Hanwha Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

Uncover the intricate web of external forces shaping Hanwha Solutions' future with our comprehensive PESTLE analysis. From evolving political landscapes and economic shifts to technological advancements and environmental regulations, this analysis provides the critical intelligence you need to anticipate challenges and seize opportunities. Don't just react to market changes; proactively strategize for success. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

Governments worldwide are doubling down on renewable energy, with policies like tax credits and feed-in tariffs becoming more common. For instance, the U.S. Inflation Reduction Act of 2022 offers significant incentives for solar installations, a key market for Hanwha Qcells. These initiatives directly translate into higher demand for Hanwha Solutions' solar products and integrated energy systems.

The stability and direction of these government policies are critical for Hanwha Solutions. A positive shift, like increased subsidies or more aggressive renewable energy targets, can unlock substantial market growth. Conversely, a rollback or adverse change in these policies, such as the expiration of tax credits or the introduction of unfavorable regulations, could significantly dampen demand and impact the company's profitability and strategic planning for the 2024-2025 period.

Geopolitical tensions and trade disputes, particularly between major economic blocs like the US, China, and Europe, pose significant risks to Hanwha Solutions. For instance, the ongoing trade friction between the US and China could lead to tariffs on key materials or components used in Hanwha's chemical and advanced materials divisions, impacting production costs. In 2024, global trade volumes are projected to see moderate growth, but protectionist policies remain a concern.

Such trade barriers can disrupt Hanwha's intricate supply chains, potentially increasing expenses for raw materials or finished goods. Restrictions on exports could also limit market access for its diverse product portfolio, including solar panels and advanced materials, directly affecting revenue streams. Navigating these complex international trade dynamics is therefore a critical strategic imperative for maintaining global operational efficiency and market competitiveness.

The political stability of countries where Hanwha Solutions operates, such as South Korea, the United States, and Germany, is crucial. For instance, South Korea's stable democratic system under President Yoon Suk-yeol's administration in 2024 provides a predictable environment for business operations. Conversely, potential political shifts or unrest in emerging markets where Hanwha might source raw materials or expand could introduce policy uncertainties and supply chain vulnerabilities.

Unstable political landscapes can directly impact Hanwha Solutions' manufacturing and distribution capabilities. For example, geopolitical tensions in regions supplying critical minerals for solar panels or advanced materials could lead to sudden price hikes or outright shortages. Monitoring and developing contingency plans for political instability, such as diversifying sourcing or establishing regional production hubs, is therefore essential for maintaining operational resilience.

Industrial Policy and Subsidies

Governments worldwide are increasingly using industrial policies to bolster sectors like chemicals, advanced manufacturing, and green technologies, areas where Hanwha Solutions operates. These policies can manifest as direct subsidies, grants, or preferential treatment for domestic production. For instance, South Korea's government has been actively supporting its chemical and advanced materials sectors, potentially offering benefits to companies like Hanwha Solutions. However, the landscape is competitive; if rivals secure more advantageous support, it could create a disadvantage for Hanwha. The company's strategic planning must remain closely attuned to these shifting national industrial priorities and subsidy programs to maximize benefits and mitigate risks.

The impact of these policies can be significant. For example, in 2024, several countries announced substantial investment packages for renewable energy and advanced materials manufacturing. Hanwha Solutions, as a key player in solar energy and advanced chemicals, is directly positioned to potentially benefit from such initiatives. The company’s ability to adapt its operational and investment strategies in response to these evolving government agendas will be crucial for maintaining its competitive edge and capitalizing on emerging opportunities within these strategically important industries.

- Government support for green technologies: Many nations are providing tax credits and grants for renewable energy projects, which directly benefits Hanwha Q CELLS' solar business.

- Local content requirements: Policies favoring local manufacturing can increase production costs if Hanwha Solutions needs to source components domestically at a higher price.

- R&D incentives: Subsidies for research and development in advanced materials and chemicals can lower Hanwha Solutions' innovation costs and accelerate product development.

- Trade protectionism: While not direct subsidies, tariffs or import restrictions on competing foreign products can indirectly benefit Hanwha Solutions by making its products more competitive in local markets.

Regulatory Frameworks for Chemicals

Political decisions significantly shape the regulatory landscape for chemicals and advanced materials, directly impacting companies like Hanwha Solutions. Governments worldwide are increasingly implementing stricter environmental protection laws and safety standards, which can lead to higher compliance costs and more complex operational procedures for Hanwha's chemical division. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, demanding rigorous data submission and risk assessment for chemical substances, potentially affecting market access and product development timelines.

These evolving regulations can translate into substantial financial implications. In 2024, global spending on environmental compliance within the chemical industry is projected to rise, driven by initiatives focused on sustainability and circular economy principles. Hanwha Solutions must navigate these varying national and international requirements, which can influence raw material sourcing, manufacturing processes, and product lifecycle management.

Conversely, the harmonization of international regulatory standards presents opportunities. When countries adopt similar frameworks for chemical safety and environmental impact, it can streamline market entry and reduce the burden of country-specific compliance efforts for Hanwha Solutions. This is particularly relevant as Hanwha Solutions expands its global footprint in advanced materials, where consistent standards are crucial for efficient supply chain management and competitive positioning.

Key considerations for Hanwha Solutions regarding political factors include:

- Anticipating and adapting to evolving environmental and safety regulations in key markets.

