Hammerson SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hammerson Bundle

Hammerson's strategic position is shaped by its prime retail locations and strong brand portfolio, but it also faces challenges from evolving consumer habits and economic headwinds. Understanding these dynamics is crucial for anyone looking to invest or compete in the retail property sector.

Ready to dive deeper and uncover the full strategic landscape of Hammerson? Our comprehensive SWOT analysis provides actionable insights, financial context, and expert commentary, empowering you to make informed decisions and capitalize on opportunities.

Gain access to a professionally written, fully editable report designed to support your planning, pitches, and research. Unlock the complete story behind Hammerson's strengths, risks, and growth drivers to gain a competitive edge.

Strengths

Hammerson has successfully repositioned its portfolio, concentrating on ten prime city destinations in the UK, France, and Ireland. These locations are recognized as leading retail and leisure hubs, aligning with the market's 'flight to quality' trend where businesses prioritize premium, high-traffic sites.

By divesting non-core assets, such as its stake in Value Retail, Hammerson has sharpened its strategic focus on these high-quality urban properties. This move is designed to capitalize on the resilience and appeal of prime real estate in the current economic climate.

Hammerson demonstrated exceptional operational strength in 2024, achieving a record year for leasing with 262 new agreements. These leases saw headline rents significantly outperform both previous passing rents and estimated rental values (ERV), underscoring the desirability and value of its retail spaces.

Occupancy rates across Hammerson's prime locations climbed to over 95% in 2024, a testament to sustained high demand. This strong performance is further validated by footfall and sales figures that consistently outpaced national averages, attracting approximately 170 million visitors annually to its destinations.

Hammerson has significantly bolstered its financial foundation over the past four years, raising £1.5 billion from asset sales, notably the disposal of Value Retail. This strategic move has driven a substantial 40% year-on-year decrease in net debt, bringing it down to £799 million.

This deleveraging has resulted in a healthier net debt to EBITDA ratio of 5.8x and a Loan-to-Value (LTV) of 30%. These positive financial developments have been recognized by credit rating agencies, with both Moody's and Fitch upgrading Hammerson's ratings.

Data-Driven and Efficient Operating Platform

Hammerson's commitment to a specialist, data-driven operating platform has yielded significant efficiency gains. Gross administration costs have seen a notable 16% year-on-year reduction, building on a substantial 36% decrease since FY20. This technological investment is directly translating into improved business performance.

The platform's analytical capabilities are crucial for strategic decision-making. It provides valuable insights that enable Hammerson to effectively curate its product mix and enhance placemaking strategies. This, in turn, drives tangible improvements in key performance indicators.

- 16% reduction in gross administration costs year-on-year.

- 36% reduction in gross administration costs since FY20.

- Platform drives higher occupancy, leasing, footfall, and sales through curated product mix and placemaking.

- Expected further enhancement of operational gearing through accelerated AI tool adoption in 2025.

Commitment to Sustainability (ESG)

Hammerson demonstrates a robust commitment to Environmental, Social, and Governance (ESG) principles, a key strength in the current investment climate. The company has set an ambitious target to achieve Net Zero by 2030, with Net Zero Asset Plans (NZAPs) already established for all its shopping destinations. This proactive stance on sustainability, which includes significant energy reduction initiatives and alignment with Task Force on Climate-related Financial Disclosures (TCFD) recommendations, is crucial for meeting evolving investor and stakeholder demands.

This dedication to sustainability is not just aspirational; it's backed by tangible progress and recognition. Hammerson's efforts in climate action have earned it awards, underscoring its leadership in the sector. For instance, in 2023, Hammerson was recognized by CDP for its climate disclosure, achieving a B rating, which reflects a strong understanding and management of climate-related risks and opportunities.

The company's focus on ESG translates into practical operational improvements and strategic advantages:

- Net Zero by 2030 Target: All destinations have Net Zero Asset Plans (NZAPs) in place, demonstrating a clear roadmap for decarbonization.

- Energy Reduction Projects: Ongoing initiatives to reduce energy consumption across its portfolio are in progress, contributing to both environmental goals and operational cost savings.

- TCFD Alignment: Adherence to TCFD recommendations ensures transparent reporting on climate-related financial risks and opportunities, enhancing investor confidence.

