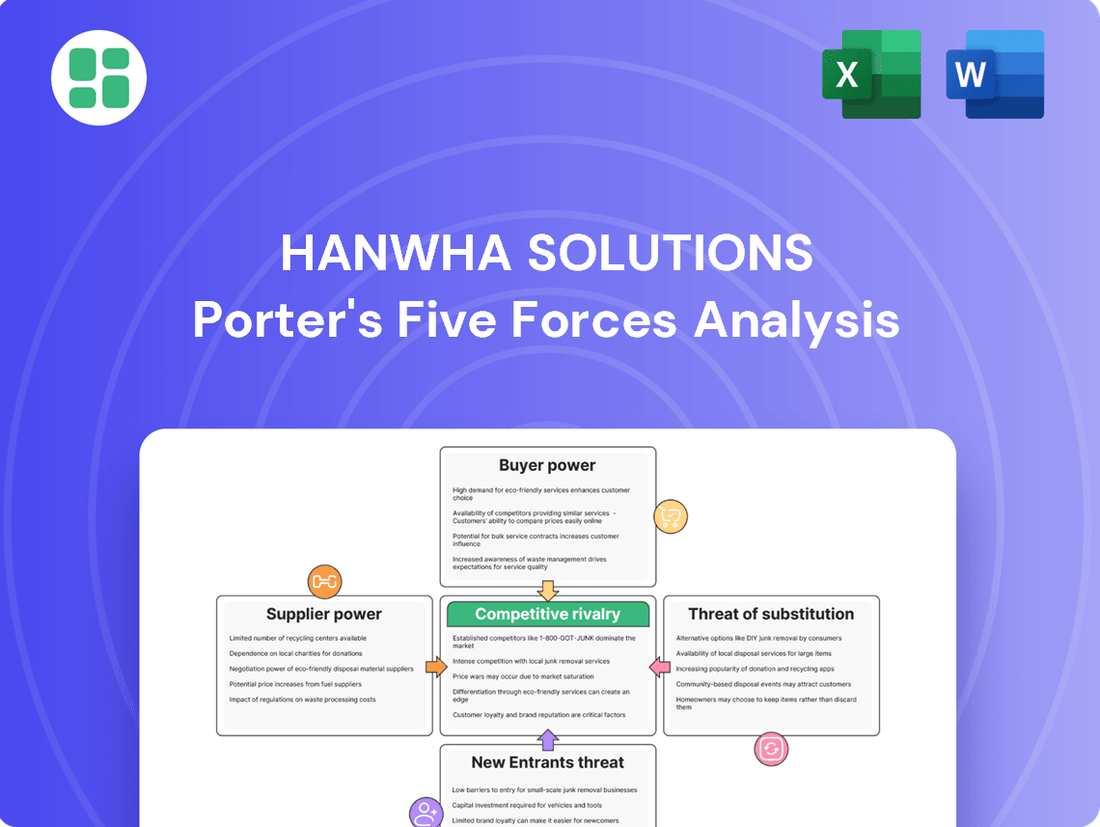

Hanwha Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

Hanwha Solutions navigates a competitive landscape shaped by moderate buyer power and the looming threat of substitutes, particularly in its core chemical and solar divisions. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Hanwha Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hanwha Solutions, particularly within its chemical and petrochemical operations, faces significant risks due to the fluctuating prices of crude oil and natural gas. These commodities serve as essential raw materials, and their price swings directly affect Hanwha's manufacturing expenses and profitability. For instance, in early 2024, Brent crude oil prices averaged around $80 per barrel, a level that can substantially impact feedstock costs.

Global economic shifts and geopolitical tensions are major drivers of these commodity price volatilities. These external factors create an unpredictable environment for Hanwha, making cost management a constant challenge. The chemical sector anticipates continued cost pressures and economic headwinds into 2025, with feedstock and energy expenses expected to remain a primary concern for companies like Hanwha Solutions.

The solar energy industry faces a significant challenge due to the concentrated nature of its key component suppliers. For instance, China's dominance in the photovoltaic wafer market is striking, controlling approximately 97% of global supply. This intense concentration grants these few suppliers substantial bargaining power.

