Hanwha Solutions Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

Hanwha Solutions leverages a robust marketing mix, focusing on innovative product development in renewable energy and advanced materials, competitive pricing, strategic global distribution, and impactful promotional campaigns. This integrated approach drives their market leadership.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Hanwha Solutions' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Diversified Sustainable Solutions, a key component of Hanwha Solutions' marketing mix, encompasses a wide array of products. These range from foundational petrochemicals and high-performance plastics to specialized materials like polyetherketoneketone (PEKK), essential for sectors such as automotive and aerospace.

The company's commitment to sustainability is evident in its focus on eco-friendly products derived from renewable carbon resources. This initiative actively supports a circular economy and contributes to environmental protection efforts.

Hanwha Solutions reported total sales of 20.9 trillion Korean Won in 2023, with its Chemical Division, which houses these diversified solutions, playing a significant role. The company is strategically investing in advanced materials and green technologies to bolster its competitive edge.

Hanwha Solutions, through its renowned Hanwha Qcells brand, offers a complete suite of solar energy solutions. This includes everything from the foundational solar cells and modules to integrated energy systems, catering to diverse global energy needs.

Their product portfolio extends beyond basic solar components to encompass crucial energy storage systems (ESS), the development of large-scale power plants, and even direct energy retail services across international markets. This broad approach positions them as a full-spectrum energy provider.

Hanwha Qcells is distinguished by its dedication to producing high-quality, high-efficiency solar products. The company is actively pushing the boundaries of photovoltaic technology, notably with its advancements in next-generation perovskite-silicon tandem cells, aiming for even greater energy conversion rates.

For instance, in 2023, Hanwha Qcells achieved a significant milestone by securing a substantial supply agreement for its high-efficiency solar modules in the United States, underscoring the market's demand for their advanced technology.

Hanwha Solutions' Advanced Materials Division is a key player in developing lightweight composite and film materials. These advanced products are crucial for industries like automotive, where they contribute to fuel efficiency, and construction, offering enhanced durability and sustainability. For instance, in 2024, the automotive sector's demand for lightweighting solutions is projected to grow significantly, driving innovation in composite materials.

The division's focus on high-performance and sustainable solutions aligns with global trends. By engineering materials that reduce environmental impact, Hanwha Solutions is positioning itself to meet the increasing regulatory and consumer pressure for eco-friendly products. This strategy is particularly relevant as many countries aim for net-zero emissions by 2050, making advanced materials indispensable for achieving these goals.

Innovation and differentiation are central to the Advanced Materials Division's strategy. They are actively developing next-generation materials to address the evolving needs of the electronics and renewable energy sectors. For example, their specialized films are integral to solar panel efficiency, a market that saw substantial growth in 2023 and is expected to continue its upward trajectory through 2025.

Innovative Technology Development

Hanwha Solutions is heavily invested in developing groundbreaking technologies that not only boost sustainability but also elevate the value of its offerings across all business areas. This commitment is evident in their leading-edge research into green hydrogen production, a critical component for a cleaner energy future. The company is also actively investing in climate tech, signaling a strategic focus on solutions that combat environmental challenges.

Their dedication to innovation extends to significant advancements in solar technology. Hanwha Solutions aims to create forward-thinking solutions that tackle pressing global issues, positioning themselves at the forefront of technological development. For instance, in 2023, Hanwha Q CELLS, a key division, achieved a significant milestone with its N-type TOPCon solar modules, reaching efficiencies of up to 26.4%. This highlights their continuous drive for enhanced performance and market leadership.

- Green Hydrogen Pioneer: Hanwha Solutions is actively developing technologies for efficient and cost-effective green hydrogen production, aiming to be a major player in this emerging sector.

- Climate Tech Investments: The company is strategically investing in various climate technologies, seeking to innovate solutions for a sustainable future and mitigate environmental impact.