- Industry Recognition: Awards and positive ratings in climate action validate Hammerson's leadership and commitment to sustainable practices.

Hammerson's strategic repositioning has created a portfolio of prime, high-quality assets in key urban centers, aligning with market demand for premium locations. This focus is supported by strong operational execution, evidenced by a record 262 new leasing agreements in 2024 with headline rents outperforming previous levels and ERVs. Occupancy rates exceeding 95% in 2024, coupled with footfall and sales figures consistently beating national averages, highlight the enduring appeal of its destinations.

The company has significantly strengthened its balance sheet, raising £1.5 billion from disposals and reducing net debt by 40% year-on-year to £799 million by the end of 2024. This deleveraging has improved its financial metrics, with a net debt to EBITDA ratio of 5.8x and LTV of 30%, leading to credit rating upgrades from Moody's and Fitch. Investments in a data-driven operating platform have driven substantial efficiency gains, including a 16% year-on-year reduction in gross administration costs, building on a 36% decrease since FY20.

Hammerson's commitment to ESG is a notable strength, with a Net Zero by 2030 target and established Net Zero Asset Plans for all its shopping destinations. The company's proactive approach to sustainability, including energy reduction initiatives and TCFD alignment, earned it a B rating from CDP in 2023 for climate disclosure.

| Metric | 2024 Data | Commentary |

|---|---|---|

| New Leasing Agreements | 262 | Record year, outperforming previous rents and ERVs. |

| Occupancy Rate | >95% | Indicative of sustained high demand for prime locations. |

| Annual Visitors | ~170 million | Demonstrates consistent footfall across key destinations. |

| Net Debt Reduction | 40% YoY | Strengthened financial position following asset disposals. |

| Gross Admin Cost Reduction | 16% YoY | Efficiency gains from data-driven operating platform. |