- Monitoring international efforts to harmonize chemical and material standards to facilitate global trade.

- Assessing the financial impact of compliance costs on profitability and investment in new technologies.

- Leveraging political support for green chemistry and sustainable material development.

Government support for renewable energy, like tax credits and subsidies, is a significant tailwind for Hanwha Solutions' solar business, particularly for Hanwha Q CELLS. For instance, the U.S. Inflation Reduction Act of 2022 continues to drive demand for solar installations in 2024-2025. Conversely, policy shifts or the expiration of incentives could dampen growth, making policy stability critical for the company's strategic planning.

Geopolitical tensions and trade disputes remain a concern, potentially impacting Hanwha Solutions' supply chains and market access. Protectionist policies, evident in global trade discussions throughout 2024, could lead to tariffs on materials or finished goods, increasing costs and affecting revenue streams. Navigating these international trade dynamics is crucial for operational efficiency.

Political stability in key operating regions, such as South Korea and the United States, provides a predictable business environment. However, political instability in emerging markets could introduce policy uncertainties and supply chain vulnerabilities, necessitating contingency planning and diversification strategies.

Industrial policies aimed at bolstering green technologies and advanced manufacturing can offer substantial benefits. In 2024, many governments are announcing investment packages for these sectors, positioning Hanwha Solutions to potentially capitalize on these initiatives through strategic adaptation.

| Policy Area | Impact on Hanwha Solutions | 2024-2025 Outlook |

|---|---|---|

| Renewable Energy Incentives | Increased demand for solar products, lower project costs | Continued strong growth driven by supportive policies |

| Trade Protectionism | Higher raw material costs, potential market access limitations | Moderate risk, requires supply chain resilience |

| Environmental Regulations | Increased compliance costs, potential for streamlined market entry with harmonization | Rising compliance spending, opportunities in standardized markets |

| Industrial Subsidies (Green Tech) | Reduced R&D costs, competitive advantage through government support | Significant potential benefit, contingent on strategic alignment |

What is included in the product

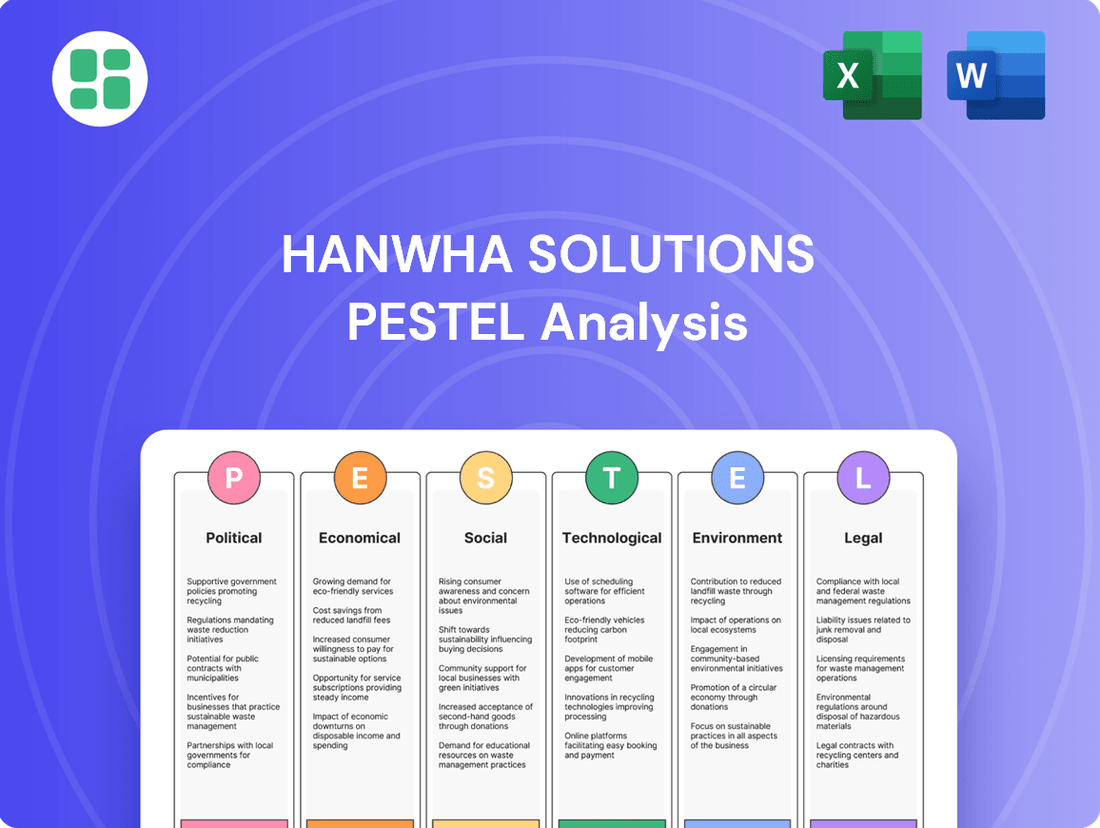

This PESTLE analysis delves into the external macro-environmental factors impacting Hanwha Solutions, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive understanding of the opportunities and threats shaping Hanwha Solutions's strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Hanwha Solutions.

Helps support discussions on external risk and market positioning during planning sessions, offering Hanwha Solutions a clear understanding of the landscape.