- Solar Technology Advancements: Hanwha Q CELLS, a subsidiary, consistently pushes the boundaries of solar module efficiency, with recent N-type TOPCon modules reaching up to 26.4% efficiency in 2023.

- R&D Focus: Hanwha Solutions dedicates substantial resources to research and development, ensuring its product pipeline is geared towards addressing future global challenges and market demands.

Integrated Energy Management Software

Under the 'Product' element of Hanwha Solutions' marketing mix, the integrated energy management software, exemplified by Geli Energy Software, represents a significant digital offering. This software suite, including Geli Predict, moves beyond hardware to provide comprehensive solutions for system design, performance optimization, and real-time energy monitoring. This digital component underscores Hanwha Qcells' dedication to leading the digital transformation within the energy sector.

This software empowers users with advanced capabilities, facilitating smarter energy management. For instance, Geli Predict aids in forecasting energy generation and consumption, crucial for grid stability and cost savings. By offering these sophisticated digital tools, Hanwha Qcells aims to deliver complete, end-to-end energy solutions, enhancing the value proposition for its customers.

- Digital Integration: Geli Energy Software, including Geli Predict, provides advanced system design and optimization.

- Real-time Monitoring: Offers continuous oversight of energy performance for enhanced efficiency.

- Energy Transition Driver: Reinforces Hanwha Qcells' commitment to digitalizing the energy landscape.

- Comprehensive Solutions: Extends value beyond hardware to deliver complete energy management capabilities.

Hanwha Solutions offers a diverse product portfolio, spanning from essential petrochemicals and advanced plastics to cutting-edge materials like PEKK for aerospace and automotive applications. Their commitment to sustainability is highlighted by their development of eco-friendly products derived from renewable carbon sources, contributing to a circular economy.

The company's solar division, Hanwha Qcells, provides comprehensive solar energy solutions, including high-efficiency solar cells, modules, energy storage systems, and large-scale power plant development. In 2023, Hanwha Qcells secured significant supply agreements for its advanced solar modules in the US, demonstrating strong market demand.

Hanwha Solutions' Advanced Materials division focuses on lightweight composite and film materials crucial for improving fuel efficiency in the automotive sector and enhancing sustainability in construction. Their investment in next-generation materials, such as specialized films for solar panel efficiency, supports the growing renewable energy market, which saw substantial growth in 2023 and is projected to continue through 2025.

Furthermore, Hanwha Solutions is pioneering green hydrogen production technologies and investing in climate tech, underscoring its dedication to innovative solutions for a sustainable future. Hanwha Qcells achieved up to 26.4% efficiency with its N-type TOPCon solar modules in 2023, showcasing their leadership in solar technology.

| Product Category | Key Products/Technologies | Target Industries | 2023/2024/2025 Data/Highlights | Sustainability Focus |

|---|---|---|---|---|

| Chemicals & Advanced Materials | Petrochemicals, High-performance plastics, PEKK, Lightweight composites, Specialized films | Automotive, Aerospace, Construction, Electronics, Renewable Energy | Total sales of 20.9 trillion KRW in 2023. Automotive lightweighting demand projected to grow significantly in 2024. Films integral to solar panel efficiency. | Eco-friendly products from renewable carbon resources, circular economy initiatives. |

| Solar Energy Solutions | Solar cells, Modules (N-type TOPCon), Energy Storage Systems (ESS), Power plants, Energy Retail | Global Energy Sector, Residential, Commercial, Utility-scale | N-type TOPCon modules reached up to 26.4% efficiency in 2023. Secured substantial US supply agreements for high-efficiency modules in 2023. | High-efficiency, high-quality solar products, advancements in perovskite-silicon tandem cells. |

| Digital Energy Management | Geli Energy Software, Geli Predict | Energy System Design, Performance Optimization, Grid Management | Enables forecasting of energy generation and consumption for grid stability and cost savings. | Digital transformation in the energy sector, enhancing energy management efficiency. |

| Emerging Technologies | Green Hydrogen Production, Climate Tech | Energy Transition, Environmental Solutions | Active investment in climate technologies and development of efficient green hydrogen production. | Solutions for a sustainable future, mitigating environmental impact. |

What is included in the product

This analysis offers a comprehensive breakdown of Hanwha Solutions' marketing strategies across Product, Price, Place, and Promotion, grounded in real-world practices and competitive positioning.

