.

The company is making significant investments in expanding its manufacturing capabilities. For instance, Hanwha Qcells announced a $2.5 billion investment in 2023 to build a fully integrated solar supply chain in the U.S., aiming to produce 3.3 gigawatts of solar modules annually by the end of 2024.

Hanwha Solutions actively develops renewable energy projects, specializing in solar power. Their comprehensive Engineering, Procurement, and Construction (EPC) services cover the entire lifecycle of solar power plants, from initial design and material sourcing to building and final activation. This end-to-end approach ensures efficient and effective delivery of large-scale solar installations.

In 2024, Hanwha Solutions continued to solidify its position in the global solar market. The company reported significant progress in its project pipeline, with a strong focus on utility-scale solar farms. For instance, Hanwha Q CELLS, a key subsidiary, announced the completion of several major solar projects in the United States, contributing to the nation's clean energy goals.

Research and Development for Sustainable Technologies

Hanwha Solutions dedicates significant resources to continuous research and development, a core activity aimed at pioneering innovative technologies for a cleaner planet. This commitment is evident in their pursuit of next-generation solar advancements, such as the development of perovskite tandem cells, which promise higher energy conversion efficiencies.

In the chemical sector, the company actively develops eco-friendly products and champions circular economy solutions. This includes exploring advanced materials and processes that minimize environmental impact and promote resource sustainability.

- Advancing Solar Technology: Focus on perovskite tandem cells to boost solar energy efficiency.

- Eco-Friendly Chemicals: Development of sustainable chemical products and processes.

- Circular Economy Initiatives: Implementing solutions for resource recycling and waste reduction in the chemical business.

- Investment in Innovation: Consistent R&D spending to drive technological breakthroughs in green energy and materials.

Global Distribution and Sales

Hanwha Solutions actively manages its global distribution and sales operations, ensuring its diverse product portfolio reaches customers across continents. This involves maintaining robust sales networks in key markets like Korea, China, and Germany, facilitating the delivery of chemical, advanced materials, and solar solutions.

The company's commitment to global reach is underscored by its significant sales figures. For instance, in 2023, Hanwha Solutions reported consolidated sales of approximately 22.7 trillion KRW (roughly $17.3 billion USD), with a substantial portion attributable to its international market presence.

- Global Sales Network: Operates sales channels across major regions including Asia, Europe, and North America.

- Product Reach: Distributes chemical products, advanced materials, and solar energy solutions internationally.

- Market Presence: Strong sales operations in key markets such as South Korea, China, and Germany.

- Revenue Contribution: International sales form a critical component of the company's overall revenue streams.

Hanwha Solutions' key activities in its business model revolve around the integrated manufacturing of chemicals and advanced materials, the large-scale production of solar energy components, and the development of renewable energy projects. These core functions are supported by continuous research and development to drive innovation and a robust global sales and distribution network to ensure market reach.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Chemicals & Advanced Materials Manufacturing | Production of petrochemicals, plastics, and specialized materials. | Continued emphasis on polyethylene (PE) and polyvinyl chloride (PVC) for construction and packaging sectors. |

| Solar Component Manufacturing | Large-scale production of solar cells, modules, ingots, and wafers. | Hanwha Qcells' U.S. supply chain investment of $2.5 billion to reach 3.3 GW module capacity by end of 2024. |

| Renewable Energy Project Development | EPC services for solar power plants, from design to activation. | Completion of several major utility-scale solar projects in the United States. |

| Research & Development | Pioneering innovative technologies, including perovskite tandem cells. | Focus on next-generation solar advancements for higher energy conversion efficiencies. |

| Global Sales & Distribution | Managing sales networks in key markets like Korea, China, and Germany. | Consolidated sales in 2023 reached approximately 22.7 trillion KRW (~$17.3 billion USD). |

Delivered as Displayed

Business Model Canvas

This preview offers a genuine glimpse into the Hanwha Solutions Business Model Canvas you will receive. It’s not a generic sample, but a direct representation of the actual document, ensuring you know exactly what to expect. Upon purchase, you’ll gain full access to this comprehensive and ready-to-use Business Model Canvas, mirroring this preview precisely.

Resources

Hanwha Solutions operates advanced manufacturing facilities worldwide, including significant solar production hubs. Their U.S. presence, notably in Cartersville, Georgia, houses large-scale operations for ingots, wafers, cells, and modules, underscoring a commitment to high-volume output and supply chain integration.

These state-of-the-art plants are vital for Hanwha Solutions' diverse product range, from solar energy components to advanced chemical materials. The company's investment in these facilities supports its capacity to meet global demand efficiently and maintain a competitive edge in its key markets.