Economic factors

Global economic growth is a critical driver for Hanwha Solutions. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a slight slowdown from 2023, but still indicative of a generally expanding economy. This expansion supports demand for Hanwha's petrochemicals and advanced materials used in various industries.

However, localized economic slowdowns or recessions can impact specific markets. For instance, a dip in manufacturing output in key regions could dampen demand for Hanwha's basic chemicals. Conversely, strong GDP growth in emerging markets often translates to increased investment in renewable energy infrastructure, a key area for Hanwha's Qcells division.

The World Bank's forecast for 2025 suggests a modest uptick in global growth to 3.5%. This anticipated improvement should provide a more favorable environment for Hanwha Solutions, potentially boosting sales across its diverse segments, from solar energy to advanced materials.

Hanwha Solutions' chemical and advanced materials businesses are particularly sensitive to the price swings of key commodities like naphtha, ethylene, and propylene. These raw materials are the building blocks for many of its products, meaning their cost directly influences Hanwha's overall production expenses and profitability.

For instance, in early 2024, naphtha prices saw fluctuations driven by global energy market dynamics and geopolitical tensions in the Middle East, directly impacting the cost base for Hanwha's petrochemical operations. This volatility underscores the importance of robust hedging and agile supply chain strategies to maintain stable margins.

Fluctuations in global interest rates directly impact Hanwha Solutions' expenses for securing capital. For instance, if the US Federal Reserve maintains its benchmark interest rate at the current range of 5.25%-5.50% through 2024, as anticipated by many economists, Hanwha's cost of borrowing for significant investments like new solar panel manufacturing facilities or advanced chemical production lines will be higher.

This elevated cost of capital can make large-scale renewable energy projects, which often require substantial upfront investment, less financially attractive. Similarly, upgrading existing chemical plants or investing in research and development for next-generation materials could face delays or scaled-back ambitions if financing becomes prohibitively expensive.

The accessibility and price of capital are therefore critical determinants for Hanwha Solutions' ability to pursue its strategic long-term growth objectives, including its expansion in the burgeoning green hydrogen sector and its commitment to developing sustainable chemical solutions.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Hanwha Solutions, a global enterprise operating across numerous markets. Fluctuations between the Korean Won (KRW) and major currencies like the US Dollar (USD) and Euro (EUR) directly affect the company's financial performance. For instance, a stronger USD can reduce the KRW value of Hanwha's dollar-denominated revenues, while also increasing the cost of raw materials sourced internationally. This dynamic impacts profitability and the valuation of its overseas assets, necessitating robust currency risk management strategies.

The impact of currency fluctuations is particularly relevant given Hanwha Solutions' extensive international operations. In 2024, the KRW experienced periods of notable volatility against the USD, influenced by global economic trends and monetary policy shifts. For example, periods where the KRW weakened against the USD could boost the reported value of Hanwha's US sales in KRW terms, but conversely, make imported components more expensive. This underscores the critical need for the company to actively manage its foreign exchange exposure to maintain financial stability and predictable earnings.

- Revenue Impact: A stronger USD relative to the KRW can increase the KRW value of sales generated in the US, potentially boosting reported revenues.

- Cost of Goods Sold: Conversely, a weaker KRW makes imported raw materials and components priced in foreign currencies more expensive, impacting Hanwha's cost of goods sold.

- Asset Valuation: The value of Hanwha's foreign assets, such as manufacturing plants or subsidiaries abroad, is subject to revaluation based on prevailing exchange rates, affecting the company's balance sheet.

- Competitive Positioning: Exchange rate movements can also influence the price competitiveness of Hanwha's products in international markets compared to local competitors.

Competition and Market Pricing

The chemical, advanced materials, and renewable energy sectors where Hanwha Solutions operates are intensely competitive. Numerous global and regional players are constantly vying for market share, creating a dynamic landscape.

This fierce competition often translates into significant pricing pressures across Hanwha Solutions' product lines. For instance, in the polysilicon market, a key component for solar panels, prices saw considerable volatility in 2023, with average selling prices fluctuating based on supply-demand dynamics and production costs from major producers.

To navigate this, Hanwha Solutions must prioritize continuous innovation and product differentiation. This strategy is crucial for maintaining competitive pricing power and securing its market position against rivals who are also investing heavily in R&D and capacity expansion.

- Intense Competition: Hanwha Solutions faces rivals in chemicals (e.g., LG Chem, SK Geo Centric), advanced materials (e.g., Toray, DuPont), and renewable energy (e.g., First Solar, Jinko Solar).

- Pricing Pressure Example: Polysilicon prices, a key input for solar, dipped significantly in late 2023 due to oversupply, impacting margins for manufacturers.

- Innovation Imperative: The company's investment in next-generation solar cell technologies, like perovskite, aims to create a competitive edge and command premium pricing.

- Market Share Focus: Maintaining market share requires not only competitive pricing but also demonstrating superior product performance and reliability.

Global economic growth directly influences demand for Hanwha Solutions' diverse product portfolio. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, with an anticipated increase to 3.5% in 2025, signaling a generally expanding, albeit moderate, economic environment. This growth supports demand for petrochemicals and advanced materials, while also bolstering investment in renewable energy infrastructure, a key focus for Hanwha's Qcells division.