It's designed for professionals seeking to understand Hanwha Solutions' marketing approach, providing a strong foundation for strategic comparisons and planning.

Simplifies Hanwha Solutions' marketing strategy by clearly outlining how its Product, Price, Place, and Promotion efforts directly address customer pain points and drive value.

Place

Hanwha Solutions’ Advanced Materials Division thrives through an extensive global network, spanning the Americas, Asia, and Europe. This strategically positioned presence ensures efficient market penetration and responsiveness to diverse customer needs worldwide.

The wider Hanwha Group boasts an impressive footprint of over 460 global networks. This vast infrastructure is instrumental in facilitating broad market access and adeptly managing global sourcing requirements, underpinning Hanwha Solutions' operational capabilities.

This widespread global network directly supports the effective distribution and accessibility of Hanwha Solutions' varied product portfolio. It allows the company to serve a broad customer base and adapt quickly to regional market dynamics, a key element of its marketing strategy.

Hanwha Solutions leverages its advanced manufacturing footprint, featuring state-of-the-art facilities in Jincheon, South Korea, and key U.S. locations such as Dalton and the recently opened Cartersville, Georgia plant.

These strategic manufacturing hubs are vital for maintaining robust supply chains and ensuring consistent production of its diverse product portfolio, including chemicals, advanced materials, and solar components. The Cartersville facility, for instance, represents a significant investment aimed at bolstering U.S. solar manufacturing capacity, aligning with global trends towards localized production and supply chain resilience.

Hanwha Solutions is establishing a significant 'Solar Hub' in Georgia, U.S., a move that integrates polysilicon, ingot, wafer, cell, and module photovoltaic production. This vertical integration is a strategic play to secure a complete solar value chain within North America.

This comprehensive approach enhances operational efficiency and significantly reduces greenhouse gas emissions typically associated with transporting components across different manufacturing stages. By 2024, Hanwha's Georgia facility alone is projected to have a significant module production capacity, contributing to the burgeoning domestic solar manufacturing landscape.

Direct Sales and Project Development

Hanwha Qcells directly sells solar modules and integrated energy systems, bypassing intermediaries to connect with customers. This direct approach is complemented by their significant involvement in developing and operating large-scale renewable energy projects.

This dual strategy enables Hanwha Solutions to provide end-to-end solutions, covering everything from supplying the necessary solar equipment to managing the installation and even brokering the power generated. They cater to a broad range of clients, including individual homeowners, commercial businesses, and large utility-scale operations.

For instance, in 2023, Hanwha Qcells secured a significant project in Germany, supplying modules for a 100 MW solar farm, showcasing their project development capabilities. Their direct sales efforts in 2024 have been bolstered by partnerships aimed at expanding residential solar adoption across North America, targeting an increased market share in the distributed generation segment.

- Direct Sales Channels: Hanwha Qcells utilizes direct sales for solar modules and energy systems, ensuring a closer relationship with customers and better control over the sales process.

- Project Development & Operation: The company actively engages in developing, constructing, and operating large-scale solar and energy storage projects, demonstrating a comprehensive approach to the renewable energy value chain.

- Comprehensive Solutions: Hanwha Qcells offers integrated solutions that span equipment supply, installation, and power brokerage, serving residential, commercial, and utility sectors.

- Market Expansion: Their strategy focuses on expanding market reach through direct engagement and strategic project wins, as evidenced by their continued growth in key global markets.

Diverse Distribution Channels

Hanwha Solutions leverages a diverse array of distribution channels to reach its varied customer base. For its chemical and advanced materials divisions, direct sales to industrial clients are paramount, ensuring tailored solutions for large-scale needs. This direct approach allows for close collaboration and understanding of specific industrial requirements.

