Hanwha Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

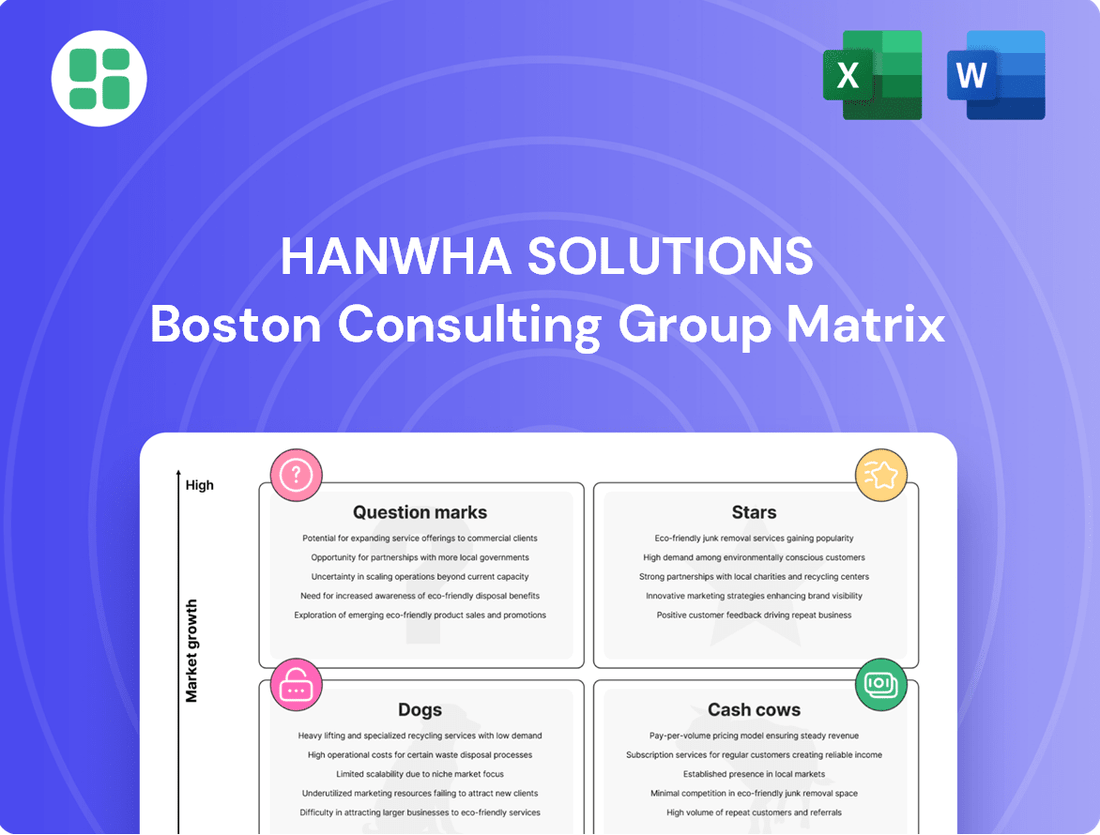

Curious about Hanwha Solutions' market performance? This glimpse into their BCG Matrix highlights key product categories, but the real power lies in the full analysis. Understand exactly which segments are driving growth and which require strategic attention.

Don't miss out on the actionable insights needed to navigate Hanwha Solutions' diverse portfolio. Purchase the complete BCG Matrix report for a detailed breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with expert recommendations to optimize your investment strategy.

Gain a competitive edge with a comprehensive understanding of Hanwha Solutions' strategic positioning. The full BCG Matrix report offers the clarity and data-driven direction you need to make informed decisions and capitalize on market opportunities.

Stars

Hanwha Qcells' U.S. solar module business is a clear star in the Hanwha Solutions portfolio. The company consistently commands over 35% of the U.S. residential and commercial solar module markets. This strong position is bolstered by a reputation for product quality, earning them multiple Top Brand awards.

Hanwha Solutions is pushing the boundaries with its next-generation perovskite-silicon tandem solar cells, achieving a remarkable 33.7% power conversion efficiency in 2024, a new world record. This breakthrough technology is poised to significantly boost solar energy output, making solar power more competitive. The company's substantial investment in commercializing these high-performance cells signals a strong commitment to leading the future solar market.