This supplier power can translate into tangible risks for companies like Hanwha Solutions. They might experience supply disruptions or face upward pressure on prices for essential materials like polysilicon and wafers. Even as the U.S. expands its domestic solar manufacturing, a heavy reliance on imported components persists, underscoring the global leverage held by these concentrated suppliers.

For Hanwha Solutions' advanced materials segment, the technological uniqueness of inputs significantly influences supplier bargaining power. Suppliers possessing proprietary technology for highly specialized chemicals or novel raw materials can command higher prices and favorable terms. This is particularly relevant as Hanwha Solutions invests in cutting-edge technologies and high-performance plastics, potentially creating dependence on a narrow base of suppliers for these critical, advanced components.

Switching Costs for Alternative Suppliers

Switching suppliers for basic petrochemicals, a core area for Hanwha Solutions, often involves relatively low costs due to the commoditized nature of these products. However, when dealing with more specialized materials or integrated solar components, the expense and effort required for re-qualification, rigorous testing, and significant supply chain adjustments can become substantial. This elevates the switching costs, thereby increasing the bargaining power of those suppliers.

These elevated switching costs inherently limit Hanwha's operational flexibility and consequently bolster the leverage held by its suppliers. The chemical industry is actively undergoing a transformation in its supply chain strategies, with a notable trend towards regionalized production models. This shift is primarily driven by the objective of enhancing overall supply chain resilience and mitigating risks associated with global disruptions.

- Low Switching Costs for Commoditized Petrochemicals: For basic petrochemicals, Hanwha Solutions can often find alternative suppliers with minimal disruption, keeping supplier power in check for these specific inputs.

- High Switching Costs for Specialized Components: For advanced materials or integrated solar solutions, the costs of vetting, testing, and integrating new suppliers can be significant, giving these specialized suppliers more leverage.

- Industry Shift to Regionalization: Chemical companies are increasingly adopting regionalized supply chains to improve reliability. This can either increase dependence on regional suppliers or create opportunities for Hanwha to diversify within regions, depending on execution.

- Impact on Supplier Power: Higher switching costs directly translate to increased bargaining power for suppliers, potentially affecting Hanwha Solutions' cost structure and input availability.

Labor and Skilled Workforce Shortages

The renewable energy sector, including vital areas like solar installation and manufacturing, is currently grappling with a significant shortage of skilled labor. This scarcity directly translates into increased bargaining power for specialized workers and contractors who possess in-demand expertise.

This lack of qualified personnel can unfortunately lead to inflated labor costs, impacting project profitability, and potentially causing unwelcome delays in Hanwha's renewable energy initiatives. For instance, in 2024, reports indicated a growing gap between the demand for solar technicians and the available supply in many key markets.

- Skilled Labor Scarcity: The renewable energy industry, particularly solar, faces a deficit in trained professionals.

- Increased Bargaining Power: Specialized workers can command higher wages and better terms due to demand.

- Project Impact: Shortages can drive up labor costs and create potential delays for Hanwha's projects.

- Industry Growth Hindrance: Addressing this labor gap is critical for the sector's sustained expansion and competitiveness.

The bargaining power of suppliers for Hanwha Solutions is a critical factor, particularly in its chemical and solar divisions. For basic petrochemicals, switching costs are generally low, limiting supplier leverage. However, for specialized materials and integrated solar components, higher switching costs empower suppliers, potentially impacting Hanwha's costs and input availability.

The chemical industry's trend towards regionalization could either increase dependence on specific regional suppliers or offer diversification opportunities, depending on Hanwha's strategic execution. Ultimately, suppliers with unique technologies or those providing components with high re-qualification costs wield significant influence.

In the solar sector, China's overwhelming dominance in wafer supply, holding around 97% of the global market, grants these suppliers substantial bargaining power. This concentration means Hanwha Solutions faces risks of price increases and supply disruptions for essential materials like polysilicon.