The solar energy segment employs a more multifaceted distribution strategy. This includes direct sales for larger projects, robust online platforms for broader accessibility, and a crucial network of certified installers. This blended approach ensures widespread availability of solar products and services, catering to both individual homeowners and commercial entities.

This multi-channel approach is critical for market penetration and customer satisfaction. For instance, in 2023, Hanwha Solutions reported significant growth in its solar module shipments, a testament to the effectiveness of its varied distribution networks in reaching diverse markets across the globe.

- Direct Sales: Primarily for industrial chemicals and large-scale solar projects, fostering deep client relationships.

- Online Platforms: Enhancing reach and convenience for solar product inquiries and smaller-scale purchases.

- Installer Networks: Crucial for the widespread adoption of solar solutions, providing localized sales and service.

- Global Reach: Distribution strategies are adapted to local market needs, supporting Hanwha's international expansion in both chemicals and renewable energy.

Place, as a part of Hanwha Solutions' marketing mix, is defined by its extensive global manufacturing and distribution network. This includes advanced facilities in South Korea and the United States, such as the Cartersville, Georgia plant, which is central to its North American solar hub strategy.

The company's strategic placement of manufacturing assets supports localized production and supply chain resilience, a critical factor in the competitive global market. This footprint ensures efficient delivery and accessibility of its diverse product range, from chemicals to solar components.

Hanwha Solutions' commitment to its physical presence is further underscored by its significant investment in the Georgia Solar Hub, aiming for vertical integration within the North American solar value chain. This strategic positioning enhances operational efficiency and market responsiveness.

The company's distribution strategy is equally robust, employing direct sales for industrial clients and a multi-channel approach for its solar business, including online platforms and certified installer networks.

| Manufacturing Location | Key Products | Strategic Importance |

|---|---|---|

| Jincheon, South Korea | Chemicals, Advanced Materials, Solar Components | Core production hub, global supply chain support |

| Dalton, Georgia, USA | Solar Modules | North American market penetration |

| Cartersville, Georgia, USA | Solar Modules (expanding capacity) | North American Solar Hub, vertical integration |