What is included in the product

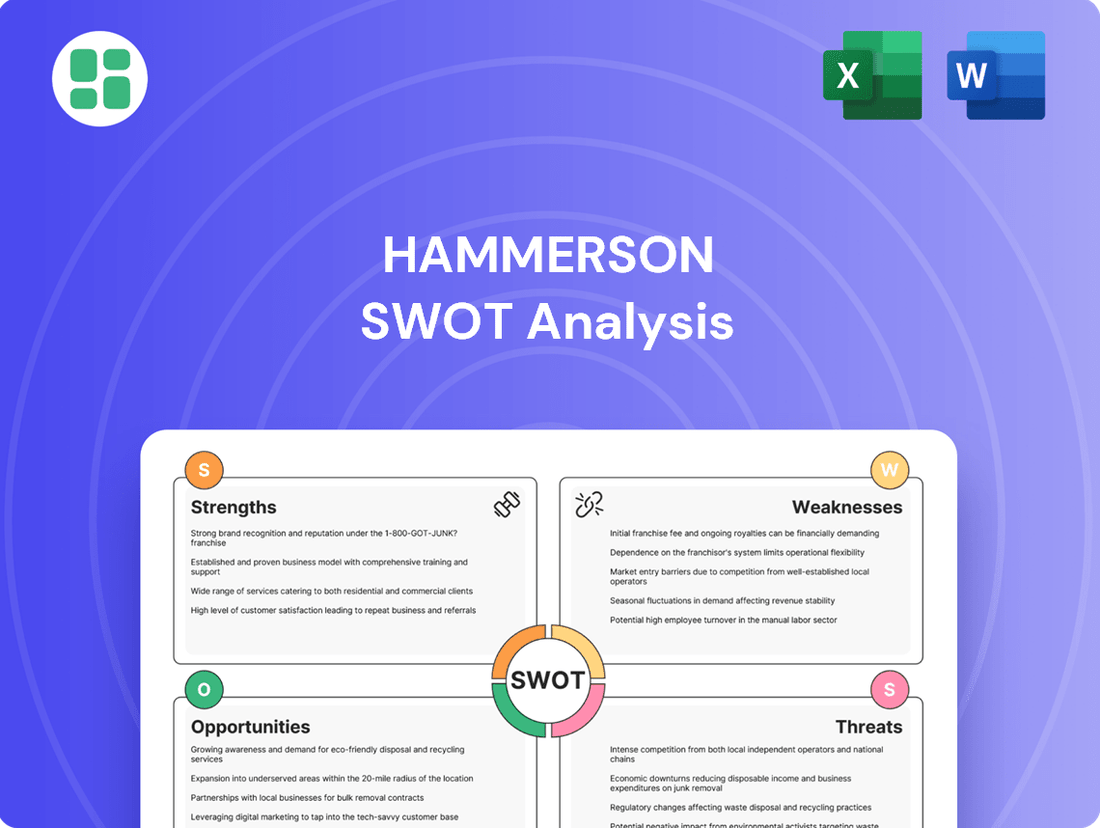

Analyzes Hammerson’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Hammerson's strategic challenges, turning potential weaknesses into opportunities.

Weaknesses

Hammerson's financial performance in 2024 was significantly impacted by a reported IFRS loss of £526 million. This represents a substantial increase from the £51 million loss recorded in the prior year.

The primary driver behind this widened loss was a £497 million impairment charge stemming from the sale of its stake in Value Retail, alongside other revaluation losses. Such considerable reported losses can negatively influence investor sentiment and overall market confidence in the company's financial health.

Hammerson's reliance on physical retail spaces presents a significant weakness as the sector grapples with the persistent growth of e-commerce and evolving consumer behaviors. Despite efforts to enhance in-store experiences, a continued shift towards online shopping could still diminish footfall and tenant interest, necessitating ongoing investment to maintain competitiveness.

For instance, while Hammerson's portfolio aims for premium locations, the broader UK retail property market, as of early 2024, continued to see vacancy rates above pre-pandemic levels in many high street and shopping center locations, underscoring the structural challenges.

Hammerson's strategic decision to divest non-core assets, a move aimed at bolstering its financial health, has predictably resulted in a decline in its gross rental income. This strategic repositioning, while beneficial for the balance sheet, directly impacts the company's immediate revenue-generating capacity.

Specifically, gross rental income for 2024 stood at £189 million, marking a significant 9.1% decrease from the £208 million reported in 2023. This reduction is largely attributable to the aforementioned asset disposals, which have shrunk the portfolio of income-producing properties.

Valuation Challenges in Certain Markets

Hammerson faces valuation challenges in specific markets, as evidenced by the contrasting performance of its UK and Irish portfolios. While UK properties experienced positive revaluations, Ireland saw a substantial £83 million loss in 2024, primarily driven by outward yield shifts. This regional disparity highlights the sensitivity of Hammerson's asset values to localized market conditions and potential headwinds in certain geographical segments.

The ongoing volatility in property markets presents a persistent risk, potentially leading to further downward revaluations. This variability underscores the difficulty in accurately valuing assets in dynamic economic environments.

- Regional Valuation Disparities: Ireland reported an £83 million revaluation loss in 2024 due to outward yield shifts, contrasting with positive revaluations in the UK.

- Market Sensitivity: This indicates ongoing sensitivity to regional property market dynamics.

- Volatility Risk: Continued market volatility could result in further revaluation losses for Hammerson.

Need for Continuous Repositioning Investment

Hammerson's business model necessitates constant adaptation, requiring significant and ongoing investment to reposition its retail and office spaces. This strategy is crucial for meeting changing consumer preferences and tenant demands in the dynamic property market. For instance, in 2023, Hammerson continued its focus on upgrading its flagship destinations, investing in new retail concepts and experiential offerings to drive footfall and rental growth.

This continuous need for capital expenditure, estimated to be a substantial portion of its annual budget for placemaking and commercialization efforts, presents a potential vulnerability. If market conditions deteriorate or the anticipated returns on these investments are delayed, it could place considerable strain on Hammerson's financial resources. The company must carefully balance these strategic investments against its overall financial health.

Key areas requiring this continuous investment include:

- Upgrading retail environments: Incorporating more leisure, dining, and experiential elements to attract shoppers beyond traditional retail.

- Enhancing digital integration: Investing in technology for improved customer experience, such as click-and-collect services and personalized marketing.

- Adapting office spaces: Refurbishing and reconfiguring office buildings to meet the evolving needs of businesses, focusing on flexibility and amenity provision.

- Sustainability initiatives: Implementing green building technologies and practices to meet environmental standards and attract environmentally conscious tenants.