Hanwha Solutions' establishment of its integrated U.S. Solar Value Chain, dubbed the 'Solar Hub,' represents a significant multi-billion dollar investment. This strategic move aims to give Hanwha control over the entire solar manufacturing process, from ingots to finished modules.

By 2024, this integrated production capacity is slated to reach an impressive 8.4 GW, positioning Hanwha as the largest solar panel manufacturer in North America. This vertical integration is a key factor in enhancing cost competitiveness and bolstering supply chain resilience within the rapidly expanding U.S. solar market.

Residential Solar Lease Business (TPO)

Hanwha Solutions is making significant strides in the U.S. residential solar lease market through its subsidiary, Enfin. This Third-Party Ownership (TPO) model is designed to attract homeowners by eliminating upfront installation costs, thereby fostering wider solar adoption.

This strategy is crucial for Hanwha Solutions as it creates a predictable, long-term revenue stream. The U.S. residential solar sector is anticipating robust expansion, with projections indicating continued strong growth through 2025.

- U.S. Residential Solar Market Growth: Expected to see substantial expansion in the coming years, driven by consumer demand for clean energy and favorable policies.

- Enfin's Role: Acts as Hanwha Solutions' key vehicle for capturing market share in the U.S. residential solar lease segment.

- TPO Model Benefits: Offers consumers zero-down installation, making solar energy accessible and providing Hanwha Solutions with recurring revenue.

- Strategic Importance: Positions the residential solar lease business as a vital growth engine for Hanwha Solutions in a rapidly developing market.

Advanced Lightweight Composite Materials for Automotive

Hanwha Advanced Materials' lightweight composite materials, StrongLite and SuperLite, are positioned as Stars in the BCG Matrix. The global automotive market's drive for fuel efficiency and reduced emissions directly fuels demand for these innovative solutions. In 2024, the lightweight materials market for automotive applications was valued at approximately $25 billion, with composites holding a significant and growing share.

The company's strong global market positions in these advanced composites reflect their technological leadership. As vehicle manufacturers prioritize weight reduction to meet stringent environmental regulations, Hanwha's materials are critical enablers. For instance, the adoption of advanced composites can reduce vehicle weight by up to 10%, leading to a corresponding improvement in fuel economy.

- Global Market Share: Hanwha Advanced Materials commands leading positions in the automotive lightweight composites sector.

- Demand Drivers: Increasing demand for fuel-efficient and lighter vehicles, driven by regulatory pressures and consumer preference.

- Innovation: Continuous research and development in both thermoplastic and thermosetting composites to maintain a competitive edge.

- Market Growth: The lightweight automotive materials market is projected to grow at a CAGR of over 7% through 2030, indicating strong future potential.

Hanwha Solutions' next-generation perovskite-silicon tandem solar cells represent a significant technological advancement, achieving a world-record 33.7% power conversion efficiency in 2024. This innovation is poised to dramatically increase solar energy output, making solar power more cost-effective and competitive. The company's substantial investment in commercializing these high-performance cells underscores its commitment to leading the future solar market.

The U.S. solar module business, particularly Hanwha Qcells, is a standout Star, consistently holding over 35% of the U.S. residential and commercial markets. This market dominance is reinforced by a strong reputation for quality, evidenced by multiple Top Brand awards. The strategic establishment of the U.S. Solar Value Chain, the 'Solar Hub,' signifies a multi-billion dollar investment to control the entire manufacturing process, aiming for 8.4 GW of integrated production capacity by 2024, making Hanwha the largest solar panel manufacturer in North America.

Hanwha Advanced Materials' lightweight composite materials, StrongLite and SuperLite, are also Stars. The global automotive industry's push for fuel efficiency and reduced emissions directly drives demand for these advanced materials. The lightweight materials market for automotive applications was valued at approximately $25 billion in 2024, with composites capturing a substantial and growing share, as these materials can reduce vehicle weight by up to 10%.

| Business Segment | Product/Technology | BCG Category | Key Performance Indicator (2024 Data) | Market Context |

|---|---|---|---|---|

| Solar | U.S. Solar Module Business (Qcells) | Star | >35% U.S. market share (residential/commercial) | Strong brand reputation, growing demand for solar |

| Solar | Perovskite-Silicon Tandem Solar Cells | Star | 33.7% world-record efficiency | Technological leadership, future market potential |

| Advanced Materials | Lightweight Composite Materials (StrongLite, SuperLite) | Star | Leading global market positions | Automotive demand for fuel efficiency, $25B market value (2024) |

What is included in the product

This BCG Matrix overview details Hanwha Solutions' business units, categorizing them by market share and growth to guide strategic investment decisions.