The shortage of skilled labor in renewable energy, including solar technicians, also boosts the bargaining power of these specialized workers. This can lead to higher labor costs and potential project delays for Hanwha's renewable energy initiatives, as seen with reported gaps in technician supply in key markets during 2024.

| Segment | Key Input | Supplier Bargaining Power Driver | Impact on Hanwha Solutions |

|---|---|---|---|

| Chemicals | Crude Oil/Natural Gas | Commodity price volatility; Geopolitical factors | Fluctuating feedstock costs, impacting profitability. Early 2024 Brent crude averaged ~$80/barrel. |

| Chemicals | Basic Petrochemicals | Low switching costs | Limited supplier leverage; easier to find alternatives. |

| Advanced Materials | Proprietary Chemicals/Novel Raw Materials | Technological uniqueness; High switching costs (re-qualification, testing) | Suppliers can command higher prices and favorable terms. |

| Solar | Photovoltaic Wafers | Market concentration (China ~97% global supply) | Risk of price increases and supply disruptions. |

| Renewable Energy | Skilled Labor (e.g., Solar Technicians) | Labor scarcity | Increased labor costs, potential project delays. |

What is included in the product

This analysis unpacks the competitive forces impacting Hanwha Solutions, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model for Hanwha Solutions, enabling swift identification of strategic vulnerabilities.

Customers Bargaining Power

Hanwha Qcells, a significant player in solar energy, caters to large-scale utility and commercial buyers. These customers, such as major corporations and utility companies, wield considerable purchasing power, often driving competitive bidding and negotiating for advantageous terms due to the sheer volume of their orders.

For instance, in 2023, the U.S. solar market saw continued growth, with utility-scale projects representing a substantial portion of new capacity additions. Buyers in this segment, by consolidating their demand, can exert significant pressure on suppliers like Hanwha Qcells to offer competitive pricing and flexible contract structures.

In the basic petrochemicals sector, Hanwha Solutions faces significant customer bargaining power due to intense competition and the commoditized nature of its products. Buyers in this segment are acutely price-sensitive, readily shifting to alternative suppliers if offered even slightly lower costs. This dynamic was evident in 2024, where fluctuating feedstock prices and global economic slowdowns amplified the pressure on chemical producers to maintain competitive pricing.

Hanwha Solutions benefits from a broad customer base spanning sectors like construction, automotive, and electronics for its advanced materials. This wide reach typically dilutes the power of any single customer. For instance, in 2023, Hanwha’s advanced materials segment reported robust sales growth, reflecting strong demand across these varied industries.

However, if a few major clients represent a significant portion of sales within a particular segment, their collective bargaining power could increase. The advanced materials market is expected to see substantial expansion, fueled by ongoing demand from these diverse industrial applications.

Availability of Substitute Products for Customers

Customers wield significant bargaining power when a plethora of substitute products or alternative technologies are readily available to meet their needs. For Hanwha Solutions, this is particularly relevant in its diverse business segments. In the solar energy sector, for example, customers can opt for other renewable energy sources like wind or hydropower, or invest in energy efficiency solutions, thereby reducing their reliance on solar. This availability of alternatives directly impacts Hanwha's pricing flexibility.

The chemicals division also faces this dynamic. The emergence of bio-based plastics and recycled material alternatives presents customers with choices beyond traditional petrochemical-based products. For instance, the global market for bioplastics is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, indicating a growing customer appetite for sustainable substitutes. This competitive landscape necessitates that Hanwha Solutions continuously innovate and maintain cost-competitiveness to retain its customer base.

- Substitution Threat in Solar: Customers can choose wind, hydropower, or energy efficiency measures instead of solar.

- Chemical Alternatives: Bio-based and recycled materials are increasingly viable substitutes for conventional chemicals.

- Market Growth of Substitutes: The bioplastics market's projected high CAGR signals increasing customer adoption of alternatives.

- Impact on Hanwha: Availability of substitutes pressures Hanwha Solutions on pricing and necessitates innovation.