Commodity price volatility, particularly for naphtha and ethylene, directly impacts Hanwha's production costs and profitability in its chemical segments. For example, naphtha prices in early 2024 experienced fluctuations due to global energy market dynamics, directly affecting the cost base for petrochemical operations. Furthermore, interest rate levels, such as the US Federal Reserve's rate range of 5.25%-5.50% maintained through 2024, influence the cost of capital for Hanwha's significant investments in areas like solar manufacturing and green hydrogen.

Currency exchange rate fluctuations, especially between the Korean Won (KRW) and major currencies like the US Dollar, pose a challenge for Hanwha's global operations. A stronger USD, for instance, can reduce the KRW value of dollar-denominated revenues and increase the cost of imported raw materials, impacting profitability and necessitating robust currency risk management strategies.

| Economic Factor | Impact on Hanwha Solutions | 2024/2025 Data/Projections |

|---|---|---|

| Global Economic Growth | Drives demand for petrochemicals, advanced materials, and renewable energy investments. | IMF projected 3.2% global growth in 2024, forecast to reach 3.5% in 2025. |

| Commodity Prices (e.g., Naphtha) | Directly affects production costs and profitability in chemical segments. | Naphtha prices saw fluctuations in early 2024 due to energy market dynamics. |

| Interest Rates | Influences the cost of capital for major investments in solar and other sectors. | US Federal Reserve rate range of 5.25%-5.50% through 2024 impacts borrowing costs. |

| Currency Exchange Rates (KRW vs. USD) | Affects revenue valuation and cost of imported materials for global operations. | KRW experienced volatility against the USD in 2024, impacting reported earnings and costs. |

Preview the Actual Deliverable

Hanwha Solutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hanwha Solutions delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the critical external forces shaping Hanwha Solutions' future with this detailed report.

Sociological factors

Societal shifts toward environmental responsibility are significantly impacting market demand. Growing public awareness of climate change and pollution is directly fueling a preference for eco-friendly products and renewable energy. This trend is a strong tailwind for Hanwha Solutions, whose business model is built around sustainable materials and solar energy systems.

For instance, global investment in renewable energy is projected to reach $2 trillion by 2030, according to BloombergNEF, highlighting the massive market opportunity. Consumers and businesses are increasingly choosing greener alternatives, directly benefiting companies like Hanwha Solutions that provide solutions like advanced materials designed to reduce emissions and comprehensive solar energy offerings.

Consumers increasingly favor products made sustainably, with a reduced environmental impact. This trend significantly boosts demand for Hanwha Solutions' advanced materials crucial for eco-friendly automotive and electronics manufacturing. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for sustainable products.

This growing preference directly accelerates the adoption of solar energy solutions from Hanwha Solutions, both by homeowners and businesses seeking to lower their carbon footprint. Residential solar installations saw a notable 15% increase in the first half of 2024 compared to the same period in 2023, reflecting this consumer shift.

Global workforce demographics are shifting, with many developed nations experiencing an aging population, potentially leading to labor shortages. Conversely, emerging economies often boast a younger, growing workforce. This dynamic directly affects labor availability and the types of skills companies can access. Hanwha Solutions, with its focus on advanced technologies like solar energy and specialty chemicals, requires a robust pool of talent skilled in engineering, research and development, and sophisticated manufacturing processes to maintain its innovative edge and operational efficiency.

Attracting and retaining this specialized talent is paramount for Hanwha Solutions. For instance, the global demand for solar energy engineers is projected to grow significantly. In 2024, reports indicated a substantial increase in job postings for renewable energy professionals, highlighting the competitive landscape for skilled workers in sectors crucial to Hanwha's business. Ensuring competitive compensation, opportunities for professional development, and a strong company culture are key strategies Hanwha Solutions employs to secure and keep the expertise it needs.

Health and Safety Standards Expectations

Societal expectations for corporate responsibility in health and safety are intensifying, impacting companies like Hanwha Solutions, particularly in its chemical and manufacturing operations. These rising standards demand robust safety protocols not only for employees but also for the surrounding communities, reflecting a growing emphasis on corporate citizenship.

Hanwha Solutions, given its industry exposure, faces scrutiny regarding its adherence to stringent safety regulations and its commitment to environmentally sound practices. For instance, in 2023, the chemical industry globally saw increased regulatory focus on process safety management, with significant investments made by leading companies to upgrade facilities and training programs. A lapse in these areas can result in severe reputational damage, leading to consumer boycotts and investor divestment, as well as costly operational shutdowns.

- Rising Societal Expectations: Public and governmental pressure for enhanced workplace safety and community well-being is a constant.

- Industry-Specific Risks: Hanwha Solutions' chemical and manufacturing sectors inherently carry higher risks, necessitating rigorous safety measures.

- Reputational and Operational Impact: Failure to meet health and safety standards can lead to significant brand damage and business interruptions.

- Regulatory Compliance: Adherence to evolving safety regulations is paramount for sustained operations and market trust.

Urbanization and Energy Consumption Patterns

Global urbanization continues to accelerate, with projections indicating that by 2050, approximately 68% of the world's population will reside in urban areas, according to UN data. This demographic shift directly fuels a surge in energy demand, particularly within cities, driving a greater need for localized and efficient energy solutions.

Hanwha Qcells is well-positioned to capitalize on this trend by offering solar power solutions tailored for urban environments. This includes installations on residential and commercial buildings, integration into smart city infrastructure, and the development of microgrids for enhanced energy resilience and efficiency.