Same Document Delivered

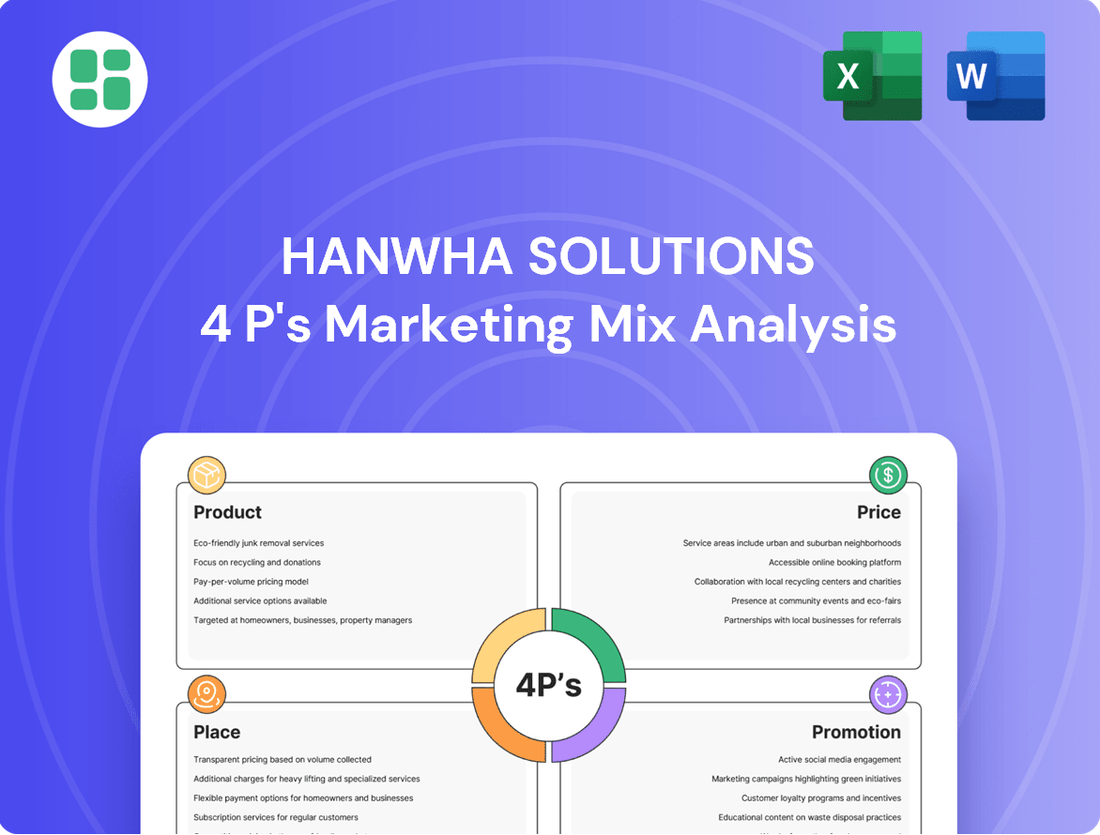

Hanwha Solutions 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hanwha Solutions 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies, offering actionable insights for your business. You'll get the complete, ready-to-use analysis immediately upon checkout.

Promotion

Hanwha Solutions' corporate branding centers on 'Unlimited Growth,' powerfully communicated through its 'Tricircle' symbol and unwavering sustainability focus. This identity underscores its pivotal role in driving the energy transition and delivering environmentally conscious solutions, a message consistently reinforced across all corporate communications and initiatives.

Hanwha Solutions prioritizes transparent sustainability reporting, a key element of its marketing strategy. The company publishes detailed annual sustainability reports, with the 2024 and 2025 editions highlighting their commitment to Environmental, Social, and Governance (ESG) principles. These reports serve as a crucial communication channel for stakeholders, outlining progress in areas like climate change mitigation and ethical business practices.

Hanwha Solutions champions innovation and leadership, particularly evident in its solar energy division, Hanwha Qcells. Qcells has consistently pushed the boundaries of solar efficiency, setting new records and earning prestigious accolades like the 'Top Brand PV' award in 2023, reflecting strong market recognition.

The company's commitment to research and development is a cornerstone of its marketing efforts. Hanwha Solutions actively highlights advancements in next-generation solar technologies and the integration of AI for smarter energy management, reinforcing its position as a forward-thinking industry leader.

Strategic Partnerships and Investments Communication

Hanwha Solutions actively communicates its strategic partnerships and significant investments as a core element of its marketing strategy. This includes promoting large-scale projects like the development of its Solar Hub in the United States, a testament to its commitment to expanding its renewable energy footprint.

These communications underscore Hanwha Solutions' dedication to market expansion and its pivotal role in accelerating the global clean energy transition. For instance, its strategic alliance with Microsoft for a global solar initiative exemplifies this forward-looking approach.

The company leverages these announcements to showcase its growth trajectory and its vision for a sustainable future. By highlighting such collaborations and investments, Hanwha Solutions reinforces its position as a leader in the renewable energy sector.

- Solar Hub Investment: Hanwha Solutions' U.S. Solar Hub, a significant investment, aims to bolster domestic solar manufacturing and deployment capabilities.

- Microsoft Partnership: The collaboration with Microsoft focuses on establishing a global solar alliance, leveraging technology for enhanced solar energy solutions.

- Growth and Expansion: These strategic moves are communicated to emphasize Hanwha Solutions' commitment to substantial growth and broader market penetration in the clean energy space.

- Clean Energy Acceleration: The company positions itself as a key player in accelerating the transition to clean energy through these high-profile partnerships and investments.