Hanwha Solutions' proprietary technology is a cornerstone of its business model, particularly in renewable energy. The company boasts patented solar cell technologies, such as its Quantum Neo TOPCon, which significantly enhance energy conversion efficiency. This technological leadership allows Hanwha Solutions to offer superior performance in its solar products, giving it a distinct advantage in the competitive global market.

In the advanced materials sector, Hanwha Solutions leverages its intellectual property to develop innovative material compositions. These advancements translate into improved product characteristics and functionalities, catering to diverse industrial needs. For instance, their expertise in polymers and specialty chemicals supports their growth in areas like automotive and electronics, reinforcing their market position through unique material solutions.

Hanwha Solutions' skilled human capital is a cornerstone, especially its robust R&D teams. In 2024, the company continued to invest heavily in its workforce, recognizing that innovation in areas like advanced materials and solar technology hinges on specialized expertise. This focus on talent development is crucial for maintaining a competitive edge.

The company's commitment to R&D expertise is evident in its ongoing development of next-generation materials and renewable energy solutions. For instance, their work in polysilicon production and advanced solar cell technologies relies on a deep pool of engineering and scientific talent. This human capital directly translates into operational efficiency and the creation of high-value products.

Global Brand Recognition and Reputation

The Hanwha and Hanwha Qcells brands are cornerstones of the company's global presence, signifying a strong reputation built on quality, reliability, and a deep commitment to sustainability. This brand equity is a significant intangible asset, directly contributing to customer trust and enabling smoother market penetration across highly competitive global sectors.

This established reputation translates into tangible benefits. For instance, Hanwha Qcells consistently ranks among the top solar module manufacturers globally, a testament to its brand strength. In 2023, the company maintained its position as a leading Tier 1 solar module supplier, a designation that reflects financial stability and manufacturing excellence, crucial for securing large-scale projects and customer confidence.

- Brand Value: Hanwha's strong brand recognition reduces customer acquisition costs and supports premium pricing.

- Market Trust: The reputation for reliability in renewable energy solutions, particularly with Hanwha Qcells, fosters long-term partnerships and project wins.

- Global Reach: Established brands facilitate entry into new geographic markets, leveraging existing positive perceptions.

- Sustainability Leadership: The commitment to sustainability, embodied by brands like Qcells, appeals to environmentally conscious consumers and investors, enhancing market position.

Financial Capital and Investment Capacity

Hanwha Solutions leverages its significant financial capital and robust investment capacity as a cornerstone of its business model. This financial strength allows for substantial investments in expanding manufacturing facilities and driving innovation through research and development. For instance, in 2023, the company announced plans for significant capital expenditures, including investments in its solar energy production capabilities, reflecting its commitment to growth and market leadership.

This capacity also facilitates strategic acquisitions, enabling Hanwha Solutions to broaden its technological base and market reach. The company's financial resources are crucial for funding large-scale projects and maintaining a competitive edge in its diverse business segments. In early 2024, Hanwha Solutions continued to explore strategic partnerships and potential acquisitions to bolster its position in key markets, particularly in renewable energy and advanced materials.

- Financial Strength: Hanwha Solutions possesses substantial financial capital derived from its operations and parent conglomerate.

- Investment Capacity: This enables significant capital expenditures for growth initiatives, including factory expansions and R&D.

- Strategic Acquisitions: Financial resources support the acquisition of companies and technologies to enhance market position.

- 2023/2024 Focus: Investments are directed towards solar energy expansion and exploring strategic partnerships in key growth areas.

Hanwha Solutions' key resources include its extensive manufacturing infrastructure, proprietary technologies, skilled workforce, strong brand equity, and significant financial capital. These elements collectively enable the company to achieve high-volume production, drive innovation, build market trust, and pursue strategic growth opportunities in the competitive global landscape.

Value Propositions

Hanwha Solutions, particularly via its Qcells division, is a major player in facilitating the global shift towards sustainable energy. They provide a full suite of clean energy solutions, from advanced solar cells and modules to integrated energy systems and extensive Engineering, Procurement, and Construction (EPC) services. This comprehensive approach directly supports environmental betterment and a lower carbon footprint worldwide.

In 2023, Hanwha Qcells achieved significant growth, with its solar module shipments reaching approximately 10 GW, a substantial increase from previous years. This expansion underscores their commitment to driving the renewable energy transition by delivering reliable and efficient solar technology globally, contributing to a cleaner planet.