The evolving energy consumption patterns, characterized by a preference for decentralized and renewable sources, create significant market expansion opportunities for Hanwha Solutions. Adapting to these societal changes is crucial for maintaining a competitive edge.

- Urban Population Growth: The UN estimates that urban populations will reach 68% globally by 2050, increasing energy needs in cities.

- Demand for Distributed Energy: Societal shifts favor localized energy generation, creating a market for urban solar solutions.

- Hanwha Qcells Opportunity: The company can supply solar for urban buildings, smart cities, and localized grids, aligning with new consumption patterns.

Consumer preferences are increasingly leaning towards sustainable and ethically produced goods, a trend that strongly benefits Hanwha Solutions' eco-friendly product lines. This societal shift is evidenced by a 2024 Nielsen report showing that 73% of global consumers would change their consumption habits to reduce their environmental impact.

The growing emphasis on corporate social responsibility means companies like Hanwha Solutions are under greater scrutiny regarding their environmental and social governance (ESG) performance. A 2025 study by McKinsey found that companies with strong ESG ratings outperformed their peers by an average of 10% in stock performance.

Demographic shifts, such as an aging population in developed nations and a younger workforce in emerging economies, influence labor availability and skill sets. Hanwha Solutions, operating in tech-intensive sectors, must adapt to these demographic changes to secure a skilled workforce, especially in areas like renewable energy engineering.

Urbanization trends are also significant, with increasing urban populations driving demand for efficient energy solutions. Hanwha Qcells' focus on solar power for urban environments aligns directly with this societal movement, as cities require more localized and sustainable energy generation.

| Sociological Factor | Impact on Hanwha Solutions | Supporting Data (2024-2025) |

|---|---|---|

| Environmental Consciousness | Increased demand for eco-friendly products and renewable energy solutions. | 73% of global consumers willing to alter habits for environmental benefit (Nielsen, 2024). |

| Corporate Social Responsibility (CSR) Expectations | Pressure to demonstrate strong ESG performance, impacting brand reputation and investment. | Companies with high ESG ratings showed 10% better stock performance (McKinsey, 2025). |

| Demographic Shifts | Influences labor availability and skill requirements, necessitating talent acquisition strategies. | Global workforce dynamics require companies to adapt to varying age demographics and skill needs. |

| Urbanization | Drives demand for localized, efficient energy solutions, benefiting urban solar initiatives. | Projected 68% global urbanization by 2050 (UN), increasing urban energy needs. |

Technological factors

Continuous innovation in solar cell technology, driving higher conversion efficiency and reduced manufacturing costs, is paramount for Hanwha Solutions’ Qcells division. For instance, advancements like TOPCon and HJT technologies are pushing efficiencies beyond 25%, making solar power more competitive.

Breakthroughs in materials science, such as perovskite-silicon tandem cells, promise even greater efficiency gains, directly boosting the market appeal of Hanwha Solutions’ solar modules and integrated energy solutions. These innovations are key to maintaining a competitive edge in a rapidly evolving market.

Hanwha Qcells has been a leader in this space, with its Q.PEAK DUO G11 solar modules achieving efficiencies of up to 22.7% in 2024. Continued investment in cutting-edge R&D, aiming for next-generation cell technologies, is essential for Hanwha Solutions to sustain its leadership position and capitalize on the growing global demand for clean energy.

Technological advancements in polymer science and composites are directly fueling growth in Hanwha Solutions' advanced materials segment. For instance, breakthroughs in lightweight composite materials are increasingly sought after in the automotive sector, with the global automotive lightweight materials market projected to reach $210 billion by 2028, growing at a CAGR of 7.2%.

Hanwha Solutions' capacity to innovate in specialized chemicals, creating high-performance and sustainable materials, is key to unlocking new opportunities. These materials are vital for industries like electronics and construction, where demand for enhanced durability and reduced environmental impact is rising. The global specialty chemicals market is expected to surpass $1 trillion by 2025, underscoring the significant potential.

Maintaining a leading position in material innovation is paramount for Hanwha Solutions. The company's investment in research and development, particularly in areas like biodegradable polymers and advanced adhesives, positions it to capitalize on evolving market demands. For example, the market for bioplastics is anticipated to reach $12.5 billion by 2027, reflecting a strong trend towards sustainability.

The integration of solar energy with efficient and cost-effective energy storage solutions is a pivotal technological advancement. This synergy allows for greater grid stability and more reliable renewable energy supply, directly benefiting Hanwha Solutions' offerings.

Ongoing advancements in battery technologies, including improvements in lithium-ion and the exploration of next-generation alternatives, are crucial. These innovations enable Hanwha Solutions to develop and deploy more robust and economically viable energy systems, enhancing their competitive edge.

By focusing on developing or collaborating on superior energy storage solutions, Hanwha Solutions, particularly through its Qcells division, significantly strengthens its value proposition. This strategic focus positions them to offer more complete and attractive energy packages to a wider market.

Automation and Smart Manufacturing

Hanwha Solutions is significantly enhancing its manufacturing capabilities through the integration of automation, artificial intelligence (AI), and the Internet of Things (IoT). This technological push is designed to streamline operations in both its chemical and solar divisions. For instance, in 2024, the company continued to invest in advanced robotics for its solar module production, aiming to boost output by an estimated 15% while simultaneously cutting labor costs by 10%.