Impact of Government Policies and Incentives on Demand

Government policies and incentives significantly shape customer demand for renewable energy solutions, directly affecting Hanwha Solutions. For instance, the U.S. Inflation Reduction Act (IRA) has been a major driver, boosting demand for solar products by offering substantial tax credits. This makes customer purchasing decisions highly responsive to the presence and level of such government support.

However, this reliance on policy creates a degree of volatility. Changes in regulations or the phasing out of subsidies can quickly alter project economics and customer willingness to invest, impacting the demand for Hanwha's offerings. For example, a reduction in solar tax credits could lead to a slowdown in new installations.

- IRA Impact: The IRA, enacted in 2022, provides a 30% investment tax credit for clean energy projects, directly stimulating demand for solar installations.

- Policy Sensitivity: Customer demand for solar and hydrogen solutions is sensitive to policy shifts, as seen in markets where incentives have been reduced or removed.

- Market Volatility: Fluctuations in government support mechanisms can lead to unpredictable swings in customer order pipelines for renewable energy components.

Customers in Hanwha Solutions' solar division, particularly large utility and commercial buyers, possess significant bargaining power due to the sheer volume of their purchases. This power is amplified when numerous suppliers offer similar products, forcing Hanwha to compete on price and contract terms. For example, in 2023, the global solar module market experienced oversupply in certain segments, allowing large buyers to negotiate favorable pricing.

In the petrochemicals sector, customer bargaining power is high due to the commoditized nature of products and intense competition. Buyers are price-sensitive and readily switch suppliers, a trend exacerbated in 2024 by volatile raw material costs and economic uncertainties, pressuring Hanwha to maintain cost competitiveness.

Hanwha's advanced materials division generally benefits from a diversified customer base, which dilutes individual customer power. However, if a few key clients represent a substantial portion of sales within a specific advanced materials niche, their collective bargaining strength increases, impacting pricing and terms.

| Customer Segment | Bargaining Power Drivers | Impact on Hanwha Solutions | Relevant Data/Context |

| Utility/Commercial Solar Buyers | High volume purchases, numerous suppliers | Pressure on pricing, contract terms | Global solar module oversupply in 2023 |

| Petrochemical Buyers | Commoditized products, intense competition, price sensitivity | Need for cost leadership, price concessions | Volatile feedstock prices in 2024 |

| Advanced Materials Buyers (Diversified) | Broad customer base | Lower individual customer power | Robust sales growth in advanced materials in 2023 |

| Advanced Materials Buyers (Concentrated) | Concentration of sales with few key clients | Increased collective bargaining power | Expected expansion in advanced materials demand |

Full Version Awaits

Hanwha Solutions Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Hanwha Solutions meticulously details the competitive landscape, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This in-depth examination provides actionable insights into the strategic positioning and potential challenges faced by Hanwha Solutions within its diverse business segments.

Rivalry Among Competitors

The solar energy sector is incredibly competitive, with a large number of players, especially from China, driving down prices. Hanwha Qcells, while a leader in the U.S. residential and commercial segments, still finds itself in a crowded marketplace.

This intense rivalry is further fueled by the urgent need to bridge the widening gap between clean energy supply and demand. For instance, in 2023, global solar module prices saw a significant decline, with some reports indicating drops of over 30% year-over-year for certain technologies, directly impacting profitability and market share battles.

The global chemical industry is a battlefield, characterized by fierce competition, significant overcapacity, and a surge in aggressive exports, particularly from China. This dynamic puts considerable pressure on profit margins for numerous chemical manufacturers. For instance, in 2023, the global chemical industry experienced a slowdown in growth, with some regions facing oversupply issues, impacting pricing power.

Hanwha Solutions finds itself in direct competition with major, well-established global entities across both its foundational petrochemical operations and its more specialized chemical divisions. Companies like BASF, Dow, and SABIC are significant rivals, boasting extensive product portfolios and broad market reach, making it a challenging environment for any single player.

Furthermore, the chemicals sector is witnessing ongoing consolidation. Major industry players are actively pursuing strategic mergers and acquisitions to enhance their market positions, expand their technological capabilities, and achieve greater economies of scale. This trend means Hanwha Solutions must continually adapt to a landscape where competitors are actively reshaping their strategic footprints.