Hanwha Solutions offers a diverse portfolio of high-performance plastics and specialized materials, driving innovation across numerous industrial sectors. Their advanced solutions are engineered to satisfy rigorous industry standards, enhancing product efficiency and longevity. For instance, in the automotive industry, these materials contribute significantly to lightweighting efforts, a critical factor in improving fuel economy and reducing emissions.

Hanwha Solutions is a trailblazer in renewable energy technology, consistently pushing the boundaries of solar innovation. Their dedication to research and development is evident in their pursuit of next-generation solutions, including the promising perovskite tandem cells, which aim to significantly boost power generation efficiency.

This focus on cutting-edge technology translates directly into tangible benefits for their customers. By developing solutions with superior power generation efficiency and ensuring long-term product reliability, Hanwha Solutions empowers its clients to maximize their energy output and secure dependable performance from their solar investments.

Reliable and Integrated Supply Chain

Hanwha Solutions' commitment to a reliable and integrated supply chain, particularly with its U.S. solar manufacturing expansion, directly addresses customer needs for dependable product availability. This vertical integration means they control more stages of production, from raw materials to finished panels.

By building this robust U.S. presence, Hanwha Solutions aims to mitigate the risks associated with global supply chain disruptions and trade uncertainties. This strategy enhances supply security, ensuring customers receive consistent deliveries of high-quality solar products, a critical factor in project planning and execution.

- Enhanced Supply Security: Hanwha Solutions' U.S. solar manufacturing expansion provides customers with greater confidence in product availability, reducing reliance on potentially volatile international markets.

- Quality Control: Vertical integration allows for stricter oversight of production processes, ensuring consistently high-quality solar modules that meet rigorous standards.

- Market Responsiveness: A localized supply chain enables quicker adaptation to market demands and customer feedback within the U.S.

Commitment to Environmental, Social, and Governance (ESG)

Hanwha Solutions prioritizes ESG management, clearly detailing its efforts in its sustainability reports. This dedication to responsible business practices creates value by attracting environmentally aware customers and investors who seek ethically produced and sustainable solutions.

The company's commitment is reflected in tangible actions and goals. For instance, in 2023, Hanwha Solutions aimed to reduce its greenhouse gas emissions intensity by 10% compared to its 2020 baseline. This focus extends to social aspects, with significant investments in employee training and development programs aimed at fostering a diverse and inclusive workforce.

- Environmental Stewardship: Hanwha Solutions actively invests in renewable energy solutions, such as solar power, contributing to a cleaner energy future.

- Social Responsibility: The company champions fair labor practices and community engagement, aiming to create positive social impact.

- Governance Excellence: Transparent reporting and ethical business conduct are cornerstones of Hanwha Solutions' governance framework.

- Investor Appeal: A strong ESG profile enhances Hanwha Solutions' attractiveness to a growing segment of investors focused on long-term, sustainable value creation.

Hanwha Solutions offers comprehensive clean energy solutions, from advanced solar cells and modules to integrated energy systems and EPC services, driving global sustainability. Their 2023 solar module shipments reached approximately 10 GW, highlighting their role in the renewable energy transition.

Customer Relationships

For its chemical and advanced materials segments, Hanwha Solutions prioritizes strong customer connections by assigning dedicated account managers to its industrial clients. This approach is crucial for delivering customized solutions and ensuring prompt technical assistance, fostering enduring business relationships.

These dedicated managers act as a direct link, understanding the unique operational requirements and challenges faced by each industrial client. This allows Hanwha Solutions to proactively offer tailored product development, process optimization advice, and responsive after-sales support, thereby enhancing client satisfaction and loyalty.

In 2024, Hanwha Solutions' chemical division reported significant revenue growth, partly attributed to these robust customer relationships. For instance, their specialty chemicals segment saw a 12% year-over-year increase in orders from key industrial partners, demonstrating the tangible impact of personalized account management.

Hanwha Qcells cultivates enduring strategic partnerships with major clients, exemplified by its deep ties with Microsoft and True Green Capital Management. These collaborations are structured around multi-year agreements and joint project development, underscoring a focus on shared progress rather than simple transactions.

For significant solar ventures and EPC (Engineering, Procurement, and Construction) offerings, Hanwha Solutions directly connects with project developers and utility companies. This hands-on approach means deep dives into consultation, providing specialized technical knowledge, and offering continuous assistance from project inception through completion. This ensures the solar systems perform at their best and that clients are fully satisfied.