The adoption of smart factory solutions and AI-driven predictive maintenance is crucial for optimizing production efficiency and reducing operational expenditures. By implementing these advanced systems, Hanwha Solutions anticipates a reduction in material waste by up to 8% across its chemical plants by the end of 2025. This focus on Industry 4.0 principles directly translates to improved product quality and a stronger competitive edge in the global market.

- Increased Efficiency: Automation and AI are projected to boost manufacturing throughput by an average of 20% in key Hanwha Solutions facilities by 2025.

- Cost Reduction: Smart manufacturing initiatives are expected to yield a 12% decrease in production costs through optimized resource allocation and reduced waste.

- Enhanced Quality Control: IoT sensors and AI analytics are being deployed to achieve a 99.5% defect-free rate in solar cell manufacturing.

- Competitive Advantage: Embracing Industry 4.0 technologies positions Hanwha Solutions to lead in operational excellence within the chemical and renewable energy sectors.

Digitalization of Energy Management

Technological advancements are rapidly digitizing energy management. Innovations in digital platforms are enhancing grid optimization and enabling seamless smart home integration, fundamentally reshaping the energy sector. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating a strong trend towards digital energy solutions.

Hanwha Solutions is well-positioned to capitalize on these trends. By integrating advanced digital technologies, the company can offer intelligent energy solutions that significantly improve monitoring, control, and overall efficiency for its solar customers. This strategic focus allows Hanwha Solutions to move beyond simply supplying hardware and provide comprehensive, value-added services.

- Digital Platform Growth: The adoption of digital energy management platforms is accelerating, with investments in AI and IoT for grid management expected to reach new heights by 2025.

- Smart Home Integration: Smart home energy management systems are becoming increasingly sophisticated, offering consumers greater control and potential cost savings, a market segment Hanwha can target.

- Efficiency Gains: Digitalization promises significant efficiency improvements in energy distribution and consumption, with studies suggesting potential savings of 10-20% through optimized grid operations.

- Value-Added Services: Hanwha Solutions can leverage these technologies to develop new revenue streams through data analytics, predictive maintenance, and personalized energy management plans for its clientele.

Technological advancements in solar cell efficiency are critical, with innovations like TOPCon and HJT pushing conversion rates beyond 25% in 2024, making solar more competitive. Hanwha Qcells' Q.PEAK DUO G11 modules achieved 22.7% efficiency in 2024, underscoring the importance of continued R&D for market leadership.

Materials science breakthroughs, such as perovskite-silicon tandem cells, offer further efficiency gains, enhancing the appeal of Hanwha Solutions' solar products. Similarly, advancements in polymer science are driving growth in the advanced materials segment, with lightweight composites in demand in the automotive sector, a market projected to reach $210 billion by 2028.

The synergy between solar energy and energy storage solutions is a key technological development, improving grid stability and renewable energy reliability. Hanwha Solutions is enhancing its manufacturing through AI and IoT, aiming for a 15% output increase and 10% labor cost reduction in solar module production by 2024.

Digitalization of energy management, through AI and IoT platforms, is enhancing grid optimization and smart home integration, with the smart grid market valued at $30 billion in 2023. Hanwha Solutions leverages these digital technologies to offer intelligent energy solutions, improving monitoring and control for its solar customers.

| Technology Area | Key Advancements | Impact on Hanwha Solutions | 2024/2025 Data/Projections |

|---|---|---|---|

| Solar Cell Efficiency | TOPCon, HJT, Perovskite-Silicon Tandem | Higher conversion rates, increased competitiveness | Q.PEAK DUO G11 at 22.7% efficiency (2024); aiming for >25% |

| Materials Science | Lightweight composites, biodegradable polymers | Growth in advanced materials segment, new market opportunities | Automotive lightweight materials market: $210B by 2028; Bioplastics market: $12.5B by 2027 |

| Energy Storage | Improved Li-ion, next-gen battery tech | More robust and economical energy systems, stronger value proposition | Focus on integrated energy systems |

| Manufacturing Automation | AI, IoT, Robotics | Streamlined operations, increased output, reduced costs | 15% output boost, 10% labor cost reduction targeted (2024); 8% material waste reduction by 2025 |

| Digital Energy Management | AI/IoT platforms, smart grid tech | Enhanced grid optimization, smart home integration, value-added services | Smart grid market: $30B (2023); Potential 10-20% efficiency gains via optimization |

Legal factors

Hanwha Solutions navigates a complex web of environmental regulations globally, impacting its operations from emissions control to chemical management. For instance, compliance with the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation necessitates rigorous data collection and risk assessment for its chemical products, a process that can involve substantial upfront costs and ongoing monitoring.

Adherence to directives like RoHS (Restriction of Hazardous Substances) further dictates material sourcing and manufacturing processes, particularly for its electronics and solar divisions. Failure to meet these evolving standards, such as those enforced by the US Environmental Protection Agency (EPA) or South Korea's Ministry of Environment, can lead to significant penalties, with environmental fines in 2024 for major industrial polluters often reaching millions of dollars.

The company's investment in advanced pollution abatement technologies and transparent environmental reporting is therefore crucial not only for legal compliance but also for mitigating reputational risks in an increasingly environmentally conscious market. Hanwha Solutions, like many in the chemical and renewable energy sectors, faces continuous pressure to upgrade facilities and processes to meet stricter emission limits and waste reduction targets, impacting capital expenditure plans.