Active Digital and Investor Relations Engagement

Hanwha Solutions actively engages its stakeholders through a robust digital and investor relations strategy. This includes regular press releases, detailed investor relations materials like earnings call transcripts and financial presentations, and a comprehensive official website. These channels are crucial for disseminating timely corporate news, financial performance updates, and strategic developments to investors, financial analysts, and the broader public, fostering transparency and facilitating informed decision-making.

For instance, in the first half of 2024, Hanwha Solutions provided detailed quarterly earnings reports and investor presentations, highlighting key performance indicators and future outlook. The company's website serves as a central hub for all investor-related information, ensuring accessibility and continuous updates. This commitment to open communication is vital for maintaining investor confidence and supporting the company's valuation.

Key elements of their engagement include:

- Timely Dissemination of Financial Results: Providing quarterly and annual reports promptly to keep investors informed.

- Investor Presentations and Webcasts: Offering in-depth analysis and Q&A sessions with management.

- Corporate Website Updates: Maintaining a dedicated investor relations section with news, filings, and presentations.

- Press Release Distribution: Announcing significant corporate events and strategic moves through official channels.

Hanwha Solutions' promotional efforts are multifaceted, focusing on its leadership in renewable energy and commitment to sustainability. The company actively communicates its technological advancements, such as enhanced solar cell efficiency, and its strategic global partnerships, like the one with Microsoft for solar initiatives. These communications aim to build a strong brand image and attract investment by highlighting growth potential and a vision for a cleaner future.

The company's digital presence and investor relations are key promotional tools. Hanwha Solutions ensures timely dissemination of financial results, including detailed quarterly reports for the first half of 2024, and provides in-depth analysis through investor presentations and webcasts. This transparent communication strategy is designed to build investor confidence and support the company's market valuation.

Hanwha Solutions leverages significant investments, such as its U.S. Solar Hub, and high-profile collaborations to promote its market expansion and role in accelerating the clean energy transition. These initiatives are consistently communicated to showcase the company's growth trajectory and its dedication to a sustainable future, reinforcing its position as an industry leader.

| Key Promotional Area | Focus | Example/Data Point (2023-2025) |

|---|---|---|

| Brand Messaging | Unlimited Growth, Sustainability | Tricircle symbol, ESG reporting (2024/2025 reports) |

| Technology Leadership | Solar Efficiency, Innovation | Top Brand PV award (2023), AI integration in energy management |

| Strategic Partnerships | Global Expansion, Clean Energy | Microsoft partnership for global solar alliance |

| Investment & Projects | Market Penetration, Domestic Manufacturing | U.S. Solar Hub development |

| Investor Relations | Transparency, Financial Performance | H1 2024 quarterly earnings reports, Investor presentations |

Price

Hanwha Qcells positions its solar panels competitively, often priced slightly below the market average to make its smart energy solutions accessible. This strategy allows them to balance high quality and efficiency with affordability for a wider range of customers. For instance, in early 2024, the average price for a high-efficiency solar panel hovered around $0.30-$0.35 per watt, with Qcells typically falling within the $0.28-$0.32 per watt range for their Q.PEAK DUO series.

Hanwha Solutions employs value-based pricing for its advanced materials, acknowledging the superior performance and unique properties of products like lightweight composites and specialized plastics. This strategy aligns pricing with the significant value these materials deliver in demanding sectors such as automotive and aerospace, where their application is critical.

For instance, the automotive industry's increasing demand for fuel efficiency drives the adoption of lightweight composites, allowing Hanwha Solutions to price these materials based on the cost savings and performance enhancements they enable for manufacturers. Similarly, specialized plastics offering enhanced durability or specific functional characteristics command premium pricing due to their critical role in product longevity and safety.

Hanwha Solutions' Chemical Division prioritizes cost competitiveness for key products like PVC, CA, and LLDPE by focusing on production efficiency. This strategy aims to deliver high-quality petrochemicals at attractive global market prices.