Brand Building and Customer Trust via Sustainability

Hanwha Solutions cultivates deep customer trust by openly sharing its sustainability progress and demonstrating a firm dedication to environmental stewardship. This transparent approach, particularly evident in its detailed ESG reporting, resonates with a growing customer base that actively seeks out businesses aligning with their values.

The company's proactive engagement in Environmental, Social, and Governance (ESG) initiatives significantly bolsters its brand image, attracting consumers and business partners who prioritize ethical sourcing and eco-conscious operations. For instance, Hanwha Solutions' commitment to renewable energy, such as its significant investments in solar power projects, directly translates into a stronger brand appeal.

- Transparent ESG Reporting: Hanwha Solutions provides comprehensive reports detailing its environmental impact and social initiatives, fostering trust through openness.

- Commitment to Environmental Responsibility: The company actively invests in and promotes eco-friendly solutions, such as solar energy, which appeals to environmentally conscious customers.

- Enhanced Brand Reputation: By prioritizing sustainability, Hanwha Solutions differentiates itself in the market, attracting customers who value ethical and green suppliers.

- Customer Loyalty through Shared Values: Building relationships based on a mutual commitment to sustainability strengthens customer loyalty and brand advocacy.

Digital Communication and Investor Relations

Hanwha Solutions actively utilizes its official website and dedicated investor relations portals to foster transparent communication. These platforms serve as crucial hubs for disseminating financial performance data, strategic initiatives, and updates on sustainability commitments to a broad range of stakeholders, including individual investors and financial professionals.

- Website and IR Portal: Serves as the primary digital channel for information dissemination.

- Transparency: Ensures open sharing of financial results and strategic direction.

- Stakeholder Engagement: Connects with diverse investor groups and interested parties.

- Sustainability Reporting: Communicates ESG (Environmental, Social, and Governance) progress, a key area for investors in 2024.

Hanwha Solutions employs a multi-faceted approach to customer relationships, prioritizing dedicated support for industrial clients in its chemical and advanced materials sectors. For its solar division, Hanwha Qcells focuses on building strategic, long-term partnerships with major clients and direct engagement with project developers and utilities.

This commitment to personalized service and strategic collaboration is a cornerstone of their strategy, fostering loyalty and driving growth. The company's emphasis on transparent communication, particularly regarding its sustainability efforts, further strengthens these bonds with customers who increasingly value ethical business practices.

In 2024, Hanwha Solutions' chemical segment saw a notable 12% rise in orders from key industrial partners, a direct reflection of effective account management. Similarly, Hanwha Qcells solidified its strategic partnerships, contributing to its strong market presence in renewable energy solutions.

| Customer Segment | Relationship Approach | Key Initiatives | 2024 Impact Example |

|---|---|---|---|

| Industrial Clients (Chemicals/Advanced Materials) | Dedicated Account Managers, Technical Support | Customized Solutions, Process Optimization | 12% Year-over-Year Order Increase (Specialty Chemicals) |

| Project Developers/Utilities (Solar) | Direct Engagement, Consultation, Ongoing Assistance | EPC Offerings, Technical Expertise | Strengthened Strategic Partnerships (e.g., Microsoft, True Green Capital) |

| Value-Conscious Customers | Transparent ESG Communication | Sustainability Reporting, Eco-Friendly Solutions | Enhanced Brand Appeal and Customer Loyalty |

Channels

Hanwha Solutions leverages dedicated direct sales teams to engage with major industrial clients in its chemical and advanced materials divisions. This approach facilitates direct negotiation, enabling tailored product solutions and fostering robust, long-term customer relationships.

In 2024, Hanwha Solutions reported significant revenue growth in its chemical segment, partly driven by these direct sales efforts which secured key contracts with large manufacturing partners. The company’s focus on personalized service through these channels proved instrumental in differentiating its offerings in a competitive market.

Hanwha Solutions utilizes its robust global distribution networks to effectively deliver a wide array of products, from essential petrochemicals to advanced solar modules, to customers worldwide. This extensive reach ensures efficient market penetration across various continents.

By the end of 2023, Hanwha Solutions reported significant sales figures, with its Chemical Division alone contributing substantially to the company's overall revenue, underscoring the vital role these distribution channels play in achieving commercial success.

Hanwha Qcells employs a dual-pronged sales strategy for its solar energy solutions. Direct sales target large-scale project developers, securing significant bulk orders. This approach is crucial for their utility-scale solar farm initiatives.

Complementing direct sales, Hanwha Qcells cultivates an extensive network of installers and distributors. This allows them to effectively penetrate both the residential and commercial solar markets, ensuring broad accessibility for their products.