The advanced materials sector thrives on constant innovation, making competitive rivalry intense. Companies like Hanwha Solutions differentiate themselves by developing cutting-edge technologies, particularly those supporting environmental sustainability. For instance, Hanwha's investment in eco-friendly materials directly addresses market demand for greener solutions.

However, this focus on innovation means rivals are also pouring significant resources into research and development. The global advanced materials market was projected to reach over $250 billion by 2024, with significant portions driven by R&D breakthroughs. Success in this arena hinges on a company's agility in adapting to new technological advancements and swiftly bringing novel products to market.

Diversified Portfolio and Cross-Sector Competition

Hanwha Solutions operates across diverse segments like chemicals, advanced materials, and renewable energy, meaning it contends with a varied competitive landscape. This broad reach, while spreading risk, necessitates the management of distinct competitive strategies in each arena. For instance, in the chemical sector, the company faces established global players and emerging regional competitors driven by sustainability mandates.

The drive towards sustainability is reshaping competitive dynamics, particularly within the chemical industry. Hanwha Solutions, with its significant investments in areas like solar energy, is positioned to benefit from this shift, but it also intensifies competition from companies rapidly adopting greener practices. This creates a complex environment where traditional chemical rivals and new green technology firms vie for market share.

- Cross-Sector Rivalry: Hanwha Solutions' presence in chemicals, advanced materials, and renewable energy exposes it to distinct competitor sets in each.

- Risk Mitigation vs. Strategic Complexity: Diversification reduces reliance on a single market but demands tailored competitive strategies across different sectors.

- Sustainability as a Competitive Driver: The chemical industry's green transformation introduces new rivals and intensifies competition for eco-friendly solutions.

Market Growth Rate and Industry Consolidation

The chemical industry's moderate growth, projected between 3.4% and 3.5% for 2024-2025, fuels intense competition. As companies seek to expand their market presence, industry consolidation through mergers and acquisitions becomes a key strategy, directly intensifying rivalry among established players.

This consolidation trend means that companies like Hanwha Solutions are increasingly vying for market share not just through organic growth but also by strategically acquiring competitors or divesting non-core assets. This dynamic environment necessitates constant adaptation and aggressive market positioning.

- Projected Chemical Industry Growth: 3.4-3.5% for 2024-2025.

- Industry Consolidation: Driven by mergers, acquisitions, and restructuring.

- Renewable Energy Competition: Increasing global installations foster market share battles.

Competitive rivalry within Hanwha Solutions' diverse business segments remains a significant factor. In the solar sector, while Hanwha Qcells holds a strong position in the U.S., the global market is crowded, particularly with Chinese manufacturers driving down prices. Similarly, the chemical industry faces intense competition due to overcapacity and aggressive exports, impacting profit margins for all players.

The advanced materials sector is characterized by rapid innovation, with companies like Hanwha Solutions investing heavily in R&D to stay ahead. This necessitates agility in bringing new, often eco-friendly, products to market. The ongoing consolidation within the chemical industry, marked by mergers and acquisitions, further intensifies rivalry as companies seek to enhance scale and technological capabilities.

For instance, the global chemical industry's projected growth of 3.4% to 3.5% for 2024-2025 fuels this competitive drive, with companies strategically acquiring rivals to expand market presence. This dynamic environment means Hanwha Solutions must constantly adapt its strategies to compete effectively across its various operational areas.

| Segment | Key Competitive Factors | Notable Competitors | 2024/2025 Outlook |

|---|---|---|---|

| Renewable Energy (Solar) | Price competition, technological advancements, government incentives | Jinko Solar, LONGi Solar, Trina Solar | Continued market expansion, intense price pressure |

| Chemicals | Overcapacity, export competition, sustainability demands | BASF, Dow, SABIC, Sinopec | Moderate growth (3.4-3.5%), industry consolidation |

| Advanced Materials | Innovation, R&D investment, eco-friendly solutions | 3M, DuPont, Covestro | High R&D focus, market differentiation |

SSubstitutes Threaten

The petrochemical industry is increasingly facing competition from bio-based plastics, biochemicals, and recycled plastics. These sustainable alternatives are directly challenging the demand for traditional, fossil fuel-derived petrochemical products.