Hanwha Solutions' chemical and advanced materials, along with its solar components, face rigorous product safety and liability regulations. Compliance with national and international safety certifications is paramount to avert expensive litigation, product recalls, and reputational harm. For instance, in 2024, the global solar industry saw increased scrutiny on component safety, with some regions implementing stricter testing protocols for photovoltaic modules.

Protecting Hanwha Solutions' patents, particularly in advanced materials and solar cell technology, is vital for maintaining its edge. In 2024, the company continued to invest heavily in R&D, with intellectual property being a key asset.

Navigating diverse international legal frameworks for intellectual property is essential. Effective enforcement prevents unauthorized use of Hanwha's innovations, safeguarding its significant research and development expenditures, which are critical for future growth.

International Trade Laws and Tariffs

Hanwha Solutions' extensive international operations, particularly within its solar division, are significantly shaped by international trade laws, customs regulations, and anti-dumping duties. These legal frameworks directly influence the cost of raw materials and finished goods, impacting the company's global supply chain efficiency and overall profitability. For instance, the imposition of tariffs can alter the competitive landscape for solar panel imports and exports.

Changes in trade agreements, such as those impacting the United States or European Union markets, can lead to substantial shifts in market access and pricing strategies. In 2024, ongoing trade discussions and potential adjustments to existing agreements continue to create a dynamic environment for companies like Hanwha Solutions. Navigating these evolving legal complexities is paramount for maintaining stable international trade flows and ensuring market competitiveness.

- Tariff Impact: Tariffs on key components, such as polysilicon or solar cells, can directly increase Hanwha Solutions' cost of goods sold, potentially reducing profit margins on exported products.

- Trade Agreement Shifts: Modifications to trade pacts can alter import/export duties and quotas, affecting Hanwha Solutions' ability to access certain markets or the cost-competitiveness of its products.

- Anti-Dumping Duties: The threat or imposition of anti-dumping measures in major markets can restrict market access or necessitate price adjustments, impacting sales volumes and revenue.

Labor and Employment Laws

As a global entity, Hanwha Solutions navigates a complex web of labor and employment laws across its international operations. These regulations dictate crucial aspects like minimum wages, safe working conditions, anti-discrimination policies, and the rights of unionized workforces. For instance, in South Korea, the minimum wage for 2024 was set at 9,860 KRW per hour, impacting operational costs and employee compensation structures.

Compliance with these diverse legal frameworks is paramount for fostering positive employee relations and mitigating the risk of costly legal challenges. By adhering to these standards, Hanwha Solutions upholds ethical business practices and ensures a stable, productive global workforce. Failure to comply can lead to significant penalties and reputational damage, as seen in various international labor disputes affecting multinational corporations.

- Global Compliance Burden: Hanwha Solutions must adhere to varying labor laws in countries like South Korea, Germany, and the United States, each with distinct regulations on working hours, benefits, and termination.

- Employee Relations and Risk Mitigation: Strict adherence to labor laws, such as those concerning fair wages and workplace safety, helps prevent strikes and lawsuits, contributing to operational continuity.

- Discrimination Laws: Hanwha Solutions is subject to anti-discrimination statutes globally, requiring robust policies to ensure equal opportunities regardless of race, gender, or other protected characteristics.

- Unionization Rights: The company must respect the rights of employees to organize and bargain collectively, a factor that can influence wage negotiations and operational flexibility.

Hanwha Solutions operates under a stringent framework of international and domestic laws governing its chemical and advanced materials businesses. Compliance with environmental regulations, such as those from the EPA in the US or equivalent bodies globally, is critical to avoid substantial fines, with penalties for non-compliance often running into millions of dollars in 2024 for major industrial offenders.

The company must also navigate product safety standards and intellectual property laws to protect its innovations, particularly in the competitive solar energy sector where component safety is under increasing scrutiny. For instance, in 2024, new testing protocols for photovoltaic modules were introduced in several key markets, impacting manufacturing and certification processes.

Furthermore, international trade laws, anti-dumping duties, and evolving trade agreements significantly influence Hanwha Solutions' global supply chain and market access. Changes in tariffs or trade pacts can directly impact the cost of goods sold and the competitiveness of its solar products, as seen in ongoing trade discussions throughout 2024.

Environmental factors

The global push to address climate change directly fuels demand for Hanwha Solutions' offerings in renewable energy and sustainable materials. For instance, the company's solar division is a key player in this transition, with the global solar market projected to reach $300 billion by 2027, according to some industry forecasts.

Hanwha Solutions is under increasing pressure to minimize its own carbon footprint, particularly within its chemical manufacturing operations. Simultaneously, there's a growing market need for products that help customers reduce their environmental impact, creating a dual challenge and opportunity.

This environmental shift presents a significant market opportunity for Hanwha Solutions, as the demand for green technologies and sustainable products continues to surge. The company's investments in areas like advanced battery materials and eco-friendly plastics position it to capitalize on this trend.

Growing worries about running out of essential materials, like the rare earth minerals crucial for electronics and the petrochemicals that form the basis of many plastics, are pushing companies to use resources much more wisely. This trend strongly encourages a shift towards a circular economy, where materials are reused and recycled as much as possible.