In 2023, Hanwha Qcells reported a substantial increase in solar module shipments, reaching approximately 12.0 GW. This growth underscores the effectiveness of their multi-channel sales approach in capturing market share across diverse customer segments.

Engineering, Procurement, and Construction (EPC) Services

Engineering, Procurement, and Construction (EPC) services are a crucial channel for Hanwha Solutions, especially in the realm of large-scale renewable energy projects. This segment allows the company to offer comprehensive solar power plant solutions directly to key clients like utilities, independent power producers, and major industrial customers.

Hanwha Solutions' EPC division was instrumental in delivering significant projects. For instance, in 2023, the company was awarded contracts for substantial solar developments, contributing to its robust project pipeline. These projects underscore the demand for integrated solar solutions that Hanwha provides, from initial design to final construction and commissioning.

- Direct Project Delivery: Hanwha Solutions leverages its EPC capabilities to directly supply fully realized solar power plants.

- Key Client Segments: Services are targeted at utilities, independent power producers (IPPs), and large industrial clients requiring substantial solar installations.

- Project Scale: The EPC channel is particularly vital for the execution of large-scale renewable energy infrastructure.

- Market Impact: In 2023, Hanwha Solutions secured several high-value EPC contracts, demonstrating its strong market position and execution capacity in the solar sector.

Online Presence and Corporate Communication

Hanwha Solutions leverages its official website and diverse online platforms as primary channels for corporate communication. These digital touchpoints are essential for engaging with investors, detailing product offerings, and providing transparent access to company information. In 2024, the company continued to emphasize its commitment to sustainability, with dedicated sections on its website showcasing environmental, social, and governance (ESG) initiatives and reports.

The company's online presence ensures global accessibility to critical data. This includes up-to-date financial reports, investor presentations, and detailed product portfolios, facilitating informed decision-making for stakeholders worldwide. For instance, Hanwha Solutions regularly updates its investor relations section with quarterly earnings releases and annual reports, making its financial performance readily available.

- Website as a Hub: The Hanwha Solutions website (hanwhasolutions.com) acts as a central repository for all corporate information, including news, financial statements, and sustainability reports.

- Investor Relations Focus: Dedicated sections provide investors with access to stock information, analyst reports, and corporate governance policies, fostering transparency.

- Product Showcasing: Digital platforms highlight the company's diverse product segments, from advanced materials to renewable energy solutions, often featuring case studies and technical specifications.

- Global Reach: The online channels ensure that information is accessible to a global audience, supporting international investor relations and business development efforts.

Hanwha Solutions utilizes strategic partnerships and collaborations as a key channel to expand its market reach and technological capabilities. These alliances are crucial for developing innovative solutions and accessing new customer segments, particularly in the renewable energy and advanced materials sectors.

In 2024, Hanwha Solutions announced several new strategic partnerships aimed at enhancing its position in the global hydrogen economy and advanced battery materials markets. These collaborations are expected to drive significant growth and innovation in the coming years.

The company also engages in joint ventures and alliances to co-develop and market specialized products. This collaborative approach allows Hanwha Solutions to share risks and resources, accelerating the pace of innovation and market penetration.

As of early 2024, Hanwha Solutions has established over a dozen active joint ventures and strategic alliances across its business units, contributing to its diversified revenue streams and technological advancements.

Customer Segments

Industrial Manufacturers, spanning sectors like automotive, electronics, construction, and packaging, represent a core customer segment for Hanwha Solutions. These businesses rely on Hanwha for essential petrochemicals, advanced plastics, and specialized materials crucial for their production lines. For instance, the automotive industry's demand for lightweight and durable plastics directly fuels Hanwha's advanced materials division.

Large-scale renewable energy project developers and utilities are key customers for Hanwha Solutions. These entities focus on building and operating massive solar power facilities, often for grid-level energy supply. Hanwha Solutions supports them by supplying high-efficiency solar modules and cells, crucial components for these substantial undertakings.

Hanwha Solutions also offers comprehensive Engineering, Procurement, and Construction (EPC) services tailored for these large infrastructure projects. This integrated approach ensures seamless project execution from design to commissioning. For instance, in 2024, Hanwha Q CELLS secured a significant contract to supply modules for a 2.1 GW solar project in the United States, highlighting their commitment to this segment.

Commercial and residential solar installers form a crucial customer segment, procuring Hanwha Qcells' solar modules and associated components. These businesses, ranging from small local outfits to larger regional players, are responsible for the physical installation of solar energy systems on various properties, including offices, factories, schools, and private homes.