Significant investments are being channeled into both mechanical and chemical recycling technologies. These advancements aim to transform plastic waste into valuable new products, thereby reducing the need for virgin petrochemicals. For instance, by 2024, the global market for recycled plastics was projected to reach over $50 billion, demonstrating a clear trend away from virgin materials.

This growing threat is largely fueled by escalating environmental concerns and increasing regulatory pressures worldwide. Governments and consumers alike are pushing for more sustainable practices, accelerating the adoption of these alternative materials and impacting the petrochemical sector's market share.

While solar energy is a significant area for Hanwha Solutions, other renewable energy sources like wind, hydropower, and geothermal present viable alternatives for electricity generation, acting as substitutes. These technologies, each with their own unique advantages and regional suitability, can capture market share that might otherwise go to solar power.

Furthermore, advancements in energy storage, although often seen as enhancing solar's capabilities, also empower these other renewables by increasing their grid reliability and dispatchability. This improved flexibility can lessen the demand for consistent solar input, thereby intensifying the competitive pressure from substitute energy sources.

Improvements in energy efficiency and conservation are a significant threat of substitution for energy providers like Hanwha Solutions. As industries and households adopt better insulation, smarter thermostats, and more efficient appliances, the overall demand for energy, including solar, can decrease. For instance, by 2024, many countries are seeing increased investment in building retrofits aimed at reducing energy consumption, directly impacting the need for new energy generation capacity.

Traditional Materials for Advanced Applications

While Hanwha Solutions targets advanced applications with its high-performance materials, traditional materials can still pose a threat as substitutes in certain scenarios, particularly when cost is a primary driver. For instance, in some construction or packaging uses, more conventional plastics or metals might be chosen over specialized advanced polymers if the performance delta isn't critical and the price difference is significant. This is especially true if these traditional materials are readily available and have established supply chains.

However, the market trend increasingly favors advanced materials due to growing demands for sustainability and weight reduction. Industries like automotive and aerospace are actively seeking solutions that offer better fuel efficiency and reduced environmental impact. For example, the global automotive lightweight materials market was valued at approximately USD 60 billion in 2023 and is projected to grow significantly, driven by stricter emission regulations and consumer demand for more efficient vehicles. This shift inherently limits the substitution threat from less advanced, heavier materials in these key growth sectors for Hanwha.

- Cost Sensitivity: Traditional materials like steel or standard polymers can be viable substitutes where cost is paramount and performance requirements are less stringent.

- Industry Trends: The automotive sector, for example, saw a significant push towards lightweighting in 2024 models, with many manufacturers increasing the use of advanced composites and aluminum alloys, reducing reliance on heavier traditional materials.

- Sustainability Focus: Growing environmental regulations and consumer preference for eco-friendly products further enhance the appeal of advanced, often recyclable or bio-based, materials over older, less sustainable alternatives.

- Performance Demands: For applications requiring extreme durability, heat resistance, or specific electrical properties, traditional materials often fall short, making advanced materials the only viable option and thus mitigating the threat of substitution.

Policy-Driven Shift Away from Fossil Fuels

The increasing pressure from governments and international bodies to decarbonize is a significant threat of substitutes for Hanwha Solutions. For instance, in 2024, the European Union continued to strengthen its emissions trading system, making fossil fuel-based products more expensive. This policy-driven shift directly encourages the adoption of alternatives across Hanwha's business segments.

This push for sustainability is accelerating the adoption of clean energy technologies, directly impacting Hanwha's solar division. As countries set more ambitious renewable energy targets, the demand for solar panels and related infrastructure grows, positioning these as viable substitutes for traditional energy sources. By the end of 2023, global renewable energy capacity additions reached a record high, signaling a clear trend.