By optimizing its streamlined production systems, Hanwha Solutions aims to maintain a strong position in the competitive chemical landscape. For instance, in 2024, the company continued to invest in process improvements to reduce manufacturing costs, a crucial factor for basic petrochemicals.

Impact of Market Dynamics and Oversupply

Hanwha Solutions’ pricing strategy, especially within its renewable energy and chemicals divisions, is highly sensitive to global economic shifts and oversupply conditions. For instance, the solar industry has experienced significant price declines due to increased production capacity worldwide, impacting Hanwha Q Cells' module pricing. Similarly, the chemicals segment faces pressure from fluctuating petrochemical feedstock costs and oversupply in key markets like polyethylene.

These external pressures can lead to price weaknesses across Hanwha Solutions' product portfolio, directly affecting profitability. In 2023, the global polysilicon market, a key input for solar panels, saw prices fluctuate, impacting module manufacturers. The chemical segment, particularly for PVC and caustic soda, also contended with oversupply in Asian markets throughout 2023 and into early 2024, creating a challenging pricing environment.

- Renewable Energy Pricing: Influenced by global solar module oversupply and fluctuating polysilicon costs.

- Chemicals Segment Pricing: Subject to petrochemical feedstock prices and regional market oversupply, particularly in Asia.

- Profitability Impact: Price weaknesses directly compress margins, necessitating cost management and strategic market positioning.

- 2024 Outlook: Continued volatility expected in both energy and chemical markets due to ongoing supply/demand imbalances and geopolitical factors.

Project-Based Pricing and Incentive Consideration

For substantial solar installations and integrated energy systems, Hanwha Solutions employs project-based pricing. This approach often entails intricate, long-term agreements that incorporate flexible financing structures tailored to the project's scale and duration.

The company actively factors in government incentives, such as those available through the U.S. Inflation Reduction Act (IRA). For instance, the IRA's clean energy tax credits, which can extend through 2032, significantly impact the overall cost-effectiveness and customer appeal of Hanwha's solar solutions, making them more competitive in the market.

- Project-Based Contracts: Long-term agreements for large-scale solar and energy systems.

- Financing Options: Consideration of flexible financing structures to suit project needs.

- Government Incentives: Integration of benefits like the U.S. Inflation Reduction Act (IRA) tax credits.

- Cost Influence: Incentives directly affect the final price and market attractiveness of solar offerings.

Hanwha Solutions' pricing strategy reflects a dynamic market approach, balancing competitive positioning for solar modules with value-based pricing for advanced materials. The company navigates global economic shifts and oversupply conditions that directly impact profitability, as seen with fluctuating polysilicon costs and regional oversupply in chemicals during 2023-2024.

For large-scale projects, Hanwha Solutions utilizes project-based pricing, integrating government incentives like the U.S. Inflation Reduction Act (IRA) to enhance cost-effectiveness. This adaptable pricing model ensures their solutions remain attractive and competitive in diverse market segments.

| Product Segment | Pricing Strategy | Key Influences | 2024 Data/Outlook |

|---|---|---|---|

| Solar Modules (Qcells) | Competitive, slightly below market average | Global oversupply, polysilicon costs | Average module price ~$0.28-$0.32/watt (Q.PEAK DUO) |

| Advanced Materials | Value-based | Performance, unique properties, industry demand | Premium pricing for lightweight composites in automotive |

| Chemicals (PVC, CA, LLDPE) | Cost-competitive | Production efficiency, feedstock costs, market oversupply | Focus on cost reduction for basic petrochemicals |

| Large-Scale Energy Systems | Project-based | Project scale, duration, financing, government incentives | IRA tax credits enhance cost-effectiveness through 2032 |

4P's Marketing Mix Analysis Data Sources

Our Hanwha Solutions 4P's Marketing Mix Analysis is meticulously constructed using a blend of official corporate disclosures, including annual reports and investor presentations, alongside comprehensive industry research and competitive intelligence. This ensures a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.