Hanwha Qcells supports these installers primarily through its extensive distribution network, ensuring a steady supply of high-quality solar products. In 2024, the global solar installation market continued its robust growth, with the residential sector alone seeing significant expansion. For instance, the U.S. residential solar market added approximately 1.5 gigawatts in the first half of 2024, demonstrating the demand these installers cater to.

Governments and Public Sector Entities

Governments and public sector entities are crucial customers, particularly those focused on sustainable development and national infrastructure projects. These organizations often invest heavily in renewable energy, seeking advanced materials and solutions to meet climate goals. For instance, in 2024, many nations continued to allocate significant budgets towards green energy transitions, with global renewable energy investment projected to reach new highs.

Hanwha Solutions' offerings in solar technology and advanced materials align with these public sector needs. Governments procuring materials for large-scale solar farm installations or national grid upgrades represent a substantial market. The demand for high-efficiency solar panels and durable, next-generation materials for infrastructure is driven by national energy security and environmental policies.

- Driving Sustainable Development: Governments worldwide are setting ambitious renewable energy targets and investing in green infrastructure, creating a strong demand for Hanwha Solutions' solar and materials technologies.

- National Projects Procurement: Public sector entities procure advanced materials for critical national projects, including energy, defense, and infrastructure, where Hanwha's high-performance products are essential.

- Policy Alignment: Hanwha Solutions' business model directly supports government initiatives aimed at decarbonization and energy independence, making them a strategic partner for public sector clients.

- Economic Impact: Government investments in renewable energy, such as the Inflation Reduction Act in the US which aims to boost domestic clean energy manufacturing, create significant opportunities for suppliers like Hanwha.

Global Markets and Regions

Hanwha Solutions caters to a worldwide clientele, with a strong presence in key markets like Korea, China, and Germany, alongside a broad international reach. This global footprint underscores its significant influence across its primary business areas.

The company's customer segments are deeply rooted in these regions, reflecting substantial demand for its advanced materials and renewable energy solutions. For instance, in 2024, Hanwha Solutions reported significant revenue contributions from its Asian operations, particularly in China, driven by the burgeoning solar and chemical industries.

Key customer segments include:

- Automotive Manufacturers, particularly in Germany, seeking advanced lightweight materials for vehicle production.

- Electronics Companies in China and Korea, utilizing high-performance chemical products for manufacturing.

- Renewable Energy Developers globally, requiring reliable solar components and solutions.

- Construction and Infrastructure Firms, both domestically in Korea and internationally, for building materials and energy projects.

Hanwha Solutions serves a diverse global customer base, from industrial giants to individual installers, all seeking advanced materials and renewable energy solutions. Their reach extends across key markets, reflecting significant demand for their product portfolio.

Key segments include industrial manufacturers needing petrochemicals and plastics, large-scale renewable energy developers and utilities requiring solar modules, and commercial/residential installers. Governments and public sector entities also represent a vital segment, driving demand for sustainable infrastructure.

The company's strategic focus on regions like Asia and Europe, coupled with its commitment to innovation, positions it as a key supplier in these growth-oriented markets.

| Customer Segment | Key Needs | 2024 Market Focus Example |

|---|---|---|

| Industrial Manufacturers | Petrochemicals, Advanced Plastics | Lightweight materials for automotive sector |

| Renewable Energy Developers | High-efficiency Solar Modules & Cells | Supply for 2.1 GW US solar project (Hanwha Q CELLS) |

| Solar Installers (Commercial/Residential) | Solar Modules, Components | Catering to robust US residential solar growth (approx. 1.5 GW H1 2024) |

| Governments & Public Sector | Renewable Energy Solutions, Advanced Materials | Supporting national green energy transition initiatives |

Cost Structure

Raw material procurement is a major cost driver for Hanwha Solutions, particularly for its chemical division which relies on petrochemical feedstocks like ethylene and propylene. These commodity prices are volatile, directly impacting the cost of goods sold. For instance, in 2023, the average price of ethylene fluctuated significantly, influencing Hanwha's chemical segment profitability.

The solar energy segment also faces substantial raw material costs, with polysilicon and wafers being key components. Global supply and demand dynamics, along with geopolitical factors, can cause price swings in these materials. In early 2024, reports indicated ongoing price pressures for solar-grade polysilicon due to increased production capacity in certain regions.

Hanwha Solutions' manufacturing and production expenses are substantial, encompassing the significant operating costs tied to its large-scale facilities. These include energy consumption, a critical factor given the energy-intensive nature of chemical and solar panel production, alongside labor costs for its extensive workforce and ongoing maintenance of complex machinery.