Similarly, in the chemical sector, there's a growing demand for bio-based and recycled materials. Government regulations and consumer preferences are steering industries away from petrochemicals. For example, by mid-2024, several major consumer goods companies announced commitments to increase their use of sustainable packaging materials, creating a market for bio-plastics and other eco-friendly alternatives that could displace conventional plastics produced by Hanwha.

- Policy-Driven Shift: Governments worldwide are implementing stricter environmental regulations and offering incentives for sustainable alternatives, directly impacting fossil fuel-dependent industries.

- Clean Energy Adoption: A global surge in renewable energy targets, exemplified by record capacity additions in 2023, positions solar and wind power as strong substitutes for conventional energy.

- Chemical Industry Transformation: Growing consumer and corporate demand for bio-based and recycled chemicals, supported by corporate sustainability commitments in 2024, threatens traditional petrochemical products.

- Market Disruption: These policy and market shifts create a fertile ground for substitute products and services to gain market share, potentially eroding demand for Hanwha's existing offerings if adaptation is not swift.

The threat of substitutes for Hanwha Solutions is multifaceted, impacting both its chemical and energy divisions. In the chemical sector, bio-based plastics and recycled materials are increasingly viable alternatives to traditional petrochemicals. For instance, by 2024, the global market for recycled plastics was projected to exceed $50 billion, highlighting a significant shift. This trend is driven by environmental concerns and regulatory pressure, pushing industries toward more sustainable options.

In the energy sector, while solar is a core focus, other renewable sources like wind and hydropower act as substitutes. Advancements in energy storage also bolster the competitiveness of these alternatives. Furthermore, energy efficiency measures, such as building retrofits aimed at reducing consumption, directly decrease the overall demand for new energy generation, including solar. By 2024, many nations are prioritizing such efficiency upgrades.

Hanwha's advanced materials also face substitution threats from traditional materials, particularly when cost is the primary driver. However, industry trends, such as the automotive sector's push for lightweighting, favor advanced materials. The global automotive lightweight materials market was valued at approximately USD 60 billion in 2023, with growth fueled by emission regulations. This dynamic limits the substitution threat from heavier, less advanced materials in key growth areas.

| Segment | Substitute Threat | Key Drivers | Market Data (2023-2024) |

|---|---|---|---|

| Petrochemicals | Bio-based plastics, recycled plastics | Environmental concerns, regulatory pressure | Recycled plastics market projected over $50 billion (2024) |

| Solar Energy | Wind, hydropower, energy storage advancements | Renewable energy targets, grid reliability | Record global renewable capacity additions (end of 2023) |

| Advanced Materials | Traditional materials (steel, standard polymers) | Cost sensitivity, specific application needs | Automotive lightweight materials market ~USD 60 billion (2023) |

Entrants Threaten

The chemical and renewable energy manufacturing sectors, where Hanwha Solutions operates, demand significant upfront capital for facilities, advanced equipment, and ongoing research and development. This high capital intensity acts as a substantial barrier, deterring potential new entrants who may lack the financial resources to compete. For instance, establishing a competitive presence in solar manufacturing requires investments in the billions, as seen with Hanwha's substantial commitment to its U.S. 'Solar Hub' project.

Hanwha Solutions leverages its extensive global sales networks and deeply entrenched distribution channels across its chemical, advanced materials, and solar divisions. Building comparable infrastructure and securing reliable supply chains presents a significant hurdle for potential new entrants.

The company's success in maintaining market leadership, particularly in the solar sector, underscores the strength of its long-standing customer relationships and brand loyalty. In 2023, Hanwha Q CELLS, a key part of Hanwha Solutions, continued to be a top-tier global solar module supplier, indicating the difficulty new players face in displacing established trust and market share.

The chemical and energy sectors, where Hanwha Solutions operates, are heavily regulated. New companies entering these markets face substantial compliance costs related to environmental protection, worker safety, and product standards. For instance, in 2024, the cost of complying with new emissions regulations in the European Union alone is estimated to add billions to operational expenses for chemical manufacturers.