Hammerson's significant reported IFRS loss of £526 million in 2024, a stark increase from £51 million in 2023, highlights a key weakness. This widening loss was primarily driven by a £497 million impairment charge related to the sale of its Value Retail stake, alongside other revaluation losses, indicating substantial financial headwinds.

The company's gross rental income also saw a notable decline, falling by 9.1% to £189 million in 2024 from £208 million in 2023. This reduction is a direct consequence of strategic asset disposals, which, while aimed at financial strengthening, have diminished the portfolio's immediate revenue-generating capacity.

Regional valuation disparities, such as the £83 million loss in Ireland during 2024 due to outward yield shifts, contrast with positive UK revaluations. This sensitivity to localized market conditions suggests vulnerability to specific geographical economic downturns.

Hammerson's business model requires continuous, significant investment in placemaking and commercialization to adapt to evolving consumer and tenant demands. This ongoing capital expenditure, essential for maintaining competitiveness, poses a financial strain if market conditions worsen or investment returns are delayed.

What You See Is What You Get

Hammerson SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Hammerson SWOT analysis, which means no hidden surprises. The full, comprehensive report is yours immediately after purchase.

Opportunities

Hammerson holds a strategic advantage with 80 acres of land and existing properties ripe for mixed-use transformation, blending retail with residential, leisure, and community spaces. This approach is crucial for revitalizing urban areas and creating sustainable value.

Key projects such as Bishopsgate Goodsyard and Dublin Central exemplify this strategy, aiming to build dynamic urban districts. These developments are designed to generate long-term returns by moving beyond a singular retail focus.

The company's pipeline, including Martineau Galleries, underscores its commitment to urban regeneration. This strategy taps into evolving consumer needs and urban planning trends, positioning Hammerson for future growth.

Hammerson's recent disposals, including the sale of its French shopping centres for €370 million in early 2024, have significantly bolstered its balance sheet. This financial strengthening provides a robust platform for capital recycling, allowing the company to pursue strategic acquisitions at more attractive yields, potentially enhancing overall portfolio returns.

The company demonstrated this strategy by increasing its stake in Brent Cross Shopping Centre and acquiring other higher-yielding assets in late 2024. These moves underscore Hammerson's proactive stance in optimizing its property portfolio, focusing on assets that offer greater income potential and growth prospects in the current market environment.

Hammerson can significantly boost customer engagement by leveraging its planned investments in data and analytics, coupled with the accelerated adoption of AI tools slated for 2025. This strategic move will unlock deeper understanding of shopper preferences and tenant requirements, enabling more tailored retail and leisure offerings.

By personalizing marketing campaigns and optimizing operations through AI, Hammerson aims to drive increased footfall and sales. For instance, in 2024, retail destinations that effectively utilized AI for personalized promotions saw an average uplift of 8% in customer conversion rates.

Leveraging ESG for Investor Attraction and Value Creation

Hammerson's dedication to achieving Net Zero by 2030, coupled with a well-defined ESG strategy, positions it favorably to attract investors increasingly focused on environmental and social impact. This commitment is not merely aspirational; in 2023, Hammerson reported that 80% of its energy consumption was from renewable sources, underscoring its tangible progress.

By showcasing leadership in sustainability, Hammerson can bolster its brand image and potentially tap into a wider range of green financing options. This strategic focus on responsible investment can unlock long-term value, appealing to a growing segment of the investment community that prioritizes ethical and sustainable business practices.

- Attracting ESG-focused investors: Growing investor demand for sustainable assets.

- Enhanced reputation: Demonstrating commitment to Net Zero by 2030.

- Access to green financing: Potential for preferential terms on sustainable debt.

- Long-term value creation: Aligning with stakeholder priorities for responsible business.

Strong Occupier Demand for Quality Space

Despite ongoing shifts in the retail landscape, there's a strong, persistent demand from occupiers for high-quality, well-located retail and leisure spaces. This trend is amplified as brands strategically consolidate their physical presence into fewer, more impactful flagship stores, seeking prime locations to maximize customer engagement and sales.

Hammerson's strategic focus on premier city destinations, such as its portfolio of flagship shopping centers in major European cities, is well-aligned to capture this demand. For instance, in 2024, Hammerson reported that its leasing activity across its portfolio saw new leases signed at an average of 6% ahead of previous passing rents, demonstrating the value placed on its prime assets by retailers.