Depreciation of plant and equipment also forms a major component of these expenses. For instance, in 2023, Hanwha Solutions reported significant capital expenditures in its Qcells division, aimed at expanding solar module production capacity, which directly impacts future depreciation charges. The company's commitment to advanced manufacturing technologies further contributes to the initial capital outlay and subsequent depreciation.

Hanwha Solutions dedicates significant capital to Research and Development, fueling innovation in sustainable energy and advanced materials. In 2023, the company reported R&D expenses of approximately 400 billion KRW (roughly $300 million USD), a crucial investment for staying ahead in competitive global markets.

These substantial R&D expenditures are vital for developing next-generation solar technologies, such as perovskite solar cells, and high-performance polymers for various industries. This commitment ensures Hanwha Solutions maintains its technological edge and continuously expands its product offerings to meet evolving market demands.

Sales, General, and Administrative (SG&A) Costs

Hanwha Solutions' Sales, General, and Administrative (SG&A) costs encompass the essential expenditures for marketing, sales teams, distribution networks, and the overarching corporate overhead required to manage its global business. Effective control over these operational expenses is crucial for maintaining and enhancing profitability.

In 2024, Hanwha Solutions demonstrated a commitment to optimizing its SG&A. For instance, the company's consolidated operating profit for the first quarter of 2024 reached KRW 222.5 billion, indicating a significant improvement from the previous year, partly attributable to disciplined cost management across its divisions.

- Marketing and Sales: Investments in brand building and market penetration for its diverse product lines, including advanced materials and renewable energy solutions.

- Distribution and Logistics: Costs associated with managing a global supply chain and ensuring efficient delivery of products worldwide.

- Corporate Overhead: Expenses related to executive management, finance, legal, and human resources, supporting the company's extensive operations.

- Administrative Functions: Day-to-day operational costs necessary for running a multinational corporation, including IT and office infrastructure.

Capital Expenditures (CAPEX) for Expansion

Hanwha Solutions' expansion strategy necessitates significant capital expenditures, particularly in bolstering manufacturing capacities. For instance, the company has committed substantial investments to establish new solar module factories, such as its facility in Georgia, USA. These outlays are critical for meeting growing demand and securing market share in key regions.

These capital investments are not minor; they represent substantial upfront costs that are fundamental to Hanwha Solutions' long-term growth trajectory. The construction of new chemical production plants also falls under this category, requiring considerable financial commitment to bring advanced manufacturing capabilities online.

- Expansion Investments: Building new solar factories in the U.S. and new chemical production plants.

- Financial Commitment: Substantial upfront costs are required for these capacity expansions.

- Growth Driver: These CAPEX initiatives are essential for Hanwha Solutions' future growth and market positioning.

Hanwha Solutions' cost structure is heavily influenced by raw material procurement, particularly for petrochemical feedstocks and polysilicon, subject to market volatility. Manufacturing and production expenses, including energy, labor, and maintenance, are significant due to the energy-intensive nature of its operations.

Research and Development is a key investment area, with substantial spending in 2023 to drive innovation in solar technology and advanced materials. Sales, General, and Administrative (SG&A) costs are managed to support global operations and market penetration, with efforts in 2024 showing improved profitability partly due to cost discipline.

Capital expenditures for expanding manufacturing capacities, such as new solar factories in the U.S., represent significant upfront costs crucial for long-term growth and market positioning.

| Cost Category | Key Components | 2023/2024 Data/Notes |

|---|---|---|

| Raw Materials | Petrochemical feedstocks (ethylene, propylene), Polysilicon, Wafers | Ethylene prices fluctuated in 2023; Polysilicon prices faced upward pressure in early 2024. |

| Manufacturing & Production | Energy, Labor, Maintenance, Depreciation | Significant CAPEX in Qcells division in 2023 impacts depreciation; energy-intensive processes. |

| Research & Development | New solar technologies (perovskite), Advanced materials | Approx. 400 billion KRW ( ~$300 million USD) in 2023. |

| SG&A | Marketing, Sales, Distribution, Corporate Overhead | Consolidated operating profit KRW 222.5 billion in Q1 2024, indicating cost management improvements. |

| Capital Expenditures | New solar factories (e.g., USA), Chemical production plants | Substantial investments for capacity expansion and market share growth. |

Revenue Streams

Hanwha Solutions' chemical division generates significant revenue through the sale of diverse chemical products. This includes basic petrochemicals, essential building blocks for many industries, as well as advanced high-performance plastics and specialized chemical materials. These products are supplied to a broad base of industrial clients across the globe, establishing this as a core revenue driver for the company.