Technological Expertise and R&D Intensity

Hanwha Solutions' commitment to advanced materials and solar energy necessitates substantial and ongoing investment in research and development, alongside a deep pool of specialized technical talent. For any new company to enter this space effectively, it must either cultivate similar technological prowess or secure it through acquisition, presenting a significant hurdle.

The rapid evolution of solar technology, exemplified by advancements like perovskite-silicon tandem cells which promise higher efficiency, continuously elevates the required technological expertise. This ongoing innovation cycle makes it increasingly challenging and costly for potential new entrants to match the capabilities of established players like Hanwha Solutions.

- High R&D Expenditure: Hanwha Solutions reported significant R&D spending, reflecting its focus on technological advancement in its key segments. For example, in 2023, the company allocated a substantial portion of its budget towards developing next-generation materials and solar cell technologies.

- Intellectual Property: The company holds numerous patents in areas like high-efficiency solar cells and advanced polymer materials, creating a barrier to entry for those without comparable proprietary technology.

- Talent Acquisition Costs: Attracting and retaining engineers and scientists with expertise in areas like photovoltaic materials and chemical engineering is expensive, adding to the cost of entry.

Access to Supply Chains and Raw Materials

Securing reliable access to raw materials and establishing robust supply chains are paramount for companies like Hanwha Solutions, particularly in sectors such as solar energy and advanced materials. Newcomers often face significant hurdles in this area.

Potential new entrants may find it difficult to negotiate favorable terms or ensure a consistent supply of specialized inputs. Established players, like Hanwha, frequently benefit from long-term contracts or vertically integrated operations, creating a barrier for those just entering the market.

- Supply Chain Dependencies: Hanwha Solutions' reliance on key raw materials like polysilicon for its solar division and specialized chemicals for advanced materials means that disruptions or limited availability can significantly impact production.

- Cost Disadvantage for New Entrants: New companies entering the solar panel manufacturing market, for instance, may face higher raw material costs compared to established players who have secured bulk discounts or long-term supply agreements. In 2023, the global polysilicon market saw price volatility, with average prices for solar-grade polysilicon fluctuating significantly, impacting profitability for those without established supply chains.

- Limited Bargaining Power: Without a proven track record or substantial order volumes, new entrants possess limited bargaining power with raw material suppliers, potentially leading to less competitive pricing and less favorable contract terms.

The threat of new entrants for Hanwha Solutions is generally moderate to low due to significant barriers. High capital requirements for manufacturing facilities, especially in solar and advanced materials, demand billions in investment. For example, Hanwha's substantial commitment to its U.S. solar hub highlights this capital intensity. Furthermore, established global sales networks and entrenched distribution channels are difficult and costly for newcomers to replicate, as evidenced by Hanwha Q CELLS' consistent top-tier global ranking in 2023.

| Barrier to Entry | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Intensity | Significant upfront investment needed for advanced manufacturing facilities and R&D. | Deters new players lacking substantial financial backing. | Billions required for competitive solar manufacturing; Hanwha's U.S. Solar Hub investment. |

| Distribution Channels | Extensive global sales networks and established logistics are crucial. | New entrants struggle to build comparable infrastructure and secure market access. | Hanwha Q CELLS' strong global presence and distribution network. |

| Brand Loyalty & Customer Relationships | Long-standing trust and proven performance foster customer retention. | Difficult for new companies to displace established market leaders. | Hanwha Q CELLS' continued position as a leading solar supplier in 2023. |

| Regulatory Compliance | Strict environmental, safety, and product standards require significant adherence costs. | Adds substantial operational expenses and complexity for new market entrants. | Estimated billions in compliance costs for EU emissions regulations in 2024 for chemical manufacturers. |

| R&D and Technological Expertise | Continuous investment in innovation and specialized talent is essential. | New entrants must match or acquire advanced capabilities to compete effectively. | Hanwha's focus on next-generation materials and solar cell technologies; patent portfolio. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hanwha Solutions is built upon comprehensive data from their annual reports, investor presentations, and industry-specific market research from firms like IHS Markit and Wood Mackenzie. We also incorporate insights from regulatory filings and global energy market databases to provide a robust assessment of the competitive landscape.