- Retailer Consolidation: Brands are prioritizing fewer, higher-performing stores, increasing the appeal of prime locations.

- Rental Growth: Hammerson's prime assets are attracting strong rental growth, with new leases in 2024 signed at an average of 6% above previous rents.

- High Occupancy: This demand helps maintain high occupancy rates, ensuring consistent revenue streams.

- Strategic Positioning: Hammerson's focus on top-tier city destinations directly benefits from the trend of occupiers seeking quality and relevance.

Hammerson's strategic repositioning into mixed-use urban regeneration presents a significant opportunity to leverage its extensive land bank and existing properties. By integrating retail with residential, leisure, and community amenities, the company can create dynamic urban districts, as seen in projects like Bishopsgate Goodsyard, driving long-term value beyond traditional retail.

The company's financial strengthening, exemplified by the €370 million sale of its French shopping centres in early 2024, enables strategic capital recycling. This allows for acquisitions of higher-yielding assets, such as increased stakes in Brent Cross and other opportunistic purchases in late 2024, optimizing the portfolio for current market conditions.

Investments in data analytics and AI, slated for accelerated adoption in 2025, offer a pathway to enhanced customer engagement and operational efficiency. This is supported by 2024 data showing an 8% conversion rate uplift for retail destinations using AI-driven personalized promotions.

Hammerson's commitment to Net Zero by 2030 and a robust ESG strategy positions it favorably to attract sustainability-focused investors. The company's 2023 report of 80% renewable energy consumption highlights tangible progress, enhancing brand image and potentially unlocking green financing options.

The ongoing trend of retailer consolidation, with brands prioritizing fewer, high-impact flagship stores, directly benefits Hammerson's focus on prime city destinations. This is evidenced by new leases in 2024 being signed at an average of 6% above previous rents, underscoring the demand for quality, well-located retail spaces.

| Opportunity Area | Description | Supporting Data/Facts |

|---|---|---|

| Urban Regeneration | Transforming existing properties and land into mixed-use developments. | 80 acres of land bank; Projects like Bishopsgate Goodsyard and Dublin Central. |

| Balance Sheet Strengthening & Capital Recycling | Disposing of non-core assets to fund strategic acquisitions. | €370 million from French asset sales (early 2024); Increased stake in Brent Cross (late 2024). |

| Data & AI Integration | Leveraging technology for enhanced customer engagement and operations. | Planned accelerated AI adoption in 2025; 8% conversion uplift from AI promotions (2024). |

| ESG Leadership | Attracting ESG-focused investors through sustainability commitments. | Net Zero by 2030 target; 80% renewable energy consumption (2023). |

| Prime Location Demand | Capitalizing on retailer demand for high-quality, well-located spaces. | New leases signed at 6% above previous rents (2024). |

Threats

The ongoing macroeconomic uncertainty, marked by persistent inflation and the likelihood of elevated interest rates through 2024 and into 2025, presents a considerable threat to Hammerson. For instance, the UK's Consumer Price Index (CPI) remained at 2.3% in April 2024, still above the Bank of England's 2% target, indicating that consumer purchasing power continues to be squeezed.

This sustained inflationary pressure directly erodes consumer discretionary spending, a critical driver for retail destinations like those managed by Hammerson. Furthermore, higher borrowing costs resulting from elevated interest rates, potentially remaining around 4.5% or higher for key central banks in 2024-2025, will increase Hammerson's financing expenses and could negatively impact the valuation of its substantial property portfolio.

The persistent growth of online retail continues to pose a significant challenge, even for businesses emphasizing physical experiences. As e-commerce penetration climbs, the demand for traditional retail spaces may dwindle, potentially leading to higher vacancies and rent reductions across Hammerson's portfolio. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, a figure expected to continue its upward trajectory.

Shifts in consumer preferences, such as a growing demand for experiences over material possessions, could decrease footfall and sales at Hammerson's shopping centers. For example, in 2024, the UK retail sector saw a continued trend towards experiential spending, with reports indicating a 15% year-over-year increase in spending on leisure and entertainment activities, directly impacting traditional retail sales.