Streamlined BCG Matrix for Hanwha Solutions, offering a clear, actionable overview of business unit performance.

Instantly exportable BCG Matrix design, simplifying the creation of compelling executive presentations.

Cash Cows

Hanwha Solutions' basic petrochemicals segment is a classic cash cow, operating in a mature industry where it benefits from an established market position. Despite facing headwinds from global economic slowdowns and fluctuating prices, this division consistently generates substantial cash flow. For instance, in 2023, Hanwha Solutions' petrochemical division reported operating profit of ₩724 billion, underscoring its stable profitability.

This segment's strength lies in its scale and the fundamental demand for its products, which act as a reliable source of capital. While growth prospects are limited compared to other business areas, the consistent cash generation from basic petrochemicals is crucial for funding investments in Hanwha Solutions' more dynamic ventures, such as its advanced materials and renewable energy businesses.

Hanwha Solutions' established high-performance plastics are classic Cash Cows. These products, while not seeing explosive growth, hold a commanding market share in specialized industrial sectors.

Their enduring strength comes from a solid competitive edge and streamlined manufacturing. This allows them to generate substantial profits and consistent cash flow with minimal marketing or distribution expenditure.

In 2024, the advanced materials division, which includes these plastics, continued to be a stable profit driver for Hanwha Solutions, demonstrating resilience in mature markets.

Existing solar power plant operations and management represent a significant cash cow for Hanwha Solutions. These established, operational assets generate predictable revenue streams through ongoing management and maintenance services. This stability means less investment is needed compared to developing new projects, allowing them to consistently contribute to the renewable energy division's cash flow.

EVA Sheet Manufacturing for Photovoltaics

Hanwha Solutions' EVA Sheet Manufacturing for Photovoltaics operates as a Cash Cow within its BCG Matrix. This segment, managed by Hanwha Advanced Materials, produces essential EVA sheets for solar modules, holding a strong position globally. The company's integrated solar value chain and consistent demand from the solar sector underpin its stability.

This product line contributes steadily to Hanwha Solutions' overall earnings due to its established market presence and robust production capabilities. The global EVA film market was valued at approximately USD 3.5 billion in 2023 and is projected to grow modestly, reflecting the stable, mature nature of this segment.

- Market Position: Leading global supplier of EVA sheets for photovoltaic modules.

- Demand Stability: Benefits from consistent, albeit moderate, growth in the solar industry.

- Contribution to Earnings: Provides a reliable and predictable revenue stream for Hanwha Solutions.

- Strategic Advantage: Leverages Hanwha's integrated solar value chain for operational efficiency.

Specialized Materials for Stable Industries

Hanwha Solutions' advanced materials division, beyond its automotive focus, serves industries characterized by slower, yet consistent demand. These specialized materials, often with high entry barriers due to unique performance needs, are likely to yield stable profit margins.

This segment offers a reliable revenue stream, minimizing the need for substantial new capital expenditures. For instance, in 2024, Hanwha Solutions reported that its advanced materials segment contributed significantly to overall revenue stability, even as other segments experienced more dynamic growth. The company's strategic focus on these niche markets underscores their role as foundational cash cows.

- Stable Demand: Materials supplied to sectors like electronics or construction often face predictable demand cycles.

- High Entry Barriers: The specialized nature of these products limits competition, protecting profit margins.

- Consistent Revenue: This division provides a reliable financial base for the company.

- Lower Investment Needs: Unlike high-growth areas, these mature markets require less aggressive reinvestment.

Hanwha Solutions' established solar power plant operations and management are key cash cows, generating predictable revenue through ongoing services. These mature assets require less capital investment than new projects, consistently contributing to the renewable energy division's cash flow.

The EVA Sheet Manufacturing for Photovoltaics, managed by Hanwha Advanced Materials, is another significant cash cow. This segment benefits from the integrated solar value chain and consistent demand, with the global EVA film market valued at approximately USD 3.5 billion in 2023.

Hanwha Solutions' basic petrochemicals division is a classic cash cow, operating in a mature market with substantial cash generation, evidenced by a ₩724 billion operating profit in 2023. This stable profitability fuels investments in growth areas.