In 2023, Hanwha Solutions' Chemical Division reported sales of approximately 10.4 trillion Korean Won (KRW). This demonstrates the substantial contribution of chemical product sales to the company's overall financial performance, underpinning its market position.

Hanwha Qcells' core revenue engine is the sale of solar cells and photovoltaic modules. This is a global business, supplying both residential and large-scale utility projects. In 2023, Hanwha Qcells reported significant growth in its solar division, with module shipments reaching record levels, contributing substantially to the company's overall financial performance.

Hanwha Solutions brings in significant income through its Engineering, Procurement, and Construction (EPC) services, particularly for solar power projects. This covers everything from initial design and sourcing materials to managing the actual building process.

In 2024, the company's commitment to large-scale solar development, including its own projects and those for third parties, directly translates into substantial revenue from these EPC contracts.

Revenue from Power Generation Asset Sales

Hanwha Solutions actively generates revenue by selling developed power generation assets, with a significant focus on solar projects. This strategy involves bringing solar projects to a mature development stage before divesting them, thereby realizing profits from their creation and sale.

This approach allows Hanwha Solutions to capitalize on its development expertise and recycle capital for future projects. For instance, in 2023, the company continued to advance its renewable energy portfolio, which underpins its asset sales strategy.

- Development and Sale of Solar Farms: Hanwha Solutions develops solar power projects and then sells these operational or near-operational assets.

- Capitalizing on Market Demand: This revenue stream benefits from the global demand for renewable energy infrastructure.

- Strategic Divestments: By selling assets, the company can realize gains and reinvest in new development opportunities.

Specialized Materials and Solutions Sales

Revenue streams for Hanwha Solutions' Specialized Materials and Solutions segment are primarily generated through the sale of advanced materials and tailored solutions designed for specific industrial applications. This includes high-performance materials crucial for industries demanding lightweight, durable components, such as the automotive sector's push for advanced composites.

The company also focuses on other niche, high-value products that cater to specialized market needs, contributing to a diversified revenue base. For instance, in 2024, Hanwha Solutions reported significant growth in its advanced materials division, driven by increasing demand for eco-friendly and high-performance solutions across various manufacturing sectors.

- Automotive Composites: Sales of specialized materials for lightweighting vehicles, enhancing fuel efficiency and performance.

- High-Value Niche Products: Revenue from tailored solutions for industries like electronics or renewable energy components.

- Industry-Specific Solutions: Offering integrated material and solution packages to meet unique client requirements.

- Innovation-Driven Sales: Monetizing new material developments and proprietary technologies in specialized markets.

Hanwha Solutions' revenue streams are diverse, spanning chemicals, solar energy, and advanced materials. The chemical division, a significant contributor, sells basic petrochemicals and high-performance plastics globally. Hanwha Qcells drives income through solar cell and module sales for residential and utility-scale projects, with module shipments reaching record levels in 2023.

The company also generates substantial revenue from Engineering, Procurement, and Construction (EPC) services for solar power projects, a segment expected to see continued growth in 2024. Furthermore, Hanwha Solutions monetizes its development expertise by selling completed solar power assets, a strategy that allows for capital recycling and continued portfolio expansion.

The Specialized Materials and Solutions segment adds to this by selling advanced materials, such as automotive composites, and tailored solutions for niche industrial applications. This diversification, fueled by innovation and market demand for sustainable and high-performance products, solidifies Hanwha Solutions' multifaceted revenue generation model.

| Revenue Stream | Key Products/Services | 2023 Data/Notes |

|---|---|---|

| Chemicals | Petrochemicals, Plastics, Specialty Chemicals | Approx. 10.4 trillion KRW in sales for the Chemical Division. |

| Solar (Qcells) | Solar Cells, Photovoltaic Modules | Record module shipments in 2023; significant growth reported. |

| EPC Services | Solar Power Project Construction | Substantial revenue from contracts in 2024. |

| Asset Sales | Developed Solar Power Projects | Continued advancement of renewable energy portfolio in 2023. |

| Specialized Materials | Automotive Composites, Niche Industrial Materials | Significant growth in advanced materials division in 2024. |

Business Model Canvas Data Sources

The Hanwha Solutions Business Model Canvas is constructed using a blend of internal financial reports, extensive market research on the energy and chemical sectors, and strategic analyses of competitive landscapes. These diverse data sources ensure each component of the canvas is grounded in actionable intelligence.