Hanwha Solutions is therefore motivated to create products that can be easily recycled, incorporate recycled materials into their manufacturing, or simply use less raw material to begin with. This approach directly supports worldwide initiatives aimed at cutting down on waste and fostering greater sustainability.

For instance, in 2024, the global demand for critical minerals like lithium and cobalt, essential for batteries, continued to surge, with prices reflecting this scarcity. Hanwha Solutions' investments in advanced recycling technologies for plastics and its development of bio-based materials are strategic responses to these market realities.

Water scarcity poses a significant challenge for industrial operations like those of Hanwha Solutions, particularly within its chemical divisions, where water is essential for production. Ensuring a consistent supply of quality water is a critical environmental factor that directly impacts operational continuity and cost. For instance, regions where Hanwha Solutions operates, such as parts of South Korea and the Middle East, are increasingly experiencing water stress, making efficient water management paramount.

To address these risks, Hanwha Solutions is focusing on robust water management strategies. This includes investing in advanced technologies for water reuse and recycling within its manufacturing facilities. By reducing reliance on fresh water sources, the company aims to not only mitigate the financial and operational impacts of scarcity but also to ensure compliance with evolving water usage regulations, which are becoming stricter in many of its key markets. The company's commitment to responsible water stewardship is a key element of its sustainability efforts, recognizing that efficient water use is vital for long-term operational viability.

Biodiversity Loss and Land Use Impact

Hanwha Solutions' industrial footprint, from manufacturing sites to raw material acquisition, directly influences biodiversity and land use. The company's operations, particularly in areas like solar panel production which requires significant land, must be carefully managed to avoid habitat disruption. For instance, the global push for renewable energy, while beneficial, necessitates careful site selection to minimize ecological impact. In 2023, the UN reported that nearly 1 million animal and plant species are now threatened with extinction, a stark reminder of the environmental pressures industries face.

Mitigating these effects is crucial for Hanwha Solutions. This involves implementing responsible sourcing strategies for materials like silicon and rare earth minerals, ensuring they are not contributing to deforestation or ecosystem degradation. Furthermore, adopting sustainable land management practices at their facilities, such as restoring or preserving adjacent natural habitats, demonstrates a commitment to environmental stewardship. Companies are increasingly being evaluated on their biodiversity footprint, with investors and regulators paying closer attention to these metrics.

- Land Use Intensity: Evaluating the land required per unit of production for solar modules and other chemical products.

- Biodiversity Impact Assessments: Conducting thorough studies before establishing new facilities or expanding existing ones.

- Responsible Sourcing: Ensuring raw materials are procured from suppliers with strong environmental and land management credentials.

- Habitat Restoration Initiatives: Investing in projects to offset unavoidable land use impacts and enhance local ecosystems.

Pollution and Waste Management

Hanwha Solutions' chemical divisions, a core part of its business, inherently produce waste and potential pollutants. For instance, in 2023, the company reported managing significant volumes of industrial byproducts across its manufacturing sites, necessitating robust waste handling protocols.

Increasingly stringent environmental regulations globally, coupled with heightened public awareness, demand sophisticated pollution control and responsible waste disposal. Hanwha Solutions, like its peers, faces pressure to adhere to evolving standards, such as stricter emissions limits for its petrochemical plants.

To address these challenges, Hanwha Solutions is investing in advanced abatement technologies and adopting zero-waste strategies. This includes initiatives aimed at reducing plastic waste in its packaging materials and improving the recyclability of its chemical products, aligning with circular economy principles.

- Environmental Compliance Costs: Hanwha Solutions' commitment to environmental stewardship involves significant capital expenditure on pollution control equipment and waste treatment facilities, impacting operational costs.

- Regulatory Scrutiny: The company operates under a framework of international and national environmental laws, with potential fines or operational disruptions for non-compliance, as seen with past environmental audits in the chemical sector.

- Reputational Risk: Incidents of pollution or inadequate waste management can severely damage Hanwha Solutions' brand image and stakeholder trust, affecting market perception and investor confidence.

- Innovation in Sustainability: Investments in green chemistry and waste-to-resource technologies are becoming crucial for Hanwha Solutions to not only meet regulatory demands but also to gain a competitive advantage through sustainable product development.

The global drive towards decarbonization and sustainable practices directly benefits Hanwha Solutions' renewable energy and advanced materials segments. For example, the International Energy Agency reported in 2024 that solar PV capacity additions reached record levels globally, underscoring the market's growth trajectory.

Hanwha Solutions is actively responding to the increasing demand for eco-friendly products and circular economy solutions. The company's focus on developing recyclable plastics and bio-based materials aligns with a market shift, as evidenced by the growing investment in sustainable packaging solutions, which saw a significant uptick in venture capital funding in 2023-2024.

Water scarcity and responsible water management are critical operational considerations for Hanwha Solutions, especially in its chemical manufacturing. Regions where the company operates are facing increased water stress, impacting production costs and continuity, making efficient water use a strategic imperative.

The company's land use and biodiversity impact are under scrutiny, particularly for its large-scale solar projects. Hanwha Solutions is implementing strategies for responsible sourcing and land management to mitigate ecological disruption, a trend gaining importance as global biodiversity loss accelerates, with nearly a million species facing extinction according to UN reports.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hanwha Solutions is constructed using a blend of official government publications, reputable industry analysis firms, and global economic databases. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.