The company's high-performance plastics also function as cash cows, holding strong market share in specialized sectors and generating consistent profits with minimal reinvestment, as seen in the advanced materials division's stable profit contribution in 2024.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Financial Insight |

|---|---|---|---|

| Basic Petrochemicals | Cash Cow | Mature industry, established market position, high volume | ₩724 billion operating profit (2023) |

| EVA Sheet Manufacturing | Cash Cow | Integrated solar value chain, consistent demand, global market presence | Global EVA film market ~USD 3.5 billion (2023) |

| High-Performance Plastics | Cash Cow | Specialized industrial sectors, strong market share, efficient manufacturing | Stable profit driver in advanced materials (2024) |

| Existing Solar Operations | Cash Cow | Predictable revenue streams, low capital reinvestment needs | Consistent cash flow contribution to renewable energy |

Full Transparency, Always

Hanwha Solutions BCG Matrix

The Hanwha Solutions BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, provides actionable insights into Hanwha Solutions' diverse business portfolio, categorizing each segment into Stars, Cash Cows, Question Marks, and Dogs. You can confidently use this preview as a direct representation of the high-quality, ready-to-deploy strategic tool that will be yours to leverage for informed decision-making and competitive advantage.

Dogs

Older, less efficient solar module technologies within Hanwha Solutions' portfolio could be classified as Dogs in the BCG Matrix. As the solar industry progresses rapidly, these older lines often struggle to compete with newer, more efficient, and cost-effective models. Their market share is likely to shrink as demand shifts towards advanced technologies.

The declining price competitiveness of older modules, especially when contrasted with the falling costs of newer silicon-based technologies, puts them at a significant disadvantage. For instance, while the average global solar panel price in early 2024 hovered around $0.20-$0.30 per watt, older, less efficient panels might command even lower prices, but with a shrinking market willing to purchase them.

Maintaining these legacy product lines can become a capital drain for Hanwha Solutions. If these modules are not generating substantial returns or possess a clear path to renewed competitiveness, the resources allocated to their production and sales could be better utilized in areas with higher growth potential, such as Hanwha's Q CELLS division which is a leader in high-efficiency solar technology.

Highly commoditized legacy chemical products, such as basic petrochemicals like ethylene and propylene, often fall into the dogs category for Hanwha Solutions. These segments are characterized by low growth prospects and intense global competition, leading to price volatility and squeezed profit margins. For instance, in 2024, the global ethylene market experienced oversupply issues, impacting pricing and profitability for producers.

While Hanwha Advanced Materials is a strong performer overall, certain specialized or legacy material segments within the portfolio might be facing headwinds. If these specific niches have struggled to capture meaningful market share or operate in markets experiencing contraction, they could be classified as dogs in the BCG matrix. For instance, a particular type of older composite material, perhaps seeing reduced adoption due to newer, more efficient alternatives emerging, could fall into this category. Continued capital allocation to these underperforming areas would likely offer negligible returns, suggesting a need for strategic review.

Geographical Markets with Low Penetration and Stagnant Growth

Geographical markets characterized by low penetration and stagnant growth represent the 'Dogs' in Hanwha Solutions' BCG Matrix. These are regions where the company has historically found it difficult to establish a strong foothold across its varied product lines, and where the overall market expansion is minimal. For instance, certain mature markets in parts of Eastern Europe or specific sub-Saharan African countries might exhibit these traits for some of Hanwha's traditional chemical or solar components, given the intense competition and limited infrastructure development.

These areas often demand a disproportionately high investment in marketing and sales initiatives to achieve even modest gains, yielding minimal returns on investment. Hanwha Solutions' strategy in such markets would likely involve a critical assessment of resource allocation, potentially divesting from or minimizing operations to redirect capital and efforts toward more promising growth areas within its portfolio.

Consider the following examples of potential 'Dog' market characteristics:

- Low Market Share: Regions where Hanwha Solutions holds less than 5% market share for key product categories.

- Stagnant Growth Rates: Markets with an annual growth rate of 1-2% for the relevant industries, significantly below global averages.

- High Competitive Intensity: Areas with numerous established local and international players, making differentiation difficult.

- Limited Infrastructure: Markets lacking robust distribution networks or supportive regulatory frameworks for advanced technologies.