Economic pressures, including inflation and rising interest rates in 2024 and projected into 2025, are likely to reduce discretionary spending by consumers. This could lead to lower sales volumes for Hammerson's tenants, impacting rental income. Data from the Office for National Statistics in late 2024 showed a 5% dip in retail sales volumes compared to the previous year, primarily attributed to reduced consumer confidence.

Hammerson needs to proactively adapt its tenant mix and overall offering to stay relevant amidst these evolving consumer behaviors. By incorporating more experiential elements, such as dining, entertainment, and services, the company can mitigate the negative impact of reduced spending on physical goods and attract a wider customer base.

Further Property Devaluations

While some property markets saw positive revaluations in 2024, Hammerson's overall portfolio remains vulnerable to further declines. The company reported significant IFRS losses and revaluation deficits in specific areas, such as Ireland, highlighting ongoing market weaknesses.

Future economic downturns or a shift in investor confidence could trigger additional devaluations across Hammerson's extensive property holdings.

- Continued Market Volatility: Despite pockets of recovery in 2024, the broader property market faces persistent downward pressures.

- Regional Weaknesses: Specific regions, like Ireland, experienced notable revaluation losses, indicating localized economic challenges impacting asset values.

- Investor Sentiment Shifts: Changes in investor appetite for real estate, driven by economic uncertainty or interest rate movements, pose a direct threat to property valuations.

- Economic Headwinds: Potential future economic downturns could exacerbate existing pressures, leading to a broader decline in the value of Hammerson's assets.

Geopolitical Instability and Regional Economic Disparities

Geopolitical instability across Hammerson's operating regions, including the UK, France, and Ireland, presents a significant threat. For instance, ongoing trade tensions or political realignments could disrupt supply chains and impact consumer spending patterns, directly affecting retail footfall and rental income.

Regional economic disparities are also a concern. A localized economic downturn in one of Hammerson's key markets, such as a sharp rise in unemployment in a specific French city where it owns retail assets, could lead to reduced retailer demand and increased vacancy rates.

The lingering effects of Brexit continue to pose a threat, potentially impacting cross-border investment and consumer confidence in the UK and Ireland. Furthermore, differing regulatory environments and economic policies across these European nations create complexity and potential headwinds for a diversified property group like Hammerson.

- Brexit's ongoing impact on UK and Irish economies.

- Potential for localized economic downturns in France or Ireland.

- Shifts in consumer confidence due to geopolitical events.

Hammerson faces significant threats from persistent inflation and high interest rates, which are expected to continue into 2025, impacting consumer spending and increasing borrowing costs. The ongoing shift to e-commerce, with global sales projected to exceed $6.3 trillion in 2024, directly challenges the demand for physical retail spaces, potentially leading to higher vacancies. Evolving consumer preferences towards experiences over goods also threaten footfall and sales in traditional shopping centers, as seen with a 15% rise in UK leisure spending in 2024.

Market volatility and regional weaknesses, such as revaluation losses in Ireland, expose Hammerson's portfolio to further declines. Geopolitical instability and the lingering effects of Brexit create further uncertainty, potentially disrupting supply chains and consumer confidence across its operating regions. Economic downturns in key markets like France could also reduce retailer demand and increase vacancies.

| Threat Category | Specific Threat | Impact on Hammerson | Relevant Data (2024/2025) |

| Macroeconomic Uncertainty | Inflation and High Interest Rates | Reduced consumer spending, increased financing costs, potential portfolio devaluation | UK CPI at 2.3% (April 2024); Interest rates around 4.5%+ |

| Competitive Landscape | Growth of E-commerce | Higher vacancies, rent reductions, diminished demand for physical retail | Global e-commerce sales > $6.3 trillion (2024 projection) |

| Consumer Behavior | Shift to Experiential Spending | Lower footfall and sales in shopping centers | 15% YoY increase in UK leisure spending (2024) |

| Market & Geopolitical Factors | Property Market Volatility & Regional Weaknesses | Asset value declines, potential for further revaluation deficits | Notable revaluation losses in Ireland |

| Market & Geopolitical Factors | Geopolitical Instability & Brexit | Supply chain disruption, reduced consumer confidence, regulatory complexity | Ongoing trade tensions, lingering Brexit effects |

SWOT Analysis Data Sources

This Hammerson SWOT analysis draws from a robust blend of data, including their latest financial reports, comprehensive market research on the retail and leisure sectors, and insights from industry experts and analysts.