Non-Core, Divested Business Units or Assets

Hanwha Solutions has strategically divested certain business units and assets, a common practice for companies to streamline operations and focus on core competencies. These divested entities, which might have previously been categorized as ‘dogs’ in a BCG matrix due to underperformance or lack of strategic fit, often represent areas that were not generating sufficient returns or were capital intensive without clear growth prospects.

For instance, the sale of its Galleria department store chain is a prime example. While specific financial details of the divestiture are not publicly available, such sales typically aim to unlock capital that can be reinvested into more promising growth areas within the company. This move allows Hanwha Solutions to shed low-return assets and improve overall capital allocation.

Similarly, divestitures within parts of its Advanced Materials company could also be seen as pruning ‘dog’ assets. These actions are crucial for maintaining a healthy portfolio, ensuring that resources are concentrated on businesses with higher growth potential and market share, thereby enhancing the company's overall financial health and strategic direction.

- Divestitures as a Strategy: Hanwha Solutions has divested non-core assets like the Galleria department store chain.

- Rationale for Divestment: These assets were likely underperforming or not strategically aligned, fitting the 'dog' category.

- Capital Reallocation: Selling off low-return or non-strategic units frees up capital for investment in core, high-growth areas.

- Portfolio Optimization: Such strategic moves help Hanwha Solutions to focus on its most profitable and promising business segments.

Older, less efficient solar module technologies and commoditized legacy chemical products, such as basic petrochemicals, are prime examples of 'Dogs' within Hanwha Solutions' portfolio. These segments often face intense global competition and low growth prospects, leading to shrinking market share and squeezed profit margins. For instance, in early 2024, the global ethylene market experienced oversupply, impacting profitability for producers of such basic chemicals.

Geographical markets with low penetration and stagnant growth, where Hanwha Solutions struggles to establish a strong foothold, also represent 'Dog' segments. These regions might demand disproportionately high investment for minimal returns, prompting a critical assessment of resource allocation. For example, certain mature markets in Eastern Europe might exhibit these traits for some of Hanwha's traditional components due to intense competition and limited infrastructure.

Hanwha Solutions has strategically divested non-core assets, such as its Galleria department store chain, which likely represented 'Dog' assets due to underperformance or lack of strategic fit. These divestitures aim to unlock capital for reinvestment into higher-growth areas, thereby optimizing the company's portfolio and enhancing overall financial health.

The company's focus on high-efficiency solar technology through its Q CELLS division, contrasted with older, less competitive module technologies, highlights the strategic pruning of 'Dog' assets. This approach ensures that resources are concentrated on businesses with greater potential for market share and profitability.

Question Marks

Hanwha Solutions is making substantial investments in green hydrogen production, notably through its involvement with Advanced Electrolyzer Company (AEC) technology. The company's ambition is to build a complete green hydrogen ecosystem, covering everything from manufacturing to storage and delivery. This strategic focus positions them within a rapidly expanding market, though securing a leading market position is still an ongoing effort.

The green hydrogen sector represents a significant growth opportunity, with global demand projected to surge. For instance, the International Energy Agency (IEA) reported that by 2030, global green hydrogen production capacity could reach 130 million tonnes per year. Hanwha's commitment to this area, including developing its own production capabilities and investing in key technologies, underscores its long-term vision for a decarbonized energy future.

However, this venture demands considerable capital outlay. The success of Hanwha's green hydrogen initiatives will ultimately depend on the widespread commercial adoption of hydrogen as an energy carrier and the ongoing development of cost-effective production and infrastructure solutions. The company's ability to navigate these challenges will be crucial in establishing a dominant market share.

Hanwha Solutions is actively investing in carbon capture, utilization, and storage (CCUS) technologies as part of its commitment to the circular economy and eco-friendly products. This strategic focus leverages renewable carbon resources, positioning the company at the forefront of sustainable innovation.

While the CCUS sector is poised for significant expansion due to increasing global sustainability mandates, Hanwha's current market share in these emerging technologies is likely modest. This necessitates considerable investment in research and development, alongside the execution of pilot projects to solidify its position.

Hanwha Qcells' strategic focus on new market entries in emerging solar regions, such as Southeast Asia and Africa, positions them for future growth, even though these ventures might initially be classified as question marks in a BCG matrix. These markets, while offering substantial long-term potential, demand significant capital investment to establish a foothold against established players and local competition. For instance, Vietnam's solar market saw a remarkable surge, with installed capacity reaching over 16 GW by the end of 2022, presenting both opportunity and intense competition for new entrants like Hanwha.

The success of these new market entries hinges on aggressive penetration strategies and the ability to navigate local regulatory landscapes and supply chain complexities. While Hanwha Qcells has a strong track record in mature markets, replicating that success in emerging economies requires tailored approaches. The global solar market is projected to grow significantly, with emerging economies expected to be key drivers, underscoring the strategic importance of these question mark opportunities for Hanwha's long-term portfolio balance.

Offshore and Marine Energy Solutions (Post-Acquisition)

Hanwha's strategic expansion into offshore and marine energy solutions, exemplified by the acquisition and relaunch of Dyna-Mac Holdings as Hanwha Offshore Singapore in early 2025, positions it within a rapidly growing sector critical for renewable energy infrastructure and global decarbonization efforts. This segment, while promising, represents a newer market presence for Hanwha, requiring substantial investment to establish a leadership position.

The significant cash consumption in this nascent business unit reflects the capital-intensive nature of building out offshore capabilities and securing market share in a competitive landscape. For instance, offshore wind projects alone demand billions in upfront investment for turbine installation, foundation construction, and subsea infrastructure, a reality Hanwha is navigating as it scales.

- Market Growth: The global offshore wind market is projected to reach over $150 billion by 2030, indicating substantial opportunity.

- Investment Needs: Developing offshore energy solutions involves high upfront capital expenditures for specialized vessels, fabrication yards, and skilled labor.

- Strategic Focus: Hanwha's acquisition signals a commitment to capturing a significant share of this expanding market.

- Cash Burn: Initial phases of market entry and capacity building are inherently cash-intensive as the company aims for scale and efficiency.

Development of Cultured Meat and Climate Tech Investments

Hanwha Solutions' commitment to sustainability is evident in its investments within the climate tech sector, notably including research into cultured meat. These ventures are characterized by their high degree of innovation and speculative nature, promising significant future growth potential.

While the market share for cultured meat is currently minimal, these early-stage, cash-intensive projects represent classic high-risk, high-reward opportunities within Hanwha Solutions' portfolio.

- Cultured Meat Investment: Hanwha Solutions is exploring cultured meat as a key climate tech investment, aligning with global trends towards sustainable food production.

- Market Position: Despite significant investment, Hanwha's current market share in cultured meat is negligible, reflecting the nascent stage of this industry.

- Growth Potential: These investments are positioned as potential future growth drivers, offering substantial upside if the technology matures and gains market acceptance.

- Risk Profile: The speculative nature of cultured meat technology places these ventures in a high-risk category, requiring substantial capital outlay with uncertain near-term returns.

Hanwha Qcells' expansion into emerging solar markets like Southeast Asia and Africa represents a strategic move into areas with high long-term growth potential but also significant initial investment requirements and competitive hurdles. These markets, while still developing, are crucial for diversifying Hanwha's global footprint and capturing future demand.

The success of these ventures hinges on effectively navigating local market dynamics and establishing a strong presence against existing players. For example, the African solar market is projected to grow substantially, with the International Renewable Energy Agency (IRENA) estimating a need for over $70 billion in investment by 2030 to meet energy access goals, highlighting the scale of opportunity and challenge.

These emerging market entries are characteristic of question marks in a BCG matrix: they require substantial investment to gain market share in industries with high growth prospects but currently limited penetration. Hanwha's ability to adapt its strategies to these diverse economic and regulatory environments will be key to transforming these question marks into stars.

Hanwha Solutions' investments in offshore and marine energy solutions, particularly through Hanwha Offshore Singapore, are aimed at capturing growth in a capital-intensive sector vital for renewable infrastructure. This segment is new for Hanwha, demanding significant cash to build capabilities and market share against established global competitors.

The high cash consumption reflects the upfront costs associated with developing offshore wind capabilities, including specialized vessels and fabrication yards. The global offshore wind market is expected to see robust growth, with projections indicating it could reach over $150 billion by 2030, underscoring the strategic importance of these investments despite their current cash demands.

These offshore ventures are classic question marks, requiring substantial capital for market entry and scaling in a sector with high growth potential but also significant barriers to entry. Hanwha's commitment here signals a long-term vision to become a key player in the expanding renewable energy infrastructure landscape.

BCG Matrix Data Sources

Our Hanwha Solutions BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.